India Digital Forensics Market Outlook to 2030

Region:Asia

Author(s):Srijan Saxena

Product Code:KR1447

October 2024

16

About the Report

India Digital Forensics Market Overview:

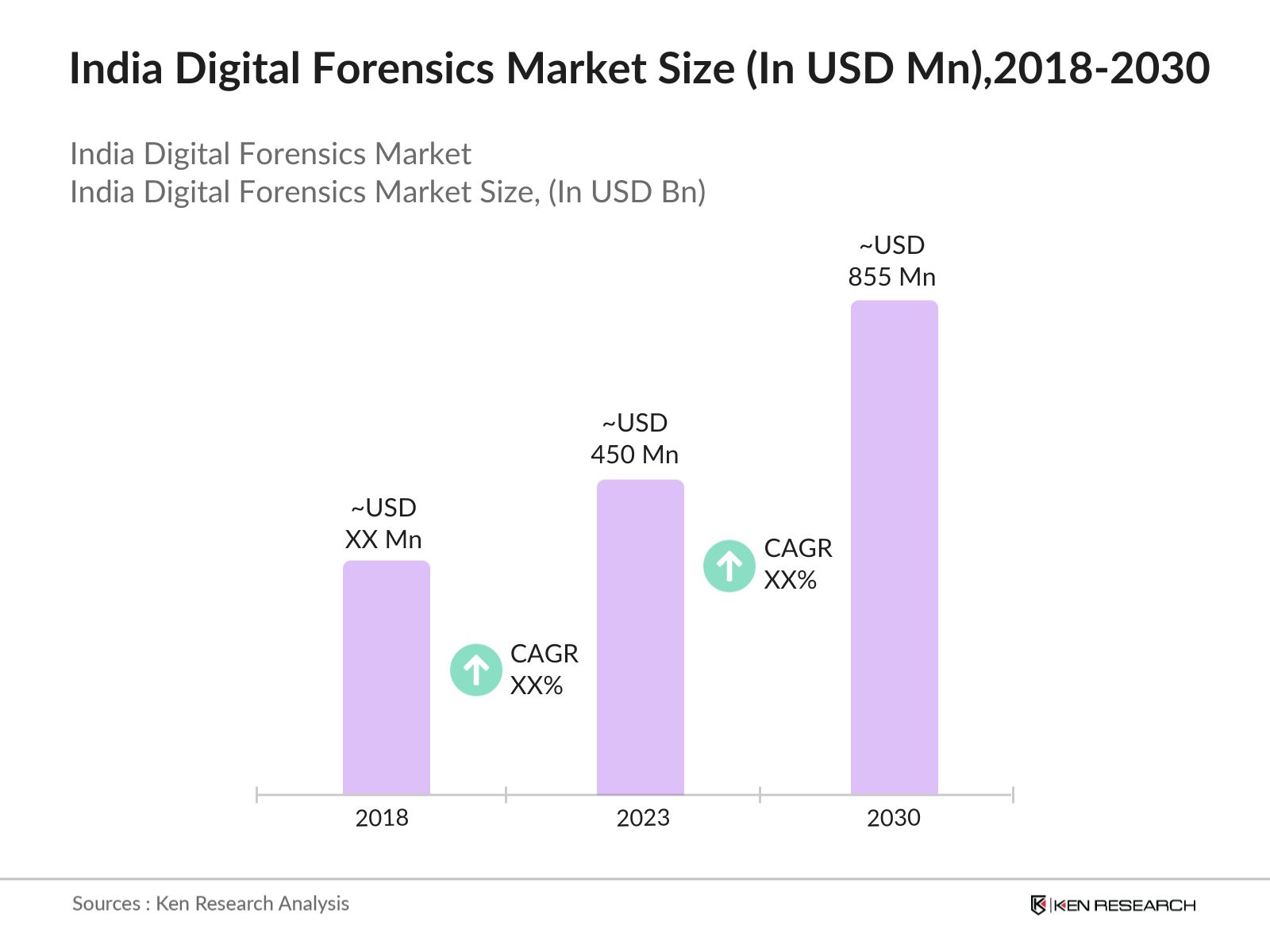

- India Digital Forensics Market is witnessing rapid growth as the market reached USD 450 million in 2023, driven by advancements like AI, Blockchain, and IoT, supported by regulatory measures & increasing highlighting the need for increased awareness and education through initiatives like PM e-Vidya.

- Prominent players in the market include KPMG, Deloitte, PwC and EY. These companies have established themselves as leaders by offering comprehensive digital forensic solutions tailored to various industries. They continue to innovate by integrating AI and machine learning into their forensic tools, enhancing their detection and analysis capabilities.

- In 2021, the Indian government announced the launch of the National Cyber Forensic Lab (NCFL) under the Ministry of Home Affairs, with an initial investment of INR 35.51 crores. The NCFL aims to enhance the country's digital forensic capabilities by providing advanced tools and training to law enforcement agencies.

- Major cities like Bangalore, Hyderabad, and Mumbai dominate the India Digital Forensics Market. These cities offer a conducive environment for the growth of digital forensics due to the concentration of IT infrastructure and skilled professionals.

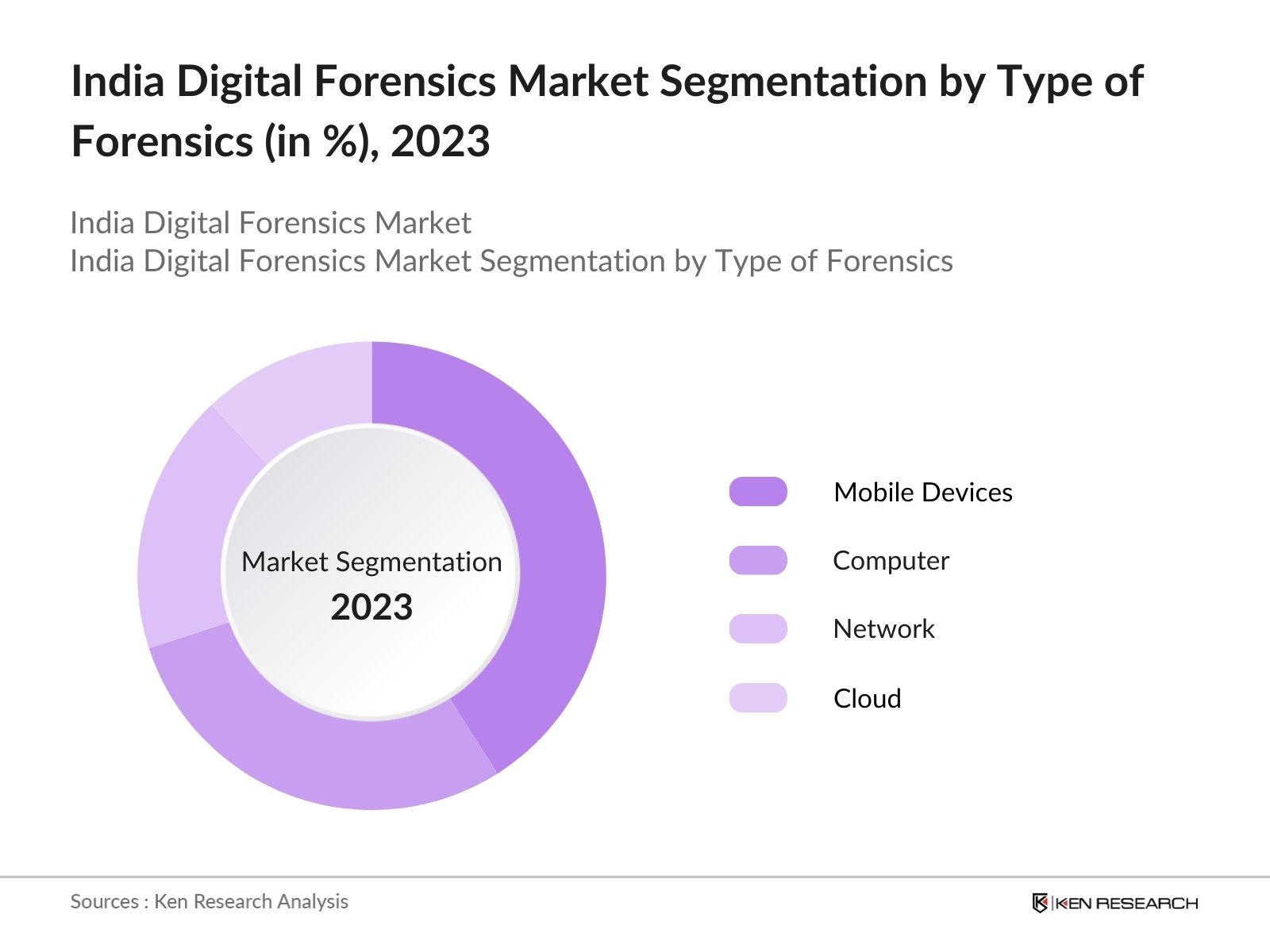

India Digital Forensics Market Segmentation

By Type of Forensics: India Digital Forensics Market is segmented into Cloud, Network, Computer & Mobile Devices. In 2023, mobile devices emerged as the dominant force driven by the increasing prevalence of smartphones and the growing complexity of mobile-based cybercrimes. The rising adoption of mobile payment systems and apps has further accelerated the demand for advanced digital forensics solutions tailored for mobile platforms.

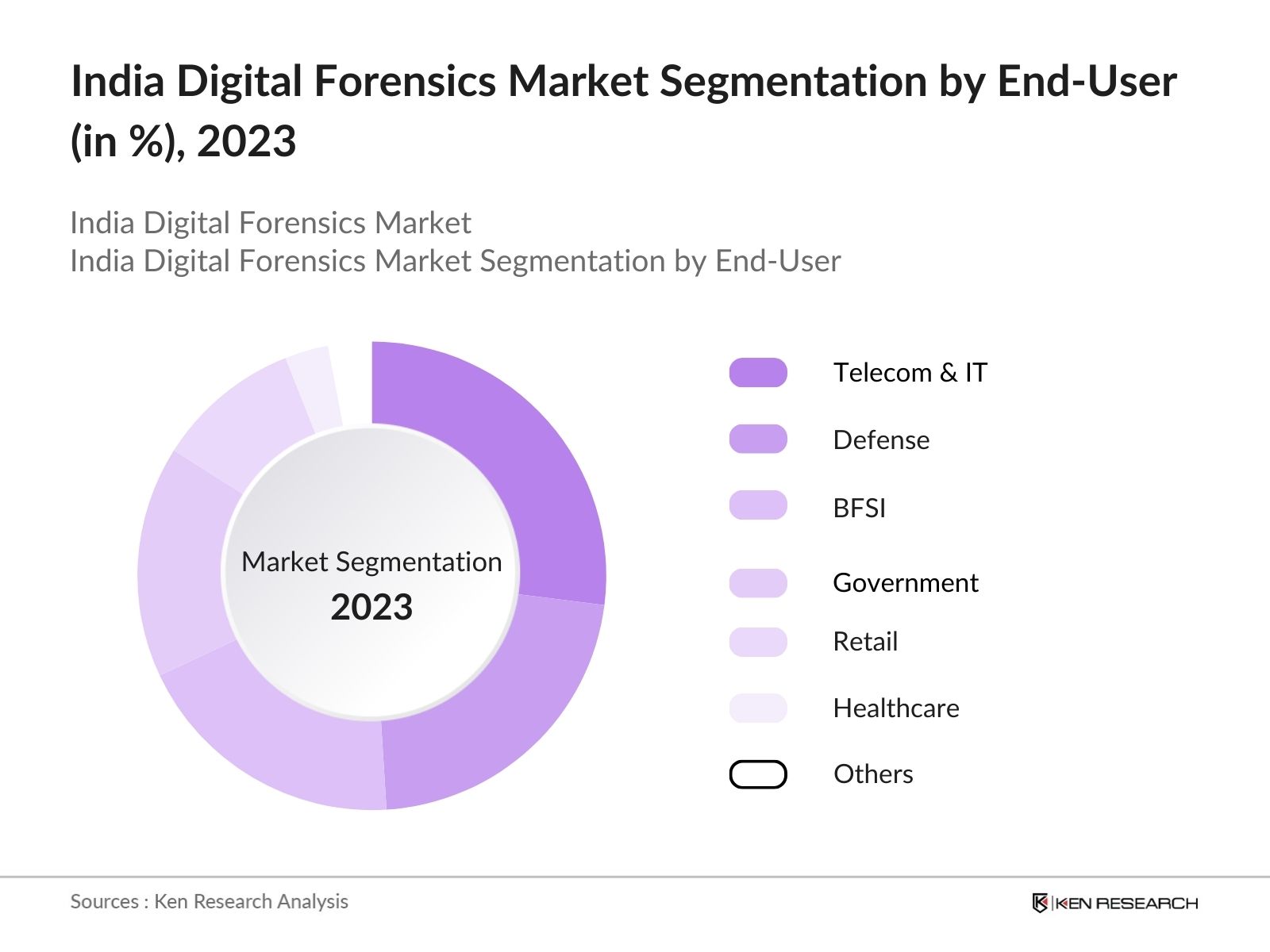

By End-User: India digital forensics market is segmented into Telecom & IT, defense, BFSI, government, retail & healthcare. In 2023, Telecom & IT emerged as the dominant segment fueled by the surge in data breaches and the need for robust cybersecurity measures within the sector. The increasing reliance on digital communication and cloud services in Telecom & IT has further driven the demand for advanced digital forensics solutions.

By Region: India Digital Forensics Market is segmented into North, South, East & West. In 2023, Southern region emerged as the dominant segment propelled by the region's strong IT infrastructure and the concentration of tech hubs in cities like Bengaluru, Hyderabad, and Chennai. The growing presence of cybersecurity firms and research institutions in the South has also contributed to the increased adoption of digital forensics solutions.

India Digital Forensics Industry Analysis

India Digital Forensics Market Growth Drivers

- Increase in Cyber Crimes: The cybercrime rate in India surged to 129 incidents per lakh population in 2023, reflecting a significant rise in hacking, data breaches, online fraud, and cyber-attacks. As digital dependence increases, there is a growing necessity for advanced forensic solutions to combat these threats effectively and protect sensitive information from cybercriminal activities.

- Increasing Number of Digital Users: In 2023, India has over 760 million smartphone users and more than 820 million active internet users. The proliferation of digital devices creates a significant demand for advanced mobile forensics solutions to manage the extensive volume of potential digital evidence.

- High Awareness Quotient: Growing awareness of cybersecurity and digital forensics among organizations, government agencies, and the public is cultivating a proactive cyber defense culture. This increasing focus on security highlights the urgent demand for forensic expertise in India. Over the next nine years, the country will need 90,000 forensic scientists to meet the rising need for specialized forensic capabilities in the market.

India Digital Forensics Market Challenges

- Shortage of Skilled Forensic Professionals: The demand for digital forensic experts in India exceeded the supply. This shortage has made it difficult for organizations to effectively implement and utilize digital forensic solutions, thereby hindering market growth. The lack of adequate training and education programs in digital forensics further exacerbates this challenge, limiting the market's potential.

- High Cost of Forensic Tools and Solutions: The high cost of digital forensic tools and solutions poses a significant challenge to the market's growth. Advanced forensic tools, which are essential for conducting thorough investigations, often require substantial financial investment. This cost barrier is particularly challenging for small and medium enterprises (SMEs) and government agencies with limited budgets, leading to slower adoption of forensic technologies.

India Digital Forensics Market Government Initiatives

- Cyber Surakshit Bharat Initiative: The Cyber Surakshit Bharat initiative, launched by MeitY in 2018 in collaboration with various industry stakeholders, focuses on strengthening cybersecurity across government and private sectors. Till December 2023, the 44th training program was conducted, with participants from various state governments. This initiative has played a crucial role in raising awareness about the importance of digital forensics, leading to increased adoption of forensic solutions in government agencies.

- Digital Personal Data Protection Act (2023): The Digital Personal Data Protection Act, introduced in 2023, mandates stringent data protection measures for organizations operating in India. The Act requires companies to implement robust digital forensic mechanisms to investigate and report data breaches. This legislation has spurred demand for forensic tools and services as organizations strive to comply with the new regulations.

India Digital Forensics Market Competitive Landscape

|

Particulars |

KPMG |

Deloitte |

PwC |

EY |

|

Year of Incorporation |

1987 |

1845 |

1998 |

1989 |

|

Headquarters |

New York, USA |

New York, USA |

London, UK |

London, UK |

|

Leadership |

Mr. Jagvinder Brar, Partner, Forensic Services |

Mr. Nikhil Bedi, Deloitte Forensics |

Mr. Puneet Garkhel, Partner, Forensics |

Mr. Arpinder Singh, EY Leader, Forensics |

- Quick Microsoft & OpenAI: In 2023, Microsoft invests $10 billion in OpenAI, the creator of ChatGPT, reinforcing their collaboration. The $10 billion investment is structured to provide Microsoft a substantial return on investment. Initially, Microsoft will receive 75% of OpenAI's profits until it recoups its investment, after which it will hold a 49% stake in the company.

- Deloitte Touche Tohmatsu India: In 2022, The Securities and Exchange Board of India (Sebi) has empaneled eight entities, including Deloitte Touche Tohmatsu India LLP, to provide digital forensic services. This move aims to enhance the regulatory body's capabilities in conducting forensic investigations in the capital markets.

India Digital Forensics Future Market Outlook

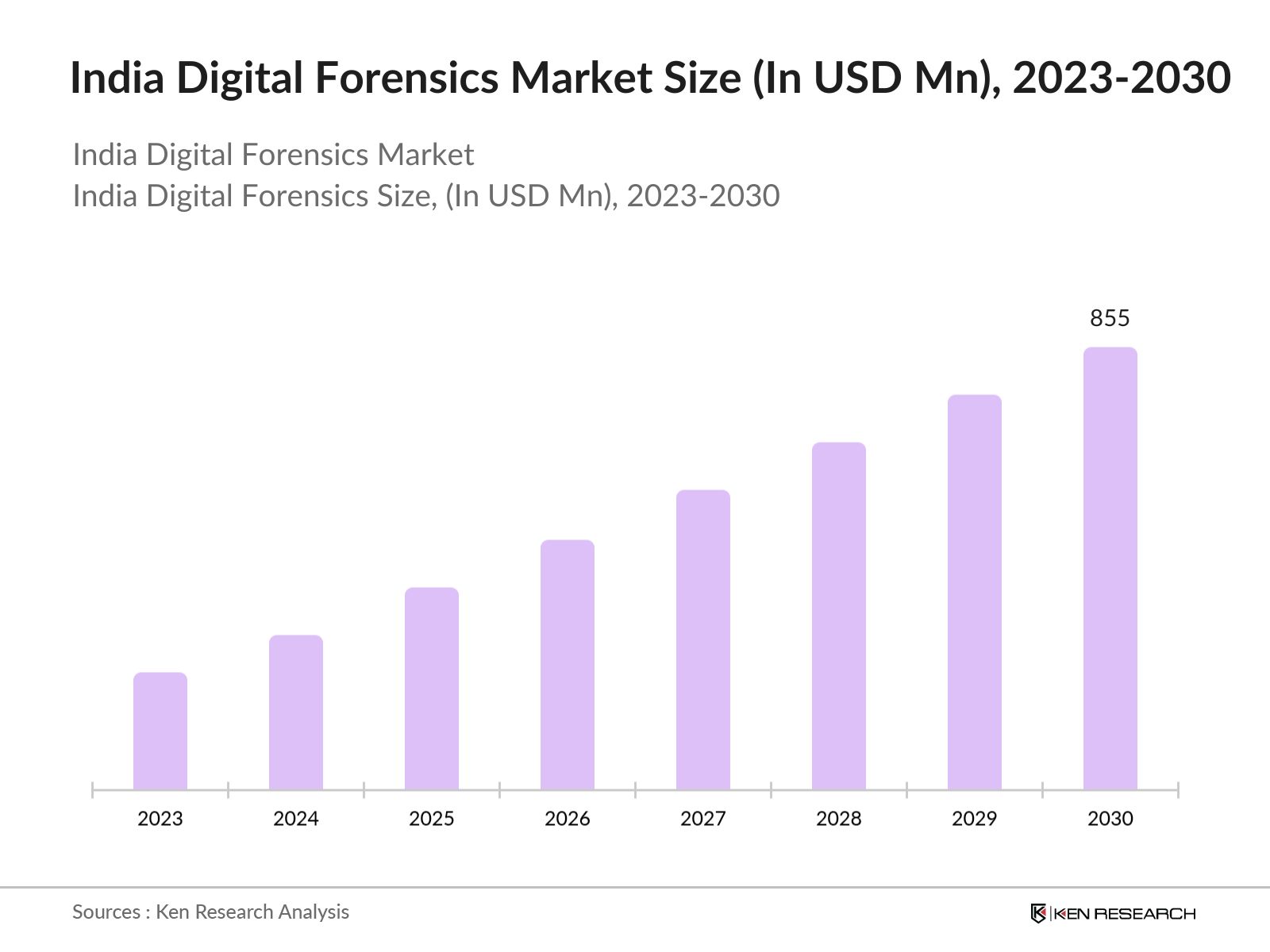

India Digital Forensics Market is expected to reach USD 855 Mn by 2030, driven by increasing cybersecurity threats and government initiatives aimed at strengthening the countrys digital infrastructure.

Future Market Trends:

- Adoption of AI and Machine Learning in Forensics: Over the next five years, the integration of AI and machine learning in digital forensics will become more prevalent. These technologies will enable faster and more accurate analysis of large datasets, helping organizations to detect and respond to cyber incidents more efficiently.

- Expansion of Forensic Capabilities in SMEs: As cyber threats continue to target small and medium enterprises (SMEs), there will be a growing need for affordable and accessible forensic solutions. Over the coming years, more vendors will develop cost-effective forensic tools tailored to the needs of SMEs. This trend will be supported by government initiatives aimed at boosting cybersecurity among smaller businesses.

Scope of the Report

|

By End-Users |

Telecom & IT Defense BFSI Government Retail Healthcare |

|

By Type of Forensics |

Cloud Network Computer Mobile Devices |

|

By Components |

Hardware Software Services |

|

By Region |

North South East West |

Products

Key Target Audience

IT and Telecommunication Companies

Defense Companies

Cybersecurity Companies

Digital Forensics Service Providers

Forensic Software Developers

Digital Forensics Service Providers

Banking and Financial Institutions

Government and Regulatory Bodies (Ministry of Home Affairs, CERT-In)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2030

Companies

Major Players Mentioned in the Report

TCG Digital

SysTools Software Pvt. Ltd.

KPMG India

Deloitte Touche Tohmatsu India LLP

Quick Heal Technologies Ltd.

Lucideus Tech Pvt. Ltd.

Paladion Networks Pvt. Ltd.

Cyber Forensics LLC

Paraben Corporation

Magent Forensics

Reboot Digital Pvt. Ltd.

Data Resolve Technologies Pvt. Ltd.

Netrika Consulting India Pvt. Ltd.

Prime Forensics

Trojan Horse Security

Table of Contents

1. Executive Summary

2. Market Sizing (2018-2030)

3. Market Segmentation (2023)

3.1 Segmentation by Components

3.2 Segmentation by Type of Forensics

3.3 Segmentation by End Users

3.4 Segmentation by Region

4. Industry Analysis

4.1 Growth Drivers for India Digital Forensics

4.2 Challenges for India Digital Forensics

4.3 Trends Disrupting Digital Forensics Market

5. Competition Outlook

5.1 Ecosystem for Digital Forensics Companies in India

5.2 Cross-Comparison of Major Companies in India (KPMG, Deloitte, PwC, and EY)

6. Future Outlook

6.1 Future Trends and Outlook for India Digital Forensics

Disclaimer

Contact Us

Research Methodology

1. Secondary Research and Data Collection

Extensive secondary research was conducted to identify key players in the Indian Digital Forensics market. This involved gathering industry information from multiple sources, including industry articles, company websites, blogs, industry reports, and proprietary databases. The goal was to compile a comprehensive list of companies with a presence in this market.

2. Primary Research via CATIs

To validate the secondary research findings, Computer-Assisted Telephonic Interviews (CATIs) were conducted with professionals from leading companies in the digital forensics domain, such as KPMG, Deloitte, EY, and eSec Forte Technologies. These interviews provided firsthand insights into market dynamics, competitive landscapes, and key industry trends.

3. Market Sizing Using Bottom-to-Top & Top-to-Bottom Approaches

A dual approach was used to estimate the overall market size for digital forensics in India. The Bottom-to-Top approach involved aggregating data from individual market segments to arrive at the total market size, while the Top-to-Bottom approach involved validating these estimates by breaking down global market figures and applying them to the Indian context.

4. Segmentation Proxy Through Expert Interviews

Market segmentation was further refined through interviews with industry experts. These experts provided insights on how the market is divided across different segments, which was then cross-referenced with global estimates to ensure accuracy.

5. Sanity Checks and Validation

To ensure the robustness of the findings, the market estimates and segmentation were subjected to sanity checks by industry veterans, professionals, and various proxy models. This step was crucial to validate the accuracy and reliability of the market analysis.

Frequently Asked Questions

01 How big is India Digital Forensics Market?

India digital forensics market is witnessing rapid growth as the market reached USD 450 million in 2023, driven by advancements like AI, Blockchain, and IoT, supported by regulatory measures.

02 What are the Key Factors Driving India Digital Forensics Market?

India digital forensics market is driven by increasing cybersecurity threats, digital users & high awareness quotient. Growing awareness of cybersecurity and digital forensics among organizations, government agencies, and the public is cultivating a proactive cyber defense culture.

03 Who are the Major Players in India Digital Forensics Market?

Prominent players in the India digital forensics market include KPMG, Deloitte, PwC and EY. These companies have established themselves as leaders by offering comprehensive digital forensic solutions tailored to various industries.

04 What is the Future of India Digital Forensics Market?

India digital forensics market is expected to reach USD 855 Mn by 2030, driven by increasing cybersecurity threats and government initiatives aimed at strengthening the countrys digital infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.