India E-learning Market Outlook to FY 2030

India E-learning Market: Growth Drivers, Segmentation, and Future Outlook to 2030

Region:Asia

Author(s):Harsh Saxena

Product Code:KR74

August 2013

60

About the Report

India E-learning Market Overview

- The India E-learning Market is valued at USD 8.2 billion, based on a five-year historical analysis. This value reflects adoption driven by rising internet penetration, widespread smartphone usage, and demand for flexible, on-demand learning across academic and professional segments. The pandemic catalyzed a structural shift toward online platforms as schools, universities, and enterprises moved learning and training online, accelerating digital tool adoption at scale.

- Key players in this market include metropolitan areas such as Bengaluru, Delhi, and Mumbai, which dominate due to robust technology ecosystems, dense educational institutions, and deep pools of digital talent; South India currently leads regionally in market share, underscoring the concentration in tech-forward hubs like Bengaluru.

- In 2023, the Indian government advanced implementation of the National Education Policy (NEP) 2020, which emphasizes technology integration, digital repositories, and online learning to enhance access and quality across K-12 and higher education.

India E-learning Market Segmentation

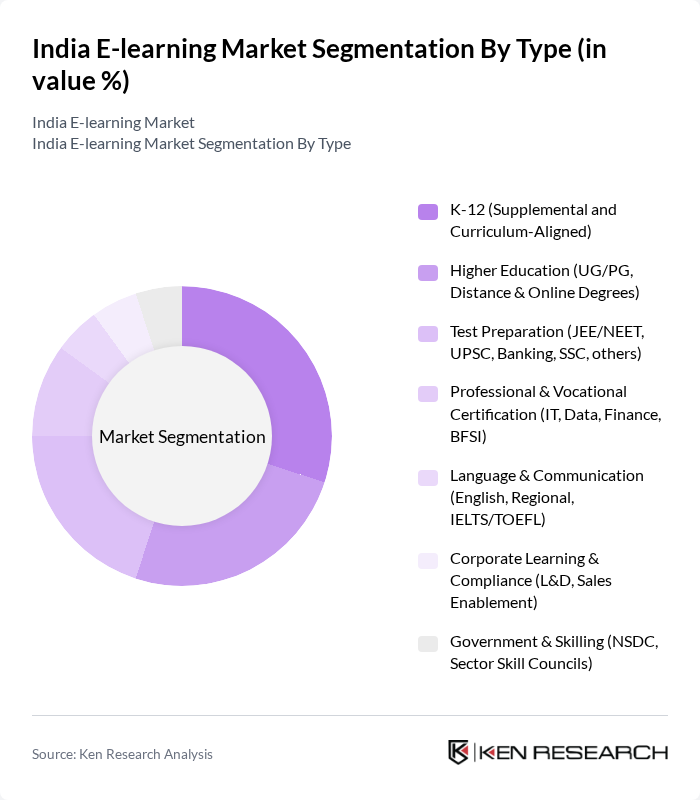

By Type: The e-learning market can be segmented into various types, including K-12, Higher Education, Test Preparation, Professional & Vocational Certification, Language & Communication, Corporate Learning & Compliance, and Government & Skilling. Among these, the K-12 segment is witnessing significant growth due to the increasing adoption of digital learning tools in schools, while the Test Preparation segment is also thriving, driven by the competitive nature of entrance exams in India. Recent trends include rapid growth of mobile e-learning, dominance of content providers, and strong academic demand, aligning with the K-12 and test-prep momentum.

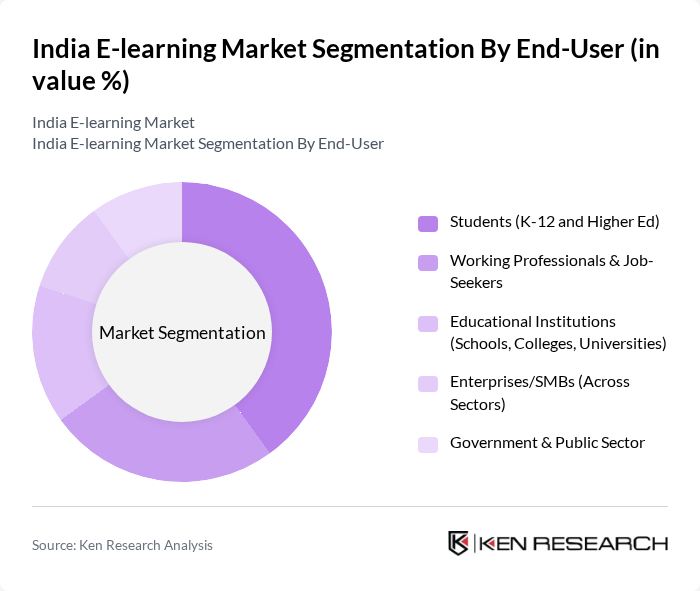

By End-User: The end-user segmentation includes Students, Working Professionals & Job-Seekers, Educational Institutions, Enterprises/SMBs, and Government & Public Sector. The student segment, particularly K-12 and higher education students, is the largest consumer of e-learning services, driven by the need for supplementary learning resources and exam preparation tools. Strong mobile-first usage and academic dominance support the student-heavy mix, while corporate training continues to expand through online programs.

India E-learning Market Competitive Landscape

The India E-learning Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYJU'S, Unacademy, Vedantu, upGrad, Simplilearn, NIIT Ltd, Coursera, edX, Great Learning, PhysicsWallah (PW), Khan Academy, Allen Digital, NextEducation India Pvt. Ltd., TalentSprint, Eruditus (Emeritus India) contribute to innovation, geographic expansion, and service delivery in this space.

| BYJU'S | 2011 | Bengaluru, India | – | – | – | – | – | – |

| Unacademy | 2015 | Bengaluru, India | – | – | – | – | – | – |

| Vedantu | 2011 | Bengaluru, India | – | – | – | – | – | – |

| upGrad | 2015 | Mumbai, India | – | – | – | – | – | – |

| Simplilearn | 2010 | Bengaluru, India | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Scale Tier (Unicorn/Large, Mid, Emerging) | Monthly Active Users (MAUs) / Enrolled Learners | Paid Subscribers / Conversion Rate (Free-to-Paid) | Course Completion Rate | Customer Acquisition Cost (CAC) | Customer Lifetime Value (LTV) and LTV:CAC |

|---|

Additional validated insights and trends - Mobile e-learning exhibits clear dominance as a delivery mode, reflecting India’s mobile-first usage patterns and low-cost data access. - Content providers represent the largest share among providers, underscoring the importance of localized, exam-aligned, and skills-focused content libraries. - Academic applications account for the majority share versus corporate and government, consistent with strong adoption across K-12, test prep, and higher education.

India E-learning Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration: As of in future, India boasts over 1,200 million internet users, a significant increase from 600 million in 2020. This surge in connectivity, driven by affordable data plans and smartphone proliferation, facilitates access to e-learning platforms. The Internet and Mobile Association of India (IAMAI) reports that urban areas have a penetration rate of 70%, while rural areas are catching up, reaching 50%. This growing digital landscape is a crucial driver for the e-learning market.

- Rising Demand for Skill Development: The Indian workforce is increasingly seeking skill enhancement, with the National Skill Development Corporation (NSDC) estimating that 400 million individuals will require upskilling by in future. This demand is fueled by the rapid evolution of industries and the need for digital competencies. E-learning platforms are responding by offering targeted courses, with over 2,000 new courses launched in 2023 alone, catering to diverse professional needs and enhancing employability.

- Government Initiatives for Digital Education: The Indian government has committed substantial resources to digital education, with an allocation of ?1,00,000 crore (approximately $13 billion) for the National Education Policy (NEP) 2020. This policy aims to integrate technology into education, promoting online learning. Additionally, initiatives like SWAYAM and DIKSHA provide free access to quality educational resources, significantly boosting the e-learning ecosystem and encouraging widespread adoption across various demographics.

Market Challenges

- Limited Digital Infrastructure in Rural Areas: Despite the growth in internet users, rural India still faces significant digital infrastructure challenges. According to the Telecom Regulatory Authority of India (TRAI), only 35% of rural households have internet access, compared to 85% in urban areas. This disparity limits the reach of e-learning platforms, hindering their ability to serve a substantial portion of the population and exacerbating educational inequalities.

- High Competition Among E-learning Platforms: The Indian e-learning market is saturated, with over 1,200 platforms competing for users. Major players like Byju's, Unacademy, and Coursera dominate the landscape, leading to intense price wars and marketing battles. This competition can dilute brand loyalty and make it challenging for new entrants to establish themselves. As a result, many platforms struggle to differentiate their offerings, impacting profitability and sustainability.

India E-learning Market Future Outlook

The future of the India e-learning market appears promising, driven by technological advancements and evolving educational needs. The integration of artificial intelligence and machine learning is expected to enhance personalized learning experiences, making education more accessible and effective. Additionally, the shift towards hybrid learning models, combining online and offline methods, will cater to diverse learning preferences. As government support continues, the market is poised for significant growth, fostering innovation and expanding access to quality education across the country.

Market Opportunities

- Expansion of Corporate Training Programs: With the corporate sector increasingly recognizing the value of continuous learning, the demand for e-learning solutions in corporate training is set to rise. Companies are investing in online training modules, with an estimated ?25,000 crore (approximately $3.4 billion) allocated for employee training in in future, creating a lucrative opportunity for e-learning providers to tailor their offerings to meet corporate needs.

- Growth of Personalized Learning Experiences: The trend towards personalized learning is gaining momentum, with platforms leveraging data analytics to tailor educational content. By in future, it is projected that 70% of e-learning platforms will offer personalized learning paths, enhancing user engagement and satisfaction. This shift presents a significant opportunity for providers to innovate and differentiate their services, catering to individual learning styles and preferences.

Scope of the Report

| By Type |

K-12 (Supplemental and Curriculum-Aligned) Higher Education (UG/PG, Distance & Online Degrees) Test Preparation (JEE/NEET, UPSC, Banking, SSC, others) Professional & Vocational Certification (IT, Data, Finance, BFSI) Language & Communication (English, Regional, IELTS/TOEFL) Corporate Learning & Compliance (L&D, Sales Enablement) Government & Skilling (NSDC, Sector Skill Councils) |

| By End-User |

Students (K-12 and Higher Ed) Working Professionals & Job-Seekers Educational Institutions (Schools, Colleges, Universities) Enterprises/SMBs (Across Sectors) Government & Public Sector |

| By Region |

North India South India East India West & Central India |

| By Application |

Online E-learning (Self-paced, Instructor-led) Mobile E-learning (Apps, Offline Access) Virtual/Classroom & Live Learning (Webinars, Live Classes) Learning Management Systems (LMS/LXP) Rapid E-learning & Microlearning Assessment, Proctoring & Analytics |

| By Investment Source |

Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes (DIKSHA, SWAYAM, PMKVY, eVidya) |

| By Policy Support |

NEP 2020 & UGC Online/ODL Guidelines Data Protection & EdTech Self-Regulation (DPDP Act, ASCI) Grants for Research, Digital Infrastructure & Teacher Training |

| By Pricing Strategy |

Subscription (B2C/B2B SaaS) Pay-Per-Course / Cohort-Based Freemium & Ad-Supported Bundled/Pathways & Degree Partnerships |

Products

E-learning, Virtual Classroom, E-Learning Softwares, Hardwares and Technologies, Technology, Content, ICT, Education, Content Authoring Tools

Companies

Players Mentioned in the Report:

BYJU'S

Unacademy

Vedantu

upGrad

Simplilearn

NIIT Ltd

Coursera

edX

Great Learning

PhysicsWallah (PW)

Khan Academy

Allen Digital

NextEducation India Pvt. Ltd.

TalentSprint

Eruditus (Emeritus India)

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. India E-learning Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 India E-learning Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. India E-learning Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Internet Penetration

3.1.2 Rising Demand for Skill Development

3.1.3 Government Initiatives for Digital Education

3.1.4 Adoption of Mobile Learning Solutions

3.2 Market Challenges

3.2.1 Limited Digital Infrastructure in Rural Areas

3.2.2 High Competition Among E-learning Platforms

3.2.3 Resistance to Change from Traditional Learning

3.2.4 Quality Assurance in Course Content

3.3 Market Opportunities

3.3.1 Expansion of Corporate Training Programs

3.3.2 Growth of Personalized Learning Experiences

3.3.3 Integration of AI and Machine Learning in Education

3.3.4 Collaboration with Educational Institutions

3.4 Market Trends

3.4.1 Rise of Gamification in Learning

3.4.2 Increased Focus on Microlearning

3.4.3 Shift Towards Hybrid Learning Models

3.4.4 Emphasis on Data Analytics for Learning Outcomes

3.5 Government Regulation

3.5.1 National Education Policy 2020

3.5.2 Guidelines for Online Education Providers

3.5.3 Data Protection Regulations for Student Information

3.5.4 Accreditation Standards for E-learning Courses

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. India E-learning Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. India E-learning Market Segmentation

8.1 By Type

8.1.1 K-12 (Supplemental and Curriculum-Aligned)

8.1.2 Higher Education (UG/PG, Distance & Online Degrees)

8.1.3 Test Preparation (JEE/NEET, UPSC, Banking, SSC, others)

8.1.4 Professional & Vocational Certification (IT, Data, Finance, BFSI)

8.1.5 Language & Communication (English, Regional, IELTS/TOEFL)

8.1.6 Corporate Learning & Compliance (L&D, Sales Enablement)

8.1.7 Government & Skilling (NSDC, Sector Skill Councils)

8.2 By End-User

8.2.1 Students (K-12 and Higher Ed)

8.2.2 Working Professionals & Job-Seekers

8.2.3 Educational Institutions (Schools, Colleges, Universities)

8.2.4 Enterprises/SMBs (Across Sectors)

8.2.5 Government & Public Sector

8.3 By Region

8.3.1 North India

8.3.2 South India

8.3.3 East India

8.3.4 West & Central India

8.4 By Application

8.4.1 Online E-learning (Self-paced, Instructor-led)

8.4.2 Mobile E-learning (Apps, Offline Access)

8.4.3 Virtual/Classroom & Live Learning (Webinars, Live Classes)

8.4.4 Learning Management Systems (LMS/LXP)

8.4.5 Rapid E-learning & Microlearning

8.4.6 Assessment, Proctoring & Analytics

8.5 By Investment Source

8.5.1 Domestic Investment

8.5.2 Foreign Direct Investment (FDI)

8.5.3 Public-Private Partnerships (PPP)

8.5.4 Government Schemes (DIKSHA, SWAYAM, PMKVY, eVidya)

8.6 By Policy Support

8.6.1 NEP 2020 & UGC Online/ODL Guidelines

8.6.2 Data Protection & EdTech Self-Regulation (DPDP Act, ASCI)

8.6.3 Grants for Research, Digital Infrastructure & Teacher Training

8.7 By Pricing Strategy

8.7.1 Subscription (B2C/B2B SaaS)

8.7.2 Pay-Per-Course / Cohort-Based

8.7.3 Freemium & Ad-Supported

8.7.4 Bundled/Pathways & Degree Partnerships

9. India E-learning Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross Comparison of Key Players

9.2.1 Company Name

9.2.2 Scale Tier (Unicorn/Large, Mid, Emerging)

9.2.3 Monthly Active Users (MAUs) / Enrolled Learners

9.2.4 Paid Subscribers / Conversion Rate (Free-to-Paid)

9.2.5 Course Completion Rate

9.2.6 Customer Acquisition Cost (CAC)

9.2.7 Customer Lifetime Value (LTV) and LTV:CAC

9.2.8 Average Revenue Per User (ARPU)

9.2.9 Enterprise ARR / B2B Share of Revenue

9.2.10 Pricing Model (Subscription, Cohort, Degree, Freemium)

9.2.11 Geographic Penetration (Tier 1/2/3 mix; India vs. overseas)

9.2.12 Content Breadth (K-12, Test Prep, Skilling, Degrees)

9.2.13 Certification/Placement Outcomes (NPS, Job Placement Rate)

9.2.14 Gross Margin and Marketing Spend as % of Revenue

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 BYJU'S

9.5.2 Unacademy

9.5.3 Vedantu

9.5.4 upGrad

9.5.5 Simplilearn

9.5.6 NIIT Ltd

9.5.7 Coursera

9.5.8 edX

9.5.9 Great Learning

9.5.10 PhysicsWallah (PW)

9.5.11 Khan Academy

9.5.12 Allen Digital

9.5.13 NextEducation India Pvt. Ltd.

9.5.14 TalentSprint

9.5.15 Eruditus (Emeritus India)

10. India E-learning Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Budget Allocation for E-learning

10.1.2 Evaluation Criteria for E-learning Solutions

10.1.3 Preferred Vendors and Partnerships

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment in E-learning Platforms

10.2.2 Budgeting for Employee Training

10.2.3 Trends in Corporate Learning Expenditure

10.3 Pain Point Analysis by End-User Category

10.3.1 Challenges Faced by Students

10.3.2 Issues Encountered by Corporates

10.3.3 Barriers for Educational Institutions

10.4 User Readiness for Adoption

10.4.1 Digital Literacy Levels

10.4.2 Access to Technology

10.4.3 Attitudes Towards Online Learning

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Measuring Learning Outcomes

10.5.2 Feedback Mechanisms for Improvement

10.5.3 Scaling Up Successful Programs

11. India E-learning Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market Gaps Identification

1.2 Business Model Framework

2. Marketing and Positioning Recommendations

2.1 Branding Strategies

2.2 Product USPs

3. Distribution Plan

3.1 Urban Retail vs Rural NGO Tie-ups

4. Channel & Pricing Gaps

4.1 Underserved Routes

4.2 Pricing Bands

5. Unmet Demand & Latent Needs

5.1 Category Gaps

5.2 Consumer Segments

6. Customer Relationship

6.1 Loyalty Programs

6.2 After-sales Service

7. Value Proposition

7.1 Sustainability

7.2 Integrated Supply Chains

8. Key Activities

8.1 Regulatory Compliance

8.2 Branding

8.3 Distribution Setup

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product Mix

9.1.2 Pricing Band

9.1.3 Packaging

9.2 Export Entry Strategy

9.2.1 Target Countries

9.2.2 Compliance Roadmap

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield Investments

10.3 Mergers & Acquisitions

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital Requirements

11.2 Timelines

12. Control vs Risk Trade-Off

12.1 Ownership vs Partnerships

13. Profitability Outlook

13.1 Breakeven Analysis

13.2 Long-term Sustainability

14. Potential Partner List

14.1 Distributors

14.2 Joint Ventures

14.3 Acquisition Targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Activity Planning

15.2.2 Milestone Tracking

Disclaimer Contact UsResearch Methodology

Phase 1: Approach

Desk Research

- Analysis of market reports from educational institutions and e-learning associations in India

- Review of government publications on digital education initiatives and funding

- Examination of academic journals and white papers on e-learning trends and technologies

Primary Research

- Interviews with key stakeholders in the e-learning sector, including platform developers and educators

- Surveys targeting students and parents to understand user preferences and challenges

- Focus group discussions with industry experts and thought leaders in digital education

Validation & Triangulation

- Cross-validation of findings through multiple data sources, including market surveys and expert opinions

- Triangulation of qualitative insights with quantitative data from user engagement metrics

- Sanity checks through peer reviews and feedback from industry panels

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of market size based on national education expenditure and digital adoption rates

- Segmentation of the market by type of e-learning (K-12, higher education, corporate training)

- Incorporation of growth projections from government digital initiatives and private sector investments

Bottom-up Modeling

- Collection of user data from leading e-learning platforms to establish usage patterns

- Analysis of subscription models and pricing strategies across different e-learning services

- Volume x revenue calculations based on user engagement and retention rates

Forecasting & Scenario Analysis

- Multi-factor regression analysis incorporating demographic trends and technology adoption rates

- Scenario modeling based on potential regulatory changes and market disruptions

- Development of baseline, optimistic, and pessimistic forecasts through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-learning Platforms | 120 | Teachers, School Administrators, Parents |

| Higher Education Online Courses | 100 | University Professors, Students, Course Coordinators |

| Corporate Training Solutions | 80 | HR Managers, Training Coordinators, Employees |

| EdTech Startups | 70 | Founders, Product Managers, Investors |

| Government E-learning Initiatives | 60 | Policy Makers, Educational Planners, NGO Representatives |

Frequently Asked Questions

What is the current value of the India E-learning Market?

The India E-learning Market is valued at approximately USD 8.2 billion, reflecting significant growth driven by increased internet penetration, smartphone usage, and the demand for flexible learning options across various educational segments.

What factors are driving the growth of the E-learning Market in India?

Key growth drivers include increasing internet penetration, rising demand for skill development, and substantial government initiatives aimed at enhancing digital education through policies like the National Education Policy (NEP) 2020.

Which regions in India dominate the E-learning Market?

Metropolitan areas such as Bengaluru, Delhi, and Mumbai lead the India E-learning Market due to their robust technology ecosystems and high concentrations of educational institutions, with South India currently holding the largest market share.

What segments are included in the India E-learning Market?

The market is segmented into K-12, Higher Education, Test Preparation, Professional & Vocational Certification, Language & Communication, Corporate Learning, and Government & Skilling, with K-12 and Test Preparation witnessing significant growth.

How has the pandemic affected the E-learning Market in India?

The pandemic accelerated the shift to online learning platforms as educational institutions transitioned to digital formats, significantly boosting the adoption of e-learning tools and services across academic and professional sectors.

What challenges does the India E-learning Market face?

Challenges include limited digital infrastructure in rural areas, high competition among numerous e-learning platforms, and resistance to change from traditional learning methods, which can hinder market growth and accessibility.

What role does the government play in the E-learning Market?

The Indian government supports the E-learning Market through substantial funding for digital education initiatives, such as the NEP 2020, and programs like SWAYAM and DIKSHA, which provide free access to quality educational resources.

What is the future outlook for the India E-learning Market?

The future of the India E-learning Market looks promising, with expected growth driven by technological advancements, the integration of AI for personalized learning, and a shift towards hybrid learning models that cater to diverse educational needs.

Who are the major players in the India E-learning Market?

Key players include BYJU'S, Unacademy, Vedantu, upGrad, Simplilearn, and international platforms like Coursera and edX, all contributing to innovation and service delivery in the e-learning space.

What is the significance of mobile e-learning in India?

Mobile e-learning is significant in India due to the country's mobile-first usage patterns and affordable data access, making it a preferred mode of learning for many users, especially in remote areas.

How is the E-learning Market segmented by end-users?

The E-learning Market is segmented by end-users into Students (K-12 and higher education), Working Professionals, Educational Institutions, Enterprises/SMBs, and Government/Public Sector, with students being the largest consumer group.

What opportunities exist for corporate training in the E-learning Market?

There is a growing opportunity for corporate training programs as companies increasingly recognize the value of continuous learning, with significant investments being made in online training modules to enhance employee skills and competencies.

What trends are shaping the future of E-learning in India?

Trends include the rise of gamification in learning, increased focus on microlearning, the shift towards hybrid learning models, and the use of data analytics to improve learning outcomes and user engagement.

What is the impact of the National Education Policy (NEP) 2020 on E-learning?

The NEP 2020 emphasizes technology integration in education, promoting online learning and digital repositories, which enhances access and quality in K-12 and higher education, significantly impacting the E-learning landscape in India.

How does the pricing strategy affect the E-learning Market?

The pricing strategy in the E-learning Market varies, including subscription models, pay-per-course, freemium options, and bundled partnerships, which influence user engagement and accessibility to educational resources.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.