India Data Analytics Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4012

November 2024

91

About the Report

India Data Analytics Market Overview

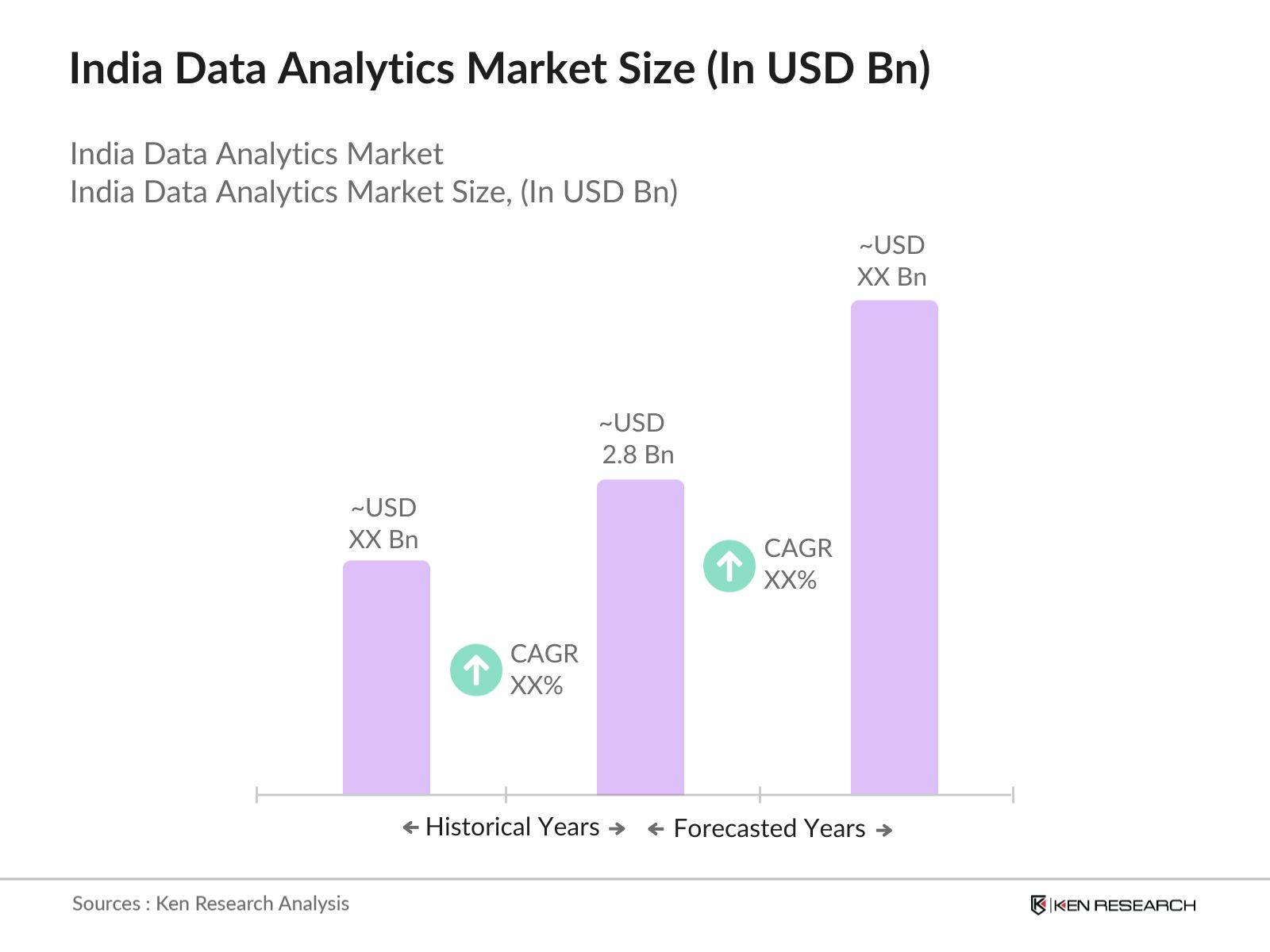

- The India Data Analytics market is valued at USD 2.8 billion, driven by the rapid adoption of big data, artificial intelligence (AI), and machine learning (ML) across industries. Companies in sectors like BFSI, retail, healthcare, and manufacturing are increasingly using data analytics to make informed decisions, improve customer experiences, and optimize operations. The market's growth is further supported by government initiatives promoting digital transformation and the increasing availability of real-time data.

- Major cities in India such as Bengaluru, Hyderabad, and Mumbai dominate the data analytics market. These cities are home to key IT hubs and multinational companies with a significant focus on data-driven technologies. Bengaluru, often referred to as the "Silicon Valley of India," leads in terms of skilled talent availability and technological innovation. Hyderabad and Mumbai also play crucial roles due to their strong IT infrastructure, presence of tech parks, and government support for tech-based innovations.

- India's Data Protection Bill of 2022 mandates that businesses store critical data locally, posing both a challenge and an opportunity for the data analytics industry. By 2024, over 50% of firms in financial services and e-commerce sectors have adjusted their data storage strategies to comply with these regulations, often incurring significant infrastructure investments. These regulatory changes are pivotal in shaping data analytics operations in India.

India Data Analytics Market Segmentation

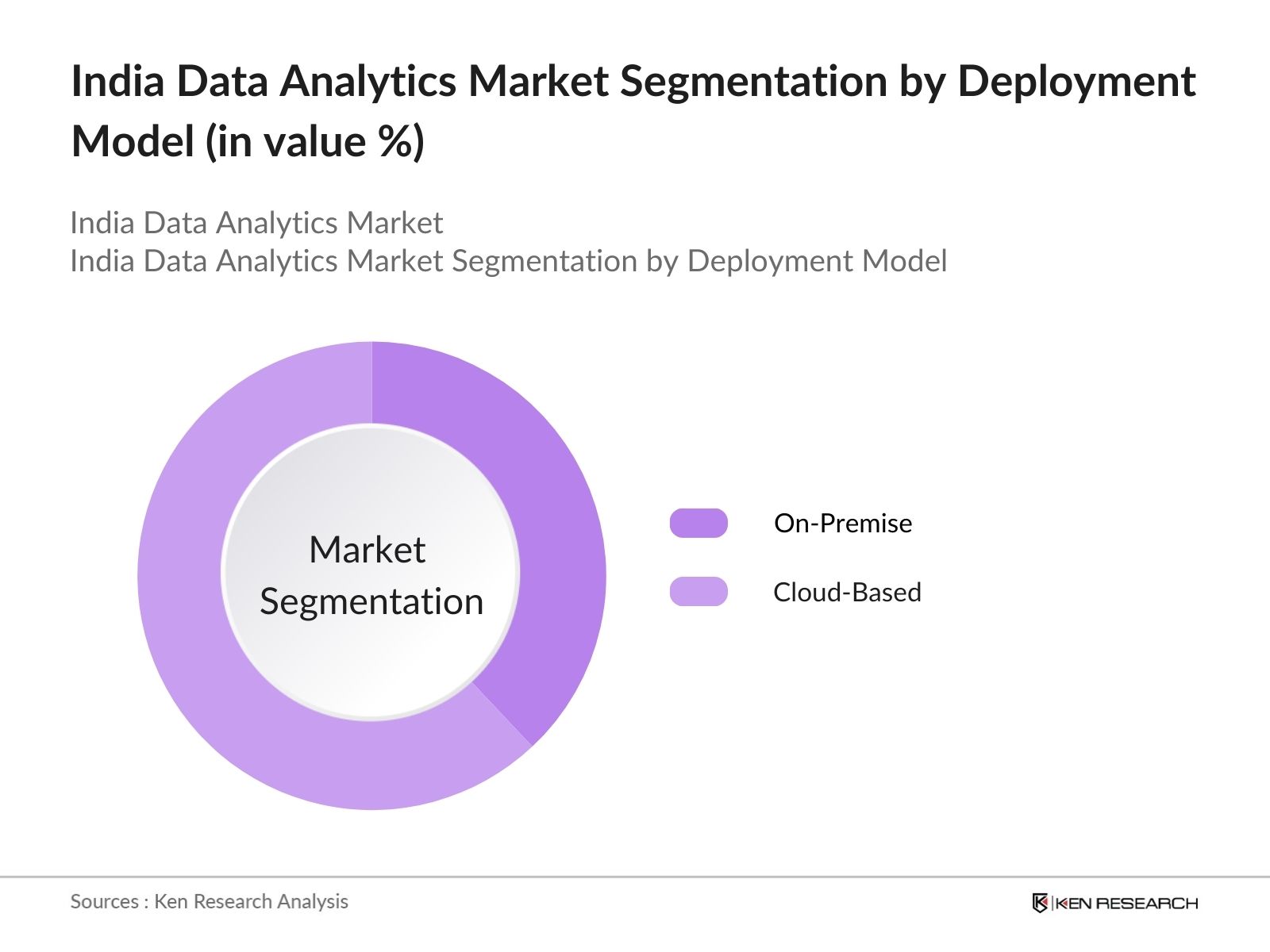

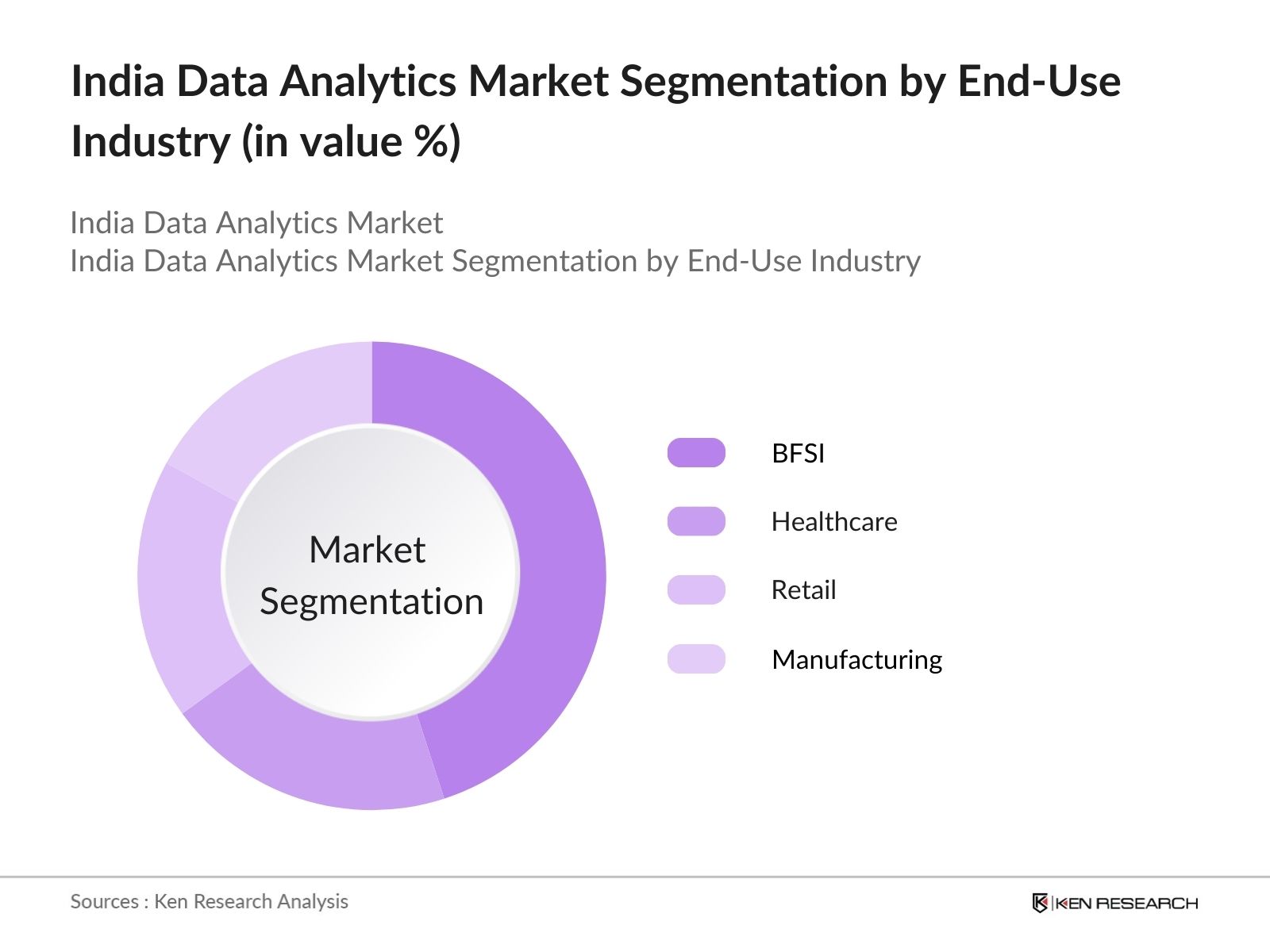

India's data analytics market is segmented by deployment model and by end-use industry.

- By Deployment Model: India's data analytics market is segmented by deployment model into on-premise and cloud-based solutions. Recently, cloud-based data analytics has dominated the market due to its scalability, cost-effectiveness, and ease of access from anywhere. Businesses are increasingly adopting cloud platforms such as AWS, Azure, and Google Cloud, which provide the necessary tools for processing and analyzing vast datasets. This shift towards cloud-based analytics is also driven by the rapid increase in remote work and the need for flexible infrastructure.

By End-Use Industry: The market is further segmented by end-use industry into BFSI, healthcare, retail, and manufacturing. Among these, the BFSI sector holds a dominant share due to its significant reliance on data analytics for fraud detection, risk management, and customer experience optimization. Data analytics helps financial institutions assess credit risk, detect anomalies in transactions, and predict market trends, making it indispensable in the sector. The high level of digitalization in BFSI ensures the widespread adoption of advanced analytics solutions.

India Data Analytics Market Competitive Landscape

The India Data Analytics market is dominated by a mix of domestic and international players, including major IT service providers and cloud platform providers. This consolidation highlights the significant influence of key companies that offer a wide range of data analytics services and solutions.

India Data Analytics Market Analysis

Growth Drivers

- Increased Data Generation India generates an estimated 2.5 quintillion bytes of data daily as of 2024, driven by rapid digitalization and expanding internet connectivity. With over 825 million internet users and increasing smartphone penetration, the country's data production has surged. The integration of IoT devices in sectors like manufacturing and agriculture further amplifies data generation. This massive volume creates a growing demand for real-time data analytics solutions, especially in urban areas like Delhi and Bengaluru, where technological adoption rates are highest.

- Rising Demand for Business Intelligence Tools As of 2023, approximately 70% of large enterprises in India are utilizing business intelligence (BI) tools to make informed decisions, particularly in banking and retail sectors. This is largely fueled by the need for data-driven decision-making to enhance operational efficiency. India's BI tools market is expanding due to the adoption of cloud-based analytics solutions and AI/ML technologies. Financial institutions alone report processing over 500 million data transactions daily, intensifying the need for advanced BI tools.

- Growing Adoption of AI and Machine Learning (AI/ML) Technologies In 2024, AI/ML adoption in India saw exponential growth, especially in healthcare, finance, and logistics sectors. The AI industry, powered by more than 20,000 startups, employs around 300,000 professionals. With AI increasingly integrated into automated decision systems, Indian banks report AI handling over 1 billion transactions annually. This growing adoption is also supported by Indias cloud infrastructure investments, with a 33% increase in cloud storage capacity between 2022 and 2024.

Market Challenges

- Complex Regulatory Environment Indias evolving data regulatory landscape poses challenges for businesses in the data analytics space. The Data Protection Bill, which mandates strict data localization and consent requirements, is a key regulatory factor affecting data handling practices. By 2024, more than 45% of businesses cited compliance difficulties in integrating these regulations with their analytics processes. The localization of data adds complexity to cross-border data exchanges, particularly for firms handling large datasets across sectors like IT and finance.

- Shortage of Skilled Data Professionals As of 2024, there is a shortage of 150,000 skilled data professionals across sectors such as healthcare, finance, and e-commerce. While India produces around 2 million engineering graduates annually, only a small fraction specializes in data science or analytics, contributing to the talent gap. This shortage has pushed firms to seek out international talent or invest heavily in reskilling programs, which increases operational costs.

India Data Analytics Market Future Outlook

Over the next five years, the India Data Analytics market is expected to experience strong growth driven by the increasing integration of AI, machine learning, and data-driven technologies in various industries. The demand for predictive analytics, cloud computing, and real-time data insights will continue to rise as companies strive to enhance their operational efficiencies and stay competitive in the digital landscape.

Market Opportunities

- Expansion of Data Analytics in Banking & Insurance Indias banking and insurance sectors are leveraging data analytics to streamline operations, manage risks, and enhance customer service. In 2023, Indian banks reported processing over 1.2 billion digital transactions per day, with analytics platforms analyzing customer data to detect fraud and optimize lending. The Insurance sector, dealing with approximately 25 million claims annually, is investing in predictive analytics to manage risk and prevent fraud. This presents a growing opportunity for data analytics solutions in financial services. Data source: IMF.

- Opportunities in Healthcare Analytics India's healthcare system processes millions of patient records annually, offering a growing opportunity for data analytics in diagnosis, patient management, and operational efficiency. As of 2023, over 700 hospitals in metro cities are utilizing AI-based diagnostic tools, analyzing millions of health records to predict outcomes and improve care. The governments push for a national health stack aims to integrate healthcare data analytics into rural healthcare delivery, creating a substantial market for health-tech firms.

Scope of the Report

Products

Key Target Audience

IT Service Providers

Data Analytics Solution Providers

Cloud Platform Providers

Large Enterprises

Small and Medium Enterprises (SMEs)

Government and Regulatory Bodies (Ministry of Electronics and Information Technology, Data Protection Authority)

Investors and Venture Capitalist Firms

Technology and Software Development Companies

Companies

Players Mention in the Report:

Tata Consultancy Services (TCS)

Infosys Limited

Wipro Limited

IBM India

Accenture India

Tech Mahindra

HCL Technologies

Deloitte India

Capgemini India

Larsen & Toubro Infotech

Cognizant Technology Solutions India

Genpact India

Mu Sigma

Mindtree

Hexaware Technologies

Table of Contents

1. India Data Analytics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Data Analytics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Data Analytics Market Analysis

3.1 Growth Drivers (Real-Time Data Processing, Advanced Predictive Analytics Adoption, Cloud-Based Solutions Expansion)

3.1.1. Increased Data Generation

3.1.2. Rising Demand for Business Intelligence Tools

3.1.3. Growing Adoption of AI and Machine Learning (AI/ML) Technologies

3.1.4. Government Initiatives on Digital Transformation (Digital India, AI for All)

3.2. Market Challenges (Data Privacy Concerns, Regulatory Compliance, Data Integration Issues)

3.2.1. Complex Regulatory Environment

3.2.2. Shortage of Skilled Data Professionals

3.2.3. High Cost of Advanced Analytics Tools

3.2.4. Limited Data Infrastructure in Rural Areas

3.3. Opportunities (SME Digitalization, Expansion of Analytics in Non-Metro Cities, Data Democratization)

3.3.1. Expansion of Data Analytics in Banking & Insurance

3.3.2. Opportunities in Healthcare Analytics

3.3.3. Growth of E-commerce Data Analytics

3.3.4. Emergence of Real-Time Edge Analytics

3.4. Trends (Edge Computing Integration, Democratization of AI, Rise of Self-Service Analytics Tools)

3.4.1. Cloud-Based Analytics Solutions

3.4.2. Real-Time Big Data Analytics in Retail

3.4.3. Growth of Citizen Data Scientists

3.4.4. Increased Use of Augmented Analytics

3.5. Government Regulations (Data Localization Norms, Data Protection Bill, GDPR Equivalent Standards)

3.5.1. Indias Data Protection and Privacy Laws

3.5.2. Data Governance Initiatives by the Government

3.5.3. AI and Data Analytics Frameworks by NITI Aayog

3.5.4. Public-Private Partnerships in Digital Infrastructure Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. India Data Analytics Market Segmentation

4.1. By Deployment Model (In Value %)

4.1.1. On-Premise

4.1.2. Cloud-Based

4.2. By End-Use Industry (In Value %)

4.2.1. BFSI

4.2.2. Healthcare

4.2.3. Retail

4.2.4. Manufacturing

4.3. By Technology (In Value %)

4.3.1. Descriptive Analytics

4.3.2. Predictive Analytics

4.3.3. Prescriptive Analytics

4.4. By Organization Size (In Value %)

4.4.1. SMEs

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Data Analytics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tata Consultancy Services (TCS)

5.1.2. Infosys Limited

5.1.3. Wipro Limited

5.1.4. IBM India

5.1.5. Accenture India

5.1.6. Tech Mahindra

5.1.7. HCL Technologies

5.1.8. Deloitte India

5.1.9. Capgemini India

5.1.10. Larsen & Toubro Infotech

5.1.11. Cognizant Technology Solutions India

5.1.12. Genpact India

5.1.13. Mu Sigma

5.1.14. Mindtree

5.1.15. Hexaware Technologies

5.2. Cross Comparison Parameters (Revenue, Headquarters, No. of Employees, Inception Year, Key Clients, Service Portfolio, Industry Certifications, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Support and Initiatives

6. India Data Analytics Market Regulatory Framework

6.1. Data Protection Laws (Personal Data Protection Bill, IT Act Compliance)

6.2. Industry Compliance Standards (ISO, GDPR, SOC 2)

6.3. Certification Requirements (Data Security and Privacy Regulations)

7. India Data Analytics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Factors Driving Future Market Growth

8. India Data Analytics Future Market Segmentation

8.1. By Deployment Model (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Technology (In Value %)

8.4. By Organization Size (In Value %)

8.5. By Region (In Value %)

9. India Data Analytics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Strategy

9.3. Business Expansion Recommendations

9.4. Key White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase of research involves identifying the key variables that influence the India Data Analytics market. This is done through extensive secondary research, analyzing industry reports, and understanding the impact of regulatory bodies and key stakeholders in the data analytics landscape.

Step 2: Market Analysis and Construction

In this step, we analyze historical data on data analytics usage across different industries and regions in India. This includes studying data consumption patterns, market penetration of cloud-based analytics, and revenue generation trends across sectors such as BFSI and healthcare.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, consultations with industry experts are conducted through telephonic and online interviews. These experts provide insights into the trends, challenges, and opportunities within the data analytics market in India.

Step 4: Research Synthesis and Final Output

In the final step, the synthesized research is used to create a comprehensive market report. The data is validated using a bottom-up approach, ensuring accurate market sizing and forecasts for the India Data Analytics market.

Frequently Asked Questions

01. How big is the India Data Analytics Market?

The India Data Analytics market is valued at USD 2.8 billion, driven by increasing digital transformation across industries, adoption of AI and ML, and government support for technology-driven growth.

02. What are the challenges in the India Data Analytics Market?

Challenges in the India Data Analytics market include a shortage of skilled professionals, concerns around data privacy, and the high cost of implementing data analytics solutions, especially for small and medium enterprises.

03. Who are the major players in the India Data Analytics Market?

Key players in India Data Analytics market include Tata Consultancy Services, Infosys Limited, Wipro Limited, IBM India, and Accenture India, all of which have a significant presence in the data analytics domain.

04. What are the growth drivers of the India Data Analytics Market?

The India Data Analytics market is driven by the increasing use of big data, AI, and machine learning across industries, as well as the rising demand for real-time data insights and cloud-based analytics solutions.

05. What are the opportunities in the India Data Analytics Market?

Opportunities in the India Data Analytics market include the growing demand for data analytics in the healthcare and BFSI sectors, advancements in AI and IoT, and the expansion of analytics services into tier 2 and 3 cities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.