| Product Type | Biodegradable Fillers Non-Biodegradable Fillers |

| Material | Hyaluronic Acid Calcium Hydroxylapatite Poly-L-lactic Acid Polymethylmethacrylate (PMMA) Others |

| Application | Facial Line Correction Lip Enhancement Scar Treatment Restoration of Volume/Fullness Others |

| End-User | Dermatology Clinics Hospitals Beauty Clinics Others |

| Region | North India South India East India West India |

India Dermal Fillers Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD4158

November 2024

99

About the Report

India Dermal Fillers Market Overview

- The India dermal fillers market is valued at USD 110 million, driven by increasing consumer awareness and the rising demand for non-surgical cosmetic treatments. The growing disposable incomes and the desire for youthful appearances have significantly boosted the adoption of dermal fillers, particularly in urban areas where aesthetic consciousness is high. Further, the influence of social media and the increasing presence of aesthetic clinics in Tier 1 and Tier 2 cities is contributing to the steady growth of the market.

- Cities like Mumbai, Delhi, and Bengaluru dominate the India dermal fillers market due to their high population of affluent consumers and a robust network of clinics offering advanced aesthetic treatments. These urban centers are not only key hubs for medical tourism but also home to a clientele that is more inclined toward aesthetic enhancements. Additionally, the presence of skilled dermatologists and easy access to premium cosmetic brands in these cities further contributes to their dominance in the dermal filler market.

- The Indian government has implemented strict cosmetic safety regulations to protect consumers from substandard products. As per the Drugs and Cosmetics Act 2023, dermal fillers must meet specific safety criteria before being marketed. The CDSCO oversees the compliance of these regulations, ensuring that products are free from harmful substances. These regulations are crucial in maintaining high safety standards in the dermal fillers market, thus boosting consumer trust.

India Dermal Fillers Market Segmentation

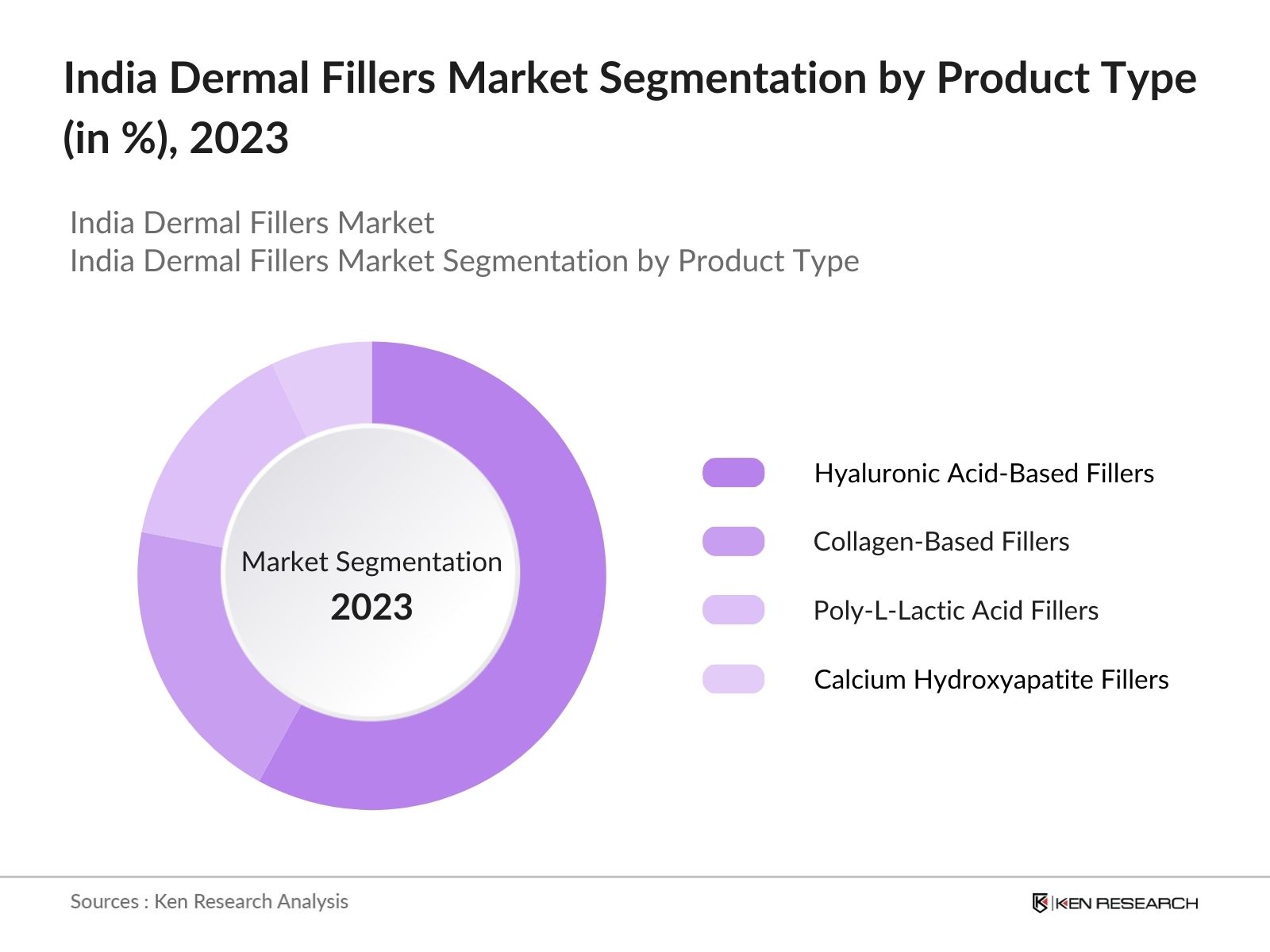

By Product Type: The market is segmented by product type into hyaluronic acid-based fillers, collagen-based fillers, poly-L-lactic acid fillers, and calcium hydroxyapatite fillers. Hyaluronic acid-based fillers hold the dominant share in the product type segmentation due to their proven safety profile, longer-lasting results, and fewer side effects. Additionally, they are reversible, making them a popular choice for first-time users. The wide availability and frequent use of these fillers for lip enhancement and wrinkle treatment further increase their demand across the market.

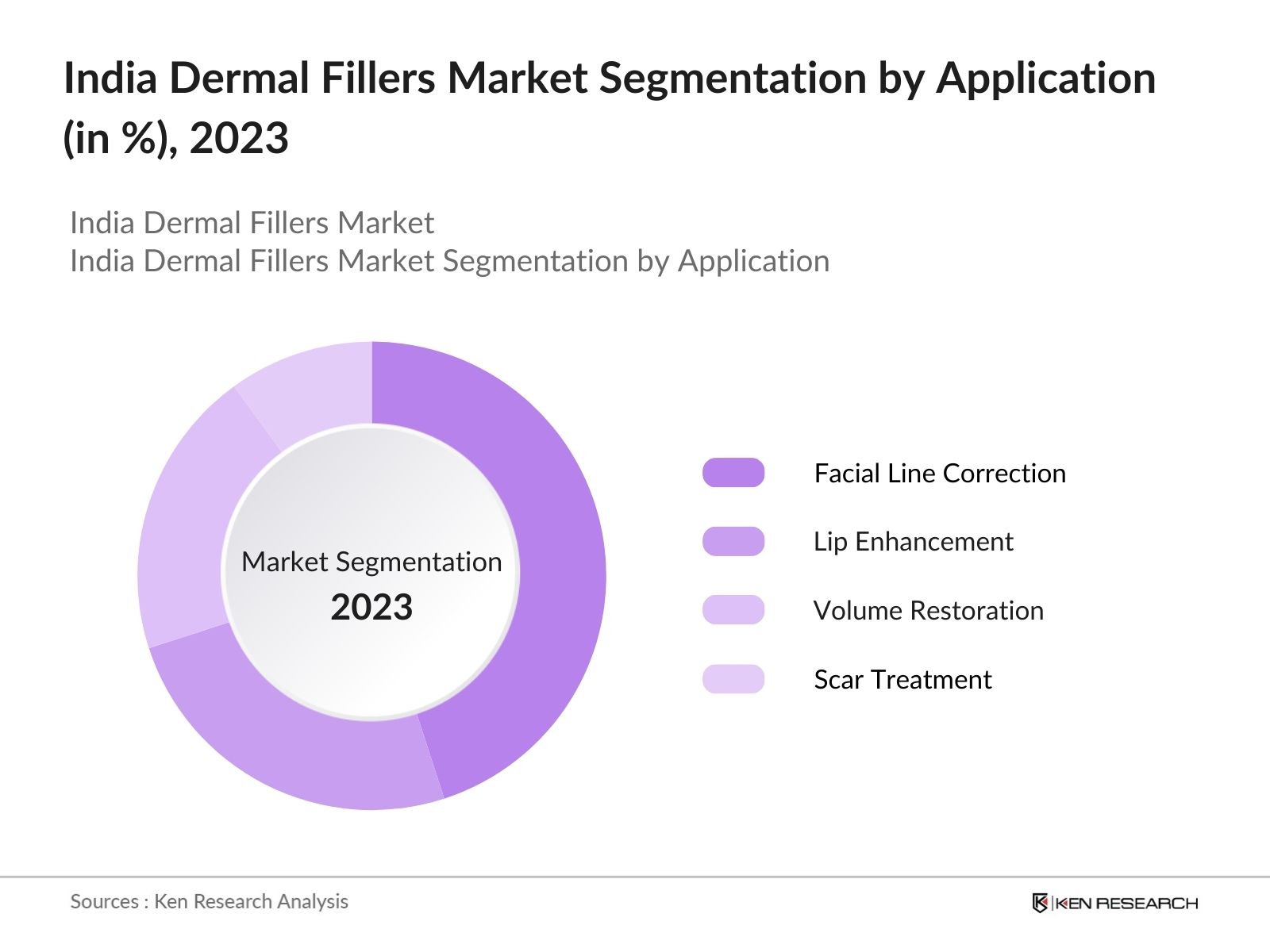

By Application: In the India market, the applications include facial line correction, lip enhancement, volume restoration, and scar treatment. Facial line correction holds a dominant market share as the procedure is increasingly popular among middle-aged consumers who seek non-invasive options for reducing signs of aging. The demand for facial line correction is further fueled by the influence of media and celebrities, who frequently endorse these treatments as part of their skincare routine.

India Dermal Fillers Market Competitive Landscape

The India dermal fillers market is competitive, with a few key players holding significant shares due to their extensive product portfolios, strategic marketing, and strong partnerships with aesthetic clinics. Companies such as Allergan and Galderma lead the market, backed by robust R&D, innovative product launches, and widespread distribution networks.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

Product Range |

Geographic Presence |

R&D Investment |

Distribution Channels |

|

Allergan |

1948 |

Dublin, Ireland |

||||||

|

Galderma |

1981 |

Lausanne, Switzerland |

||||||

|

Merz Pharmaceuticals |

1908 |

Frankfurt, Germany |

||||||

|

Teoxane Laboratories |

2003 |

Geneva, Switzerland |

||||||

|

Revance Therapeutics |

1999 |

Newark, USA |

India Dermal Fillers Industry Analysis

Growth Drivers

- Rising Aesthetic Awareness: The rising aesthetic awareness among Indian consumers is a critical driver for the dermal fillers market. With the increasing use of social media and global exposure to beauty standards, more individuals are opting for non-surgical cosmetic treatments. As per India's Ministry of Health and Family Welfare, the country witnessed a rise in cosmetic procedures in urban areas, with more than 250,000 procedures in 2023 alone, of which dermal fillers constituted a significant portion. This rise in awareness is driving demand for aesthetic treatments, contributing to market growth.

- Increasing Disposable Income: India's increasing disposable income has enabled more consumers to spend on cosmetic enhancements. According to the Reserve Bank of India (RBI), Indias gross national disposable income rose to INR 225 trillion in 2023, up from INR 203 trillion in 2022. The higher disposable income allows for greater spending on lifestyle improvements, including cosmetic procedures like dermal fillers. This economic improvement is particularly evident in urban areas, where affluent consumers are driving demand for aesthetic procedures.

- Advancements in Injection Techniques: Technological advancements in dermal filler injection techniques have made procedures safer and more effective, attracting more consumers. In 2023, India saw an increase in certified clinics adopting cutting-edge technology, improving patient outcomes and reducing recovery time. The Indian Association of Plastic Surgeons reported that over 12,000 certified clinics now use advanced filler injection techniques, making procedures more precise and increasing consumer confidence. This rise in technological sophistication has significantly contributed to market growth.

Market Challenges

- High Cost of Dermal Fillers: One of the main challenges in the India dermal fillers market is the high cost of procedures, which limits access for a large portion of the population. In 2023, the average cost of a dermal filler procedure in India ranged between INR 25,000 to INR 50,000, according to data from the Indian Medical Association. This cost is considered high compared to average incomes in Tier 2 and Tier 3 cities, creating a barrier to market penetration.

- Regulatory Hurdles: India's regulatory environment for cosmetic procedures is stringent, creating challenges for new entrants in the dermal fillers market. The Central Drugs Standard Control Organization (CDSCO) regulates the import and use of dermal fillers, and clinics must meet rigorous licensing requirements. In 2023, over 30% of clinics applying for dermal filler licenses faced delays due to stringent regulatory hurdles, impacting market expansion. These regulatory barriers slow down the growth of the market.

India Dermal Fillers Market Future Outlook

Over the next few years, the India dermal fillers market is expected to grow significantly, driven by a rising aesthetic consciousness and technological advancements in filler products. Increased focus on non-invasive procedures, coupled with expanding access to these services across urban and semi-urban regions, is likely to shape the markets growth trajectory. Innovations such as longer-lasting filler materials and more personalized treatments will also create new avenues for the expansion of the market.

Future Market Opportunities

- Growing Medical Tourism: India has emerged as a key destination for medical tourism, which is positively impacting the dermal fillers market. In 2023, the Ministry of Tourism reported that India received over 600,000 medical tourists, many of whom sought cosmetic procedures. The cost of cosmetic treatments in India is lower than in Western countries, drawing foreign patients. Dermal fillers are becoming a popular choice for medical tourists, contributing to market growth.

- Adoption of Non-Invasive Treatments: The growing preference for non-invasive treatments over surgical procedures is creating opportunities in the dermal fillers market. In 2023, data from the Indian Society of Cosmetic Surgery indicated that 70% of cosmetic treatments performed were non-invasive, including dermal fillers. Non-invasive treatments offer quicker recovery times and fewer complications, making them increasingly attractive to consumers, particularly young professionals in urban areas, thus boosting market growth.

Scope of the Report

Products

Key Target Audience for the India Dermal Fillers Market

Aesthetic Clinics

Beauty Clinics

Hospitals

Dermatologists

Medical Spas

Investors and Venture Capitalist Firms

Banks and Financial Institutes

Government and Regulatory Bodies (Indian Ministry of Health & Family Welfare, Central Drugs Standard Control Organization)

Cosmetic Surgery Associations

Companies

Major Players in the India Dermal Fillers Market

Allergan

Galderma

Merz Pharmaceuticals

Teoxane Laboratories

Revance Therapeutics

Sinclair Pharma

BIOHA Laboratories

Prollenium Medical Technologies

Suneva Medical

Ipsen Pharma

AQTIS Medical

BIOPLUS Co. Ltd.

Croma-Pharma

HUGEL Pharma

Medytox

Table of Contents

Research Methodology

Step 1: Identification of Key Variables

The first phase involved constructing an ecosystem map that covered all major stakeholders in the India dermal fillers market. Desk research was conducted using secondary databases and proprietary information to identify critical factors that drive or inhibit the market.

Step 2: Market Analysis and Construction

This phase included the assessment of historical data, with a detailed focus on penetration rates, pricing models, and product innovations. The data also included evaluations of service quality and customer satisfaction in key regions.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including dermatologists and cosmetic professionals, were consulted through in-depth interviews to validate market hypotheses. Their insights provided valuable data on operational challenges, consumer preferences, and market trends.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing data from multiple stakeholders, including clinics and manufacturers, to provide a detailed market analysis. Data accuracy was ensured through a combination of bottom-up approaches and expert feedback.

Frequently Asked Questions

01. How big is the India Dermal Fillers Market?

The India dermal fillers market is valued at USD 152 million, driven by increasing aesthetic consciousness and the rising popularity of non-invasive cosmetic treatments.

02. What are the challenges in the India Dermal Fillers Market?

Challenges in the market include the high cost of premium dermal filler products, regulatory hurdles in product approval, and a shortage of certified cosmetic professionals.

03. Who are the major players in the India Dermal Fillers Market?

Key players in the market include Allergan, Galderma, Merz Pharmaceuticals, Revance Therapeutics, and Teoxane Laboratories, all of which are recognized for their extensive product portfolios and strong market presence.

04. What are the growth drivers of the India Dermal Fillers Market?

Growth drivers include the increasing demand for non-surgical cosmetic procedures, rising disposable incomes, and the growing influence of social media on consumer behavior.

05. What trends are shaping the India Dermal Fillers Market?

Current trends include the rising popularity of hyaluronic acid-based fillers, the shift towards customizable treatments, and the growing demand for procedures that offer minimal downtime.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.