India Drop shipping market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD6876

November 2024

93

About the Report

India Drop Shipping Market Overview

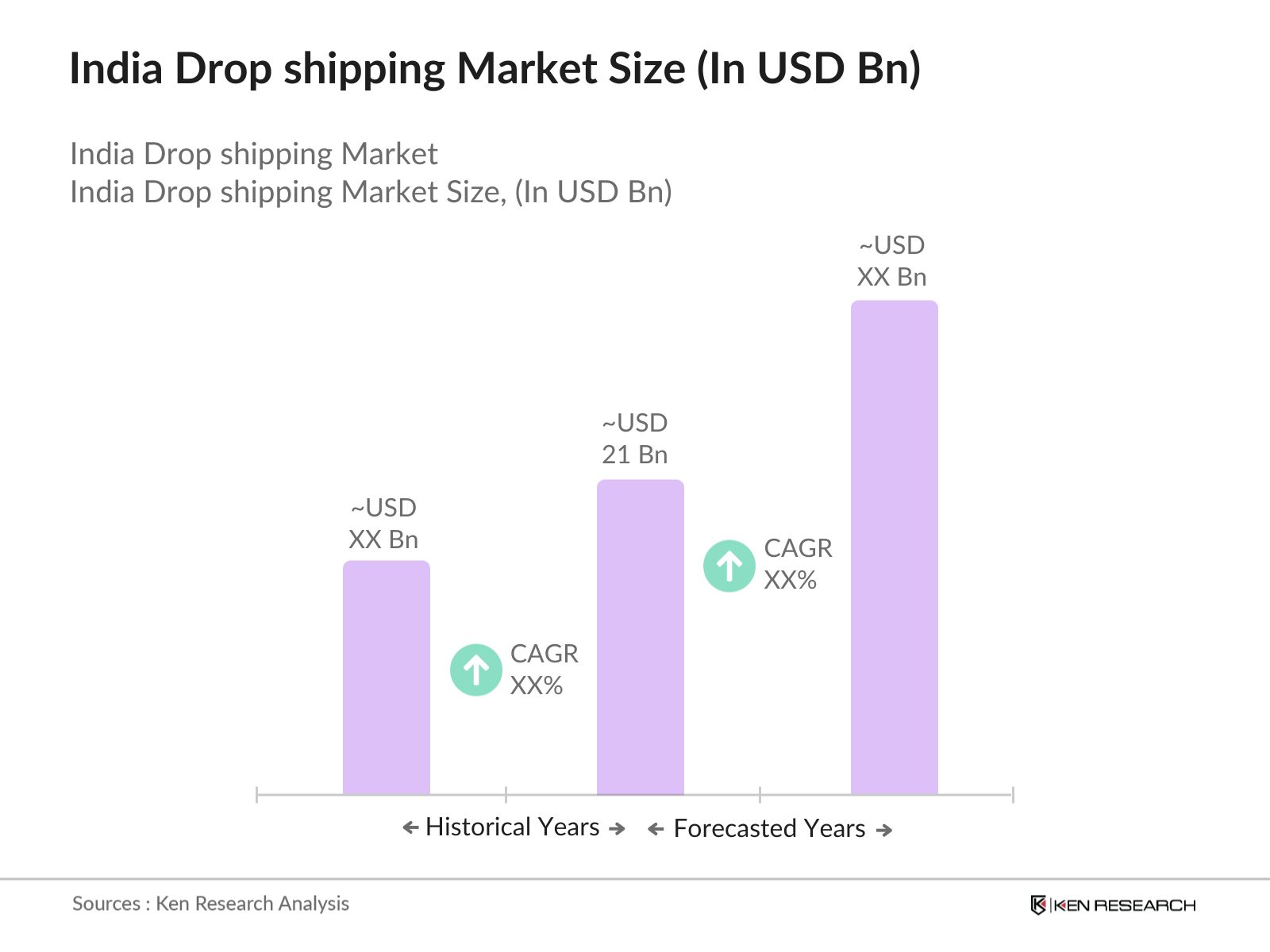

- The India Drop shipping market is valued at USD 21 billion, driven by the rapid growth of e-commerce platforms and the increasing use of internet-enabled devices. With more consumers shifting towards online shopping due to convenience and lower prices, the drop shipping model is flourishing as it requires minimal investment. The scalability of this business model, coupled with the ease of managing inventory through third-party suppliers, makes it highly attractive for small and medium-sized enterprises (SMEs). These factors are anticipated to continue driving the market forward into 2024.

- Metropolitan areas like Mumbai, Delhi, and Bengaluru dominate the India Drop Shipping market due to their established e-commerce ecosystems, access to advanced logistics infrastructure, and a large base of tech-savvy consumers. These cities are also home to a high concentration of small businesses and startups that leverage Drop Shipping to scale their operations. The dominance of these cities is attributed to their digital readiness, strong supply chain networks, and the availability of digital payment options, which are essential for the growth of the Drop Shipping industry.

- The Indian governments Digital India campaign is a significant enabler for the growth of the dropshipping market. The campaign aims to provide high-speed internet access to all citizens, with a focus on rural areas. By 2024, the government plans to provide fiber optic connectivity to over 250,000 gram panchayats, facilitating e-commerce operations in rural India. This initiative directly supports dropshipping businesses, allowing them to reach previously untapped rural markets through digital platforms.

India Drop Shipping Market Segmentation

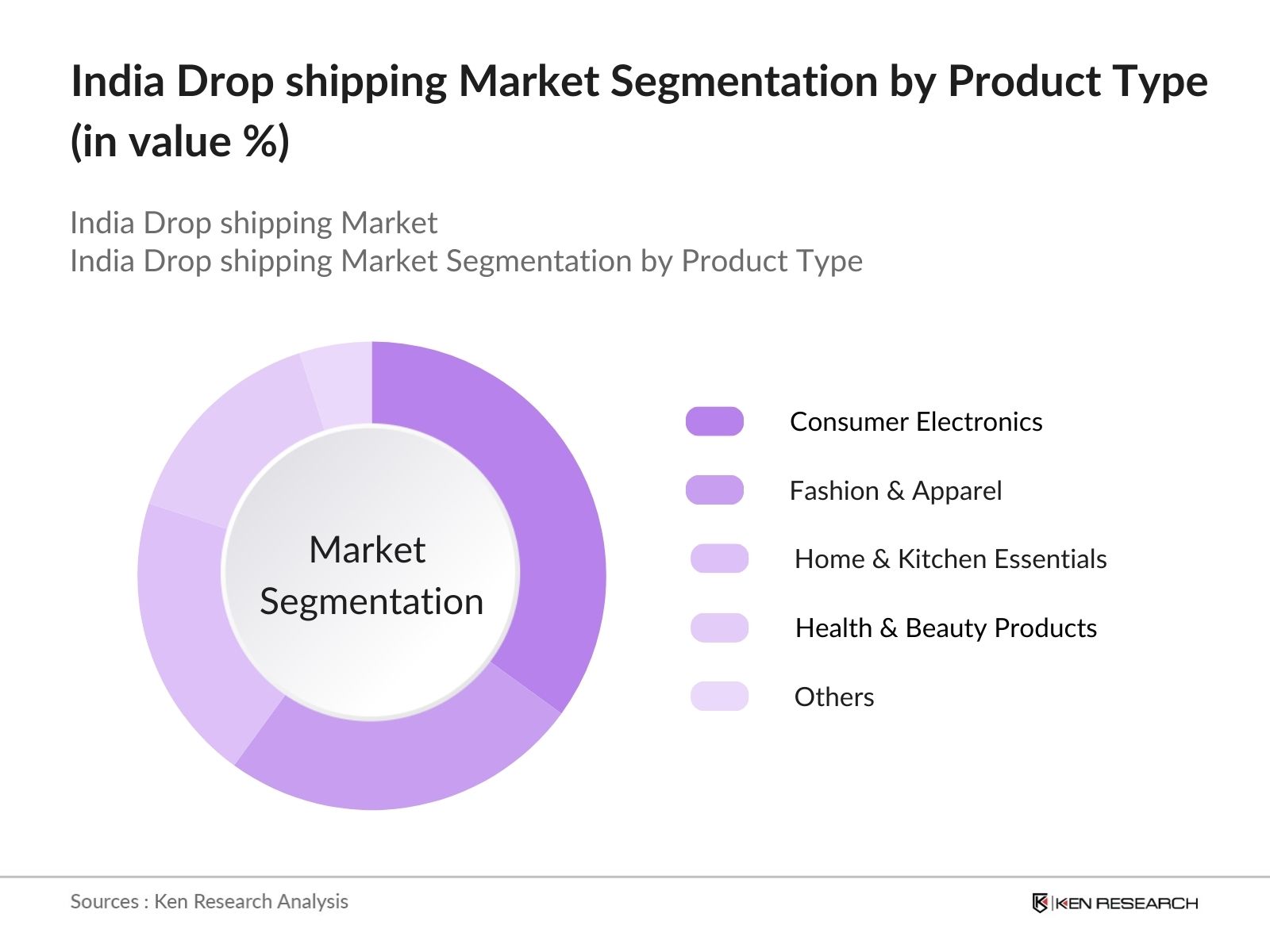

By Product Type: India Drop Shipping market is segmented by product type into Consumer Electronics, Fashion & Apparel, Home & Kitchen Essentials, and Health & Beauty Products. Among these, Consumer Electronics holds a dominant share due to the high demand for gadgets and accessories across urban and rural markets. The convenience of accessing a wide variety of tech products at competitive prices through Drop Shipping platforms has been a major driver. Additionally, the rapid turnover of newer models keeps this category in high demand, further boosting its dominance.

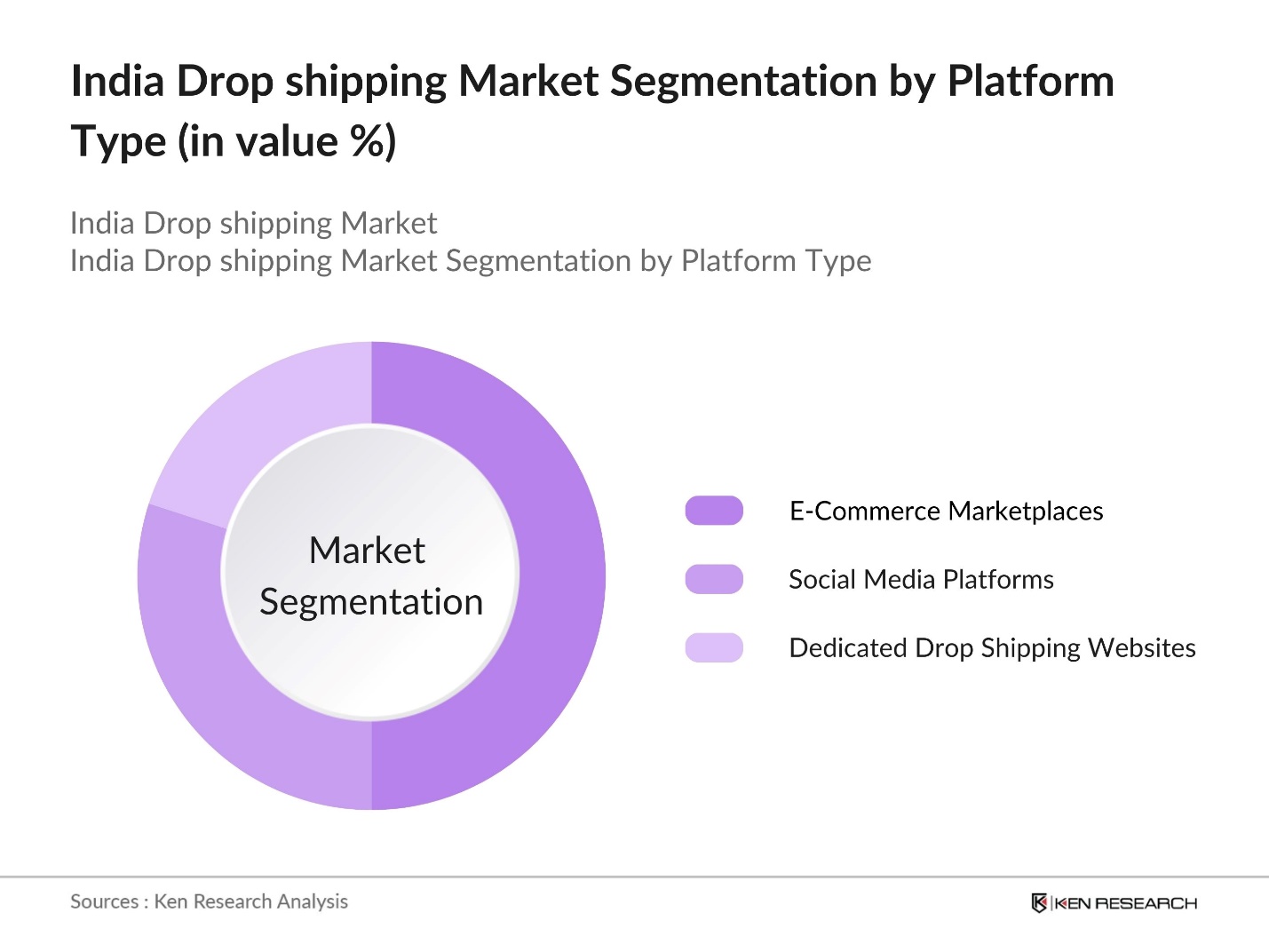

By Platform Type: India Drop Shipping market is also segmented by platform type into E-commerce Marketplaces, Social Media Platforms, and Dedicated Drop Shipping Websites. E-commerce Marketplaces like Amazon and Flipkart account for the largest share of the market as they provide a robust and trusted platform for sellers to reach a vast customer base. These platforms offer integrated payment solutions, extensive logistics networks, and promotional tools, making them the preferred choice for Drop Shipping businesses. The dominance of e-commerce marketplaces is bolstered by their strong brand reputation and customer trust.

India Drop Shipping Market Competitive Landscape

The India Drop Shipping market is competitive with both global and local players. The landscape is characterized by partnerships between e-commerce platforms and third-party suppliers, with a focus on expanding product offerings and improving logistical capabilities.

|

Company Name |

Year of Establishment |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Major Product Categories |

Logistics Network |

E-commerce Partnerships |

|

Shopify |

2006 |

Ottawa, Canada |

- | - | - | - | - |

|

Oberlo |

2015 |

Vilnius, Lithuania |

- | - | - | - | - |

|

AliExpress |

2010 |

Hangzhou, China |

- | - | - | - | - |

|

Amazon |

1994 |

Seattle, USA |

- | - | - | - | - |

|

Meesho |

2015 |

Bangalore, India |

- | - | - | - | - |

India Drop Shipping Market Analysis

Growth Drivers

-

Expansion of E-commerce Ecosystem: The growth of the e-commerce ecosystem in India is playing a crucial role in driving the Drop Shipping market. The Indian e-commerce market is expected to grow significantly, reaching over USD 53 billion by 2024, fueled by a booming online consumer base and increasing digital transactions. Drop Shipping has gained prominence within this ecosystem due to the convenience of selling without holding inventory. This ecosystem includes payment gateways, logistic networks, and marketplaces like Amazon and Flipkart, which facilitate easy Drop Shipping operations and provide scalability opportunities for new entrants. Government-backed initiatives like the Digital India campaign and improving logistics infrastructure further support this growth.

-

Increased Internet Penetration and Smartphone Usage: Indias internet user base is projected to cross 900 million by 2024, driven by affordable smartphones and data plans. The accessibility of the internet has led to a surge in online shopping, expanding the reach of Drop Shipping businesses. Smartphone usage, in particular, facilitates on-the-go shopping and online retail operations. E-commerce growth is closely tied to internet penetration, and with rural internet penetration growing to nearly 40% by 2024, new markets for Drop Shipping are opening up across Tier 2 and Tier 3 cities.

- Low Initial Investment Required

Drop Shipping requires minimal upfront investment, making it an attractive business model for aspiring entrepreneurs. Since sellers dont need to purchase or store inventory, the initial costs are restricted to creating an online store, marketing, and transaction processing. The capital required to start a Drop Shipping business in India can be as low as INR 50,000, a substantial incentive for small business owners looking to enter the e-commerce space. As online tools become more affordable and accessible, the entry barrier continues to lower.

Market Challenges

-

Supply Chain and Logistics Complexities: One of the major challenges in the Indian Drop Shipping market is the complexity of managing supply chains and logistics. While global suppliers can offer competitive pricing, the time taken for deliveries, especially from international markets, often leads to delays. In India, delivery times for international products can take up to 45 days, resulting in customer dissatisfaction and increased returns. Furthermore, poor last-mile connectivity in rural areas exacerbates the challenge of timely deliveries, limiting the scope for efficient order fulfillment in these regions.

- Competition and Market Saturation: The ease of entry into Drop Shipping has led to increased competition, both from domestic sellers and international players. By 2024, it is estimated that there will be over 100,000 active Drop Shipping businesses in India, making market differentiation a major challenge. New entrants often face difficulties in creating unique value propositions, leading to price wars and thinning profit margins. Saturation in product categories such as electronics, fashion, and home goods further intensifies the competition, requiring businesses to explore niche markets for survival.

Future Outlook

The India Drop Shipping market is poised for rapid growth over the next five years, driven by increasing digitization, consumer demand for diverse product categories, and the ease of starting a Drop Shipping business with minimal capital investment. As more individuals turn to online retail for convenience, the market will likely see greater penetration into Tier 2 and Tier 3 cities. Additionally, advancements in AI-powered order fulfillment and inventory management systems are expected to further enhance operational efficiency, enabling Drop Shipping businesses to scale more effectively.

Market Opportunities

-

Integration of Automation and AI in Order Management: The integration of automation and AI technologies in order management systems offers substantial opportunities for Drop Shipping businesses to streamline their operations. By 2024, AI-based tools for demand forecasting and automated inventory updates are expected to reduce operational costs by nearly INR 10 billion for e-commerce businesses. For Drop Shipping, AI integration can help optimize supplier selection, manage order tracking, and reduce the risk of stockouts. The use of AI can improve order accuracy, leading to better customer satisfaction and faster delivery times.

- Expansion of Niche Product Markets: Drop Shipping businesses have a significant opportunity to cater to niche product markets in India. Consumers in Tier 2 and Tier 3 cities are increasingly seeking specialized products that may not be readily available locally. Markets for products such as eco-friendly goods, personalized items, and specialty electronics are expected to see growth by 2024. Entrepreneurs can tap into these underserved markets by offering unique product lines, positioning themselves as differentiated sellers in an otherwise saturated market.

Scope of the Report

|

By Product Type |

Consumer Electronics Fashion & Apparel Home & Kitchen Essentials Health & Beauty Products Others |

|

By Platform Type |

E-commerce Marketplaces Social Media Platforms Dedicated Drop Shipping Websites |

|

By Order Type |

Direct-to-Consumer Business-to-Business (B2B) |

|

By Payment Method |

Digital Wallets Credit/Debit Cards Cash on Delivery |

|

By Region |

North South East West |

Products

Key Target Audience

E-commerce Businesses

Drop Shipping Entrepreneurs

Logistics and Supply Chain Providers

Payment Gateway Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Commerce & Industry, Ministry of Electronics and Information Technology)

Online Marketplaces

Wholesalers and Distributors

Companies

Players Mentioned in the Report:

Shopify

AliExpress

Oberlo

Amazon

Meesho

Flipkart

Ecwid

BigCommerce

SaleHoo

Spocket

Table of Contents

1. India Drop Shipping Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview (Logistics Infrastructure, E-commerce Growth, Consumer Adoption)

1.4. Market Segmentation Overview

2. India Drop Shipping Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Growth Rate Analysis

2.3. Market Milestones and Key Developments (Rise of E-commerce Platforms, Consumer Preference Shifts)

3. India Drop Shipping Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of E-commerce Ecosystem

3.1.2. Increased Internet Penetration and Smartphone Usage

3.1.3. Low Initial Investment Required

3.1.4. Scalability without Inventory Management

3.2. Market Challenges

3.2.1. Supply Chain and Logistics Complexities

3.2.2. Competition and Market Saturation

3.2.3. Regulatory and Taxation Barriers

3.2.4. Consumer Trust and Return Management

3.3. Opportunities

3.3.1. Integration of Automation and AI in Order Management

3.3.2. Expansion of Niche Product Markets

3.3.3. Regional Drop Shipping Expansion (Tier 2 and 3 Cities)

3.4. Trends

3.4.1. Shift Towards Sustainable Drop Shipping Models

3.4.2. Increase in Cross-border Drop Shipping

3.4.3. Personalized and Custom Product Offerings

3.5. Government Regulations (GST Impact, E-commerce Regulations)

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Competitive Landscape Ecosystem (Partnerships, Alliances)

4. India Drop Shipping Market Segmentation (By Value %)

4.1. By Product Type

4.1.1. Consumer Electronics

4.1.2. Fashion and Apparel

4.1.3. Home and Kitchen Essentials

4.1.4. Health and Beauty Products

4.1.5. Others

4.2. By Platform Type

4.2.1. E-commerce Marketplaces (Amazon, Flipkart)

4.2.2. Social Media Platforms (Instagram, Facebook)

4.2.3. Dedicated Drop Shipping Websites (Shopify)

4.3. By Order Type

4.3.1. Direct-to-Consumer

4.3.2. Business-to-Business (B2B)

4.4. By Payment Method

4.4.1. Digital Wallets

4.4.2. Credit/Debit Cards

4.4.3. Cash on Delivery

4.5. By Region

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Drop Shipping Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. Shopify

5.1.2. Oberlo

5.1.3. AliExpress

5.1.4. Amazon

5.1.5. Flipkart

5.1.6. Meesho

5.1.7. Ecwid

5.1.8. SaleHoo

5.1.9. Wholesale2B

5.1.10. Spocket

5.1.11. BigCommerce

5.1.12. Printful

5.1.13. ShipRocket

5.1.14. Indiamart

5.1.15. GlowRoad

5.2. Cross Comparison Parameters (No. of Active Sellers, Monthly Traffic, Market Penetration, Revenue Model, Pricing, Delivery Options, Seller Support Systems, Fulfillment Network Size)

5.3. Market Share Analysis (By Platform and Product Category)

5.4. Strategic Initiatives (Partnerships, Technology Adoption)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Incentives for E-commerce

6. India Drop Shipping Market Regulatory Framework

6.1. Compliance with E-commerce Laws

6.2. Taxation and GST Implementation

6.3. Consumer Protection Regulations

6.4. Cross-border Trade Regulations

7. India Drop Shipping Future Market Size (In USD Bn)

7.1. Market Growth Projections

7.2. Key Drivers for Future Growth

8. India Drop Shipping Future Market Segmentation

8.1. By Product Type

8.2. By Platform Type

8.3. By Order Type

8.4. By Payment Method

8.5. By Region

9. India Drop Shipping Market Analyst's Recommendations

9.1. Business Model Optimization

9.2. Product Selection Strategy

9.3. Vendor Management and Fulfillment Optimization

9.4. Consumer Trust Building Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, key variables influencing the India Drop Shipping Market were identified through extensive desk research. This step involved mapping all major stakeholders and industry players, utilizing a combination of proprietary databases and publicly available reports to gather crucial industry-level data.

Step 2: Market Analysis and Construction

During this phase, historical data pertaining to the India Drop Shipping Market was analyzed to assess market growth, penetration, and service quality. Key performance indicators such as the ratio of active sellers to customers, product categories, and delivery times were used to evaluate market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, using CATIs to gather insights from seasoned professionals within the e-commerce and logistics sectors. These consultations provided direct, operational feedback and financial insights, corroborating the data collected.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the research, which included direct engagement with industry players, detailed analysis of product categories, and validation of the data through a bottom-up approach. The final report presents a comprehensive, accurate analysis of the India Drop Shipping Market.

Frequently Asked Questions

01. How big is the India Drop Shipping Market?

The India Drop Shipping market is valued at USD 21 billion, driven by the rapid growth of the e-commerce ecosystem and the increasing use of internet-enabled devices.

02. What are the challenges in the India Drop Shipping Market?

Challenges in India Drop Shipping market include complex logistics operations, high competition from established e-commerce platforms, and regulatory hurdles such as tax implications and compliance with consumer protection laws.

03. Who are the major players in the India Drop Shipping Market?

Key players in India Drop Shipping market include Shopify, Oberlo, AliExpress, Amazon, and Meesho, all of which have a strong presence in the market due to their advanced e-commerce solutions and wide customer base.

04. What are the growth drivers of the India Drop Shipping Market?

Growth drivers in India Drop Shipping market include increased internet penetration, rising smartphone usage, and the demand for affordable goods, allowing businesses to scale without managing inventory directly.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.