India Dishwashing Machines Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD7106

December 2024

91

About the Report

India Dishwashing Machines Market Overview

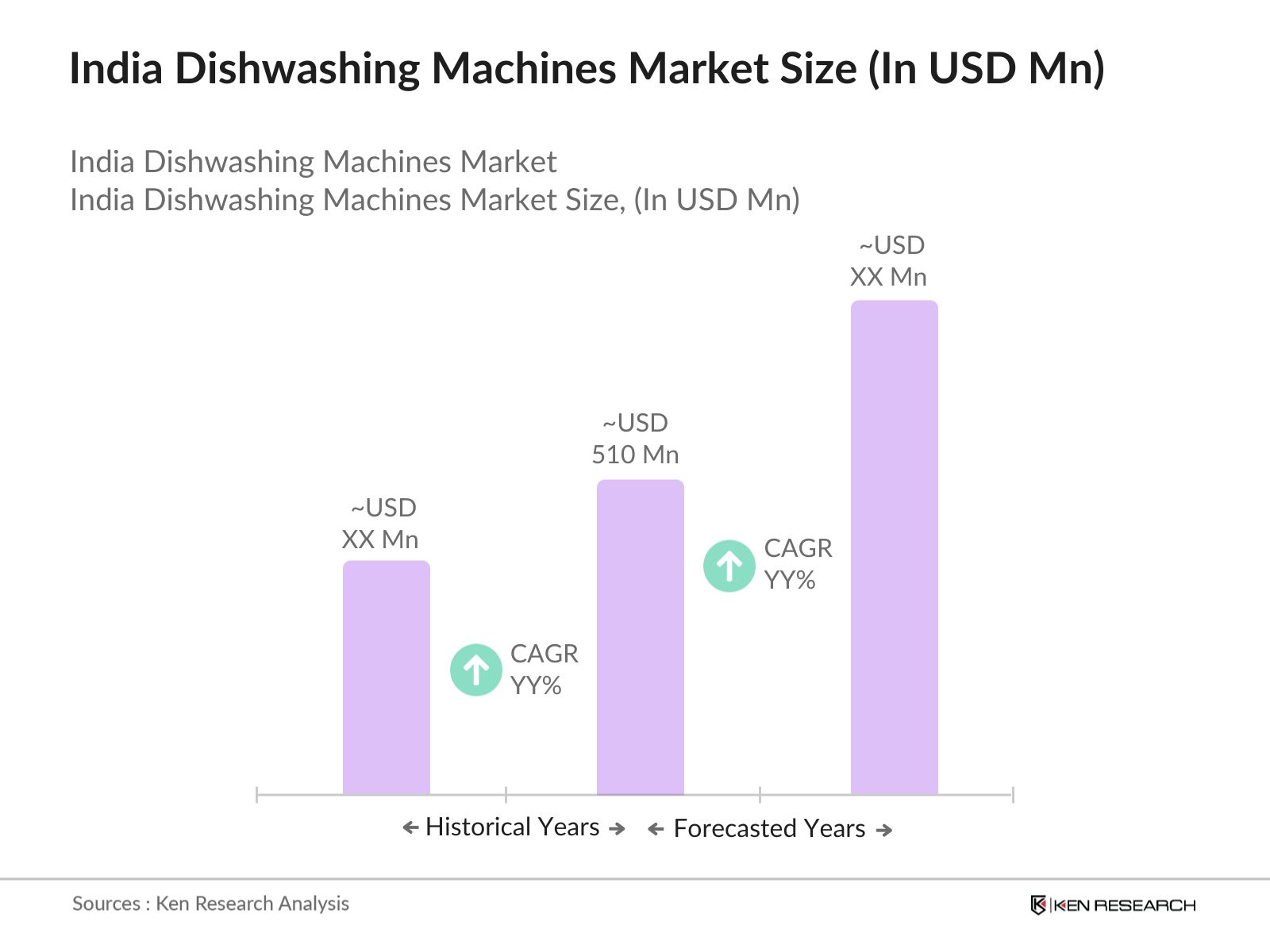

- The India dishwashing machines market is valued at USD 510 million, driven by an evolving preference for convenience and energy-efficient appliances among urban consumers. The increased demand for smart and IoT-connected home devices is accelerating the adoption of dishwashers, appealing to a growing demographic of dual-income households. Product advancements and expanding consumer awareness further support this trend, as consumers increasingly seek hygienic and time-saving solutions.

- Southern India remains a dominant region within the market due to higher urbanization levels and a large working-class population that readily adopts innovative home technologies. The regions rising number of dual-income households and demand for modular kitchen setups also contribute to its lead. Additionally, regions like Northern and Western India, particularly metropolitan cities such as Delhi, Mumbai, and Bangalore, are experiencing robust demand due to their higher income levels and greater access to retail and e-commerce platforms, facilitating the spread of dishwashing technology.

- Under the Jal Jeevan Mission, the government has introduced awareness programs on efficient water usage in home appliances, including dishwashers. By 2024, this mission has impacted 200 million households, encouraging them to invest in water-saving appliances, which includes dishwashing machines with advanced water-recycling features.

India Dishwashing Machines Market Segmentation

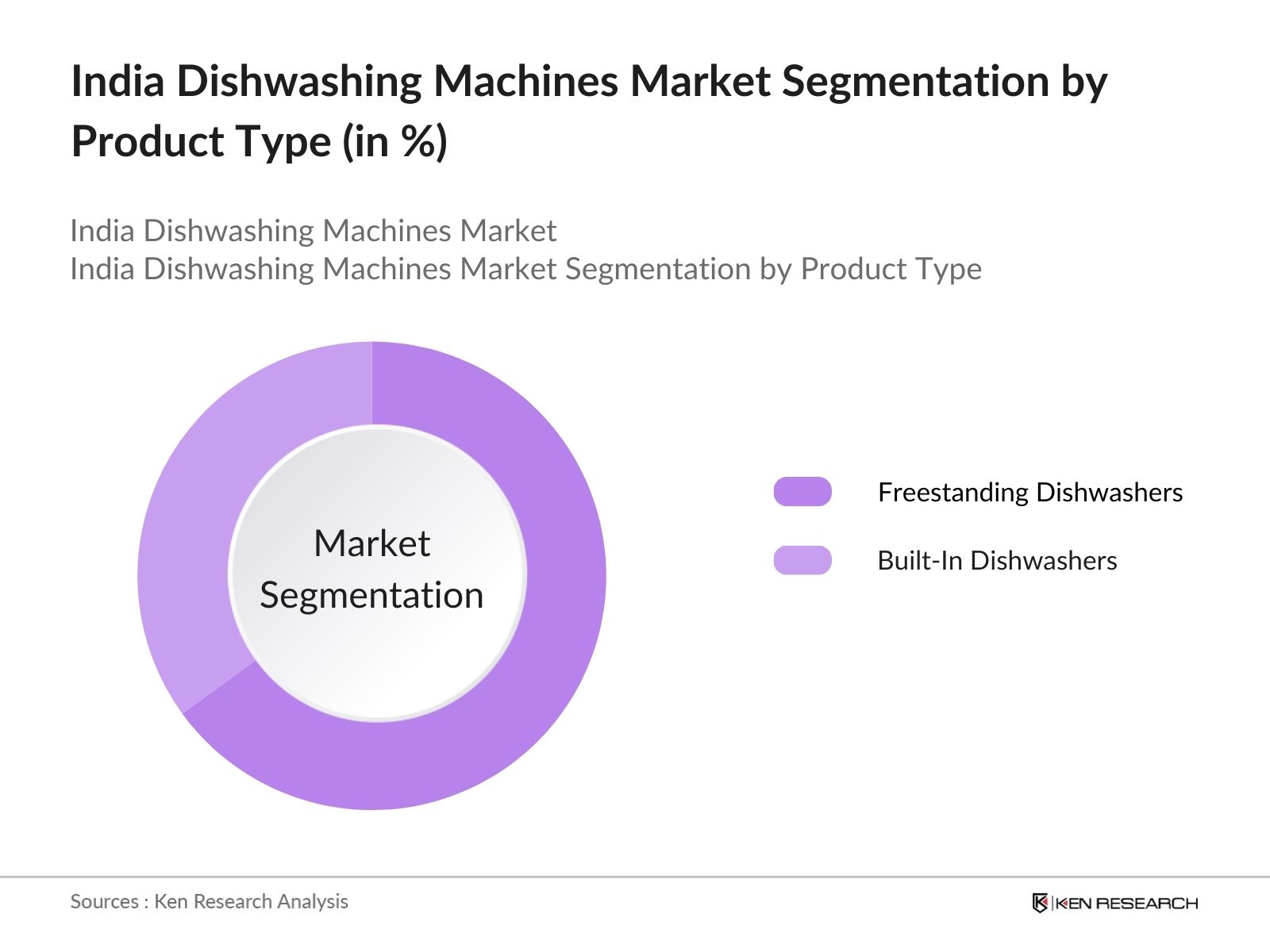

By Product Type: The market is segmented by product type into Freestanding Dishwashers and Built-in Dishwashers. Freestanding dishwashers hold a dominant market share due to their flexible placement options, cost-effectiveness, and ease of installation, making them a popular choice among Indian households. Consumers find freestanding models convenient for smaller kitchens, common in urban apartments, as they do not require permanent installation. Brands like Bosch and IFB have contributed significantly to this segments success by offering localized features tailored for Indian kitchens.

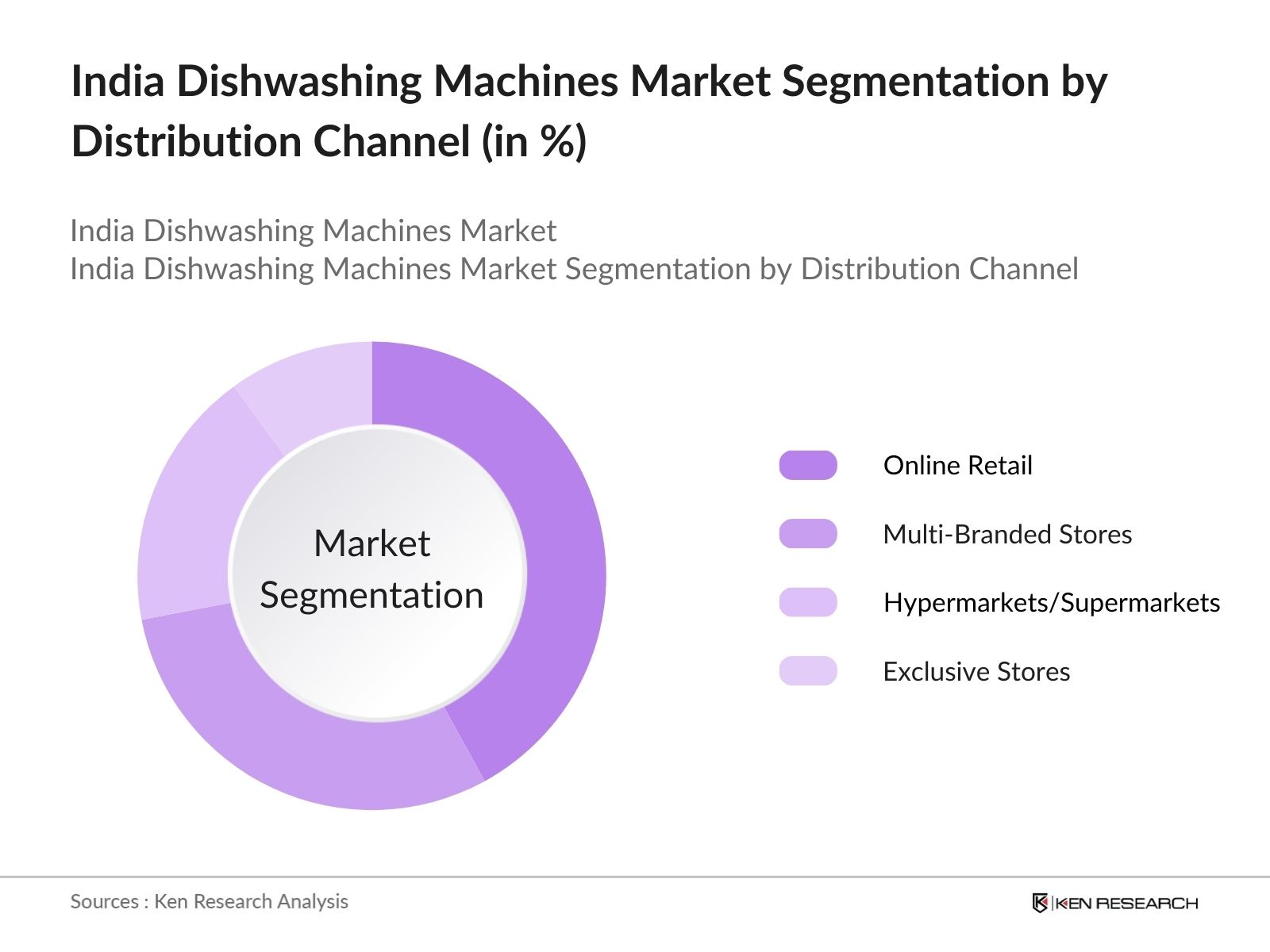

By Distribution Channel: Distribution of dishwashers in India is divided into Multi-Branded Stores, Exclusive Stores, Online Retail, and Hypermarkets/Supermarkets. Multi-branded stores dominate due to their reach and capacity to showcase multiple brands, catering to customers seeking comparative options. However, online retail has rapidly grown, supported by e-commerce giants like Amazon and Flipkart, offering extensive product ranges and competitive prices that appeal to tech-savvy urban customers seeking convenience and diverse options.

India Dishwashing Machines Market Competitive Landscape

The market is dominated by both global and local brands. Leading companies are focusing on expanding product portfolios, integrating smart technologies, and enhancing water conservation features to cater to Indian consumers specific needs.

India Dishwashing Machines Market Analysis

Market Growth Drivers

- Increasing Urban Housing Development and Rising Compact Kitchen Spaces: With India projected to have more than 500 million people residing in urban areas by 2025, the demand for space-saving home appliances, such as dishwashing machines, is set to rise. Given limited kitchen spaces, especially in urban centers, families are increasingly inclined towards appliances that maximize convenience and efficiency.

- Growing Workforce Participation, Especially Among Women: By 2024, Indias workforce participation has grown to over 470 million people, with a significant increase in female labor force participation across metropolitan areas. Dual-income households are prioritizing appliances that reduce manual labor, and dishwashers fit this trend. Studies indicate that time-saving appliances such as dishwashers are increasingly in demand in dual-income households as they save an average of 4-5 hours per week in manual dishwashing chores (National Employment Survey, 2024).

- Surge in Consumer Awareness on Health and Hygiene: Since 2020, post-pandemic consumer awareness about hygiene and sanitation has surged across India, prompting more households to seek solutions for effective and high-standard cleaning. Dishwashing machines, which can sanitize at higher temperatures, have become desirable due to their effective removal of germs and pathogens.

Market Challenges

- Low Awareness and Acceptance in Rural and Semi-Urban Areas: In 2024, around 65% of the Indian population resides in rural or semi-urban areas, where awareness and acceptance of dishwashing machines remain low. With traditional cleaning practices still preferred, these areas have low appliance penetration.

- High Water and Electricity Consumption Concerns: Water scarcity in urban centers like Delhi and Chennai, which face deficits of over 500 million liters per day, has led to increased concerns over water-intensive appliances. Dishwashing machines, which consume between 10-15 liters per cycle, face scrutiny in water-stressed regions.

India Dishwashing Machines Market Future Outlook

Over the next five years, the India dishwashing machines industry is expected to experience robust growth, driven by rising consumer awareness, improved product availability, and a growing emphasis on energy and water conservation.

Future Market Opportunities

- Rising Demand in Tier-2 and Tier-3 Cities through Affordable Financing Options: With financing options improving, including zero-interest EMIs, dishwasher adoption is anticipated to grow in Tier-2 and Tier-3 cities. Market analysts estimate that by 2028, 60% of sales will stem from these regions as more middle-income households can afford premium appliances.

- Introduction of Smart, AI-Enabled Dishwashers for Enhanced Usability: By 2028, AI-enabled dishwashers with features like load-sensing, automatic cycle adjustments, and voice control will dominate the premium appliance market. These advancements will likely boost dishwasher penetration, especially among tech-savvy urban consumers seeking high-efficiency home solutions.

Scope of the Report

|

Product Type |

Freestanding Dishwashers Built-In Dishwashers Countertop Models |

|

End-User |

Residential Commercial |

|

Distribution Channel |

Multi-Branded Stores Exclusive Stores Online Retail Hypermarkets/Supermarkets |

|

Region |

Northern Southern Western Eastern |

|

Customer Demographics |

Urban Market Rural Market Dual-Income Households |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Domestic Appliance Manufacturers

Banks and Financial Institution

Private Equity Firms

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Consumer Affairs, Bureau of Energy Efficiency)

Water Conservation and Environmental Agencies

Companies

Players Mentioned in the Report:

Bosch

IFB Industries

LG Electronics

Siemens

Whirlpool Corporation

Samsung Electronics

Voltas Beko

Elica PB India

Hafele India

Faber Appliances

Table of Contents

1. India Dishwashing Machines Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Segmentation Overview

2. India Dishwashing Machines Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Key Market Milestones

2.3 Year-On-Year Growth Analysis

3. India Dishwashing Machines Market Analysis

3.1 Growth Drivers

3.1.1 Demand for Energy Efficiency and Water Conservation

3.1.2 Shift Towards Modern Kitchen Appliances

3.1.3 Growing Middle-Class Income Levels

3.1.4 Increased Product Awareness

3.2 Market Challenges

3.2.1 High Initial Costs (Pricing Sensitivity)

3.2.2 Cultural Bias Against Machine Washing

3.2.3 Water Supply Constraints

3.2.4 Limited Awareness in Tier-2 and Tier-3 Cities

3.3 Opportunities

3.3.1 Expansion in Rural Markets

3.3.2 Integration with IoT for Smart Kitchens

3.3.3 Potential for Customized Models

3.3.4 Expansion through E-commerce Channels

3.4 Trends

3.4.1 Adoption of Modular Kitchen Appliances

3.4.2 Rising Popularity of Freestanding Models

3.4.3 Preference for Compact and Portable Units

3.4.4 Influence of Product Durability and After-Sales Service

3.5 Government Initiatives

3.5.1 Make in India for Local Manufacturing

3.5.2 Subsidies for Energy-Efficient Appliances

3.5.3 Water Conservation Regulations

4. India Dishwashing Machines Market Segmentation

4.1 By Product Type

4.1.1 Freestanding Dishwashers

4.1.2 Built-In Dishwashers

4.1.3 Countertop Models

4.2 By End-User (in Value %)

4.2.1 Residential

4.2.2 Commercial

4.3 By Distribution Channel

4.3.1 Multi-Branded Stores

4.3.2 Exclusive Stores

4.3.3 Online Retail

4.3.4 Hypermarkets/Supermarkets

4.4 By Region

4.4.1 Northern India

4.4.2 Southern India

4.4.3 Western India

4.4.4 Eastern India

4.5 By Customer Demographics

4.5.1 Urban vs Rural Market Adoption

4.5.2 Dual-Income Households

5. India Dishwashing Machines Market Competitive Landscape

5.1 Competitor Analysis

5.1.1 IFB Industries

5.1.2 Bosch Home Appliances

5.1.3 LG Electronics

5.1.4 Siemens

5.1.5 Samsung Electronics

5.1.6 Whirlpool Corporation

5.1.7 Voltas Beko

5.1.8 Elica PB India

5.1.9 Hafele India

5.1.10 Faber Appliances

5.1.11 Haier India

5.1.12 Glen Appliances

5.1.13 Hindware Appliances

5.1.14 Croma (Tata Enterprises)

5.1.15 Kaff Appliances

5.2 Cross Comparison Parameters (Product Range, Distribution Network, R&D Expenditure, Brand Loyalty, After-Sales Service, Pricing Strategies, Marketing Tactics, Local Manufacturing)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Mergers, Acquisitions, Partnerships)

5.5 Investment and Funding Landscape

6. India Dishwashing Machines Market Regulatory Framework

6.1 Environmental Standards and Certifications

6.2 Compliance Requirements for Smart Appliances

6.3 Tax Benefits on Energy-Efficient Appliances

7. India Dishwashing Machines Future Market Size (in USD Mn)

7.1 Projected Market Growth

7.2 Factors Expected to Influence Future Growth

8. India Dishwashing Machines Future Market Segmentation

8.1 By Product Type

8.2 By End-User

8.3 By Distribution Channel

8.4 By Region

8.5 By Customer Demographics

9. India Dishwashing Machines Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Insights

9.3 Marketing Strategies for Market Penetration

9.4 White Space Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on constructing an in-depth market framework involving all stakeholders within the India dishwashing machines market. Desk research across trusted databases and proprietary sources is conducted to define key variables that influence market dynamics.

Step 2: Market Analysis and Construction

This phase involves collecting historical data, examining market penetration trends, and analyzing revenue and growth trajectories. Product performance, consumer behavior, and service quality statistics are evaluated to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are formed based on collected data, which are then validated through interviews with industry experts, gaining insights into operational challenges, financial trends, and market-specific attributes.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from various market participants to verify trends in product segments, sales, and consumer preferences. This process ensures a comprehensive, validated analysis of the India dishwashing machines market.

Frequently Asked Questions

01. How big is the India Dishwashing Machines Market?

The India dishwashing machines market is valued at USD 510 million, driven by the increasing demand for automated home solutions and convenience appliances among urban households.

02. What challenges face the India Dishwashing Machines Market?

Key challenges in the India dishwashing machines market include cultural biases toward hand-washing, concerns over water consumption, and price sensitivity, particularly in tier-2 and tier-3 cities.

03. Who are the major players in the India Dishwashing Machines Market?

Key players in the India dishwashing machines market include Bosch, IFB, LG, Siemens, and Whirlpool, each contributing through brand strength, product innovation, and a robust distribution network.

04. What drives the India Dishwashing Machines Market?

The India dishwashing machines market is driven by factors like dual-income households, increased consumer awareness, and the availability of compact, energy-efficient models tailored for Indian kitchens.

05. Which regions dominate the India Dishwashing Machines Market?

Southern India leads due to higher urbanization rates and a large working-class population, with demand also coming from metropolitan cities in Northern and Western India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.