India Conversational AI Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4638

December 2024

90

About the Report

India Conversational AI Market Overview

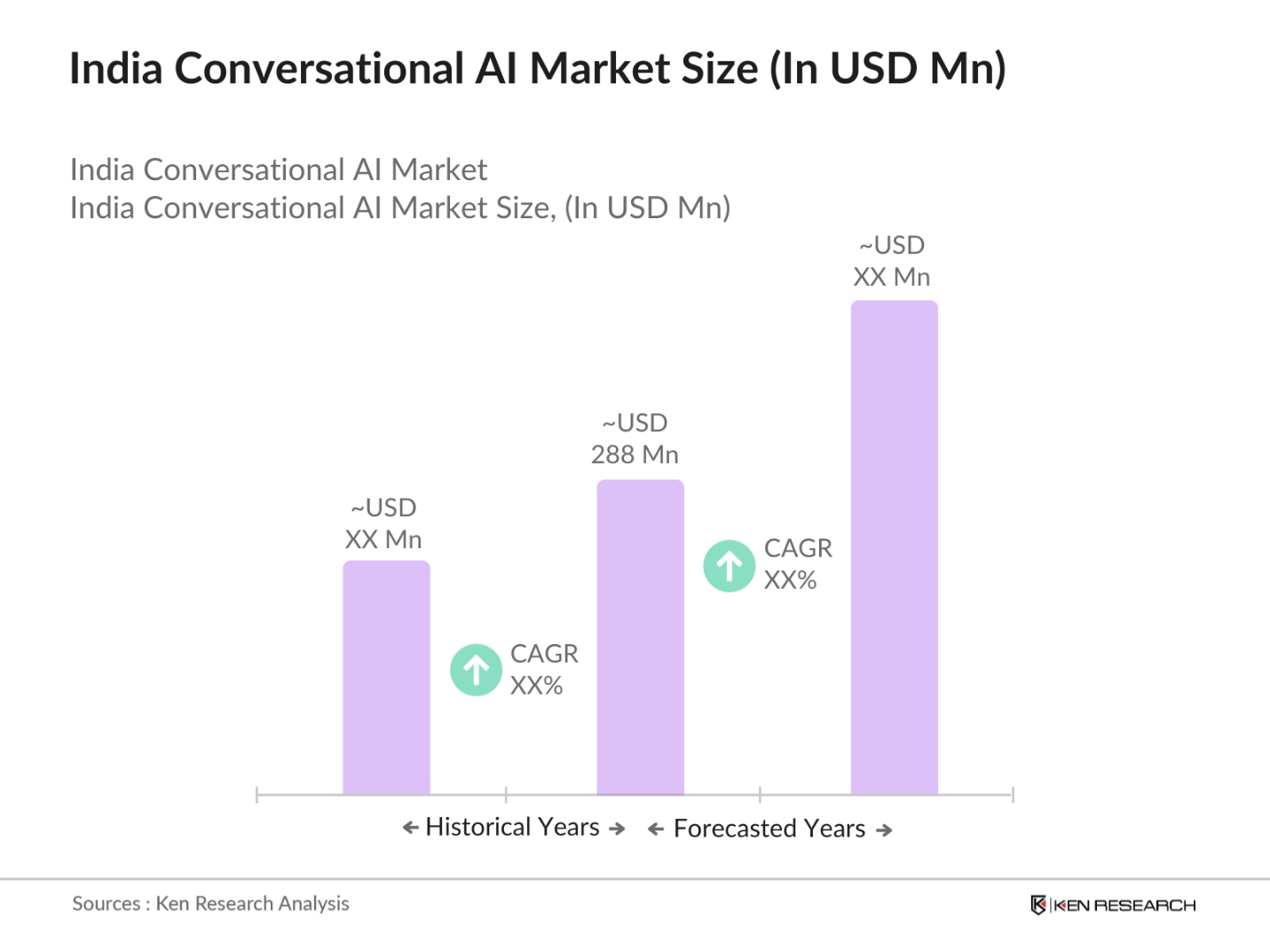

- The India Conversational AI market is valued at approximately USD 288 million based on a five-year historical analysis, driven by rapid digitalization across industries such as BFSI, retail, and healthcare. The growing adoption of AI-based virtual assistants and chatbots, particularly by enterprises seeking to enhance customer engagement, has propelled this market. The proliferation of smartphone usage, enhanced internet connectivity, and a burgeoning e-commerce sector further fuel the demand for AI-driven solutions.

- Cities such as Bengaluru, Mumbai, and Hyderabad dominate the Indian Conversational AI market due to the presence of significant tech infrastructure, access to a skilled workforce, and thriving startup ecosystems. Bengaluru, often referred to as the "Silicon Valley of India," has emerged as a hub for AI innovation, attracting considerable investment and talent. Mumbais dominance is linked to its status as the financial capital of India, where major BFSI companies are adopting Conversational AI to improve customer service.

- India's National Strategy for AI, developed by NITI Aayog, emphasizes AI deployment across key sectors like agriculture, healthcare, and education. As part of this strategy, the government in 2023 committed to establishing AI research centers and encouraging public-private partnerships, fostering a conducive environment for the growth of conversational AI. These initiatives aim to position India as a global AI leader while addressing critical societal challenges.

India Conversational AI Market Segmentation

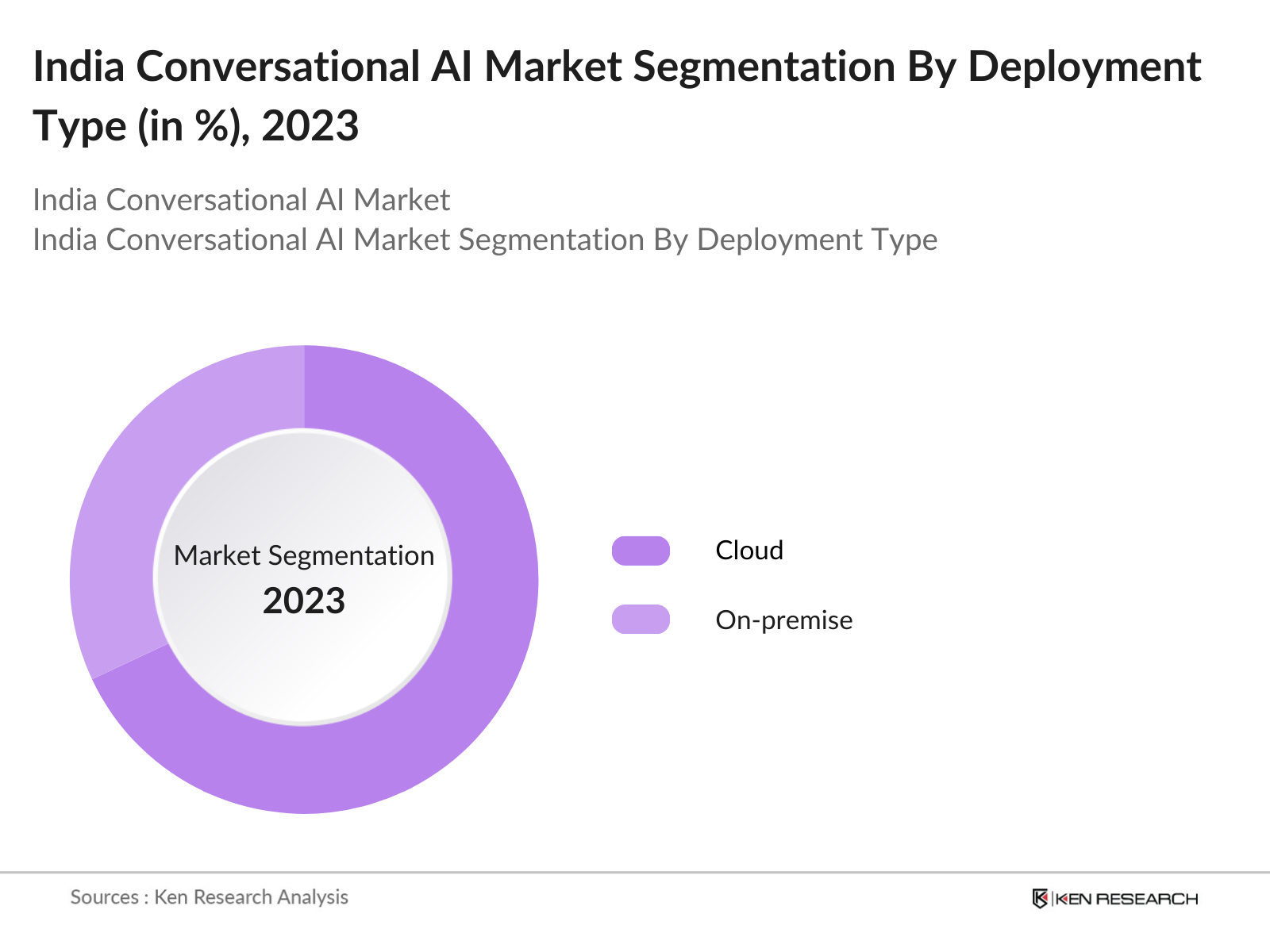

By Deployment Type: The India Conversational AI market is segmented by deployment type into Cloud and On-premise solutions. Cloud-based deployment holds a dominant market share due to its scalability, cost-effectiveness, and easy integration with existing systems. Enterprises prefer cloud solutions as they allow seamless updates and reduced infrastructure costs. On-premise deployments, while less dominant, are preferred by large-scale organizations with stringent security requirements, especially in sectors like banking and government.

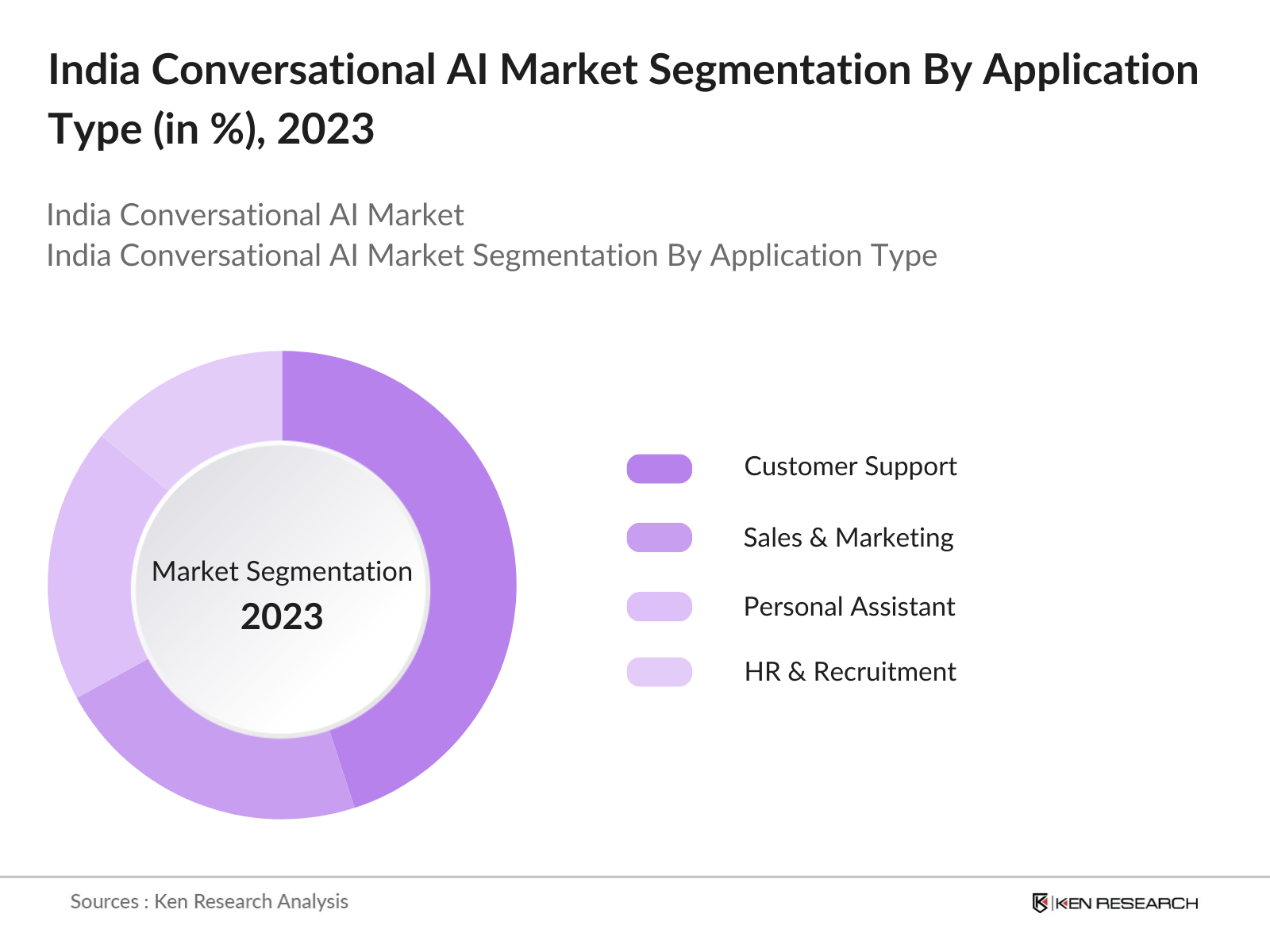

By Application: Conversational AI is further segmented by application into Customer Support, Sales and Marketing, Personal Assistant, HR and Recruitment, and Healthcare. Customer Support is the leading segment, primarily driven by the BFSI and telecom sectors, which leverage chatbots and virtual agents to enhance customer service efficiency and response times. The ability to automate routine queries while providing round-the-clock support has positioned this sub-segment as the largest application area.

India Conversational AI Market Competitive Landscape

The India Conversational AI market is dominated by key players leveraging innovative technologies to stay ahead of the competition. These companies focus on enhancing their AI algorithms, natural language processing capabilities, and expanding their product portfolios to cater to diverse industries. The market shows a mix of domestic players like Haptik and Yellow.ai, alongside global tech giants such as Google and Microsoft, which have localized their offerings for the Indian market.

|

Company |

Establishment Year |

Headquarters |

Employee Size |

Technology Focus |

Revenue (USD Mn) |

Language Capabilities |

Regional Presence |

Market Segment Focus |

Industry Collaboration |

|

Haptik |

2013 |

Mumbai |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Yellow.ai |

2016 |

Bengaluru |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Uniphore |

2008 |

Chennai |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Microsoft |

1975 |

Redmond |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

|

1998 |

Mountain View |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

India Conversational AI Industry Analysis

Growth Drivers

- Increasing Digitalization: India has experienced a significant increase in digital adoption, supported by over 800 million internet users in 2024, a massive leap driven by governmental efforts and private initiatives. The Digital India program has played a key role, aiming to improve the infrastructure necessary to provide high-speed internet across rural and urban areas. The number of digital transactions grew to 10.62 billion per month in 2023, indicating a growing dependence on online services. This digital transformation fuels the demand for Conversational AI, particularly in customer support and user engagement sectors.

- Growth in Mobile Penetration: Indias mobile phone penetration stood at around 1.14 billion in 2023, with 700 million of these being smartphone users. This extensive smartphone adoption provides fertile ground for the growth of conversational AI technologies, especially mobile apps, voice assistants, and chatbots. In particular, regions outside metropolitan areas have seen substantial mobile growth, driven by affordable data plans and the expansion of 4G networks. This connectivity surge enhances the accessibility of Conversational AI services.

- AI and NLP Advancements: India has witnessed a significant investment in AI and Natural Language Processing (NLP) technologies, resulting in better user experience across multiple domains, including e-commerce, healthcare, and education. With over 50 AI-focused initiatives being funded by the Indian government in 2023, the innovation in NLP technologies is providing a platform for conversational AI to handle more complex tasks such as understanding regional dialects and managing large-scale queries. NLP in Indian languages like Hindi, Bengali, and Tamil has improved, leading to broader accessibility.

Market Challenges

- Data Privacy and Security Concerns: With the rise of conversational AI, India faces increasing challenges related to data privacy and security. The introduction of the Digital Personal Data Protection Act in 2023 highlights concerns about data breaches and misuse. India reported over 200,000 cybersecurity incidents in 2022, many involving compromised personal data from AI-driven services, reflecting the need for more robust data protection measures within AI-based systems. This has led to stringent compliance requirements, increasing operational complexity for companies deploying AI-based conversational tools.

- Integration Challenges with Legacy Systems: Many businesses, especially in sectors like banking and insurance, still rely on outdated IT systems that struggle to integrate with advanced AI technologies. Around 60% of Indian companies in 2022 reported difficulties in implementing AI solutions due to legacy infrastructure. These challenges include the high cost of upgrading systems, compatibility issues, and the technical skills gap within IT teams, all of which hinder the adoption of conversational AI solutions.

Source: Ministry of Finance, India

India Conversational AI Market Future Outlook

Over the next five years, the India Conversational AI market is expected to experience significant growth due to advancements in AI technologies, increased demand for digital customer engagement, and the expansion of AI applications across new verticals. As more enterprises adopt AI-driven solutions to streamline operations, improve customer experience, and gain a competitive edge, the demand for tailored conversational interfaces will surge. Furthermore, the Indian governments push for digital transformation, along with investments in AI research and development, will create ample opportunities for market expansion.

Opportunities

- Expansion in Non-English Conversational AI: India's linguistic diversity presents significant opportunities for conversational AI. The country's regional languages dominate interactions in non-urban areas, and with only 10% of the population fluent in English, the development of AI tools supporting regional languages like Marathi, Bengali, and Telugu is crucial. In 2023, nearly 450 million internet users communicated in regional languages, underscoring the need for AI applications in these languages to drive wider adoption and deeper market penetration.

- Increasing Demand in E-commerce and BFSI: Indias e-commerce market has surged to over 1.2 billion digital buyers in 2023. The banking, financial services, and insurance (BFSI) sector also saw major growth, with conversational AI facilitating over 50 million interactions monthly. This demand is driven by the need for automation in customer service and personalized interactions, as conversational AI improves service efficiency and customer experience across platforms like mobile banking apps and e-commerce websites.

Scope of the Report

|

Deployment Type |

Cloud On-premise |

|

Application |

Customer Support Sales & Marketing Personal Assistant HR & Recruitment Healthcare |

|

Technology |

NLP ML Deep Learning ASR |

|

Industry Vertical |

BFSI Retail & E-commerce Healthcare IT & Telecom Government |

|

Region |

North India South India West India East India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (MeitY, NITI Aayog)

AI Solution Companies

Telecom Companies

BFSI Enterprises

E-commerce Industries

Healthcare Companies

Large Enterprises (B2C Service Providers)

Companies

Players Mentioned in the Report

Haptik

Yellow.ai

Uniphore

Gupshup

Senseforth.ai

Mihup

Vernacular.ai

Exotel

Avaamo

Kore.ai

Table of Contents

1. India Conversational AI Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Conversational AI Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Conversational AI Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Digitalization

3.1.2. Growth in Mobile Penetration

3.1.3. AI and NLP Advancements

3.1.4. Government Digital Initiatives

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. Integration Challenges with Legacy Systems

3.2.3. Limited Regional Language Support

3.3. Opportunities

3.3.1. Expansion in Non-English Conversational AI

3.3.2. Increasing Demand in E-commerce and BFSI

3.3.3. Scope in Healthcare and Telemedicine

3.4. Trends

3.4.1. Proliferation of Voice Assistants

3.4.2. Use of AI in Customer Experience Enhancement

3.4.3. Rise in Conversational AI Startups

3.5. Government Regulation

3.5.1. National AI Strategy and Initiatives

3.5.2. Data Protection and Privacy Regulations

3.5.3. AI Policy in the IT Sector

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Conversational AI Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. Cloud

4.1.2. On-premise

4.2. By Application (In Value %)

4.2.1. Customer Support

4.2.2. Sales and Marketing

4.2.3. Personal Assistant

4.2.4. HR and Recruitment

4.2.5. Healthcare

4.3. By Technology (In Value %)

4.3.1. Natural Language Processing (NLP)

4.3.2. Machine Learning (ML)

4.3.3. Deep Learning

4.3.4. Automated Speech Recognition (ASR)

4.4. By Industry Vertical (In Value %)

4.4.1. Banking, Financial Services & Insurance (BFSI)

4.4.2. Retail & E-commerce

4.4.3. Healthcare

4.4.4. IT & Telecom

4.4.5. Government

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Conversational AI Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Haptik

5.1.2. Yellow.ai

5.1.3. Uniphore

5.1.4. Gupshup

5.1.5. Senseforth.ai

5.1.6. Mihup

5.1.7. Vernacular.ai

5.1.8. Exotel

5.1.9. Avaamo

5.1.10. Kore.ai

5.1.11. TCS (Conversational AI Solutions)

5.1.12. Infosys (AI Practice)

5.1.13. Wipro (AI & Automation)

5.1.14. Tech Mahindra (AI Solutions)

5.1.15. Accenture (AI Integration)

5.2. Cross Comparison Parameters (Employee Size, Headquarters, Revenue, Market Presence, Technology Focus, Language Capabilities, AI Integration Approach, Customer Segments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Conversational AI Market Regulatory Framework

6.1. Data Privacy Laws

6.2. AI Ethics and Compliance

6.3. Certification Processes for AI Systems

6.4. Government Funding for AI Startups

7. India Conversational AI Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Conversational AI Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Industry Vertical (In Value %)

8.5. By Region (In Value %)

9. India Conversational AI Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involved developing an ecosystem map that identifies all major stakeholders within the India Conversational AI market. Comprehensive desk research, using a combination of secondary sources and proprietary databases, was conducted to gather industry-level data. The focus was on identifying critical variables affecting market dynamics, including AI adoption rates and customer satisfaction levels.

Step 2: Market Analysis and Construction

In this step, historical data for the India Conversational AI market was compiled and analyzed, assessing factors such as market penetration across sectors, user preferences, and the revenue generated by AI solutions. Service quality metrics were also evaluated to ensure the reliability of revenue and growth estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were developed regarding market drivers and restraints, followed by consultations with industry experts from key companies. These interviews provided financial and operational insights, ensuring the accuracy of the market analysis.

Step 4: Research Synthesis and Final Output

The final step involved direct engagement with AI solution providers and enterprises utilizing conversational AI. This primary data was combined with secondary research findings to produce a comprehensive and validated report that accurately reflects the state of the India Conversational AI market.

Frequently Asked Questions

01. How big is the India Conversational AI Market?

The India Conversational AI market is valued at approximately USD 288 million, driven by increasing digitalization across multiple sectors, including BFSI and healthcare.

02. What are the challenges in the India Conversational AI Market?

The primary challenges include data privacy concerns, integration difficulties with legacy systems, and the need for Conversational AI solutions in regional languages.

03. Who are the major players in the India Conversational AI Market?

Major players include Haptik, Yellow.ai, Uniphore, and global giants like Google and Microsoft, which dominate through strong technology portfolios and localized offerings.

04. What are the growth drivers of the India Conversational AI Market?

Key growth drivers include rising smartphone penetration, increased digital adoption across industries, and advancements in AI technologies, particularly in Natural Language Processing (NLP).

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.