India Dry Chilies Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD252

June 2024

100

About the Report

India Dry Chilies Market Overview

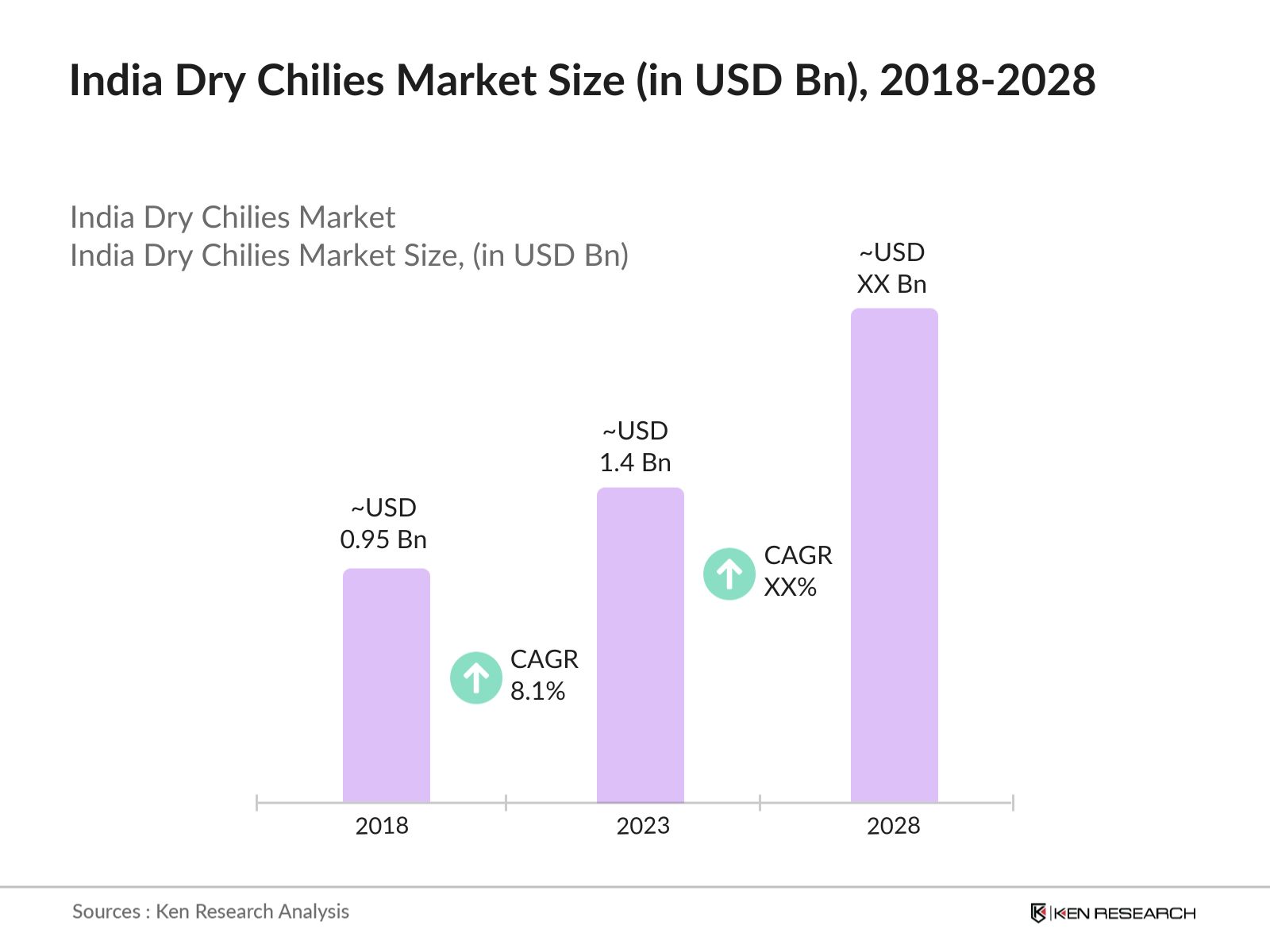

The market was USD 0.95 Bn in 2018, boosted by the global popularity of Indian cuisine and higher disposable incomes in India.

The India dry chilies market, valued at USD 1.4 Bn in 2023, is driven by domestic consumption and exports to the USA, China, and Thailand. Growth is fueled by rising health awareness and the expansion of the processed food industry.

Key players include Everest Spices, MDH Spices, Badshah Masala, and Ramdev Food Products, known for their strong distribution networks, brand recognition, and product quality.

Challenges include fluctuating prices from climate variability, pest attacks, high production costs, and competition from synthetic flavorings and international producers.

Growth drivers include increasing health consciousness, demand for natural spices, a growing food processing industry, and favorable climatic conditions for chili cultivation.

India Dry Chilies Current Market Analysis

- The market is highly competitive with Everest Spices leading due to its diverse product range and extensive market presence. Consumer preference is shifting towards organic and hygienically processed chilies.

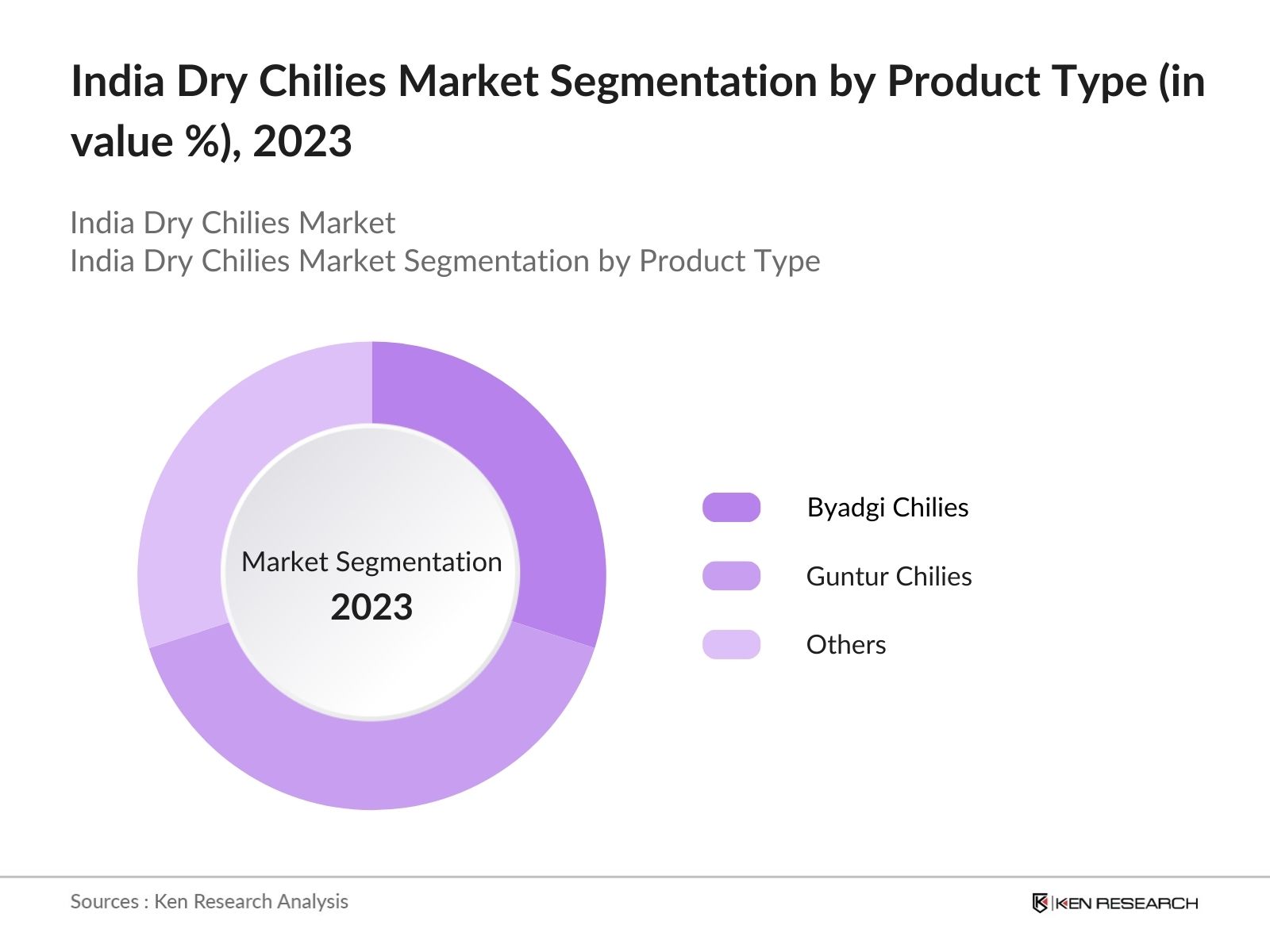

- Byadgi and Guntur varieties are the bestselling products due to their rich color and flavor. These varieties are extensively used in both domestic and international cuisines.

- Guntur chilies are the top-selling product, favored for their spiciness and rich aroma. They are particularly popular in South Indian cuisine and are widely exported.

- There is a growing preference for organic and pesticide-free dry chilies. Consumers are increasingly willing to pay a premium for products that are perceived as healthier and safer.

- Everest Spices remains dominant due to its strong brand loyalty, wide product range, and extensive distribution network, ensuring availability across urban and rural markets.

India Dry Chilies Market Segmentation

The Indian Dry Chilies Market can be segmented based on several factors:

By Product Type:In the India Dry Chilies Market Segmentation by Product Type in 2023, Guntur Chilies reign as the most dominant sub-segment, holding a substantial market share. Renowned for their pungency and rich aroma, they enjoy widespread usage in both domestic and export markets, particularly in South Indian cuisine.

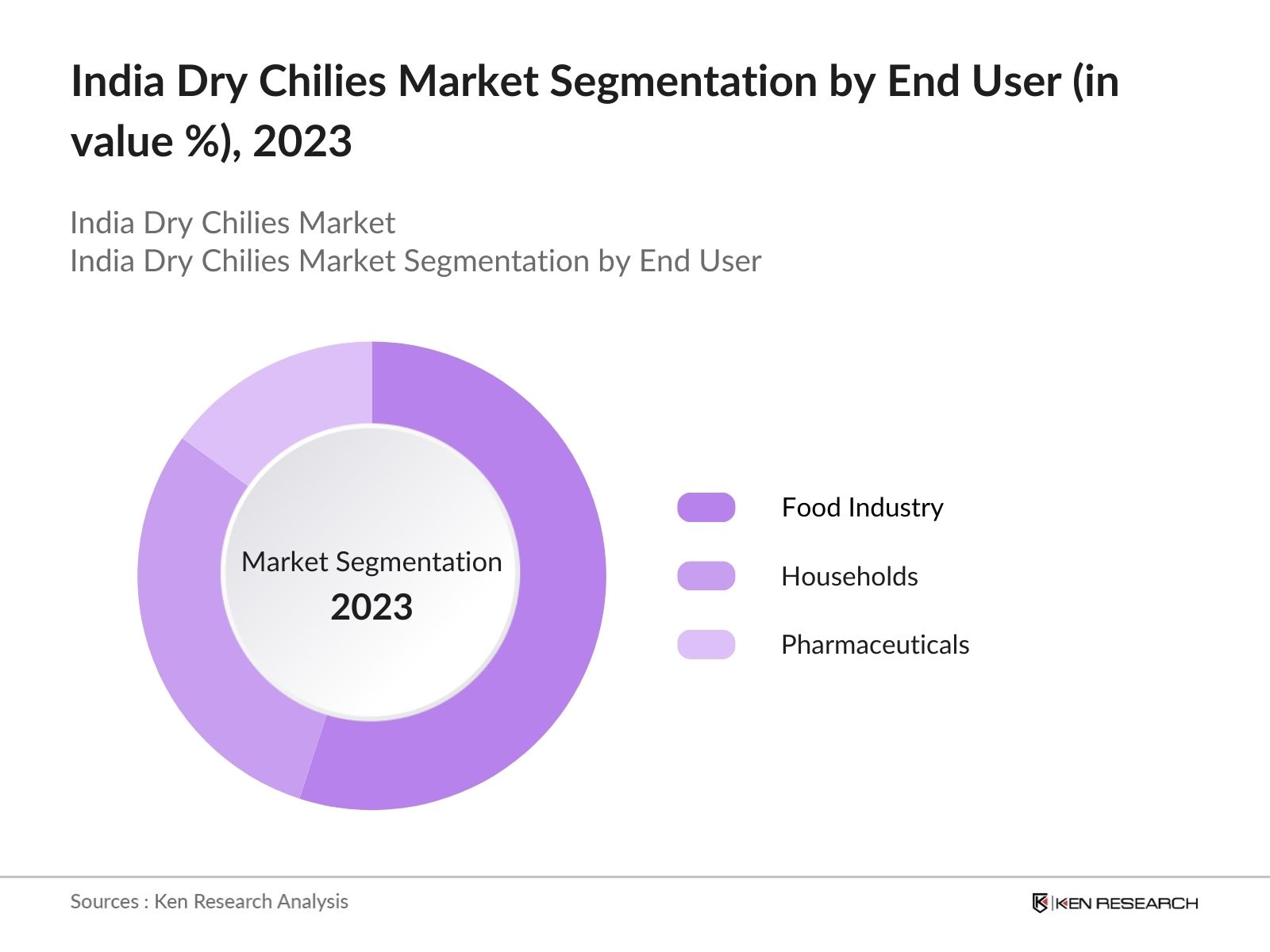

By End User: In the India Dry Chilies Market Segmentation by End User in 2023, the food industry emerges as the most dominant sub-segment, commanding a significant percentage of the market share. This dominance is attributed to the extensive use of dry chilies in food processing, spice mixes, and ready-to-eat meals, highlighting their integral role in culinary applications and driving market demand.

By Distribution Channel: In the 2023 Indian dry chilies market, the distribution channel segment prevails due to its widespread availability across supermarkets, grocery stores, and online platforms. This dominance caters to individual consumers, underscoring the channel's pivotal role in driving market growth.

India Dry Chilies Market Competitive Landscape

- Prices of dry chilies fluctuate based on crop yields and demand, with significant variability during periods of lower production in major states like Andhra Pradesh and Telangana.

- Consistent quality is maintained through grading based on heat levels (measured in SHU) and color intensity. Varieties like Guntur Sannam are prized for their high pungency, crucial for domestic and export markets.

- India's diverse regions contribute to varied chili flavors and profiles. Andhra Pradesh alone accounts for over 40% of India's chili production, followed by Karnataka and Maharashtra, enabling access to different chili varieties.

- Monitoring trends like the rise in organic chili demand or preferences for specific varieties helps companies adapt offerings and capitalize on emerging market opportunities, sustaining competitiveness in a dynamic industry landscape.

India Dry Chilies Industry Analysis

India Dry Chilies Market Growth Drivers:

Growing Food Processing Industry: The expansion of India's food processing sector creates a surge in demand for dry chilies. With the sector growing at a steady rate annually, there is a consistent need for chilies in various spice mixes and ready-to-eat products, supporting market growth.

Favorable Climatic Conditions: India's diverse climatic conditions provide optimal environments for chili cultivation. With over 200 different varieties of chilies grown across the country, the availability of suitable climates ensures a steady and varied supply of chilies throughout the year.

Export Demand: Increasing international demand for Indian dry chilies, particularly from Asian and North American markets, is a significant growth driver. For instance, India's chili exports witnessed rise in value in 2021 compared to the previous year, highlighting the growing global appetite for Indian chilies.

Government Support: Government initiatives aimed at supporting agriculture and export activities further enhance the growth prospects of the dry chilies market. Subsidies, infrastructure development, and trade agreements facilitate smoother operations for chili farmers and exporters, contributing to market expansion.

India Dry Chilies Market Challenges:

Price Fluctuations: Climate variability and pest attacks cause price volatility, affecting both producers and consumers.

High Production Costs: Rising costs of inputs like seeds, fertilizers, and labor pose a challenge to profitability.

Pest and Disease Management: Managing pests and diseases is a significant challenge that impacts yield and quality.

Competition from Synthetic Flavors: Increasing use of synthetic flavorings in the food industry threatens the demand for natural chilies.

India Dry Chilies Market Trends and Developments:

Product Launches: Digital Globe introduced a new high-resolution satellite, capable of capturing images with a resolution of 30 centimeters, significantly improving the quality and detail of satellite imagery available.

Store Expansions: Planet Labs expanded its satellite constellation, increasing its capacity to provide more frequent and comprehensive data coverage, catering to diverse client needs.

Partnerships: Airbus partnered with leading technology firms to integrate AI and machine learning capabilities into its satellite imagery services, enhancing data analysis and predictive modeling.

Sustainability Initiatives: ISRO launched a green satellite program, focusing on developing eco-friendly satellites and sustainable launch practices, aligning with global environmental goals.

India Dry Chilies Market Government Initiatives:

Crop Insurance: In 2021, over 2 million chili farmers in India were covered under the Pradhan Mantri Fasal Bima Yojana, ensuring compensation for crop failures.

Irrigation Projects: The Sardar Sarovar Project in Gujarat, India, has irrigated 1.8 million hectares, significantly benefiting chili cultivation in the region.

Storage Facilities: In Andhra Pradesh, India, 200 new cold storage units with a capacity of 500,000 tons were established, aiding chili farmers in preserving their produce.

Market Information Systems: The e-NAM platform in India, with over 1.6 million registered farmers, facilitates better price discovery and reduces dependence on middlemen.

Policy Framework: India’s National Policy on Spices aims to increase chili production by 10% annually, targeting 3 million tons by 2025.

India Dry Chilies Future Market Outlook

The Indian Dry Chilies market is expected to show robust growth driven by increasing export demand, rising popularity of spicy foods globally, expansion of organic and specialty varieties.

Factors Influencing Growth

- Expansion of Organic Segment: The organic segment is expected to experience substantial growth due to rising health consciousness. The global organic food market is expanding significantly, driven by increasing consumer awareness of health benefits and sustainable practices.

- Technological Advancements: Adoption of advanced farming and processing technologies expected to enhance productivity. Precision agriculture technologies can increase crop yields by up to 25%.

- Increasing Exports: Export growth anticipated, supported by strong international demand. India shipped over 444,000 metric tons of dried chilies in 2020.

Scope of the Report

|

India Dry Chilies Market Segmentation |

|

|

By Product Type |

Byadgi Chilies Guntur Chilies Others |

|

By End User |

Food Industry Households Guntur Chilies |

|

By Distribution Channel |

Retail Wholesale Export |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Spice Manufacturers

Spice Exporters and Importers

Food Processing Companies

Investors and Financial Institutions

Major Spice Retailers and Distributors

Culinary Institutes and Chefs

Restaurant Chains and Caterers

Research Institutions and Agricultural Universities

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:Â

Everest Spices

MDH Spices

Badshah Masala

Ramdev Food Products

Sakthi Masala

Aachi Masala Foods

Eastern Condiments

Priya Foods

Catch Spices

MTR Foods

Mother's Recipe

Patanjali Ayurved

Organic Tattva

24 Mantra Organic

Keya Foods

Pushp Brand

Rajesh Spices

Sunpure Spices

Kamadhenu Spices

Orkay Spices

Table of Contents

1. India Dry Chilies Market Overview

1.1 India Dry Chilies Market Taxonomy

2. India Dry Chilies Market Size (in USD Bn), 2018-2023

3. India Dry Chilies Market Analysis

3.1 India Dry Chilies Market Growth Drivers

3.2 India Dry Chilies Market Challenges and Issues

3.3 India Dry Chilies Market Trends and Development

3.4 India Dry Chilies Market Government Regulation

3.5 India Dry Chilies Market SWOT Analysis

3.6 India Dry Chilies Market Stake Ecosystem

3.7 India Dry Chilies Market Competition Ecosystem

4. India Dry Chilies Market Segmentation, 2023

4.1 India Dry Chilies Market Segmentation by Product Type (in %), 2023

4.2 India Dry Chilies Market Segmentation by End User (in %), 2023

4.3 India Dry Chilies Market Segmentation by Distribution Channel (in %), 2023

5. India Dry Chilies Market Competition Benchmarking

5.1 India Dry Chilies Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Dry Chilies Future Market Size (in USD Bn), 2023-2028

7. India Dry Chilies Future Market Segmentation, 2028

7.1 India Dry Chilies Market Segmentation by Product Type (in %), 2028

7.2 India Dry Chilies Market Segmentation by End User (in %), 2028

7.3 India Dry Chilies Market Segmentation by Distribution Channel (in %), 2028

8. India Dry Chilies Market Analysts’ Recommendations

8.1 India Dry Chilies Market TAM/SAM/SOM Analysis

8.2 India Dry Chilies Market Customer Cohort Analysis

8.3 India Dry Chilies Market Marketing Initiatives

8.4 India Dry Chilies Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Indian dry chilies market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India dry chilies market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple dry chilies companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from dry chilies companies.

Frequently Asked Questions

01 How big is Indian Dry Chilies Market?

The Indian Dry Chilies Market was valued at USD 1.4 Bn in 2023 driven by domestic consumption and exports to the USA, China, and Thailand. Growth is fueled by rising health awareness and the expansion of the processed food industry.

02 What are the key challenges faced in Indian Dry Chilies Market?

The key challenges faced by the Indian Dry Chilies Market are price fluctuation and competition from synthetic flavors.

03 Who are some of the major players in the Indian Dry Chilies Market?

Some of the major players in the Indian Dry Chilies Market include Everest Spices, MDH Spices and Badshah Masala.

04 What are the major factors driving India chilies market?

Growth drivers include increasing health consciousness, demand for natural spices, a growing food processing industry, and favorable climatic conditions for chili cultivation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.