India Dental Market Outlook to 2029

Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KROD11493

June 2025

90

About the Report

India Dental Market Overview

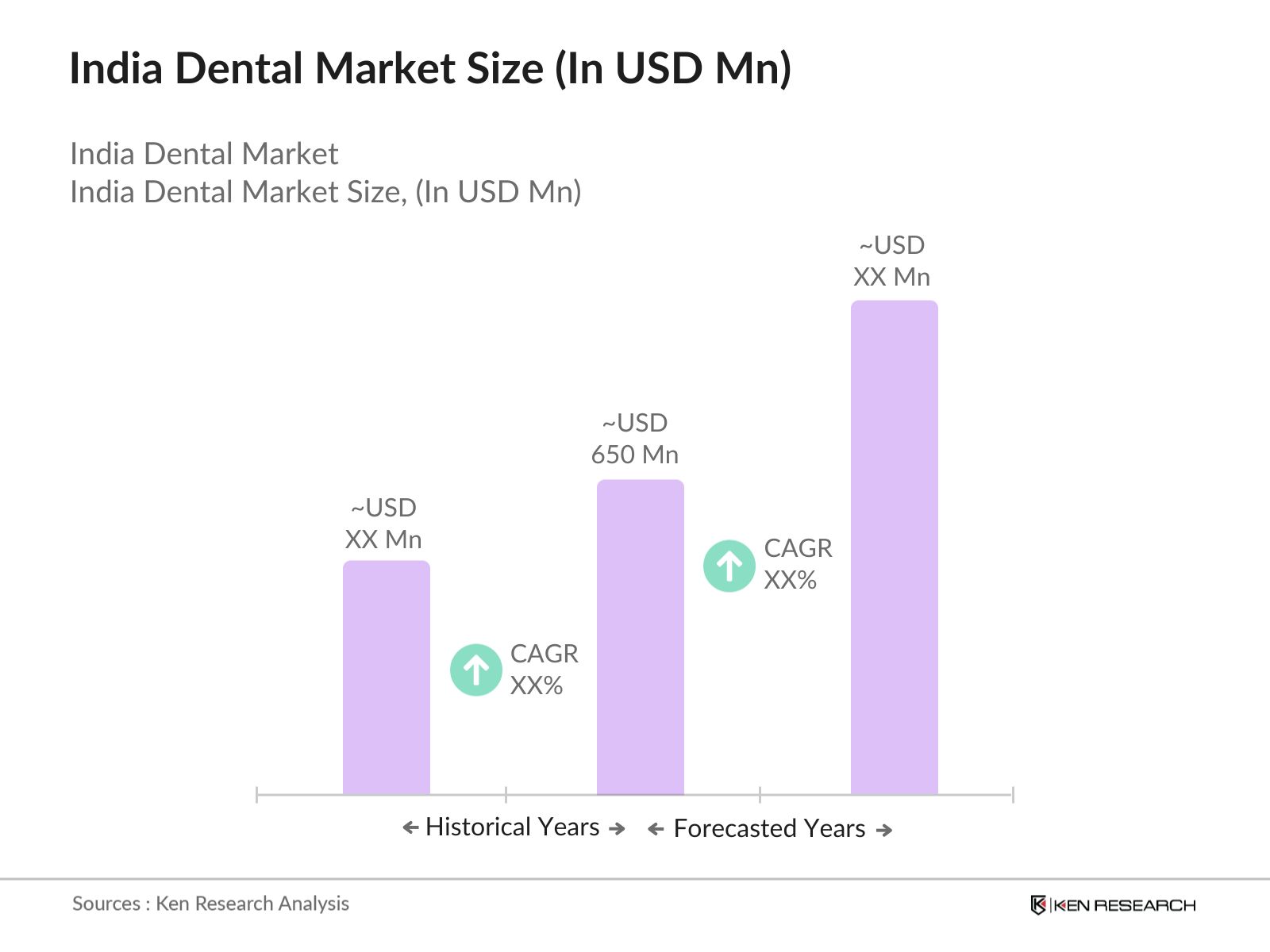

- The India Dental Market is valued at USD 650 million, based on a five-year historical analysis. This growth is primarily driven by increasing awareness of oral health, rising disposable incomes, and advancements in dental technology. The demand for dental services and products has surged, fueled by a growing population and a shift towards preventive dental care.

- Key cities dominating the market include Mumbai, Delhi, and Bangalore. These metropolitan hubs are distinguished by a dense network of dental clinics, state-of-the-art healthcare infrastructure, and a substantial population actively seeking dental services. The concentration of renowned dental professionals and leading institutions—such as Maulana Azad Institute of Dental Sciences in Delhi and Nair Hospital Dental College in Mumbai—further strengthens their dominance in the dental market

- In 2023, the Indian government continued to expand the National Oral Health Programme, which aims to improve dental health awareness and increase access to dental care nationwide. This initiative includes ongoing funding for dental health education, capacity building and training for dental professionals, and the establishment of dental units in rural and underserved areas, thereby strengthening the overall dental care infrastructure across India.

India Dental Market Segmentation

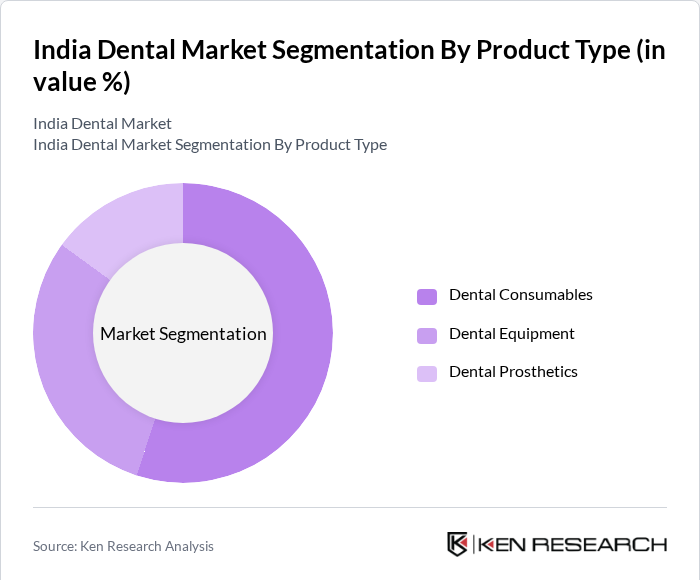

By Product Type: The product type segmentation includes dental consumables, dental equipment, and dental prosthetics. Among these, dental consumables hold the largest market share due to their critical role in routine dental procedures. The rising volume of dental treatments and increasing focus on preventive care have driven demand for consumables such as restorative materials, orthodontic products, and oral hygiene items. Furthermore, the growth of dental tourism in India has contributed to higher consumption of these products, as international patients seek affordable yet high-quality dental services.

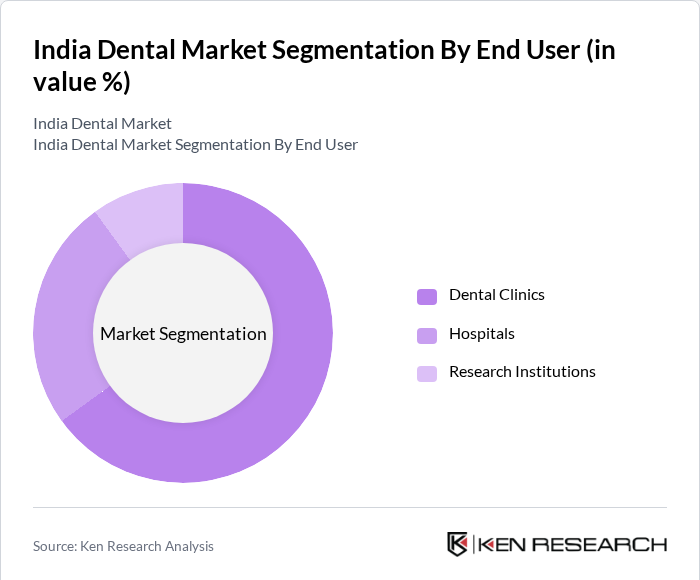

By End User: The end-user segmentation comprises dental clinics, hospitals, and academic or research institutions. Dental clinics account for the largest market share, driven by the proliferation of private practices and the increasing demand for specialized dental services. Growing awareness of oral health and rising interest in cosmetic dentistry have led to a significant increase in patient visits to dental clinics. Additionally, the expansion of organized dental chains and the adoption of advanced dental technologies in these clinics have further strengthened their market dominance.

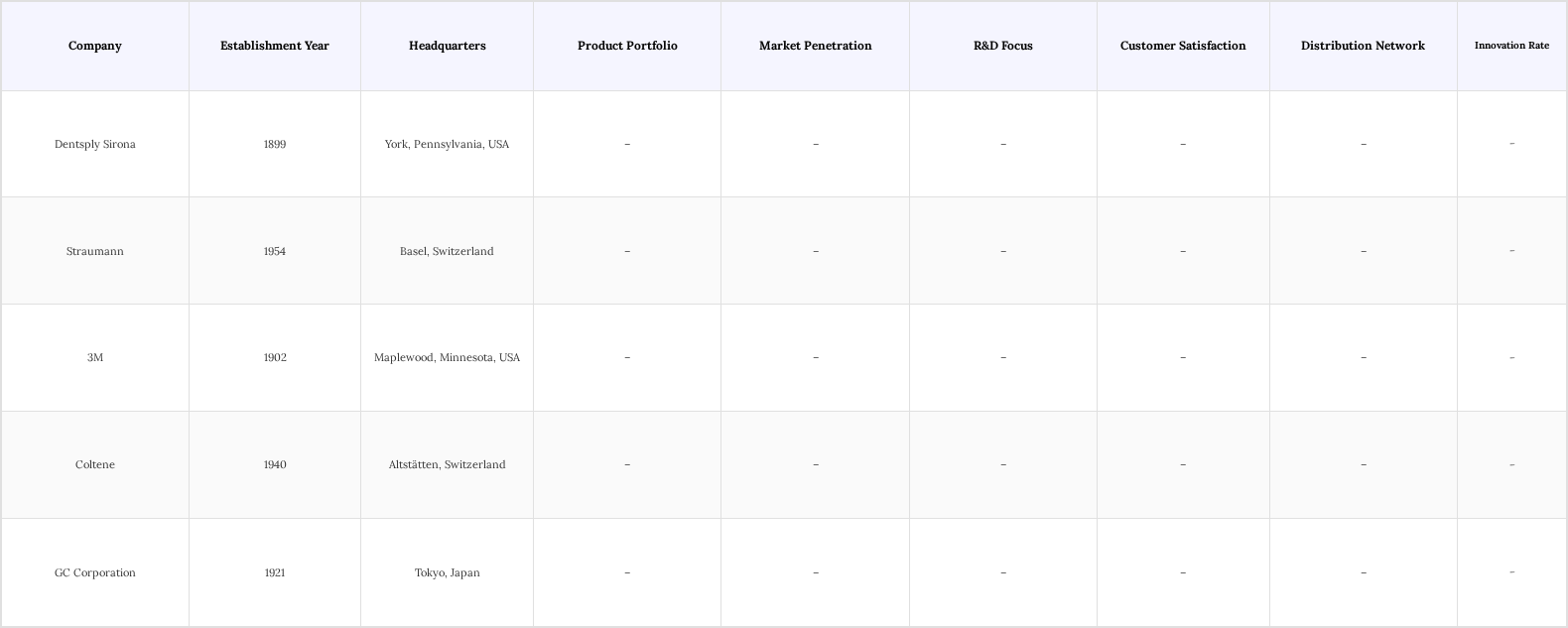

India Dental Market Competitive Landscape

The India Dental Market is characterized by a competitive landscape with several key players, including Dentsply Sirona, Straumann, and 3M. These companies are known for their innovative products and strong distribution networks, which enhance their market presence. The market is moderately concentrated, with a mix of local and international players competing for market share through product differentiation and strategic partnerships.

India Dental Market Industry Analysis

Growth Drivers

- Increasing Oral Health Awareness: Growing awareness of oral hygiene among Indians is driving demand in the dental market. Approximately 60–65% of the population now recognizes the importance of dental care, resulting in higher dental clinic visits. The government’s National Oral Health Programme invested around 300 million in 2023 for public health campaigns promoting oral health education. These efforts are boosting demand for dental services and products, and supporting market growth across urban and rural areas.

- Rising Disposable Income and Spending on Dental Care: India’s GDP growth is projected at around 6.5% for 2024-25, supporting rising disposable incomes. Average household healthcare expenditure, including dental care, has increased by about 12% over the past two years, reaching approximately 11,000 annually. This trend is especially strong in urban areas, where greater health awareness and affordability drive increased spending on dental services and products, fueling market growth.

- Technological Advancements in Dental Treatments: The adoption of advanced technologies is transforming dental care in India, with over 70% of urban dental clinics now equipped with digital imaging and CAD/CAM systems as of 2024. The use of 3D printing for dental prosthetics has increased by 30% year-on-year, while laser dentistry procedures have grown by nearly 25%, improving treatment precision and patient outcomes. These innovations are attracting more patients to modern dental services, driving rapid industry growth.

Market Challenges

- High Cost of Advanced Dental Procedures: The high cost associated with advanced dental procedures remains a significant challenge to market growth. Treatments such as dental implants and orthodontics involve substantial expenses, making them inaccessible to a large portion of the population, especially in rural and lower-income areas. This financial barrier restricts access to essential dental care and limits the overall market potential across diverse socioeconomic groups.

- Shortage of Skilled Dental Professionals: India’s dental sector continues to face a shortage of qualified dental professionals, with a considerable gap between demand and supply. The distribution of dentists is heavily skewed toward urban centers, leaving rural regions underserved. This uneven availability results in longer patient wait times and limited access to quality dental services, thereby impacting the efficiency and expansion of the dental market nationwide.

India Dental Market Future Outlook

The future of the India dental market is projected to be strong, supported by continuous technological advancements and growing consumer awareness. Government investments in public health programs are expected to enhance dental care accessibility, particularly in underserved regions. Furthermore, the adoption of tele-dentistry and digital health platforms is anticipated to improve patient engagement and expand treatment options. These developments suggest a positive growth trajectory for the dental market, with innovation and enhanced patient experiences driving the sector’s evolution.

Market Opportunities

- Expansion of Dental Insurance Coverage: Dental insurance penetration in India is rapidly increasing, with over 15 million new policyholders added in 2023 alone. Currently, around 10% of the urban population has some form of dental coverage, up from 7%. This growing insurance adoption is improving access to preventive and elective dental procedures, encouraging more frequent dental visits, and boosting demand for a wide range of dental services, benefiting both patients and providers.

- Growth of Medical Tourism for Dental Services: India is emerging as a hub for dental tourism, attracting international patients seeking affordable and high-quality dental care. This trend offers significant revenue potential for dental clinics and hospitals, as they cater to a growing number of foreign patients seeking advanced dental treatments.

Scope of the Report

| By Product Type |

Dental Consumables Dental Equipment Dental Prosthetics |

| By End User |

Dental Clinics Hospitals Research Institutions |

| By Region |

North South East West |

| By Distribution Channel |

Online Offline |

| By Application |

Orthodontics Periodontics Endodontics Cosmetic Dentistry |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare, Dental Council of India)

Manufacturers and Producers

Distributors and Retailers

Dental Equipment Suppliers

Insurance Companies

Industry Associations (e.g., Indian Dental Association)

Pharmaceutical Companies

Companies

Players Mentioned in the Report:

Dentsply Sirona

Straumann

3M

Coltene

GC Corporation

SmileCare Innovations

DentalTech Solutions

OrthoMax India

BrightSmile Dental Supplies

Apex Dental Systems

Table of Contents

1. India Dental Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Dental Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Dental Market Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Oral Health Awareness

3.1.2. Rising Disposable Income and Spending on Dental Care

3.1.3. Technological Advancements in Dental Treatments

3.2. Market Challenges

3.2.1. High Cost of Advanced Dental Procedures

3.2.2. Shortage of Skilled Dental Professionals

3.2.3. Regulatory Hurdles in Product Approvals

3.3. Opportunities

3.3.1. Expansion of Dental Insurance Coverage

3.3.2. Growth of Medical Tourism for Dental Services

3.3.3. Increasing Demand for Cosmetic Dentistry

3.4. Trends

3.4.1. Adoption of Digital Dentistry Solutions

3.4.2. Rise in Preventive Dental Care Practices

3.4.3. Integration of AI and Robotics in Dental Procedures

3.5. Government Regulation

3.5.1. Overview of Dental Health Policies

3.5.2. Licensing and Accreditation Requirements for Dental Practices

3.5.3. Safety Standards for Dental Equipment and Materials

3.5.4. Guidelines for Dental Advertising and Marketing

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Dental Market Segmentation

4.1. By Product Type

4.1.1. Dental Consumables

4.1.2. Dental Equipment

4.1.3. Dental Prosthetics

4.2. By End User

4.2.1. Dental Clinics

4.2.2. Hospitals

4.2.3. Research Institutions

4.3. By Region

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

4.4. By Distribution Channel

4.4.1. Online

4.4.2. Offline

4.5. By Application

4.5.1. Orthodontics

4.5.2. Periodontics

4.5.3. Endodontics

4.5.4. Cosmetic Dentistry

5. India Dental Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dentsply Sirona

5.1.2. Straumann

5.1.3. 3M

5.1.4. Coltene

5.1.5. GC Corporation

5.1.6. SmileCare Innovations

5.1.7. DentalTech Solutions

5.1.8. OrthoMax India

5.1.9. BrightSmile Dental Supplies

5.1.10. Apex Dental Systems

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Product Portfolio Diversity

5.2.3. Geographic Presence

5.2.4. R&D Investment Levels

5.2.5. Customer Satisfaction Ratings

5.2.6. Pricing Strategies

5.2.7. Distribution Network Efficiency

5.2.8. Brand Recognition and Reputation

6. India Dental Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Dental Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Dental Market Future Market Segmentation

8.1. By Product Type

8.1.1. Dental Consumables

8.1.2. Dental Equipment

8.1.3. Dental Prosthetics

8.2. By End User

8.2.1. Dental Clinics

8.2.2. Hospitals

8.2.3. Research Institutions

8.3. By Region

8.3.1. North

8.3.2. South

8.3.3. East

8.3.4. West

8.4. By Distribution Channel

8.4.1. Online

8.4.2. Offline

8.5. By Application

8.5.1. Orthodontics

8.5.2. Periodontics

8.5.3. Endodontics

8.5.4. Cosmetic Dentistry

9. India Dental Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Dental Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Dental Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Dental Market.

Frequently Asked Questions

01. How big is the India Dental Market?

The India Dental Market is valued at USD 650 million, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Dental Market?

Key challenges in the India Dental Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Dental Market?

Major players in the India Dental Market include Dentsply Sirona, Straumann, 3M, Coltene, GC Corporation, among others.

04. What are the growth drivers for the India Dental Market?

The primary growth drivers for the India Dental Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.