India Dry Fruits Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD4659

December 2024

90

About the Report

India Dry Fruits Market Overview

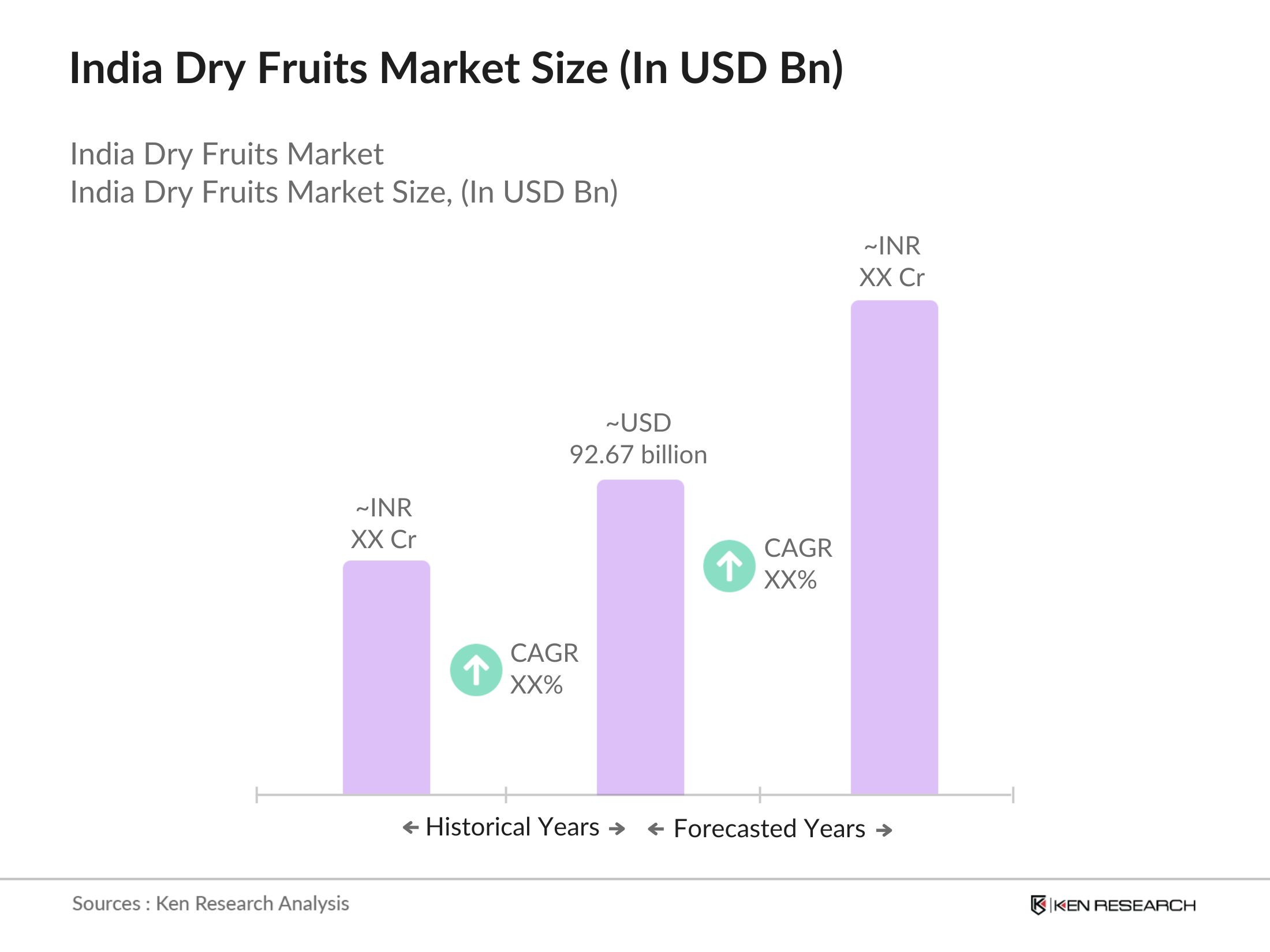

- The India dry fruits market is valued at USD 92.67 billion, based on a five-year historical analysis. The growth of this market is primarily driven by rising consumer awareness of health benefits associated with dry fruits consumption, increasing disposable income, and expanding demand for convenience foods. Dry fruits such as almonds, cashews, and walnuts are considered healthy snacks rich in nutrients. The market's expansion is further fueled by the growing use of dry fruits in the food and beverage industry, particularly in confectionery, bakery, and dairy products.

- Major cities such as Delhi, Mumbai, and Bangalore dominate the India dry fruits market due to their large population bases, high disposable incomes, and rapidly growing urbanization. These cities have well-established retail networks and e-commerce infrastructure, which facilitate the widespread availability and consumption of dry fruits. Additionally, these cities are key economic hubs where premium and organic dry fruit brands are gaining popularity among health-conscious consumers.

- The Government of India has introduced the National Horticulture Mission, aimed at promoting the cultivation of high-value crops such as almonds, cashews, and walnuts. In 2023, the initiative received an allocation of INR 2,200 crore to support dry fruit cultivation and infrastructure development. This policy initiative is designed to reduce dependence on imports and strengthen the domestic production of dry fruits, benefiting local farmers and the overall market.

India Dry Fruits Market Segmentation

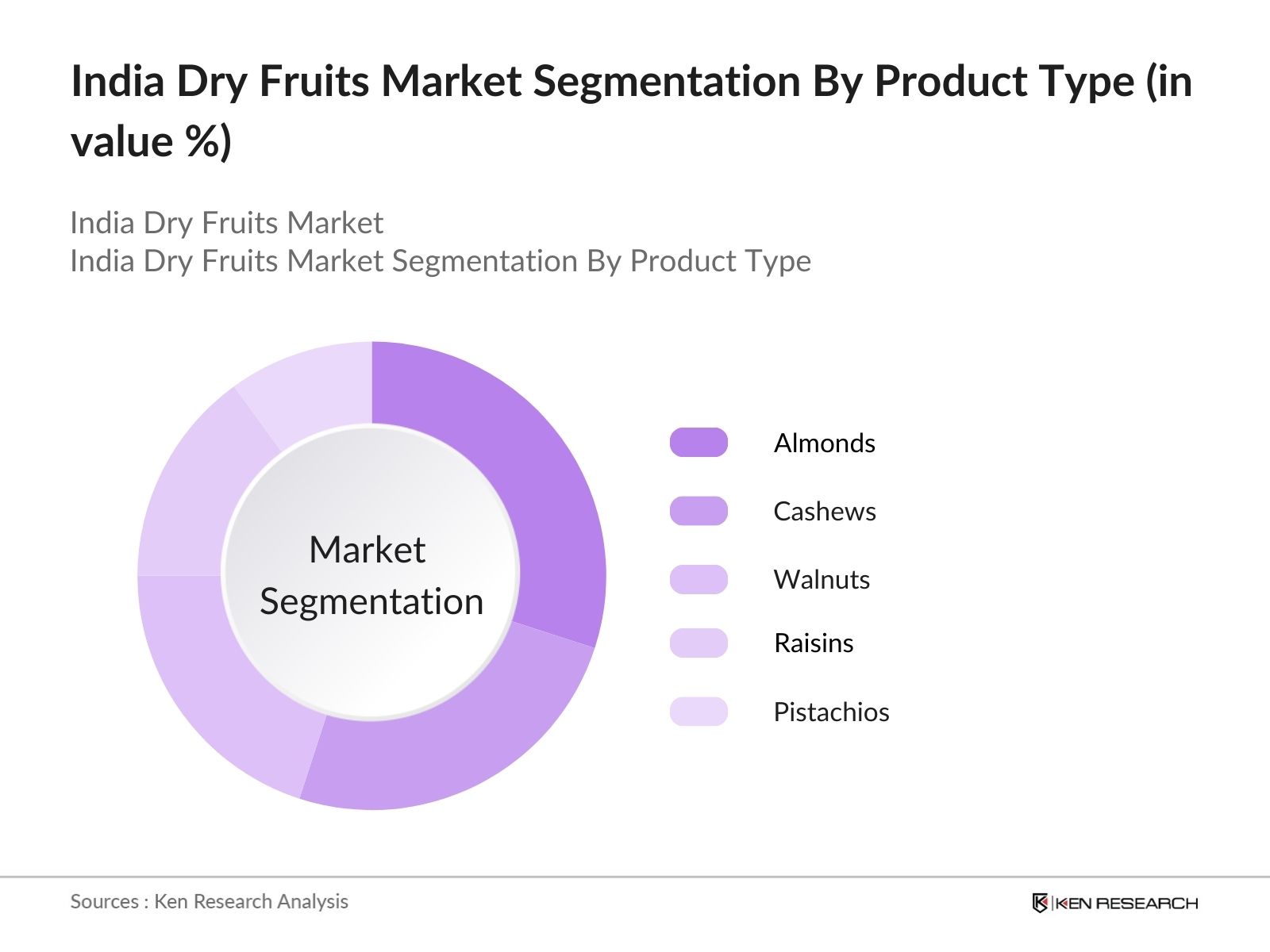

By Product Type: The India dry fruits market is segmented by product type into almonds, cashews, walnuts, raisins, and pistachios. Almonds currently hold the dominant market share due to their versatile usage in both snacking and culinary applications. They are consumed raw, roasted, or processed into almond milk and other products. The growing consumer preference for plant-based alternatives, such as almond-based milk and flour, has further contributed to the dominance of this sub-segment. Moreover, almonds are often marketed as a premium, healthy option with high protein content, making them a favorite among health-conscious individuals.

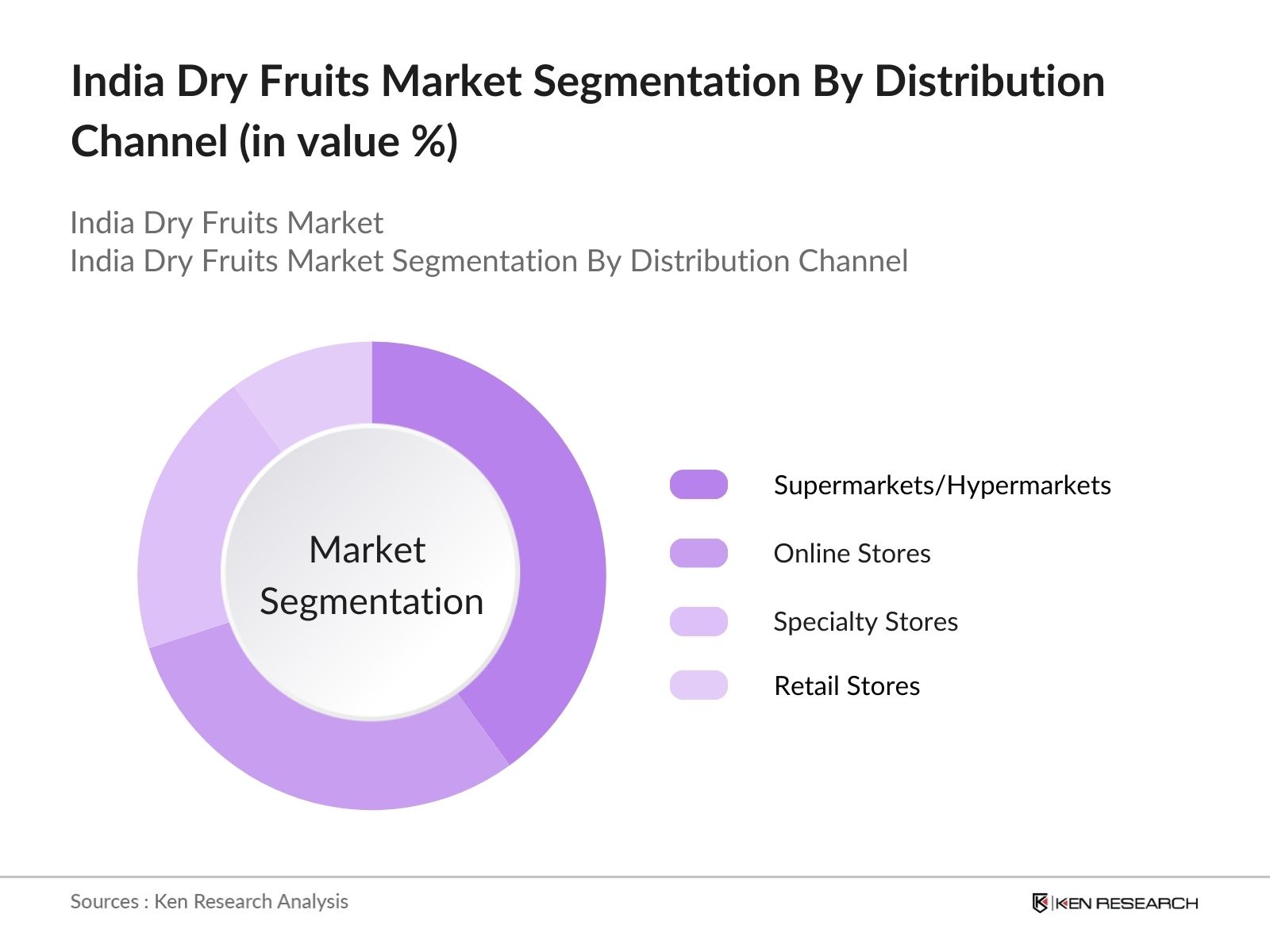

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, online stores, specialty stores, and retail stores. Online stores have witnessed a significant surge in market share recently due to the convenience they offer to consumers and the growing penetration of e-commerce platforms like Amazon and Flipkart. The availability of a wide variety of products, coupled with discounts and fast delivery options, has made online shopping a popular choice. Additionally, the pandemic-induced shift to online shopping has further cemented this channel's dominance in the market.

India Dry Fruits Market Competitive Landscape

The India dry fruits market is dominated by both local and international players, each striving to gain a competitive edge through product innovation, brand positioning, and distribution expansion. The market is relatively fragmented, with both premium and budget segments competing for consumer attention. Some of the key players in the market include:

|

Company Name |

Establishment Year |

Headquarters |

Revenue (INR Bn) |

No. of Employees |

Product Range |

Distribution Network |

Market Share (%) |

R&D Investments |

Geographical Presence |

|

Haldirams |

1937 |

Nagpur, India |

- | - | - | - | - | - | - |

|

Bikanervala Foods Pvt Ltd |

1950 |

Delhi, India |

- | - | - | - | - | - | - |

|

Sahyadri Farms |

2010 |

Nashik, India |

- | - | - | - | - | - | - |

|

Royal Dry Fruits Pvt Ltd |

1985 |

Mumbai, India |

- | - | - | - | - | - | - |

|

Vijayalakshmi Cashew Company |

1957 |

Karnataka, India |

- | - | - | - | - | - | - |

India Dry Fruits Market Analysis

Growth Drivers

- Rising Health Awareness and Dietary Changes: The increasing focus on healthier eating habits is significantly driving the demand for dry fruits in India. Indian consumers are opting for more nutritious, wholesome food products, including almonds, walnuts, and cashews, which are rich in proteins, vitamins, and minerals. In 2024, Indias per capita health expenditure crossed INR 6,500, reflecting a substantial shift towards healthier lifestyles. This rise in health consciousness is directly impacting the dry fruits market, where such products are positioned as healthier alternatives to traditional snack foods.

- Increase in E-commerce and Digital Retail Channels: The expansion of digital retail and e-commerce platforms has led to increased accessibility of dry fruits for consumers across both urban and rural regions. India saw more than 900 million internet users in 2024, with online grocery sales gaining significant momentum. Large platforms like Amazon and Flipkart have been instrumental in the widespread distribution of dry fruits, enabling consumers to purchase them from the convenience of their homes. Additionally, Indias retail sector saw a gross value addition of over INR 21 trillion in 2024, underlining the digital transformations contribution to the dry fruits market.

- Growing Demand for Packaged and Processed Foods: As consumer lifestyles become increasingly fast-paced, the demand for packaged and processed dry fruit products have seen an upward trend. Innovations such as ready-to-eat dry fruit mixes, dry fruit bars, and flavored nuts cater to this demand. Dry fruits, marketed as convenient and healthy snacking options, are a crucial part of this trend, boosting overall demand.

Market Challenges

- Fluctuating Commodity Prices: The prices of raw dry fruits, especially imported ones like almonds and pistachios, are highly susceptible to global market fluctuations. For example, in 2023, India experienced a price surge in almonds due to poor harvests in California, a key exporter. With almond imports amounting to crores, these price swings directly impacted supply chains and retailer margins. Such volatility remains a significant challenge in maintaining price stability and profitability in the Indian dry fruits market.

- Heavy Dependence on Imports: India imports over 70% of its dry fruits, including almonds and pistachios, making the market vulnerable to international supply chain disruptions. In 2022, disruptions in shipments from Afghanistan and geopolitical tensions affected the supply of raisins and other dry fruits. This heavy reliance on imports poses risks in terms of consistent supply and pricing, leading to challenges in meeting domestic demand during periods of international instability.

India Dry Fruits Market Future Outlook

Over the next five years, the India dry fruits market is expected to show significant growth driven by rising health awareness, increased demand for ready-to-eat snacks, and the penetration of online retail platforms. Consumers are increasingly opting for healthy snack options, such as dry fruits, which offer high nutritional value, leading to a steady rise in their consumption. Additionally, the growing preference for plant-based and organic food products will continue to shape the market dynamics.

Market Opportunities

- Growth in Healthy Snacks Segment: With a growing focus on healthier snacking options, the demand for dry fruits in the Indian snack segment has seen a notable increase. The shift from traditional snacks to health-conscious alternatives is supported by rising consumer incomes and awareness of the health benefits associated with dry fruits. In 2024, the average household expenditure on healthy foods in urban India rose, showcasing a broader shift towards premium, health-focused food categories. This trend offers a significant opportunity for the dry fruits market to position itself as a key player in the expanding healthy snacks segment.

- Expanding Urbanization: India's rapid urbanization continues to present significant opportunities for the dry fruits market. With over 600 million people living in urban areas by 2024, the rising disposable incomes of urban consumers have translated into higher spending on premium food items, including dry fruits. Average per capita income in urban India reached INR 1.97 lakh in 2024, driving demand for high-quality, nutrient-rich products. As the urban middle class grows, so does the preference for health-conscious food choices, offering the dry fruits market a chance to capture this lucrative demographic.

Scope of the Report

|

By Product Type |

Almonds Cashews Walnuts Raisins Pistachios |

|

By Form |

Whole Powdered Sliced Flavored |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Stores Specialty Stores Retail Stores |

|

By End-User |

Household Consumers Food & Beverage Industry Foodservice Industry Nutraceuticals |

|

By Region |

North South West East |

Products

Key Target Audience

Retail Chains

Dry Fruit Processors and Manufacturers

Food & Beverage Companies

Nutraceutical Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, APMC)

Exporters and Importers

E-Commerce Platforms

Companies

Players Mentioned in the report:

Haldirams

Bikanervala Foods Pvt Ltd

Vijayalakshmi Cashew Company

Agrocel Industries Pvt Ltd

Sahyadri Farms

Royal Dry Fruits Pvt Ltd

Adani Wilmar

Reliance Fresh

Patanjali Ayurved Ltd

Jabs International Pvt Ltd

Table of Contents

1. India Dry Fruits Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Dry Fruits Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Dry Fruits Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness (Increase in Demand for Nutrient-Rich Foods)

3.1.2. Expansion of Retail Chains (Growth of E-Commerce and Organized Retail)

3.1.3. Favorable Government Policies (Agri Export Policies)

3.1.4. Seasonal Festivities and Gifting Trends (Increase in Seasonal Consumption)

3.2. Market Challenges

3.2.1. Fluctuating Prices of Raw Materials (Volatile Commodity Prices)

3.2.2. High Dependence on Imports (Supply Chain Disruptions)

3.2.3. Lack of Cold Storage Infrastructure (Storage and Preservation Issues)

3.3. Opportunities

3.3.1. Growth in Healthy Snacks Segment (Increased Consumer Focus on Healthy Snacking)

3.3.2. Expanding Urbanization (Rising Disposable Income in Urban Areas)

3.3.3. Product Innovation (Introduction of Value-Added Dry Fruits Products)

3.4. Trends

3.4.1. Shift Towards Organic Products (Demand for Chemical-Free Dry Fruits)

3.4.2. Sustainable Packaging (Eco-Friendly Packaging Solutions)

3.4.3. Premiumization of Products (High-Quality Packaging and Branding)

3.5. Government Regulation

3.5.1. Agricultural Produce Market Committee (APMC) Regulations

3.5.2. FSSAI Standards (Food Safety and Standards Authority of India)

3.5.3. Import Tariff Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Farmers and Suppliers

3.7.2. Distributors and Wholesalers

3.7.3. Retailers

3.7.4. Exporters

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Dry Fruits Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Almonds

4.1.2. Cashews

4.1.3. Walnuts

4.1.4. Raisins

4.1.5. Pistachios

4.2. By Form (In Value %)

4.2.1. Whole

4.2.2. Powdered

4.2.3. Sliced

4.2.4. Flavored

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Online Stores

4.3.3. Specialty Stores

4.3.4. Retail Stores

4.4. By End-User (In Value %)

4.4.1. Household Consumers

4.4.2. Food & Beverage Industry

4.4.3. Foodservice Industry

4.4.4. Nutraceuticals

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Dry Fruits Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Haldirams

5.1.2. Bikanervala Foods Pvt Ltd

5.1.3. Vijayalakshmi Cashew Company

5.1.4. Agrocel Industries Pvt Ltd

5.1.5. Sahyadri Farms

5.1.6. Royal Dry Fruits Pvt Ltd

5.1.7. Adani Wilmar

5.1.8. Reliance Fresh

5.1.9. Patanjali Ayurved Ltd

5.1.10. Jabs International Pvt Ltd

5.1.11. Gujarat Cooperative Milk Marketing Federation Ltd (GCMMF)

5.1.12. Badamwala Dry Fruits

5.1.13. Baidyanath Ayurved Bhawan Pvt Ltd

5.1.14. Amazon India (Private Label)

5.1.15. TATA Sampann

5.2. Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. India Dry Fruits Market Regulatory Framework

6.1. FSSAI Guidelines

6.2. Import and Export Regulations

6.3. Labeling and Packaging Standards

7. India Dry Fruits Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Dry Fruits Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Form (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Dry Fruits Market Analyst's Recommendations

9.1. Market Penetration Strategies

9.2. Customer Segmentation Analysis

9.3. Innovation and Product Development

9.4. Geographic Expansion Opportunities

Research Methodology

Step 1: Identification of Key Variables

In the first phase, an ecosystem map of the India dry fruits market was constructed, focusing on major stakeholders such as manufacturers, distributors, and consumers. Desk research was used to gather comprehensive industry-level information, identifying critical variables that influence market dynamics such as price fluctuations, supply chains, and consumer preferences.

Step 2: Market Analysis and Construction

The second phase involved analyzing historical market data, including production volumes, distribution channels, and revenue generated. Market penetration was assessed, along with the ratio of domestic to imported dry fruits. This analysis provided an accurate overview of market performance and key growth drivers.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through interviews with industry experts and stakeholders, ensuring that data collected from secondary sources was accurate and reflective of real market conditions. These consultations helped refine revenue estimates and highlighted emerging trends in product innovation and consumer preferences.

Step 4: Research Synthesis and Final Output

Finally, direct engagement with manufacturers and distributors was conducted to obtain detailed insights into the performance of different product segments. This information was used to finalize the report, ensuring a holistic and validated analysis of the India dry fruits market.

Frequently Asked Questions

01. How big is the India Dry Fruits Market?

The India dry fruits market is valued at USD 92.67 billion, driven by rising consumer health awareness and increasing demand for nutrient-dense snack options.

02. What are the challenges in the India Dry Fruits Market?

Challenges in the India dry fruits market include fluctuating raw material prices due to dependence on imports, inadequate cold storage infrastructure, and volatility in supply chains that can disrupt market stability.

03. Who are the major players in the India Dry Fruits Market?

Key players in the India dry fruits market include Haldiram’s, Bikanervala Foods Pvt Ltd, Royal Dry Fruits Pvt Ltd, and Sahyadri Farms, which dominate through their expansive distribution networks and strong brand presence.

04. What are the growth drivers of the India Dry Fruits Market?

Key players in the India dry fruits market include Haldiram’s, Bikanervala Foods Pvt Ltd, Royal Dry Fruits Pvt Ltd, and Sahyadri Farms, which dominate through their expansive distribution networks and strong brand presence.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.