India Data Center Virtualization Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD9983

December 2024

84

About the Report

India Data Center Virtualization Market Overview

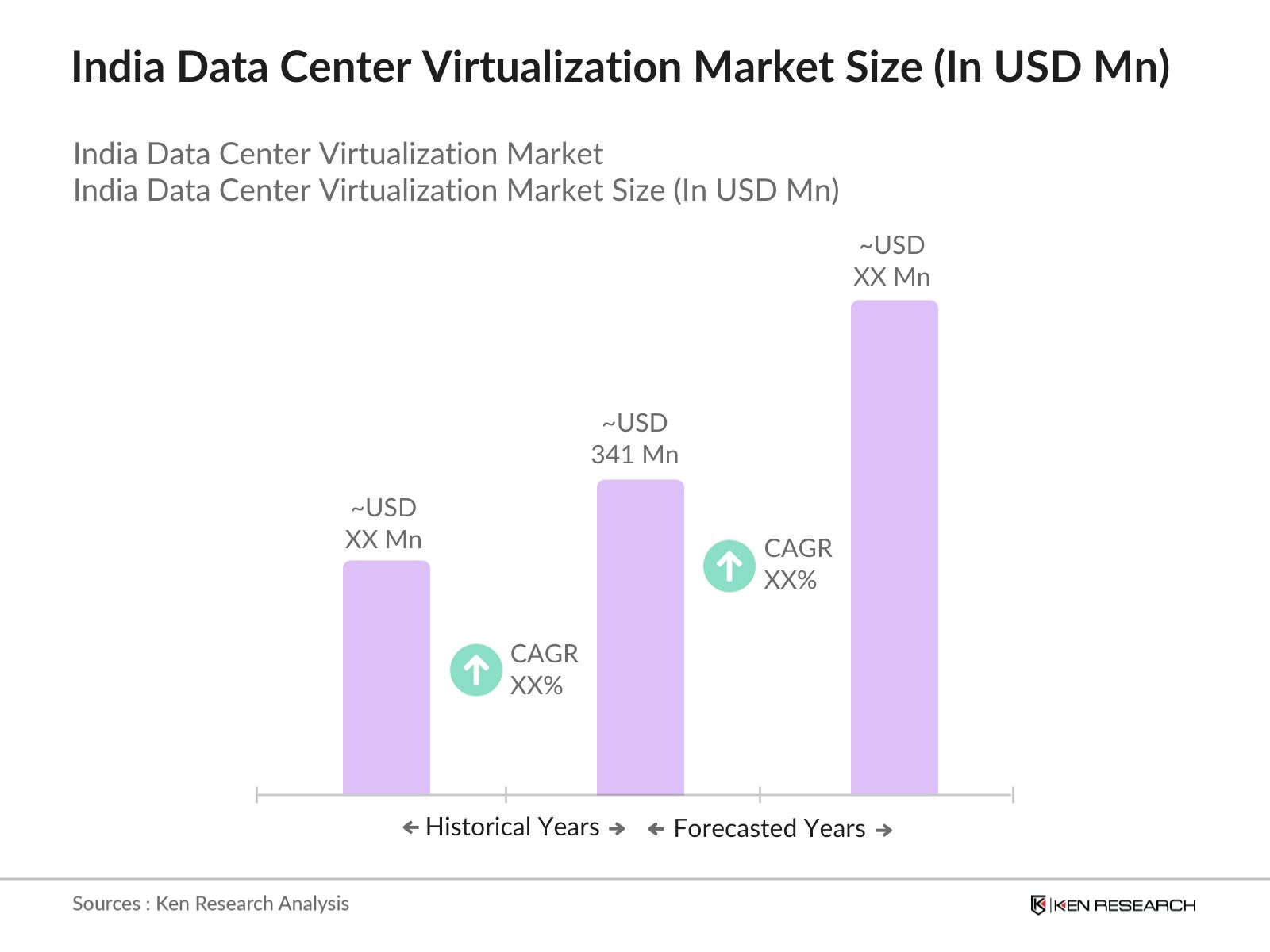

- The India Data Center Virtualization Market is valued at USD 341 million, based on a five-year historical analysis. This growth is driven by factors such as the rapid expansion of digital infrastructure, increased data demands due to a rise in mobile and broadband usage, and government initiatives promoting cloud adoption. The trend toward more scalable and efficient IT environments has made virtualization a preferred solution for optimizing server usage and reducing operational costs, making it a strategic investment for large enterprises and SMEs alike.

- The market is predominantly led by urban centers like Mumbai, Delhi NCR, and Bengaluru, where technological infrastructure and data center facilities are most developed. These cities host numerous IT hubs and attract heavy investments from global players due to a higher concentration of corporate headquarters and demand for data services. The presence of IT service giants and well-established digital ecosystems further bolsters the markets growth in these regions, positioning them as dominant contributors to data center virtualization advancements.

- Indias Personal Data Protection Bill enforces data localization, requiring companies to store critical data within Indias borders. The Ministry of Electronics and Information Technology reported that compliance with this regulation led to a 25% increase in localized data storage solutions in 2023, enhancing data sovereignty. Virtualization aids in complying with these mandates by facilitating secure, localized data management across distributed data centers. This regulation drives the demand for secure, virtualized data centers that ensure compliance.

India Data Center Virtualization Market Segmentation

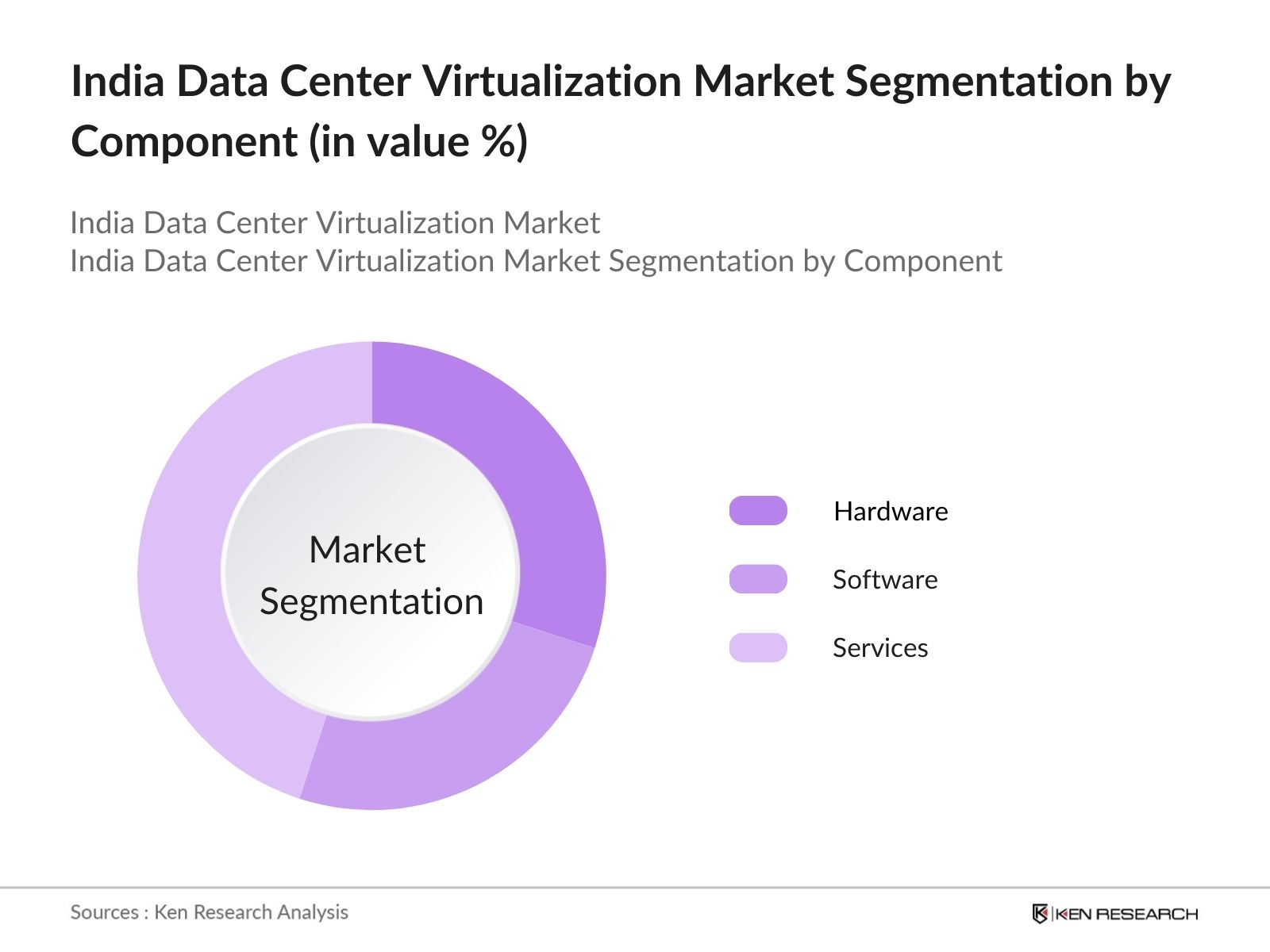

- By Component: The market is segmented by component into hardware, software, and services. Recently, services have a dominant market share under the component segmentation. This is largely due to the need for maintenance, consulting, and support services in optimizing virtualized environments. Companies often rely on third-party service providers for specialized skills in data migration, security management, and infrastructure upgrades, which ensures the virtualized infrastructure operates at peak efficiency and aligns with compliance standards.

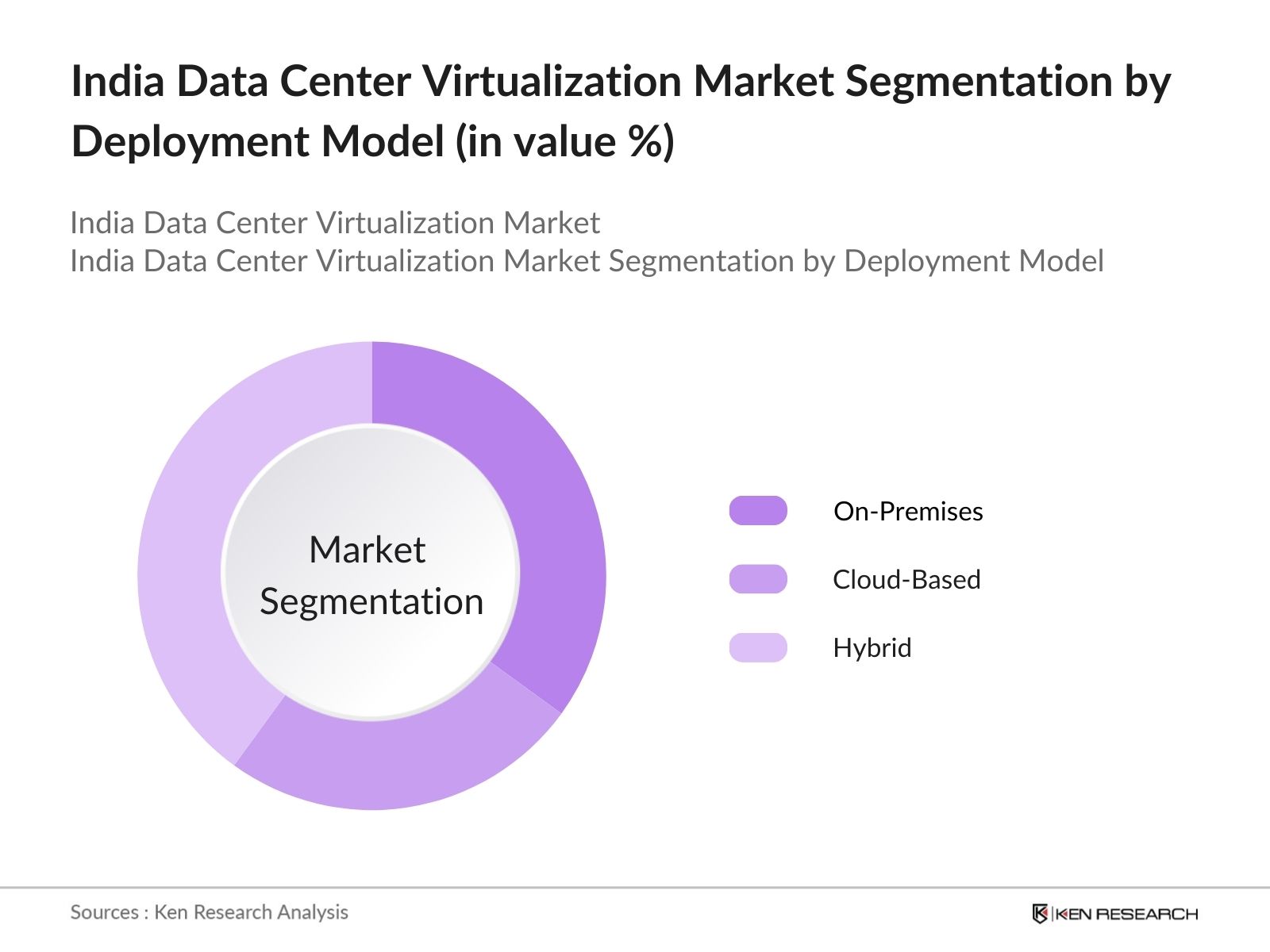

- By Deployment Mode: Indias Data Center Virtualization market is segmented by deployment mode into on-premises, cloud-based, and hybrid. Hybrid deployment has gained a notable share within the deployment mode category. Organizations are increasingly adopting hybrid models to balance data security concerns associated with cloud-based systems with the cost-efficiency and scalability that cloud offers. This approach also allows enterprises to manage workloads dynamically, giving them greater flexibility in resource allocation while optimizing performance and control.

India Data Center Virtualization Market Competitive Landscape

The India Data Center Virtualization Market is characterized by a blend of international and local players who contribute to its robust competitive landscape. This includes established IT firms and technology conglomerates that dominate due to extensive R&D investments, innovative offerings, and partnerships that enhance their service portfolios.

Company | Establishment Year | Headquarters | Revenue | Employee Strength | Cloud Capabilities | Data Center Coverage | Innovation Index |

IBM Corporation | 1911 | Armonk, New York, USA | - | - | - | - | - |

Cisco Systems, Inc. | 1984 | San Jose, California | - | - | - | - | - |

Microsoft Corporation | 1975 | Redmond, Washington | - | - | - | - | - |

Hewlett Packard Enterprise | 2015 | San Jose, California | - | - | - | - | - |

VMware, Inc. | 1998 | Palo Alto, California | - | - | - | - | - |

India Data Center Virtualization Market Analysis

Market Growth Drivers

- Increasing Data Demand and Cloud Adoption: Indias rapid digital expansion, with internet usage climbing to over 830 million users in 2023 (source: TRAI), is driving data center virtualization. Cloud adoption surged due to remote work, e-commerce, and digital services, leading to increased data handling. The National Digital Communications Policy 2022 states that Indias data consumption has grown nearly threefold since 2021, emphasizing the need for scalable and efficient data management. This surge requires virtualization to manage workloads efficiently within data centers. Cloud service providers increasingly rely on data center virtualization to optimize resources and handle the surge.

- Data Center Energy Efficiency Needs: Indias power demand for data centers increased by 35% from 2021 to 2023 due to extensive digitalization and cloud demands, as per the Ministry of Power. Energy-efficient data centers are crucial in this scenario. Data center virtualization reduces physical server dependency, thereby optimizing power usage substantially. The Ministry of Power reported that improved energy management could cut energy consumption by up to 40% in virtualized centers compared to traditional setups, highlighting virtualizations potential in achieving sustainability goals.

- Rise of Edge Computing: Edge computing adoption in India is fueled by the rise of real-time applications in IoT and autonomous technology. As per the Department of Telecommunications, India is projected to host over 10 billion IoT-connected devices by 2025, requiring fast and localized data processing. Virtualization supports edge data centers by enabling scalable management, leading to increased efficiency in IoT data processing across remote locations. The virtualization market is directly benefiting from this edge computing growth as it enhances data responsiveness and reliability, key factors in Indias IoT expansion.

Market Challenges

- High Initial Investment Costs: The setup of virtualized data centers requires investment due to the cost of high-performance servers and network infrastructure. The Ministry of Finance reported that, as of 2023, data center infrastructure costs averaged INR 1,200 crore per facility, highlighting financial barriers to virtualization adoption. This cost factor often limits smaller enterprises from investing in virtualized data solutions. While virtualization ultimately lowers operational expenses, initial capital constraints remain a hurdle for many organizations in India.

- Complexity of Legacy System Integration: Integrating virtualization technology with Indias existing legacy IT systems poses challenges. The Ministry of Electronics and Information Technology indicated that over 60% of Indian enterprises still rely on legacy infrastructure. These outdated systems lack compatibility with virtualized environments, resulting in increased complexity and higher maintenance costs. Additionally, the process of migrating data from legacy systems to virtualized platforms can lead to temporary operational disruptions, discouraging some organizations from transitioning.

India Data Center Virtualization Market Future Outlook

Over the next five years, the India Data Center Virtualization market is expected to show consistent growth, propelled by continued government investments in digital infrastructure, the surge in data-driven applications, and evolving data security regulations. Increasing demand for energy-efficient data centers and technological advancements like artificial intelligence and machine learning in virtualized environments will support this trend. Additionally, hybrid and cloud-based virtualization models are anticipated to gain further traction as more businesses transition to scalable, flexible IT frameworks.

Market Opportunities

- Adoption of AI and Automation: Indias focus on artificial intelligence and automation, fueled by the National AI Strategy, opens new avenues for data center virtualization. AI-driven automation can streamline data center operations, improving resource allocation and reducing downtime. The Department for Promotion of Industry and Internal Trade (DPIIT) noted a 40% increase in AI-related infrastructure investments in 2023, which aligns with the demand for virtualized data environments that can support AI processing requirements efficiently. This integration of AI within virtualized frameworks represents a growth opportunity for data center providers in India.

- Expansion of 5G Network: Indias 5G rollout, with over 200,000 new towers deployed by 2023 (as per the Department of Telecommunications), is a catalyst for data center expansion. Virtualization technology is essential for managing 5G-enabled devices and services, providing flexibility and scalability. The increased network speed and bandwidth foster data-intensive applications, demanding virtualized data solutions to handle and process large volumes of data efficiently. The nationwide deployment of 5G in India drives the need for virtualized data centers that support next-generation connectivity.

Scope of the Report

By Component | Hardware Software Services |

By Deployment Mode | On-Premises Cloud-Based Hybrid |

By Application | IT & Telecom BFSI Healthcare Retail |

By Organization Size | SMEs Large Enterprises |

By Region | North India South India East India West India |

Products

Key Target Audience

Cloud Service Providers

IT and Telecom Companies

Data Center Solution Providers

Financial and Banking Institutions

Healthcare IT Administrators

Retail and E-commerce Organizations

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Electronics and Information Technology, Ministry of Power)

Companies

Players Mentioned in the Report

IBM Corporation

Cisco Systems, Inc.

Microsoft Corporation

Hewlett Packard Enterprise

VMware, Inc.

Amazon Web Services (AWS)

Oracle Corporation

Red Hat, Inc.

Huawei Technologies Co., Ltd.

Dell Technologies

Table of Contents

1. India Data Center Virtualization Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Data Center Virtualization Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Data Center Virtualization Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Data Demand and Cloud Adoption

3.1.2 Government Digitalization Initiatives

3.1.3 Data Center Energy Efficiency Needs

3.1.4 Rise of Edge Computing

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Complexity of Legacy System Integration

3.2.3 Data Security Concerns

3.2.4 Skilled Workforce Shortage

3.3 Opportunities

3.3.1 Adoption of AI and Automation

3.3.2 Expansion of 5G Network

3.3.3 Hyper-Converged Infrastructure

3.4 Trends

3.4.1 Adoption of Software-Defined Data Centers (SDDC)

3.4.2 Increased Focus on Green Data Centers

3.4.3 Advancements in Virtual Machine (VM) Management

3.4.4 Growth of Micro Data Centers

3.5 Government Regulation

3.5.1 Data Localization Mandates

3.5.2 Energy Efficiency Standards

3.5.3 Digital Infrastructure Policy Frameworks

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem Analysis

4. India Data Center Virtualization Market Segmentation

4.1 By Component (In Value %)

4.1.1 Hardware

4.1.2 Software

4.1.3 Services

4.2 By Deployment Mode (In Value %)

4.2.1 On-Premises

4.2.2 Cloud-Based

4.2.3 Hybrid

4.3 By Application (In Value %)

4.3.1 IT & Telecom

4.3.2 BFSI

4.3.3 Healthcare

4.3.4 Retail

4.4 By Organization Size (In Value %)

4.4.1 SMEs

4.4.2 Large Enterprises

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Data Center Virtualization Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 IBM Corporation

5.1.2 Cisco Systems, Inc.

5.1.3 Microsoft Corporation

5.1.4 Hewlett Packard Enterprise

5.1.5 VMware, Inc.

5.1.6 Citrix Systems, Inc.

5.1.7 Amazon Web Services (AWS)

5.1.8 Oracle Corporation

5.1.9 Red Hat, Inc.

5.1.10 Huawei Technologies Co., Ltd.

5.1.11 Dell Technologies

5.1.12 Google Cloud Platform

5.1.13 Fujitsu Ltd.

5.1.14 SAP SE

5.1.15 NetApp, Inc.

5.2 Cross Comparison Parameters (Revenue, Service Offerings, Regional Presence, Employee Strength, Inception Year, Market Share, Cloud Capabilities, Innovation Index)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Expansion Plans

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

5.9 Government Grants and Subsidies

6. India Data Center Virtualization Market Regulatory Framework

6.1 Data Security Compliance

6.2 Energy Usage Regulations

6.3 Certifications and Standards

6.4 Environmental Impact Regulations

6.5 Government Subsidies for Data Centers

7. India Data Center Virtualization Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. India Data Center Virtualization Future Market Segmentation

8.1 By Component (In Value %)

8.2 By Deployment Mode (In Value %)

8.3 By Application (In Value %)

8.4 By Organization Size (In Value %)

8.5 By Region (In Value %)

9. India Data Center Virtualization Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Strategic Positioning Analysis

9.3 Marketing and Sales Strategy

9.4 Potential White Space Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involves creating an in-depth ecosystem map of all major stakeholders in the India Data Center Virtualization Market. By conducting desk research through proprietary databases, the research identifies core variables impacting market trends, such as data center expansion and technology adoption.

Step 2: Market Analysis and Construction

In this step, historical data related to market penetration and revenue generation is compiled. The analysis evaluates market dynamics, comparing service quality, technology adoption, and revenue contributions from each segment to construct a reliable market framework.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are generated and validated through telephone interviews with industry experts, providing firsthand insights. This process involves cross-verifying operational and financial assumptions to reinforce data accuracy.

Step 4: Research Synthesis and Final Output

The final synthesis involves interaction with data center operators and technology providers, acquiring insights on performance, consumer preferences, and emerging trends. This approach ensures a well-rounded, validated view of the market, combining both top-down and bottom-up analysis.

Frequently Asked Questions

01. How big is the India Data Center Virtualization Market?

The India Data Center Virtualization Market is valued at USD 341 million, influenced by rising demand for efficient data management solutions and government support for digitalization.

02. What are the challenges in the India Data Center Virtualization Market?

Challenges include the high initial costs of setup, integration complexities with legacy systems, and a shortage of skilled workforce to manage and optimize virtualized environments.

03. Who are the major players in the India Data Center Virtualization Market?

Key players include IBM Corporation, Microsoft Corporation, VMware, Hewlett Packard Enterprise, and Cisco Systems, with these companies dominating due to strong R&D capabilities and comprehensive service portfolios.

04. What drives the growth of the India Data Center Virtualization Market?

The market is driven by growing digital data needs, expanding cloud adoption, government-led digital initiatives, and a shift towards more scalable IT infrastructures.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.