India Dialysis Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD5028

December 2024

100

About the Report

India Dialysis Market Overview

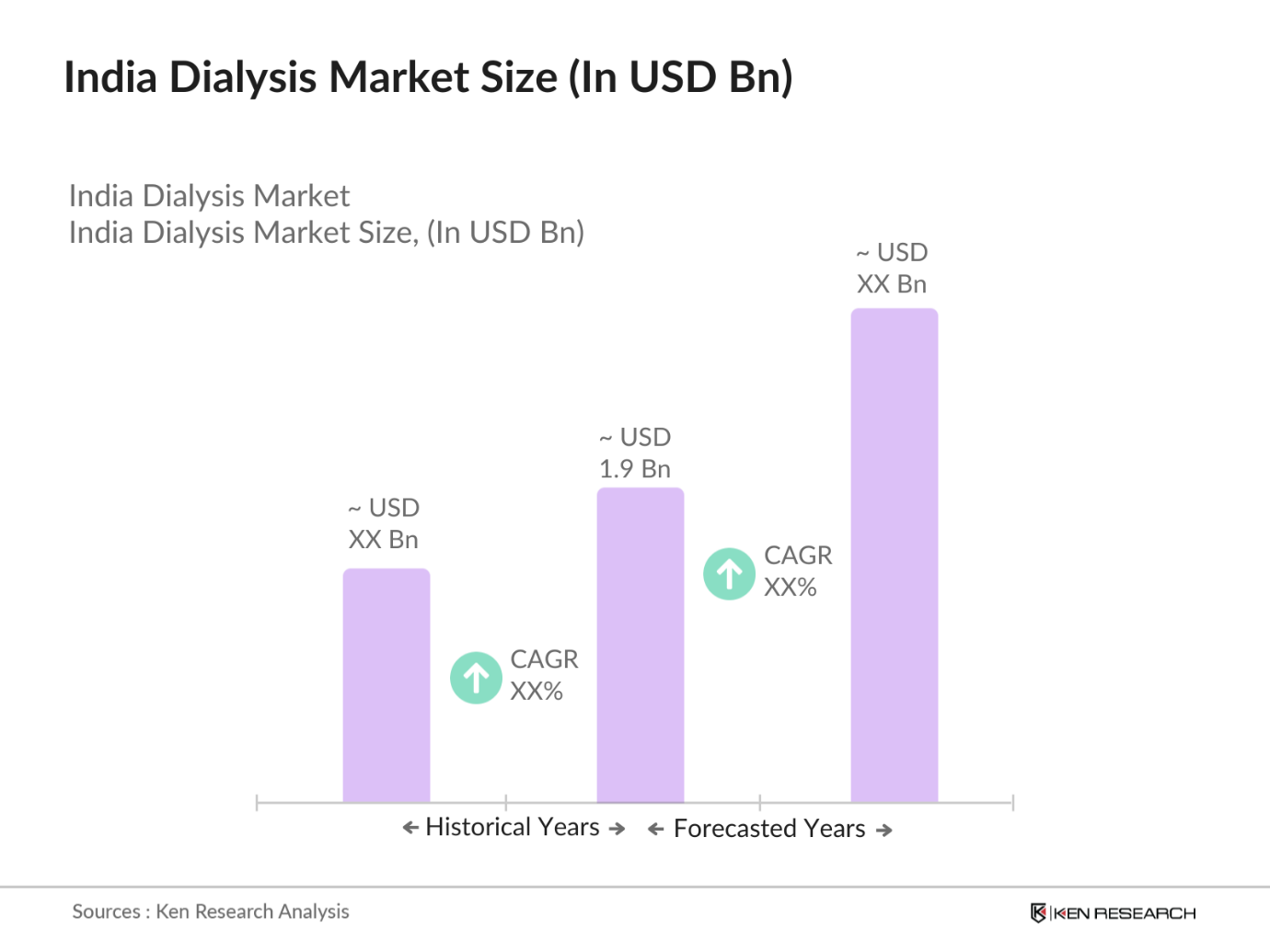

- The India Dialysis Market is valued at USD 1.9 billion, according to a comprehensive analysis of the industry over the past five years. The market is primarily driven by the rising prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), leading to a higher demand for dialysis services. Additionally, advancements in dialysis technology, increased healthcare spending, and government healthcare schemes such as Ayushman Bharat have significantly fueled market growth. The ongoing expansion of dialysis centers, particularly in urban regions, further boosts market size.

- Key cities such as Delhi, Mumbai, and Chennai dominate the dialysis market in India. The dominance of these regions is attributed to their advanced healthcare infrastructure, concentration of leading dialysis service providers, and greater access to government-funded healthcare programs. These cities also have a higher proportion of patients suffering from CKD due to lifestyle diseases such as diabetes and hypertension, contributing to their significant share in the market.

- Awareness of kidney diseases and dialysis options has increased significantly in recent years, particularly due to nationwide campaigns launched by the Ministry of Health and Family Welfare. In 2024, over 500,000 people have attended educational seminars and workshops on kidney health, particularly focusing on prevention, treatment options, and access to government programs. These efforts are aimed at reducing the number of undiagnosed CKD cases and improving early intervention, thereby boosting the overall dialysis treatment rate in the country.

India Dialysis Market Segmentation

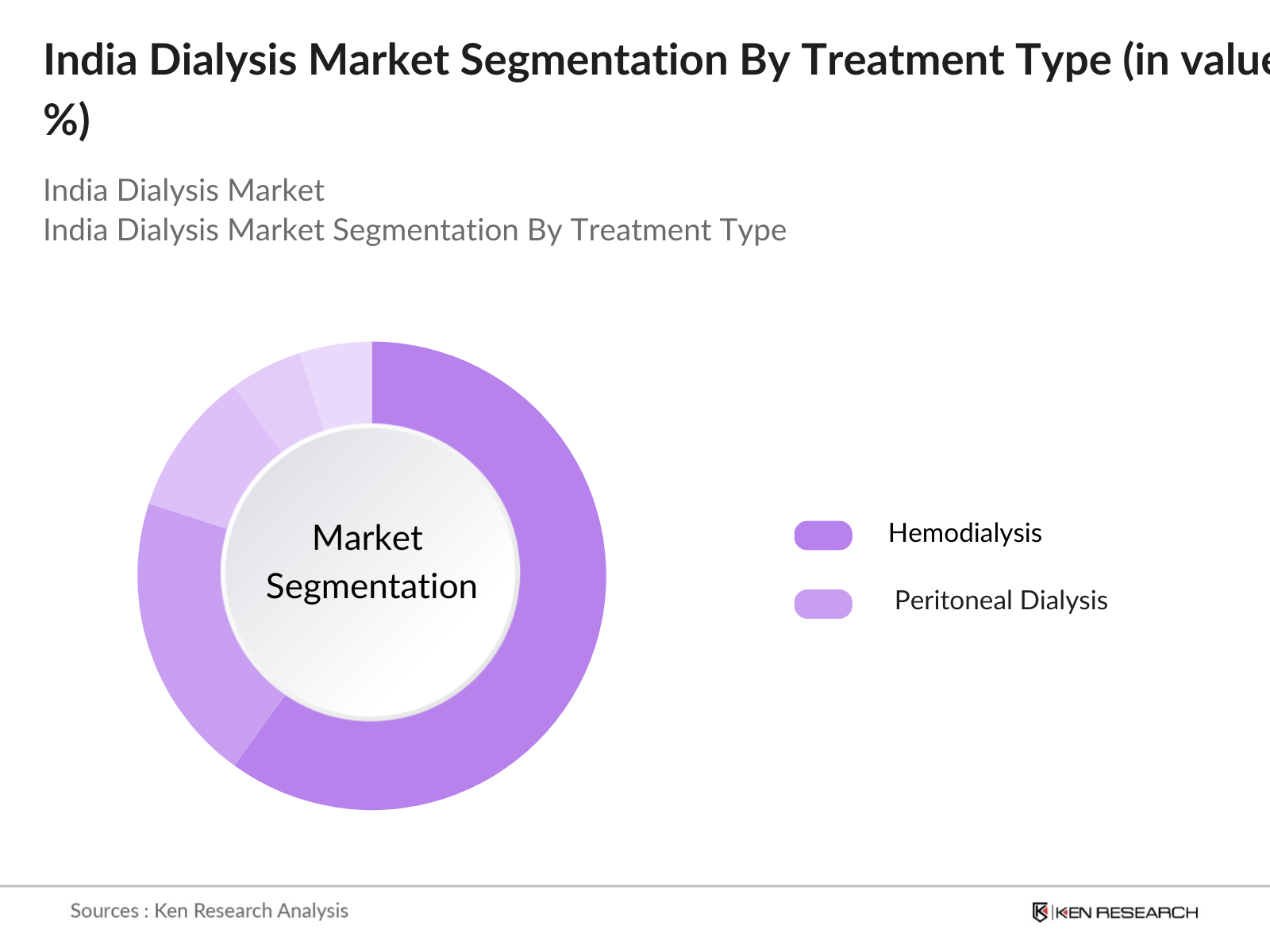

- By Treatment Type: India's dialysis market is segmented by treatment type into hemodialysis and peritoneal dialysis. Hemodialysis holds a dominant market share due to its widespread availability in both government and private healthcare facilities. The preference for hemodialysis among patients is largely because of its familiarity and the lack of trained professionals to manage peritoneal dialysis. Moreover, healthcare infrastructure in India has been developed to support in-center hemodialysis more effectively, ensuring patients receive necessary care.

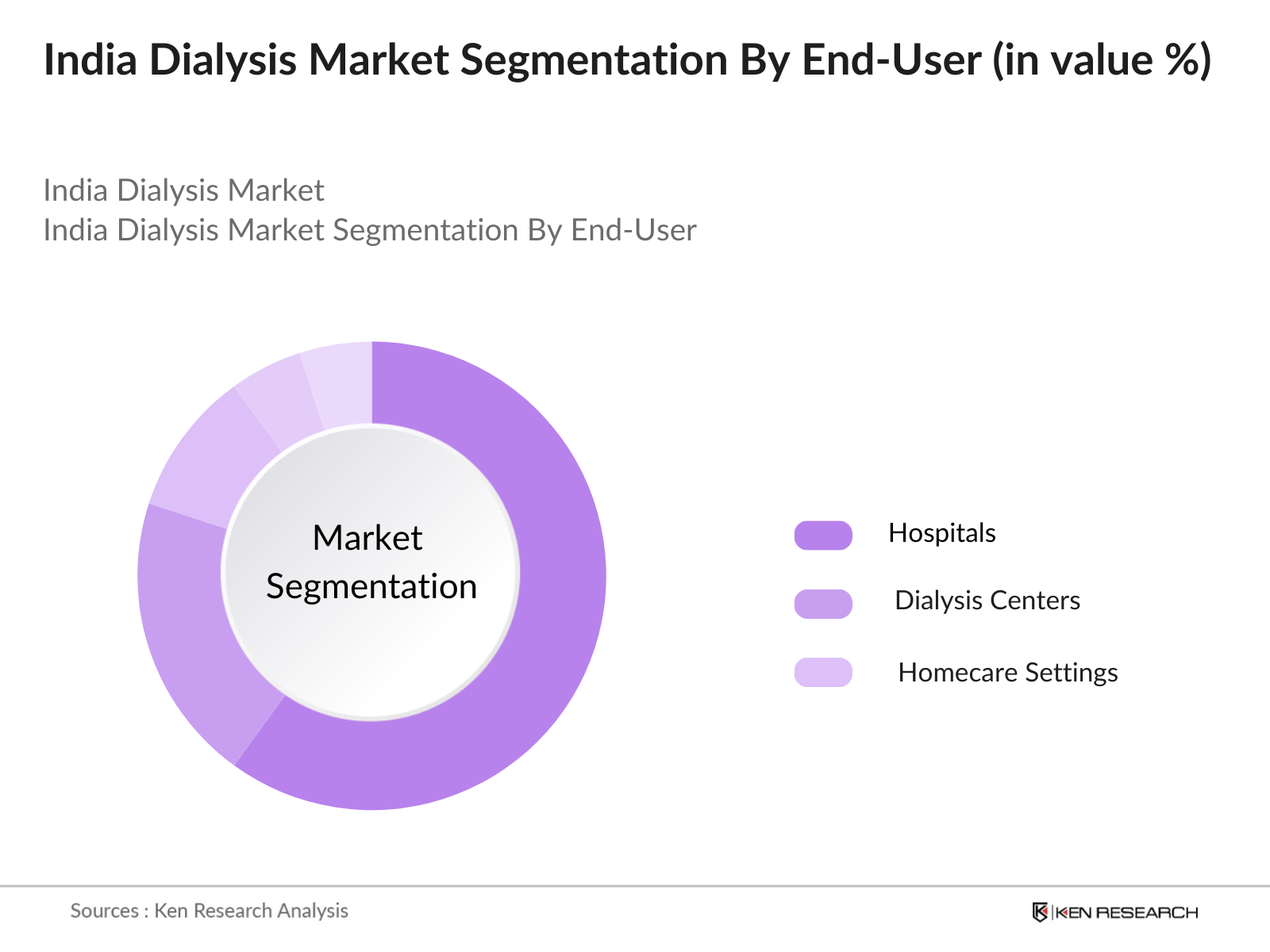

- By End-User: The dialysis market in India is categorized by end-users into hospitals, dialysis centers, and homecare settings. Hospitals dominate the market, mainly due to the established reputation and trust that patients have in hospital-based care. Dialysis centers are increasingly gaining traction as they offer specialized care and are more cost-effective. However, homecare settings, while having a smaller market share, are expected to grow due to the increasing adoption of home dialysis, driven by convenience and improvements in portable dialysis devices.

- By Region: The India Dialysis Market is categorized based on regional distribution, encompassing four key geographical regions: North India, South India, East India, and West India. This segmentation allows for a focused analysis of market trends, growth opportunities, and challenges specific to each region.

India Dialysis Market Competitive Landscape

The India Dialysis Market is characterized by the presence of both global and local players. Major international manufacturers dominate the dialysis equipment market, while local service providers are prominent in dialysis care services. These companies are focused on expanding their services to tier-2 and tier-3 cities, driven by increasing patient numbers and government schemes promoting better access to healthcare.

|

Company |

Establishment Year |

Headquarters |

Key Parameters |

|

Fresenius Medical Care |

1912 |

||

|

Baxter International |

1931 |

||

|

B. Braun Melsungen AG |

1839 |

||

|

DaVita Inc. |

1994 |

||

|

NephroPlus |

2009 |

India Dialysis Market Analysis

Growth Drivers

- Increasing prevalence of chronic kidney disease (CKD): Chronic kidney disease is a significant health concern in India, with over 10 million cases currently diagnosed across the country in 2024. Factors like rising diabetes and hypertension contribute to the growing CKD incidence. According to the World Bank's health reports, India has seen a rise in non-communicable diseases, particularly CKD, which now accounts for a substantial portion of the national disease burden. In 2024, Indias healthcare system is straining to accommodate the growing number of patients, leading to increased demand for dialysis services across urban and rural areas.

- Government healthcare initiatives: India's government has implemented several healthcare reforms aimed at improving access to dialysis. The Pradhan Mantri National Dialysis Program, launched in 2016, continues to expand its reach, offering free dialysis services in over 1,100 districts in 2024. This initiative has successfully increased access to dialysis treatments in government hospitals. The National Health Mission further supports this initiative, adding more dialysis units in rural areas to meet the rising demand. These efforts have made a significant impact, resulting in an increase of dialysis patients receiving treatments in government facilities.

- Technological advancements: The dialysis sector in India has benefited from substantial technological advancements, such as the integration of AI in dialysis machines. These innovations improve treatment accuracy and reduce human error. In 2024, dialysis machines equipped with AI and remote monitoring capabilities are being widely adopted across India, helping improve patient outcomes. This shift has also led to the rise of portable dialysis machines, enabling more patients to receive treatment from home. The Indian healthcare system is progressively modernizing to meet the demand for advanced, efficient dialysis services.

Market Challenges

- High treatment costs: Despite government initiatives, dialysis remains a costly treatment for many patients in India. An average patient undergoing hemodialysis requires about 120 sessions annually, each costing approximately INR 2,000 in private hospitals in 2024. For a typical patient, this translates into INR 240,000 annually, which is beyond the reach of a large portion of Indias population, where the per capita income stands at around INR 172,000 according to the World Bank. The disparity between private and public healthcare systems exacerbates the challenge of accessibility for lower-income individuals.

- Limited availability of skilled professionals: India faces a significant shortage of nephrologists and trained dialysis technicians in 2024, with less than 1 nephrologist available per 1,000 CKD patients, as per data from the Medical Council of India. This shortage of skilled professionals hampers the effective delivery of dialysis services, especially in rural and semi-urban areas. The lack of adequate training and education programs for dialysis technicians adds to this problem, resulting in fewer qualified professionals to manage the growing patient load.

India Dialysis Market Future Outlook

The India Dialysis Market is expected to continue its upward trajectory over the next few years, driven by factors such as increased government support, a growing prevalence of CKD, and innovations in home dialysis solutions. Government healthcare schemes, particularly Ayushman Bharat, aim to improve access to dialysis services in rural and underserved regions, potentially widening the market. Furthermore, advancements in portable and wearable dialysis devices could revolutionize the homecare dialysis market segment, making it a significant contributor to overall market growth.

Market Opportunities

- Emergence of home dialysis: Home dialysis is gaining traction in India, particularly with the introduction of portable dialysis machines. In 2024, more than 10,000 patients in urban centers have opted for home dialysis, benefiting from the convenience and flexibility it offers. This trend is supported by advancements in peritoneal dialysis technology, which allows patients to perform dialysis at home with minimal medical supervision. Home dialysis is expected to alleviate some of the pressure on overburdened hospital dialysis centers and improve patient outcomes through more consistent treatment schedules.

- Public-private partnerships: India's healthcare sector is seeing a rise in public-private partnerships (PPPs) in 2024, aimed at expanding dialysis services across the country. Private healthcare providers are increasingly collaborating with the government under the Pradhan Mantri National Dialysis Program to set up dialysis centers in underserved areas. These partnerships have already led to the establishment of over 200 dialysis centers nationwide, improving access to treatment for thousands of patients in both rural and urban settings.

Scope of the Report

|

Segment |

Sub-Segments |

|---|---|

|

Treatment Type |

Hemodialysis Peritoneal Dialysis |

|

End-User |

Hospitals Dialysis Centers Homecare Settings |

|

Product Type |

Equipment (Dialysis Machines, Water Treatment Systems) Consumables (Dialyzers) |

|

Modality |

In-center Dialysis Home Dialysis |

|

Region |

North India South India East India West India |

Products

Key Target Audience

Dialysis Centers

Hospitals

Homecare Providers

Government and Regulatory Bodies (Ayushman Bharat, NABH)

Dialysis Equipment Manufacturers

Healthcare Investors and Venture Capital Firms

Medical Consumables Suppliers

Insurance Providers

Companies

Players mentioned in the report

Fresenius Medical Care

Baxter International Inc.

B. Braun Melsungen AG

Nipro Corporation

DaVita Inc.

Asahi Kasei Corporation

Medtronic Plc

JJM Healthcare Pvt. Ltd.

NephroPlus

Apex Kidney Care

Rockwell Medical

Poly Medicure Ltd.

D.Med Healthcare

Terumo Corporation

Mar Cor Purification

Table of Contents

1. India Dialysis Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Dialysis Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Dialysis Market Analysis

3.1. Growth Drivers (Increasing prevalence of chronic kidney disease, rising aging population, government healthcare initiatives, technological advancements)

3.2. Market Challenges (High treatment costs, limited availability of skilled professionals, infrastructure limitations in rural areas, patient accessibility)

3.3. Opportunities (Emergence of home dialysis, public-private partnerships, telemedicine integration, growing awareness)

3.4. Trends (Shift toward peritoneal dialysis, integration of AI in dialysis machines, portable dialysis devices, increasing adoption of consumables)

3.5. Government Regulations (National Health Mission programs, Ayushman Bharat, GST on medical devices, NABH standards)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Government hospitals, private healthcare providers, insurance companies, dialysis machine manufacturers)

3.8. Porters Five Forces (Bargaining power of suppliers, bargaining power of buyers, threat of new entrants, threat of substitutes, industry rivalry)

3.9. Competition Ecosystem

4. India Dialysis Market Segmentation

4.1. By Treatment Type (In Value %)

4.1.1. Hemodialysis

4.1.2. Peritoneal Dialysis

4.2. By End-User (In Value %)

4.2.1. Hospitals

4.2.2. Dialysis Centers

4.2.3. Homecare Settings

4.3. By Product Type (In Value %)

4.3.1. Equipment (Dialysis machines, water treatment systems)

4.3.2. Consumables (Dialyzers, catheters, bloodlines)

4.4. By Modality (In Value %)

4.4.1. In-center Dialysis

4.4.2. Home Dialysis

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Dialysis Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Fresenius Medical Care

5.1.2. Baxter International Inc.

5.1.3. B. Braun Melsungen AG

5.1.4. Nipro Corporation

5.1.5. DaVita Inc.

5.1.6. Asahi Kasei Corporation

5.1.7. Medtronic Plc

5.1.8. JJM Healthcare Pvt. Ltd.

5.1.9. NephroPlus

5.1.10. Apex Kidney Care

5.1.11. Rockwell Medical

5.1.12. Poly Medicure Ltd.

5.1.13. D.Med Healthcare

5.1.14. Terumo Corporation

5.1.15. Mar Cor Purification

5.2. Cross Comparison Parameters (Revenue, R&D expenditure, No. of dialysis centers, Product portfolio, Technological innovations, Market share, Partnerships and collaborations, Customer base)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers & Acquisitions, Joint ventures, Collaborations, New product launches)

5.5. Investment Analysis (Venture capital funding, Private equity investments)

5.6. Government Grants and Incentives

6. India Dialysis Market Regulatory Framework

6.1. Certification Processes (NABH, ISO standards)

6.2. Compliance Requirements (GST, medical device regulations)

6.3. Reimbursement Policies (Ayushman Bharat, Private insurance)

7. India Dialysis Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Dialysis Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with identifying and mapping key variables influencing the India Dialysis Market. This involves extensive secondary research and leveraging proprietary databases to identify industry stakeholders, including hospitals, dialysis centers, equipment manufacturers, and government healthcare initiatives.

Step 2: Market Analysis and Construction

Historical data on market growth, treatment types, and end-user penetration are collected and analyzed. The market size for 2023 is calculated by assessing sales of dialysis equipment and consumables and by considering the number of dialysis centers operating across different regions in India.

Step 3: Hypothesis Validation and Expert Consultation

The market data is validated through interviews and surveys with healthcare professionals, dialysis service providers, and government representatives. This expert consultation ensures the data is accurate and reflects the actual market dynamics.

Step 4: Research Synthesis and Final Output

All findings are compiled to create a comprehensive analysis. This includes synthesizing insights from equipment manufacturers and service providers to understand consumer behavior and market trends, ensuring a holistic and validated market report.

Frequently Asked Questions

01. How big is the India Dialysis Market?

The India Dialysis Market was valued at USD 1.9 billion, driven by a growing patient population requiring regular dialysis services and significant investments in healthcare infrastructure.

02. What are the challenges in the India Dialysis Market?

Key challenges include high treatment costs, limited availability of skilled professionals, and inadequate infrastructure in rural regions, making access to dialysis services difficult for many.

03. Who are the major players in the India Dialysis Market?

Major players in the market include Fresenius Medical Care, Baxter International, B. Braun Melsungen AG, DaVita Inc., and NephroPlus. These companies dominate due to their extensive networks and technological innovations.

04. What are the growth drivers of the India Dialysis Market?

The market is driven by the rising prevalence of chronic kidney diseases, government healthcare initiatives, and advancements in dialysis technologies, making treatment more accessible and efficient.

05. What trends are shaping the India Dialysis Market?

Key trends include the growing adoption of home dialysis, the integration of AI in dialysis equipment, and increasing investments in portable dialysis devices to improve patient convenience and outcomes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.