India Crane Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD6355

November 2024

96

About the Report

India Crane Market Overview

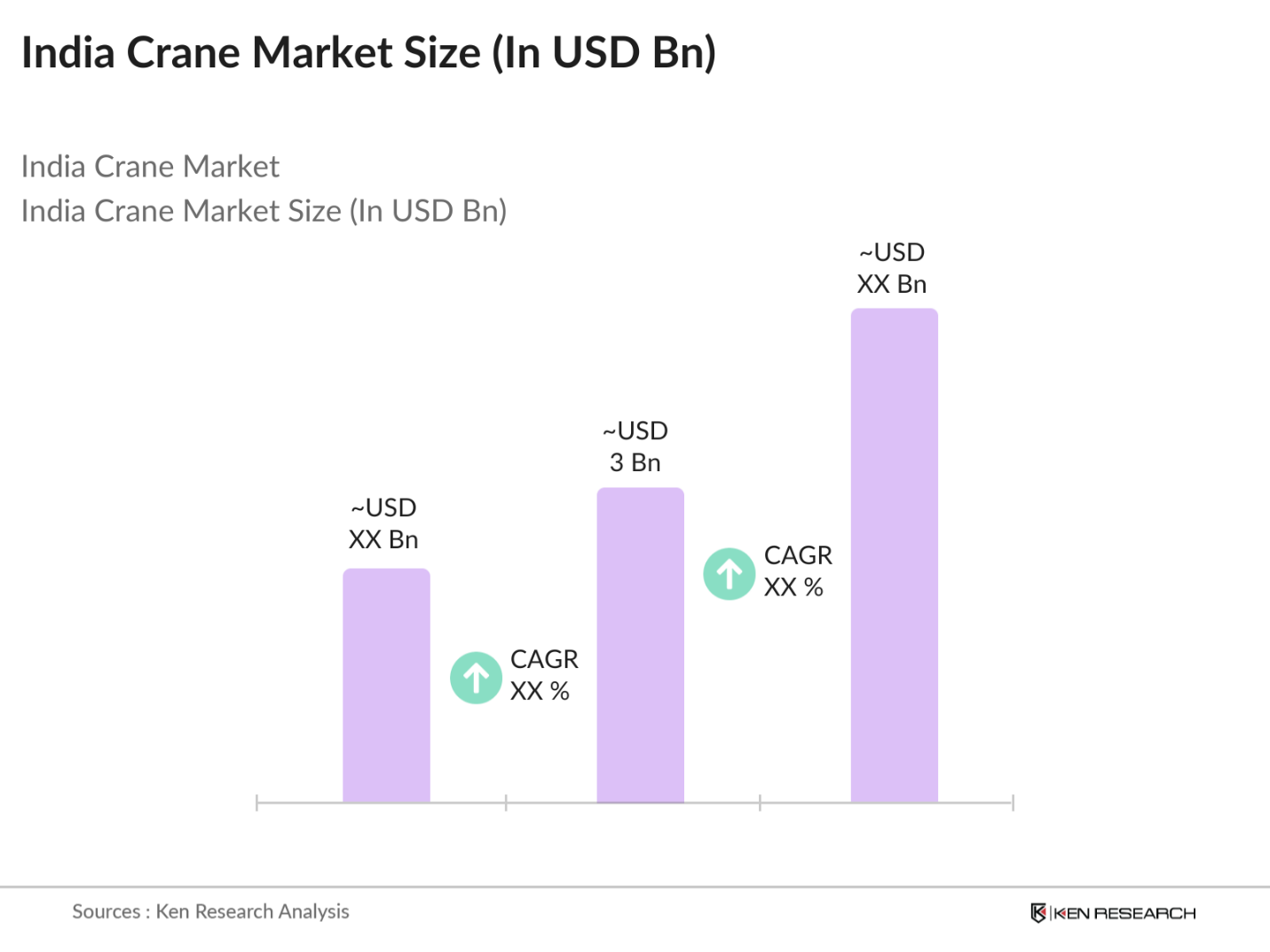

- The India crane market is valued at USD 3 billion, based on a five-year historical analysis. This market is primarily driven by infrastructure projects, including the expansion of highways, bridges, and urban real estate developments. Government initiatives like the National Infrastructure Pipeline and Smart City projects have significantly increased the demand for cranes across construction, utilities, and transportation sectors. Additionally, the rising adoption of advanced technologies such as automation in crane operations and the increasing use of mobile cranes in diverse terrains contribute to the steady growth of the market.

- Mumbai, Delhi, and Bangalore are key cities dominating the crane market in India. The dominance of these cities stems from their significant contribution to infrastructure projects, real estate development, and industrial expansions. These regions serve as major hubs for economic activity, with a high concentration of both public and private sector investments in construction, driving the demand for various types of cranes. The presence of leading construction companies and international firms further solidifies the markets dominance in these cities.

- Indias Bureau of Indian Standards (BIS) mandates safety norms for construction equipment, aligning with OSHA guidelines. These regulations ensure that cranes meet rigorous safety requirements, including load capacity limits and operator safety protocols. In 2023, over 200 crane-related accidents were reported, highlighting the need for strict adherence to safety standards. BIS-compliant cranes are equipped with safety features like overload protection systems and emergency brakes, making safety compliance critical for manufacturers and users alike.

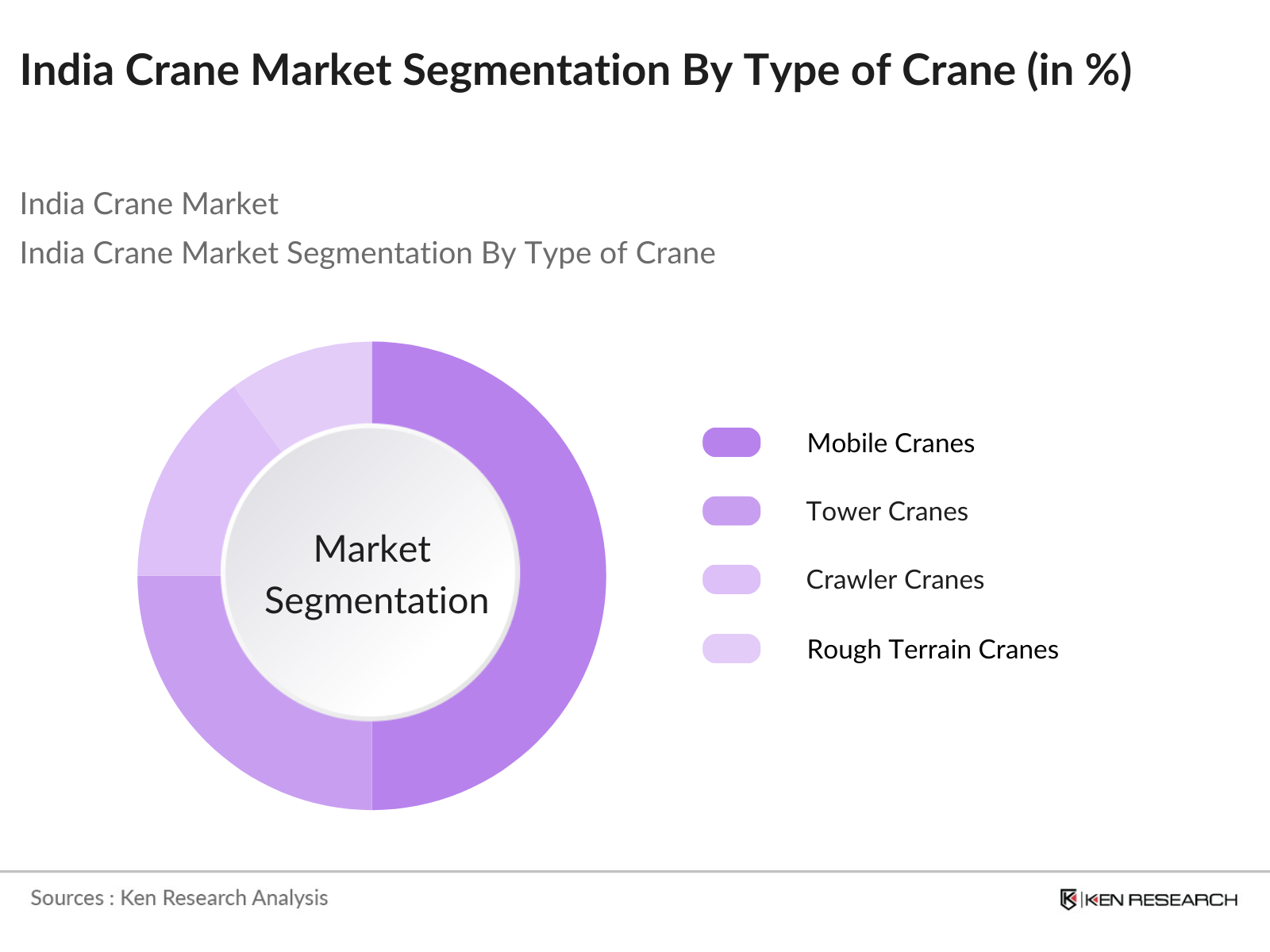

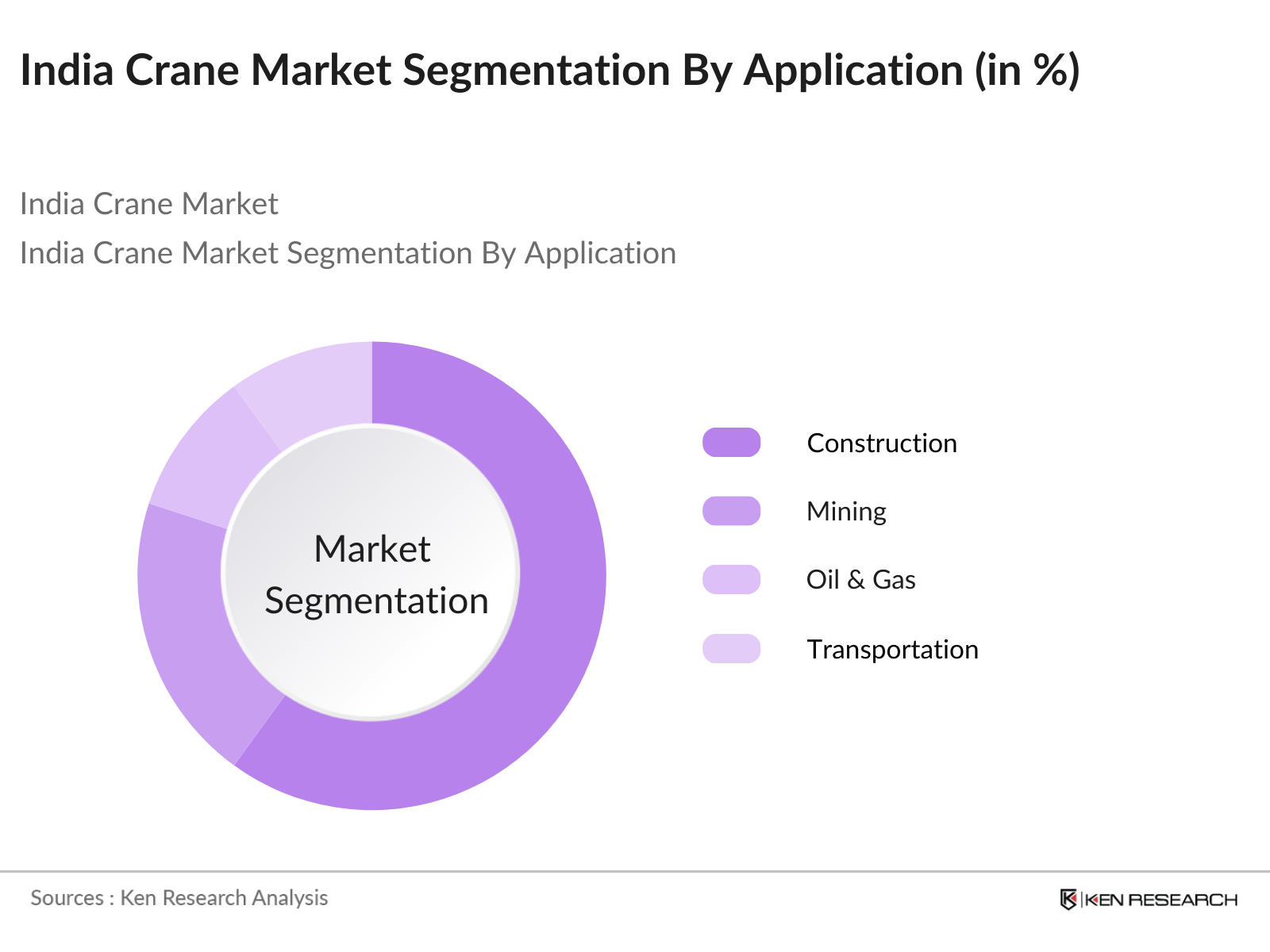

India Crane Market Segmentation

By Type of Crane: The India crane market is segmented by type of crane into mobile cranes, tower cranes, crawler cranes, rough terrain cranes, and all-terrain cranes. Among these, mobile cranes dominate the market due to their versatility, ease of transportation, and widespread use across construction, logistics, and infrastructure projects.

By Application: The crane market in India is also segmented by application into construction, mining, oil & gas, transportation, and utilities & infrastructure. The construction sector is the largest application segment, driven by ongoing infrastructure projects such as the development of highways, bridges, and residential complexes. The increased focus on urbanization and housing projects, along with government programs like Housing for All, has significantly increased the demand for cranes in construction.

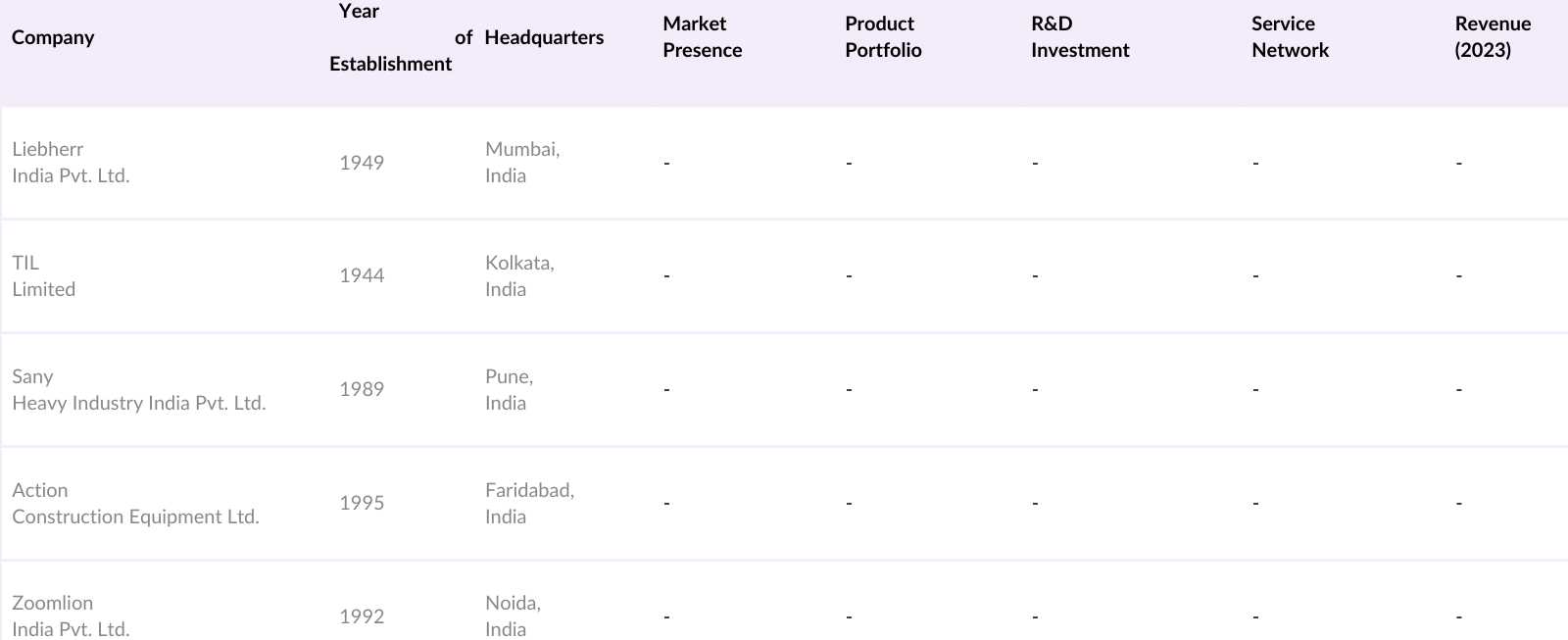

India Crane Market Competitive Landscape

The India crane market is dominated by several key players who have established themselves with strong brand equity, expansive distribution networks, and technological innovations. The competitive landscape is characterized by both local and international companies, many of which have made strategic investments to capture larger market shares. These companies offer a broad portfolio of cranes catering to various industries, including construction, mining, and utilities.

India Crane Industry Analysis

Growth Drivers

- Infrastructure Development (Government Investments, Smart Cities): India's infrastructure investments are set to reach USD 1.4 trillion between 2020 and 2025, driven by the National Infrastructure Pipeline (NIP). Government initiatives like Smart Cities Mission have allocated INR 2.05 lakh crore to 100 cities, focusing on improving urban infrastructure, including roads, bridges, and airports. Such developments create increased demand for cranes, essential for high-scale construction projects.

- Expansion in Construction Sector (Housing, Commercial, Industrial Projects): The Indian construction sector is poised for rapid expansion, valued at USD 640 billion in 2024, primarily driven by the governments affordable housing push and industrial expansion projects. In 2023, over 70 lakh houses were sanctioned under the Pradhan Mantri Awas Yojana, while private sector commercial real estate investments hit USD 2.6 billion. The construction of industrial facilities and logistical hubs, particularly in tier-II cities, necessitates the use of cranes for lifting and assembly tasks.

- Rise in Demand for Heavy Machinery (Industrial Expansion, Warehousing Growth): India's warehousing market, driven by the e-commerce boom, reached 380 million sq. ft. of capacity by 2023, with substantial investments from multinational companies. This growing demand necessitates efficient material handling, leading to a surge in the use of cranes for heavy machinery movement and warehousing tasks. Concurrently, industrial sectors, such as steel and automotive manufacturing, continue to expand, with over 135 million tons of steel production expected by 2024.

Market Challenges

- High Initial Costs of Cranes (CapEx, Maintenance): The high capital expenditure required to purchase cranes is a significant barrier for small and medium enterprises in India. On average, the price for a mid-sized crane ranges from INR 75 lakh to INR 1.5 crore, depending on its capacity. Additionally, maintenance and operational costs add further financial burden, as annual maintenance expenses can exceed INR 10 lakh for larger cranes.

- Fluctuations in Steel Prices (Raw Material Costs, Supply Chain): Steel, a critical component in crane manufacturing, experienced price volatility throughout 2022 and 2023 due to global supply chain disruptions and geopolitical issues. In 2023, steel prices ranged from INR 55,000 to INR 70,000 per ton, contributing to fluctuating manufacturing costs. India imports a substantial portion of its steel, further impacting the crane market, as price increases translate directly to higher crane production costs.

India Crane Market Future Outlook

The India crane market is expected to experience significant growth over the next five years, driven by ongoing infrastructure developments, the expansion of the construction sector, and increasing government initiatives aimed at modernizing the countrys transportation and urban infrastructure. Furthermore, advancements in crane technologies such as automation, hybrid engines, and the integration of IoT solutions for predictive maintenance will further enhance operational efficiency and reduce costs, making cranes an essential component in upcoming projects across various industries.

Market Opportunities

- Technological Advancements (Automation, Remote Monitoring): Indias adoption of automated crane technologies has surged, with demand for remote monitoring and predictive maintenance tools increasing across the construction sector. Smart cranes, equipped with IoT sensors, allow operators to track real-time operational data and reduce breakdowns. For instance, leading companies now offer automated cranes that integrate with AI-based software to boost efficiency. As of 2024, over 25% of new crane purchases in India include these advanced technologies, signaling a shift toward innovation and efficiency.

- Growing Leasing and Rental Markets (Cost-Effectiveness, Short-Term Projects): Indias crane leasing and rental markets are flourishing, accounting for 50% of crane usage across infrastructure projects as of 2024. Leasing provides a cost-effective solution for construction firms that prefer short-term equipment use. With increasing industrial and infrastructure projects, companies are turning to rentals to avoid high upfront costs. The rental market, valued at INR 17,000 crore in 2023, caters to both large-scale government projects and private sector initiatives.

Scope of the Report

|

By Type of Crane |

Mobile Cranes Tower Cranes Crawler Cranes Rough Terrain Cranes All-Terrain Cranes |

|

By Application |

Construction Mining Oil & Gas Transportation Utilities & Infrastructure |

|

By Capacity |

Upto 20 Tons 20 to 100 Tons 100 to 200 Tons Above 200 Tons |

|

By Operation Type |

Manual Cranes Semi-Automated Cranes Fully Automated Cranes |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Construction and Real Estate Developers

Infrastructure and Utilities Companies

Oil & Gas Companies

Mining and Exploration Firms

Government and Regulatory Bodies (Ministry of Road Transport and Highways, Ministry of Housing and Urban Affairs)

Investors and Venture Capitalist Firms

Crane Rental and Leasing Companies

Transportation and Logistics Companies

Companies

Players Mentioned in the Report

Liebherr India Pvt. Ltd.

TIL Limited

Sany Heavy Industry India Pvt. Ltd.

Action Construction Equipment Ltd.

Zoomlion India Pvt. Ltd.

Manitowoc Cranes India Pvt. Ltd.

Terex Corporation India

Konecranes India Pvt. Ltd.

Kobelco Cranes India Pvt. Ltd.

Escorts Construction Equipment

Table of Contents

1. India Crane Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Crane Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Crane Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Government Investments, Smart Cities)

3.1.2. Expansion in Construction Sector (Housing, Commercial, Industrial Projects)

3.1.3. Rise in Demand for Heavy Machinery (Industrial Expansion, Warehousing Growth)

3.1.4. Government Policies (Make in India, National Infrastructure Pipeline)

3.2. Market Challenges

3.2.1. High Initial Costs of Cranes (CapEx, Maintenance)

3.2.2. Fluctuations in Steel Prices (Raw Material Costs, Supply Chain)

3.2.3. Shortage of Skilled Operators (Training, Certification)

3.3. Opportunities

3.3.1. Technological Advancements (Automation, Remote Monitoring)

3.3.2. Growing Leasing and Rental Markets (Cost-Effectiveness, Short-Term Projects)

3.3.3. Market Penetration in Tier II & III Cities (Urbanization, Industrial Expansion)

3.4. Trends

3.4.1. Electrification and Hybrid Cranes (Sustainability, Energy Efficiency)

3.4.2. Integration of IoT and AI (Predictive Maintenance, Operational Efficiency)

3.4.3. Expansion of Crane Rental Services (Short-Term Demand, Flexible Solutions)

3.5. Government Regulations

3.5.1. Construction Safety Standards (BIS, OSHA Compliance)

3.5.2. Heavy Equipment Import & Export Policies (Customs Duties, Trade Regulations)

3.5.3. Environmental Regulations (Emission Norms, Sustainability Initiatives)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Crane Market Segmentation

4.1. By Type of Crane (In Value %) 4.1.1. Mobile Cranes

4.1.2. Tower Cranes

4.1.3. Crawler Cranes

4.1.4. Rough Terrain Cranes

4.1.5. All-Terrain Cranes

4.2. By Application (In Value %) 4.2.1. Construction

4.2.2. Mining

4.2.3. Oil & Gas

4.2.4. Transportation

4.2.5. Utilities & Infrastructure

4.3. By Capacity (In Value %) 4.3.1. Upto 20 Tons

4.3.2. 20 to 100 Tons

4.3.3. 100 to 200 Tons

4.3.4. Above 200 Tons

4.4. By Operation Type (In Value %) 4.4.1. Manual Cranes

4.4.2. Semi-Automated Cranes

4.4.3. Fully Automated Cranes

4.5. By Region (In Value %) 4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Crane Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Liebherr India Pvt. Ltd.

5.1.2. TIL Limited

5.1.3. Sany Heavy Industry India Pvt. Ltd.

5.1.4. Action Construction Equipment Ltd.

5.1.5. Manitowoc Cranes India Pvt. Ltd.

5.1.6. Zoomlion India Pvt. Ltd.

5.1.7. Terex Corporation India

5.1.8. Konecranes India Pvt. Ltd.

5.1.9. Kobelco Cranes India Pvt. Ltd.

5.1.10. Escorts Construction Equipment

5.1.11. ElectroMech Material Handling Systems

5.1.12. ACE Cranes & Equipment

5.1.13. Hitachi Construction Machinery India

5.1.14. Bharat Earth Movers Limited (BEML)

5.1.15. Caterpillar India Pvt. Ltd.

5.2. Cross Comparison Parameters (Annual Revenue, Market Share, Regional Presence, No. of Employees, Production Capacity, Distribution Network, Service Contracts, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Crane Market Regulatory Framework

6.1. Safety & Compliance Standards

6.2. Import/Export Licensing

6.3. Certification & Licensing for Operators

6.4. Environmental & Sustainability Regulations

7. India Crane Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Crane Market Future Segmentation

8.1. By Type of Crane (In Value %)

8.2. By Application (In Value %)

8.3. By Capacity (In Value %)

8.4. By Operation Type (In Value %)

8.5. By Region (In Value %)

9. India Crane Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves a comprehensive analysis of the Indian crane market's key variables, which include industry size, growth drivers, technological trends, and competitive dynamics. We gather secondary data from credible sources, industry reports, and government databases to identify market-specific trends.

Step 2: Market Analysis and Construction

In this step, historical data regarding crane usage in India, industry revenue trends, and demand drivers are analyzed. The data helps us estimate the market size and assess future growth potential by segmenting the market based on the type of crane, application, and region.

Step 3: Hypothesis Validation and Expert Consultation

We consult with industry experts, crane manufacturers, and major construction firms through interviews to validate our market hypotheses. This step includes cross-checking industry insights to ensure accuracy and reliability in data interpretation.

Step 4: Research Synthesis and Final Output

This phase involves synthesizing all collected data into a cohesive market report, verifying findings through a bottom-up approach to ensure accuracy. We present insights into market size, competitive landscape, future outlook, and key growth drivers.

Frequently Asked Questions

1. How big is the India Crane Market?

The India crane market is valued at USD 3 billion, based on a five-year historical analysis. This market is primarily driven by infrastructure projects, including the expansion of highways, bridges, and urban real estate developments.

2. What are the key challenges in the India Crane Market?

Key challenges in the India crane market include fluctuating steel prices, high initial investment costs, and a shortage of skilled crane operators, which limit the adoption of advanced crane technologies.

3. Who are the major players in the India Crane Market?

Major players include Liebherr India Pvt. Ltd., TIL Limited, Sany Heavy Industry India Pvt. Ltd., Action Construction Equipment Ltd., and Zoomlion India Pvt. Ltd. These companies dominate due to their strong presence in both local and global markets, along with their wide product offerings.

4. What are the growth drivers of the India Crane Market?

Growth drivers include rapid urbanization, government initiatives such as the National Infrastructure Pipeline, and the increasing use of advanced technologies in crane manufacturing, such as automation and hybrid engines.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.