India Diabetes Care Drugs Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD6848

November 2024

97

About the Report

India Diabetes Care Drugs Market Overview

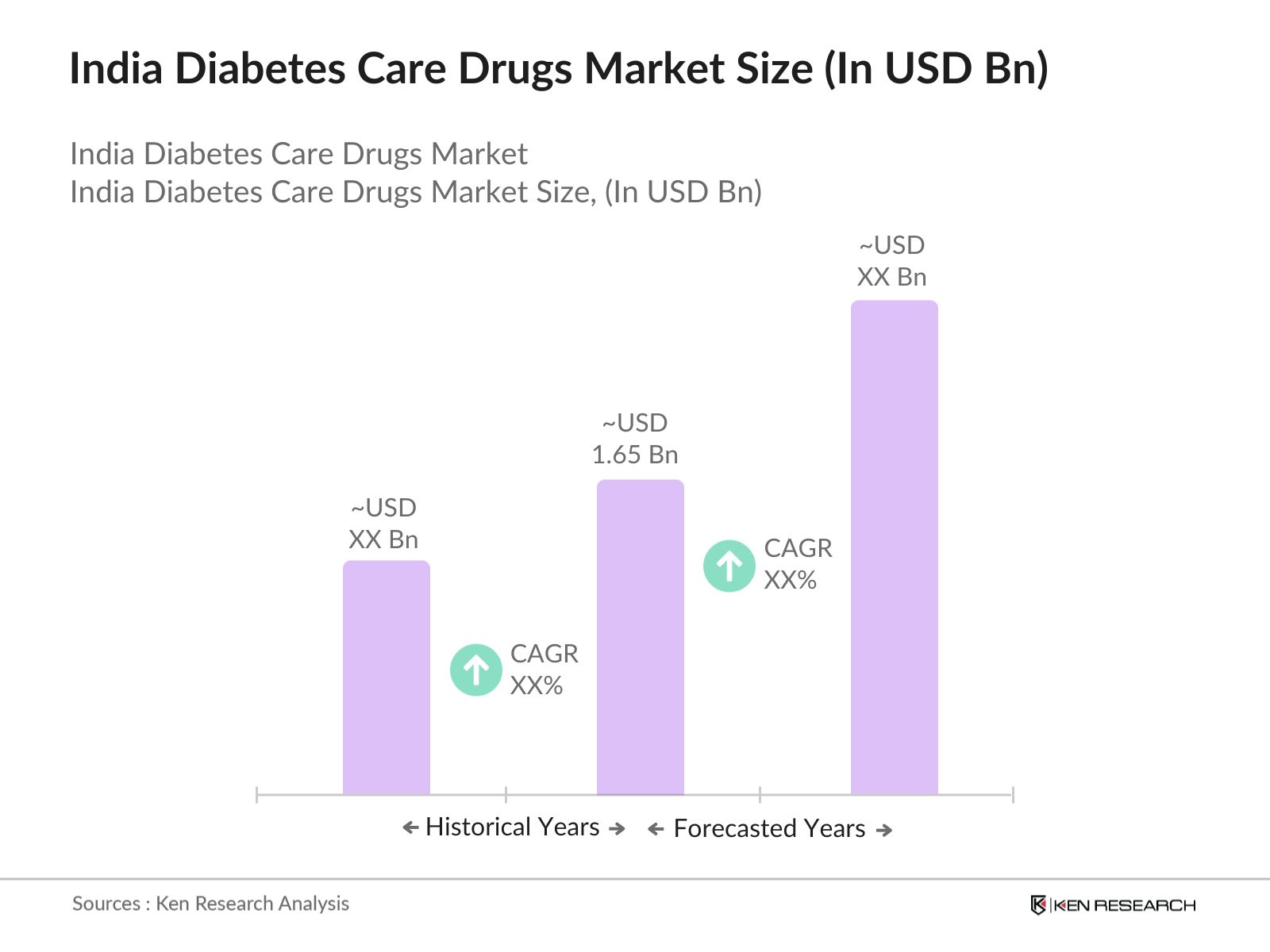

- The India Diabetes Care Drugs market is valued at USD 1.65 billion, based on a five-year historical analysis. This growth is largely driven by the rising incidence of diabetes due to a shift in lifestyle patterns, such as increased urbanization and sedentary habits. The government's healthcare initiatives, including the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS), have also boosted the demand for diabetes care drugs, ensuring access to medications across urban and rural areas.

- The market is dominated by metropolitan cities like Mumbai, Delhi, and Bangalore due to their high population density, greater healthcare accessibility, and better diagnostic capabilities. These cities host some of the top healthcare institutions and pharmaceutical hubs, facilitating both demand and supply for diabetes care drugs. Additionally, these urban centers witness high patient compliance and access to newer diabetes management therapies compared to rural areas.

- The Indian government continues to expand this national initiative, which aims to prevent and control major non-communicable diseases, including diabetes. As of 2024, the program operates in over 700 districts, offering free diagnostic services and diabetes medications at government health centers. The initiative is set to expand further by 2025, targeting an additional 300 districts to improve the availability and affordability of diabetes care drugs for millions of patients in both urban and rural regions.

India Diabetes Care Drugs Market Segmentation

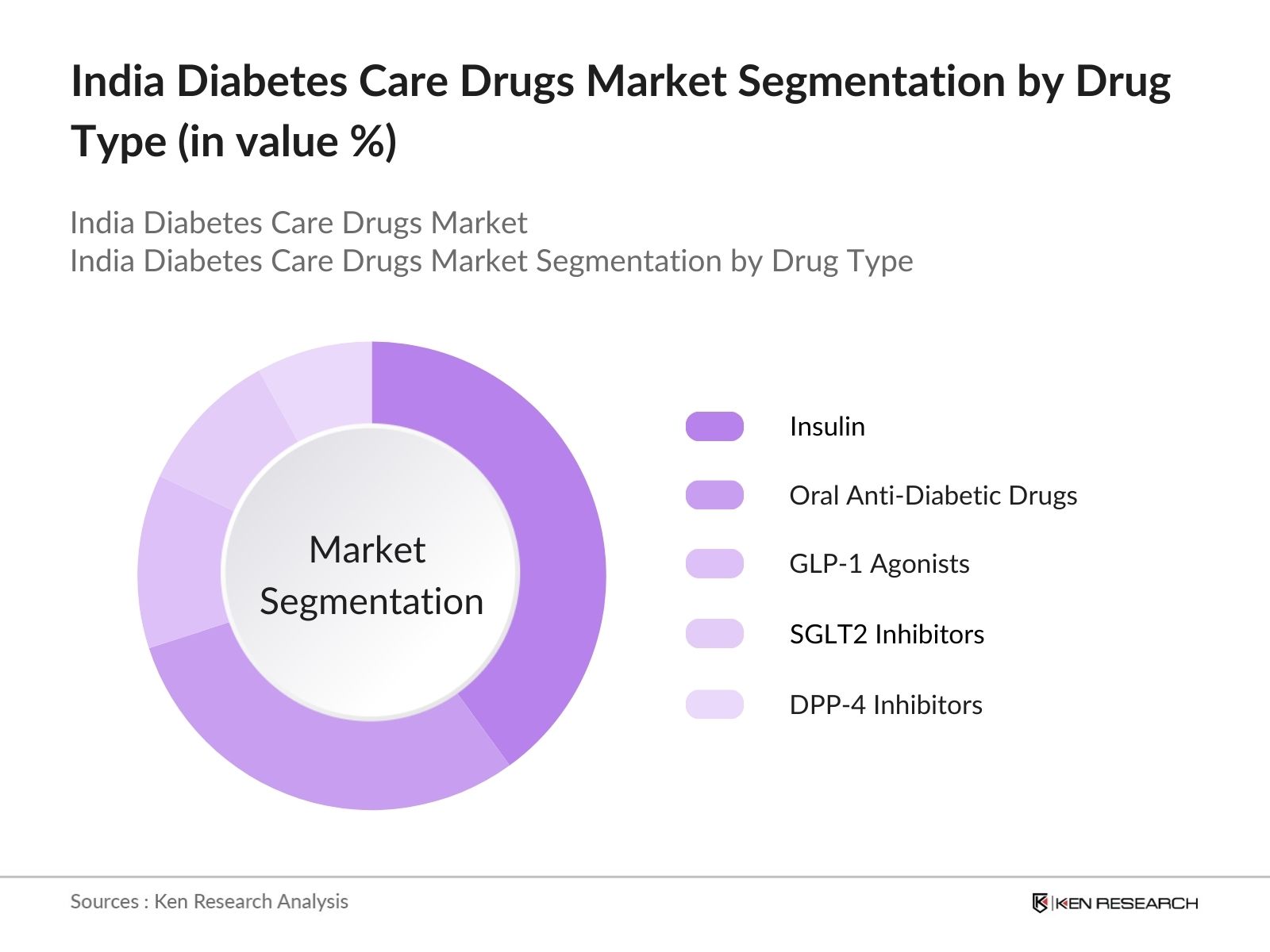

By Drug Type: India's Diabetes Care Drugs market is segmented by drug type into insulin, oral anti-diabetic drugs, GLP-1 agonists, SGLT2 inhibitors, and DPP-4 inhibitors. Insulin remains a dominant segment within the drug type category due to its irreplaceable role in managing type 1 diabetes and increasingly type 2 diabetes in severe cases. The affordability of biosimilar insulin drugs in India has also contributed to the growing usage, alongside government schemes that make insulin more accessible to lower-income populations.

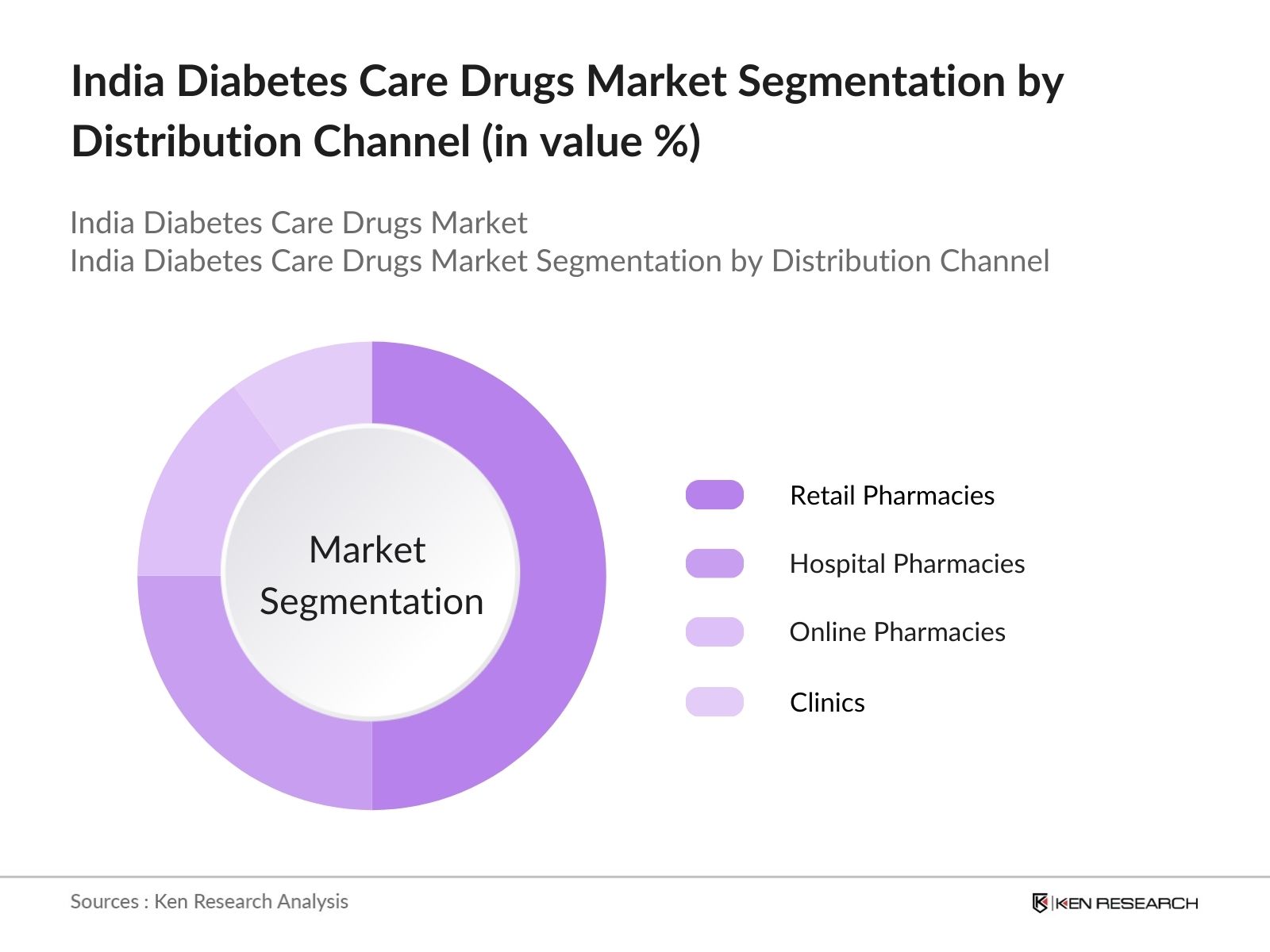

By Distribution Channel: Indias diabetes care drugs are primarily distributed through hospital pharmacies, retail pharmacies, online pharmacies, and clinics. Retail pharmacies dominate this segment because of their widespread availability in both urban and semi-urban areas, where diabetes is becoming more prevalent. Furthermore, partnerships between retail chains and pharmaceutical companies provide better reach and more affordable drugs.

India Diabetes Care Drugs Market Competitive Landscape

The India Diabetes Care Drugs market is dominated by both global and domestic players who continuously innovate to expand their product portfolios. The presence of top pharmaceutical manufacturers like Sanofi, Novo Nordisk, and domestic firms like Cipla and Biocon underscores the competitive nature of this market. These players have adopted strategies such as introducing biosimilar drugs, forming alliances, and conducting extensive R&D for new diabetes care solutions.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Product Portfolio |

R&D Investment |

Revenue (USD) |

Market Share |

Key Strategic Focus |

|---|---|---|---|---|---|---|---|---|

|

Sanofi India Limited |

1956 |

Mumbai |

- | - | - | - | - | - |

|

Novo Nordisk India Pvt. Ltd. |

1923 |

Bangalore |

- | - | - | - | - | - |

|

Eli Lilly and Company (India) |

1876 |

Gurgaon |

- | - | - | - | - | - |

|

Cipla Limited |

1935 |

Mumbai |

- | - | - | - | - | - |

|

Biocon Biologics India Limited |

1978 |

Bangalore |

- | - | - | - | - | - |

India Diabetes Care Drugs Market Analysis

Growth Drivers

- Increasing Prevalence of Diabetes (Prevalence Rate): According to government data, the number of people diagnosed with diabetes in India reached 77 million in 2024, and this number is projected to increase due to changing lifestyles and poor dietary habits. This growing prevalence directly supports the demand for diabetes care drugs, including insulin, oral anti-diabetics, and other related medications. The Indian government estimates that the number of diabetics could reach 87 million by 2025, creating a surge in demand for effective treatment and management options.

- Rising Geriatric Population (Demographic Changes): The Indian population above the age of 60 years is expected to grow from 138 million in 2024 to 167 million by 2027, according to government demographic data. As this age group is more prone to developing chronic conditions like diabetes, it significantly drives the need for diabetes care drugs. The elderly are also likely to suffer from comorbid conditions, leading to higher consumption of combination therapies and drugs.

- Government Healthcare Initiatives (National Diabetes Control Programs): The Indian government has continued expanding the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS) into 2024. With over 700 districts covered, the program provides free diagnostic services and medications for diabetic patients, ensuring that the accessibility of diabetes care drugs grows in both urban and rural areas. By 2025, the program aims to cover over 1,000 districts, which will increase drug distribution and access to insulin and other essential diabetes medications.

Market Challenges

- High Cost of Diabetes Care Drugs (Pricing Dynamics): Despite government subsidies, diabetes care drugs remain costly for a large portion of the population. In 2024, the average annual out-of-pocket expenditure for a diabetic patient in India was 12,000, primarily driven by insulin and newer drug formulations. Many patients, especially in lower-income brackets, struggle to afford long-term diabetes management. The cost barrier is particularly acute for biologic drugs and combination therapies that are yet to achieve widespread affordability.

- Regulatory Hurdles (FDA, CDSCO Approval Processes): The Central Drugs Standard Control Organisation (CDSCO) has strict regulations for the approval of new diabetes drugs, which slows the entry of novel treatments into the market. As of 2024, there are still over 50 new drug applications pending approval, delaying market access. Regulatory bottlenecks in biosimilars and insulin analogs, in particular, hinder the availability of advanced treatment options, creating a lag in meeting the growing demand for diabetes care.

India Diabetes Care Drugs Market Future Outlook

Over the next five years, the India Diabetes Care Drugs market is expected to see significant growth driven by an increasing diabetes prevalence rate, which is projected to impact over 80 million individuals. The governments focus on public healthcare infrastructure, combined with an increasing patient shift towards innovative and combination therapies, is likely to further propel the market. Moreover, continuous R&D efforts and collaboration between global and local pharmaceutical companies will lead to the introduction of more affordable drugs and advanced delivery systems.

Market Opportunities

- Expansion of Generic Drug Manufacturing (Patent Expirations): Several key diabetes drugs are set to lose their patents between 2023 and 2025, creating an opportunity for Indian pharmaceutical companies to expand the production of generic versions. In 2024, it is estimated that 25 million diabetic patients could shift to generics, which will increase market competitiveness and drive down drug costs, while expanding access to more affordable treatments.

- Increased Adoption of Digital Therapeutics (Telemedicine & Digital Health Solutions): In 2024, over 35 million Indians used telemedicine platforms for diabetes care consultations, as per government health records. Digital health solutions, such as remote monitoring of blood glucose levels and teleconsultations, are expanding, offering cost-effective diabetes management options, particularly in semi-urban and rural areas. This trend is likely to intensify, as the Ministry of Health plans to invest further in digital health infrastructure by 2025.

Scope of the Report

|

By Drug Type |

Insulin Oral Anti-Diabetic Drugs GLP-1 Agonists SGLT2 Inhibitors DPP-4 Inhibitors |

|

By Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies Clinics |

|

By Patient Type |

Type 1 Diabetes Type 2 Diabetes Gestational Diabetes |

|

By Mode of Action |

Insulin Sensitizers Insulin Secretagogues Alpha-glucosidase Inhibitors Combination Drugs |

|

By Region |

North South West East |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Pharmaceutical Manufacturers

Government and Regulatory Bodies (CDSCO, NPPA)

Healthcare Providers and Hospitals

Retail Pharmacy Chains

Online Pharmacy Platforms

Health Insurance Companies

Research Institutes and R&D Organizations

Companies

Players Mentioned in the Report:

Sanofi India Limited

Novo Nordisk India Pvt. Ltd.

Eli Lilly and Company (India) Pvt. Ltd.

Cipla Limited

Biocon Biologics India Limited

Glenmark Pharmaceuticals

Sun Pharmaceutical Industries Ltd.

Lupin Limited

Zydus Cadila

Torrent Pharmaceuticals

Table of Contents

1. India Diabetes Care Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Diabetes Care Drugs Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Diabetes Care Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Diabetes (Prevalence Rate)

3.1.2. Rising Geriatric Population (Demographic Changes)

3.1.3. Government Healthcare Initiatives (National Diabetes Control Programs)

3.1.4. Advancements in Drug Development (Biologics and Insulin Analogs)

3.1.5. Growing Demand for Oral Anti-Diabetic Drugs (Drug Categories)

3.2. Market Challenges

3.2.1. High Cost of Diabetes Care Drugs (Pricing Dynamics)

3.2.2. Regulatory Hurdles (FDA, CDSCO Approval Processes)

3.2.3. Limited Accessibility in Rural Areas (Geographical Access)

3.2.4. Low Healthcare Infrastructure in Remote Areas (Healthcare Penetration)

3.3. Opportunities

3.3.1. Expansion of Generic Drug Manufacturing (Patent Expirations)

3.3.2. Increased Adoption of Digital Therapeutics (Telemedicine & Digital Health Solutions)

3.3.3. Emerging Markets for Combination Therapies (New Drug Combinations)

3.3.4. Rising Investment in R&D for Diabetes Drugs (Research Funding and Collaborations)

3.4. Trends

3.4.1. Shift Towards Personalized Diabetes Care (Personalized Medicine)

3.4.2. Integration of AI in Drug Delivery Systems (AI-driven Drug Dispensing)

3.4.3. Growing Use of Continuous Glucose Monitors (Glucose Monitoring Devices)

3.4.4. Increase in Insulin Pen and Pump Adoption (Insulin Delivery Technology)

3.5. Government Regulation

3.5.1. National Diabetes Control Programs (India's Healthcare Policy)

3.5.2. CDSCO Guidelines for Diabetes Drugs (Regulatory Compliance)

3.5.3. Price Control by National Pharmaceutical Pricing Authority (NPPA) (Price Regulations)

3.5.4. Pharmaceutical Distribution Reforms (Drug Distribution Network)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Diabetes Care Drugs Market Segmentation

4.1. By Drug Type (In Value %)

4.1.1. Insulin

4.1.2. Oral Anti-Diabetic Drugs

4.1.3. GLP-1 Agonists

4.1.4. SGLT2 Inhibitors

4.1.5. DPP-4 Inhibitors

4.2. By Distribution Channel (In Value %)

4.2.1. Hospital Pharmacies

4.2.2. Retail Pharmacies

4.2.3. Online Pharmacies

4.2.4. Clinics

4.3. By Patient Type (In Value %)

4.3.1. Type 1 Diabetes

4.3.2. Type 2 Diabetes

4.3.3. Gestational Diabetes

4.4. By Mode of Action (In Value %)

4.4.1. Insulin Sensitizers

4.4.2. Insulin Secretagogues

4.4.3. Alpha-glucosidase Inhibitors

4.4.4. Combination Drugs

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Diabetes Care Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sanofi India Limited

5.1.2. Novo Nordisk India Pvt. Ltd.

5.1.3. Eli Lilly and Company (India) Pvt. Ltd.

5.1.4. Cipla Limited

5.1.5. Biocon Biologics India Limited

5.1.6. Glenmark Pharmaceuticals

5.1.7. Sun Pharmaceutical Industries Ltd.

5.1.8. Lupin Limited

5.1.9. Zydus Cadila

5.1.10. Torrent Pharmaceuticals

5.1.11. Dr. Reddys Laboratories

5.1.12. Wockhardt Limited

5.1.13. Merck India

5.1.14. Abbott India Ltd.

5.1.15. Pfizer India

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Therapeutic Areas, Market Share, Pipeline Products)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Diabetes Care Drugs Market Regulatory Framework

6.1. Regulatory Authorities (CDSCO, NPPA)

6.2. Compliance Requirements

6.3. Drug Approval Processes (Clinical Trials, Fast-Track Approvals)

6.4. Price Control Mechanisms (NPPA Price Ceilings)

7. India Diabetes Care Drugs Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Aging Population, Rising Disease Burden)

8. India Diabetes Care Drugs Future Market Segmentation

8.1. By Drug Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Patient Type (In Value %)

8.4. By Mode of Action (In Value %)

8.5. By Region (In Value %)

9. India Diabetes Care Drugs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved the identification of key market drivers, challenges, and opportunities for the India Diabetes Care Drugs Market. This step incorporated desk research from proprietary databases and secondary sources such as government healthcare publications, industry reports, and pharmaceutical data repositories.

Step 2: Market Analysis and Construction

The second phase included a detailed analysis of historical data to construct a market model for 2023. The research evaluated market penetration, drug adoption rates, and patient usage patterns across India. All these factors contributed to estimating the market's revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including endocrinologists and key opinion leaders (KOLs) from major pharmaceutical companies, were consulted through structured interviews. These consultations helped validate the research hypotheses related to diabetes care drug usage and market trends.

Step 4: Research Synthesis and Final Output

In the final step, the gathered data was synthesized to provide a validated and comprehensive analysis. Inputs from major pharmaceutical companies were incorporated, ensuring that the report accurately reflects the current market dynamics and future trends in the India Diabetes Care Drugs market.

Frequently Asked Questions

1. How big is the India Diabetes Care Drugs market?

The India Diabetes Care Drugs market is valued at USD 1.65 billion, driven by rising diabetes incidence and government healthcare schemes that focus on making diabetes management drugs more accessible.

2. What are the key challenges in the India Diabetes Care Drugs market?

The market faces challenges such as the high cost of diabetes medications, particularly insulin and biologics, and regulatory complexities surrounding drug approvals. Access to healthcare in rural areas is also limited, hindering market expansion.

3. Who are the major players in the India Diabetes Care Drugs market?

Major players in this market include Sanofi India Limited, Novo Nordisk India Pvt. Ltd., Eli Lilly and Company (India) Pvt. Ltd., Cipla Limited, and Biocon Biologics India Limited. These companies are industry leaders due to their diverse portfolios and strong market presence.

4. What are the growth drivers of the India Diabetes Care Drugs market?

Growth in this market is propelled by increasing diabetes cases due to lifestyle changes, advancements in diabetes management technologies, and the government's emphasis on improving access to affordable diabetes medications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.