India Dolls and Stuffed Toys Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD4763

November 2024

89

About the Report

India Dolls and Stuffed Toys Market Overview

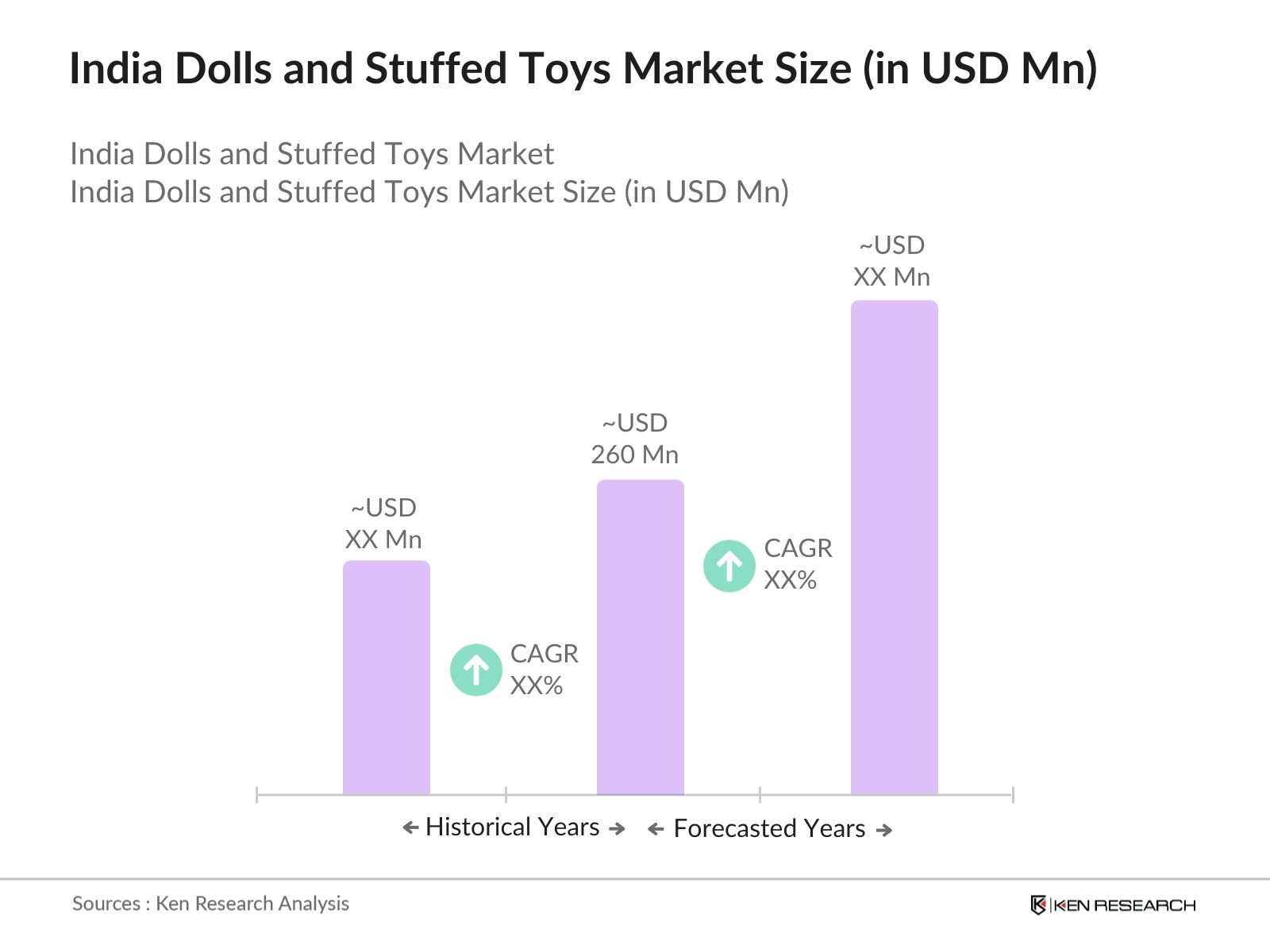

- The India Dolls and Stuffed Toys market is valued at USD 260 million, based on a detailed five-year historical analysis, with projections showing robust growth driven by an increasing demand for educational and developmental toys. Key drivers include a rising population of young children, a growing middle class, and consumer preference for toys that foster cognitive development. Additionally, the advent of eco-friendly materials and customizable toys is shaping the market.

- Maharashtra, Tamil Nadu, and Karnataka dominate the market due to their well-established manufacturing infrastructure, access to raw materials, and a large consumer base. Maharashtra, in particular, leads because of its industrial capacity and extensive distribution networks that facilitate large-scale production and export operations.

- Technological advancements are revolutionizing Indias toy market, with an increasing number of products integrating augmented reality (AR), virtual reality (VR), and mobile applications. Government data from the Ministry of Electronics and Information Technology shows that the usage of mobile applications in toys increased by 15% in 2023. These interactive toys, particularly popular among children aged 5 to 10, include features such as smart sensors and voice recognition, which enhance engagement. The rise of smart classrooms in India, which are expected to reach 500,000 units by the end of 2024, is also driving the demand for tech-enabled educational toys.

India Dolls and Stuffed Toys Market Segmentation

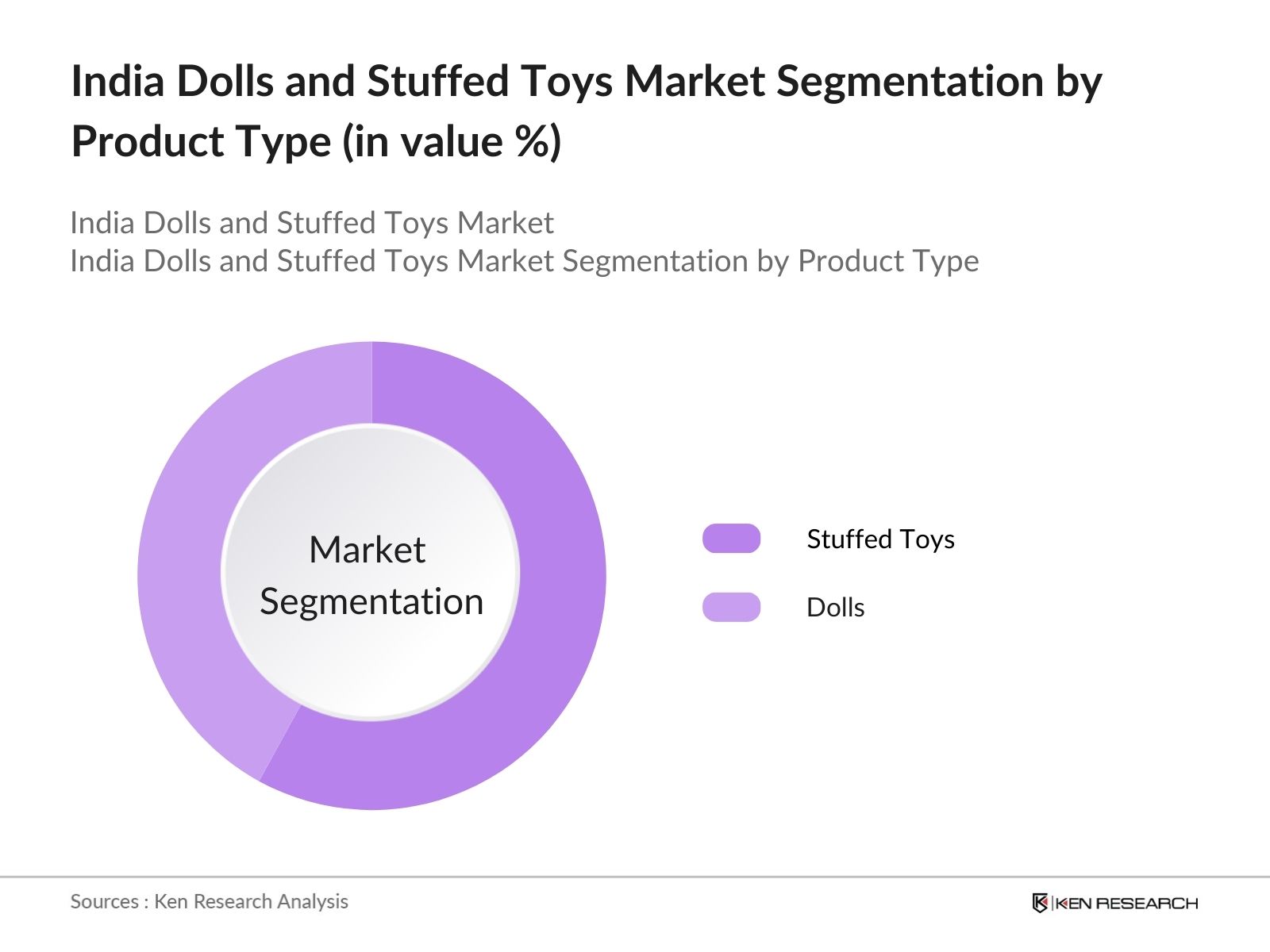

By Product Type: The market is segmented by product type into Dolls and Stuffed Toys. Recently, Dolls have maintained a dominant market share due to the rising popularity of themed dolls and character-based figurines, driven by TV shows and movies. Dolls like Barbie and locally themed dolls are particularly popular among younger children, influencing this segments leadership.

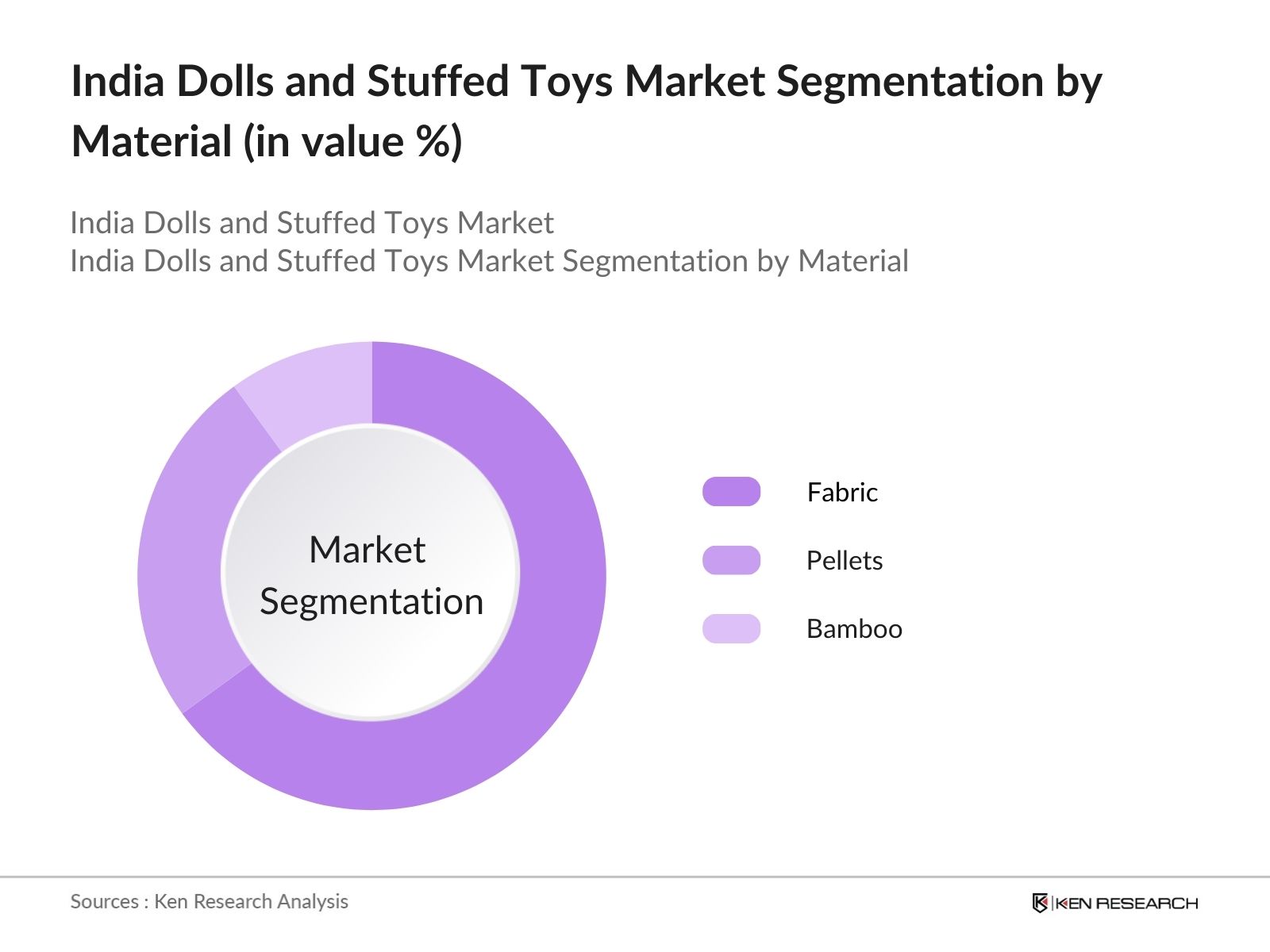

By Material: The market is also segmented by material into Fabric, Pellets, and Bamboo. Among these, Fabric dominates the market due to its versatility and wide availability. Toys made from fabric, such as plush animals and dolls, offer a soft texture, making them highly favored by younger children and parents alike. Additionally, there is a growing trend toward using organic cotton and other eco-friendly fabrics, which resonates with environmentally conscious consumers.

India Dolls and Stuffed Toys Market Competitive Landscape

The market includes both domestic manufacturers like Funskool and international giants such as Lego and Mattel. These companies invest heavily in innovation and branding to capture consumers' attention. Notably, Funskool leads the domestic market due to its strong understanding of local preferences, while global brands dominate through their extensive product variety and licensing agreements with popular franchises.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

Regional Focus |

Innovation Index |

Sustainability Initiatives |

|

Funskool |

1987 |

Chennai, India |

||||||

|

Lego |

1932 |

Billund, Denmark |

||||||

|

Mattel |

1945 |

El Segundo, USA |

||||||

|

Hasbro |

1923 |

Pawtucket, USA |

||||||

|

Green Gold Animation |

2001 |

Hyderabad, India |

India Dolls and Stuffed Toys Industry Analysis

Growth Drivers

- Rising Demand for Educational and Cognitive Development Toys: The Indian market for educational and cognitive development toys is seeing significant growth as parents increasingly prioritize their children's intellectual development. In 2024, more than 30% of toys in the Indian market were focused on education, reflecting growing consumer demand for products that help develop cognitive skills in children under 12. Data from the Ministry of Commerce shows that imports of educational toys have decreased by 18% since 2022 due to rising domestic manufacturing, supported by the governments push for local production. Indias growing middle-class population, currently estimated at over 300 million, is also driving this demand.

- Expansion of E-Commerce Platforms: The rapid growth of e-commerce platforms in India has contributed significantly to the sales of dolls and stuffed toys. As of 2024, online sales of toys in India have exceeded 15 million units annually, supported by platforms like Flipkart, Amazon India, and niche online toy retailers. Government data indicates that digital transactions now constitute over 30% of all retail toy sales. Additionally, with the widespread availability of affordable internet, covering 840 million internet users in India, the e-commerce segment for toys is expected to keep expanding, allowing smaller businesses to reach customers across tier 2 and 3 cities.

- Government Initiatives Supporting Local Toy Manufacturing: Government policies under the "Make in India" and "Atmanirbhar Bharat" initiatives have been pivotal in promoting local toy manufacturing, reducing dependence on imports. As of 2024, the Indian government has set up six toy clusters across key states, including Karnataka, Uttar Pradesh, and Tamil Nadu, leading to a 30% increase in domestic toy production capacity since 2022. This initiative has provided over 25,000 direct jobs in the toy sector. The Indian Ministry of Micro, Small and Medium Enterprises (MSME) has also allocated over 300 crore in financial assistance to help smaller players modernize their production processes.

Market Challenges

- Limited Availability of Locally Manufactured High-Quality Toys: Indias local toy manufacturing industry, although growing, still struggles to compete with the high-quality standards set by international brands. According to DPIIT, only 35% of domestically produced toys meet the Bureau of Indian Standards (BIS) certifications for safety and quality in 2024. This results in limited options for consumers seeking high-quality, durable toys that can compete with international brands. Additionally, a lack of advanced manufacturing infrastructure and skilled labor further hinders local manufacturers from producing at scale while maintaining quality, contributing to the demand for imported toys despite higher costs.

- Fluctuating Raw Material Costs: Manufacturers in the Indian dolls and stuffed toys market face challenges due to fluctuating raw material costs, especially for essential materials like synthetic pellets, cotton, and bamboo. Data from the Ministry of Textiles indicates that the price of fabric materials surged by 10% in 2023, directly impacting production costs. Similarly, the cost of synthetic pellets, a key material for stuffing, increased by 12% in 2024 due to global supply chain disruptions. Bamboo, an eco-friendly material for toy manufacturing, also saw price hikes of around 8%, making it harder for domestic producers to maintain profitability while adhering to eco-friendly standards.

India Dolls and Stuffed Toys Market Future Outlook

Over the next five years, the India Dolls and Stuffed Toys market is expected to grow significantly due to increasing consumer demand for eco-friendly toys and growing digital engagement, particularly through e-commerce platforms. Technological advancements in toy-making, including interactive and sensory features, will further drive market expansion. As more manufacturers adopt sustainable production processes and introduce new lines of customizable toys, the market is set to see further differentiation and innovation, encouraging increased investment from global players.

Future Market Opportunities

- Growth in Licensed Merchandise and Movie-Based Toys: The Indian toy market is witnessing a boom in demand for licensed merchandise, driven by popular franchises like Disney, Marvel, and Indian films. According to the Ministry of Information and Broadcasting, licensed toys associated with movies and popular characters grew by 25% in 2023, supported by the increase in movie viewership across streaming platforms. Bollywood-themed dolls and stuffed toys are particularly popular among children aged 5 to 12, with sales expected to exceed 8 million units in 2024. This trend offers local manufacturers opportunities to collaborate with media houses to produce region-specific, licensed merchandise that resonates with Indian audiences.

- Expansion of Organized Retail and Distribution Networks: Indias retail sector is rapidly organizing, with shopping malls and retail chains expanding into tier 2 and 3 cities. According to government estimates, Indias organized retail sector grew by 18% between 2022 and 2024. With this expansion, toys are becoming more accessible to customers in semi-urban and rural areas, providing an opportunity for both local and international manufacturers. It is about 25% of toy sales in India now occur through organized retail channels, including outlets like Big Bazaar and Reliance Retail. This growing retail network facilitates better product availability, leading to an increase in sales of dolls and stuffed toys across the country.

Scope of the Report

|

By Product Type |

Dolls Stuffed Toys Playsets |

|

By Material |

Pellets Fabric Bamboo |

|

By Gender |

Unisex Boys Girls |

|

By Distribution Channel |

Online Specialty Stores Supermarkets |

|

By Region |

North South East West |

Products

Key Target Audience

Toy Manufacturers

Banks and Financial Institutes

Toy Importers and Exporters

E-Commerce Platforms

Government and Regulatory Bodies (BIS, Ministry of Commerce and Industry)

Investors and Venture Capitalist Firms

Material Suppliers

Licensing and Franchise Owners

Companies

Players Mentioned in the Report

Funskool

Lego

Mattel

Hasbro

Green Gold Animation

Simba

Dreamland Publications

Rubbabu

Hamleys

Zephyr Toymakers

Table of Contents

1. India Dolls and Stuffed Toys Market Overview

1.1. Definition and Scope (Market-specific definition of product categories)

1.2. Market Taxonomy (Dolls, Stuffed Toys, Playsets)

1.3. Market Growth Rate (Increased consumer demand for educational and eco-friendly toys)

1.4. Market Segmentation Overview (By Toy Type, Gender, Distribution Channel, Material)

2. India Dolls and Stuffed Toys Market Size (In USD Mn)

2.1. Historical Market Size (Analysis of market growth and shifts from traditional to modern toys)

2.2. Year-on-Year Growth Analysis (Growth rate driven by demand for themed dolls and character-based toys)

2.3. Key Market Developments and Milestones (Launches, expansions, and significant market activities)

3. India Dolls and Stuffed Toys Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Educational and Cognitive Development Toys

3.1.2. Expansion of E-Commerce Platforms (Increasing digital sales for toys)

3.1.3. Government Initiatives Supporting Local Toy Manufacturing

3.1.4. Increasing Environmental Consciousness (Demand for eco-friendly materials)

3.2. Restraints

3.2.1. High Competition from International Brands

3.2.2. Fluctuating Raw Material Costs (Pellets, Fabric, Bamboo)

3.2.3. Limited Availability of Locally Manufactured High-Quality Toys

3.3. Opportunities

3.3.1. Growth in Licensed Merchandise and Movie-Based Toys

3.3.2. Expansion of Organized Retail and Distribution Networks

3.4. Trends

3.4.1. Adoption of Technologically Advanced Toys (Integration with apps, AR/VR)

3.4.2. Shift towards Organic and Handcrafted Stuffed Toys

3.4.3. Increase in Customized and Personalized Toys for Niche Markets

3.5. SWOT Analysis

3.6. Stakeholder Ecosystem

3.7. Porter's Five Forces Analysis

4. India Dolls and Stuffed Toys Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dolls (Cartoon Characters, Traditional Dolls, Theme-based)

4.1.2. Stuffed Toys (Animals, Plush Toys, Customized Toys)

4.1.3. Playsets (Interactive Sets, Building Playsets)

4.2. By Material (In Value %)

4.2.1. Pellets

4.2.2. Fabric

4.2.3. Bamboo

4.2.4. Others

4.3. By Gender (In Value %)

4.3.1. Unisex

4.3.2. Boys

4.3.3. Girls

4.4. By Distribution Channel (In Value %)

4.4.1. Online Retail

4.4.2. Specialty Stores

4.4.3. Supermarkets and Hypermarkets

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Dolls and Stuffed Toys Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Funskool

5.1.2. Lego

5.1.3. Mattel

5.1.4. Hasbro

5.1.5. Simba

5.1.6. Dreamland Publications

5.1.7. Rubbabu

5.1.8. Green Gold Animation

5.1.9. Hamleys

5.1.10. Zephyr Toymakers

5.1.11. Fisher-Price

5.1.12. Smartcraft Toys

5.1.13. Chicco India

5.1.14. Spin Master

5.1.15. PlayShifu

5.2. Cross Comparison Parameters (Product Portfolio, Production Capabilities, Sales Networks, Revenue, No. of Employees)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Collaborations, Licensing Deals)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants for Local Manufacturing

6. India Dolls and Stuffed Toys Market Regulatory Framework

6.1. Environmental and Safety Standards (Toy Safety Certifications)

6.2. Compliance with Import-Export Regulations (Licensing, Taxation)

6.3. Certification Processes (BIS, ISO Certifications)

7. India Dolls and Stuffed Toys Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Including eco-friendly and technological trends)

7.2. Key Factors Driving Future Market Growth (Customization, Personalization, Licensing)

8. India Dolls and Stuffed Toys Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material (In Value %)

8.3. By Gender (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Dolls and Stuffed Toys Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives for Growth in Domestic Market

9.3. White Space Opportunity Analysis (Niche and Specialty Markets)

9.4. Customer Cohort Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with identifying the key variables driving the India Dolls and Stuffed Toys market, including material costs, consumer trends, and import-export data. This is done through a combination of secondary research and industry reports.

Step 2: Market Analysis and Construction

In this step, historical data from credible sources is analyzed to evaluate the market size, key segments, and performance indicators. Additionally, the market penetration of key brands and the correlation between price points and consumer preferences are assessed.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, interviews are conducted with industry experts, including manufacturers and retailers. Their insights help refine revenue projections and provide an on-the-ground perspective on market conditions.

Step 4: Research Synthesis and Final Output

The final step involves compiling all data and insights into a comprehensive market report. This includes synthesizing data points from both primary interviews and secondary research, ensuring that the report is exhaustive and reliable.

Frequently Asked Questions

01 How big is the India Dolls and Stuffed Toys market?

The India Dolls and Stuffed Toys market was valued at USD 260 million, with significant growth driven by increasing consumer demand for educational toys and eco-friendly materials.

02 What are the challenges in the India Dolls and Stuffed Toys market?

Challenges in India Dolls and Stuffed Toys market include fluctuating raw material costs and high competition from global brands, which can make it difficult for domestic players to maintain price competitiveness and innovation.

03 Who are the major players in the India Dolls and Stuffed Toys market?

Major players in India Dolls and Stuffed Toys market include Funskool, Lego, Mattel, Hasbro, and Green Gold Animation. These companies dominate the market through their product variety, innovation, and extensive distribution networks.

04 What is driving growth in the India Dolls and Stuffed Toys market?

Growth in India Dolls and Stuffed Toys market is driven by the increasing demand for educational toys, the rise of e-commerce platforms, and the trend toward using eco-friendly materials in toy manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.