India Diesel Exhaust Fluid (DEF) Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD657

October 2024

81

About the Report

India Diesel Exhaust Fluid (DEF) Market Overview

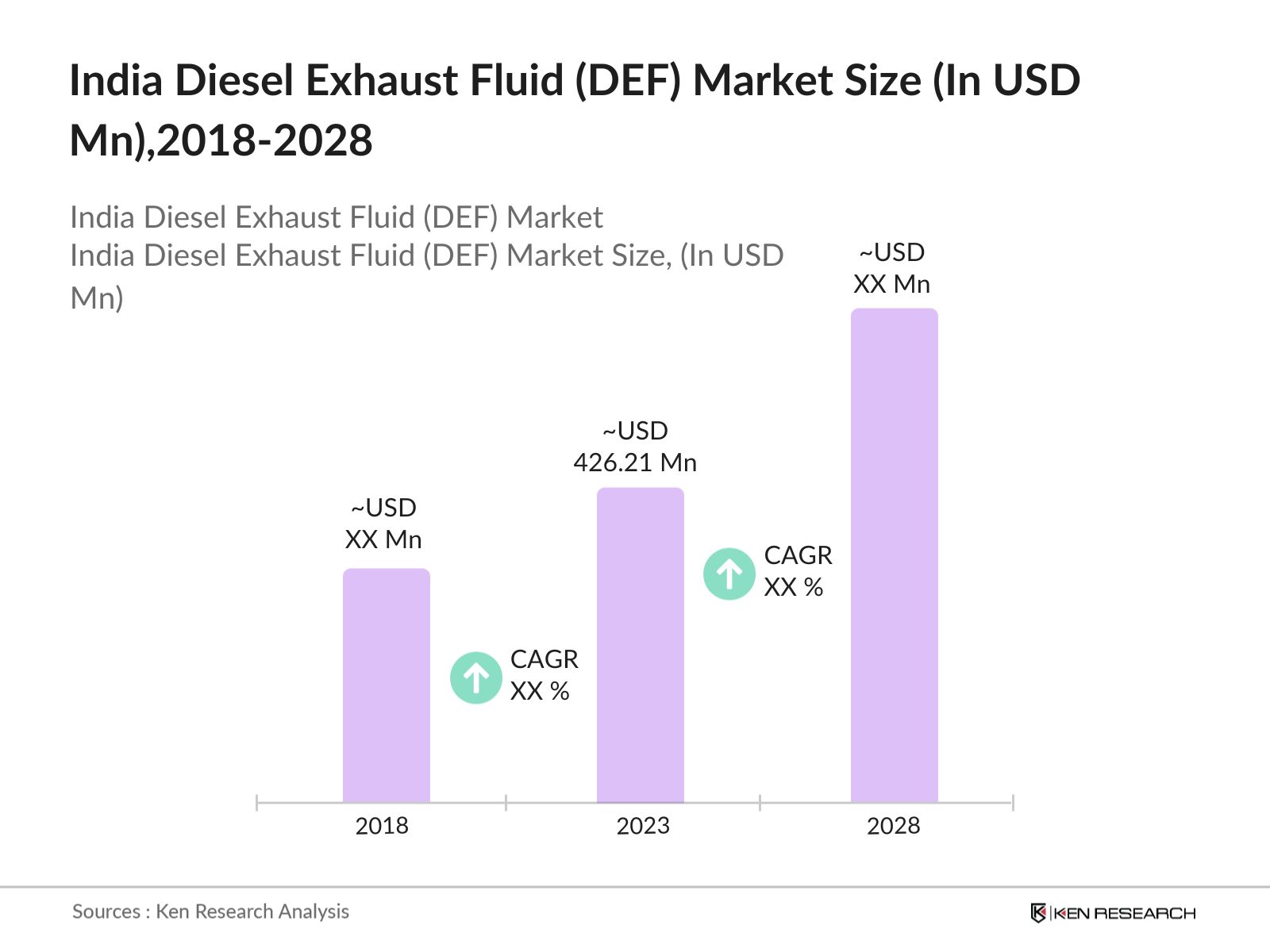

- The India Diesel Exhaust Fluid (DEF) Market was valued at USD 426.21 million in 2023. This growth is driven by stringent government regulations aimed at reducing vehicular emissions, increasing awareness about environmental pollution, and the rising adoption of DEF by commercial vehicle owners to comply with emission standards.

- The Indian DEF Market is characterized by the presence of several key players, including major international and domestic companies. Prominent players in the market include Yara International, Brenntag AG, BASF SE, Tata Chemicals, and Indian Oil Corporation. These companies are actively involved in product development, strategic partnerships, and expansions to strengthen their market position.

- In February 2024, BPCL, the Maharatna Energy Fortune 500 Corporation of India is the primary player and offers a unique solution that fights pollution caused by combustion engines and gives everyone a chance to own an ecological fuel.

- In 2023, Uttar Pradesh was dominating the in India. The dominance of this region can be attributed to the high number of commercial vehicles operating in the state, coupled with the presence of major logistics and transportation hubs. Additionally, the state's proactive measures to curb vehicular emissions and the availability of DEF dispensing stations have further contributed to its leading position in the market.

India Diesel Exhaust Fluid (DEF) Market Segmentation

The India DEF Market can be segmented by various factors like by product type, by end user and by region.

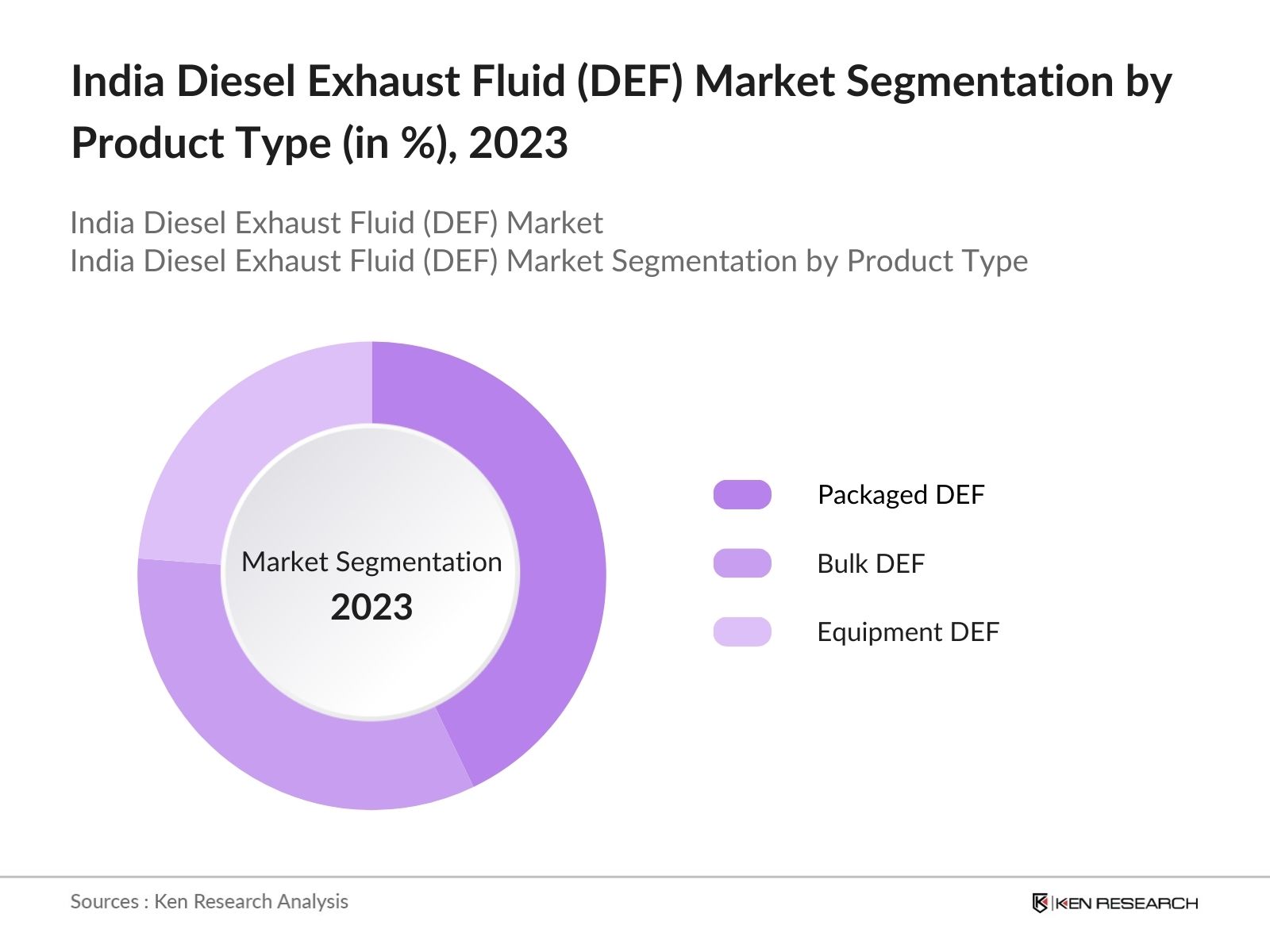

By Product Type: The India DEF market is segmented by product type into Packaged DEF, Bulk DEF, and Equipment DEF. In 2023, Packaged DEF was dominating this segment is due to its convenience and ease of use, particularly for smaller fleet operators and individual vehicle owners who prefer pre-packaged quantities of DEF for regular use.

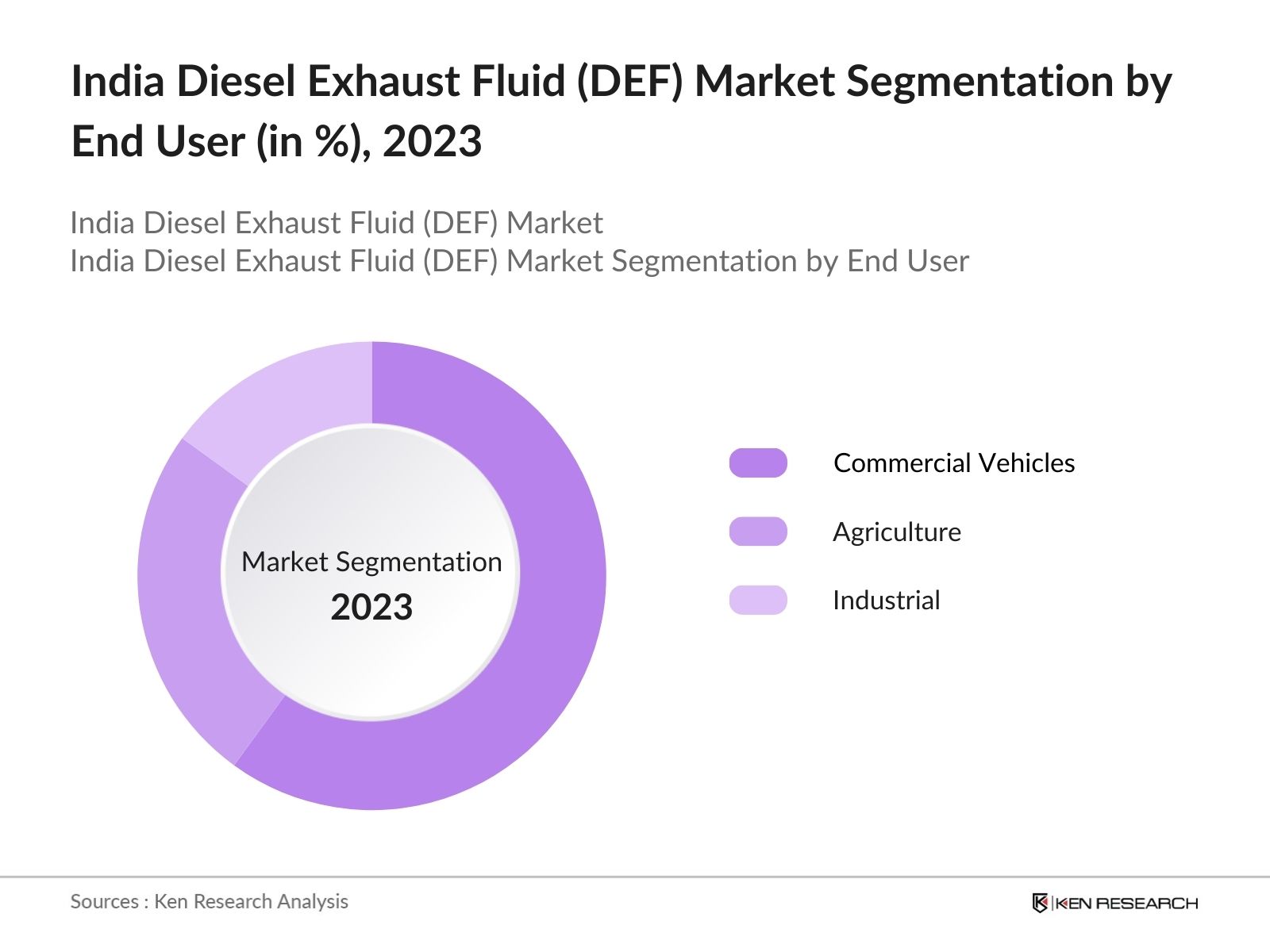

By End-User; The India DEF market is segmented by end-user into Commercial Vehicles, Agriculture, and Industrial. In 2023, the Commercial Vehicles segment was dominating the market due to its high adoption rate of DEF among commercial vehicle operators, driven by stringent emission norms and the need for compliance, is a key factor for this dominance.

By Region: The India DEF market is segmented by region into North, South, East, and West. In 2023, the Northern region was dominating due to its high number of commercial vehicles, coupled with the presence of major logistics hubs and proactive government measures, contribute to the region's dominance.

India Diesel Exhaust Fluid Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Yara International |

1905 |

Oslo, Norway |

|

Brenntag AG |

1874 |

Essen, Germany |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

Tata Chemicals |

1939 |

Mumbai, India |

|

Indian Oil Corporation |

1959 |

New Delhi, India |

Indian Oil Corporation: In late 2023, Indian Oil Corporation, in collaboration with Air1, launched India's first DEF dispensing station. This station aims to meet the increasing demand from commercial vehicles, enhancing the infrastructure for DEF supply and compliance with Bharat Stage VI (BS VI) emission standards.

BASF SE: In August 2021, BASF and SINOPEC will further expand their Verbund site at Nanjing, China, operated by BASFYPC Co., Ltd., a joint venture between both companies. For instance, new facilities, including a tert-butyl acrylate plant, have been added for several downstream chemical business as capacity development strategy to back up Chinese market growth. This expansion will help SINOPEC diversify through its DEF product line beyond.

India Diesel Exhaust Fluid Market Analysis

Market Growth Drivers

- Expansion of DEF Dispensing Infrastructure: The establishment and expansion of DEF dispensing stations across India have greatly facilitated market growth. This growth is supported by initiatives from major oil companies like Indian Oil Corporation and Bharat Petroleum, which have invested in setting up DEF dispensing units at their fuel stations. The expansion of infrastructure ensures better accessibility of DEF for vehicle operators, particularly in rural and semi-urban areas, thus promoting the widespread adoption of DEF.

- Implementation of BS-VI Emission Norms: The introduction of Bharat Stage VI (BS-VI) emission norms by the Indian government in April 2020 has been a significant growth driver for the . These stringent regulations require the use of Selective Catalytic Reduction (SCR) technology in diesel vehicles, which necessitates the use of DEF to reduce nitrogen oxide emissions. As of 2024, the diesel vehicles in India using SCR technology, creating a substantial and growing demand for DEF.

- Rising Environmental Awareness Among Consumers: There is a growing awareness among consumers regarding the environmental impact of diesel emissions, leading to increased demand for cleaner alternatives. Public campaigns and educational initiatives about the benefits of DEF in reducing harmful emissions have resulted in a notable shift in consumer behavior. This shift in consumer mindset is expected to further drive the DEF market as more users recognize the importance of compliance with environmental regulations.

Market Challenges

- Technical Adaptation of Diesel Engines: The adaptation of existing diesel engines to utilize DEF effectively poses technical challenges. Many older diesel engines may require modifications to be compatible with SCR technology, which can incur additional costs and downtime for operators. This technical barrier can slow the adoption of DEF, particularly among operators of older vehicles who may be reluctant to invest in necessary upgrades.

- Logistical Challenges in DEF Distribution: The distribution of Diesel Exhaust Fluid presents significant logistical challenges, particularly in rural and remote areas of India. The current infrastructure for DEF distribution is limited, with only about 30% of fuel stations offering DEF. This lack of availability can hinder the adoption of DEF among diesel vehicle operators, particularly in regions where access to DEF is sparse. Addressing these logistical issues will be crucial for the market's growth, as an efficient supply chain is necessary to meet the increasing demand.

Market Government Initiatives

- National Clean Air Programme (NCAP) and BS-VI Implementation: The Indian government's National Clean Air Programme (NCAP) and the implementation of BS-VI emission norms have driven significant demand for Diesel Exhaust Fluid (DEF). These initiatives require DEF use in diesel vehicles with SCR systems to reduce emissions, boosting market growth and infrastructure expansion. This regulatory support ensures better air quality and compliance with emission standards.

- Expansion of DEF Dispensing Infrastructure: The government, in collaboration with major oil companies, has been actively involved in expanding the network of DEF dispensing stations across the country. By the end of 2024, there were over 3,000 DEF dispensing stations nationwide, compared to 2,200 in 2023. This expansion is part of a broader effort to enhance the accessibility of DEF, particularly in rural and semi-urban areas. The Ministry of Petroleum and Natural Gas has been instrumental in driving this initiative, ensuring that DEF is readily available to meet the growing demand from the commercial vehicle sector.

India Diesel Exhaust Fluid Market Future Outlook

The DEF market in India is expected to continue its upward growth by 2028. The growth will be driven by continued government initiatives to curb vehicular emissions, technological advancements in DEF production, and the expansion of DEF dispensing infrastructure. Additionally, the increasing fleet of commercial vehicles and the adoption of DEF by other sectors such as agriculture and construction will further propel market growth.

Market Trends

- Technological Advancements in DEF Production: Technological advancements in DEF production are expected to reduce costs and improve product quality. By 2028, innovations in production processes and raw material sourcing are projected to lower the average cost of DEF, making it more affordable for consumers and boosting market growth.

- Increasing Adoption of DEF in Non-Automotive Sectors: Over the next five years, the adoption of DEF in non-automotive sectors such as agriculture and industrial applications is expected to increase. By 2028, it is estimated that the demand for DEF in these sectors will grow annually, driven by stricter emission norms and the need for sustainable practices.

Scope of the Report

|

By Product Type |

Packaged DEF Bulk DEF Equipment DEF |

|

By End User |

Commercial Vehicles Agriculture Industrial |

|

By Region |

North South West East |

Products

Key Target Audience Organizations and Entities who can benefit by subscribing this report:

Commercial Vehicle Manufacturers

Agriculture Equipment Manufacturers

Industrial Machinery Manufacturers

DEF Manufacturers and Suppliers

Logistics and Transportation Companies

Fleet Management Companies

DEF Dispensing Equipment Manufacturers

Oil and Gas Companies

Industrial Equipment Distributors

DEF Storage Tank Manufacturers

Government Regulatory Bodies (Automotive Research Association of India (ARAI), Bureau of Indian Standards (BIS)

Investor and VC Firms

Time Period Captured in the Report:

Historical Period:2018-2023

Base Year:2023

Forecast Period:2023-2028

Companies

Major Players Mention in the Report:

Yara International

Brenntag AG

BASF SE

Tata Chemicals

Indian Oil Corporation

TotalEnergies

Shell

GreenChem

AdBlue

Cummins Filtration

Old World Industries

Mitsui Chemicals

Siam Kem

Sinopec

Mahindra & Mahindra

Table of Contents

1. India Diesel Exhaust Fluid Market Overview

1.1 India Diesel Exhaust Fluid Market Taxonomy

2. India Diesel Exhaust Fluid Market Size (in USD Bn), 2018-2023

3. India Diesel Exhaust Fluid Market Analysis

3.1 India Diesel Exhaust Fluid Market Growth Drivers

3.2 India Diesel Exhaust Fluid Market Challenges and Issues

3.3 India Diesel Exhaust Fluid Market Trends and Development

3.4 India Diesel Exhaust Fluid Market Government Regulation

3.5 India Diesel Exhaust Fluid Market SWOT Analysis

3.6 India Diesel Exhaust Fluid Market Stake Ecosystem

3.7 India Diesel Exhaust Fluid Market Competition Ecosystem

4. India Diesel Exhaust Fluid Market Segmentation, 2023

4.1 India Diesel Exhaust Fluid Market Segmentation by Product Type (in %), 2023

4.2 India Diesel Exhaust Fluid Market Segmentation by Application (in %), 2023

4.3 India Diesel Exhaust Fluid Market Segmentation by Region (in %), 2023

5. India Diesel Exhaust Fluid Market Competition Benchmarking

5.1 India Diesel Exhaust Fluid Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Diesel Exhaust Fluid Market Future Market Size (in USD Bn), 2023-2028

7. India Diesel Exhaust Fluid Market Future Market Segmentation, 2028

7.1 India Diesel Exhaust Fluid Market Segmentation by Product Type (in %), 2028

7.2 India Diesel Exhaust Fluid Market Segmentation by Application (in %), 2028

7.3 India Diesel Exhaust Fluid Market Segmentation by Region (in %), 2028

8. India Diesel Exhaust Fluid Market Analysts Recommendations

8.1 India Diesel Exhaust Fluid Market TAM/SAM/SOM Analysis

8.2 India Diesel Exhaust Fluid Market Customer Cohort Analysis

8.3 India Diesel Exhaust Fluid Market Marketing Initiatives

8.4 India Diesel Exhaust Fluid Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step 2: Market Building

Collating statistics on India Diesel Exhaust Fluid Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Diesel Exhaust Fluid Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team will approach multiple diesel producers companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach fromsuch diesel producers companies.

Frequently Asked Questions

01 How big is the India Diesel Exhaust Fluid (DEF) Market?

The India Diesel Exhaust Fluid (DEF) Market, valued at USD 426.21 million in 2023, is driven by stringent government regulations, increasing awareness about environmental pollution, and the rising adoption of DEF by commercial vehicle owners to comply with emission standards.

02. What are the challenges in the India Diesel Exhaust Fluid (DEF) Market?

Challenges in the India Diesel Exhaust Fluid (DEF) Market include the high cost of DEF production, limited awareness among small fleet operators, supply chain disruptions, and ensuring regulatory compliance and quality standards. These factors impact market penetration and overall growth.

03. Who are the major players in the India Diesel Exhaust Fluid (DEF) Market?

Key players in the India Diesel Exhaust Fluid (DEF) Market include Yara International, Brenntag AG, BASF SE, Tata Chemicals, and Indian Oil Corporation. These companies have established a strong presence through strategic initiatives, extensive distribution networks, and innovative product offerings.

04. What are the growth drivers of the India Diesel Exhaust Fluid (DEF) Market?

The India Diesel Exhaust Fluid (DEF) Market is propelled by factors such as the implementation of BS-VI emission norms, an increase in commercial vehicle sales, the expansion of DEF dispensing infrastructure, and government subsidies and incentives. These drivers contribute to the rising demand and adoption of DEF across various sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.