India Crop Protection Chemicals Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3775

November 2024

90

About the Report

India Crop Protection Chemicals Market Overview

- The India Crop Protection Chemicals market is valued at USD 2.30 billion, driven primarily by the need for increased food security to support the countrys growing population. The adoption of advanced agricultural techniques, including the usage of herbicides, insecticides, fungicides, and biopesticides, further fuels the demand. Additionally, government initiatives such as subsidies for farmers and technological advancements are fostering the development of the crop protection chemicals market. Sources confirm this market valuation based on a five-year historical analysis of the sector.

- Indias northern and western regions dominate the crop protection chemicals market due to their extensive agricultural activity, particularly in states like Punjab, Haryana, and Maharashtra. These areas have large-scale farms that require significant crop protection solutions to combat pests and improve yields. Moreover, the widespread presence of agricultural universities and research institutions in these states helps in quicker adoption of modern agrochemical solutions.

- Indonesias Making Indonesia 4.0 roadmap includes a dedicated plan for smart transportation, emphasizing IoT-enabled vehicles and infrastructure. In 2022, the government set aside $1.5 billion for the development of smart city projects, including the adoption of IoT in transportation. This regulatory framework is designed to enhance urban mobility through real-time traffic management and connected vehicle systems.

India Crop Protection Chemicals Market Segmentation

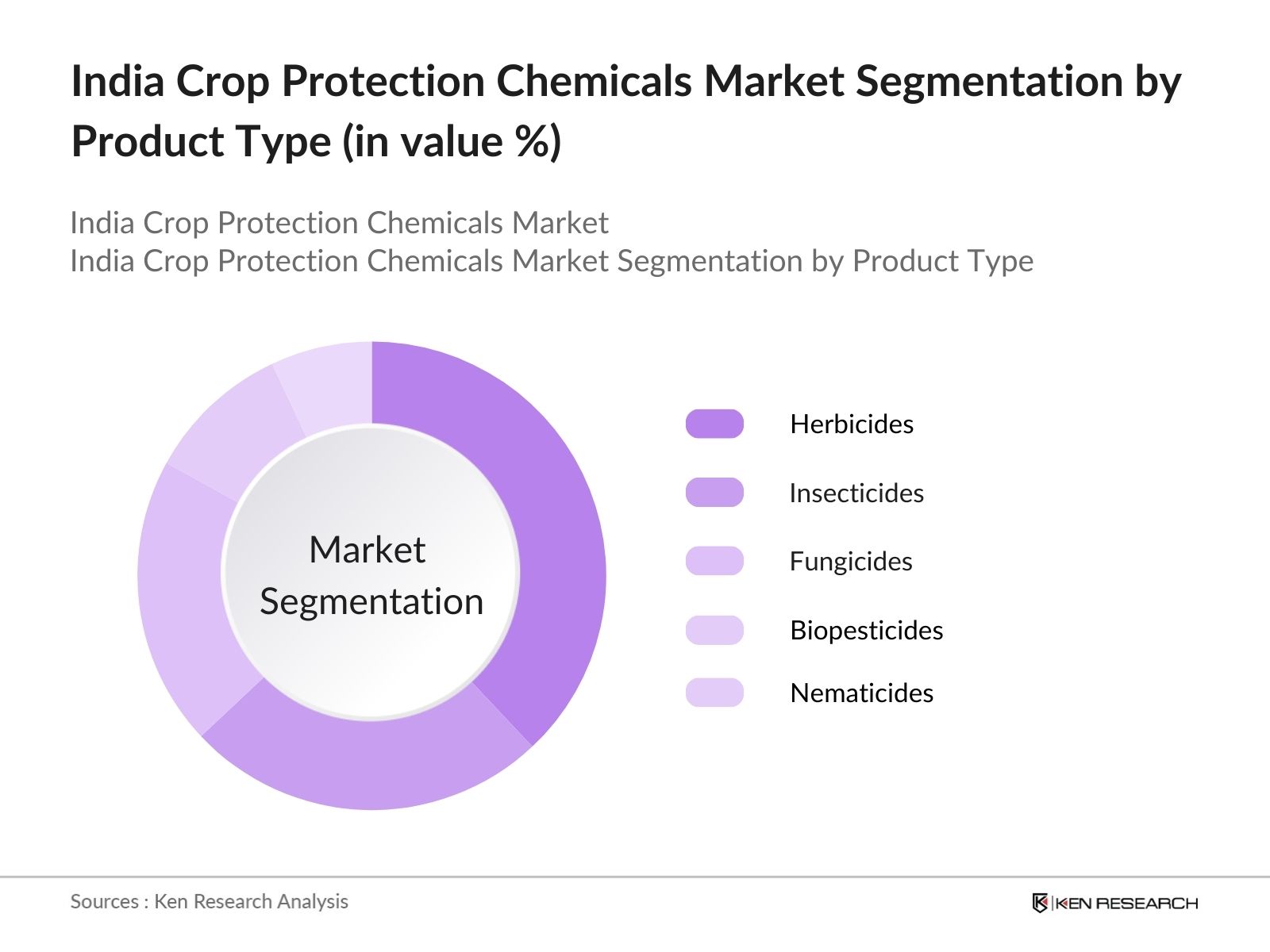

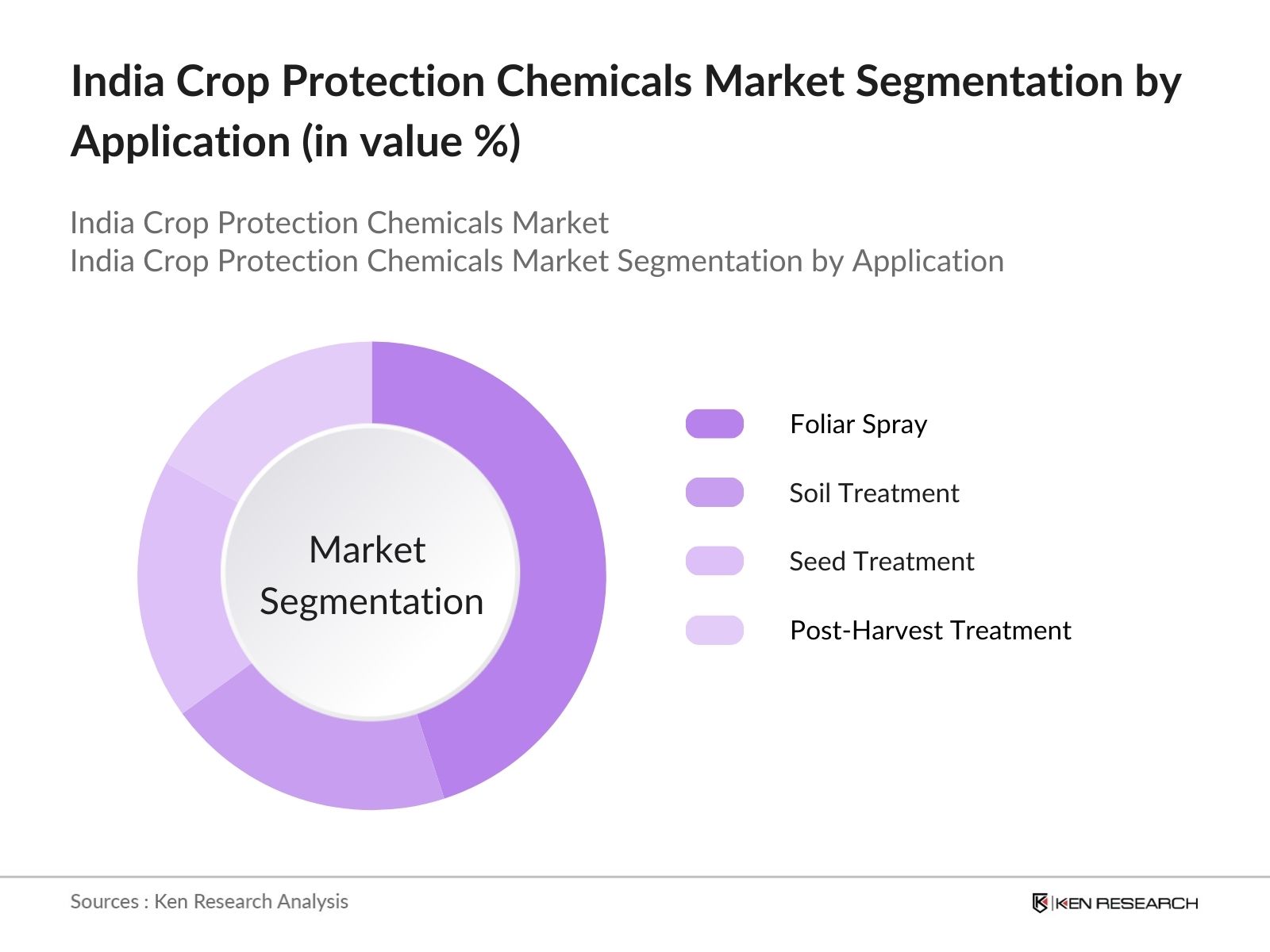

The India Crop Protection Chemicals market is segmented by product type and by mode of application.

- By Product Type: The market is segmented by product type into herbicides, insecticides, fungicides, biopesticides, and nematicides. Among these, herbicides hold a dominant market share in India, largely due to their effectiveness in controlling weeds, which are a major issue in large-scale rice and wheat cultivation. The strong presence of established brands and the consistent demand for weed management products contribute to this segments leadership.

- By Mode of Application: The market is also segmented by mode of application into foliar spray, soil treatment, seed treatment, and post-harvest treatment. Foliar spray holds the highest market share because it allows for more precise and direct application of chemicals, ensuring better crop health and yield. It is widely adopted due to its ease of use and immediate effects on pest control.

India Crop Protection Chemicals Market Competitive Landscape

The India Crop Protection Chemicals market is dominated by both domestic and multinational players, reflecting a consolidation of market power among a few major companies. These firms benefit from strong distribution networks, extensive product portfolios, and continuous investment in R&D to develop eco-friendly solutions. Key competitors are leveraging government support for sustainable agriculture to maintain their competitive edge.

|

Company |

Established |

Headquarters |

Product Range |

Revenue (2023) |

No. of Employees |

|

UPL Limited |

1969 |

Mumbai, India |

|||

|

Bayer CropScience Ltd |

1863 |

Leverkusen, Germany |

|||

|

Syngenta India |

2000 |

Basel, Switzerland |

|||

|

BASF India |

1865 |

Ludwigshafen, Germany |

|||

|

PI Industries |

1947 |

Udaipur, India |

India Crop Protection Chemicals Market Analysis

Growth Drivers

- Rising Demand for Connected Vehicles: Indonesia has witnessed a growing demand for connected vehicles, with an increase in automotive IoT applications like GPS navigation and advanced driver assistance systems (ADAS). In 2023, Indonesia's vehicle population surpassed 155 million, creating an expansive market for IoT integrations in vehicles. The countrys adoption of digital technologies has been supported by robust 4G infrastructure, and Indonesia's National ICT Plan has committed $2 billion toward improving connectivity by 2024, which will further enable IoT use in automotive applications.

- Government Smart Mobility Initiatives: The Indonesian government has been aggressively promoting smart mobility solutions through its Making Indonesia 4.0 roadmap, aiming to transform its transportation network. In 2022, the Ministry of Transportation allocated $500 million to upgrade smart road infrastructure, including IoT-enabled traffic management systems. These initiatives are integral to optimizing traffic flow and enhancing vehicle communication, facilitating an environment ripe for automotive IoT adoption.

- Consumer Shift Toward In-Vehicle Automation: Indonesias tech-savvy consumer base is pushing the demand for automated in-vehicle solutions. According to the World Bank, internet penetration reached 76% of the population in 2023, fueling demand for IoT-based in-car automation features such as remote diagnostics and real-time traffic updates. This has created an upward trajectory for IoT integration in passenger and commercial vehicles, driving the market for smarter mobility.

Market Challenges

- High Cost of Implementation: The deployment of IoT solutions in Indonesias automotive sector remains costly due to the need for advanced infrastructure, data storage, and processing facilities. According to the Ministry of Finance, the average cost of deploying a full IoT system in a fleet vehicle was approximately $2,500 in 2023. This has proven to be a significant barrier for small- to medium-sized enterprises looking to adopt these technologies.

- Data Privacy and Security Concerns: Indonesia faces challenges in securing the massive amount of data generated by automotive IoT devices. The country recorded over 200 million cyberattacks in 2023, as per government data, raising concerns about the vulnerability of vehicle-generated data to breaches. The lack of a robust data protection framework further exacerbates this challenge, stalling the mass adoption of IoT solutions in vehicles.

India Crop Protection Chemicals Market Future Outlook

Over the next five years, the India Crop Protection Chemicals market is expected to experience steady growth, driven by increased demand for sustainable agricultural practices and higher food production needs. Government regulations supporting eco-friendly products and the growing adoption of biopesticides will also play a pivotal role in market expansion. Technological innovations such as precision farming and digital agriculture are set to redefine pest control methods, ensuring better crop yields and resource optimization for farmers across the country.

Future Market Opportunities

- Partnerships with Telecom Operators for 5G Integration: The Indonesian automotive IoT market presents significant growth opportunities through partnerships with telecom operators. With the rollout of 5G technology underway, telecom companies are poised to offer enhanced connectivity solutions for IoT devices in vehicles. By 2023, the government had invested $3 billion in 5G infrastructure development, providing an opportunity for automotive IoT companies to deliver high-speed, low-latency services.

- Increasing Use of Cloud Computing in IoT Infrastructure: Cloud computing is becoming a crucial component in the development of Indonesias IoT ecosystem, particularly for automotive applications. The Indonesian Cloud Association reported that over 45% of the countrys IoT devices were linked to cloud platforms in 2022, enabling real-time data storage and processing. As cloud adoption increases, automotive companies can offer enhanced IoT services such as predictive maintenance and remote vehicle monitoring.

Scope of the Report

|

Herbicides Insecticides Fungicides Bio-Pesticides Nematicides |

|

|

By Distribution Channel |

Liquid Formulation Solid Formulation |

|

By Application |

Cereals and Grains Fruits and Vegetables Pulses and Oilseeds Commercial Crops |

|

By Consumer Group |

Foliar Spray Soil Treatment Seed Treatment Post-Harvest Treatment |

|

By Region |

North East West South |

Products

Key Target Audience

Government and Regulatory Bodies (Pesticide Management Bill Authority, Ministry of Agriculture & Farmers Welfare)

Agricultural Cooperatives

Agrochemical Manufacturers

Exporters and Importers of Agrochemicals

Retailers and Distributors of Crop Protection Products

Large-Scale Farmers and Farming Communities

Investment and Venture Capitalist Firms

Crop Advisory Services

Companies

Players mention in the Report:

UPL Limited

Bayer CropScience Ltd

Syngenta India

BASF India

PI Industries

Rallis India Limited

Dhanuka Agritech Ltd

Sumitomo Chemical India Pvt Ltd

Adama India Pvt Ltd

Excel Crop Care Ltd

Insecticides India Ltd

Corteva Agriscience India Pvt Ltd

NACL Industries Ltd

Gharda Chemicals

FMC India Pvt Ltd

Table of Contents

1. India Crop Protection Chemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Crop Protection Chemicals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Crop Protection Chemicals Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Food Security

3.1.2. Increasing Adoption of Sustainable Farming Practices

3.1.3. Government Initiatives and Subsidies for Farmers

3.1.4. Growth in Agrochemical Exports

3.2. Market Challenges

3.2.1. Stringent Regulatory Policies and Environmental Concerns

3.2.2. Resistance Development in Pests

3.2.3. High Costs of Research and Development

3.3. Opportunities

3.3.1. Adoption of Bio-based Crop Protection Solutions

3.3.2. Growing Demand for Integrated Pest Management (IPM) Solutions

3.3.3. Expansion in Untapped Rural Markets

3.4. Trends

3.4.1. Shift Toward Organic Crop Protection Solutions

3.4.2. Technological Innovations in Application Methods

3.4.3. Rise in Precision Farming Techniques

3.5. Government Regulations

3.5.1. Pesticide Management Bill

3.5.2. Crop Insurance Schemes and Subsidies

3.5.3. Ban on Harmful Chemicals and Shifts to Eco-Friendly Alternatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Crop Protection Chemicals Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Herbicides

4.1.2. Insecticides

4.1.3. Fungicides

4.1.4. Bio-Pesticides

4.1.5. Nematicides

4.2. By Formulation (In Value %)

4.2.1. Liquid Formulation

4.2.2. Solid Formulation

4.3. By Crop Type (In Value %)

4.3.1. Cereals and Grains

4.3.2. Fruits and Vegetables

4.3.3. Pulses and Oilseeds

4.3.4. Commercial Crops

4.4. By Mode of Application (In Value %)

4.4.1. Foliar Spray

4.4.2. Soil Treatment

4.4.3. Seed Treatment

4.4.4. Post-Harvest Treatment

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Crop Protection Chemicals Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. UPL Limited

5.1.2. Bayer CropScience Limited

5.1.3. Syngenta India

5.1.4. BASF India

5.1.5. PI Industries

5.1.6. Rallis India Limited

5.1.7. Adama India

5.1.8. Sumitomo Chemical India Pvt Ltd

5.1.9. Dhanuka Agritech Ltd

5.1.10. Excel Crop Care Ltd

5.1.11. NACL Industries Ltd

5.1.12. Insecticides India Ltd

5.1.13. Corteva Agriscience India Pvt Ltd

5.1.14. Gharda Chemicals

5.1.15. FMC India Pvt Ltd

5.2. Cross Comparison Parameters (R&D Investment, Market Share, Manufacturing Capacity, Geographic Reach, Product Portfolio, Environmental Sustainability Initiatives, Distribution Network, Digital Agriculture Solutions)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Crop Protection Chemicals Market Regulatory Framework

6.1. Compliance Requirements

6.2. Certification Processes

6.3. Environmental Standards

7. India Crop Protection Chemicals Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Crop Protection Chemicals Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Formulation (In Value %)

8.3. By Crop Type (In Value %)

8.4. By Mode of Application (In Value %)

8.5. By Region (In Value %)

9. India Crop Protection Chemicals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involves mapping out the entire ecosystem of stakeholders within the India Crop Protection Chemicals market. By conducting extensive desk research, using proprietary databases, and analyzing government reports, key variables such as product innovation, regulatory frameworks, and end-user behaviors are identified.

Step 2: Market Analysis and Construction

This stage includes compiling historical data and trends within the crop protection chemicals sector. Key factors analyzed include the application rates of chemicals, agricultural yield improvements, and regional crop protection dynamics. Quantitative data from agricultural reports is integrated to refine market estimations.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses, particularly around product adoption and geographic influence, are validated through consultations with crop scientists, industry experts, and agrochemical company executives. These insights ensure the reliability and accuracy of the market forecasts.

Step 4: Research Synthesis and Final Output

The final phase integrates data obtained from market participants and secondary sources, including product trends, regional analysis, and expert consultations. This step ensures a comprehensive and well-rounded perspective on the India Crop Protection Chemicals market, resulting in a thoroughly vetted report.

Frequently Asked Questions

01. How big is the India Crop Protection Chemicals Market?

The India Crop Protection Chemicals market is valued at INR 2.30 billion, driven by the need for higher agricultural productivity and government support for modern farming techniques.

02. What are the challenges in the India Crop Protection Chemicals Market?

Challenges in India Crop Protection Chemicals market include stringent regulatory policies, the rising threat of pest resistance, and the high costs associated with R&D in developing sustainable crop protection products.

03. Who are the major players in the India Crop Protection Chemicals Market?

Key players in the India Crop Protection Chemicals market include UPL Limited, Bayer CropScience, Syngenta India, and BASF India, among others, with dominance due to their extensive product portfolios and strong distribution networks.

04. What are the growth drivers of the India Crop Protection Chemicals Market?

The India Crop Protection Chemicals market is propelled by the need for food security, advancements in agrochemical technology, and government initiatives aimed at improving agricultural productivity and promoting sustainable farming.

05. What trends are shaping the India Crop Protection Chemicals Market?

Key trends in India Crop Protection Chemicals market include a shift towards biopesticides, increased adoption of precision farming techniques, and innovations in eco-friendly chemical formulations aimed at minimizing environmental impact.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.