India Digital Banking Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1879

November 2024

80

About the Report

India Digital Banking Market Overview

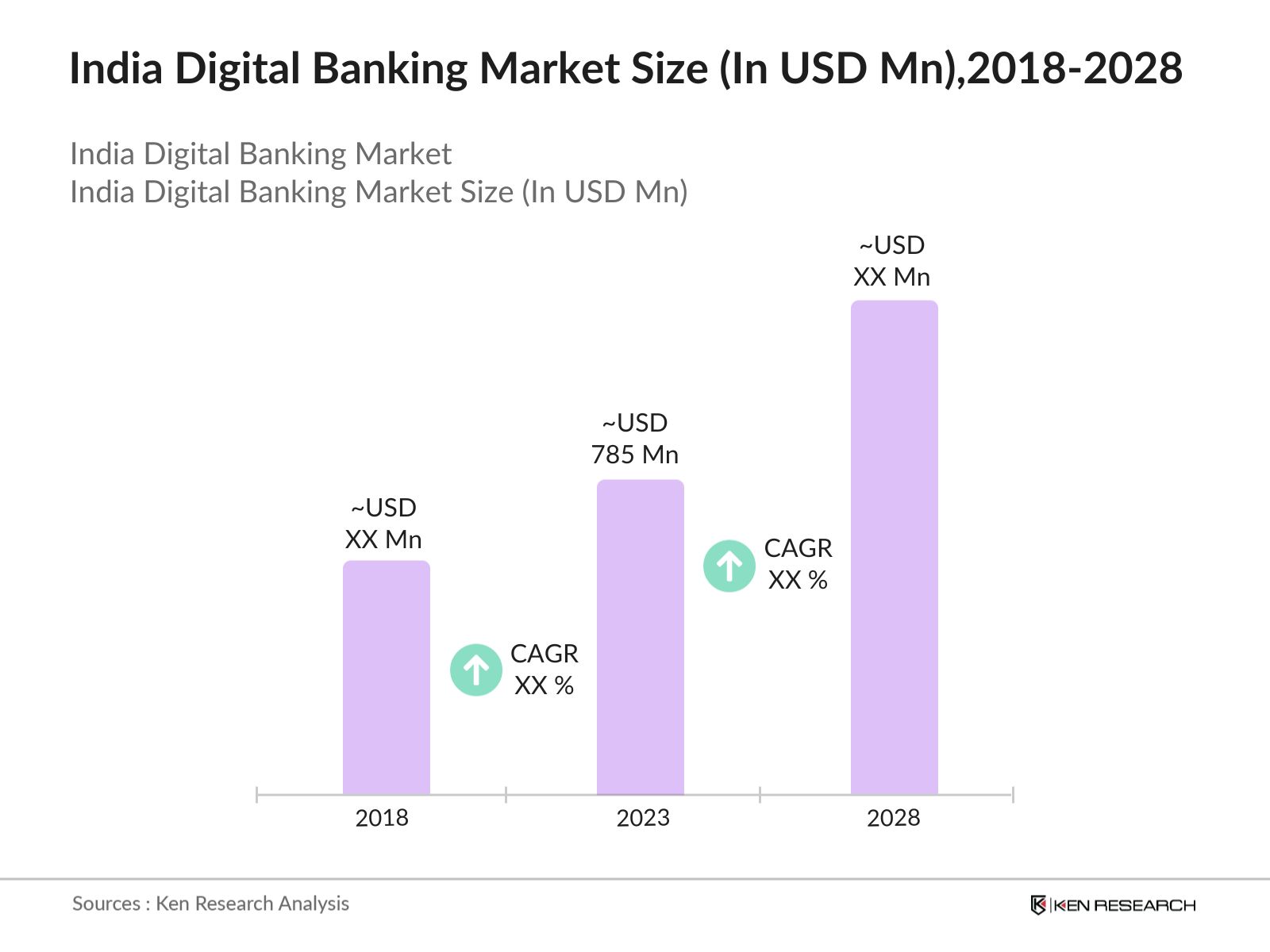

- The India Digital Banking Market was valued at USD 785 million in 2023, driven by increasing internet penetration, a surge in smartphone usage, and the government's push towards a cashless economy. The market encompasses various services, including mobile banking, internet banking, digital wallets, and payment gateways, catering to a diverse consumer base.

- Key players in the India Digital Banking Market include HDFC Bank, ICICI Bank, State Bank of India (SBI), Paytm, and PhonePe. These companies maintain strong market positions through extensive digital ecosystems, innovative financial products, and strategic collaborations with fintech firms and technology providers. They focus on enhancing customer experience through user-friendly interfaces and secure transactions to meet the growing demand for digital banking solutions.

- Major regions such as Maharashtra, Karnataka, Delhi NCR, and Tamil Nadu lead the market due to their high urbanization rates, substantial technological infrastructure, and proactive state policies promoting digital payments. These states also exhibit higher demand for digital banking services, driven by their burgeoning tech-savvy population and increasing preference for convenient banking options.

- In 2023, the bank added 908 branches, contributing to its growth strategy aimed at enhancing customer reach and deposit mobilization.Additionally, HDFC Bank plans to significantly expand its branch network, targeting over 13,000 branches within the next 3-5 years.

India Digital Banking Market Segmentation

The India Digital Banking Market is segmented by type, service channel, and region.

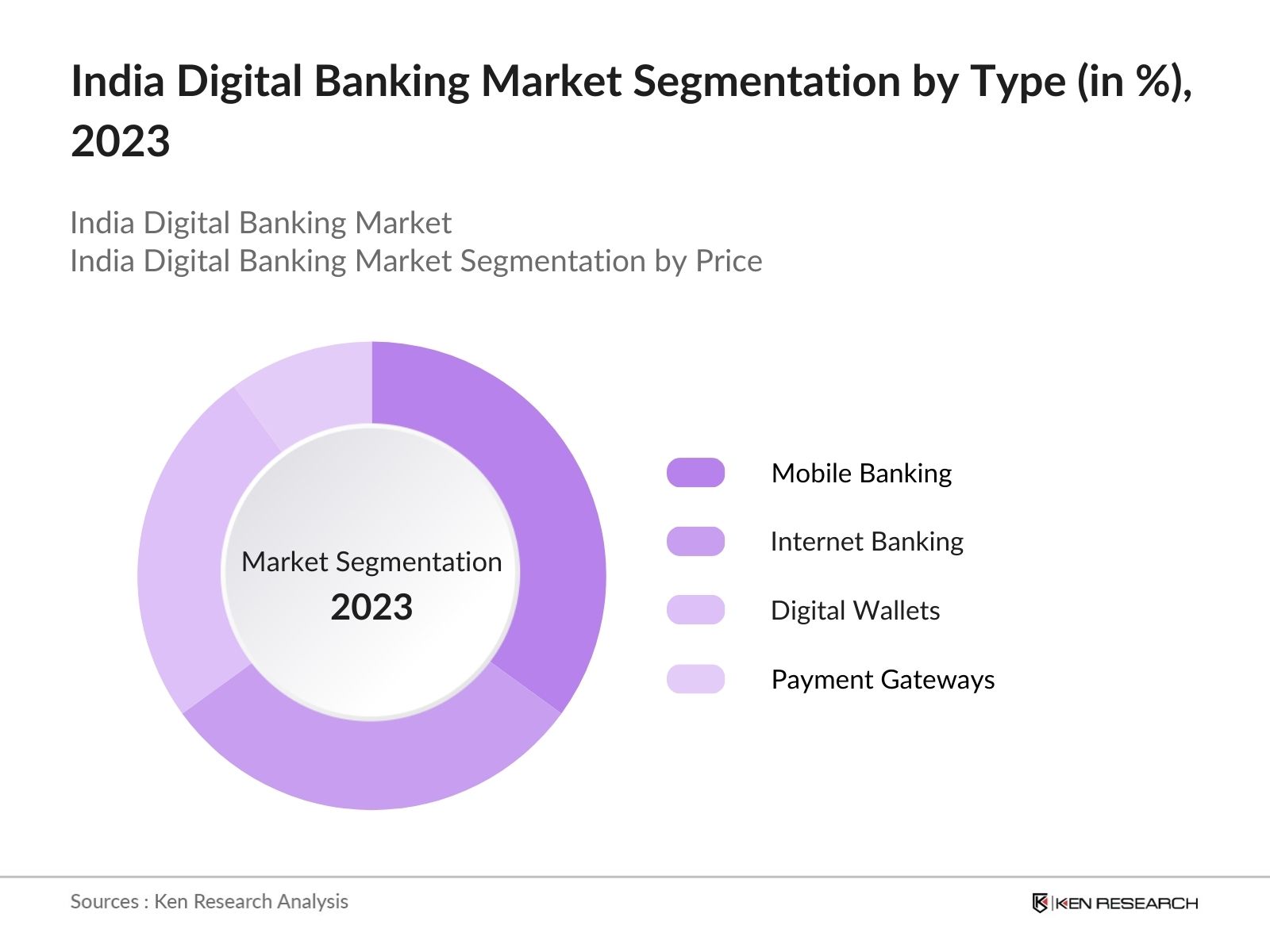

- By Type: The market is segmented into Mobile Banking, Internet Banking, Digital Wallets & Payment Gateways. In 2023, Mobile Banking held the dominant market share due to the increasing adoption of smartphones and mobile internet, along with the convenience and security provided by mobile banking applications. Companies like Paytm and PhonePe are key players in this segment, offering a range of mobile-based financial services tailored to different consumer needs.

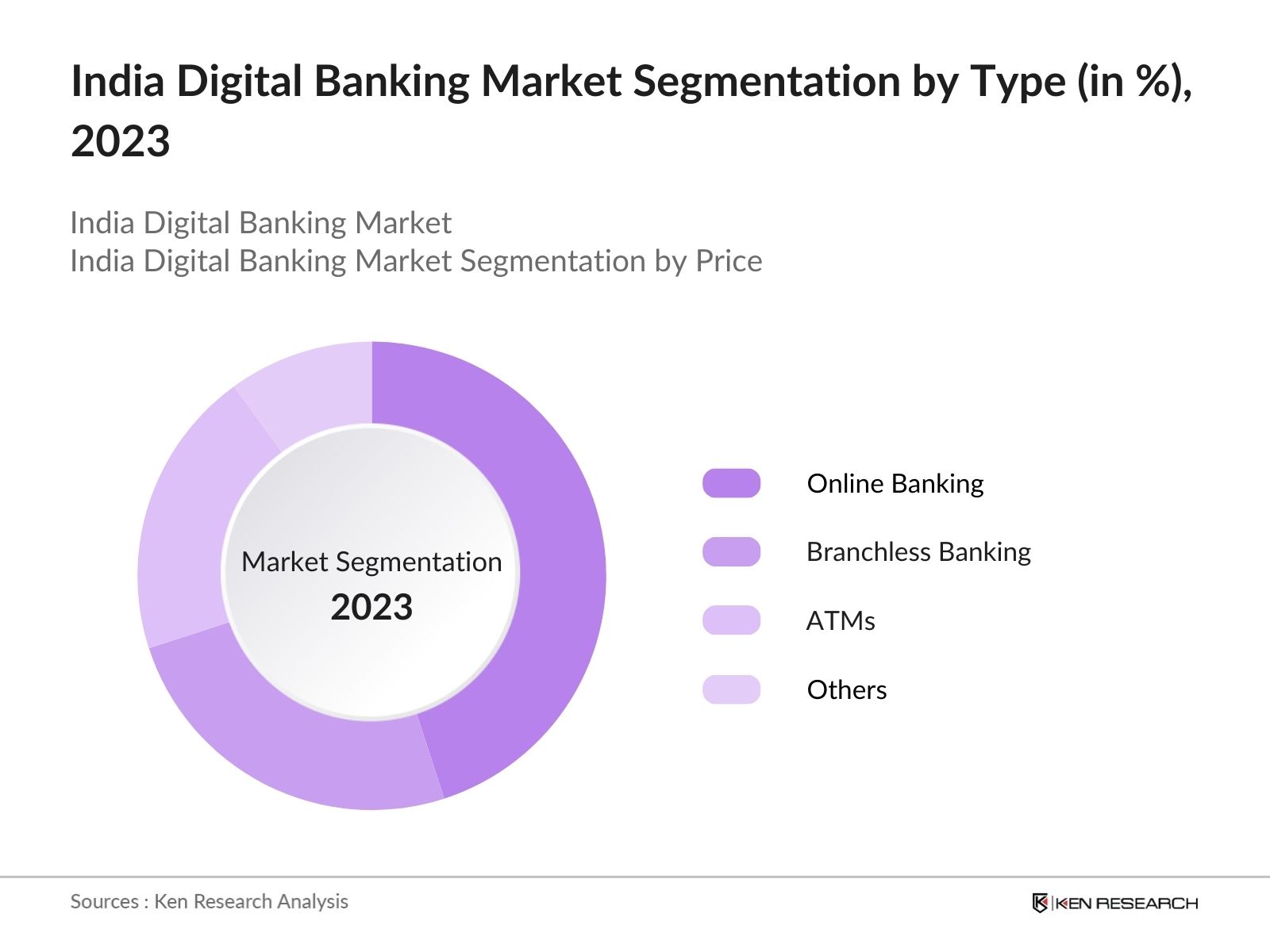

- By Service Channel: The market is categorized by service channel into Online Banking, Branchless Banking, ATMs, and Others. Online Banking led the market in 2023, owing to its accessibility, 24/7 availability, and enhanced features such as instant transfers, real-time balance updates, and integrated financial planning tools. Online Banking is favored for its comprehensive service offerings, which are crucial for maximizing customer satisfaction and retention.

- By Region: The market is segmented by region into North, South, East, and West India. West India, particularly Maharashtra and Gujarat, dominates the market in 2023 due to the strong presence of financial institutions and advanced digital infrastructure. The South region, including states like Karnataka and Tamil Nadu, holds a substantial share due to its robust technology sector and high digital literacy rates.

India Digital Banking Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

HDFC Bank |

1994 |

Mumbai, Maharashtra |

|

ICICI Bank |

1994 |

Mumbai, Maharashtra |

|

State Bank of India (SBI) |

1955 |

Mumbai, Maharashtra |

|

Paytm |

2010 |

Noida, Uttar Pradesh |

|

PhonePe |

2015 |

Bengaluru, Karnataka |

- State Bank of India: State Bank of India (SBI) launched 11 new digital banking initiatives on October 1, 2023, coinciding with its 69th Foundation Day celebrations. These initiatives include features like UPI tap and pay, YONO Business, and Corporate Internet Banking tailored for small businesses, aimed at streamlining loan applications and transactions to enhance customer experience in India's digital banking landscape.

- ICICI Bank: In 2023, ICICI Bank launched ICICI STACK for exporters to enhance its digital banking presence, this program provides a comprehensive suite of digital solutions aimed at streamlining the export lifecycle. This initiative includes features like instant export finance, Trade APIs for transaction handling, and a focus on customer pain points, ultimately improving efficiency for exporters and fostering business growth in India's digital banking market.

India Digital Banking Market Analysis

Growth Drivers

- Rising Digital Payment Adoption: Digital payment adoption in India has seen a substantial increase, with Unified Payments Interface (UPI) transactions crossed 100 billion for the first time in FY 2023-24, reaching 131 billion transactions compared to 84 billion in the previous year. This surge is driven by the convenience, speed, and security that UPI offers, coupled with widespread smartphone usage. The Reserve Bank of India reported a 20% increase in the number of merchants accepting digital payments between 2023 and 2024, which reflects a broader acceptance of digital banking platforms.

- Increased Focus on Financial Inclusion: The Indian government has been aggressively promoting financial inclusion through initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY). As of 2024, over 490 million bank accounts were opened under PMJDY, with a substantial portion utilizing digital banking services. This initiative has expanded the customer base for digital banking platforms, especially among rural and semi-urban populations, who are increasingly using digital channels for financial transactions. Moreover, the availability of digital banking services in regional languages has further accelerated adoption rates in non-metro areas, where the population is traditionally underbanked.

- Emergence of Neobanks and Fintech Innovations: Neobanks have emerged as a noteworthy force in Indias digital banking landscape, with over 15 operational neobanks catering to different customer segments by the end of 2024. These digital-only banks offer innovative solutions such as zero-fee accounts, AI-based customer service, and personalized financial products, appealing to tech-savvy millennials and small businesses. The success of these fintech innovations indicates a strong market preference for user-friendly, tech-enabled financial services.

Challenges

- Cybersecurity Threats: The India Digital Banking Industry faces important challenges related to cybersecurity. With increasing digital transactions, the risk of cyber fraud and data breaches has escalated. According to industry reports, cyber fraud cases in digital banking saw a 30% increase in 2023, highlighting the need for robust security measures and customer awareness. A lack of robust cybersecurity infrastructure, especially among smaller financial institutions, has made them more vulnerable to attacks.

- Regulatory and Compliance Challenges: The Indian digital banking sector faces substantial regulatory challenges, particularly with the introduction of stricter guidelines by the Reserve Bank of India (RBI) in 2024 concerning Know Your Customer (KYC) norms and data localization. These regulations require banks and fintech companies to invest heavily in compliance measures, driving up operational costs.

Government Initiatives

- Digital India Initiative: Launched in 2015, the Digital India initiative aims to transform India into a digitally empowered society and knowledge economy. The initiative encompasses various programs, including BharatNet, Aadhaar, and e-Governance, and has significantly contributed to increasing internet penetration and enhancing digital services across the country.

- National Digital Literacy Mission (NDLM) Expansion: The NDLM was launched in2014, and it has been expanded over the years. The NDLM aims to make at least one member of every household digitally literate, and it has undergone various iterations, including the Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA), which has a target to cover 60 million rural households. This initiative aims to bridge the digital divide, particularly in rural and semi-urban areas.

India Digital Banking Market Future Outlook

The India Digital Banking Market is expected to witness robust growth by 2028, driven by increasing investments in digital infrastructure, rising demand for convenient and secure banking solutions, and government initiatives supporting digital payments and financial inclusion.

Future Market Trends

- Growth in Blockchain and AI Integration: By 2028, a substantial portion of digital banking services is expected to incorporate blockchain technology and AI to enhance security and provide more personalized banking experiences. Banks are focusing on AI-driven analytics and blockchain-based payment solutions to cater to the growing demand for secure and efficient digital transactions.

- Expansion of Digital Financial Ecosystems: The future will see a continued expansion of digital financial ecosystems, with banks collaborating more with fintech firms to offer a wider range of financial products and services, including loans, insurance, and investment options, through digital platforms.

Scope of the Report

|

By Type |

Mobile Banking Internet Banking Digital Wallets Payment Gateways Others |

|

By Service Channel |

Online Banking Branchless Banking ATMs Others |

|

By Region |

North East South West |

Products

Key Target Audience

Digital Banking Service Providers

Financial Institutions and Banks

Fintech Companies

Technology Solution Providers

Digital Payment System Providers

E-commerce Platforms

Digital Marketing Agencies

Government and Regulatory Bodies (e.g., Reserve Bank of India, Ministry of Finance)

Investment and Venture Capitalist

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

HDFC Bank

ICICI Bank

State Bank of India (SBI)

Paytm

PhonePe

Axis Bank

Kotak Mahindra Bank

IndusInd Bank

Yes Bank

Google Pay

Amazon Pay

Airtel Payments Bank

Jio Payments Bank

Razorpay

Pine Labs

Table of Contents

1. India Digital Banking Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Valuation and Historical Performance

1.4 Key Market Trends and Developments

1.5 Market Segmentation Overview

2. India Digital Banking Market Size (in USD Bn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Digital Banking Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Internet Penetration

3.1.2 Government Push for Cashless Economy

3.1.3 Technological Advancements in Banking Solutions

3.2 Challenges

3.2.1 Cybersecurity Threats

3.2.2 Digital Divide and Limited Digital Literacy

3.3 Opportunities

3.3.1 Growth in Blockchain Integration

3.3.2 Expansion of Digital Financial Ecosystems

3.4 Trends

3.4.1 Increasing Use of AI and Machine Learning

3.4.2 Integration of Blockchain Technology

3.5 Government Initiatives

3.5.1 Digital India Initiative

3.5.2 NPCI Developments

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. India Digital Banking Market Segmentation, 2023

4.1 By Type (in Value %)

4.1.1 Mobile Banking

4.1.2 Internet Banking

4.1.3 Digital Wallets

4.1.4 Payment Gateways

4.1.5 Others

4.2 By Service Channel (in Value %)

4.2.1 Online Banking

4.2.2 Branchless Banking

4.2.3 ATMs

4.2.4 Others

4.3 By Region (in Value %)

4.3.1 North India

4.3.2 South India

4.3.3 East India

4.3.4 West India

5. India Digital Banking Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 HDFC Bank

5.1.2 ICICI Bank

5.1.3 State Bank of India (SBI)

5.1.4 Paytm

5.1.5 PhonePe

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Digital Banking Market Competitive Landscape Analysis

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

7. India Digital Banking Market Regulatory Framework

7.1 RBI Guidelines

7.2 Compliance Requirements and Certification Processes

8. India Digital Banking Market Future Outlook (in USD Bn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. India Digital Banking Future Market Segmentation, 2028

9.1 By Type (in Value %)

9.2 By Service Channel (in Value %)

9.3 By Region (in Value %)

10. India Digital Banking Market Analysts Recommendations

10.1 TAM/SAM/SOM Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2 Market Building:

Collating statistics on the India digital banking market over the years, penetration of digital channels, and service provider ratios to compute revenue generated for the digital banking sector. Reviewing service quality statistics to ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 1 Research Output:

Engaging with multiple key digital banking companies to understand the nature of product segments, user preferences, and other parameters to validate statistics derived through a bottom-up approach.

Frequently Asked Questions

1. How big is the India Digital Banking Market?

The India Digital Banking Market was valued at USD 780 million in 2023, driven by increasing internet penetration, a surge in smartphone usage, and the government's push towards a cashless economy.

2. What are the challenges in the India Digital Banking Market?

Challenges in the India Digital Banking Market include cybersecurity threats, regulatory compliance burdens, and the digital divide affecting rural and underserved areas. These factors limit the widespread adoption of digital banking services across the country.

3. Who are the major players in the India Digital Banking Market?

Key players in the India Digital Banking Market include HDFC Bank, ICICI Bank, SBI, Paytm, and PhonePe. These companies lead the market due to their robust digital ecosystems, innovative financial products, and strategic partnerships with fintech firms.

4. What are the growth drivers of the India Digital Banking Market?

The market is driven by factors such as increased adoption of digital payments, government initiatives for financial inclusion, and the emergence of neobanks and fintech innovations. Additionally, the widespread use of mobile banking apps and digital wallets contributes to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.