India Dehumidifier Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD6838

December 2024

97

About the Report

India Dehumidifier Market Overview

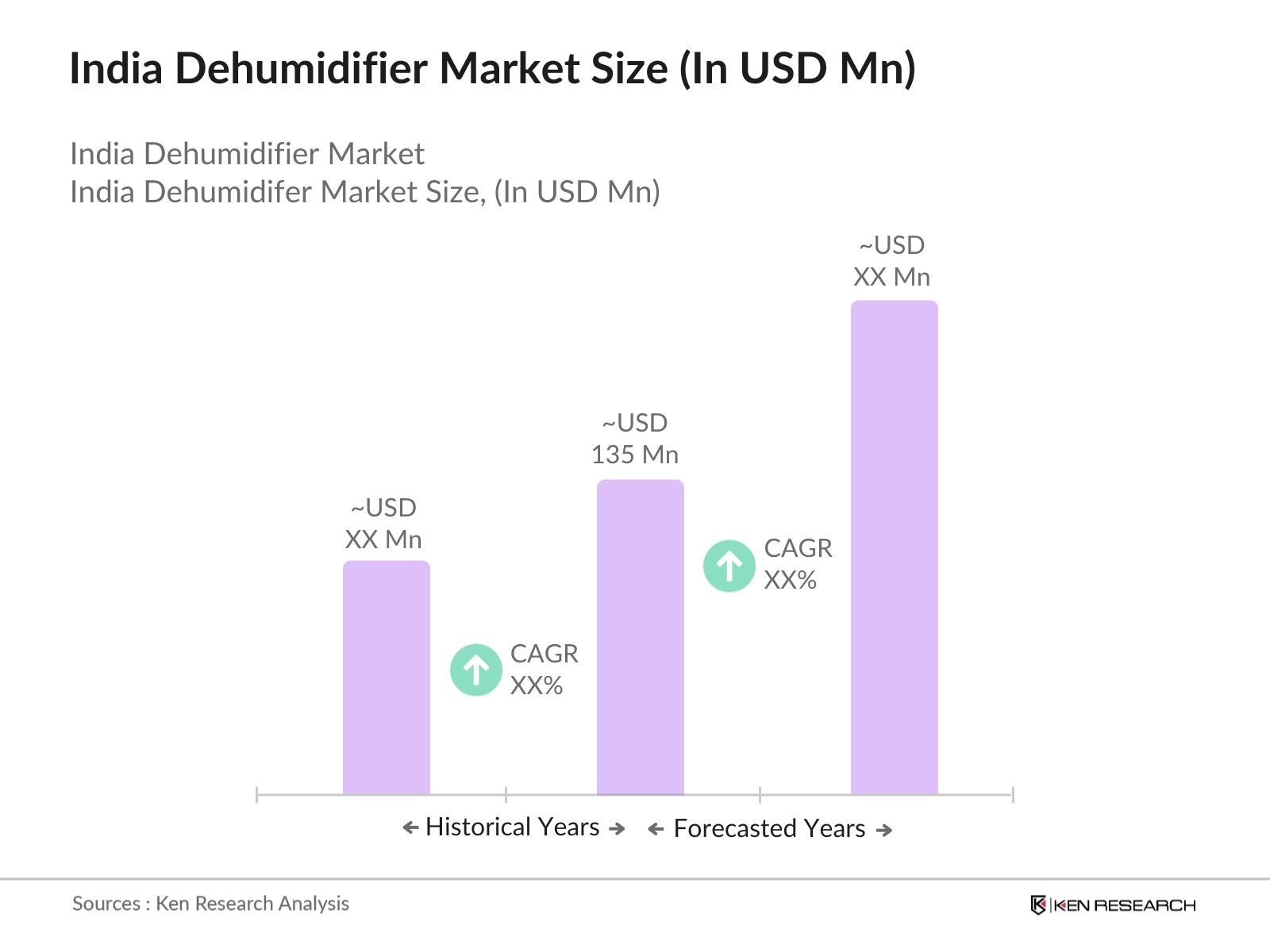

- India Dehumidifier Market is valued at USD 135 million, is driven by increasing demand from residential, commercial, and industrial sectors. With rising humidity levels, especially in coastal cities like Mumbai, Chennai, and Kolkata, consumers and businesses are seeking efficient solutions to control moisture levels. Additionally, growing concerns about mold growth, health issues caused by dampness, and the demand for energy-efficient solutions are pushing the market toward consistent growth.

- Major cities such as Mumbai, Bengaluru, and Delhi dominate the India dehumidifier market due to their rapid urbanization, growing construction activities, and high commercial property demand. Coastal regions like Kerala and Tamil Nadu also show higher demand due to their consistently humid climates. The commercial and hospitality sectors in these regions often require dehumidifiers to maintain air quality, contributing to their market dominance.

- India continues to impose tariffs on the import of key components used in dehumidifiers, such as compressors and condensers, which are primarily sourced from China and Taiwan. As of 2024, import duties on these components range from 7.5% to 10%, contributing to the higher production costs of dehumidifiers in India. However, the government has been exploring options to incentivize local production under the "Make in India" initiative to reduce dependency on imports and encourage the development of a robust domestic supply chain.

India Dehumidifier Market Segmentation

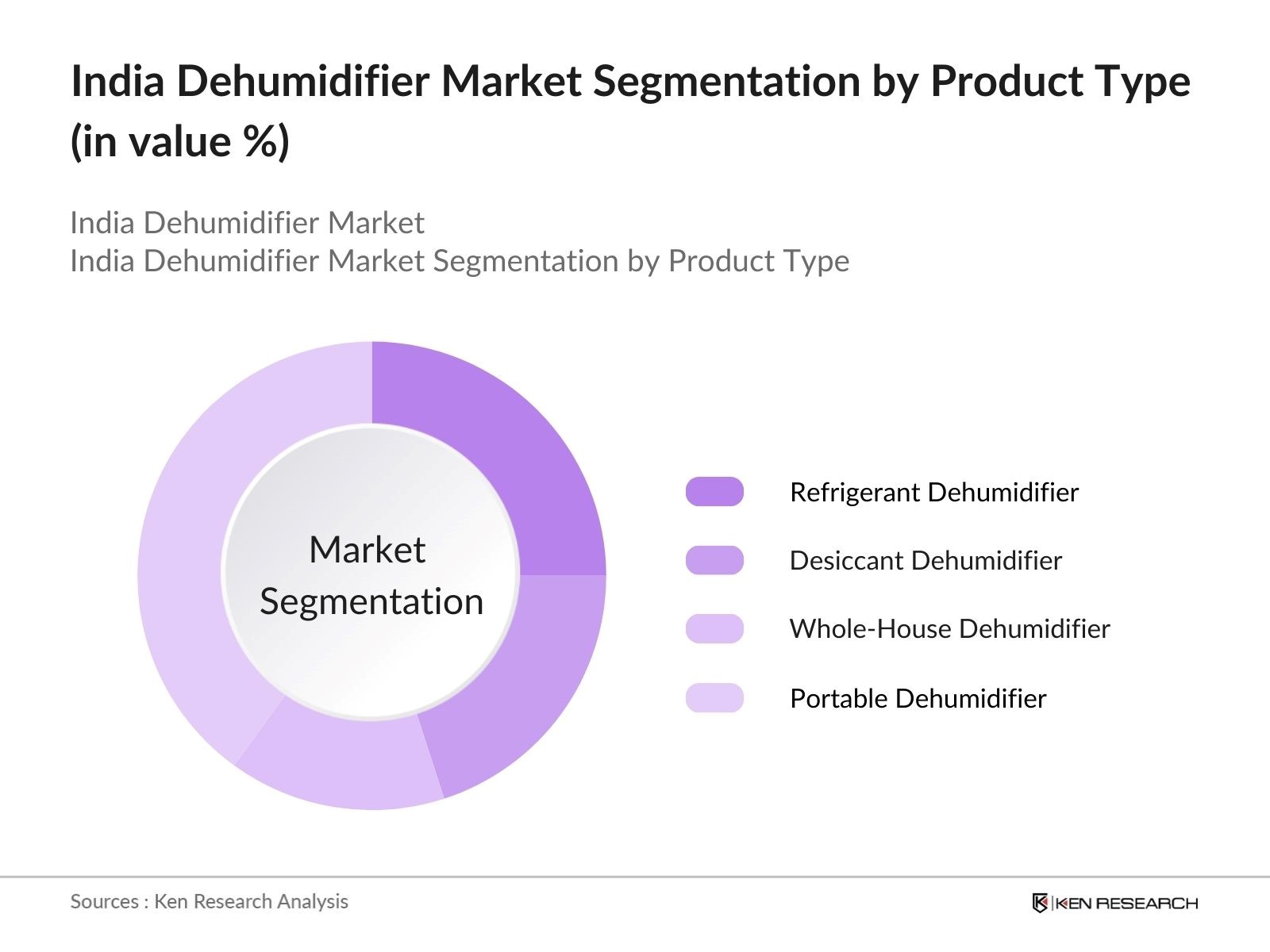

By Product Type: The India dehumidifier market is segmented by product type into refrigerant dehumidifiers, desiccant dehumidifiers, whole-house dehumidifiers, and portable dehumidifiers. Recently, portable dehumidifiers have captured a dominant market share under the product type segment due to their increasing popularity among consumers for residential use. Their ease of mobility, lower cost, and compact design make them highly preferred, especially in urban areas.

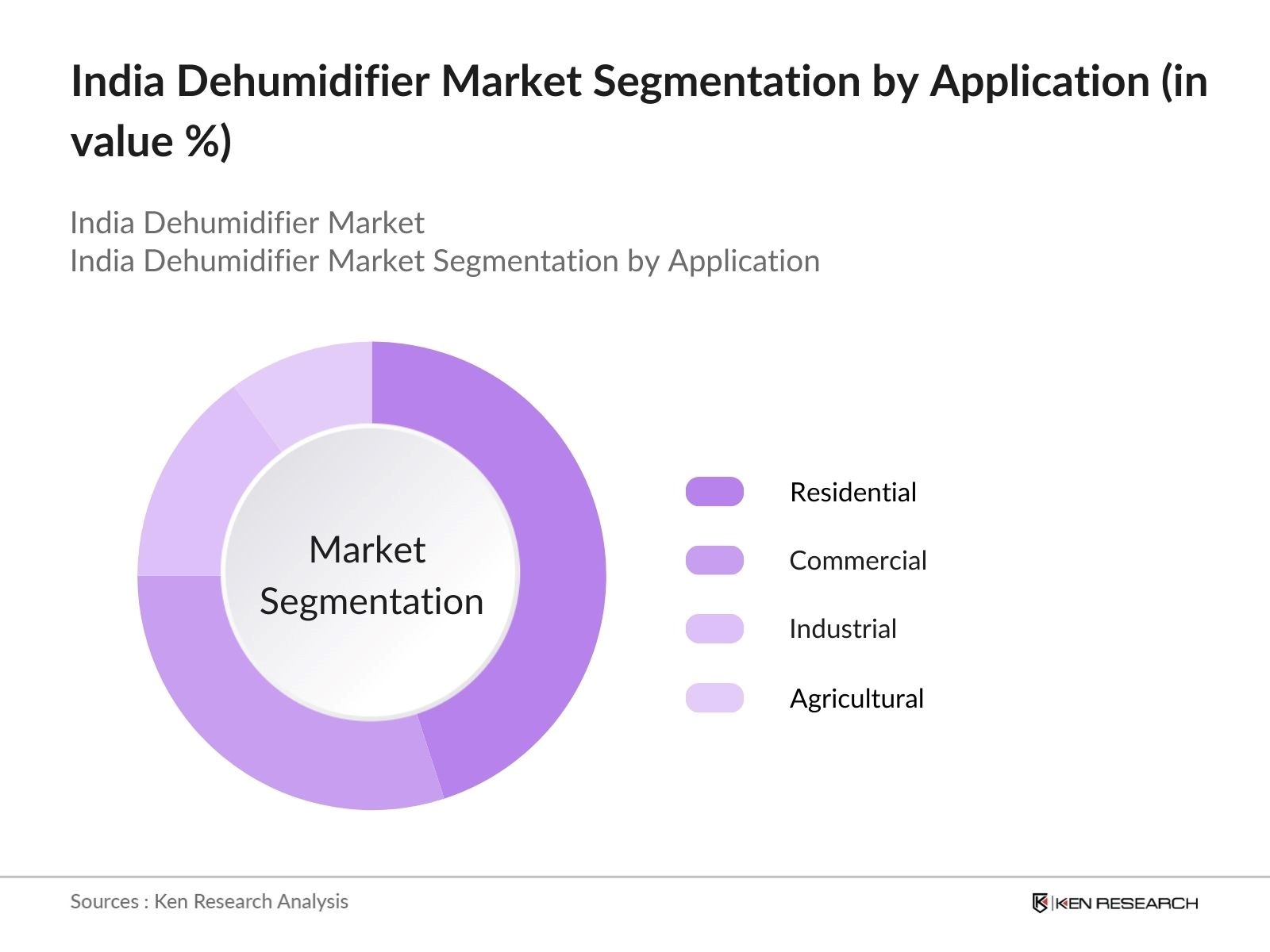

By Application: The market is segmented by application into residential, commercial, industrial, and agricultural. The residential sector dominates the market, primarily due to increasing awareness of health issues related to humidity, such as respiratory problems and mold growth. With a growing number of nuclear families, coupled with the rise of health-conscious consumers, the demand for dehumidifiers in residential settings is on the rise. Urban regions, in particular, are adopting these solutions as part of smart home systems, further propelling the residential segments market share.

India Dehumidifier Market Competitive Landscape

The India dehumidifier market is dominated by several key players that focus on innovation, energy efficiency, and expanding their distribution networks. Local manufacturers, alongside international brands, provide a mix of premium and budget-friendly options. Brands like Sharp India and Panasonic lead in consumer electronics, while companies like Honeywell and Blue Star target the industrial and commercial segments.

|

Company |

Established Year |

Headquarters |

Distribution Network |

Product Range |

Energy Efficiency |

Technology Focus |

Customer Service |

Warranty |

Revenue (USD Mn) |

|

Sharp India |

1912 |

Pune, India |

- |

- |

- |

- |

- |

- |

- |

|

Panasonic India |

1918 |

Gurgaon, India |

- |

- |

- |

- |

- |

- |

- |

|

Blue Star |

1943 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

|

Honeywell India |

1906 |

Bangalore, India |

- |

- |

- |

- |

- |

- |

- |

|

Crompton Greaves |

1937 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

The dehumidifier market is becoming increasingly consolidated, with top companies controlling a significant portion of the market share. With established brands like Blue Star and Panasonic offering energy-efficient solutions and focusing on technological advancements, the competitive landscape remains dynamic. Additionally, local brands are focusing on affordable models to capture rural and semi-urban markets.

India Dehumidifier Market Analysis

Growth Drivers

- Rising Humidity Levels: India has been witnessing a significant rise in humidity levels, particularly in coastal cities such as Mumbai, Chennai, and Kolkata, where humidity often exceeds 85% during monsoons. This is largely driven by climate patterns affected by the Bay of Bengal and the Arabian Sea, leading to prolonged moisture-laden winds. With 14 of Indias 20 largest cities located on or near coastlines, the demand for dehumidifiers is rising, especially in urban residential settings where air quality is compromised by excess moisture.

- Increasing Demand from Residential and Commercial Sectors: The residential sector is experiencing heightened demand for dehumidifiers, particularly in metro cities, as apartment living becomes more common and indoor air quality is prioritized. The government has focused on projects such as the Smart Cities Mission and affordable housing schemes, which are expected to create millions of additional housing units.

- Government Incentives on Energy-Efficient Devices: The Indian government has been actively promoting energy efficiency through initiatives such as the Perform, Achieve, and Trade (PAT) scheme, and subsidies for eco-friendly appliances. Dehumidifiers that meet the Bureau of Energy Efficiency (BEE) standards are incentivized through reduced import duties and tax benefits. The Energy Conservation Building Code (ECBC) introduced by the Ministry of Power in 2024 emphasizes energy-efficient devices in commercial spaces, helping to reduce electricity consumption.

Market Challenges

- High Product Costs: While there is increasing demand for dehumidifiers, the high upfront cost remains a deterrent for many potential buyers, particularly in lower-income segments. With India's per capita income hovering around USD 2,500 in 2024, many consumers prioritize affordability over advanced home appliances, making high-end dehumidifiers less accessible. Despite this, rising disposable incomes in urban areas are expected to ease this challenge in the long term.

- Limited Awareness in Rural Areas: India's rural population, accounting for around 65% of the total population in 2024, has limited awareness of the benefits of dehumidifiers. This is primarily due to a lack of targeted marketing and education efforts by manufacturers, as well as the rural focus on basic appliances. However, with ongoing rural electrification efforts under schemes like the Deendayal Upadhyaya Gram Jyoti Yojana, the potential for penetration in these regions is increasing.

India Dehumidifier Future Market Outlook

India dehumidifier market is expected to witness significant growth driven by increasing residential adoption, industrial demand, and rising awareness about indoor air quality. Continuous advancements in energy-efficient dehumidifiers, coupled with smart technology integration like IoT, are likely to boost the market further. As the real estate and hospitality sectors continue to expand, especially in urban centers, demand for dehumidifiers will remain strong.

Market Opportunities

- Technological Advancements in Energy Efficiency: Recent advances in energy-efficient technologies present a significant opportunity for manufacturers of dehumidifiers. The growing focus on reducing energy consumption has led to innovations like dual-rotor compressors and variable speed motors in 2024, which enhance efficiency by up to 35%. The Indian governments push towards sustainable energy use under its Energy Efficiency Mission is driving demand for such advanced products, especially in the commercial sector.

- Expansion in Industrial and Agricultural Applications: Dehumidifiers are increasingly finding applications in industries such as food processing, pharmaceuticals, and textiles, where controlling moisture is critical. The agriculture sector, particularly in greenhouse farming, is also adopting dehumidification technologies to maintain optimal growing conditions. In 2024, India's agricultural exports reached USD 48.82 billion, underscoring the importance of technologies like dehumidifiers in ensuring product quality and longevity.

Scope of the Report

|

By Segment |

Sub-Segment |

|

By Product Type |

Refrigerant Dehumidifiers |

|

Desiccant Dehumidifiers |

|

|

Whole-House Dehumidifiers |

|

|

Portable Dehumidifiers |

|

|

By Application |

Residential |

|

Commercial |

|

|

Industrial |

|

|

Agricultural |

|

|

By Technology |

Smart Dehumidifiers |

|

Energy-Efficient Dehumidifiers |

|

|

Solar-Powered Dehumidifiers |

|

|

Hybrid Technology Dehumidifiers |

|

|

By Capacity |

Below 20 Liters |

|

20-50 Liters |

|

|

Above 50 Liters |

|

|

By Region |

North India |

|

South India |

|

|

East India |

|

|

West India |

Products

Key Target Audience

Facility Management Companies

HVAC Companies

Industrial Manufacturers

Consumer Electronics Companies

Consumer Electronics Distributors

Smart Home Technology Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Bureau of Energy Efficiency)

Companies

Major Players

Sharp India

Panasonic India

Blue Star

Honeywell India

Crompton Greaves

Carrier Midea

DeLonghi Appliances

V-Guard Industries

Thermax Limited

TTK Prestige

Table of Contents

1. India Dehumidifier Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Dehumidifier Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Dehumidifier Market Analysis

3.1. Growth Drivers

3.1.1. Rising Humidity Levels (Weather Patterns, Coastal Cities)

3.1.2. Increasing Demand from Residential and Commercial Sectors

3.1.3. Government Incentives on Energy-Efficient Devices

3.1.4. Growth in Health and Wellness Awareness

3.2. Market Challenges

3.2.1. High Product Costs (Price Sensitivity)

3.2.2. Limited Awareness in Rural Areas

3.2.3. Import Dependency for Key Components

3.2.4. Distribution Network Challenges in Tier-2 and Tier-3 Cities

3.3. Opportunities

3.3.1. Technological Advancements in Energy Efficiency

3.3.2. Expansion in Industrial and Agricultural Applications

3.3.3. Growth of Smart Home Technology Integration

3.3.4. Potential for Export to Neighboring Countries

3.4. Trends

3.4.1. Integration of IoT and Smart Dehumidifiers

3.4.2. Increasing Preference for Portable Dehumidifiers

3.4.3. Rise of Subscription and Rental Models

3.4.4. Growing Consumer Focus on Noise Reduction

3.5. Government Regulation

3.5.1. Energy Efficiency Standards (BEE Ratings)

3.5.2. Import Tariffs on Key Components

3.5.3. Environmental Policies Related to Manufacturing

3.5.4. Subsidies and Incentives for Eco-Friendly Devices

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. India Dehumidifier Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Refrigerant Dehumidifiers

4.1.2. Desiccant Dehumidifiers

4.1.3. Whole-House Dehumidifiers

4.1.4. Portable Dehumidifiers

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Agricultural

4.3. By Technology (In Value %)

4.3.1. Smart Dehumidifiers

4.3.2. Energy-Efficient Dehumidifiers

4.3.3. Solar-Powered Dehumidifiers

4.3.4. Hybrid Technology Dehumidifiers

4.4. By Capacity (In Value %)

4.4.1. Below 20 Liters

4.4.2. 20-50 Liters

4.4.3. Above 50 Liters

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Dehumidifier Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. Sharp India

5.1.2. Panasonic India

5.1.3. DeLonghi Appliances

5.1.4. Blue Star

5.1.5. Carrier Midea

5.1.6. Havells India

5.1.7. Honeywell India

5.1.8. Thermax Limited

5.1.9. TTK Prestige

5.1.10. Amfah India

5.1.11. Crompton Greaves

5.1.12. V-Guard Industries

5.1.13. Whirlpool India

5.1.14. Voltas

5.1.15. Lloyd (Havells)

5.2 Cross Comparison Parameters (Product Range, Energy Efficiency, Distribution Network, Price Range, Technological Advancements, Customer Service, Warranty, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Dehumidifier Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Dehumidifier Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Dehumidifier Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Capacity (In Value %)

8.5. By Region (In Value %)

9. India Dehumidifier Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved creating an ecosystem map encompassing all the key stakeholders in the India Dehumidifier Market. This was done through extensive desk research utilizing secondary sources such as industry reports and proprietary databases to gather critical industry-level information. The aim was to identify and define the factors that impact market dynamics.

Step 2: Market Analysis and Construction

In this stage, historical data for the India Dehumidifier Market was compiled and analyzed, focusing on sales performance, product penetration, and market size by segment. Special attention was given to consumer trends and regional data to ensure an accurate analysis of market growth and potential revenue.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated based on the collected data and then validated through interviews with industry experts. These consultations provided deep operational insights, allowing for the refinement of initial estimates. Inputs from dehumidifier manufacturers, distributors, and key stakeholders were particularly useful in confirming the market trends.

Step 4: Research Synthesis and Final Output

In the final phase, all the research data was synthesized, and a comprehensive report was generated. This report integrates top-down and bottom-up approaches, verifying the findings with multiple data sources, thus ensuring a robust and accurate market forecast.

Frequently Asked Questions

01. How big is India Dehumidifier Market?

The India dehumidifier market is valued at USD 135 million, driven by rising demand across residential, commercial, and industrial sectors. Urban centers with high humidity levels are particularly driving sales, with energy-efficient and smart dehumidifiers leading the growth.

02. What are the challenges in India Dehumidifier Market?

The major challenges of India Dehumidifier Market in the India dehumidifier market include high product costs, limited awareness among rural consumers, and the dependency on imported components. These factors restrict market penetration in price-sensitive regions.

03. Who are the major players in the India Dehumidifier Market?

Key players in India Dehumidifier Market include Sharp India, Panasonic India, Blue Star, Honeywell India, and Crompton Greaves. These companies dominate the market due to their broad distribution networks, technological advancements, and focus on energy efficiency.

04. What are the growt`h drivers of India Dehumidifier Market?

Key growth drivers of India Dehumidifier Market include increasing health awareness about indoor air quality, rising humidity levels in coastal regions, and the expanding commercial and industrial sectors. The integration of smart home technologies is also propelling demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.