India Contact Lenses Manufacturers Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7756

November 2024

89

About the Report

India Contact Lenses Manufacturers Market Overview

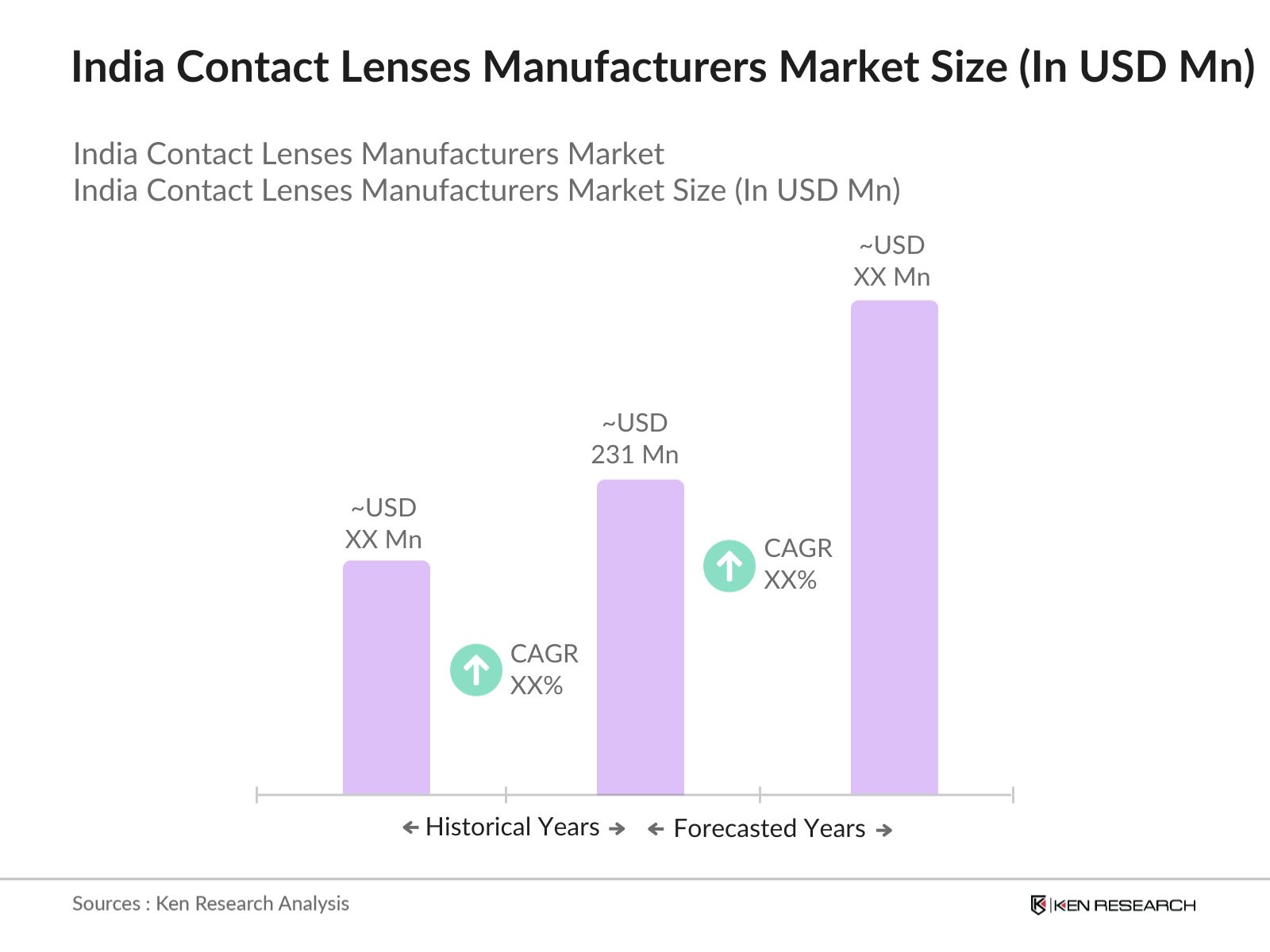

- The India Contact Lenses Manufacturers Market is valued at USD 231 million, based on a five-year historical analysis. This growth is driven by increasing awareness of eye health, rising disposable incomes, and a shift towards aesthetic enhancements. The prevalence of refractive errors and the convenience offered by contact lenses over traditional eyewear have further propelled market expansion.

- Major metropolitan areas such as Delhi, Mumbai, and Bangalore dominate the market due to higher urbanization rates, greater access to eye care services, and a more fashion-conscious population. These cities have a higher concentration of optical retailers and clinics, facilitating easier adoption of contact lenses among consumers.

- Contact lenses are classified as medical devices, which requires manufacturers and importers to obtain a registration certificate from the CDSCO before selling their products in India. This rule came into effect on October 1, 2022. Adhering to these regulations is mandatory, helping maintain consumer safety but also posing compliance challenges for manufacturers.

India Contact Lenses Manufacturers Market Segmentation

By Material Type: The market is segmented by material type into silicone hydrogel, gas permeable, and hybrid lenses. Silicone hydrogel lenses hold a dominant market share due to their high oxygen permeability, which enhances comfort and reduces the risk of eye infections. Their ability to retain moisture makes them suitable for extended wear, catering to the lifestyle needs of modern consumers.

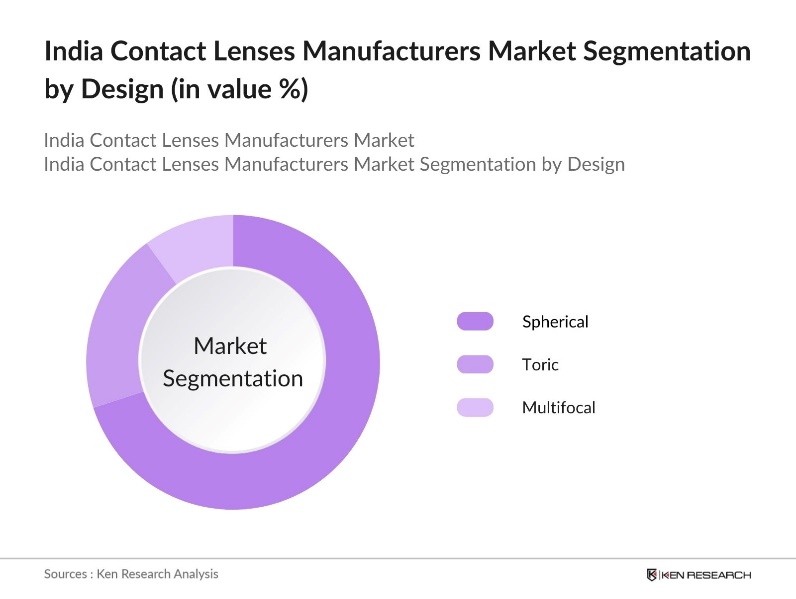

By Design: The market is segmented by design into spherical, toric, and multifocal lenses. Spherical lenses dominate this segment, primarily because they effectively correct common refractive errors such as myopia and hyperopia. Their straightforward design and widespread availability make them a popular choice among first-time contact lens users.

India Contact Lenses Manufacturers Market Competitive Landscape

The India contact lenses manufactures market is characterized by the presence of both international and domestic manufacturers, leading to a competitive environment. Key players focus on product innovation, strategic partnerships, and extensive distribution networks to maintain their market positions.

India Contact Lenses Manufacturers Industry Analysis

Growth Drivers

- Rising Disposable Income and Urbanization: India's per capita income has been 2239.25 US dollars in 2023, as per the National Statistical Office. This increase in disposable income, coupled with rapid urbanizationevident from the urban population growing to the total populationhas led to higher consumer spending on healthcare and personal care products, including contact lenses. Urban residents, with greater access to optical retail outlets and awareness of vision correction options, are more inclined to adopt contact lenses for both corrective and aesthetic purposes

- Technological Advancements in Contact Lens Materials: The contact lens industry in India has benefited from technological innovations, particularly the development of silicone hydrogel lenses. These lenses offer enhanced oxygen permeability, improving comfort for extended wear. Manufacturers are also introducing lenses with UV protection and moisture retention features, catering to the specific needs of the Indian demographic. Such advancements have made contact lenses more appealing to consumers seeking both comfort and eye health benefits.

- Growing Awareness of Eye Health and Aesthetics: There is an increasing awareness among Indians about eye health, driven by initiatives from organizations like the National Programme for Control of Blindness and Visual Impairment. For instance, the Department of Health and Family Welfare in Karnataka revealed that 1.73 lakh school children were diagnosed with refractive errors. The combination of health consciousness and fashion trends has expanded the consumer base for contact lenses beyond those with refractive errors.

Market Challenges

- High Cost of Advanced Contact Lenses: Advanced contact lenses, including silicone hydrogel and multifocal types, are often expensive, limiting accessibility for many consumers. This cost barrier particularly affects lower-income groups, steering them toward more affordable vision correction options. The premium pricing of these lenses impacts their overall market penetration, as budget constraints make traditional lenses or other corrective methods a more viable choice for a significant portion of the population.

- Availability of Alternative Vision Correction Methods: Spectacles and refractive surgeries present strong alternatives to contact lenses. Spectacles offer a cost-effective, low-maintenance solution, while refractive surgeries provide a permanent correction for those seeking independence from corrective lenses. These alternatives, favored for their practicality and varying costs, pose challenges to contact lens adoption, as many consumers still prefer them for vision correction due to ease, affordability, and longevity.

India Contact Lenses Manufacturers Market Future Outlook

Over the next five years, the India contact lenses manufacturers market is expected to show significant growth driven by continuous advancements in lens technology, increasing consumer demand for convenience and aesthetics, and expanding distribution channels, including online platforms. The introduction of innovative products, such as smart contact lenses and lenses designed for specific eye conditions, is anticipated to further stimulate market growth.

Market Opportunities

Scope of the Report

|

Material Type |

Silicone Hydrogel Gas Permeable Hybrid |

|

Design |

Spherical Toric Multifocal |

|

Usage Type |

Daily Disposable Monthly Disposable Extended Wear |

|

Distribution Channel |

Optical Stores Online Retail Hospitals & Clinics |

|

End-User |

Adults Teenagers Children |

Products

Key Target Audience

Contact Lens Manufacturers

Eye Care Industry

Medical Device MAnufacturers

E-commerce Platforms

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Central Drugs Standard Control Organization)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Bausch & Lomb

Johnson & Johnson Vision Care

Alcon Inc.

CooperVision

Menicon Co., Ltd.

Hoya Corporation

Carl Zeiss AG

Essilor International

Contamac Ltd.

SEED Co., Ltd.

Table of Contents

1. India Contact Lenses Manufacturers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Contact Lenses Manufacturers Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Contact Lenses Manufacturers Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Refractive Errors

3.1.2. Rising Disposable Income and Urbanization

3.1.3. Technological Advancements in Contact Lens Materials

3.1.4. Growing Awareness of Eye Health and Aesthetics

3.2. Market Challenges

3.2.1. High Cost of Advanced Contact Lenses

3.2.2. Availability of Alternative Vision Correction Methods

3.2.3. Regulatory Compliance and Quality Standards

3.3. Opportunities

3.3.1. Expansion into Tier II and Tier III Cities

3.3.2. Development of Customized and Specialty Lenses

3.3.3. Growth in Online Retail Channels

3.4. Trends

3.4.1. Adoption of Daily Disposable and Silicone Hydrogel Lenses

3.4.2. Integration of Smart Technologies in Contact Lenses

3.4.3. Increasing Demand for Cosmetic and Colored Lenses

3.5. Government Regulations

3.5.1. Medical Device Regulations in India

3.5.2. Import and Export Policies

3.5.3. Standards for Manufacturing and Quality Control

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Contact Lenses Manufacturers Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Silicone Hydrogel

4.1.2. Gas Permeable

4.1.3. Hybrid

4.2. By Design (In Value %)

4.2.1. Spherical

4.2.2. Toric

4.2.3. Multifocal

4.3. By Usage Type (In Value %)

4.3.1. Daily Disposable

4.3.2. Monthly Disposable

4.3.3. Extended Wear

4.4. By Distribution Channel (In Value %)

4.4.1. Optical Stores

4.4.2. Online Retail

4.4.3. Hospitals & Clinics

4.5. By End-User (In Value %)

4.5.1. Adults

4.5.2. Teenagers

4.5.3. Children

5. India Contact Lenses Manufacturers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bausch & Lomb

5.1.2. Johnson & Johnson Vision Care

5.1.3. Alcon Inc.

5.1.4. CooperVision

5.1.5. Menicon Co., Ltd.

5.1.6. Hoya Corporation

5.1.7. Carl Zeiss AG

5.1.8. Essilor International

5.1.9. Contamac Ltd.

5.1.10. SEED Co., Ltd.

5.1.11. Camax Optical Corp.

5.1.12. Conforma Contact Lenses

5.1.13. Sauflon Pharmaceuticals Ltd.

5.1.14. UltraVision CLPL

5.1.15. Novartis AG

5.2. Cross Comparison Parameters (Product Range, Distribution Reach, Product Innovation, Market Share, Manufacturing Capabilities, Customer Base, Pricing Strategy, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Contact Lenses Manufacturers Market Regulatory Framework

6.1. Medical Device Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Contact Lenses Manufacturers Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Contact Lenses Manufacturers Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Design (In Value %)

8.3. By Usage Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By End-User (In Value %)

9. India Contact Lenses Manufacturers Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Contact Lenses Manufacturers Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Contact Lenses Manufacturers Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple contact lens manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Contact Lenses Manufacturers Market.

Frequently Asked Questions

01 How big is the India Contact Lenses Manufacturers Market?

The India Contact Lenses Manufacturers Market is valued at USD 231 million, based on a five-year historical analysis. Additionally, advancements in lens materials, such as silicone hydrogel, which provides higher comfort and safety, further support market growth.

02 What are the challenges in the India Contact Lenses Manufacturers Market?

Challenges in India Contact Lenses Manufacturers Market include the high cost of advanced contact lenses, availability of alternative vision correction methods, and stringent regulatory compliance and quality standards.

03 Who are the major players in the India Contact Lenses Manufacturers Market?

Key players in the India Contact Lenses Manufacturers Market include Bausch & Lomb, Johnson & Johnson Vision Care, Alcon Inc., CooperVision, and Menicon Co., Ltd. These companies dominate due to their extensive distribution networks, established brand presence, and strong focus on innovation in contact lens technology.

04 What are the growth drivers of the India Contact Lenses Manufacturers Market?

The India Contact Lenses Manufacturers Market is driven by factors such as rising disposable incomes, increasing awareness of eye health, and the growing trend toward aesthetic enhancements.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.