India Cycling Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD11218

November 2024

92

About the Report

India Cycling Market Overview

- India Cycling Market is valued at USD 3 billion, driven primarily by the growing awareness of health and fitness among urban populations. The adoption of cycling as a fitness activity has surged due to rising health concerns, traffic congestion, and the need for eco-friendly transportation options. A recent analysis highlights that cycling initiatives by local governments are further accelerating growth in this sector, enhancing the market's reach across metropolitan areas.

- Key cities like Bengaluru, Mumbai, and New Delhi dominate the India Cycling Market due to their substantial investments in cycling infrastructure and a strong presence of fitness-conscious populations. These cities have invested in dedicated cycling lanes, urban mobility projects, and initiatives promoting eco-friendly transportation, positioning them as leaders in the national cycling market.

- India's urban mobility plans are increasingly supportive of non-motorized transport, including cycling. The Ministry of Housing and Urban Affairs allocated USD 53.5 million in 2023 to support cities in developing integrated cycling lanes and parking facilities. With metro cities like Mumbai and Kolkata incorporating cycling pathways in public transit designs, the accessibility of cycling is anticipated to grow, benefiting the overall cycling market. These initiatives reinforce the role of cycling as a sustainable mode within urban transport frameworks.

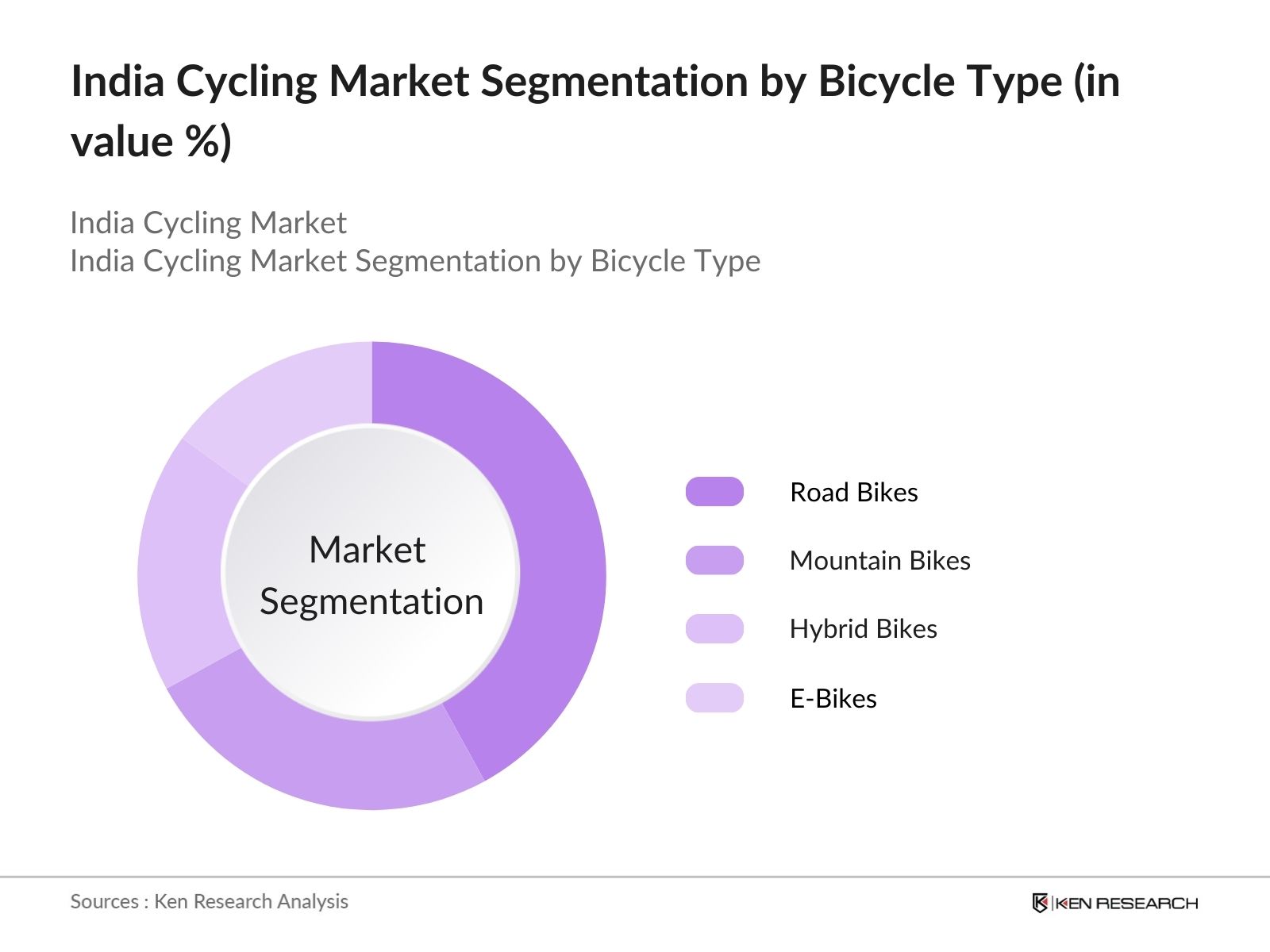

India Cycling Market Segmentation

By Bicycle Type: The India Cycling Market is segmented by bicycle type into road bikes, mountain bikes, hybrid bikes, and e-bikes. Among these, road bikes maintain a dominant share due to their widespread popularity for urban commuting and recreational riding. With their lightweight frames and durability, road bikes are particularly favored in urban areas with infrastructure catering to smooth, paved paths.

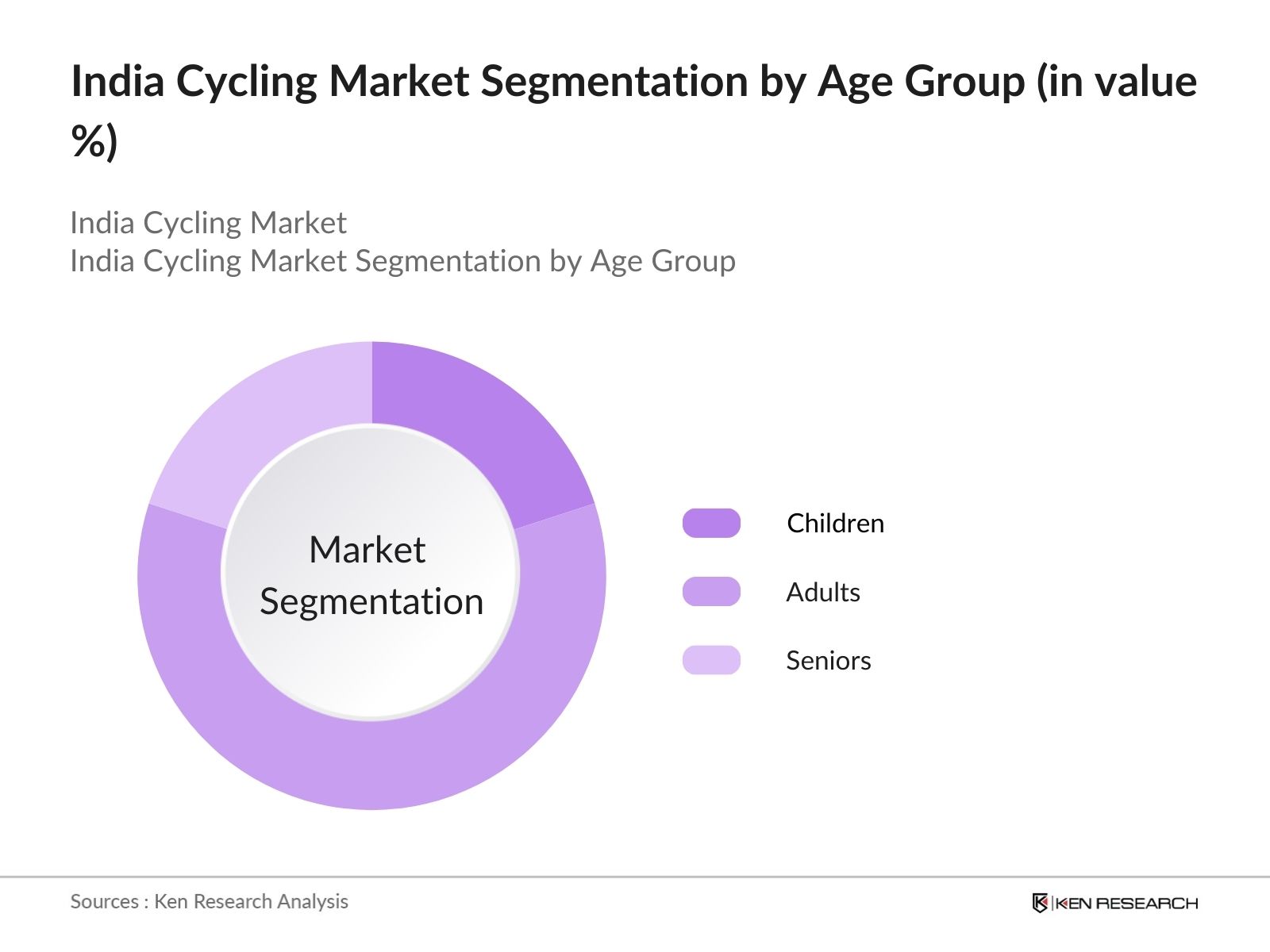

By Age Group: The market segmentation by age group includes children, adults, and seniors. The adult segment leads in market share due to the growing adoption of cycling for both commuting and fitness. Many adults view cycling as a sustainable, cost-effective commuting option, which has led to a significant increase in demand within this demographic.

India Cycling Market Competitive Landscape

The India Cycling Market is characterized by prominent players who bring diverse product offerings and innovative features to the sector. The market is led by companies such as Hero Cycles and Firefox Bikes, whose extensive distribution networks and brand presence provide them with a competitive edge. This consolidation emphasizes the influence of established companies in shaping market trends and consumer preferences.

India Cycling Market Analysis

Growth Drivers

- Fitness and Health Awareness: The growing emphasis on fitness and health in India has driven a considerable increase in cycling adoption. In 2024, an estimated 200 million people in India are affected by lifestyle diseases such as diabetes, hypertension, and obesity, according to government health reports, motivating citizens to pursue active lifestyles, including cycling as a preventive health measure. This shift towards fitness has translated into higher demand for bicycles, particularly in urban areas where health-focused activities have gained popularity. Health ministries advocate for cycling as a cost-effective way to improve public health outcomes and decrease the burden on healthcare systems.

- Urban Infrastructure Development: Indian cities are gradually developing urban infrastructure to promote cycling. For example, Pune and Bengaluru have dedicated 500 km and 400 km of cycling lanes, respectively, as part of their urban mobility initiatives in 2023. By promoting dedicated cycling lanes and integrating cycle-sharing programs, cities aim to reduce congestion and improve urban air quality. These developments encourage urban residents to adopt bicycles for commuting. Furthermore, the Ministry of Urban Development projects that additional cycling lanes will expand across major cities, indicating an increase in cycling-friendly urban areas.

- Rise in Sustainable Transportation: Transport data indicates that around 30 million tons of CO emissions are contributed by road transportation annually, and cycling helps reduce this environmental impact. In 2024, cycling became a preferred alternative to private vehicles, particularly in tier-1 cities with high pollution levels. Government policies like the National Clean Air Program encourage citizens to adopt eco-friendly transportation options to lower emissions. This aligns with India's commitment to achieving a reduction of 1 billion tons of CO by 2030.

Challenges

- Road Safety Concerns: India reported over 150,000 road fatalities in 2023, with cyclists making up a significant percentage of these accidents, highlighting the need for safer cycling infrastructure. Due to limited dedicated cycling lanes and safety measures in many cities, cyclists face higher risks on congested roads, which deters new users. The absence of protective infrastructure remains a critical concern, impacting the growth of cycling adoption among individuals who prioritize road safety. This barrier necessitates enhanced infrastructure to support safer cycling environments.

- Lack of Infrastructure: Indias cycling infrastructure lags behind other transportation modes, with only a few cities implementing comprehensive cycling lanes. For example, while Delhi has 400 km of cycle tracks, the network is often discontinuous and underutilized due to poorly maintained paths. In 2024, the Ministry of Housing and Urban Affairs highlighted that fewer than 10% of urban roads are equipped with cycling lanes, hindering the adoption of bicycles in densely populated urban centers. This lack of well-planned infrastructure restricts cycling to recreational areas, reducing its potential as a viable commuting option.

India Cycling Market Future Outlook

India Cycling Market is expected to witness significant growth driven by government policies promoting eco-friendly transport and the expansion of urban cycling infrastructure. The shift in consumer preferences toward sustainable commuting solutions, coupled with the increasing integration of technology in e-bikes, is likely to create new growth avenues for the market.

Market Opportunities

- Government Cycling Initiatives: The Indian government has rolled out multiple cycling initiatives, like the Cycle4Change Challenge, to encourage cycling in urban areas. Over 100 cities registered for this initiative in 2024, implementing changes to make cycling more accessible. For instance, Bhopal and Chennai are creating bike-sharing programs in association with public transportation networks to ease last-mile connectivity. Such government-backed programs signal a growing support for cycling, which enhances market opportunities, especially for manufacturers and service providers that cater to urban cycling infrastructure and shared mobility solutions.

- Eco-Friendly Transportation Options: Indias shift towards eco-friendly transportation aligns with global sustainability goals, creating growth potential in the cycling market. According to the Ministry of Environment, Forest and Climate Change, promoting cycling could save approximately 7 million liters of fuel per year across urban India. This shift also aligns with India's Nationally Determined Contributions under the Paris Agreement to reduce carbon emissions. This eco-conscious trend is favorable for the cycling market as more citizens turn to bicycles as a low-impact commuting option.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Type of Bicycle |

Road Bikes Mountain Bikes Hybrid Bikes E-Bikes |

|

By Age Group |

Children Adults Seniors |

|

By Price Range |

Economy Mid-Range Premium |

|

By Distribution Channel |

Offline Retail Online Retail |

|

By Region |

North South East West |

Products

Key Target Audience

Bicycle Manufacturers

Cycling Accessories Providers

Retail and E-Commerce Businesses

Health and Fitness Clubs

Environmental Non-Governmental Organizations

Urban Planning and Infrastructure Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Road Transport and Highways, State Municipal Corporations)

Companies

Players Mentioned in the Report

Hero Cycles

Avon Cycles

Firefox Bikes

Hercules Cycles

Atlas Cycles

TI Cycles (BSA, Montra)

Mach City

Decathlon India

Giant Bicycles

Scott Sports

Table of Contents

1. India Cycling Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Cycling Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Cycling Market Analysis

3.1. Growth Drivers

3.1.1. Fitness and Health Awareness

3.1.2. Urban Infrastructure Development

3.1.3. Rise in Sustainable Transportation

3.1.4. Increased Disposable Income

3.2. Market Challenges

3.2.1. Road Safety Concerns

3.2.2. Lack of Infrastructure

3.2.3. High Import Costs for Premium Cycles

3.3. Opportunities

3.3.1. Government Cycling Initiatives

3.3.2. Eco-Friendly Transportation Options

3.3.3. Expansion into Rural Markets

3.4. Trends

3.4.1. E-Bike Popularity

3.4.2. Growth of Cycling Clubs and Communities

3.4.3. Rising Demand for Premium and Sports Bicycles

3.5. Government Regulations

3.5.1. Cycling Promotion Policies

3.5.2. Urban Mobility Plans

3.5.3. Import Tariff Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Cycling Market Segmentation

4.1. By Type of Bicycle (In Value %)

4.1.1. Road Bikes

4.1.2. Mountain Bikes

4.1.3. Hybrid Bikes

4.1.4. E-Bikes

4.2. By Age Group (In Value %)

4.2.1. Children

4.2.2. Adults

4.2.3. Seniors

4.3. By Price Range (In Value %)

4.3.1. Economy

4.3.2. Mid-Range

4.3.3. Premium

4.4. By Distribution Channel (In Value %)

4.4.1. Offline Retail

4.4.2. Online Retail

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Cycling Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hero Cycles

5.1.2. Avon Cycles

5.1.3. Firefox Bikes

5.1.4. Hercules Cycles

5.1.5. Atlas Cycles

5.1.6. TI Cycles (BSA, Montra)

5.1.7. Mach City

5.1.8. Decathlon India

5.1.9. Giant Bicycles

5.1.10. Scott Sports

5.2. Cross Comparison Parameters (Brand Presence, Pricing, Distribution Reach, Product Range, Manufacturing Capacity, Market Share, Customer Reviews, Digital Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. India Cycling Market Regulatory Framework

6.1. Import and Export Regulations

6.2. Cycling Safety Standards

6.3. Compliance Requirements

6.4. Certification Processes

7. India Cycling Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. India Cycling Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Segment Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This stage involves mapping the primary stakeholders and variables impacting the India Cycling Market. Using comprehensive desk research, data was gathered from reliable databases, focusing on market dynamics, infrastructure development, and demographic factors.

Step 2: Market Analysis and Construction

Historical data analysis for the India Cycling Market was conducted to assess product and service penetration rates, analyze pricing trends, and identify the distribution channels shaping the market.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through expert interviews, using CATI methodologies, with executives from top cycling manufacturers and urban planners. This provided insights into operational and financial perspectives that refined our data interpretation.

Step 4: Research Synthesis and Final Output

The final phase entailed direct engagement with industry leaders, confirming product segment data, sales metrics, and consumer preferences. These insights were integrated into a bottom-up approach to deliver a validated, comprehensive analysis of the India Cycling Market.

Frequently Asked Questions

1. How big is the India Cycling Market?

The India Cycling Market, valued at USD 3 billion, is driven by increased health consciousness and a push for sustainable transport options.

2. What are the challenges in the India Cycling Market?

Key challenges in India Cycling Market include insufficient cycling infrastructure, high import tariffs on premium models, and safety concerns on Indian roads.

3. Who are the major players in the India Cycling Market?

Major players in India Cycling Market include Hero Cycles, Avon Cycles, Firefox Bikes, and Atlas Cycles, known for their extensive distribution networks and diverse product offerings.

4. What factors are driving growth in the India Cycling Market?

Growth drivers in India Cycling Market include rising health awareness, government incentives promoting eco-friendly transport, and the expansion of cycling infrastructure in urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.