India Digital Advertising Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD7151

December 2024

86

About the Report

India Digital Advertising Market Overview

- The India Digital Advertising market is valued at USD 4.9 billion, based on a five-year historical analysis. This growth is driven by the increased penetration of the internet, with over 800 million internet users, and the widespread adoption of smartphones. The booming e-commerce sector and rising consumption of online content across social media platforms and OTT channels have also boosted the market, leading to higher ad spend across these platforms.

- Mumbai, Delhi, and Bangalore dominate the market due to their concentration of technology companies, e-commerce hubs, and a growing number of startups. These cities serve as epicenters for innovation and digital growth, with advertisers focusing on these regions to capture high-income, tech-savvy urban populations. Furthermore, the high digital literacy and business-friendly policies in these regions contribute to their dominance in digital advertising.

- India's Digital Personal Data Protection Act, 2023, has introduced comprehensive guidelines for the collection, storage, and use of personal data. The law mandates strict data protection protocols, including user consent for data collection and usage. For digital advertisers, this regulation creates new challenges in handling user data while ensuring compliance. The law also introduces penalties for data breaches and non-compliance, which could impact how advertisers operate in the digital space. Advertisers must adapt to these changes while maintaining transparency in their data practices.

India Digital Advertising Market Segmentation

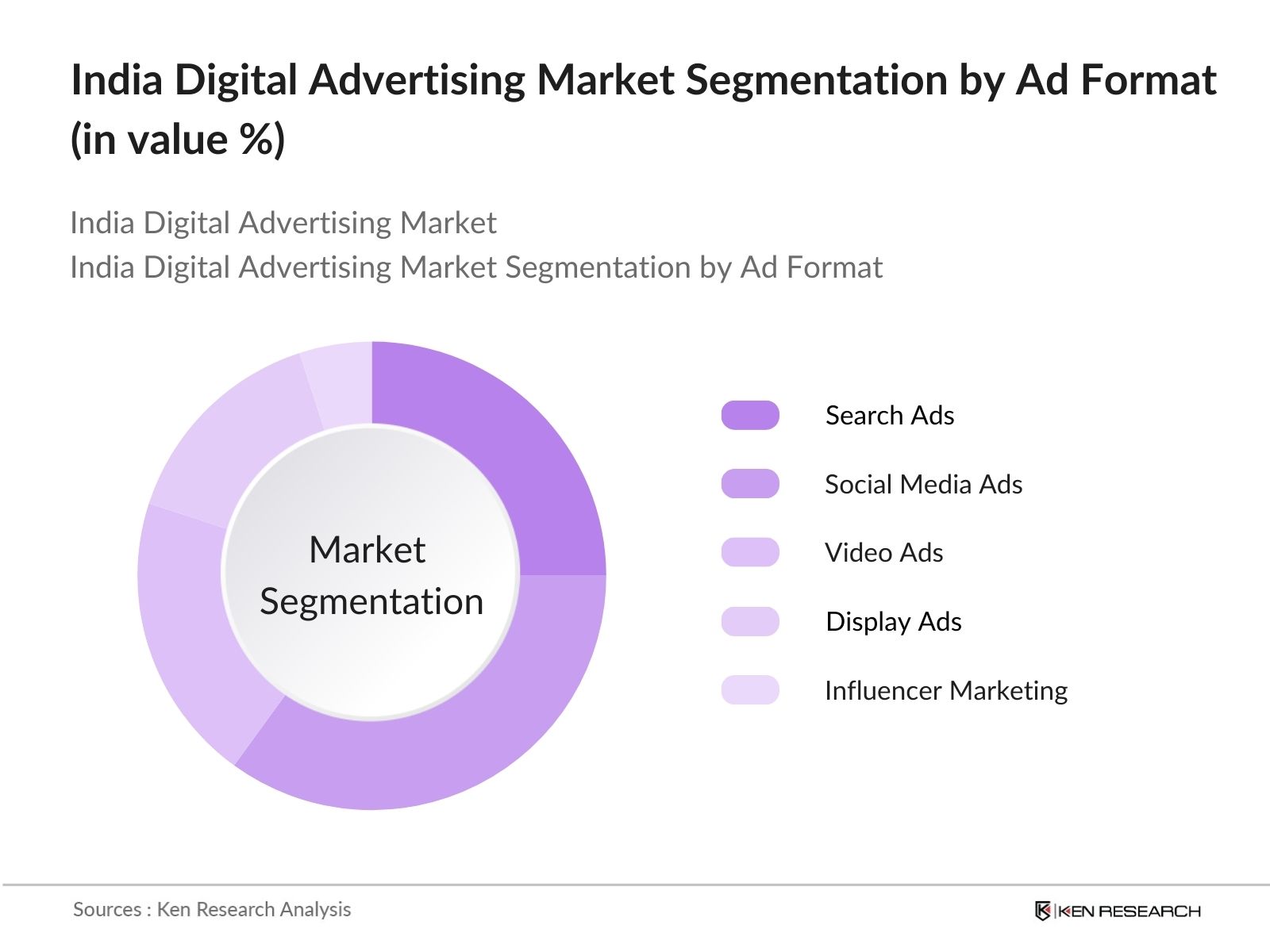

- By Ad Format: The India Digital Advertising market is segmented by ad format into search ads, social media ads, video ads, display ads, and influencer marketing. Social media ads dominate the ad format segment due to the massive growth of platforms like Facebook, Instagram, and YouTube. The rise of influencer marketing on these platforms has further enhanced ad revenues, as businesses find it easier to target specific demographics and niche markets. The interactive nature and user engagement on social media platforms make them highly attractive for advertisers seeking high conversion rates.

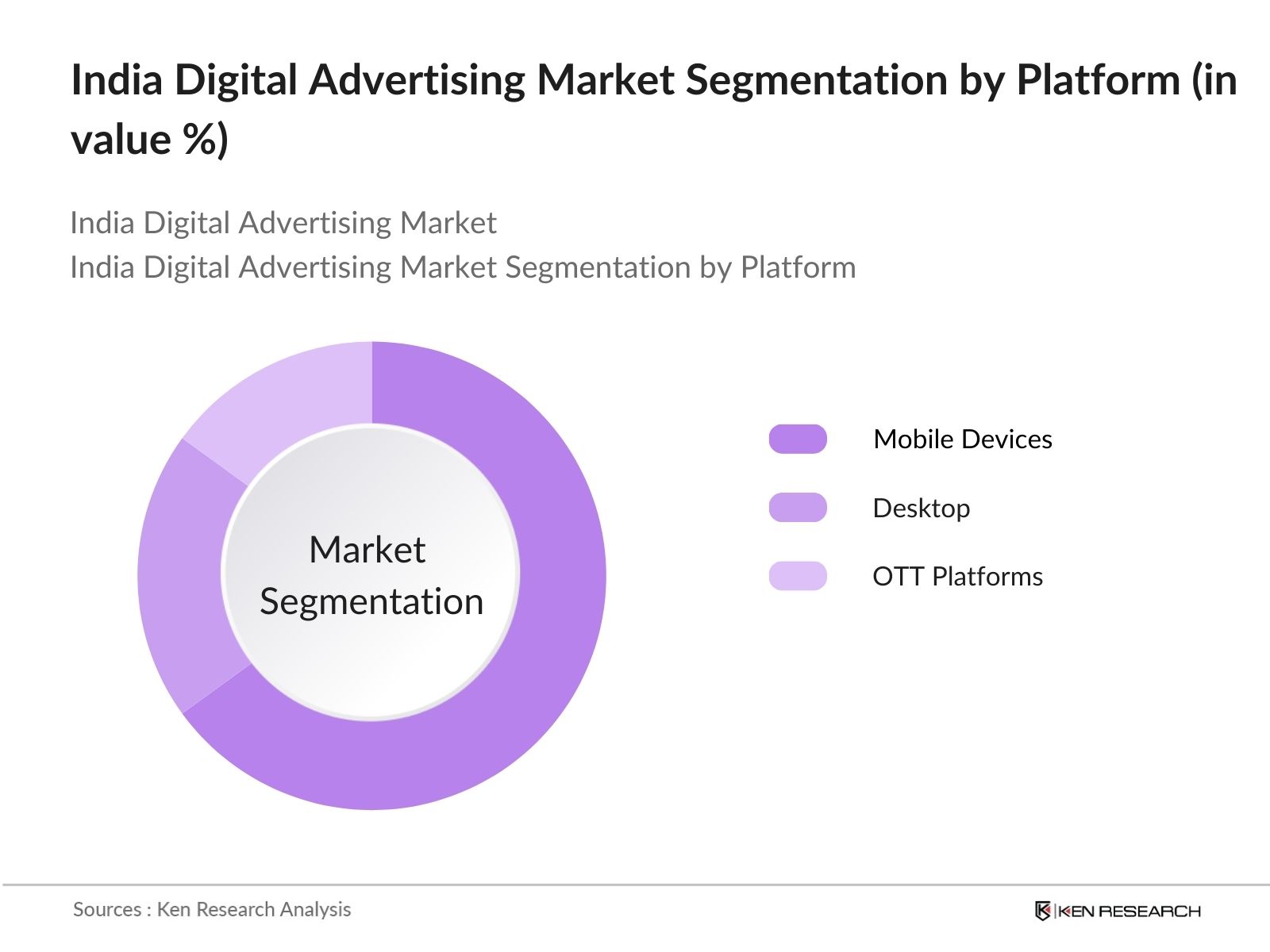

- By Platform: The India Digital Advertising market is segmented by platform into mobile devices, desktops, and OTT platforms. Mobile devices dominate the platform segment with a notable share of the market. The proliferation of smartphones and affordable mobile internet services has increased mobile usage, with consumers spending more time on apps and mobile browsers. Consequently, advertisers allocate a large portion of their ad budgets to mobile advertising to reach their target audience more effectively.

India Digital Advertising Market Competitive Landscape

The India Digital Advertising market is dominated by a mix of global and domestic players who leverage advanced technologies and targeted advertising solutions to maintain their competitive edge. These companies focus on delivering personalized and data-driven advertising experiences, which has allowed them to capture market share.

|

Company Name |

Establishment Year |

Headquarters |

Monthly Active Users |

Ad Revenue (USD bn) |

Employee Strength |

Ad Spend Share (%) |

Mobile Ad Share (%) |

Social Media Presence |

|

Google India |

2004 |

Hyderabad, India |

- |

- |

- |

- |

- |

- |

|

Facebook India (Meta) |

2006 |

Gurgaon, India |

- |

- |

- |

- |

- |

- |

|

Amazon Advertising |

2012 |

Bangalore, India |

- |

- |

- |

- |

- |

- |

|

Times Internet |

1999 |

Noida, India |

- |

- |

- |

- |

- |

- |

|

Flipkart Ads |

2007 |

Bangalore, India |

- |

- |

- |

- |

- |

- |

India Digital Advertising Market Analysis

India Digital Advertising Market Growth Drivers

- Increased Internet Penetration: India has witnessed a increase in internet penetration, with over 846 million internet subscribers as of 2023, according to the Telecom Regulatory Authority of India (TRAI). The expansion of 4G networks and affordable data packages has driven widespread adoption, especially in urban areas, where internet usage is becoming more prevalent. This growth is also fueled by the government's Digital India initiative, which aims to make broadband internet accessible to rural areas. Increased internet penetration is directly influencing the growth of digital advertising, creating vast opportunities for advertisers to target a wider audience across various platforms.

- Rising Adoption of Smartphones: Smartphone usage in India has surged, with over 730 million users in 2023, according to the International Telecommunication Union (ITU). The widespread availability of affordable smartphones and the growing preference for mobile internet have led to an increase in the consumption of digital content. This shift is pivotal for the digital advertising market, as more users access online platforms via their smartphones, providing advertisers a direct avenue to reach consumers through mobile-friendly ads, apps, and content. As smartphone penetration grows, advertisers can leverage the platform to target different demographics, driving growth in mobile advertising.

- E-commerce Expansion: India's e-commerce market is expected to reach $111 billion by 2024, according to the India Brand Equity Foundation (IBEF). With the increasing digitization of shopping habits and the growing number of online shoppers, brands are heavily investing in digital advertising to enhance their online presence. E-commerce platforms are one of the primary buyers of digital advertising, utilizing social media, search engines, and mobile apps to engage users. The seamless integration of advertising into e-commerce channels is boosting the demand for digital ads, especially with the rising number of consumers making online purchases.

India Digital Advertising Market Challenges

- Ad-blocking Software Impact: The use of ad-blocking software continues to rise, with over 290 million internet users in India actively employing these tools by 2024. According to a report from the Ministry of Communications, this growing trend poses a major challenge for advertisers, as ad-blockers reduce the visibility of ads, thereby impacting the reach and effectiveness of digital campaigns. Advertisers must innovate and explore non-intrusive advertising formats such as native ads or sponsored content to mitigate the losses incurred due to ad-blocking software.

- Data Privacy Regulations: The Indian government has implemented stringent data privacy regulations under the Digital Personal Data Protection Act, 2023. These laws require companies to handle user data with greater transparency and accountability, posing challenges for digital advertisers who rely on consumer data for targeted advertising. Compliance with these regulations adds operational costs for companies and limits the extent to which user data can be leveraged for advertising. Advertisers must now navigate these restrictions while ensuring personalized advertising experiences without violating privacy norms.

India Digital Advertising Market Future Outlook

Over the next five years, the India Digital Advertising market is expected to grow, driven by the continuous increase in internet users, rising smartphone penetration, and the expansion of the e-commerce sector. The adoption of advanced technologies such as AI, machine learning, and programmatic advertising will further accelerate the markets growth. With OTT platforms gaining popularity and advertisers focusing more on personalized content, the digital advertising ecosystem will witness robust investment and innovation.

India Digital Advertising Market Opportunities

- Growth of OTT Platforms: India's over-the-top (OTT) platforms are growing exponentially, with over 460 million users streaming content by 2024, according to the Ministry of Information and Broadcasting. The rise of these platforms provides a lucrative opportunity for advertisers to target a diverse audience. OTT platforms offer highly targeted ad placements based on user behavior and preferences, allowing advertisers to deliver personalized ads to a more engaged audience. As consumption of digital content increases on OTT platforms, advertisers are likely to see better ROI through these channels.

- Programmatic Advertising Adoption: Programmatic advertising is gaining traction in India, with automated ad buying contributing to over $3 billion in digital ad spend by 2024, according to the Reserve Bank of India (RBI). This form of advertising allows brands to target users with precision, using algorithms and data to optimize ad delivery in real-time. The efficiency and scalability of programmatic advertising are attracting more brands, as it offers better targeting, reduced costs, and higher conversion rates compared to traditional digital advertising methods.

Scope of the Report

|

Ad Format |

Search Ads Social Media Ads Display Ads Video Ads Influencer Marketing |

|

Platform |

Mobile Devices Desktop OTT Platforms |

|

Industry Vertical |

FMCG Retail and E-commerce Media and Entertainment BFSI Automotive |

|

Target Audience |

Urban Users Rural Users Millennials Gen Z |

|

Region |

North India South India East India West India |

Products

Key Target Audience

Digital Advertising Agencies

E-commerce Companies

FMCG Brands

Government and Regulatory Bodies (Advertising Standards Council of India)

Technology Companies

Banks and Financial Institutions

Investor and Venture Capitalist Firms

OTT Platforms

Social Media Companies

Companies

Players Mentioned in the Report

Google India

Facebook India (Meta)

Amazon Advertising

Times Internet

Flipkart Ads

InMobi

LinkedIn (Microsoft India)

Hotstar (Disney+ Hotstar)

Zomato Media

Paytm Advertising

Table of Contents

1. India Digital Advertising Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Digital Advertising Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Digital Advertising Market Analysis

3.1. Growth Drivers

3.1.1. Increased Internet Penetration

3.1.2. Rising Adoption of Smartphones

3.1.3. E-commerce Expansion

3.1.4. Rise of Social Media Platforms

3.2. Market Challenges

3.2.1. Ad-blocking Software Impact

3.2.2. Data Privacy Regulations

3.2.3. Low Digital Literacy in Rural Areas

3.3. Opportunities

3.3.1. Growth of OTT Platforms

3.3.2. Programmatic Advertising Adoption

3.3.3. Increasing Investment in Video Advertising

3.4. Trends

3.4.1. Growth in Influencer Marketing

3.4.2. Shifts Toward Vernacular Content

3.4.3. Focus on Personalization and Consumer Targeting

3.5. Government Regulation

3.5.1. Data Protection and Digital Privacy Laws

3.5.2. Advertising Standards Council of India (ASCI) Guidelines

3.6. SWOT Analysis

3.7. Porters Five Forces

3.8. Stakeholder Ecosystem

3.9. Competitive Ecosystem

4. India Digital Advertising Market Segmentation

4.1. By Ad Format (In Value %)

4.1.1. Search Ads

4.1.2. Social Media Ads

4.1.3. Display Ads

4.1.4. Video Ads

4.1.5. Influencer Marketing

4.2. By Platform (In Value %)

4.2.1. Mobile Devices

4.2.2. Desktop

4.2.3. OTT Platforms

4.3. By Industry Vertical (In Value %)

4.3.1. FMCG

4.3.2. Retail and E-commerce

4.3.3. Media and Entertainment

4.3.4. BFSI

4.3.5. Automotive

4.4. By Target Audience (In Value %)

4.4.1. Urban Users

4.4.2. Rural Users

4.4.3. Millennials

4.4.4. Gen Z

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Digital Advertising Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Google India

5.1.2. Facebook India (Meta Platforms)

5.1.3. Hotstar (Disney+ Hotstar)

5.1.4. Amazon Advertising

5.1.5. LinkedIn (Microsoft India)

5.1.6. InMobi

5.1.7. Flipkart Ads

5.1.8. Times Internet

5.1.9. Zomato Media

5.1.10. Paytm Advertising

5.1.11. TikTok India (ByteDance)

5.1.12. ShareChat

5.1.13. Quora India

5.1.14. Taboola India

5.1.15. Outbrain India

5.2. Cross Comparison Parameters (Market Share, Revenue, Ad Spend, Monthly Active Users, CTR, ROI, Conversion Rate, Engagement Rate)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. India Digital Advertising Market Regulatory Framework

6.1. Compliance with ASCI

6.2. Data Protection and Cybersecurity Laws

6.3. Certification and Licensing Processes

7. India Digital Advertising Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Digital Advertising Future Market Segmentation

8.1. By Ad Format (In Value %)

8.2. By Platform (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Target Audience (In Value %)

8.5. By Region (In Value %)

9. India Digital Advertising Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical variables such as internet penetration, smartphone usage, and digital content consumption in the India Digital Advertising market. A combination of secondary and proprietary databases is used to gather this information.

Step 2: Market Analysis and Construction

We collect and analyze historical data on ad spend, platform usage, and ad performance to construct the market analysis. This includes data on mobile vs. desktop advertising and the growing significance of OTT platforms.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts in advertising agencies, social media platforms, and e-commerce companies, offering insights into digital advertising trends and challenges.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data collected from digital advertising platforms, analysing market trends, and consolidating this with expert feedback to generate a comprehensive market report.

Frequently Asked Questions

01. How big is the India Digital Advertising Market?

The India Digital Advertising market is valued at USD 4.9 billion, driven by internet penetration, smartphone adoption, and e-commerce growth.

02. What are the challenges in the India Digital Advertising Market?

Challenges in the India Digital Advertising market include the rise of ad-blocking software, increasing data privacy concerns, and the lack of digital literacy in rural areas.

03. Who are the major players in the India Digital Advertising Market?

Key players in the India Digital Advertising market include Google India, Facebook India, Amazon Advertising, Times Internet, and Flipkart Ads, all of which dominate through advanced advertising solutions and targeting capabilities.

04. What are the growth drivers of the India Digital Advertising Market?

India Digital Advertising market growth is fueled by the proliferation of smartphones, increased internet penetration, and the rising consumption of digital content across OTT platforms and social media channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.