India Data Center Cooling Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD3783

October 2024

92

About the Report

India Data Center Cooling Market Overview

- The India Data Center Cooling market is valued at USD 1.6 billion, driven by increasing digitalization, cloud adoption, and the rapid expansion of hyperscale data centers across the country. As the country experiences significant growth in internet users and demand for data services, enterprises are investing heavily in expanding their data infrastructure.

- Bengaluru, Mumbai, and Hyderabad dominate the market, primarily due to their advanced infrastructure, availability of reliable power, and proximity to tech hubs. These cities have become major data center hubs because they provide easy access to key IT infrastructure, a skilled workforce, and large-scale digital transformation projects.

- In 2023, the Indian government allocated INR 4,000 crore to develop data center parks in various parts of the country. These parks will be equipped with cutting-edge cooling technologies, reducing the overall energy consumption of data centers housed within them. The scheme aims to encourage private sector investment in high-efficiency cooling systems, particularly in regions like Maharashtra and Tamil Nadu, where energy consumption and cooling needs are most critical.

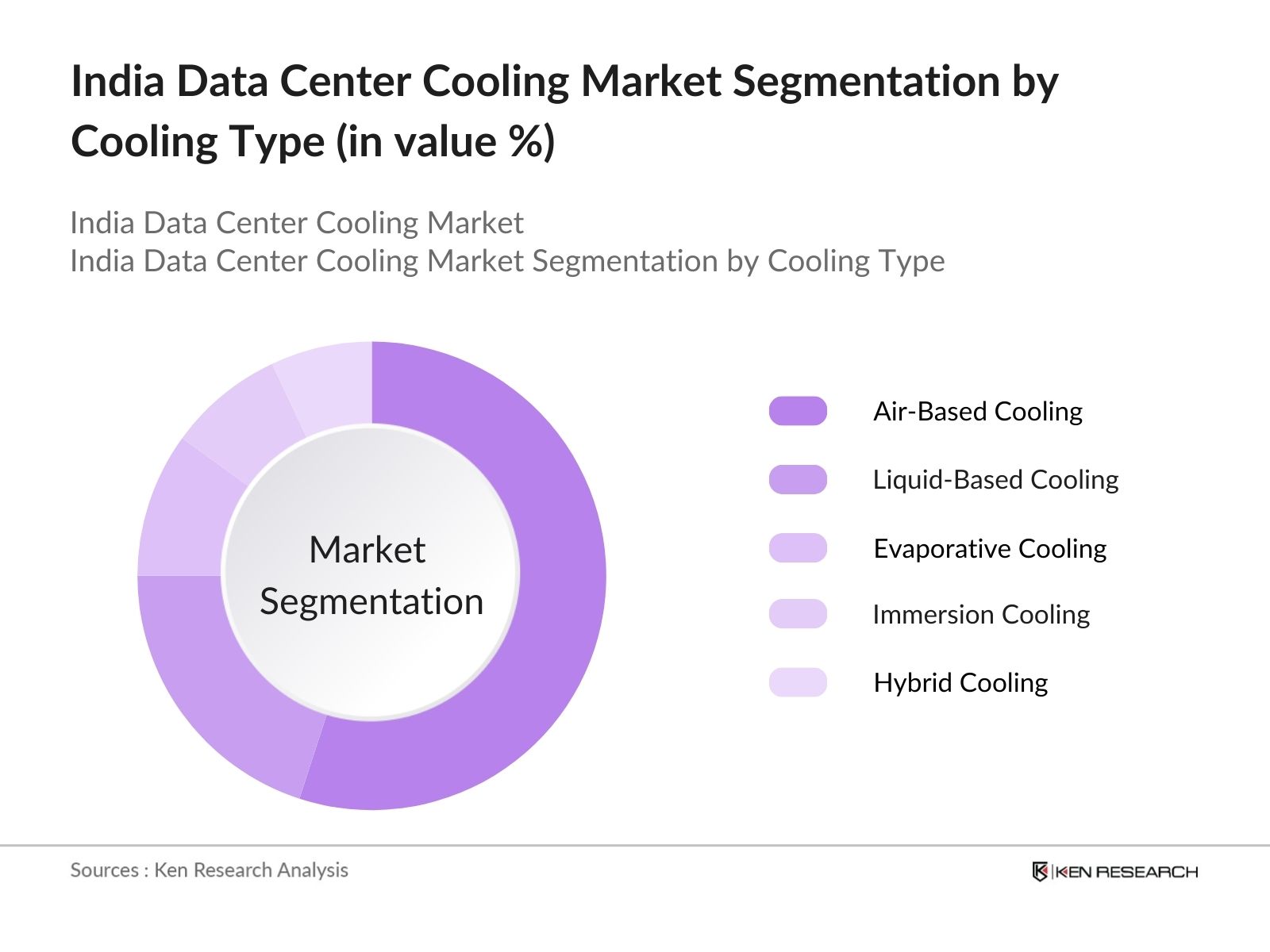

India Data Center Cooling Market Segmentation

By Cooling Type: The market is segmented by cooling type into air-based cooling, liquid-based cooling, evaporative cooling, immersion cooling, and hybrid cooling. Air-based cooling remains the dominant segment, driven by its established presence and ease of deployment in existing data centers. This segment is highly popular due to its cost-efficiency and compatibility with various data center sizes, including hyperscale facilities.

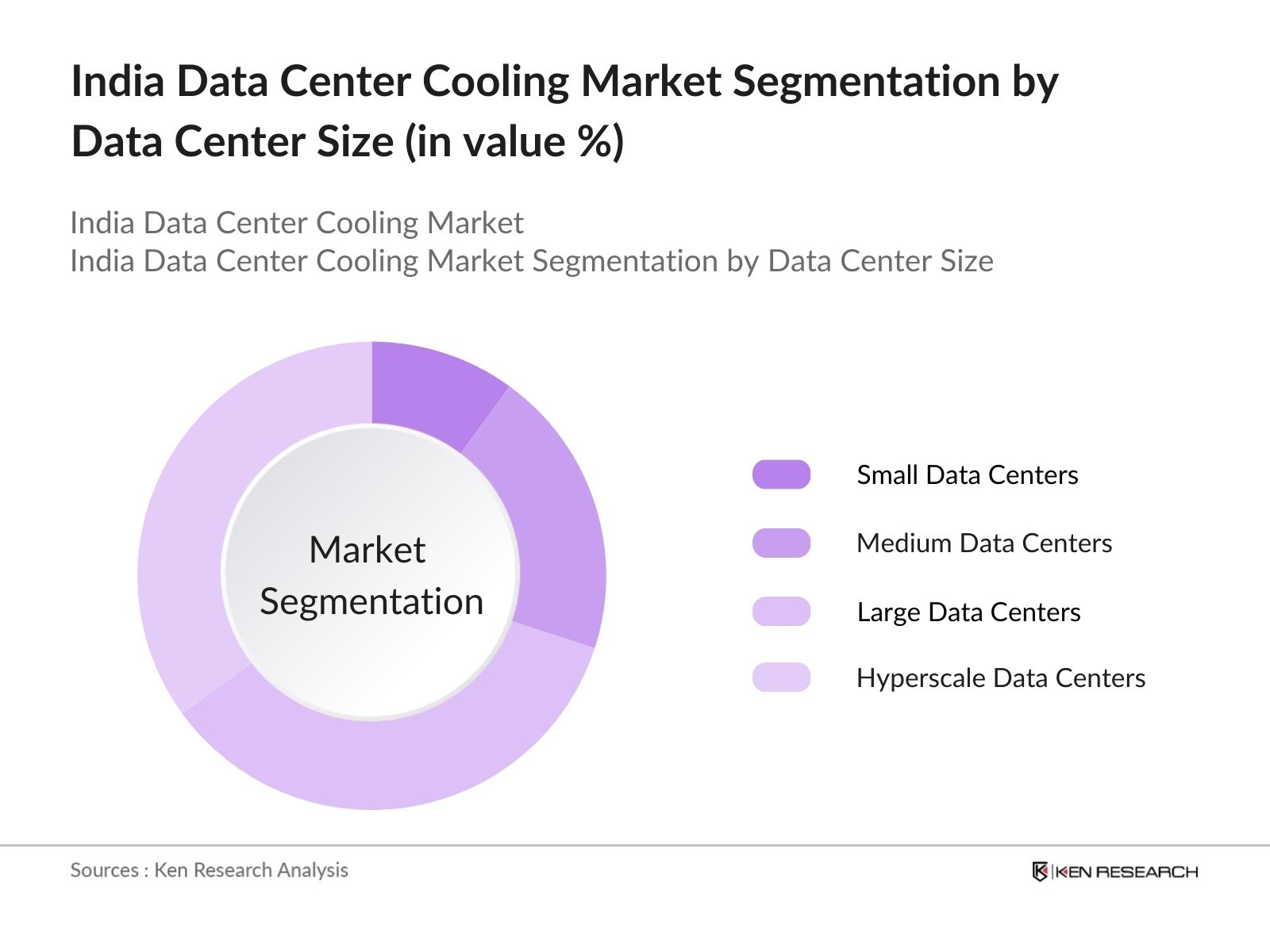

By Data Center Size: The market is further segmented by data center size into small, medium, large, and hyperscale data centers. Large and hyperscale data centers dominate the market, as they house massive server racks that generate heat, requiring specialized cooling solutions to maintain optimal temperatures. The hyperscale data center segment is particularly growing due to increased investments by global technology companies in India, drawn by the countrys strategic importance as a data hub.

India Data Center Cooling Market Competitive Landscape

The market is dominated by both international and domestic players, with leading companies specializing in energy-efficient cooling technologies. The market competition is characterized by the push for sustainability, as players innovate to reduce the carbon footprint of data center operations.

|

Company |

Year Established |

Headquarters |

Cooling Type Focus |

Energy Efficiency Innovations |

Product Portfolio Size |

Key Data Center Partnerships |

Revenue (INR Bn) |

Technology Integration |

Presence in India |

|

Vertiv Group Corp. |

1946 |

Ohio, USA |

|||||||

|

Schneider Electric |

1836 |

Rueil-Malmaison, France |

|||||||

|

STULZ GmbH |

1947 |

Hamburg, Germany |

|||||||

|

Mitsubishi Electric Corp. |

1921 |

Tokyo, Japan |

|||||||

|

Huawei Technologies Co., Ltd. |

1987 |

Shenzhen, China |

India Data Center Cooling Market Analysis

Market Growth Drivers

- Expansion of Cloud Computing Services: The rapid adoption of cloud computing in India is a key driver for the growth of the market. By 2023, India had 700 million internet users, with the cloud services market growing due to increasing demand from sectors like healthcare, banking, and IT. As companies shift more data to the cloud, the need for large-scale data centers equipped with advanced cooling systems is crucial to handle massive workloads and maintain operational efficiency. Indias push toward digital transformation, including the Digital India program, has significantly accelerated this trend.

- Surge in Data Traffic: India's data traffic has surged, with mobile data consumption reaching over 44967 petabytes per month in 2023, according to the Telecom Regulatory Authority of India. This increase has necessitated the construction of new data centers to manage growing volumes of information. As data traffic continues to expand, maintaining optimal temperatures in data centers becomes more challenging, driving demand for highly efficient cooling systems that can manage the heat generated by increased server usage.

- Investments in Green Data Centers: India has seen a rise in investments aimed at establishing environmentally sustainable data centers. These green initiatives focus on adopting energy-efficient cooling technologies to reduce power consumption and carbon emissions, aligning with Indias climate goals under the Paris Agreement. This drive for sustainability is expected to accelerate the adoption of advanced cooling solutions across the country.

Market Challenges

- Limited Power Infrastructure: One of the primary challenges facing the Indian data center cooling market is the countrys limited power infrastructure. Data centers consume enormous amounts of electricity, and India's power generation capabilities, though improving, still struggle to meet these demands. The countrys energy sector reported an average deficit of 5,000 megawatts in 2023, which often leads to power outages and increased operational costs for data centers relying on cooling technologies.

- Water Scarcity for Cooling: Water is a critical component for many cooling technologies, particularly in liquid cooling systems. However, India faces severe water shortages, with the Ministry of Jal Shakti reporting that 12 Indian states experienced acute water stress in 2023. This scarcity limits the feasibility of using water-intensive cooling solutions in regions where water is a precious commodity. As water availability diminishes, data centers in these areas may struggle to implement advanced cooling technologies that require substantial water resources.

India Data Center Cooling Market Future Outlook

Over the next five years, the India Data Center Cooling industry is expected to experience robust growth, driven by the increasing demand for digital services, cloud adoption, and continued investments in hyperscale data centers. Government support for data localization and policies favoring energy-efficient cooling systems will further boost the market.

Future Market Opportunities

- Adoption of Liquid Cooling: Over the next five years, liquid cooling is expected to become the dominant technology in market. This method, which immerses components in a liquid coolant, is likely to be widely adopted due to its superior energy efficiency. Liquid cooling systems have shown the ability to reduce energy consumption by up to 40% in recent trials, and more data centers are expected to implement this technology as energy efficiency regulations tighten.

- Integration of AI for Cooling Efficiency: The use of Artificial Intelligence (AI) in optimizing data center cooling will increase significantly. AI can analyze real-time data to automatically adjust cooling systems, improving energy efficiency and reducing operational costs. By 2025, AI-driven cooling solutions will become standard across large data centers in India, allowing for more precise temperature control and reduced energy consumption.

Scope of the Report

|

Cooling Type |

Air-Based Cooling |

|

Liquid-Based Cooling |

|

|

Evaporative Cooling |

|

|

Immersion Cooling |

|

|

Hybrid Cooling |

|

|

Component |

Chillers |

|

Air Handling Units (AHUs) |

|

|

Computer Room Air Conditioners (CRACs) |

|

|

Pumps |

|

|

Cooling Towers |

|

|

Data Center Size |

Small Data Centers |

|

Medium Data Centers |

|

|

Large and Hyperscale Data Centers |

|

|

End-User |

IT & Telecom |

|

BFSI |

|

|

Healthcare |

|

|

Government and Defense |

|

|

Retail and E-commerce |

|

|

Region |

North |

|

South |

|

|

East |

|

|

West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

IT Infrastructure Providers

Telecommunications Companies

Government and Regulatory Bodies (Department of Telecommunications, Ministry of Electronics and IT)

Cloud Service Providers

Industrial Cooling Solution Providers

Investments and Venture Capitalist Firms

Energy Efficiency Consulting Firms

Companies

Players Mentioned in the Report:

Vertiv Group Corp.

Schneider Electric

STULZ GmbH

Mitsubishi Electric Corporation

Huawei Technologies Co., Ltd.

Rittal GmbH & Co. KG

Delta Electronics, Inc.

Trane Technologies

Daikin Industries Ltd.

Fujitsu General

ABB Group

CoolIT Systems Inc.

Asetek A/S

Nortek Air Solutions

Hitachi, Ltd.

Table of Contents

1. India Data Center Cooling Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Data Center Cooling Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Data Center Cooling Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Digitalization

3.1.2 Government Initiatives for Data Localization

3.1.3 Rising Demand for Energy-Efficient Solutions

3.1.4 Expansion of Cloud Services and Hyperscale Data Centers

3.2 Market Challenges

3.2.1 High Initial Setup Costs

3.2.2 Energy Consumption Regulations (Energy efficiency standards)

3.2.3 Lack of Skilled Workforce for Maintenance

3.2.4 High Heat Dissipation Requirements

3.3 Opportunities

3.3.1 Emergence of Green Data Centers

3.3.2 Increasing Adoption of Liquid Cooling Systems

3.3.3 Strategic Partnerships with Technology Providers

3.3.4 Government Incentives for Energy-Efficient Cooling Solutions

3.4 Trends

3.4.1 Adoption of IoT for Real-Time Monitoring

3.4.2 Integration with Smart Power Distribution Units

3.4.3 Use of Renewable Energy for Cooling (Renewable energy sources integration)

3.4.4 Modular Data Center Design

3.5 Government Regulation

3.5.1 Cooling System Efficiency Regulations

3.5.2 Energy Consumption Standards

3.5.3 Green Data Center Policies

3.5.4 Environmental Impact Assessment Regulations

3.6 SWOT Analysis

3.7 Stake Ecosystem (Key stakeholders: operators, equipment manufacturers, regulators)

3.8 Porters Five Forces (Bargaining power of suppliers, threat of substitutes, etc.)

3.9 Competition Ecosystem

4. India Data Center Cooling Market Segmentation

4.1 By Cooling Type (In Value %)

4.1.1 Air-Based Cooling

4.1.2 Liquid-Based Cooling

4.1.3 Evaporative Cooling

4.1.4 Immersion Cooling

4.1.5 Hybrid Cooling

4.2 By Component (In Value %)

4.2.1 Chillers

4.2.2 Air Handling Units (AHUs)

4.2.3 Computer Room Air Conditioners (CRACs)

4.2.4 Pumps

4.2.5 Cooling Towers

4.3 By Data Center Size (In Value %)

4.3.1 Small Data Centers

4.3.2 Medium Data Centers

4.3.3 Large and Hyperscale Data Centers

4.4 By End-User (In Value %)

4.4.1 IT & Telecom

4.4.2 BFSI

4.4.3 Healthcare

4.4.4 Government and Defense

4.4.5 Retail and E-commerce

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. India Data Center Cooling Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Vertiv Group Corp.

5.1.2 Schneider Electric

5.1.3 STULZ GmbH

5.1.4 Mitsubishi Electric Corporation

5.1.5 Nortek Air Solutions

5.1.6 Rittal GmbH & Co. KG

5.1.7 Fujitsu General

5.1.8 Daikin Industries Ltd.

5.1.9 CoolIT Systems Inc.

5.1.10 Asetek A/S

5.1.11 Huawei Technologies Co., Ltd.

5.1.12 ABB Group

5.1.13 Delta Electronics, Inc.

5.1.14 Trane Technologies

5.1.15 Hitachi, Ltd.

5.2 Cross Comparison Parameters (Cooling efficiency, data center footprint, technology partnerships, regional presence, etc.)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Data Center Cooling Market Regulatory Framework

6.1 Energy-Efficiency Standards (Government regulations on energy usage)

6.2 Compliance Requirements

6.3 Certification Processes

7. India Data Center Cooling Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Data Center Cooling Market Future Market Segmentation

8.1 By Cooling Type (In Value %)

8.2 By Component (In Value %)

8.3 By Data Center Size (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. India Data Center Cooling Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we map out all stakeholders within the India Data Center Cooling Market. This includes identifying relevant companies, technologies, and government policies. Secondary data is gathered through extensive desk research, utilizing proprietary databases and industry reports to pinpoint market dynamics.

Step 2: Market Analysis and Construction

This step involves gathering historical data on data center cooling technologies and evaluating their market penetration in different regions of India. We also analyze key metrics like operational efficiency and energy consumption to derive revenue estimates and trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by engaging with industry experts through telephone interviews and online consultations. Experts from top data center firms provide key insights on market challenges, cooling technology advancements, and upcoming trends.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all the collected data into a comprehensive report, ensuring that the insights gathered are accurate and well-validated. Data center operators and technology providers are consulted directly to confirm findings.

Frequently Asked Questions

01. How big is the India Data Center Cooling Market?

The India Data Center Cooling market is valued at USD 1.6 billion, driven by rapid digitalization, cloud services, and government initiatives for data localization.

02. What are the challenges in the India Data Center Cooling Market?

Key challenges in the India Data Center Cooling market include high initial investment costs, energy efficiency regulations, and the lack of skilled workforce to manage advanced cooling solutions.

03. Who are the major players in the Market?

Major players in the India Data Center Cooling market include Vertiv Group Corp., Schneider Electric, STULZ GmbH, Mitsubishi Electric Corporation, and Huawei Technologies Co., Ltd.

04. What are the growth drivers of the India Data Center Cooling Market?

The India Data Center Cooling market is propelled by increasing digitalization, rising demand for energy-efficient data centers, and the expansion of cloud services in India.

05. What future trends are expected in the India Data Center Cooling Market?

Key trends in the India Data Center Cooling market include the adoption of liquid cooling technologies, green data centers, and the integration of AI and IoT for real-time monitoring and optimization of cooling systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.