India Corporate Travel Market Outlook to 2030

Region:Asia

Author(s):y

Product Code:KROD7246

December 2024

92

About the Report

India Corporate Travel Market Overview

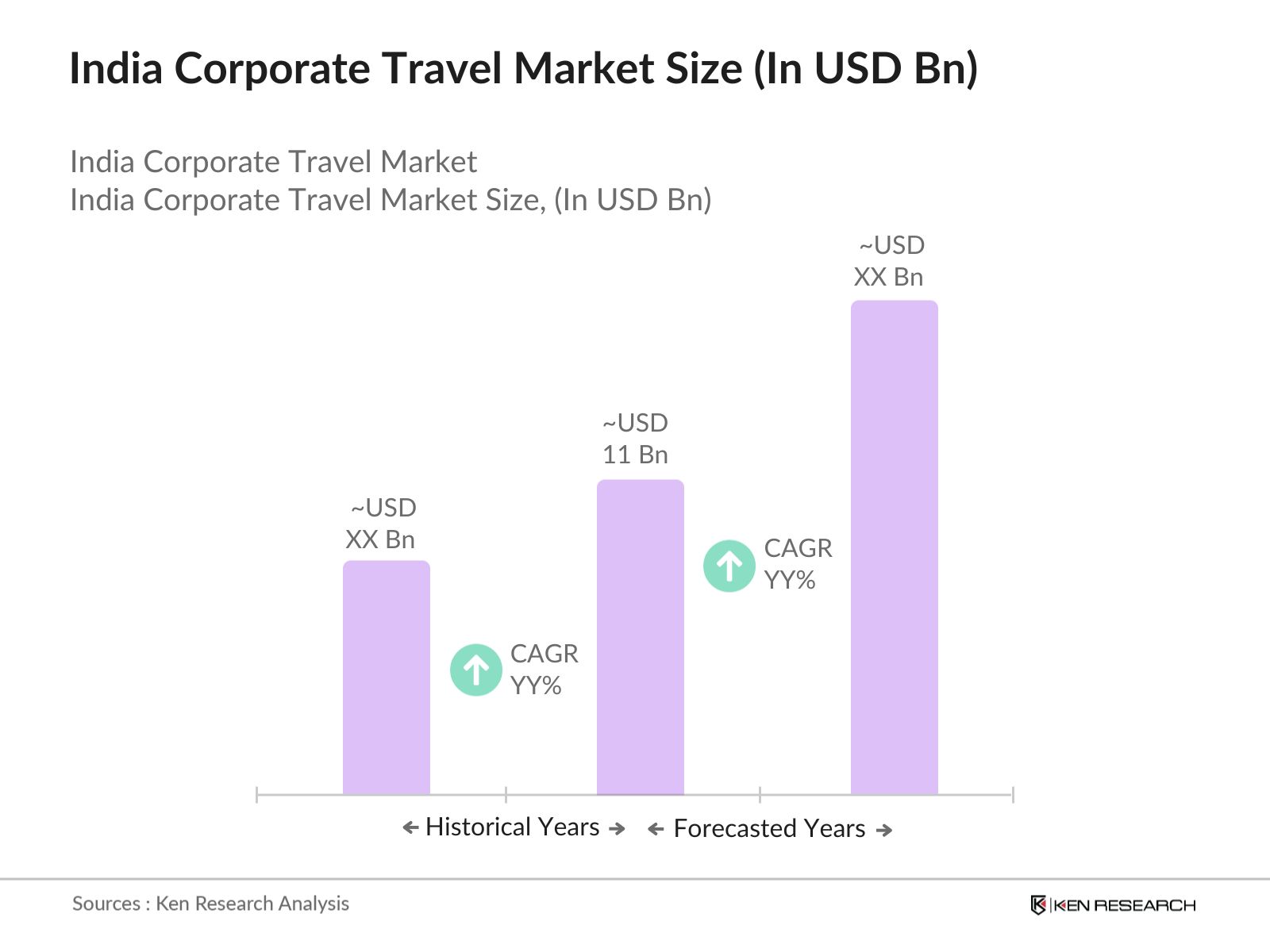

- The India Corporate Travel Market, valued at USD 11 billion, shows significant growth due to the increasing needs of businesses for travel services. This market is driven by rising corporate spending on travel, primarily from sectors like IT, pharmaceuticals, and BFSI. Technological advancements have also enhanced travel efficiency, with Travel Management Companies (TMCs) offering automated booking, expense management, and streamlined workflows to meet corporate demand.

- The primary cities driving Indias corporate travel sector include Mumbai, Delhi NCR, and Bengaluru. These cities are corporate and financial hubs, hosting the headquarters of numerous multinational and domestic corporations. Their infrastructure, global connectivity, and proximity to client bases further contribute to their dominance in corporate travel requirements. Emerging hubs like Ahmedabad and Bhubaneswar are also growing as business destinations due to lower operating costs and government incentives for regional economic development.

- The UDAN (Ude Desh ka Aam Naagrik) scheme has been instrumental in boosting regional connectivity by facilitating affordable flights to smaller cities. By 2024, more than 60 new routes were added under this scheme, directly improving accessibility for corporate travelers and expanding business travel options within the country. This initiative helps bridge connectivity gaps, especially for businesses with clients in less accessible regions.

India Corporate Travel Market Segmentation

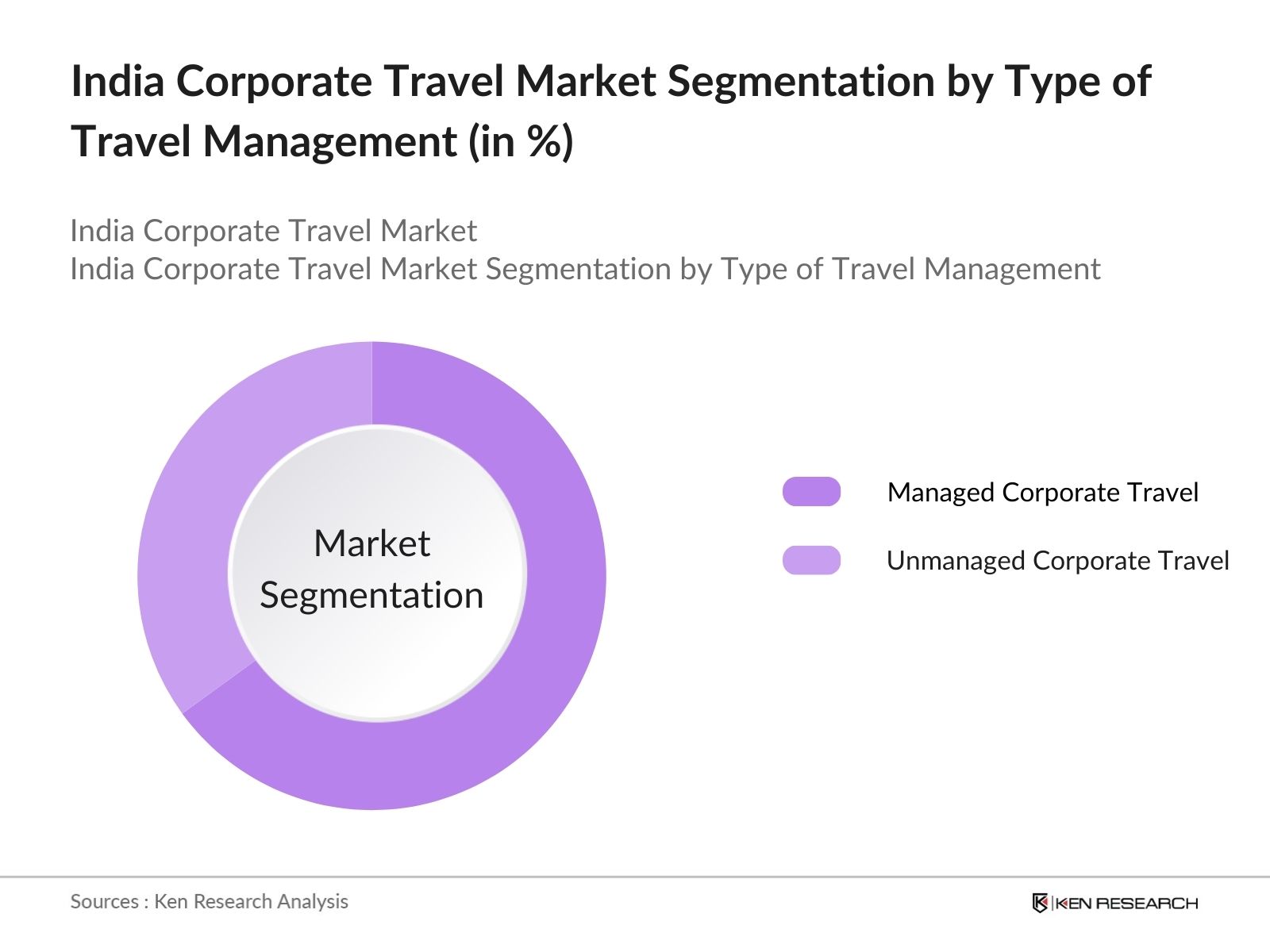

By Type of Travel Management: The market is segmented by type of travel management. Managed corporate travel holds a dominant position in the India Corporate Travel Market. Large corporations favor managed travel programs as they provide comprehensive support for booking, expenses, and travel safety, which are critical in todays travel landscape. Travel Management Companies (TMCs) and Online Travel Agencies (OTAs) facilitate end-to-end travel services with tailored solutions that ensure cost-effectiveness and compliance with corporate travel policies.

By Expenditure Category: The market is also segmented by expenditure category. The travel fare segment holds a substantial share within the expenditure category, as transportation costs constitute a major portion of corporate travel expenses. Airline tickets, which often include business class and flexible fare options, are significant for employees attending high-priority meetings and events.

India Corporate Travel Market Competitive Landscape

The market is competitive, with key players such as MakeMyTrip, Yatra, and Thomas Cook India dominating the market. These companies offer comprehensive corporate travel solutions, often integrating artificial intelligence and machine learning to enhance user experience.

India Corporate Travel Market Analysis

Market Growth Drivers

- Increasing Business Activity Across Major Indian Cities: The corporate travel market in India is driven by the heightened level of business activity in major cities like Mumbai, Delhi, and Bengaluru, which account for a significant share of business travel demand. In 2024, around 1.2 million business trips are anticipated from Mumbai alone, with similar figures projected for Delhi and Bengaluru, indicating a steady demand for corporate travel services.

- Rising Foreign Direct Investment (FDI) and Business Collaborations: The inflow of FDI into India, which amounted to nearly USD 50 billion by mid-2024, has led to an increase in business collaboration and partnership opportunities. This growth in FDI has spurred corporate travel as companies seek to enhance networking, joint ventures, and business expansions. With many international companies setting up or expanding their operations, the demand for travel management services, corporate bookings, and meeting spaces has seen a significant increase, benefiting the corporate travel ecosystem.

- Increase in Small and Medium Enterprises (SME) Participation: India hosts over 60 million SMEs, with a growing number engaging in inter-state and international business activities. The governments support for SMEs through subsidies and easier financing options has allowed these enterprises to expand beyond local boundaries, contributing to a substantial rise in corporate travel needs.

Market Challenges

- High Cost of Corporate Travel and Accommodation: With inflationary pressures on transportation and hotel prices, corporate travel expenses have escalated. As of 2024, the average cost for a three-day domestic business trip in India, covering flights, accommodation, and local transport, is estimated to be INR 1 lakh per employee. Many companies are experiencing budget constraints, which limits the frequency and scale of travel.

- Regional Instabilities and Safety Concerns: Several regions across India face varying levels of political and social instability, impacting the ease of travel for corporate entities. In 2024, travel advisories were issued for certain states due to security concerns, limiting business travel to these areas. Corporate travelers may be deterred from traveling to such areas, impacting the volume of travel and limiting the markets growth in affected regions.

India Corporate Travel Market Future Outlook

Over the next five years, the India Corporate Travel industry is anticipated to grow, driven by an expanding corporate sector, increasing emphasis on travel efficiency, and the evolving needs of businesses for specialized travel services.

Future Market Opportunities

- Growing Demand for Customized Corporate Travel Solutions: Over the next five years, companies will increasingly seek customized corporate travel solutions that align with their specific needs, including customizable itineraries and meeting room access in hotels. By 2029, corporate travel service providers are expected to expand personalized packages that cater to diverse corporate sectors, driven by the evolving preferences of business travelers.

- Increased Use of Data Analytics for Optimizing Travel Budgets: Data analytics in corporate travel management is set to gain traction as companies look to optimize travel expenditures by analyzing travel data. By 2029, around 75% of large corporations are projected to employ analytics-driven solutions to reduce travel costs and improve operational efficiency, offering a competitive advantage for companies in managing travel budgets.

Scope of the Report

|

Type of Travel |

Managed Corporate Travel Unmanaged Corporate Travel |

|

Sector |

IT and BFSI Pharmaceuticals Manufacturing FMCG Energy |

|

Expenditure |

Travel Fare Accommodation Transportation Dining |

|

Company Size |

Small Medium Large Enterprises |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Corporate Travel Managers

Banks and Financial Institution

Private Equity Firms

Travel Management Companies (TMCs)

Hospitality Sector (Hotel Chains)

Airlines and Transportation Services

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Civil Aviation, Ministry of Tourism)

Companies

Players Mentioned in the Report:

MakeMyTrip

Yatra

Thomas Cook India

Cleartrip

CWT

American Express GBT

FCM Travel Solutions

Expedia Group

Cox & Kings

TravelTriangle

Table of Contents

1. India Corporate Travel Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Market Segmentation Overview

2. India Corporate Travel Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Corporate Travel Market Analysis

3.1 Growth Drivers

3.1.1 Hybrid Work Model Adoption

3.1.2 Demand for MICE Travel (Meetings, Incentives, Conventions, and Exhibitions)

3.1.3 Sustainability Focus in Travel Choices

3.1.4 Rising Integration of TMCs (Travel Management Companies)

3.2 Market Challenges

3.2.1 Infrastructure Limitations

3.2.2 High-Cost Structures

3.2.3 Taxation and Compliance Complexities

3.3 Opportunities

3.3.1 Expansion into Tier-2 and Tier-3 Cities

3.3.2 Technological Innovations (e.g., AI, Automation)

3.3.3 Personalization and Loyalty Programs

3.4 Trends

3.4.1 AI and VR for Travel Experience Enhancement

3.4.2 Corporate Demand for Integrated Booking Platforms

3.4.3 Growth in SME Travel Spend

3.5 Government Policies and Initiatives

3.5.1 Policies for MICE Sector Development

3.5.2 GST Benefits for Corporate Travel

3.5.3 Infrastructure Development Programs

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. India Corporate Travel Market Segmentation

4.1 By Type of Travel Management (in Value %)

4.1.1 Managed Corporate Travel

4.1.2 Unmanaged Corporate Travel

4.2 By Sector (in Value %)

4.2.1 IT and BFSI

4.2.2 Pharmaceuticals and Healthcare

4.2.3 Manufacturing and Automotive

4.2.4 FMCG and Retail

4.2.5 Energy and Infrastructure

4.3 By Expenditure Category (in Value %)

4.3.1 Travel Fare

4.3.2 Accommodation

4.3.3 Transportation and Logistics

4.3.4 Dining and Miscellaneous Expenses

4.4 By Company Size (in Value %)

4.4.1 Small Enterprises

4.4.2 Medium Enterprises

4.4.3 Large Enterprises

4.5 By Region (in Value %)

4.5.1 North

4.5.2 East

4.5.3 West

4.5.4 South

5. India Corporate Travel Market Competitive Analysis

5.1 Profiles of Major Competitors

5.1.1 MakeMyTrip

5.1.2 Yatra

5.1.3 Thomas Cook India

5.1.4 Cleartrip

5.1.5 CWT

5.1.6 FCM Travel Solutions

5.1.7 American Express GBT

5.1.8 ATPI

5.1.9 Expedia Group

5.1.10 Cox & Kings

5.1.11 Indias Top OTA and TMC Providers

5.1.12 Uniglobe

5.1.13 Concur Travel

5.1.14 TravelTriangle

5.1.15 HRG Worldwide

5.2 Cross Comparison Parameters (Number of Clients, Inception Year, Total Revenue, Employee Count, Geographical Reach, Service Offerings, Technological Integration, Client Satisfaction Scores)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Partnerships

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Government Grants and Support

5.8 Private Equity and Venture Capital Investment

6. India Corporate Travel Market Regulatory Framework

6.1 Compliance Requirements and Taxation

6.2 Certification and Licensing

6.3 Policy Framework for Sustainability Initiatives

7. India Corporate Travel Future Market Size (in USD Bn)

7.1 Market Forecast

7.2 Key Factors Driving Future Growth

8. India Corporate Travel Future Market Segmentation

8.1 By Travel Type (Value %)

8.2 By Sectoral Demand (Value %)

8.3 By Service Type (Value %)

8.4 By Company Size (Value %)

8.5 By Region (Value %)

9. India Corporate Travel Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Key Target Audience Analysis

9.3 Marketing and Expansion Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map covering all key stakeholders in the India Corporate Travel Market. This step is based on secondary research, accessing proprietary and public databases to gather critical market data, which helps define variables driving market dynamics.

Step 2: Market Analysis and Construction

This stage compiles and assesses historical data, examining market penetration and revenue generation across major segments. Service quality data is also analyzed to validate the accuracy of revenue estimates and provide a clear picture of market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through interviews with industry experts and corporate travel managers. These consultations offer operational and financial insights, ensuring that the data aligns with current industry trends and challenges.

Step 4: Research Synthesis and Final Output

The final stage involves engagement with major travel companies and corporate clients, allowing for detailed insight into product segments and user preferences. This comprehensive approach ensures a robust analysis, validated through both primary and secondary research sources.

Frequently Asked Questions

01. How big is the India Corporate Travel Market?

The India Corporate Travel Market, valued at USD 11 billion, is driven by an increase in business travel demand, especially within the IT, BFSI, and pharmaceutical sectors.

02. What are the challenges in the India Corporate Travel Market?

The India Corporate Travel Market faces challenges including high operational costs, inadequate infrastructure, and complex tax regulations, impacting overall efficiency and cost management for companies.

03. Who are the major players in the India Corporate Travel Market?

Key players in the India Corporate Travel Market include MakeMyTrip, Yatra, Thomas Cook India, and global entities like American Express GBT and CWT, which offer competitive travel solutions for corporate clients.

04. What are the growth drivers of the India Corporate Travel Market?

The India Corporate Travel Market growth is propelled by increased business travel needs, advancements in travel management technology, and a shift towards managed travel solutions among large corporations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.