India Digital Therapeutics Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD2319

December 2024

93

About the Report

India Digital Therapeutics Market Overview

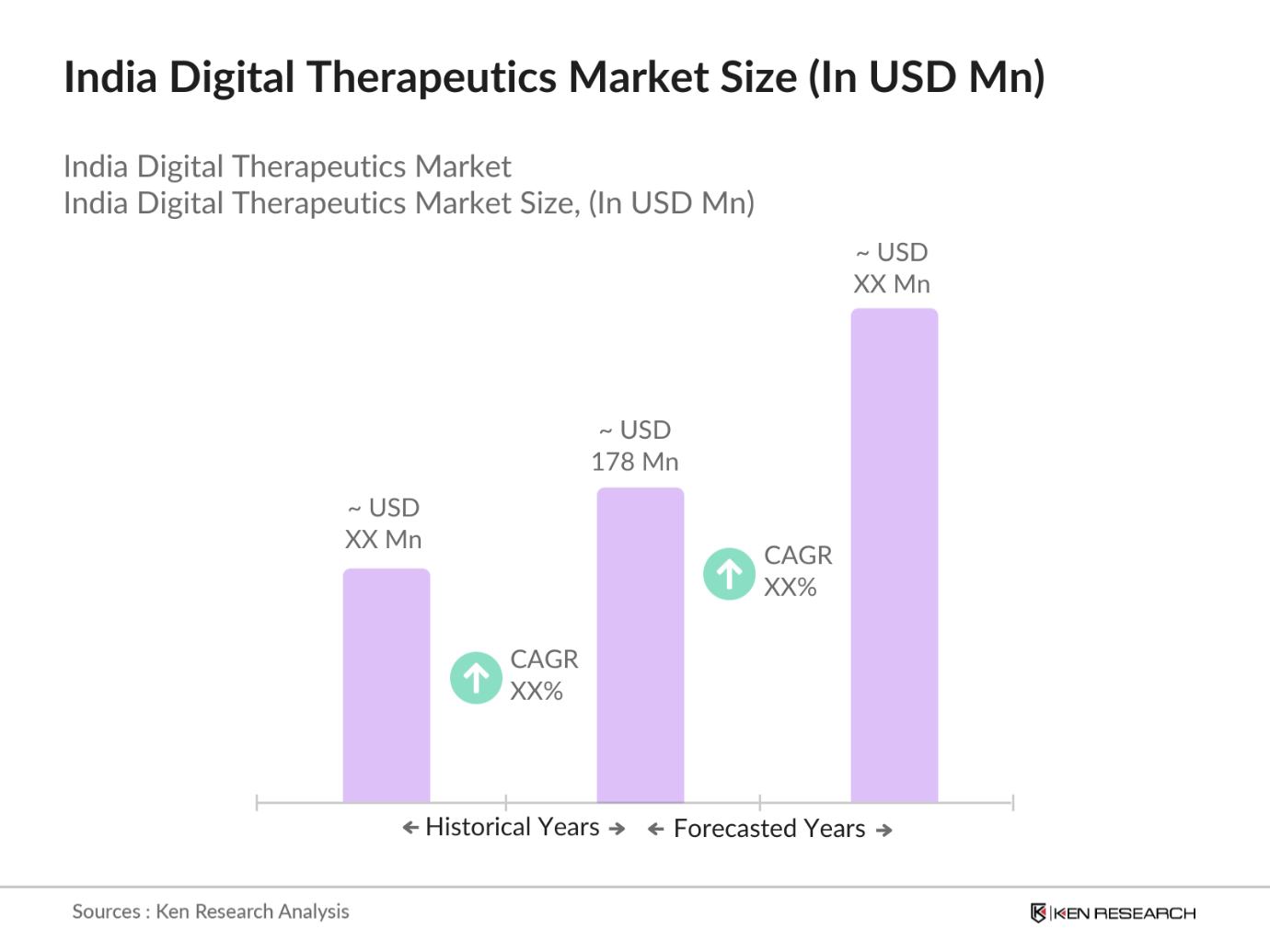

- In 2023, the India digital therapeutics (DTx) market was valued at USD 178 million. The market's growth is driven by the rising prevalence of chronic diseases like diabetes, cardiovascular issues, and respiratory disorders, which require ongoing digital management solutions. The increasing adoption of smartphones and enhanced internet penetration, particularly in rural regions, is also pushing the market forward. India's significant healthcare burden, combined with technological innovations, provides the market with an opportunity for sustainable growth.

- Several key players are driving the India DTx market. Prominent companies include Wellthy Therapeutics, BeatO, and Fitterfly, which offer digital platforms addressing diabetes and hypertension management. International companies like Livongo (now part of Teladoc) and Omada Health are also expanding their reach in India. These players are collaborating with healthcare providers and leveraging AI-based platforms to offer personalized health solutions, contributing to the markets expansion.

- The India DTx market is dominated by metropolitan areas such as Mumbai, Delhi, and Bengaluru. These cities are hubs for digital health startups, healthcare institutions, and advanced technological infrastructure. Additionally, high awareness levels, better healthcare access, and a higher rate of smartphone usage contribute to the dominance of these cities. Mumbai, for example, houses multiple leading digital therapeutics companies, ensuring the citys continued dominance in this sector through its robust digital health ecosystem.

- In 2023, the Indian government launched the Digital Health Mission under the Ayushman Bharat scheme, focusing on promoting digital healthcare solutions, including DTx, across the country. This initiative aims to create a National Digital Health Ecosystem by 2024, offering integrated and accessible healthcare data to millions. The government's support for digitizing healthcare, combined with policy reforms, is catalyzing the adoption of digital therapeutics platforms, which are viewed as a crucial element in the future of healthcare in India.

India Digital Therapeutics Market Segmentation

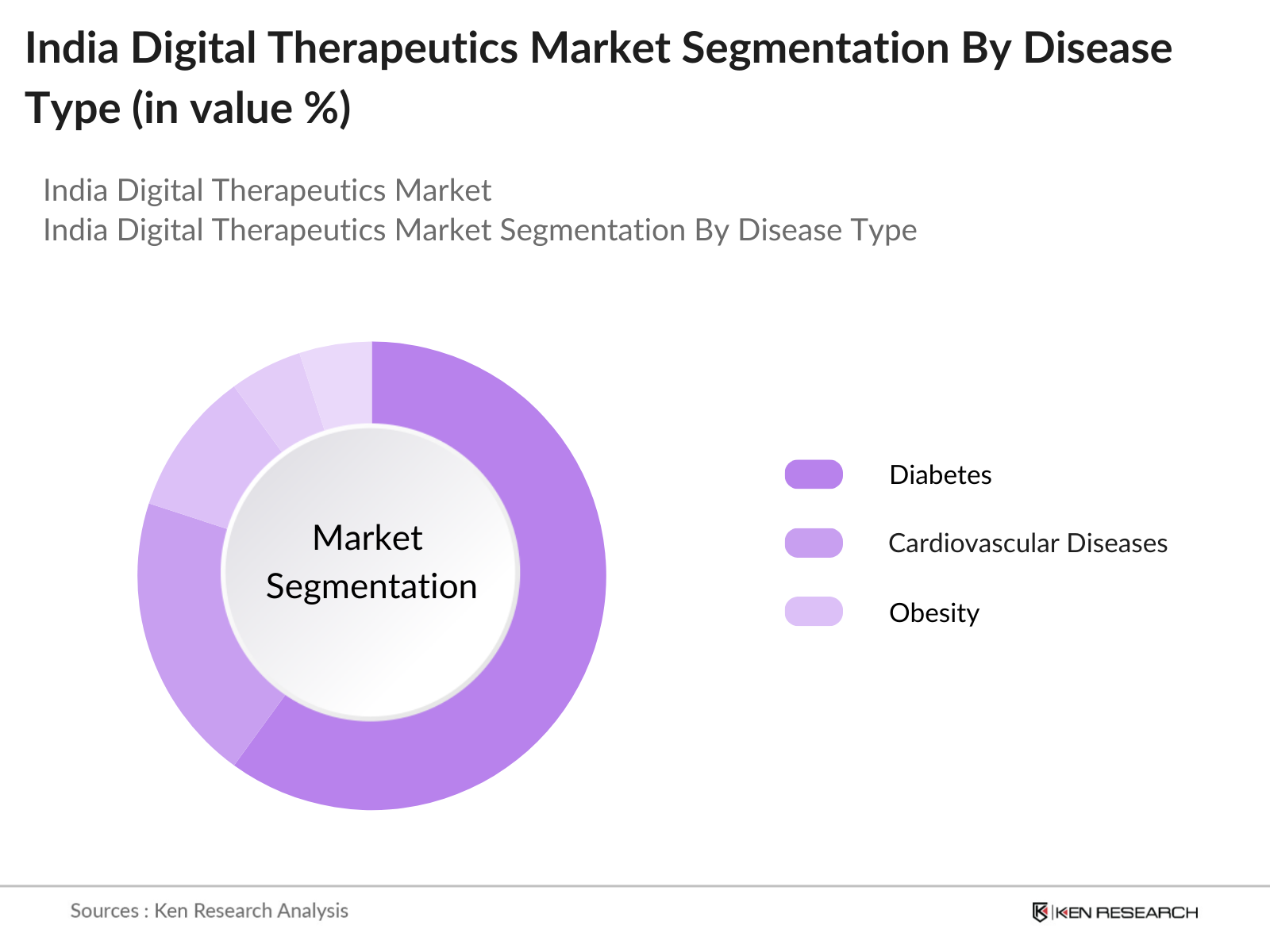

- By Disease Type: The market is segmented by disease type into diabetes, cardiovascular diseases, and obesity. In 2023, diabetes management held the dominant market share. This is due to the increasing prevalence of diabetes in India, with over 77 million patients as of 2023. Solutions like those from BeatO and Wellthy Therapeutics focus on managing glucose levels, lifestyle changes, and medication adherence. As diabetes requires constant monitoring, digital tools provide an accessible way for patients to manage their condition remotely, contributing to the dominance of this segment.

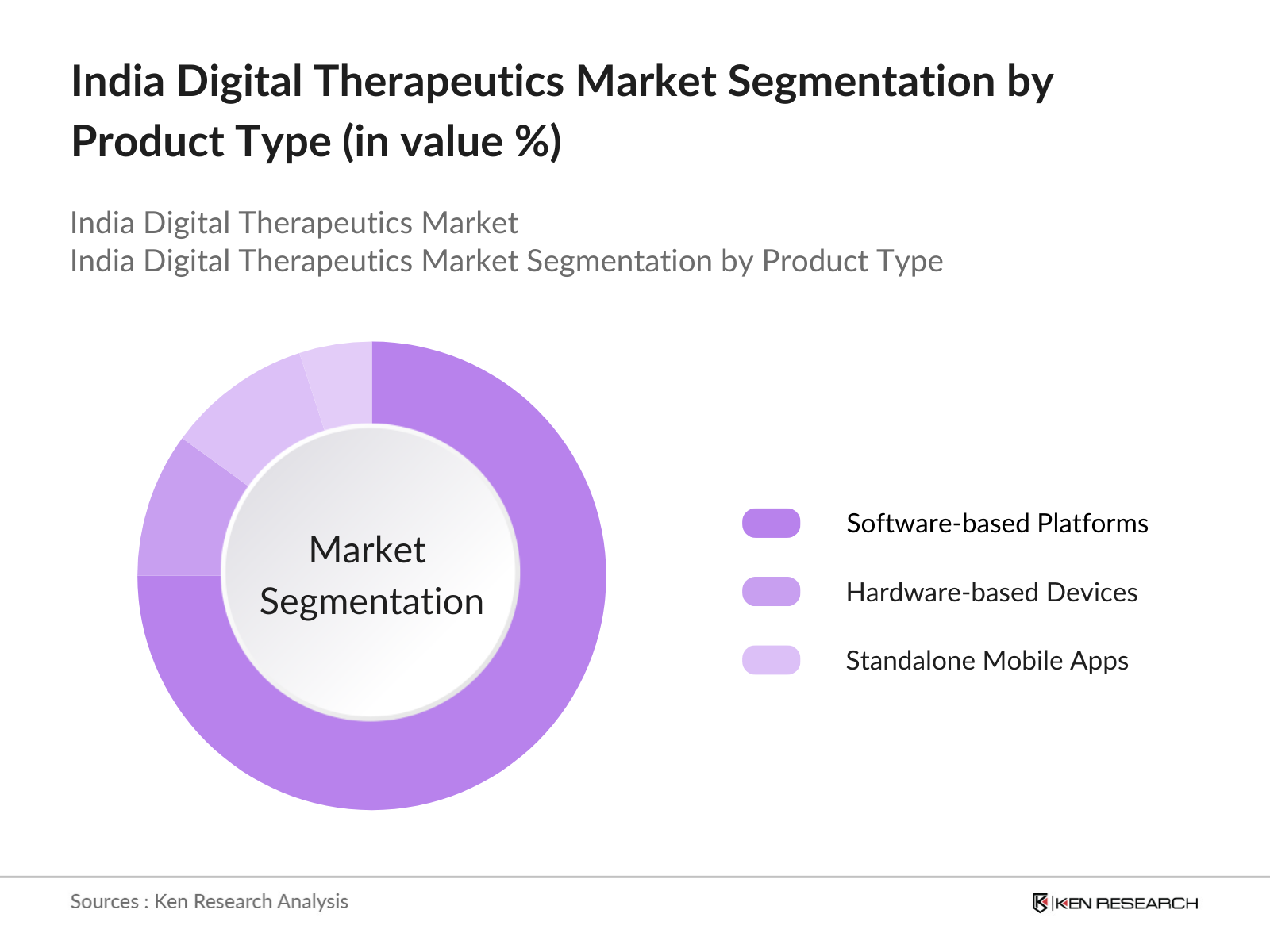

- By Product Type: The market is segmented by product type into software-based platforms, hardware-based devices, and standalone mobile apps. Software-based platforms dominated the market in 2023, as these platforms offer a holistic approach to healthcare management. Many software platforms integrate multiple chronic disease management tools into a single platform, offering a seamless experience for users. These platforms often use AI to provide personalized care plans, monitor patient data, and offer real-time insights. Their ease of use and integration with other healthcare systems has made them a popular choice among users.

- By Region: The India digital therapeutics market is segmented by region into North, South, East and West. In 2023, Western region held the largest market share due to the regions higher concentration of healthcare institutions and technology companies. The presence of advanced IT infrastructure, especially in Maharashtra, and the adoption of digital healthcare solutions in the region contribute to its dominance. Additionally, major players in digital health are headquartered here, driving regional growth. West India also benefits from a strong investment ecosystem, which supports digital health startups.

India Digital Therapeutics Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Wellthy Therapeutics |

2015 |

Mumbai |

|

BeatO |

2015 |

Delhi |

|

Fitterfly |

2016 |

Mumbai |

|

Livongo (Teladoc) |

2008 |

New York, USA |

|

Omada Health |

2011 |

California, USA |

- Wellthy Therapeutics: In August 2023, Wellthy Therapeutics expanded its strategic collaboration with Lupin to further extend their digital diabetes care solutions across India. The platform aims to reach over 1 million patients in the next two years. Wellthy Therapeutics has invested in AI-based technologies to provide real-time insights to patients and healthcare professionals, helping reduce complications and improve outcomes.

- BeatO: BeatO, a Delhi-based digital health platform, secured INR 55 crore in funding in July 2023. The company aims to use the funds to expand its diabetes care offerings across tier-2 and tier-3 cities. The platform, which combines smartphone-enabled glucometers with a comprehensive diabetes management app, now serves over 1 million users, marking a significant milestone for its mission to make chronic disease management accessible.

India Digital Therapeutics Market Analysis

Growth Drivers

- Rising Prevalence of Chronic Diseases: One of the significant growth drivers of the India Digital Therapeutics (DTx) market is the increasing burden of chronic diseases. As per a 2023 report by the Indian Council of Medical Research (ICMR), India has more than 77 million people diagnosed with diabetes, making it the second-highest in the world. Additionally, the World Health Organization (WHO) estimates that cardiovascular diseases account for nearly 28% of all deaths in India annually. This growing burden of chronic diseases is driving the adoption of digital therapeutics as a scalable solution for disease management, contributing to the increasing demand for DTx platforms in 2024.

- Government's Push Towards Digital Healthcare: The Indian governments initiatives towards building a robust digital health infrastructure are pivotal in driving the growth of the DTx market. In 2022, the government launched the Ayushman Bharat Digital Mission (ABDM) as part of the National Digital Health Mission (NDHM). The mission aims to digitize health records of millions of Indian citizens by 2025, creating a connected ecosystem of digital health services. In 2024, the program reported onboarding over 200 million citizens, improving access to digital therapeutics by enabling the integration of digital platforms within mainstream healthcare.

- Growing Smartphone Penetration and Internet Access: India's expanding digital infrastructure, coupled with increasing smartphone usage, is another key growth driver for the DTx market. According to the Telecom Regulatory Authority of India (TRAI), India had over 850 million internet users by the end of 2023, with rural areas accounting for a significant portion of new internet connections. This widespread internet access is critical for the digital therapeutics market, allowing patients in both urban and rural areas to access remote healthcare services.

Challenges

- Limited Awareness Among Healthcare Providers: Despite the rising demand for digital therapeutics, one of the main challenges for the India DTx market is the limited awareness among healthcare professionals. This gap in knowledge leads to resistance among physicians when recommending or prescribing digital therapeutics. In 2024, addressing this knowledge gap through awareness programs and medical training will be essential to increasing the adoption rate of DTx solutions in clinical practice, as only well-informed healthcare professionals can encourage widespread use among patients.

- Data Privacy and Security Concerns: With the increased usage of digital health platforms, there has been a rise in apprehensions about the security of patient data. In 2023, India introduced the Digital Personal Data Protection Act to regulate the collection, processing, and storage of digital health data. However, the lack of stringent enforcement mechanisms poses challenges for companies in securing sensitive health information, leading to reluctance among patients and healthcare providers.

Government Initiatives

- Ayushman Bharat Digital Mission (ABDM) 2022

Launched in September 2022, the Ayushman Bharat Digital Mission (ABDM) aims to digitize the healthcare ecosystem of India by creating a secure and integrated digital health infrastructure. In 2024, over 200 million health records had been digitized under the scheme, allowing patients and healthcare providers to access health data through a unified digital platform. The initiative's push towards digital health integration supports the growth of digital therapeutics by enabling seamless access to digital tools for chronic disease management, thus promoting patient engagement with DTx platforms. - National Digital Health Mission (NDHM) 2021

The National Digital Health Mission (NDHM), launched in 2021, focuses on establishing a robust digital health ecosystem by linking healthcare stakeholders through technology. By 2024, the initiative had reached over 500 million individuals with a digital health ID, streamlining the delivery of digital therapeutics solutions. This initiative has been instrumental in creating a framework for digital healthcare delivery in India, including digital therapeutics, which is gaining popularity as patients seek more convenient and personalized care options.

India Digital Therapeutics Market Future Outlook

Over the next five years, the India Digital Therapeutics (DTx) market is projected to experience robust growth, driven by advancements in technology, government initiatives, and increasing patient demand for personalized healthcare solutions. The market is expected to be deeply integrated with the broader healthcare ecosystem, offering enhanced digital health solutions for managing chronic diseases like diabetes, cardiovascular issues, and obesity. A significant factor contributing to this growth will be the increased focus on AI and machine learning technologies, enabling DTx platforms to offer highly tailored treatment plans and real-time monitoring for patients.

Future Trends

- Expansion of AI-Powered DTx Platforms: Artificial intelligence will play a pivotal role in the future of digital therapeutics in India. AI-powered platforms will dominate the market, offering personalized care plans, remote monitoring, and real-time analysis of patient data. These platforms will not only improve patient outcomes but will also significantly reduce the burden on healthcare providers, making them a cornerstone of chronic disease management.

- Integration with Health Insurance Providers: Digital therapeutics platforms will become a regular feature in health insurance packages, offering preventive care solutions as part of health policies. Insurance companies will increasingly collaborate with DTx providers to offer policyholders tools for managing chronic diseases, reducing healthcare costs, and improving overall patient health outcomes.

Scope of the Report

|

By Disease Type |

Diabetes Cardiovascular Diseases Obesity |

|

By Product Type |

Software-based Platforms Hardware-based Devices Standalone Mobile Apps |

|

By Region |

North South West East |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Healthcare providers and hospitals

Pharmaceutical companies

Health insurance companies

Medical device manufacturers

Digital health startups

Corporate wellness programs

Chronic disease management clinics

Digital therapeutics solution providers

Investors and venture capitalist firms

Government and regulatory bodies (Indian Ministry of Health & Family Welfare, National Health Authority)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Wellthy Therapeutics

BeatO

Fitterfly

Livongo (Teladoc)

Omada Health

Tata Health

HealthifyMe

GOQii

Cure.fit

Medtronic

1mg (Tata Digital)

Practo

Phable

Twin Health

DayToDay Health

Table of Contents

1. India Digital Therapeutics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Key growth metrics including financial parameters, operational indicators)

1.4. India Digital Therapeutics Ecosystem Overview

1.5. Digital Therapeutics in India Healthcare Landscape

1.6. Key Innovations and Technological Advancements

2. India Digital Therapeutics Market Size (In INR and USD)

2.1. Historical Market Size (in INR crore/USD)

2.2. Year-on-Year Growth Analysis (Detailed operational metrics)

2.3. Key Market Developments and Milestones (Financial and strategic highlights)

2.4. Market Volume Analysis (Patient volume metrics and adoption rates)

3. India Digital Therapeutics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing prevalence of chronic diseases (Data-driven insight into diabetes, cardiovascular conditions)

3.1.2. Rising internet penetration and smartphone usage

3.1.3. Government initiatives promoting digital health (Operational impact)

3.1.4. Partnerships between digital therapeutics providers and healthcare institutions

3.2. Challenges

3.2.1. Limited awareness among healthcare professionals

3.2.2. Concerns over data privacy and security regulations

3.2.3. Infrastructure gaps in rural regions

3.3. Opportunities

3.3.1. AI-driven personalized healthcare solutions

3.3.2. Expansion in Tier-2 and Tier-3 cities

3.3.3. Integration with health insurance policies

3.4. Key Market Trends

3.4.1. Adoption of AI and machine learning in digital therapeutics

3.4.2. Increasing use of wearables for remote monitoring

3.4.3. Growing emphasis on preventive healthcare solutions

3.5. Government Regulations

3.5.1. Ayushman Bharat Digital Mission

3.5.2. Digital Personal Data Protection Act

3.5.3. National Digital Health Mission

3.6. SWOT Analysis (Market-specific strengths, weaknesses, opportunities, threats)

3.7. Stakeholder Ecosystem (Financial performance of stakeholders, operational metrics)

3.8. Competitive Ecosystem (Competitor operational performance and strategic insights)

4. India Digital Therapeutics Market Segmentation

4.1. By Disease Type (in value %, INR crore)

4.1.1. Diabetes Management

4.1.2. Cardiovascular Disease Management

4.1.3. Respiratory Disease Management

4.1.4. Obesity and Weight Management

4.1.5. Mental Health Solutions

4.2. By Product Type (in value %, INR crore)

4.2.1. Software-Based Platforms

4.2.2. Hardware Devices (Wearables, connected devices)

4.2.3. Standalone Mobile Applications

4.3. By End User (in value %, INR crore)

4.3.1. Hospitals and Clinics

4.3.2. Pharmaceutical Companies

4.3.3. Health Insurance Providers

4.3.4. Corporate Wellness Programs

4.4. By Distribution Channel (in value %, INR crore)

4.4.1. Business-to-Business (B2B) Platforms

4.4.2. Direct-to-Consumer (D2C) Models

4.4.3. Telemedicine and Online Platforms

4.5. By Region (in value %, INR crore)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Digital Therapeutics Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Wellthy Therapeutics

5.1.2. BeatO

5.1.3. Fitterfly

5.1.4. Livongo (Teladoc)

5.1.5. Omada Health

5.1.6. GOQii

5.1.7. HealthifyMe

5.1.8. Tata Health

5.1.9. Cure.fit

5.1.10. Phable

5.1.11. Twin Health

5.1.12. DayToDay Health

5.1.13. Practo

5.1.14. Medtronic

5.1.15. 1mg (Tata Digital)

5.2. Cross Comparison Parameters (Financial and operational parameters: revenue, number of employees, market share, strategic initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. India Digital Therapeutics Market Regulatory Framework

6.1. Compliance Requirements

6.2. Data Privacy Laws (Digital Personal Data Protection Act)

6.3. Telemedicine and Remote Monitoring Regulations

6.4. Certification Processes for Digital Therapeutics Providers

7. India Digital Therapeutics Market Forecast

7.1. Future Market Size Projections (Financial forecasting and growth metrics)

7.2. Key Factors Driving Future Market Growth

7.2.1. Integration with health insurance

7.2.2. Growth in AI-driven platforms and remote healthcare

7.2.3. Government-backed digital healthcare initiatives

7.3. Forecasted Market Segmentation

7.3.1. By Disease Type

7.3.2. By Product Type

7.3.3. By End User

7.3.4. By Distribution Channel

7.3.5. By Region

8. India Digital Therapeutics Competitive Dynamics and Strategies

8.1. Competitive Strategies and Differentiators

8.1.1. Key strategic moves by leading players

8.1.2. Partnerships and Collaborations

8.1.3. Product Launches and Technological Innovations

8.2. Market Leaders and Innovators

8.3. Competitive Barriers and Market Entrants

9. India Digital Therapeutics Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Addressable Market, Serviceable Obtainable Market metrics)

9.2. Market Entry Strategies

9.3. Customer Cohort Analysis

9.4. Investment and Growth Opportunities

9.5. White Space Opportunities in the Market

9.6. Recommendations for New Market Entrants

10. Contact Us

10.1. Consultation and Market Research Services

10.2. Detailed Methodology Overview

10.3. Further Inquiries and Customization Requests

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step 2: Market Building

Collating statistics on the India Digital Therapeutics Market over the years, analyzing the penetration of India Digital Therapeutics technologies, and computing the revenue generated for the market. This step also involves reviewing technology adoption rates and application effectiveness to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple India Digital Therapeutics companies to understand the nature of technology segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these India Digital Therapeutics companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the India Digital Therapeutics market?

The India digital therapeutics market, valued at USD 178 million in 2023, is primarily driven by the increasing prevalence of chronic diseases, widespread internet penetration, and a growing demand for personalized healthcare solutions.

02. What are the challenges in the India Digital Therapeutics market?

Key challenges include limited awareness among healthcare providers, data privacy concerns, and infrastructure gaps in rural areas. Additionally, regulatory complexities related to the handling of sensitive health data pose significant barriers to market growth.

03. Who are the major players in the India Digital Therapeutics market?

Major players in the market include Wellthy Therapeutics, BeatO, Fitterfly, Livongo (Teladoc), and Omada Health. These companies are leading due to their innovative digital platforms, strategic partnerships, and focus on chronic disease management.

04. What are the growth drivers of the India Digital Therapeutics market?

Growth drivers include the rising incidence of chronic diseases, government initiatives like the Ayushman Bharat Digital Mission, and the growing adoption of smartphones and internet access, which enable remote healthcare solutions across India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.