India Disposable Hygiene Products Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD10026

November 2024

99

About the Report

India Disposable Hygiene Products Market Overview

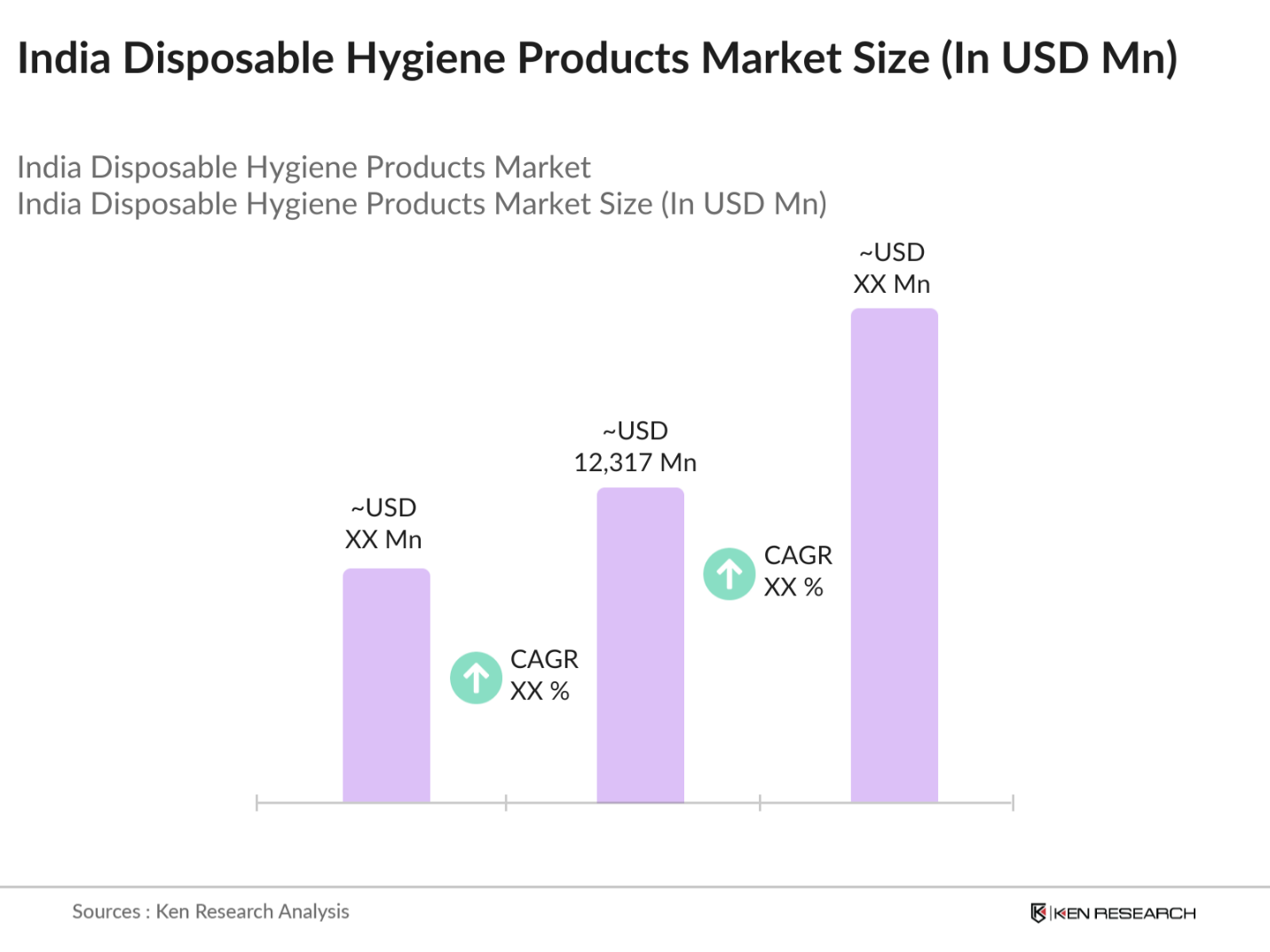

- The India Disposable Hygiene Products Market is valued at USD 12,317 million, based on a five-year historical analysis. This market is largely driven by increasing health and hygiene awareness, rising disposable incomes, and growing urbanization in India. Key product segments like baby diapers, adult incontinence products, and sanitary napkins are experiencing robust demand due to enhanced accessibility through organized retail channels and expanding e-commerce reach.

- Delhi, Mumbai, and Bangalore are major cities driving demand within the market. High population density, urbanization, and significant purchasing power in these cities fuel the demand for disposable hygiene products. Additionally, the concentration of major retailers and advanced healthcare infrastructure in these regions enhances accessibility and consumer awareness, supporting product uptake and establishing these cities as leading markets within India.

- The Indian government has introduced regulations mandating the responsible disposal and recycling of hygiene products, pushing companies towards sustainable alternatives. Compliance with these regulations, under Indias Plastic Waste Management Rules, is vital for companies operating in the market.

India Disposable Hygiene Products Market Segmentation

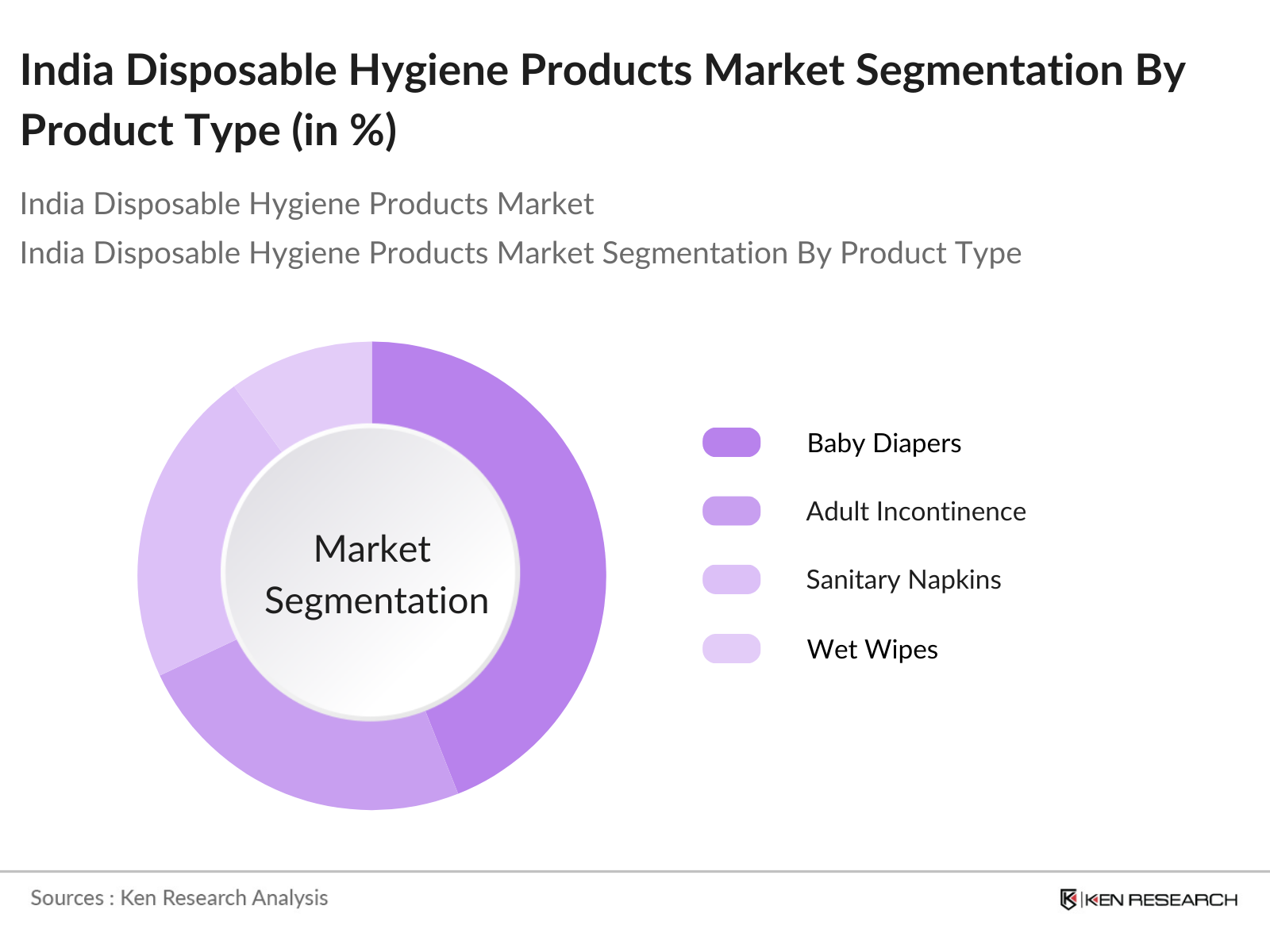

By Product Type: The market is segmented by product type into baby diapers, adult incontinence products, sanitary napkins, wet wipes, and others. Baby diapers dominate the segment due to increased birth rates, improved standards of living, and heightened awareness of infant hygiene. Market leaders like Procter & Gamble and Unicharm cater to this demand with extensive product lines designed for comfort and absorbency, which strengthen the market share of this sub-segment.

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, pharmacies, online channels, and others. Supermarkets and hypermarkets lead the market share, largely due to the availability of a wide product range, attractive promotional discounts, and the convenience offered to consumers. Organized retail outlets continue to be a strong choice, with brands using these locations for strategic marketing and product positioning.

India Disposable Hygiene Products Market Competitive Landscape

The India Disposable Hygiene Products Market is dominated by global and local players. Major companies drive innovation through product development in eco-friendly alternatives and a strong focus on pricing strategies to cater to various income groups. The competitive landscape is shaped by these companies ability to adapt to consumer preferences while adhering to environmental standards.

India Disposable Hygiene Products Industry Analysis

Growth Drivers

- Increasing Urbanization and Disposable Income: India's urban population is projected to rise to over 600 million by 2030, spurring demand for disposable hygiene products as urban consumers prioritize convenience and hygiene. Rising disposable incomes, currently estimated at $2,300 per capita, have increased affordability for premium and essential hygiene products like diapers and sanitary napkins. The expanding middle class, representing 31% of the population, now allocates more spending towards healthcare and hygiene, contributing to market growth in urban and semi-urban areas.

- Health Awareness and Personal Hygiene Importance: Public health campaigns such as Swachh Bharat Abhiyan have amplified awareness around personal hygiene, with 80% of urban households reportedly adopting hygiene products regularly. Additionally, the governments awareness programs are reaching rural areas, helping reduce preventable diseases related to inadequate hygiene practices. Survey data from 2023 highlights a 20% increase in rural hygiene product adoption, underscoring the societal shift towards consistent hygiene practices in India.

- Technological Advancements in Product Development: Advances in materials science have led to the development of skin-safe, hypoallergenic, and biodegradable hygiene products. The introduction of ultra-thin and high-absorbency materials in sanitary pads and diapers has made them more effective and comfortable, attracting a broader user base. Recent investments by multinational corporations have enabled local manufacturers to access improved technology, enabling better product standards and expanded market reach.

Market Challenges

- Environmental Impact and Sustainability Concerns: With India generating 0.5 million tons of non-biodegradable waste from hygiene products annually, sustainability concerns are rising among consumers. Environmental advocacy groups are pushing for alternatives, and approximately 15% of Indian consumers have started opting for biodegradable hygiene products. This growing environmental consciousness, driven by NGO campaigns and consumer advocacy, presents a challenge for conventional product segments.

- Raw Material Cost Fluctuations: The cost of imported raw materials, such as superabsorbent polymers and fluff pulp, has increased by 10-15% in 2023 due to currency fluctuations and supply chain issues. Given that 70% of India's hygiene products rely on imports for these key materials, manufacturers face cost pressures, which could impact product pricing and affordability in the domestic market.

India Disposable Hygiene Products Market Future Outlook

The India Disposable Hygiene Products Market is expected to witness steady growth driven by continued urbanization, increased healthcare awareness, and rising disposable incomes. The adoption of eco-friendly products will grow as consumers increasingly seek sustainable alternatives to reduce environmental impact. Additionally, online channels and direct-to-consumer models will gain further traction, fueled by a young, tech-savvy consumer base and improved internet penetration.

Market Opportunities

- Demand for Biodegradable and Eco-Friendly Products: With rising environmental awareness, Indias eco-friendly hygiene product segment has seen a surge, notably in urban areas where 25% of consumers reportedly prefer biodegradable options. This shift is fueled by growing health and sustainability consciousness among younger consumers and government incentives for sustainable manufacturing.

- Expansion into Rural Markets: Government initiatives like Jan Aushadhi Kendra, which provides affordable hygiene products, have improved rural access, where 70% of India's population resides. Such efforts, combined with subsidies on essential health products, are creating growth potential in underserved rural markets, positioning companies to tap into a largely unaddressed customer base.

Scope of the Report

|

Product Type |

Baby Diapers Adult Incontinence Sanitary Napkins Wet Wipes Others |

|

Distribution Channel |

Supermarkets Pharmacies E-commerce Local Retailers |

|

Material Type |

Non-Woven Polymer-Based Biodegradable |

|

Age Group |

Infants Adults Elderly |

|

Region |

North South East West India |

Products

Key Target Audience

Manufacturers and Suppliers of Disposable Hygiene Products

Retailers and Distributors

E-commerce Platforms

Hospitals and Medical Facilities

Government and Regulatory Bodies (Ministry of Health and Family Welfare, Central Pollution Control Board)

Environmental Organizations and NGOs

Investment and Venture Capitalist Firms

Packaging and Material Suppliers

Companies

Players Mentioned in the Report

Procter & Gamble India

Kimberly-Clark India Pvt. Ltd.

Unicharm India Pvt. Ltd.

Johnson & Johnson Pvt. Ltd.

Essity India

Ontex Group India

Domtar Corporation

Kao Corporation India

Edgewell Personal Care

Hengan International

Table of Contents

1. India Disposable Hygiene Products Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Segmentation Overview

2. India Disposable Hygiene Products Market Size (In INR and USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Milestones and Developments

3. India Disposable Hygiene Products Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urbanization and Disposable Income

3.1.2 Health Awareness and Personal Hygiene Importance

3.1.3 Technological Advancements in Product Development

3.1.4 Expanding Retail and E-commerce Channels

3.2 Market Challenges

3.2.1 Environmental Impact and Sustainability Concerns

3.2.2 Raw Material Cost Fluctuations

3.2.3 Competition with Local and Unbranded Products

3.3 Opportunities

3.3.1 Demand for Biodegradable and Eco-Friendly Products

3.3.2 Expansion into Rural Markets

3.3.3 Increased Government Support and Initiatives

3.4 Key Trends

3.4.1 Use of Plant-Based and Biodegradable Materials

3.4.2 Product Customization and Premiumization

3.4.3 Rise in Subscription and Direct-to-Consumer Models

4. Regulatory Landscape

4.1 Environmental Standards and Regulations

4.2 Compliance Requirements for Product Materials

4.3 Government Initiatives Promoting Hygiene Awareness

4.4 Certifications and Safety Standards in India

5. Market Segmentation Analysis

5.1 By Product Type (In Volume and Value)

5.1.1 Baby Diapers

5.1.2 Adult Incontinence Products

5.1.3 Sanitary Napkins

5.1.4 Wet Wipes

5.1.5 Others (Tissues, Cotton Pads)

5.2 By Distribution Channel

5.2.1 Supermarkets and Hypermarkets

5.2.2 Drug Stores and Pharmacies

5.2.3 E-commerce

5.2.4 Local Retailers

5.3 By Material Type

5.3.1 Non-Woven

5.3.2 Polymer-Based

5.3.3 Biodegradable

5.4 By Age Group

5.4.1 Infants

5.4.2 Adults

5.4.3 Elderly

5.5 By Region (In Value)

5.5.1 North India

5.5.2 South India

5.5.3 East India

5.5.4 West India

6. Competitive Landscape

6.1 Company Profiles and Market Shares

6.1.1 Procter & Gamble India

6.1.2 Kimberly-Clark India Pvt. Ltd.

6.1.3 Unicharm India Pvt. Ltd.

6.1.4 Johnson & Johnson Pvt. Ltd.

6.1.5 Essity India

6.1.6 Ontex Group India

6.1.7 Domtar Corporation

6.1.8 Kao Corporation India

6.1.9 Edgewell Personal Care

6.1.10 Hengan International

6.1.11 First Quality Enterprises

6.1.12 Nobel Hygiene Pvt. Ltd.

6.1.13 Niine Sanitary Napkins

6.1.14 Bella Hygiene India

6.1.15 Dispowear Sterite Co.

6.2 Cross Comparison Parameters (Headquarters, Employees, Revenue, Profit Margin, Innovation Rate, Sustainability Initiatives, Distribution Reach, Market Share)

6.3 Strategic Developments

6.4 Market Share Analysis

7. Future Market Size (INR and USD Bn)

7.1 Future Market Projections

7.2 Key Factors Influencing Future Market Growth

8. Future Market Segmentation

8.1 By Product Type

8.2 By Distribution Channel

8.3 By Material Type

8.4 By Age Group

8.5 By Region

9. Market Analyst Recommendations

9.1 Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Market Entry and Growth Strategies

9.3 White Space and Emerging Opportunity Analysis

9.4 Investment Opportunities and Partnering Prospects

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping stakeholders across Indias Disposable Hygiene Products Market, including manufacturers, distributors, and consumers. Extensive secondary research was conducted to gather industry-level insights, focusing on product innovations and consumer preferences.

Step 2: Market Analysis and Construction

In this phase, historical data was analyzed to determine the impact of market drivers, consumer demographics, and emerging trends. A comparative analysis across different regions within India was conducted to validate revenue data and establish market penetration ratios.

Step 3: Hypothesis Validation and Expert Consultation

A hypothesis on growth trends was validated through in-depth interviews with industry experts, including executives from major disposable hygiene product companies. Insights gathered helped refine data accuracy and identify key growth areas.

Step 4: Research Synthesis and Final Output

The final synthesis involved consolidating data from previous steps with direct input from industry participants, ensuring a robust, validated outlook for the India Disposable Hygiene Products Market.

Frequently Asked Questions

01. How big is the India Disposable Hygiene Products Market?

The India Disposable Hygiene Products Market is valued at USD XX million, based on a five-year historical analysis. This market is largely driven by increasing health and hygiene awareness, rising disposable incomes, and growing urbanization in India.

02. What are the challenges in the India Disposable Hygiene Products Market?

Challenges include high environmental impact due to non-biodegradable materials, fluctuating raw material costs, and competition from local brands offering cheaper alternatives.

03. Who are the major players in the India Disposable Hygiene Products Market?

Key players include Procter & Gamble India, Kimberly-Clark India, Unicharm India Pvt. Ltd., Johnson & Johnson Pvt. Ltd., and Essity India, all holding significant shares due to strong brand presence and distribution networks.

04. What drives growth in the India Disposable Hygiene Products Market?

Growth is driven by rising hygiene awareness, urbanization, and disposable income levels. Demand for eco-friendly options is also propelling innovation within the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.