India Cosmetic Packaging Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD9941

December 2024

95

About the Report

India Cosmetic Packaging Market Overview

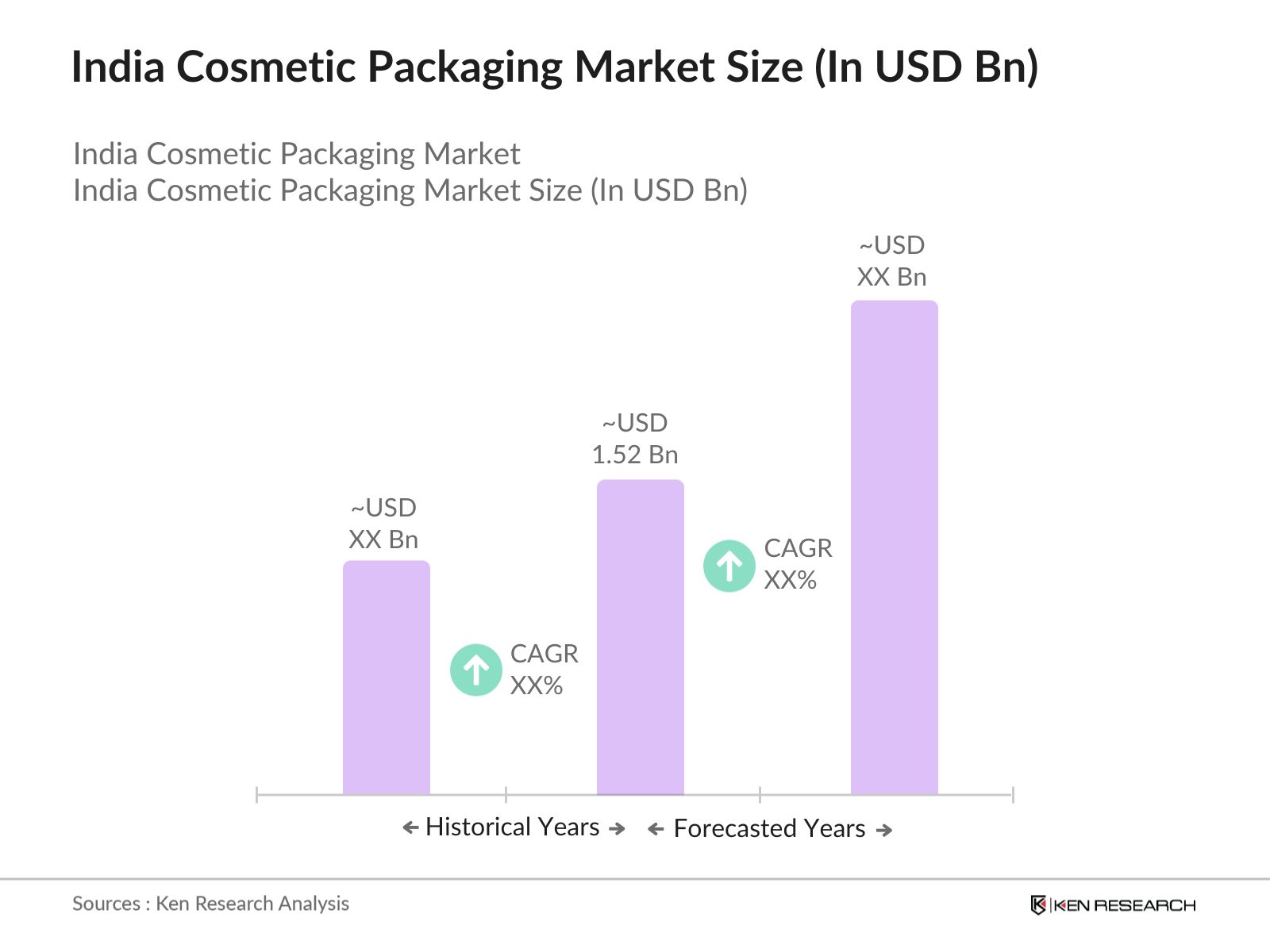

- The India cosmetic packaging market is valued at USD 1.52 billion, based on a five-year historical analysis. This growth is driven by increasing consumer demand for cosmetics, advancements in packaging technologies, and a shift towards sustainable packaging solutions. The expansion of e-commerce platforms has also contributed to the rising demand for innovative and attractive packaging.

- Major metropolitan areas such as Mumbai, Delhi, and Bangalore dominate the market due to their large urban populations, higher disposable incomes, and a growing awareness of personal grooming. These cities serve as hubs for both domestic and international cosmetic brands, further bolstering the demand for diverse packaging solutions.

- The Indian government has implemented several policies to encourage sustainable packaging, particularly within the cosmetics industry. In 2023, the Ministry of Environment released packaging regulations requiring companies to limit single-use plastics, aiming to reduce plastic waste by 20% by 2025. Cosmetic companies must adapt their packaging to meet these new standards, fostering the use of biodegradable and recyclable materials. These policies promote an eco-friendly shift in the industry, compelling manufacturers to innovate and comply with sustainable practices.

India Cosmetic Packaging Market Segmentation

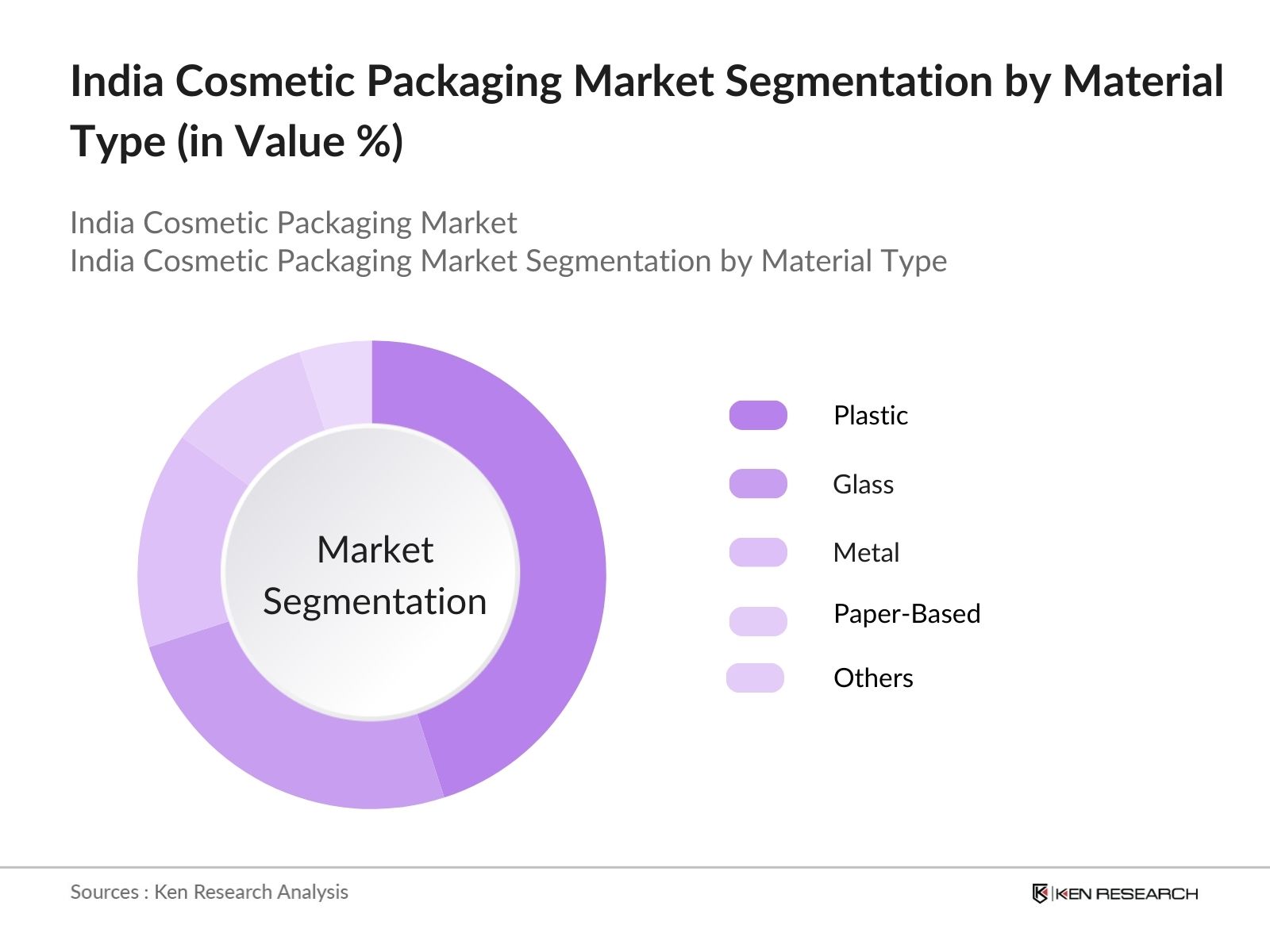

- By Material Type: The market is segmented by material type into plastic, glass, metal, paper-based, and others. Plastic packaging holds a dominant market share due to its versatility, cost-effectiveness, and lightweight nature. It offers flexibility in design and is widely used for various cosmetic products, making it a preferred choice among manufacturers.

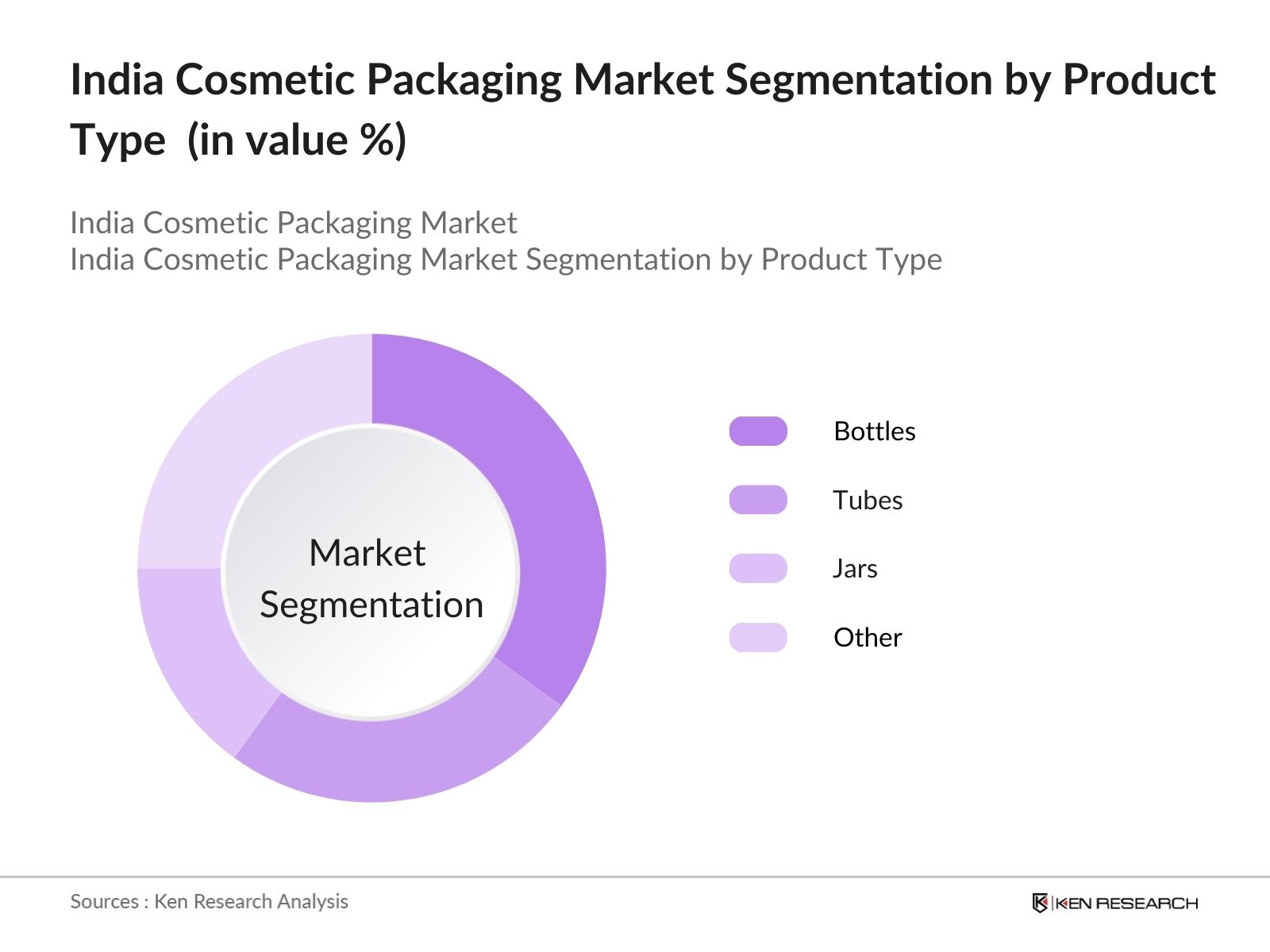

- By Product Type: The market is also segmented by product type into bottles, tubes, jars, containers, blister & strip packs, aerosol cans, folding cartons, flexible plastics, and others. Bottles have a dominant market share, primarily due to their extensive use in packaging liquid cosmetics such as shampoos, lotions, and perfumes. Their durability and ease of use make them a popular choice among consumers and manufacturers alike.

India Cosmetic Packaging Market Competitive Landscape

The India cosmetic packaging market is characterized by the presence of both domestic and international players, leading to a competitive environment. Key companies focus on innovation, sustainability, and strategic partnerships to maintain their market positions.

Company Name | Establishment Year | Headquarters | Revenue (USD Million) | Product Portfolio | Regional Presence | Sustainability Initiatives | Technological Innovations |

Amcor PLC | 1860 | Zurich, Switzerland | - | - | - | - | - |

Berry Global Inc. | 1967 | Evansville, USA | - | - | - | - | - |

AptarGroup Inc. | 1940 | Crystal Lake, USA | - | - | - | - | - |

Gerresheimer AG | 1864 | Dsseldorf, Germany | - | - | - | - | - |

Huhtamaki Oyj | 1920 | Espoo, Finland | - | - | - | - | - |

India Cosmetic Packaging Market Analysis

Market Growth Drivers

- Rising Consumer Demand for Cosmetics: Indias rising disposable income is directly fueling growth in the cosmetics sector. In 2023, the country saw a substantial increase in per capita income, reaching over 172,000 INR, up from 150,000 INR in 2022. This growth has heightened demand for personal care products and cosmetics, driving expansion in packaging requirements to meet consumer needs. Additionally, Indias younger demographic, with over 65% of the population under the age of 35, has increased consumption, aligning with changing lifestyle preferences toward premium cosmetic brands and packaging.

- Advancements in Packaging Technologies: Technological advancements in India are enabling innovative packaging for cosmetics, catering to durability and aesthetic appeal. For example, in 2023, around 18,000 cosmetic brands reported a shift to advanced packaging methods such as airless bottles and flexible pouches to improve product longevity and reduce waste. Packaging technology in India has also seen an increase in automation, with manufacturing plants like the ones in Maharashtra and Tamil Nadu upgrading to robotics for efficient, precision-driven production processes. The adoption of such technologies has positioned India as an emerging hub for cosmetic packaging innovation.

- Shift Towards Sustainable Packaging Solutions: There is a notable shift toward sustainable cosmetic packaging in India, driven by consumer awareness and government regulations promoting eco-friendly practices. As per the Central Pollution Control Board (CPCB), India generated 3.4 million tons of plastic waste in 2022, urging industries, including cosmetics, to adopt biodegradable or recyclable packaging. The Ministry of Environment, Forest, and Climate Change (MOEFCC) has promoted these shifts with stringent packaging guidelines, motivating brands to integrate materials such as bioplastics and plant-based materials. This transition aligns with Indias commitment to reducing its carbon footprint by 33% by 2030.

Market Challenges

- Fluctuating Raw Material Prices: The Indian cosmetic packaging industry faces substantial challenges due to fluctuations in raw material prices, particularly for plastics and resins. According to the Ministry of Chemicals and Fertilizers, in 2023, Indias raw material imports reached about 15 million tons, with notable price increases due to supply chain disruptions. The unstable pricing environment has impacted manufacturers, as sourcing costs have grown unpredictably, affecting their profit margins. This challenge is expected to persist as global supply dynamics shift and India remains heavily reliant on imports for packaging materials.

- Regulatory Compliance and Standards: Stringent regulations on packaging materials pose challenges for cosmetic companies aiming to comply with safety and environmental standards. The Bureau of Indian Standards (BIS) introduced updated packaging guidelines in 2022, requiring all cosmetic packaging to meet specific chemical safety benchmarks to minimize consumer health risks. Compliance costs are substantial, especially for small and medium enterprises (SMEs) that form a large portion of the industry. Non-compliance could result in fines or product recalls, affecting market performance and pushing companies toward higher investments in regulatory adherence

India Cosmetic Packaging Market Future Outlook

Over the next five years, the India cosmetic packaging market is expected to show growth driven by continuous advancements in packaging technologies, increasing consumer demand for eco-friendly solutions, and the expansion of the cosmetics industry. The shift towards sustainable and innovative packaging is anticipated to create new opportunities for market players.

Market Opportunities

- Growth in Organic and Natural Cosmetics Segment: Indias organic and natural cosmetics segment has seen notable growth due to a surge in consumer interest in sustainable and natural products. In 2023, the National Medicinal Plants Board (NMPB) reported a 20% increase in organic ingredient imports for cosmetics. This shift is creating demand for packaging that emphasizes natural aesthetics and biodegradable materials. The focus on organic cosmetics aligns with growing consumer preferences, offering companies an opportunity to tap into this expanding segment with innovative packaging solutions that highlight their sustainability and natural appeal.

- Innovations in Smart Packaging: The adoption of smart packaging is an emerging opportunity within the Indian cosmetic market, driven by consumer demand for innovative, interactive solutions. In 2023, the National Association of Software and Service Companies (NASSCOM) reported that Indian technology firms have developed over 500 smart packaging solutions for cosmetics that utilize QR codes and RFID for traceability and customer engagement. This trend enables brands to enhance customer experiences, provide product authenticity details, and gather consumer insights, positioning smart packaging as a valuable tool in the digital transformation of the cosmetics industry.

Scope of the Report

Material Type | Plastic Glass Metal Paper-Based Others |

Product Type | Bottles Tubes Jars Others |

Application | Skin Care Hair Care Color Cosmetics Sun Care Oral Care Fragrances & Perfumes Others |

Capacity | Less than 50 ml 50-100 ml 101-200 ml 201-500 ml Above 500 ml |

Region | North India South India East India West India Central India |

Products

Key Target Audience

Cosmetic Manufacturers

Packaging Material Suppliers

Retailers and Distributors

E-commerce Platforms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Bureau of Indian Standards)

Research and Development Institutes

Environmental Organizations

Companies

Players Mentioned in the Report

Amcor PLC

Berry Global Inc.

AptarGroup Inc.

Gerresheimer AG

Huhtamaki Oyj

Essel Propack Limited

HCP Packaging

Albea Group

Quadpack Industries

Sonoco Products Company

Table of Contents

1. India Cosmetic Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Cosmetic Packaging Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Cosmetic Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Demand for Cosmetics

3.1.2. Advancements in Packaging Technologies

3.1.3. Shift Towards Sustainable Packaging Solutions

3.1.4. Expansion of E-commerce Platforms

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Regulatory Compliance and Standards

3.2.3. High Competition Among Local and Global Players

3.3. Opportunities

3.3.1. Growth in Organic and Natural Cosmetics Segment

3.3.2. Innovations in Smart Packaging

3.3.3. Increasing Male Grooming Product Segment

3.4. Trends

3.4.1. Adoption of Eco-friendly Materials

3.4.2. Customization and Personalization in Packaging

3.4.3. Use of Refillable and Reusable Packaging

3.5. Government Regulations

3.5.1. Policies Promoting Sustainable Packaging

3.5.2. Standards for Packaging Safety and Quality

3.5.3. Initiatives Supporting Domestic Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Cosmetic Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Plastic

4.1.2. Glass

4.1.3. Metal

4.1.4. Paper-Based

4.1.5. Others

4.2. By Product Type (In Value %)

4.2.1. Bottles

4.2.2. Tubes

4.2.3. Jars

4.2.4. Others

4.3. By Application (In Value %)

4.3.1. Skin Care

4.3.2. Hair Care

4.3.3. Color Cosmetics

4.3.4. Sun Care

4.3.5. Oral Care

4.3.6. Fragrances & Perfumes

4.3.7. Others

4.4. By Capacity (In Value %)

4.4.1. Less than 50 ml

4.4.2. 50-100 ml

4.4.3. 101-200 ml

4.4.4. 201-500 ml

4.4.5. Above 500 ml

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

4.5.5. Central India

5. India Cosmetic Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amcor PLC

5.1.2. Berry Global Inc.

5.1.3. AptarGroup Inc.

5.1.4. Gerresheimer AG

5.1.5. Huhtamaki Oyj

5.1.6. Essel Propack Limited

5.1.7. HCP Packaging

5.1.8. Albea Group

5.1.9. Quadpack Industries

5.1.10. Sonoco Products Company

5.1.11. Silgan Holdings Inc.

5.1.12. DS Smith PLC

5.1.13. Graham Packaging Company

5.1.14. Libo Cosmetics Company Ltd.

5.1.15. Hindustan National Glass & Industries Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Regional Presence, Sustainability Initiatives, Technological Innovations, Strategic Partnerships, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By Application (In Value %)

8.4. By Capacity (In Value %)

8.5. By Region (In Value %)

9. Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Cosmetic Packaging Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Cosmetic Packaging Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cosmetic packaging manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Cosmetic Packaging market.

Frequently Asked Questions

01. How big is the India Cosmetic Packaging Market?

The India Cosmetic Packaging Market was valued at USD 1.52 billion, driven by rising consumer demand, growth in e-commerce, and an increased focus on sustainable packaging solutions.

02. What factors are driving growth in the India Cosmetic Packaging Market?

Growth in this market is fueled by advancements in packaging technologies, rising urbanization, and increased consumer awareness of eco-friendly products. These factors contribute to the demand for innovative packaging across multiple cosmetic segments.

03. Who are the major players in the India Cosmetic Packaging Market?

Key players include Amcor PLC, Berry Global Inc., AptarGroup Inc., Gerresheimer AG, and Huhtamaki Oyj, all of whom contribute to the competitive landscape with innovations and sustainable packaging practices.

04. What challenges does the India Cosmetic Packaging Market face?

The market faces challenges such as fluctuating raw material prices, regulatory compliance requirements, and intense competition among local and global players, all impacting profit margins.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.