India Digital Twin Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD2269

October 2024

92

About the Report

India Digital Twin Market Overview

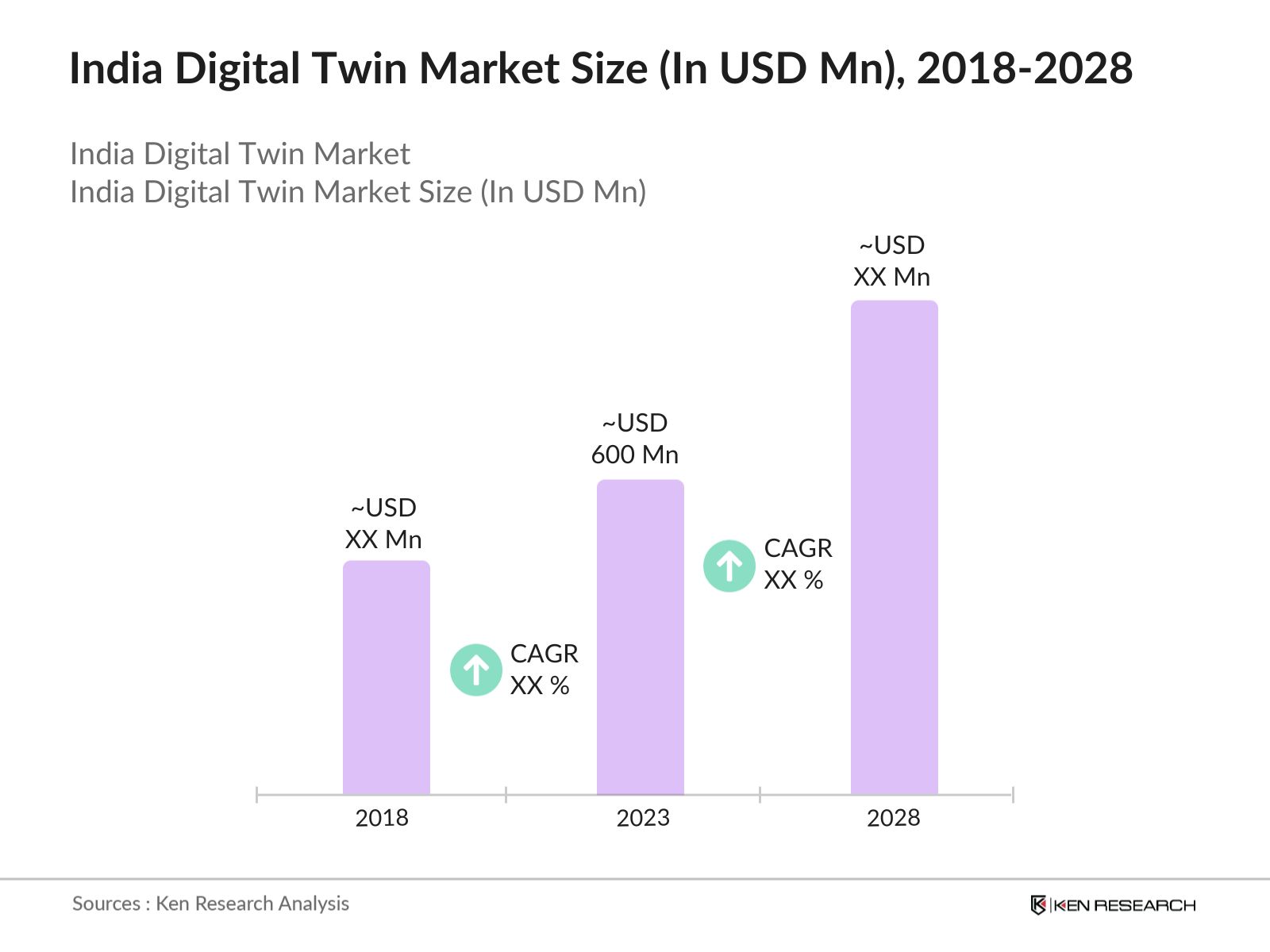

- The India Digital Twin Market is valued at USD 600 million, driven by advancements in Industry 4.0 technologies, increasing adoption across industries such as manufacturing, energy, and healthcare, and the rising demand for real-time asset monitoring and predictive maintenance. The market consists of various segments, including product twins, process twins, and system twins, all of which play a critical role in the digital transformation of businesses.

- Major players in the Indian digital twin market include Siemens AG, General Electric, Microsoft Corporation, and IBM Corporation. These companies maintain a strong market presence by investing in cutting-edge digital twin solutions, collaborating with local industries, and integrating IoT, AI, and machine learning technologies to enhance the efficiency of operations.

- The demand for digital twin technology is particularly high in sectors such as energy, automotive, and manufacturing, where the need for accurate simulations and performance optimization is crucial. Industrialized regions like Maharashtra, Gujarat, and Karnataka are seeing noteworthy adoption of digital twin solutions due to the concentration of advanced manufacturing units and energy projects.

- In January 2024, Siemens announced the expansion of its digital twin platform in India, focusing on energy management and smart manufacturing. This initiative is expected to drive growth in the market by offering solutions that enhance efficiency and reduce operational costs for businesses.

India Digital Twin Market Segmentation

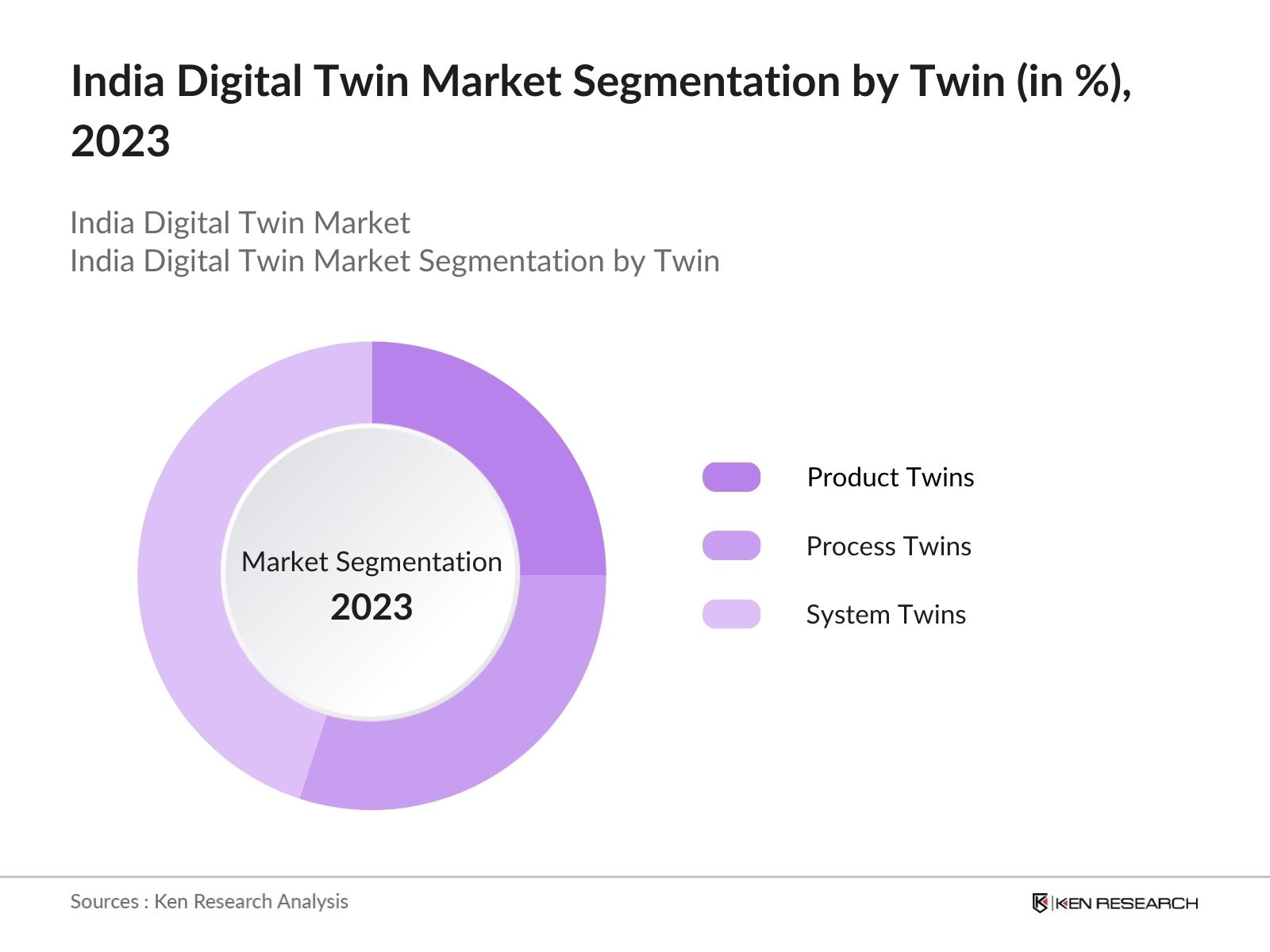

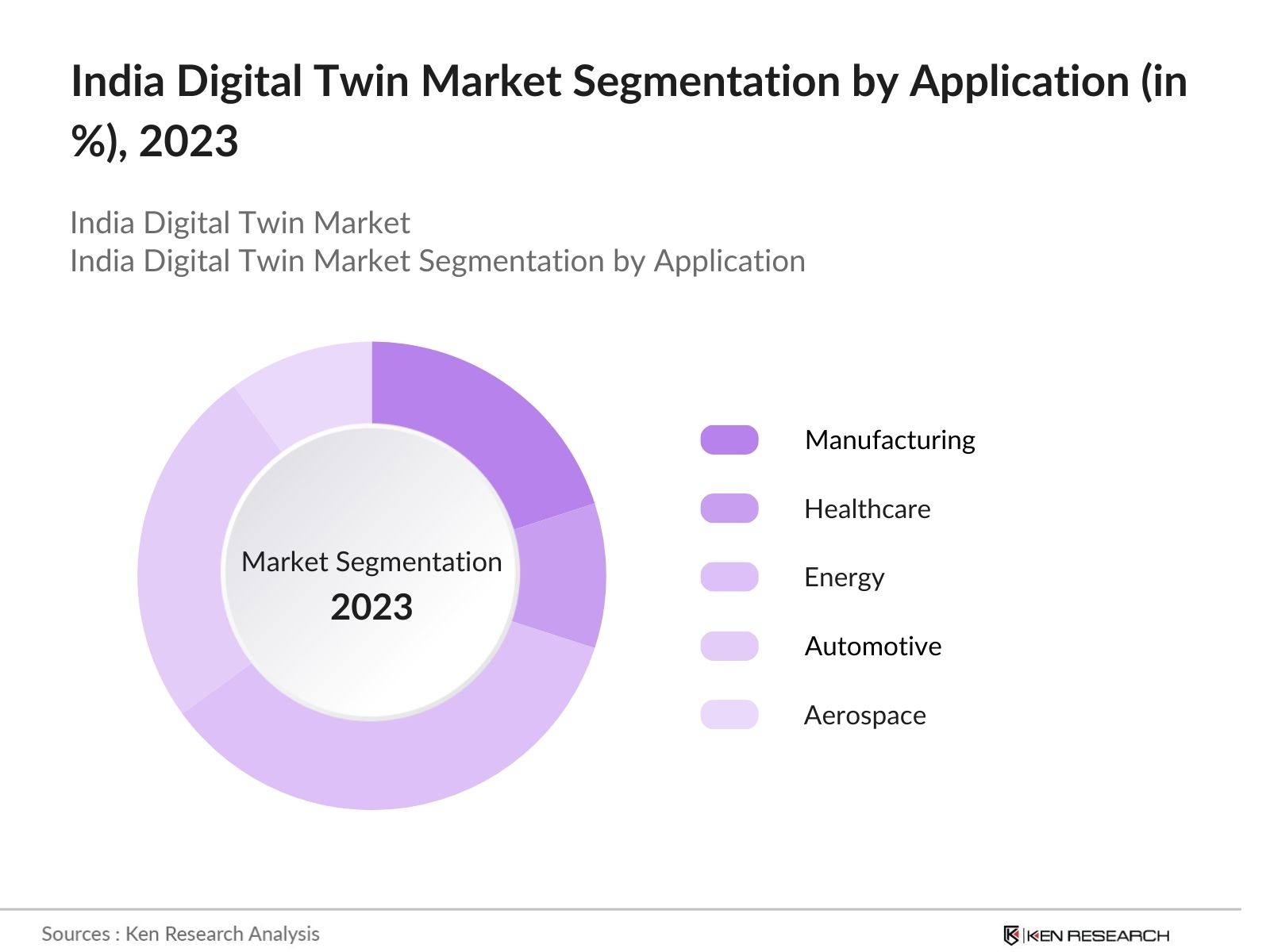

The India Digital Twin Market is segmented based on twin type, application, and region.

- By Twin Type: The market is segmented into product twins, process twins, and system twins. In 2023, system twins dominated the market, driven by the increasing need for comprehensive digital representations of entire systems in sectors like energy and manufacturing. Siemens AG and General Electric lead this segment with their robust digital twin offerings.

- By Application: The market is categorized into manufacturing, healthcare, energy, automotive, and aerospace. The energy sector held the largest share in 2023, fueled by the growing need for real-time monitoring and optimization of power plants and renewable energy assets. The automotive sector is also experiencing rapid growth, driven by the demand for advanced simulations in vehicle production and design.

- By Region: The market is divided into North, South, East, and West India. In 2023, West India, particularly Maharashtra and Gujarat, led the market due to the high concentration of manufacturing industries and energy projects. South India, with its growing technology hubs and industrial base, also holds a substantial share of the market.

India Digital Twin Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Siemens AG |

1847 |

Munich, Germany |

|

General Electric |

1892 |

Boston, USA |

|

Microsoft Corporation |

1975 |

Redmond, USA |

|

IBM Corporation |

1911 |

Armonk, USA |

|

Dassault Systmes |

1981 |

Vlizy-Villacoublay, France |

- General Electric: Recently, GE has introduced its Network Digital Twin technology, which integrates physical systems with digital capabilities to provide a comprehensive view of energy grids. This technology is designed to address challenges related to decentralization and decarbonization in the energy sector, making it particularly relevant for utilities and grid operators in India.

- Microsoft Corporation: Microsoft, Bentley Systems, and L&T Technology Services (LTTS) established a Center of Excellence (CoE) in Chennai, India, in 2024. This CoE aims to accelerate the adoption of digital twin technologies in manufacturing and industrial sectors. Utilizing Microsoft Azure's platform, the CoE will develop advanced digital solutions to optimize operations and enhance customer experiences through AI, ML, and data analytics.

India Digital Twin Market Analysis

Growth Drivers:

- Adoption of Industry 4.0 and IoT: The integration of IoT, AI, and advanced analytics has driven the adoption of digital twins in India. In 2023, more than half of large-scale manufacturers adopted automation and AI-driven systems, using digital twins for predictive maintenance and process optimization. This trend is expected to continue as companies aim to reduce downtime and operational costs while enhancing production efficiency.

- Energy Sectors Focus on Efficiency and Sustainability: With Indias renewable energy capacity reaching 30 GW by the end of 2024, the energy sector is increasingly relying on digital twin technology to monitor, optimize, and predict the performance of assets like wind turbines and solar panels. Companies such as NTPC and Reliance have integrated digital twin platforms for real-time data monitoring, improving energy output while reducing maintenance costs.

- Automotive Sectors Digital Transformation: In 2024, the Indian automotive sector produced 28 million vehicles including passenger vehicles, three-wheelers, two-wheelers, and quadricycles, a key growth driver for digital twin adoption in vehicle design, simulation, and production optimization. Automakers such as Tata Motors and Maruti Suzuki use digital twins to reduce product development cycles, enhance vehicle safety, and improve design accuracy.

Challenges:

- Lack of Skilled Workforce: The lack of skilled professionals with expertise in IoT, AI, and data analytics is a noteworthy challenge for the digital twin market in India. Many companies struggle to find talent that can manage advanced digital systems, particularly in the manufacturing and energy sectors. This skills gap necessitates extensive investments in training programs, which can increase operational costs and delay the implementation of digital twin technology.

- Data Privacy and Security Concerns: As digital twin technology becomes more integrated with IoT devices, there is an increased risk of cybersecurity breaches. The sensitive data managed by these systems makes them prime targets for cyberattacks. Ensuring secure data transfer and compliance with stringent data privacy regulations, such as the Personal Data Protection Bill, remains a critical challenge for companies operating in this space.

Government Initiatives:

- Digital India Initiative: The Indian governments Digital India initiative has played a crucial role in promoting the adoption of digital technologies, including digital twins. The amount allocated for the Digital India initiative in the 2023 budget is INR 4,795 crore. The initiative focuses on enhancing infrastructure, promoting digital literacy, and fostering innovation in IoT and AI.

- National Smart Manufacturing Policy: The National Smart Manufacturing Policy aims to enhance India's manufacturing sector by promoting the adoption of Industry 4.0 technologies, including automation and AI. It focuses on supporting MSMEs, establishing demonstration centers, and fostering collaboration with educational institutions. The policy has an allocation of Rs. 2,200 crores to facilitate its implementation and drive innovation in smart manufacturing practices.

India Digital Twin Market Future Outlook

The India Digital Twin Market is expected to grow at a substantial rate over the forecast period, driven by advancements in AI, IoT, and Industry 4.0 technologies k, along with key growth sectors including energy, automotive, and manufacturing.

Future Market Trends:

- Increased Adoption in Healthcare: By 2028, the healthcare sector is expected to be a significant adopter of digital twin technology. Hospitals and healthcare providers will use digital twins to simulate patient treatments, monitor medical devices, and improve operational efficiency.

- Expansion of Digital Twin Applications in Healthcare: The healthcare sector is projected to witness increased adoption of digital twin technology for patient care management and medical equipment optimization. By 2028, it is expected that major hospital chains in India will deploy digital twins to simulate treatment plans for critical illnesses.

Scope of the Report

|

By Twin |

Product Twins Process Twins System Twins |

|

By Application |

Manufacturing Healthcare Energy Automotive Aerospace |

|

By Region |

North East South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report

Digital Twin Solution Providers

IoT and AI Companies

Manufacturing Firms

Energy Providers

Healthcare Institutions

Automotive Companies

Government Bodies (Ministry of Electronics and Information Technology)

Investors and Venture Capitalists

Banks and Financial Institutes

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Siemens AG

General Electric

IBM Corporation

Microsoft Corporation

Dassault Systmes

Bosch Rexroth

ABB Ltd.

Honeywell International Inc.

Schneider Electric

PTC Inc.

ANSYS Inc.

Oracle Corporation

Hitachi Ltd.

Tata Consultancy Services

Infosys Limited

Table of Contents

India Digital Twin Market Overview

1.1. Definition and Scope

1.2. Market Structure and Taxonomy

1.3. Market Growth Rate Analysis (Financial and Operational Metrics)

1.4. Key Market Developments and Milestones

India Digital Twin Market Size (USD Billion)

2.1. Historical Market Size (Value and Volume)

2.2. Year-on-Year Growth Analysis (Operational Parameters)

2.3. Contribution of Key Regions (North, South, East, West)

2.4. Industry Revenue Analysis (Top-to-Bottom Approach)

2.5. Breakdown of Market Value by Twin Type (Product Twins, Process Twins, System Twins)

India Digital Twin Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Adoption of IoT and AI in Manufacturing

3.1.2. Increased Focus on Energy Efficiency and Sustainability

3.1.3. Government Initiatives Supporting Digital Transformation

3.2. Market Challenges

3.2.1. High Initial Investment Costs for SMEs

3.2.2. Lack of Skilled Workforce in Advanced Technologies

3.2.3. Data Privacy and Cybersecurity Concerns

3.3. Market Opportunities

3.3.1. Expansion of Digital Twins in Healthcare

3.3.2. Development of Smart Cities and Infrastructure

3.3.3. Integration of Digital Twins in Renewable Energy Projects

India Digital Twin Market Segmentation

4.1. By Twin Type (In Value %)

4.1.1. Product Twins

4.1.2. Process Twins

4.1.3. System Twins

4.2. By Application (In Value %)

4.2.1. Manufacturing

4.2.2. Healthcare

4.2.3. Energy

4.2.4. Automotive

4.2.5. Aerospace

4.3. By Region (In Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

India Digital Twin Market Competitive Landscape

5.1. Competitive Market Share Analysis (Market Share %, Financial and Operational Metrics)

5.2. Strategic Initiatives and Partnerships (Investments, JVs, and Alliances)

5.3. Key Market Players Analysis

5.3.1. Siemens AG

5.3.2. General Electric

5.3.3. IBM Corporation

5.3.4. Microsoft Corporation

5.3.5. Dassault Systmes

5.4. Cross-Comparison (Company Profiles Establishment Year, Headquarters, Revenue, No. of Employees)

5.4.1. Tata Consultancy Services

5.4.2. PTC Inc.

5.4.3. Bosch Rexroth

5.4.4. Oracle Corporation

5.4.5. Hitachi Ltd.

India Digital Twin Market Financial Analysis

6.1. Financial Performance of Key Players

6.1.1. Revenue Analysis by Key Companies

6.1.2. Operational Efficiency Metrics (Production Volume, Cost Efficiency)

6.2. Investment and Venture Capital Analysis

6.2.1. Recent Investments and Fundings (Venture Capital, Government Grants)

6.2.2. Mergers and Acquisitions

6.3. Profitability and Revenue Forecasts

India Digital Twin Market Regulatory Framework

7.1. Government Policies Supporting Digital Transformation

7.2. Compliance and Certification Requirements for Digital Twin Providers

7.3. Data Privacy and Cybersecurity Regulations

7.4. Standards for IoT and AI Integration in Digital Twin Systems

Future Outlook for India Digital Twin Market

8.1. Market Growth Projections

8.2. Key Trends Shaping Future Demand (Energy, Healthcare, Smart Cities)

8.3. Expansion of Domestic Production and Export Opportunities

8.4. Sustainability and Integration of Renewable Energy in Digital Twin Solutions

India Digital Twin Future Market Segmentation, 2028

9.1. By Twin Type (In Value %)

9.2. By Application (In Value %)

9.3. By Region (In Value %)

Analyst Recommendations

10.1. TAM/SAM/SOM Analysis for Digital Twin Market

10.2. Key Strategic Recommendations for Digital Twin Solution Providers

10.3. Emerging Markets and White-Space Opportunities (Healthcare, Smart Cities, Automotive)

10.4. Customer-Centric Approach for Enhanced Digital Twin Solutions

Disclaimer

Contact Us

Research Methodology

Step 1 Identifying Key Variables

: Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry-level information.

Step 2 Market Building

: Collating statistics on the India digital twin market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the India digital twin market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing

: Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research Output

: Our team will approach multiple essential Technology and Software companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us to validate statistics derived through a bottom-to-top approach from Technology and Software companies.

Frequently Asked Questions

-

How big is the India Digital Twin Market?

The India Digital Twin Market was valued at USD 600 million in 2023, driven by the rapid adoption of Industry 4.0 technologies, IoT integration, and increasing demand for real-time asset monitoring in sectors such as manufacturing, energy, and healthcare. -

What are the challenges in the India Digital Twin Market?

Challenges in the India Digital Twin Market include the high initial investment costs for small and medium enterprises, the lack of skilled professionals, and growing concerns about data privacy and cybersecurity as more systems become interconnected. -

Who are the major players in the India Digital Twin Market?

Key players in the India Digital Twin Market include Siemens AG, General Electric, Microsoft Corporation, IBM Corporation, and Dassault Systmes. These companies dominate due to their advanced digital twin platforms and strong presence in industries such as manufacturing and energy. -

What are the growth drivers of the India Digital Twin Market?

The India Digital Twin Market is driven by the increasing adoption of IoT and AI technologies in manufacturing, the rising focus on energy efficiency, and government initiatives promoting digital transformation across various sectors like automotive and smart cities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.