India Dog Food Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD5132

October 2024

95

About the Report

India Dog Food Market Overview

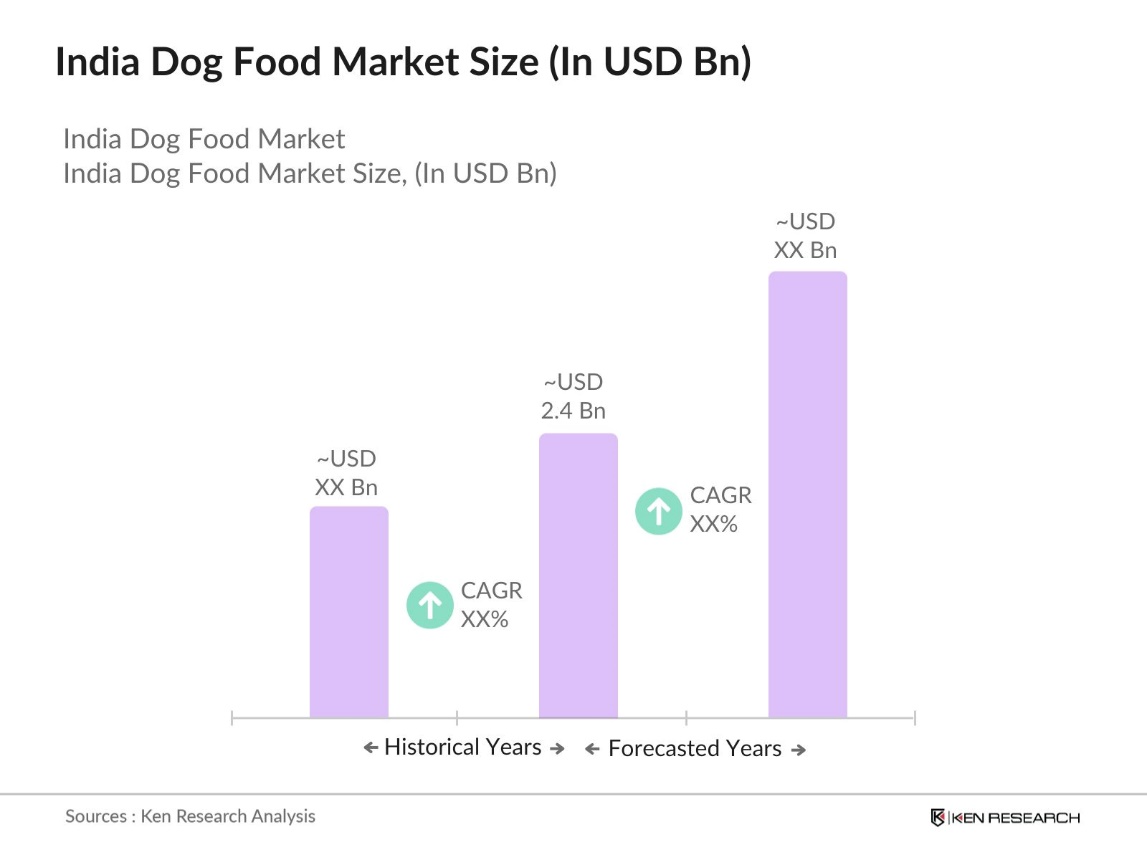

- The India Dog Food Market is valued at USD 2.4 billion based on a five-year historical analysis. The market has grown due to the increasing pet adoption rates and growing awareness among pet owners regarding the nutritional needs of their dogs. Urbanization and a shift towards nuclear families have also contributed significantly to the rising demand for dog food, as more families adopt dogs as companions. The demand for premium and specialized dog food products is steadily increasing due to rising disposable incomes and the willingness of consumers to spend on pet healthcare and wellness.

- In India, major cities like Mumbai, Delhi, and Bengaluru dominate the dog food market. This dominance is attributed to the higher pet ownership rates in these urban centers and the presence of a growing middle-class population that values pet nutrition and wellness. Additionally, these cities have better distribution networks and access to international dog food brands. The availability of premium products and the rise in e-commerce further drive sales in these regions.

- In March 2024, India's Drugs Technical Advisory Board recommended a national ban on the veterinary drug nimesulide, which is toxic to vultures. This follows years of research by conservation groups and the Indian Veterinary Research Institute, showing that vultures die after ingesting cattle treated with nimesulide. The move builds on prior bans of aceclofenac and ketoprofen, furthering efforts to protect vulture populations in India.

India Dog Food Market Segmentation

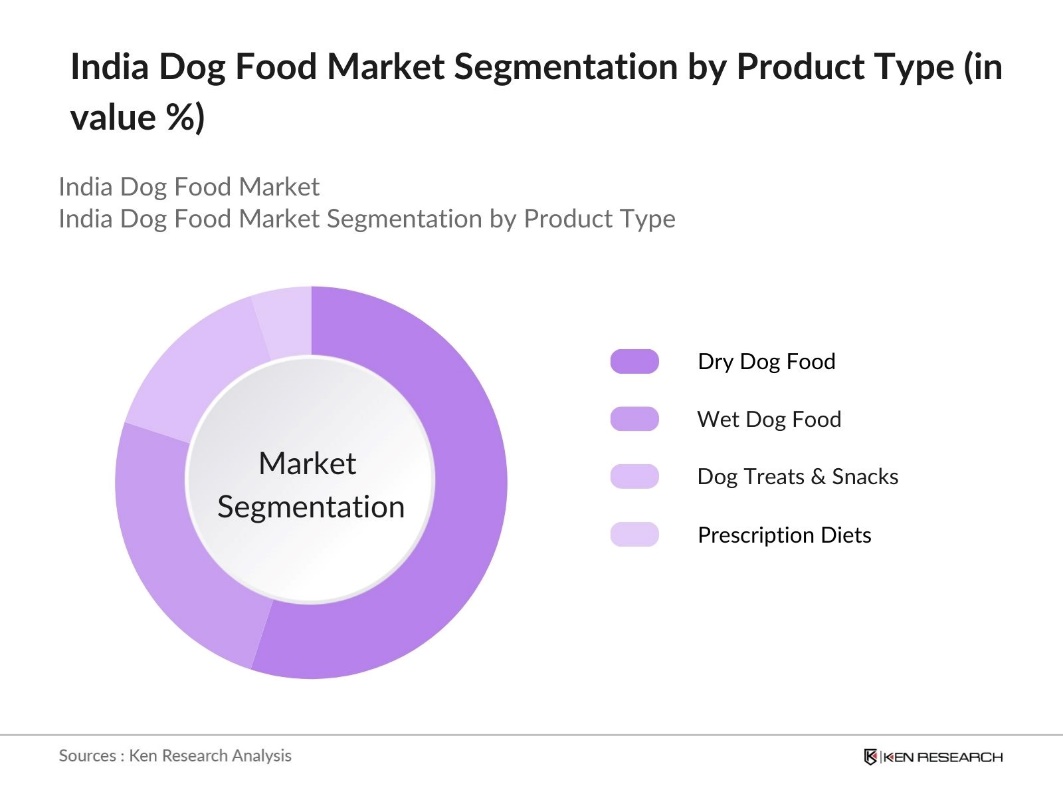

By Product Type: The India Dog Food Market is segmented by product type into dry dog food, wet dog food, dog treats and snacks, and prescription diets. Dry dog food holds the largest market share under this segmentation due to its affordability and longer shelf life compared to wet dog food. Pet owners prefer dry dog food for its ease of storage, feeding convenience, and cost-effectiveness. Brands like Pedigree and Royal Canin have established themselves as trusted providers of high-quality dry dog food, cementing the dominance of this sub-segment.

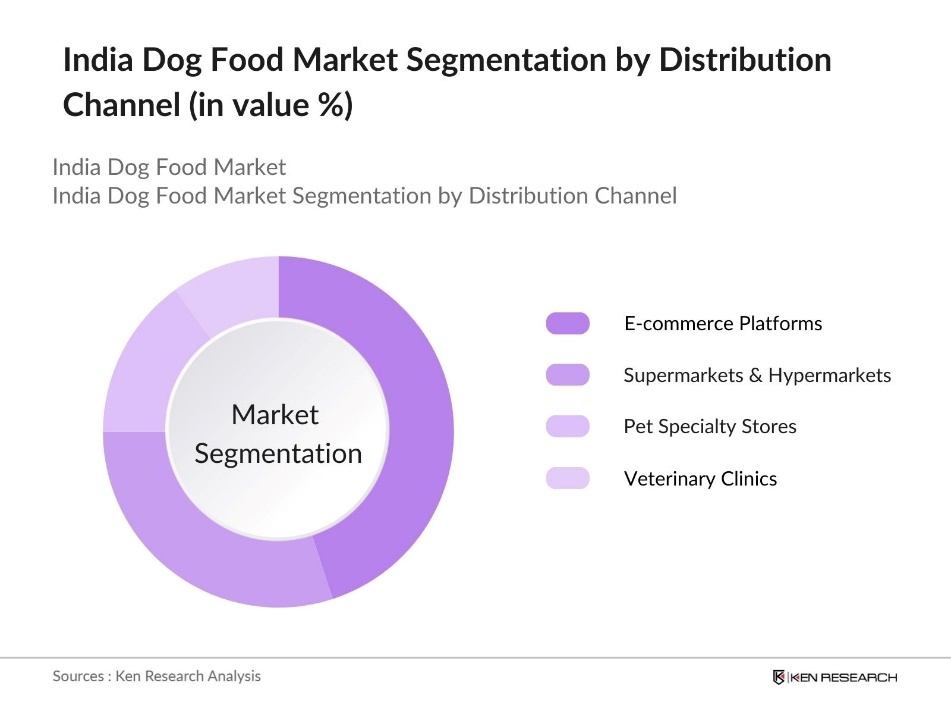

By Distribution Channel: The India Dog Food Market is segmented by distribution channels into e-commerce platforms, supermarkets and hypermarkets, pet specialty stores, and veterinary clinics. E-commerce platforms dominate this segment due to the rising penetration of online shopping and the convenience of home delivery. Platforms like Amazon, Flipkart, and PetSutra have revolutionized pet food purchasing by offering a wide range of products and discounts. E-commerce has been especially impactful in Tier 2 and Tier 3 cities where access to premium products was previously limited.

India Dog Food Market Competitive Landscape

The market is characterized by the presence of several global and domestic players, with a few key brands dominating due to their established distribution networks and brand recognition. The market is dominated by brands such as Mars Petcare and Nestl Purina PetCare, which have long been the trusted providers for dog owners in India. Local players like Himalaya Herbal Healthcare are also gaining traction by offering natural and organic dog food products, which appeal to health-conscious pet owners.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (INR Bn) |

Product Range |

No. of Employees |

Distribution Network |

E-commerce Strategy |

Manufacturing Facilities |

|

Mars Petcare India Pvt Ltd |

1911 |

Gurgaon, India |

||||||

|

Nestl Purina PetCare India |

1894 |

Mumbai, India |

||||||

|

Royal Canin India Pvt Ltd |

1967 |

Hyderabad, India |

||||||

|

Himalaya Herbal Healthcare |

1930 |

Bengaluru, India |

||||||

|

Drools Pet Food Pvt Ltd |

2010 |

Noida, India |

India Dog Food Industry Analysis

Growth Drivers

- Rising Disposable Income: The India per capita disposable income reached an increase from INR 2.14 Lakh in 2024, driven by economic growth and a burgeoning middle class. As disposable income grows, so does the ability of pet owners to spend on premium dog food products, health supplements, and grooming services. The trend is particularly visible in urban areas like Delhi, Mumbai, and Bengaluru, where pet owners spend significantly on high-quality and specialized dog food, boosting the market's overall growth. This economic uplift is crucial in driving the dog food market upward in both the short and long term.

- Increasing Pet Adoption Rates: The growing trend of pet adoption is a major driver for the dog food market in India. In 2023, over 33 million has overall population of dog. This growth is supported by increasing urbanization, as more urban families seek companionship from pets. Furthermore, the rise in nuclear families and single-person households has accelerated pet ownership.

- Shift Toward Premium Dog Food Products: There is a clear trend toward premium dog food products as pet owners increasingly prioritize nutritional benefits for their pets. Urban consumers, in particular, are driving this shift, with a growing preference for organic, grain-free, and gluten-free options. This demand for higher-quality products is also supported by enhanced regulations and quality standards, such as those set by the Food Safety and Standards Authority of India (FSSAI), which have contributed to building consumer trust in premium dog food brands.

Market Challenges

- High Price Sensitivity in Rural Areas: In rural India, price sensitivity is a hurdle for this market. Consumers in these regions tend to opt for lower-priced or homemade alternatives due to limited purchasing power. High costs of premium dog food products make them less accessible in rural areas, where there is less disposable income. As a result, market penetration of branded dog food remains low in comparison to urban areas, where spending capacity is higher, leading to a more robust market.

- Dependence on Imports for High-Quality Ingredients: Indias dog food industry relies heavily on imported ingredients, particularly for premium segments. These imported components, such as specialty grains and meat meals, are essential for producing high-quality dog food. However, reliance on international supply chains makes the market vulnerable to fluctuations in global availability and pricing. Additionally, import duties further raise the cost of production, limiting the competitiveness of premium dog food products and contributing to higher consumer prices in India.

India Dog Food Market Future Outlook

Over the next five years, the India Dog Food Market is expected to show significant growth driven by increasing pet ownership, the expansion of premium dog food categories, and the rise of e-commerce platforms. Additionally, growing awareness about the importance of balanced nutrition and pet wellness is likely to fuel demand for high-quality and specialized products like prescription diets and natural ingredients. The market will also benefit from innovations in packaging, sustainability efforts, and increased investment in pet healthcare.

Market Opportunities

- E-commerce Penetration: Indias e-commerce growth has significantly impacted the pet food market, making dog food more accessible across various regions. The convenience of online shopping has driven demand for premium and niche brands, especially in smaller cities. Major platforms, along with pet-focused online retailers, provide a wide range of products, contributing to the increasing penetration of dog food through digital channels.

- Customization and Niche Diets (Gluten-Free, Grain-Free, Organic): Consumers are increasingly opting for specialized dog food, such as gluten-free, grain-free, and organic options, to meet specific dietary needs. This growing demand for customized diets is driven by heightened awareness of pet health, with many dog owners seeking products that cater to allergies or other conditions. Domestic manufacturers are responding to this trend by offering more niche products, creating opportunities for both established players and new entrants in the market.

Scope of the Report

|

Product Type |

Dry Dog Food, Wet Dog Food Dog Treats & Snacks Prescription Diets Raw & Freeze-Dried Dog Food |

|

Ingredient Type |

Animal-Based Ingredients Plant-Based Ingredients Organic Ingredients Synthetic Additives |

|

Price Range |

Premium Dog Food Mid-Range Dog Food Economical Dog Food |

|

Distribution Channel |

E-commerce Platforms Supermarkets & Hypermarkets Pet Specialty Stores Veterinary Clinics |

|

Region |

North South East West |

Products

Key Target Audience

Dog Food Manufacturers

E-commerce Platforms (Amazon, Flipkart, PetSutra)

Dog Breeding Centers

Luxury Pet Product Brands

Government and Regulatory Bodies (FSSAI)

Investment and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Major Players

Mars Petcare India Pvt Ltd

Nestl Purina PetCare India

Royal Canin India Pvt Ltd

Himalaya Herbal Healthcare

Drools Pet Food Pvt Ltd

Farmina Pet Foods India

Arden Grange

Hill's Pet Nutrition

Me-o Pet Food

Purepet

Dogsee Chew

Taste of the Wild

IAMS

Canine Creek

Pedigree India

Table of Contents

1. India Dog Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Dog Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Dog Food Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Pet Adoption Rates

3.1.2. Rising Disposable Income

3.1.3. Shift Toward Premium Dog Food Products

3.1.4. Awareness of Dog Health and Nutrition

3.2. Market Challenges

3.2.1. High Price Sensitivity in Rural Areas

3.2.2. Dependence on Imports for High-Quality Ingredients

3.2.3. Limited Distribution Channels in Tier 3 and 4 Cities

3.3. Opportunities

3.3.1. E-commerce Penetration

3.3.2. Customization and Niche Diets (Gluten-Free, Grain-Free, Organic)

3.3.3. Urbanization and Nuclear Families Leading to Higher Pet Ownership

3.4. Trends

3.4.1. Growth in Organic and Natural Dog Food

3.4.2. Increased Spending on Pet Supplements

3.4.3. Rise of Subscription-Based Dog Food Services

3.5. Government Regulation

3.5.1. Food Safety and Standards Authority of India (FSSAI) Regulations

3.5.2. Import Duty on Dog Food Ingredients

3.5.3. Veterinary Drug Control Guidelines

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. India Dog Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dry Dog Food

4.1.2. Wet Dog Food

4.1.3. Dog Treats & Snacks

4.1.4. Prescription Diets

4.1.5. Raw & Freeze-Dried Dog Food

4.2. By Ingredient Type (In Value %)

4.2.1. Animal-Based Ingredients

4.2.2. Plant-Based Ingredients

4.2.3. Organic Ingredients

4.2.4. Synthetic Additives

4.3. By Price Range (In Value %)

4.3.1. Premium Dog Food

4.3.2. Mid-Range Dog Food

4.3.3. Economical Dog Food

4.4. By Distribution Channel (In Value %)

4.4.1. E-commerce Platforms

4.4.2. Supermarkets & Hypermarkets

4.4.3. Pet Specialty Stores

4.4.4. Veterinary Clinics

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Dog Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mars Petcare India Pvt Ltd

5.1.2. Nestl Purina PetCare India

5.1.3. Royal Canin India Pvt Ltd

5.1.4. Himalaya Herbal Healthcare

5.1.5. Pedigree India

5.1.6. Drools Pet Food Pvt Ltd

5.1.7. Farmina Pet Foods India

5.1.8. Arden Grange

5.1.9. Hill's Pet Nutrition

5.1.10. Me-o Pet Food

5.1.11. Purepet

5.1.12. Dogsee Chew

5.1.13. Taste of the Wild

5.1.14. IAMS

5.1.15. Canine Creek

5.2. Cross Comparison Parameters (Market Share, Revenue, Product Portfolio, Number of SKUs, Distribution Network, Market Positioning, Local Manufacturing Units, Marketing Expenditure)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. New Product Launches

5.8. Joint Ventures and Collaborations

6. India Dog Food Market Regulatory Framework

6.1. FSSAI Guidelines for Pet Food

6.2. Licensing and Labeling Requirements

6.3. Quality Control Standards for Dog Food Manufacturers

6.4. Import Regulations on Raw Materials

7. India Dog Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Dog Food Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient Type (In Value %)

8.3. By Price Range (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Dog Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Emerging Markets Targeting

9.4. Product Innovation Opportunities

Research Methodology

Step 1: Identification of Key Variables

The first step involves creating a market ecosystem map of the India Dog Food Market, identifying key stakeholders such as manufacturers, retailers, and distributors. Extensive desk research and analysis of proprietary databases are conducted to pinpoint the critical variables driving market dynamics.

Step 2: Market Analysis and Construction

Historical data related to the India Dog Food Market is collected and analyzed, focusing on product categories, sales volumes, and revenue generation. This analysis includes assessing consumer demand trends and growth in the online retail sector for dog food.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews with professionals from prominent dog food companies. Their insights are used to refine the data and ensure its accuracy, particularly regarding competitive strategies, consumer preferences, and distribution channels.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the research into an actionable report, including data from bottom-up market estimations. This ensures the report is both comprehensive and accurate, covering all critical aspects of the India Dog Food Market.

Frequently Asked Questions

01 How big is the India Dog Food Market?

The India Dog Food Market is valued at USD 2.4 billion, driven by the increasing pet ownership rate, a rise in disposable incomes, and awareness regarding pet nutrition.

02 What are the challenges in the India Dog Food Market?

Challenges in the India Dog Food Market include high price sensitivity, particularly in rural areas, the reliance on imported raw materials, and the lack of well-established distribution networks outside major cities.

03 Who are the major players in the India Dog Food Market?

Key players in the India Dog Food Market include Mars Petcare India Pvt Ltd, Nestl Purina PetCare India, Royal Canin India Pvt Ltd, Himalaya Herbal Healthcare, and Drools Pet Food Pvt Ltd. These companies lead due to their established brands, wide distribution networks, and comprehensive product portfolios.

04 What are the growth drivers of the India Dog Food Market?

The India Dog Food Market is driven by the increasing adoption of dogs as pets, rising disposable incomes in urban centers, and a growing awareness of the need for nutritious pet food. Additionally, the expansion of e-commerce platforms has significantly boosted market accessibility.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.