India Corporate Wellness Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD1964

October 2024

91

About the Report

India Corporate Wellness Market Overview

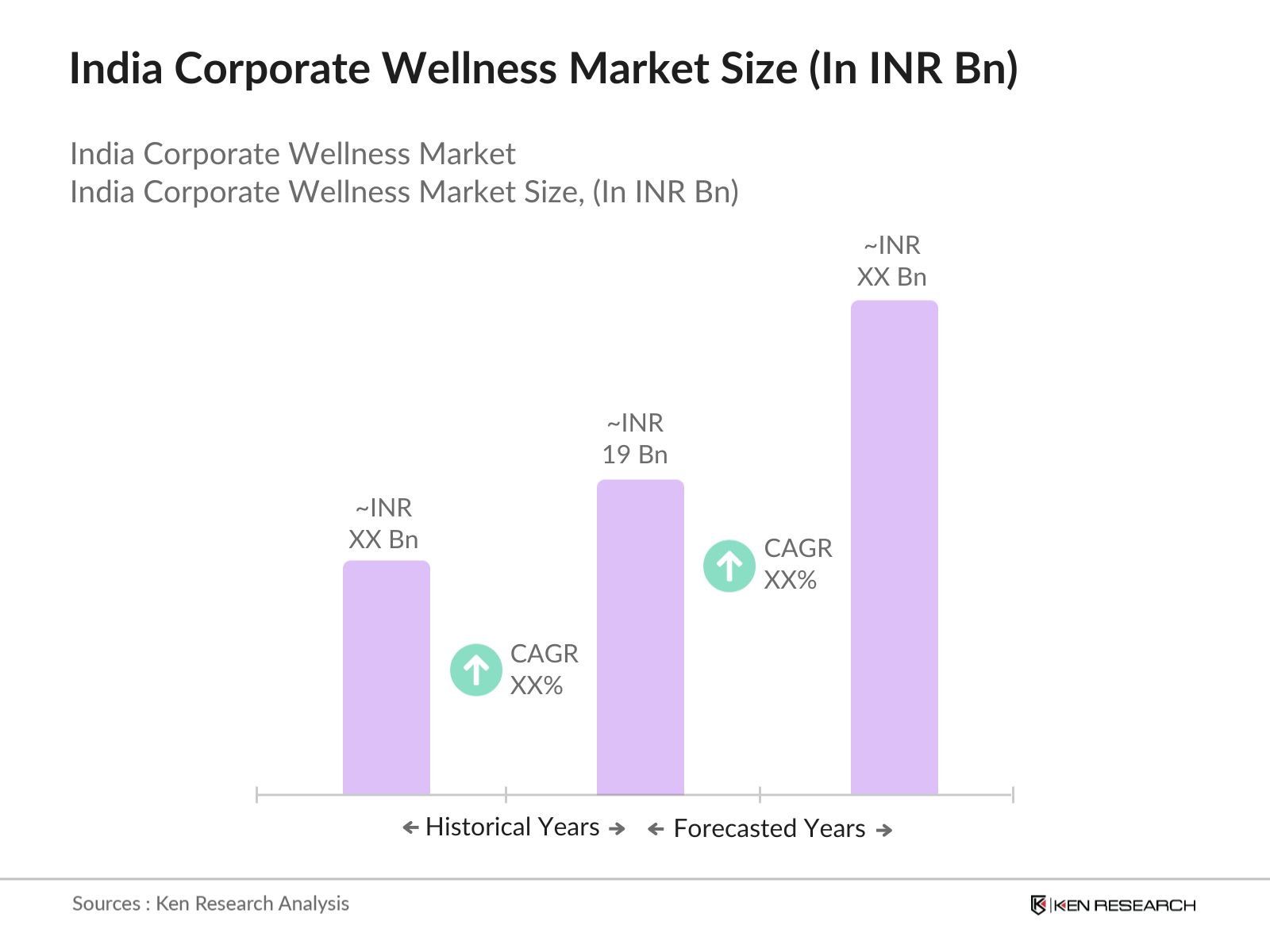

- In 2023, the India corporate wellness market was valued at INR 19 billion. This market is primarily driven by the growing awareness among corporates about the importance of employee well-being and productivity. Increasing healthcare costs and the rising prevalence of chronic diseases among employees have also contributed to the market's growth. The CAGR for the period from 2018 to 2023 is recorded at 12.6%, reflecting a steady increase in corporate investments in wellness programs to improve employee health and productivity.

- Major players in the India corporate wellness market include Truworth Wellness, Apollo Life, HealthifyMe, Optum Health, and Workplace Options. These companies offer a range of services, including health assessments, fitness programs, mental health support, and nutritional guidance, tailored to meet the specific needs of corporate clients. Their strong presence and comprehensive service offerings have enabled them to maintain a dominant position in the market.

- In March 2021, Medibuddy, a leading digital healthcare platform in India, introduced a new initiative named Medibuddy Wellness, specifically designed for corporate employees. This program focuses on enhancing employee well-being by offering comprehensive wellness services, including health assessments, fitness plans, and mental health support, tailored to meet the needs of the corporate workforce in India.

- Major metropolitan cities such as Mumbai, Delhi, Bengaluru, and Hyderabad dominate the corporate wellness market in India. This dominance is primarily due to the high concentration of multinational companies and large corporate offices in these cities. Additionally, these cities have a higher awareness and adoption rate of wellness programs, driven by a well-educated workforce and the availability of advanced healthcare infrastructure.

India Corporate Wellness Market Segmentation

By Service Type: The India corporate wellness market is segmented by service type into health risk assessments, nutrition and weight management, smoking cessation, fitness services, and stress management. In 2023, health risk assessments held a dominant market share due to the rising demand for personalized wellness programs and the focus on early detection of chronic diseases among employees. Companies are increasingly opting for these assessments to identify health risks and implement targeted interventions, contributing to the dominance of this segment.

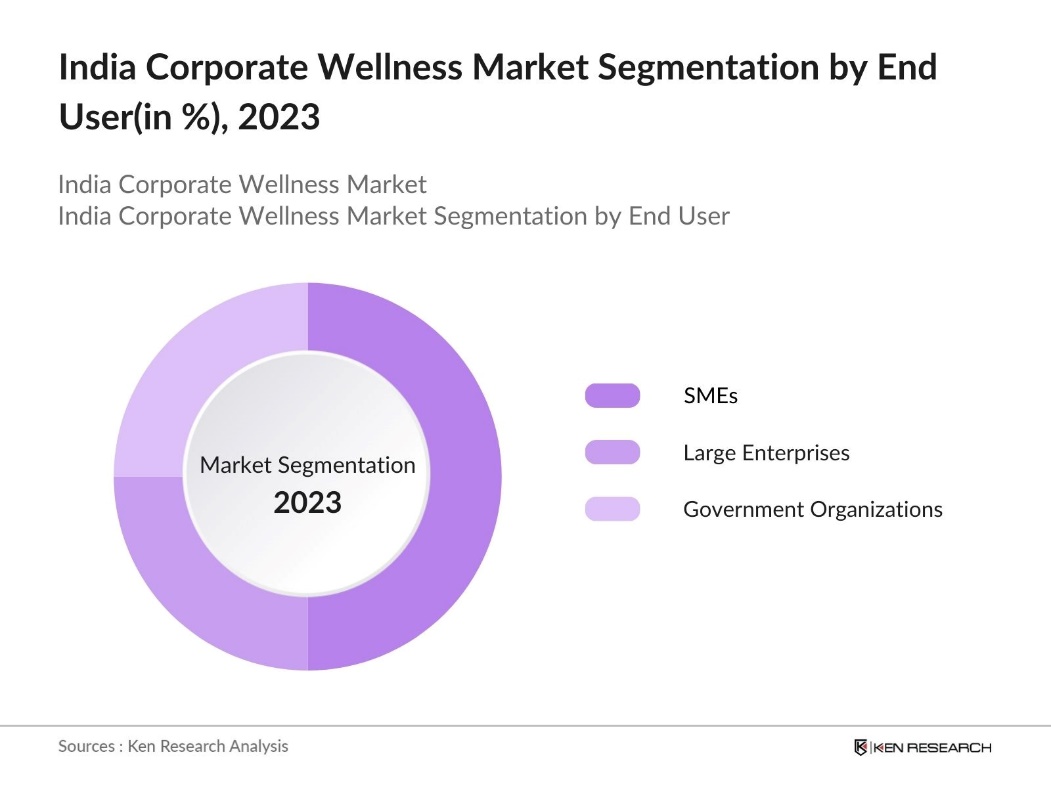

By End-User: By end-user, the market is segmented into small and medium enterprises (SMEs), large enterprises, and government organizations. Large enterprises dominated the market share in 2023 due to their substantial financial resources and larger workforce, enabling them to invest heavily in comprehensive wellness programs. These enterprises often have structured wellness initiatives, including gym memberships, wellness apps, and mental health counseling services, which help them retain and attract talent, thereby driving the dominance of this segment.

By Region: The regional segmentation of the India corporate wellness market includes North, South, East, and West India. In 2023, South India led the market share due to the high concentration of IT and ITES companies in cities like Bengaluru, Chennai, and Hyderabad. These sectors are proactive in adopting wellness programs to enhance employee satisfaction and reduce turnover rates. The region's focus on promoting a healthy work-life balance has contributed significantly to its leading position in the corporate wellness market.

India Corporate Wellness Market Competitive Landscape

|

Company |

Established Year |

Headquarters |

|---|---|---|

|

Truworth Wellness |

2011 |

Jaipur, Rajasthan |

|

Apollo Life |

2008 |

Hyderabad, Telangana |

|

HealthifyMe |

2012 |

Bengaluru, Karnataka |

|

Optum Health |

1999 |

Gurugram, Haryana |

|

Workplace Options |

1982 |

Bengaluru, Karnataka |

- Truworth Wellness: Truworth Wellness has launched CarePass, an innovative health membership designed for corporate employees in India, focusing on primary and preventive care needs. This comprehensive solution includes services like doctor consultations, health checks, diagnostics, pharmacy, dental, and vision care, all accessible through their SOC2 Type2 certified platform, "The Wellness Corner," enhancing employee health management and convenience.

- Apollo Life: Apollo Life has recently expanded its corporate wellness offerings in India through a comprehensive program that integrates fitness, preventive healthcare, and wellness solutions. This initiative includes services such as health checks, physiotherapy, and personalized wellness plans, aimed at enhancing employee well-being and productivity within corporate settings, leveraging both physical facilities and digital platforms for better health management.

India Corporate Wellness Market Analysis

Growth Drivers

-

Impact on Absenteeism and Productivity: Companies that have adopted wellness programs report tangible benefits, including a 22% increase in employee productivity and a 14% reduction in medical costs per employee. These improvements are linked to reduced absenteeism, as wellness initiatives help employees manage their health more effectively.

-

Rising Prevalence of Lifestyle Diseases: The rise in lifestyle diseases such as diabetes, hypertension, and heart conditions among India's working population has significantly driven the corporate wellness market. A 2023 National Health Profile report indicates 40% of urban workers are at risk, leading companies to adopt wellness programs focused on weight management, smoking cessation, and stress management, boosting employee engagement by up to 30%.

- Technological Integration in Wellness Programs: The integration of technology into corporate wellness programs has emerged as a critical growth driver in 2024. The adoption of digital health platforms, wearable devices, and mobile apps has facilitated real-time health monitoring and personalized wellness solutions. These technological advancements allow for more effective data-driven health interventions, enhancing the overall impact and reach of corporate wellness initiatives.

Challenges

- Low Awareness and Participation Among SMEs: Despite the growing awareness of corporate wellness benefits, small and medium enterprises (SMEs) in India face significant challenges in implementing these programs. The cost of setting up wellness programs is a considerable barrier for SMEs, which often operate on tighter budgets and cannot afford the high upfront costs associated with comprehensive wellness initiatives.

- Cultural Barriers and Stigma Around Mental Health: Cultural attitudes and stigma associated with mental health continue to pose challenges to the corporate wellness market in India. This cultural stigma prevents many employees from participating in mental health programs offered by their employers, limiting the effectiveness and reach of these wellness initiatives.

Government Initiatives

- National Mental Health Program: The Indian Government's National Mental Health Program is a comprehensive initiative aimed at improving mental health services across the country. It focuses on providing accessible care, raising awareness, and promoting mental well-being, including in workplaces. The program integrates mental health into primary healthcare systems, ensuring early intervention and support. By addressing stigma and providing education on mental health, it aims to create a healthier, more supportive environment for individuals and employees nationwide.

- Ayushman Bharat Digital Mission: The Ayushman Bharat Digital Mission (ABDM) is a major government initiative aimed at creating the world's largest digital health ecosystem. It focuses on universal health coverage and enhancing digital infrastructure, which supports the corporate wellness market by facilitating accessible healthcare services and promoting comprehensive wellness programs for employees across India.

India Corporate Wellness Market Future Outlook

Market Trends

The India Corporate Wellness Market is projected to grow exponentially by 2028. This growth will be driven by the Impact on Absenteeism and Productivity, Rising Prevalence of Lifestyle Diseases and Technological Integration in Wellness Programs.

- Growth of AI and Machine Learning in Wellness Programs: Over the next five years, the integration of AI and machine learning in corporate wellness programs is expected to surge, providing more personalized and predictive health solutions. This trend will likely be driven by advancements in digital health technology and the increasing availability of data analytics tools that enable real-time health monitoring and personalized intervention strategies.

- Expansion of Wellness Services to Include Family Members: Looking ahead to 2028, there will be a growing trend among Indian companies to extend wellness programs beyond employees to include their family members. This approach is expected to enhance employee satisfaction and loyalty. By encompassing the health of employees' families, companies aim to create a more supportive and holistic wellness environment, thereby fostering a healthier and more productive workforce.

Scope of the Report

|

By Service Type |

health risk assessments nutrition and weight management smoking cessation fitness services stress management |

|

By Fuel Type |

small and medium enterprises (SMEs) large enterprises government organizations |

|

By Region |

North South East West |

Products

Key Target Audience

Corporate HR Departments

Large Enterprises

Small and Medium Enterprises (SMEs)

Insurance Companies

Health and Wellness Providers

Technology Firms specializing in Health Tech

Pharmaceutical Companies

Hospitals and Healthcare Providers

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare)

Investment and Venture Capitalist Firms

Occupational Health Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Truworth Wellness

Apollo Life

HealthifyMe

Optum Health

Workplace Options

Talwalkars Health Clubs

VLCC Healthcare Ltd.

Fitternity

Stepathlon Lifestyle Pvt. Ltd.

FYI Health

Indian Health Organisation (IHO)

The Workplace Health Company

Premise Health

HealthCubed

Medall Healthcare Pvt. Ltd.

Table of Contents

01. India Corporate Wellness Market Overview

1.1. Market Definition and Scope

1.2. Market Size and Growth

1.3. Key Market Drivers

1.4. Overview of Market Segmentation

1.5. Dominant Cities and Regional Insights

02. India Corporate Wellness Market Size and Analysis, 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. India Corporate Wellness Market Dynamics

3.1. Growth Drivers

3.1.1. Impact on absenteeism and productivity

3.1.2. Rising Prevalence of Lifestyle Diseases

3.1.3. Technological Integration in Wellness Programs

3.2. Market Challenges

3.2.1. Low Awareness and Participation Among SMEs

3.2.2. Cultural Barriers and Stigma Around Mental Health

3.2.3. Fragmented Regulatory Framework

3.3. Government Initiatives

3.3.1. National Mental Health Program

3.3.2. Ayushman Bharat Digital Mission

3.3.3. Workplace Wellness Promotion by Ministry of Labour and Employment

3.4. Current Market Trends

3.4.1. Shift Towards Holistic Wellness Programs

3.4.2. Increased Focus on Digital Wellness Platforms

3.4.3. Partnerships and Collaborations with Healthcare Providers

04. India Corporate Wellness Market Segmentation, 2023

4.1. By Service Type (Value %)

4.1.1. Health Risk Assessments

4.1.2. Nutrition and Weight Management

4.1.3. Smoking Cessation

4.1.4. Fitness Services

4.1.5. Stress Management

4.2. By End-User (Value %)

4.2.1. Small and Medium Enterprises (SMEs)

4.2.2. Large Enterprises

4.2.3. Government Organizations

4.3. By Region (Value %)

4.3.1. North India

4.3.2. South India

4.3.3. East India

4.3.4. West India

05. India Corporate Wellness Market Competitive Landscape

5.1. Key Players and Market Share Analysis

5.2. Strategic Initiatives and Developments

5.3. Mergers, Acquisitions, and Investments

5.4. Company Profiles

5.4.1. Truworth Wellness

5.4.2. Apollo Life

5.4.3. HealthifyMe

5.4.4. Optum Health

5.4.5. Workplace Options

06. India Corporate Wellness Market Regulatory and Legal Framework

6.1. Regulatory Policies and Guidelines

6.2. Certification and Compliance Requirements

07. India Corporate Wellness Market Forecast, 2023-2028

7.1. Future Market Size Projections

7.2. Factors Influencing Future Market Growth

08. Future Market Trends and Opportunities, 2028

8.1. AI and Machine Learning in Wellness Programs

8.2. Expansion of Wellness Services to Include Family Members

8.3. Increased Investment in Mental Health Programs

09. Strategic Insights and Analyst Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Customer and Market Potential Analysis

9.3. Key Strategic Initiatives for Market Penetration

10. India Corporate Wellness Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Strategic Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Frequently Asked Questions

1. How big is the India corporate wellness market?

The India corporate wellness market was valued at INR 19 billion in 2023. This growth is primarily driven by increasing corporate awareness of employee well-being, rising healthcare costs, and the prevalence of lifestyle-related diseases among the workforce.

2. What are the challenges in the India corporate wellness market?

Challenges in the India corporate wellness market include low participation rates among SMEs due to budget constraints, cultural stigma associated with mental health issues, and a fragmented regulatory environment that lacks standardized guidelines for wellness programs.

3. Who are the major players in the India corporate wellness market?

Key players in the India corporate wellness market include Truworth Wellness, Apollo Life, HealthifyMe, Optum Health, and Workplace Options. These companies lead the market due to their extensive service offerings, strong client base, and innovative wellness solutions.

4. What are the growth drivers of the India corporate wellness market?

The market is driven by increased corporate investment in employee health, rising prevalence of lifestyle diseases, and technological advancements that integrate digital health solutions into wellness programs. Government support and incentives also play a significant role in promoting wellness initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.