India Digital Mapping Market Outlook to 2030

Region:Asia

Author(s):Rajat Galav

Product Code:KROD1246

May 2025

90

About the Report

India Digital Mapping Market Overview

- The India Digital Mapping Market was valued at USD 1025 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for location-based services, advancements in technology, and the rising adoption of digital mapping solutions across various sectors, including transportation, logistics, and urban planning. The integration of Geographic Information Systems (GIS) and the proliferation of smartphones have further fueled this market's expansion.

- Key cities such as Bengaluru, Delhi, and Mumbai dominate the market due to their status as technology hubs and centers for innovation. These cities are home to numerous startups and established companies that leverage digital mapping for various applications, including smart city initiatives and e-commerce logistics. The concentration of tech talent and investment in infrastructure in these urban areas significantly contributes to their market dominance.

- In 2023, the Indian government implemented the National Geospatial Policy, which aims to promote the use of geospatial data and technologies across sectors. This policy encourages the development of a robust digital mapping ecosystem by facilitating data sharing, enhancing data quality, and fostering innovation in geospatial technologies. The initiative is expected to streamline urban planning and improve service delivery in various sectors.

India Digital Mapping Market Segmentation

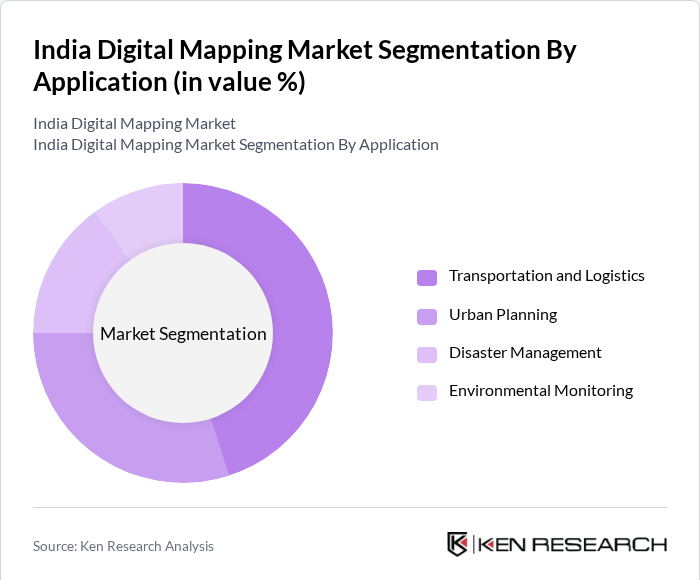

By Application: The digital mapping market can be segmented into various applications, including transportation and logistics, urban planning, disaster management, and environmental monitoring. Among these, the transportation and logistics segment is dominating the market due to the increasing reliance on digital navigation systems and location-based services. The rise of e-commerce and the need for efficient supply chain management have led to a surge in demand for accurate mapping solutions. Companies are increasingly adopting digital mapping technologies to optimize routes, reduce delivery times, and enhance customer satisfaction.

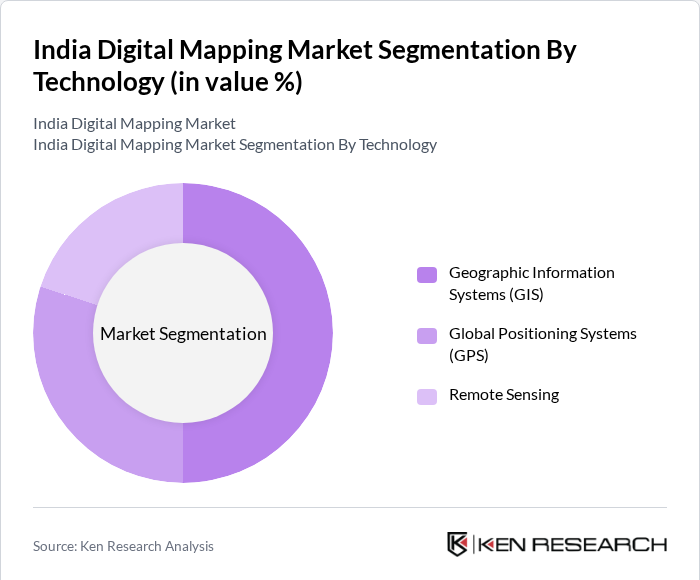

By Technology: The market can also be segmented based on technology, including Geographic Information Systems (GIS), Global Positioning Systems (GPS), and Remote Sensing. The GIS segment is currently leading the market due to its comprehensive capabilities in data analysis, visualization, and management. Organizations across various sectors are increasingly utilizing GIS for spatial analysis and decision-making processes. The growing emphasis on data-driven strategies and the need for effective resource management are propelling the adoption of GIS technologies in digital mapping.

India Digital Mapping Market Competitive Landscape

The India Digital Mapping Market is characterized by a competitive landscape featuring both established players and emerging startups. Major companies are focusing on technological advancements and strategic partnerships to enhance their service offerings and maintain a competitive edge. The presence of local firms alongside global giants fosters innovation and drives market growth.

India Digital Mapping Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration and Internet Accessibility: As of 2024, India has around 700 million smartphone users, with smartphone shipments reaching approximately 151 million units during the year. This widespread smartphone adoption is driving increased demand for digital mapping services, as users rely more on location-based applications for navigation, travel, and logistics. Internet penetration in India stood at about 52% in early 2024, supporting the growth of digital services. The expanding mobile user base and improving internet access are propelling the digital mapping market, as businesses and consumers seek efficient navigation and location solutions amid growing digital engagement.

- Government Initiatives for Smart City Development: The Indian government has committed substantial funding to the Smart Cities Mission, targeting the development of 100 smart cities across the country by 2025. This ambitious initiative underscores the critical role of advanced digital mapping solutions in enabling effective urban planning, infrastructure development, and optimized resource management. By integrating digital mapping technologies, smart city projects can leverage real-time data collection and analysis, which are vital for informed decision-making and efficient city operations. This growing reliance on digital mapping is a key driver of market expansion in this sector.

- Rising Demand for Location-Based Services Across Industries: The location-based services sector in India is rapidly expanding, supported by companies like MapmyIndia, which leads with over 30 million app users and holds around 80% market share in automobile navigation systems. MapmyIndia’s revenue grew 29% year-on-year in FY25, driven by a shift from hardware sales to cloud-based SaaS offerings, enhancing recurring income and customer retention. The company’s solutions serve diverse sectors including e-commerce, logistics, banking, and government projects, reflecting broad adoption of digital mapping technologies. This widespread use of real-time, accurate mapping data is enabling businesses to optimize delivery routes, improve customer experiences, and make data-driven decisions.

Market Challenges

- Data Privacy and Security Concerns: With the increasing reliance on digital mapping solutions, data privacy and security have become significant challenges. The Indian government is expected to implement stricter data protection regulations in 2024, which may impose additional compliance costs on mapping service providers. The potential for data breaches and misuse of personal information can deter users from adopting digital mapping services, thereby hindering market growth.

- High Costs Associated with Advanced Mapping Technologies: The initial investment required for advanced mapping technologies, such as Geographic Information Systems (GIS) and remote sensing, can be substantial. As of 2024, the average cost of implementing a comprehensive GIS solution is estimated to be around USD 100,000 for small to medium enterprises. This financial barrier can limit the adoption of digital mapping solutions, particularly among smaller businesses and startups, posing a challenge to market expansion.

India Digital Mapping Market Future Outlook

In the coming years, the digital mapping market in India is expected to witness significant advancements driven by technological innovations, increased government support for urban development, and the growing demand for location-based services. As industries continue to embrace digital transformation, the integration of AI and machine learning in mapping solutions will further enhance accuracy and efficiency, positioning the market for robust growth.

Market Opportunities

- Expansion of E-Commerce and Logistics Sectors: India’s expanding e-commerce sector is boosting demand for digital mapping solutions to optimize last-mile delivery. Companies use advanced mapping technologies for efficient route planning, reducing delivery times, and enhancing customer satisfaction. Integration of real-time data and AI-driven tools enables dynamic route adjustments, driving improved logistics performance and fueling growth in digital mapping adoption across the industry.

- Integration of AI and Machine Learning in Mapping Solutions: The adoption of AI and machine learning technologies in digital mapping is expected to revolutionize the industry by providing real-time data analysis and predictive insights. As businesses increasingly seek to enhance operational efficiency and decision-making processes, the integration of these technologies will create new opportunities for mapping service providers to offer innovative solutions tailored to specific industry needs.

Scope of the Report

| By Application | Transportation and Logistics Urban Planning Disaster Management Environmental Monitoring |

| By Technology | Geographic Information Systems (GIS) Global Positioning Systems (GPS) Remote Sensing |

| By End-User | Government Commercial Residential Industrial |

| By Region | North India South India East India West India |

| By Deployment Type | Cloud-based On-premises |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Electronics and Information Technology, Survey of India)

Geospatial Technology Companies

Telecommunications Service Providers

Urban Planning and Development Authorities

Logistics and Transportation Companies

Real Estate Developers and Property Management Firms

Environmental and Conservation Organizations

Companies

Players Mentioned in the Report:

MapmyIndia

Google Maps

HERE Technologies

Esri India

OpenStreetMap

GeoSmart India

Mapbox India

CartoDB India

Navteq Solutions

Spatial India Solutions

Table of Contents

1. India Digital Mapping Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Digital Mapping Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Digital Mapping Market Market Analysis

3.1. Growth Drivers

3.1.1. Increasing smartphone penetration and internet accessibility

3.1.2. Government initiatives for smart city development

3.1.3. Rising demand for location-based services across industries

3.2. Market Challenges

3.2.1. Data privacy and security concerns

3.2.2. High costs associated with advanced mapping technologies

3.2.3. Limited infrastructure in rural areas affecting data accuracy

3.3. Opportunities

3.3.1. Expansion of e-commerce and logistics sectors

3.3.2. Integration of AI and machine learning in mapping solutions

3.3.3. Growing interest in sustainable urban planning initiatives

3.4. Trends

3.4.1. Adoption of real-time mapping solutions

3.4.2. Increasing use of augmented reality in navigation

3.4.3. Shift towards open-source mapping platforms

3.5. Government Regulation

3.5.1. Policies governing data collection and usage

3.5.2. Compliance with national mapping standards

3.5.3. Regulations on cross-border data flow

3.5.4. Initiatives promoting local mapping solutions and technologies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Digital Mapping Market Segmentation

4.1. By Application

4.1.1. Transportation and Logistics

4.1.2. Urban Planning

4.1.3. Disaster Management

4.1.4. Environmental Monitoring

4.2. By Technology

4.2.1. Geographic Information Systems (GIS)

4.2.2. Global Positioning Systems (GPS)

4.2.3. Remote Sensing

4.3. By End-User

4.3.1. Government

4.3.2. Commercial

4.3.3. Residential

4.3.4. Industrial

4.4. By Region

4.4.1. North India

4.4.2. South India

4.4.3. East India

4.4.4. West India

4.5. By Deployment Type

4.5.1. Cloud-based

4.5.2. On-premises

5. India Digital Mapping Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. MapmyIndia

5.1.2. Google Maps

5.1.3. HERE Technologies

5.1.4. Esri India

5.1.5. OpenStreetMap

5.1.6. GeoSmart India

5.1.7. Mapbox India

5.1.8. CartoDB India

5.1.9. Navteq Solutions

5.1.10. Spatial India Solutions

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Product Offerings

5.2.4. Geographic Presence

5.2.5. Customer Base

5.2.6. Technological Advancements

5.2.7. Strategic Partnerships

5.2.8. Customer Satisfaction Ratings

6. India Digital Mapping Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Digital Mapping Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Digital Mapping Market Future Market Segmentation

8.1. By Application

8.1.1. Transportation and Logistics

8.1.2. Urban Planning

8.1.3. Disaster Management

8.1.4. Environmental Monitoring

8.2. By Technology

8.2.1. Geographic Information Systems (GIS)

8.2.2. Global Positioning Systems (GPS)

8.2.3. Remote Sensing

8.3. By End-User

8.3.1. Government

8.3.2. Commercial

8.3.3. Residential

8.3.4. Industrial

8.4. By Region

8.4.1. North India

8.4.2. South India

8.4.3. East India

8.4.4. West India

8.5. By Deployment Type

8.5.1. Cloud-based

8.5.2. On-premises

9. India Digital Mapping Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Digital Mapping Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Digital Mapping Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Digital Mapping Market.

Frequently Asked Questions

01. How big is the India Digital Mapping Market?

The India Digital Mapping Market is valued at USD 1025 million, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Digital Mapping Market?

Key challenges in the India Digital Mapping Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Digital Mapping Market?

Major players in the India Digital Mapping Market include MapmyIndia, Google Maps, HERE Technologies, Esri India, OpenStreetMap, among others.

04. What are the growth drivers for the India Digital Mapping Market?

The primary growth drivers for the India Digital Mapping Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.