India Dyes and Pigments Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD1994

December 2024

97

About the Report

India Dyes and Pigments Market Overview

- In 2023, the India dyes and pigments market reached a valuation of USD 66 billion. The market is primarily driven by the country's strong textile industry, which contributes 2% to India's GDP. Additionally, rising demand for automotive coatings and industrial applications has bolstered growth. Factors like increasing exports of Indian textiles and expanding domestic production capacity have further fueled the market.

- Prominent players in Indias dyes and pigments market include Atul Ltd., Kiri Industries Ltd., Bodal Chemicals Ltd., Clariant Chemicals India Ltd., and AksharChem India Ltd. These companies are leaders due to their wide product range, extensive distribution networks, and significant production capacities. Their presence is vital in catering to both domestic and export demands.

- The Indian Ministry of Textiles launched the Production Linked Incentive (PLI) scheme in 2021 to promote large-scale manufacturing in textiles and related sectors. This initiative includes incentives for dyes and pigments manufacturers who focus on reducing their environmental footprint. An allocation of INR 10,683 crore was set aside for the scheme, which also aims at boosting exports of textiles and dyes to global markets like the U.S. and Europe.

- The cities of Ahmedabad, Vadodara, and Mumbai dominate Indias dyes and pigments market. Ahmedabad and Vadodara in Gujarat are hubs due to the presence of major manufacturing facilities and easy access to raw materials like chemicals. Mumbai serves as a major commercial center, with strong financial backing and an extensive export network.

India Dyes and Pigments Market Segmentation

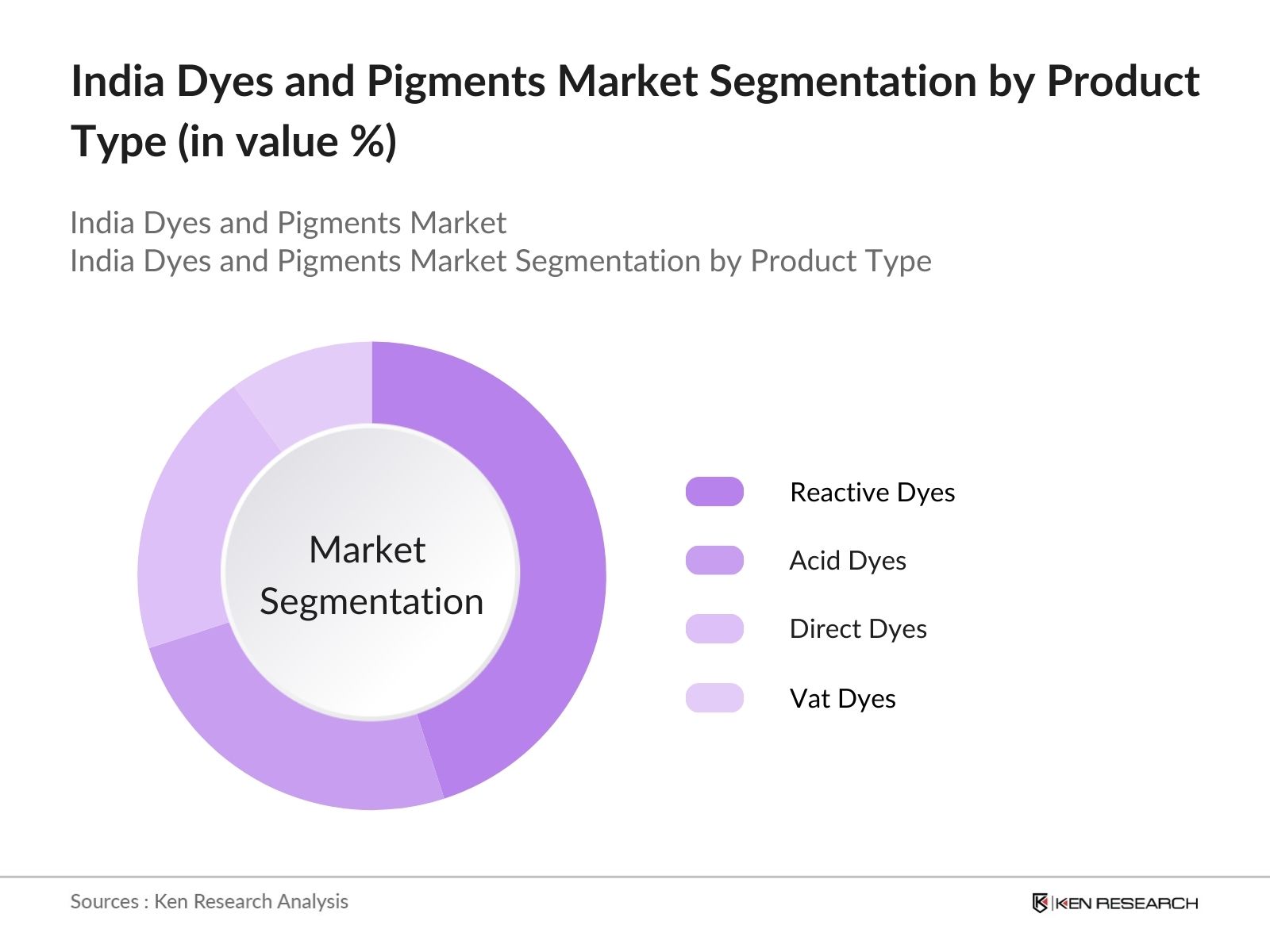

By Product Type: Indias dyes and pigments market is segmented by product type into Acid Dyes, Reactive Dyes, Direct Dyes, and Vat Dyes. In 2023, Reactive Dyes held the largest market share due to their widespread application in the textile industry. Reactive dyes have a high fixation rate with cotton and are preferred for their bright, vibrant colors. The increasing demand for colored textiles in fashion and home textiles has further bolstered the demand for this segment.

|

Product Type |

Market Share (2023) |

|

Reactive Dyes |

45% |

|

Acid Dyes |

25% |

|

Direct Dyes |

20% |

|

Vat Dyes |

10% |

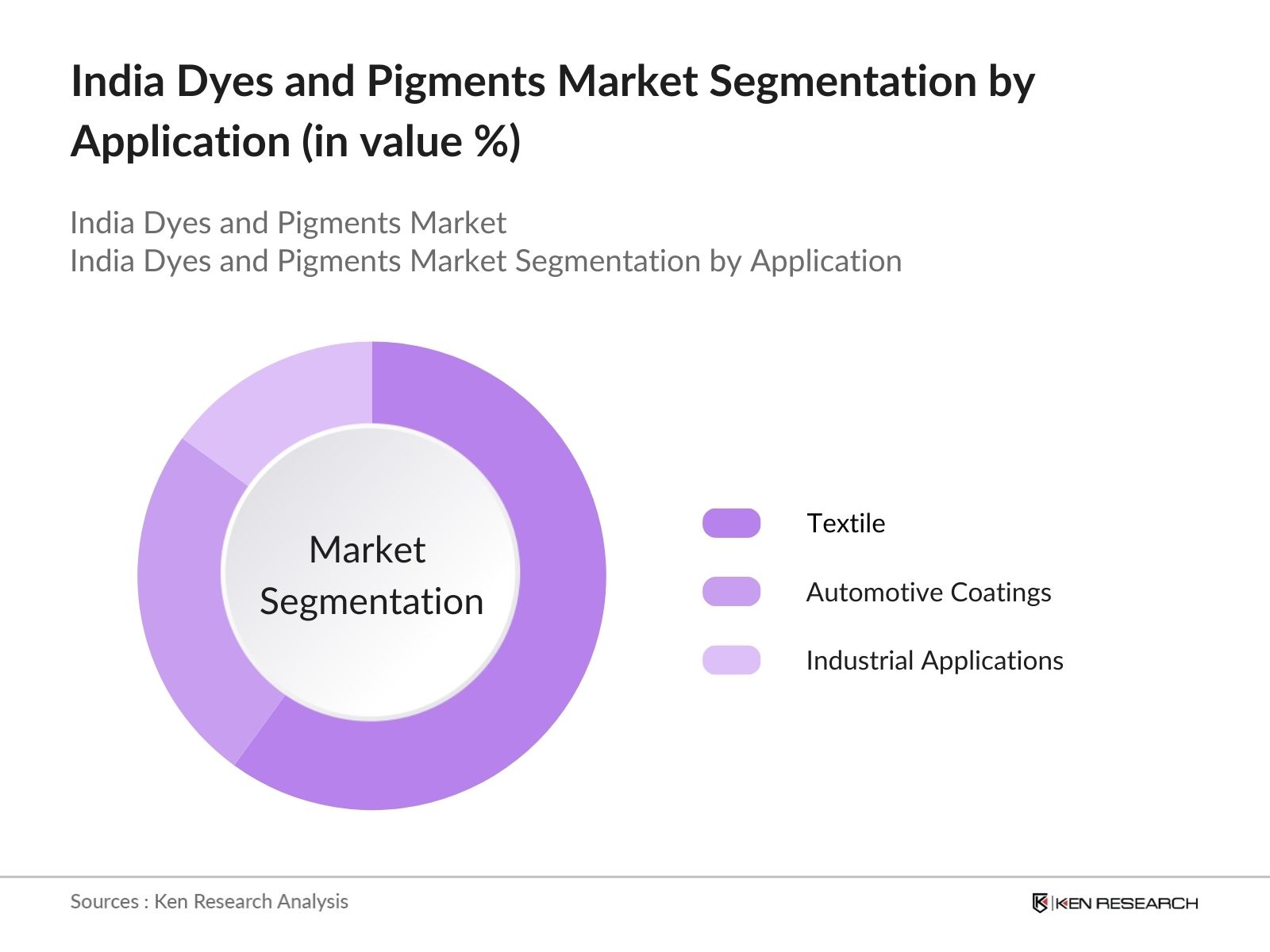

By Application: The market is segmented by application into Textile, Automotive Coatings, and Industrial Applications. In 2023, the Textile segment dominated with the largest market share due to Indias robust textile industry, which contributes over USD 150 billion to the countrys economy. The application of dyes in textile manufacturing is indispensable, with the demand for vibrant and colorfast fabrics driving the use of dyes. This segments growth is further reinforced by rising exports of textiles to Europe and the Middle East.

|

Application |

Market Share (2023) |

|

Textile |

60% |

|

Automotive Coatings |

25% |

|

Industrial Applications |

15% |

By Region: Indias dyes and pigments market is divided into four key regions: North, South, East, and West. In 2023, the West region, including Gujarat and Maharashtra, held the dominant market share, largely due to the presence of significant manufacturing hubs and raw material suppliers in Gujarat. This regions well-established chemical industry and easy access to ports have made it the epicenter of production and exports of dyes and pigments.

|

Region |

Market Share (2023) |

|

West |

50% |

|

South |

20% |

|

North |

20% |

|

East |

10% |

India Dyes and Pigments Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Atul Ltd. |

1947 |

Gujarat, India |

|

Kiri Industries Ltd. |

1998 |

Ahmedabad, India |

|

Bodal Chemicals Ltd. |

1986 |

Gujarat, India |

|

Clariant Chemicals India |

1956 |

Navi Mumbai, India |

|

AksharChem India Ltd. |

1989 |

Gujarat, India |

- Atul Ltd.: In 2023, Atul Ltd. inaugurated a state-of-the-art specialty dyes facility in Gujarat, valued at INR 600 crore. This move is aimed at increasing production by 15,000 metric tons annually to meet rising domestic and global demand. The facility also emphasizes sustainable manufacturing practices, aligning with Atul's commitment to environmental sustainability and reducing carbon emissions in dye production.

- Bodal Chemicals Ltd.: In early 2024, Bodal Chemicals announced an investment of INR 350 crore to expand its pigment production facility in Vadodara. The expansion, expected to be completed by Q4 2024, aims to cater to the increasing demand for high-performance pigments used in automotive coatings and industrial applications. This investment also reflects Bodal's strategic focus on enhancing export capabilities.

Growth Drivers

- Rising Export Demand for Textiles and Dyes: A significant driver in the Indian dyes and pigments market is the increased global demand for Indian textiles. In 2023, Indias textile exports stood at USD 44.4 billion, with a substantial portion of this value being dependent on the use of dyes and pigments. Countries like the U.S., Germany, and the U.K. are key export destinations. The Indian governments push to enhance exports via schemes like the RoDTEP (Remission of Duties and Taxes on Exported Products), introduced in 2021, is further fueling this demand.

- Expanding Automotive Sector: India's automotive sector continues to drive the demand for specialty pigments used in coatings and paints. The shift toward electric vehicles (EVs) is further boosting the demand for high-performance pigments that provide durability and aesthetic appeal. India is the world's 4th largest automotive market and the 7th largest manufacturer of commercial vehicles in 2022.

- Sustainability Mandates and Eco-Friendly Dyes: With increasing global awareness about environmental issues, the Central Pollution Control Board (CPCB) has enforced stricter guidelines in 2023 regarding effluent discharge from dye manufacturing plants. This has pushed companies to adopt greener practices. Consequently, there is a rising demand for biodegradable and low-water-consuming dyes, especially among textile manufacturers. Leading Indian companies, like Kiri Industries, are investing heavily in R&D to develop sustainable dye alternatives.

Challenges

- Stringent Environmental Regulations: Indias stringent environmental laws, particularly the Hazardous and Other Wastes (Management and Transboundary Movement) Rule pose a challenge for dye manufacturers. The increased scrutiny on waste management, chemical effluent discharge, and air pollution has led to a surge in operational costs for companies. Compliance with regulations like the ZLD (Zero Liquid Discharge) has led to companies incurring significant capital expenditure, limiting profitability, particularly for small- and medium-sized enterprises.

- Volatility in Raw Material Prices: The Indian dyes and pigments market heavily depends on petrochemical derivatives, the prices of which are highly volatile. In 2023, crude oil prices surged per barrel due to geopolitical tensions and supply chain disruptions. This volatility directly impacts the cost of manufacturing dyes and pigments, as key raw materials like benzene and toluene are derived from crude oil. Companies are forced to either absorb these rising costs or pass them onto consumers, impacting market stability.

Government Initiatives

- Production Linked Incentive (PLI) Scheme for Textiles: Launched in 2023, the PLI scheme for the textiles sector has incentivized the manufacturing of man-made fibers, technical textiles, and dyes and pigments used in these industries. The government allocated INR 10,683 crore towards the scheme, with a special focus on enhancing domestic production capabilities for eco-friendly and sustainable dye products. This initiative is set to significantly boost domestic production while reducing reliance on imports, thus promoting local industries.

- Gujarat Industrial Development Corporation (GIDC) Support: In 2023, the GIDC announced plans to develop a special chemical zone in the Dahej Industrial Estate, specifically aimed at boosting the production capacity of dyes and pigments manufacturers. The government has earmarked INR 1,200 crore for infrastructure development in this zone, providing manufacturers with access to essential utilities like water, power, and logistics. This initiative will create a conducive environment for companies to scale up operations, contributing to the markets overall growth.

India Dyes and Pigments Market Future Outlook

The future outlook for the India dyes and pigments market shows steady growth, driven by increasing demand from the textiles, automotive, and construction industries. With government initiatives supporting local manufacturing and sustainability efforts, the market is expected to expand, particularly with the rising focus on eco-friendly and high-performance products.

Future Trends

- Expansion of Eco-Friendly Dye Production: By 2028, the production of eco-friendly dyes is expected to dominate the market, driven by stringent environmental regulations in both domestic and export markets. Indian manufacturers will focus on developing bio-based and water-saving dyes to cater to global sustainability demands. This shift is anticipated to increase by 50%, as large textile players and automotive sectors worldwide look for sustainable alternatives. The Indian government is expected to implement stricter policies to ensure compliance, further propelling this trend.

- Technological Integration in Manufacturing: The dyes and pigments industry in India is expected to see a significant shift towards automation and digitalization by 2028. Manufacturers will increasingly adopt Industry 4.0 technologies like AI-based process control, robotics, and IoT to enhance production efficiency and product quality. This shift is likely to reduce production costs while improving the sustainability of the manufacturing process. Companies are expected to invest heavily in upgrading their production lines to meet international standards.

Scope of the Report

|

By Product Type |

Reactive Dyes Acid Dyes Direct Dyes Vat Dyes |

|

By Application |

Textile Automotive Coatings Industrial Applications |

|

By Region |

West South North East |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Textile Manufacturers

Automotive Paint Companies

Industrial Coating Companies

Chemical Manufacturers

Export-Oriented Units

Importers of Dyes and Pigments

Environmental Agencies

Industrial Machinery Manufacturers

Packaging Industry

Industrial Cleaning Products Manufacturers

Government and Regulatory Bodies (e.g., Ministry of Textiles)

Investments and Venture Capitalist Firms

Time-Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Atul Ltd.

Kiri Industries Ltd.

Bodal Chemicals Ltd.

Clariant Chemicals India Ltd.

AksharChem India Ltd.

Sudarshan Chemical Industries Ltd.

Meghmani Organics Ltd.

Shree Pushkar Chemicals & Fertilisers Ltd.

Aarti Industries Ltd.

Vipul Organics Ltd.

Jaysynth Dyestuff India Ltd.

Narayan Organics Ltd.

Roha Dyechem Pvt. Ltd.

Rung International

Camlin Fine Sciences Ltd.

Table of Contents

1. India Dyes and Pigments Market Overview

1.1. Market Definition and Scope

1.2. Market Size and Growth

1.3. Key Market Drivers

1.4. Overview of Market Segmentation

2. India Dyes and Pigments Market Size and Analysis, 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Dyes and Pigments Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Export Demand for Textiles

3.1.2. Expanding Automotive Sector

3.1.3. Sustainability Mandates

3.2. Market Restraints

3.2.1. Stringent Environmental Regulations

3.2.2. Volatility in Raw Material Prices

3.3. Market Opportunities

3.3.1. Eco-Friendly and Sustainable Dyes

3.4. Current Market Trends

3.4.1. Shift Toward Water-Based Pigments

3.4.2. High-Performance Pigments in Automotive and Industrial Applications

4. India Dyes and Pigments Market Segmentation, 2023

4.1. By Product Type (Value %)

4.1.1. Reactive Dyes

4.1.2. Acid Dyes

4.1.3. Direct Dyes

4.1.4. Vat Dyes

4.2. By Application (Value %)

4.2.1. Textiles

4.2.2. Automotive Coatings

4.2.3. Industrial Applications

4.3. By Region (Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. India Dyes and Pigments Market Competitive Landscape

5.1. Key Players and Market Share Analysis

5.2. Strategic Initiatives and Developments

5.3. Mergers, Acquisitions, and Investments

5.4. Company Profiles

5.4.1. Atul Ltd.

5.4.2. Kiri Industries Ltd.

5.4.3. Bodal Chemicals Ltd.

5.4.4. Clariant Chemicals India Ltd.

5.4.5. AksharChem India Ltd.

6. India Dyes and Pigments Market Regulatory and Legal Framework

6.1. Environmental Standards and Compliance

6.2. Certification and Regulatory Approvals

7. India Dyes and Pigments Market Forecast, 2023-2028

7.1. Future Market Size Projections

7.2. Factors Influencing Future Market Growth

8. Future Market Segmentation, 2028

8.1. By Product Type (Value %)

8.2. By Application (Value %)

8.3. By Technology (Value %)

8.4. By Pollutant Type (Value %)

8.5. By Region (Value %)

9. Analyst Recommendations and Strategic Insights

9.1. Total Addressable Market (TAM) Analysis

9.2. Customer and Market Potential Analysis

9.3. Key Strategic Initiatives for Market Penetration

10. India Dyes and Pigments Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step 2: Market Building

Collating statistics on the India Dyes and Pigments Market over the years, analyzing the penetration of India Dyes and Pigments technologies, and computing the revenue generated for the market. This step also involves reviewing technology adoption rates and application effectiveness to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple India Dyes and Pigments companies to understand the nature of technology segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these India Dyes and Pigments companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is India dyes and pigments market?

The India dyes and pigments market was valued at USD 66 billion in 2023, driven by the robust textile industry, growing automotive coatings demand, and a shift toward sustainable products.

02. What are the challenges in the India dyes and pigments market?

Key challenges in India dyes and pigments market include stringent environmental regulations, volatility in raw material prices due to crude oil dependency, and the high cost of compliance with wastewater treatment and sustainability standards.

03. Who are the major players in the India dyes and pigments market?

Prominent players in India dyes and pigments include Atul Ltd., Kiri Industries Ltd., Bodal Chemicals Ltd., Clariant Chemicals India Ltd., and AksharChem India Ltd. These companies dominate due to their production capacities, global export networks, and R&D focus.

04. What are the growth drivers of the India dyes and pigments market?

Major growth drivers in India dyes and pigments include rising global demand for Indian textiles, expanding automotive sectors, and government incentives promoting sustainable manufacturing practices, such as the Production Linked Incentive (PLI) scheme.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.