India Curtain Manufacturing Market Outlook to 2029

Region:Asia

Author(s):Shashank Kashyap

Product Code:KR1514

July 2025

90

About the Report

India Curtain Manufacturing Market Overview

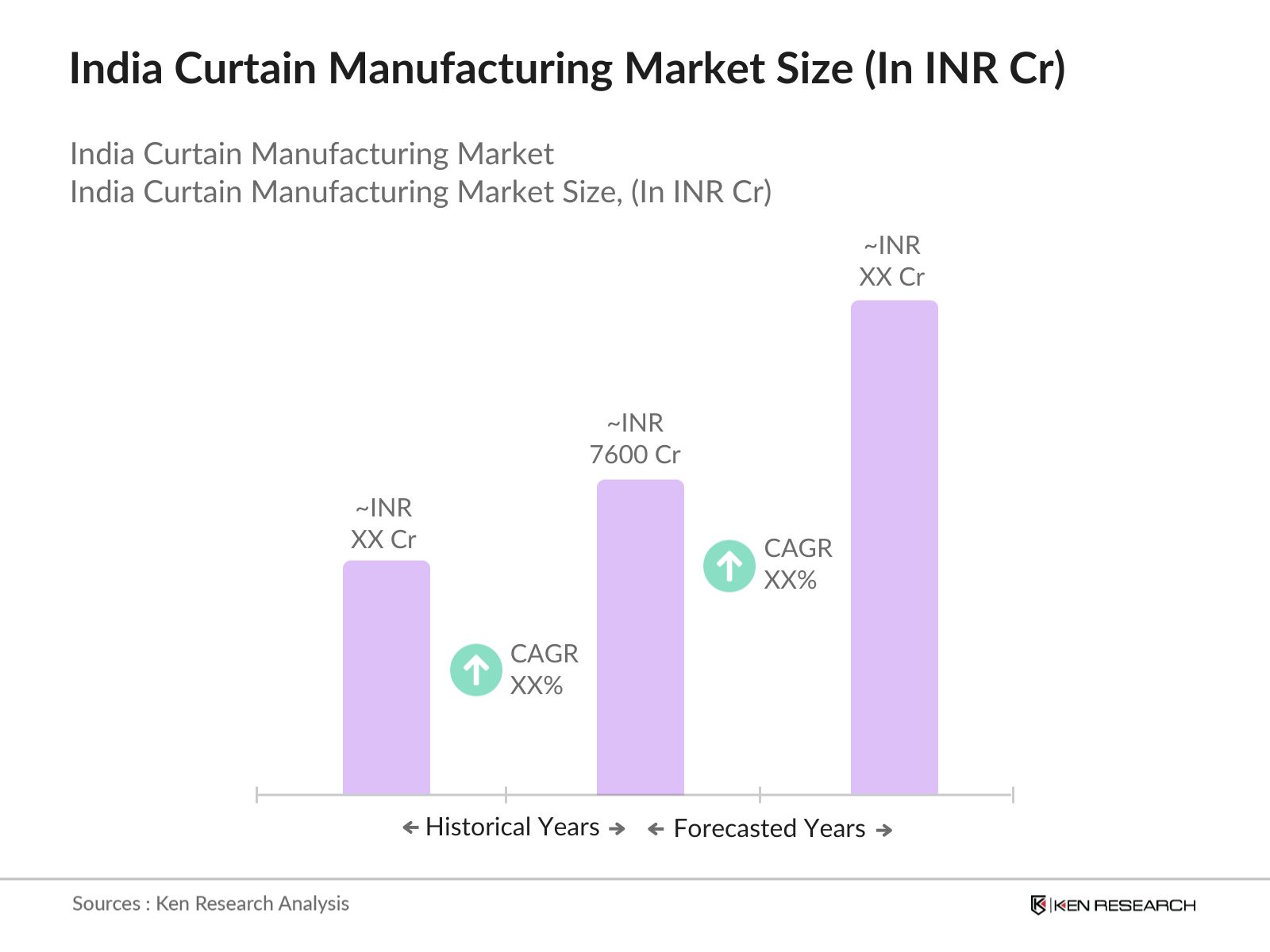

- The India Curtain Manufacturing Market is valued at INR 7,600 crores, based on a five-year historical analysis. This market value reflects the combined demand for curtains and window blinds, with growth primarily driven by increasing urbanization, rising disposable incomes, and a growing focus on home decor and interior aesthetics. The demand for curtains, especially those offering both visual appeal and functional benefits, has risen as consumers invest more in enhancing their living environments.

- Key cities dominating this market include Mumbai, Delhi, and Bengaluru. These urban centers have a high concentration of affluent consumers and a dynamic real estate sector, which drives demand for home furnishings such as curtains. The proliferation of retail outlets and the rapid expansion of e-commerce platforms in these cities further improve market accessibility and consumer reach.

- The Indian Textile Policy 2023 promotes sustainability via the 3-R model (Reduce, Reuse, Recycle), enhances cotton processing, offers financial incentives for technology upgrades, supports women empowerment, boosts exports, and aims for ?25,000 crore investment with 5 lakh job creation over five years, covering the entire textile value chain.

India Curtain Manufacturing Market Segmentation

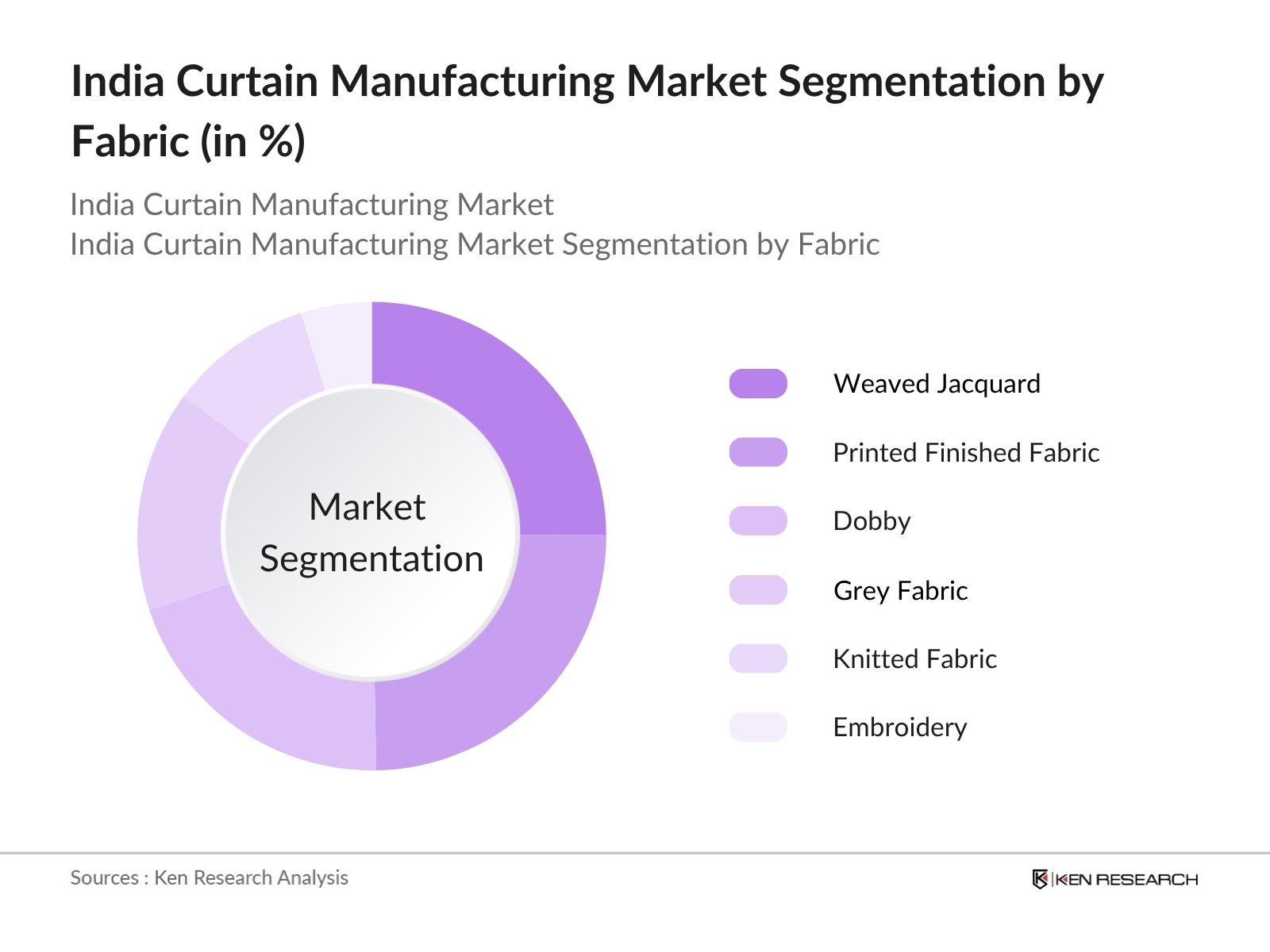

By Fabric Type: The curtain manufacturing market is segmented into weaved jacquard, printed finished curtain, dobby, grey fabric, knitted fabric, and embroidery. Weaved Jacquard holds the largest market share, driven by its intricate patterns, luxurious texture, and strong demand in high-end residential and hospitality interiors. Printed Finished Curtains follow, favored for their ready-to-use convenience and a broad range of contemporary designs

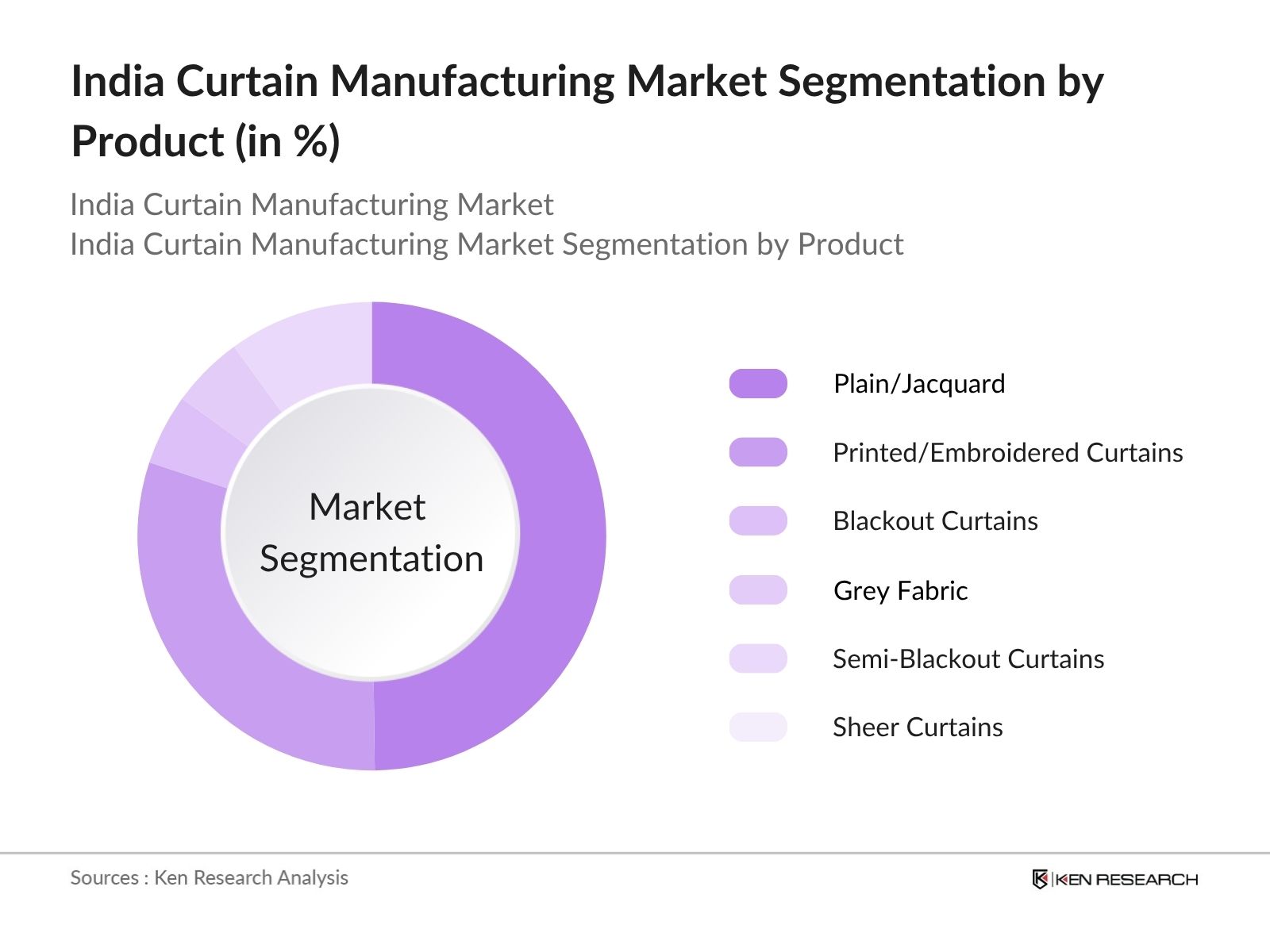

By Product Type: The market is segmented into plain/jacquard, printed/embroidered curtains, blackout curtains, semi-blackout curtains, and sheer curtains. lead the market due to their popularity in modern homes for allowing natural light while maintaining privacy. Plain/Jacquard curtains lead the market, driven by their elegant, timeless appeal and versatility in both traditional and contemporary interior settings. These designs are highly favored for premium home décor and hospitality applications. Sheer Curtains follow, valued for their ability to let in natural light while maintaining a degree of privacy, making them a staple in modern urban homes. Blackout and Semi-Blackout Curtains are witnessing rising demand due to their

India Curtain Manufacturing Market Competitive Landscape

The India Curtain Manufacturing Market is characterized by a competitive landscape with several key players, including D’Decor Home Fabrics Pvt Ltd., GM Fabrics Pvt Ltd, and Orbit Exports Ltd. These companies are recognized for their innovative product portfolios and robust distribution networks, which enhance their market presence. The market remains moderately concentrated, with both established brands and emerging players competing through quality, design innovation, and pricing strategies.

India Curtain Manufacturing Market Industry Analysis

Growth Drivers

- Increasing Urbanization: Urbanization in India is projected to reach approximately 600 million people in the future, driving demand for home furnishings, including curtains. The urban population's growth leads to a higher number of households, with the number of urban households expected to increase in the future. This demographic shift creates a significant market for curtain manufacturers, as urban dwellers prioritize home aesthetics and functionality, thus boosting sales in the curtain manufacturing sector.

- Rising Disposable Incomes: India's per capita income is expected to rise to approximately $2,500 in the future, enhancing consumer purchasing power. As disposable incomes increase, consumers are more inclined to invest in home decor, including high-quality curtains. This trend is particularly evident in urban areas, where households are increasingly willing to spend on premium products, thereby driving growth in the curtain manufacturing market as consumers seek to enhance their living spaces.

- Expansion of E-commerce Platforms: The e-commerce sector in India is projected to reach approximately $200 billion in the future, significantly impacting the curtain manufacturing market. Online platforms provide manufacturers with a broader reach, allowing them to tap into diverse consumer bases across urban and rural areas. The convenience of online shopping, coupled with targeted marketing strategies, is expected to drive sales of curtains, making e-commerce a vital growth driver in the industry.

Market Challenges

- Intense Competition: The curtain manufacturing market in India is characterized by intense competition, with over 1,000 manufacturers vying for market share. This saturation leads to price wars, which can erode profit margins. Additionally, established brands face challenges from new entrants offering innovative products at competitive prices. The need for differentiation and brand loyalty becomes crucial for survival in this highly competitive landscape, impacting overall market stability.

- Fluctuating Raw Material Prices: The curtain manufacturing industry is heavily reliant on raw materials such as cotton and polyester, whose prices can fluctuate significantly. For instance, cotton prices have seen a substantial increase in recent period due to supply chain disruptions and climate change impacts. These fluctuations can lead to increased production costs, forcing manufacturers to either absorb the costs or pass them onto consumers, which can affect demand and profitability.

India Curtain Manufacturing Market Future Outlook

The India curtain manufacturing market is poised for significant transformation driven by technological advancements and changing consumer preferences. As smart home technology becomes more prevalent, manufacturers are likely to integrate smart features into curtain designs, enhancing functionality. Additionally, the growing emphasis on sustainability will push manufacturers to adopt eco-friendly materials and practices. These trends, combined with the expansion of online retail, will create a dynamic market environment, fostering innovation and new product development in the coming years.

Market Opportunities

- Eco-friendly Curtain Options: The demand for eco-friendly products is rising, with the market for sustainable textiles. Manufacturers can capitalize on this trend by offering curtains made from organic or recycled materials, appealing to environmentally conscious consumers and enhancing brand reputation in a competitive market.

- Customization Trends: Customization is becoming increasingly popular, with approximately 40% of consumers expressing interest in personalized home decor. By offering tailored curtain solutions, manufacturers can meet specific consumer needs and preferences, thereby increasing customer satisfaction and loyalty, which can lead to higher sales and market share.

Scope of the Report

| By Fabric Type |

Weaved Jacquard Printed Finished Fabric Dobby Grey Fabric Knitted Fabric Embroidery |

| By Product Type |

Plain/Jacquard Printed/Embroidered Curtains Blackout Curtains Semi-Blackout Curtains Sheer Curtains |

| By Region |

North East Central West South |

| By Distribution Channel |

Retail (Other Brands) Retail (OwnBrands) Wholesale B2B |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Textiles, Bureau of Indian Standards)

Manufacturers and Producers

Distributors and Retailers

Interior Designers and Decorators

Home Furnishing Brands

Textile Exporters

Financial Institutions

Companies

Players Mentioned in the Report:

D’Decor Home Fabrics Pvt Ltd.

GM Fabrics Pvt Ltd

Orbit Exports Ltd

Himatsingka Seide Ltd

Shree Karni Fabcom

Reliance Industries Limited

Trident Group

Fabindia

Home Centre

CurtainCraft India

Table of Contents

1. Macroeconomic Overview

1.1. Global Macroeconomic Scenario

1.2. Indian Economic Outlook

2. Indian Home Textile Market

2.1. Indian Home Textile Industry Taxonomy

2.2. India’s Home Textile Industry Overview and Size, FY20–FY25 & FY25–FY31F

2.3. Market Genesis of Curtains and Upholstery in India

2.4. Size of India’s Domestic Home Textile Market & Curtain Market

3. Value Chain and Process Flow of Curtain Manufacturing

3.1. Textile Industry Value Chain

3.2. Product Flow For Curtain Manufacturing

3.3. Business Model Comparison: Fully Integrated vs Asset-Light Textile Manufacturers

4. India’s Domestic Curtain Market

4.1. India Curtain Market Size and Segmentation, FY20–FY25 & FY25–FY31F

5. Industry Analysis

5.1. Curtain Market Regional Clusters in India

5.2. Market Trends and Developments

5.3. Market Challenges and Threats

5.4. Regulatory Landscape

6. Competitive Landscape

6.1. Key Factors Shaping Competition in the Sector

6.2. Ecosystem of Entities Present in the Sector

6.3. Cross-Comparison of Peers in the India Curtain Market

7. Conclusion – Way Forward

8. Research Methodology

8.1. Market Definitions

8.2. Abbreviations

8.3. Market Sizing and Modeling

• Consolidated Research Approach

• Limitations

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key players and stakeholders in the India Curtain Manufacturing Market. This step relies on extensive desk research, utilizing secondary data sources such as industry reports, market studies, and proprietary databases to gather relevant information. The goal is to pinpoint and define the essential variables that drive market trends and dynamics.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data related to the India Curtain Manufacturing Market. This includes evaluating market size, growth rates, and segmentation by product type and distribution channels. Additionally, we will assess competitive landscape metrics to ensure a thorough understanding of market positioning and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts and key stakeholders. These consultations will provide insights into market trends, challenges, and opportunities, allowing for a more nuanced understanding of the market landscape. The feedback from these experts will be crucial in refining our hypotheses and ensuring data accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and insights from various sources, including direct interactions with manufacturers and retailers. This step aims to validate the findings through cross-referencing with market data and expert opinions. The outcome will be a comprehensive report that encapsulates the current state and future outlook of the India Curtain Manufacturing Market.

Frequently Asked Questions

What is the current value of the India Curtain Manufacturing Market?

The India Curtain Manufacturing Market is valued at approximately INR 7,600 crore, reflecting the combined demand for curtains and window blinds, driven by urbanization, rising disposable incomes, and a growing focus on home decor.

Which cities are the key players in the India Curtain Manufacturing Market?

Key cities dominating the India Curtain Manufacturing Market include Mumbai, Delhi, and Bengaluru. These urban centers have a high concentration of affluent consumers and a dynamic real estate sector, driving demand for home furnishings like curtains.

What are the main growth drivers for the India Curtain Manufacturing Market?

The main growth drivers include increasing urbanization, rising disposable incomes, and the expansion of e-commerce platforms. These factors contribute to a higher demand for home decor, particularly stylish and functional curtains.

What challenges does the India Curtain Manufacturing Market face?

The market faces challenges such as intense competition among over 1,000 manufacturers, fluctuating raw material prices, and supply chain disruptions. These factors can impact profit margins and overall market stability.

What is the impact of the "Textile Policy 2023" on the curtain manufacturing sector?

The "Textile Policy 2023" aims to boost the textile and apparel sector, including curtain manufacturing, by providing financial incentives, promoting sustainable practices, and enhancing export capabilities, thereby supporting market expansion.

How is the India Curtain Manufacturing Market segmented by application?

The market is segmented into residential, commercial, and institutional applications. The residential segment holds the largest share, driven by trends in home decoration and renovation, as consumers invest in stylish curtains.

What types of materials are used in curtain manufacturing in India?

The curtain manufacturing market in India is primarily segmented into fabric, vinyl, and other materials. Fabric curtains dominate due to their versatility, aesthetic appeal, and customization options, making them a popular choice among consumers.

What are the emerging trends in the India Curtain Manufacturing Market?

Emerging trends include the integration of smart home technology into curtain designs, a growing emphasis on sustainability, and the increasing popularity of customization options, allowing consumers to tailor products to their specific needs.

Who are the major players in the India Curtain Manufacturing Market?

Major players in the India Curtain Manufacturing Market include D'Decor, Reliance Industries Limited, Trident Group, Fabindia, and Home Centre. These companies are known for their innovative products and strong distribution networks.

What opportunities exist for eco-friendly curtains in the market?

With rising consumer demand for sustainable products, there is a significant opportunity for manufacturers to offer eco-friendly curtains made from organic or recycled materials, appealing to environmentally conscious consumers and enhancing brand reputation.

How does e-commerce influence the curtain manufacturing market in India?

The expansion of e-commerce platforms significantly influences the curtain manufacturing market by providing manufacturers with broader reach and access to diverse consumer bases, facilitating online shopping convenience and targeted marketing strategies.

What is the expected future outlook for the India Curtain Manufacturing Market?

The future outlook for the India Curtain Manufacturing Market is positive, driven by technological advancements, changing consumer preferences, and a focus on sustainability, which will foster innovation and new product development in the coming years.

What are the different types of curtains available in the market?

The market offers various types of curtains, including polyester, cotton, silk, blackout, sheer, and thermal curtains. Each type caters to different consumer needs, preferences, and functional requirements in home decor.

How do consumer preferences impact the curtain manufacturing market?

Consumer preferences significantly impact the curtain manufacturing market by driving demand for stylish, functional, and customizable products. As consumers increasingly invest in home decor, manufacturers must adapt to these evolving preferences to remain competitive.

What role does urbanization play in the curtain manufacturing market?

Urbanization plays a crucial role in the curtain manufacturing market by increasing the number of households and driving demand for home furnishings. As urban populations grow, consumers prioritize home aesthetics, boosting sales in the curtain sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.