India ECG Equipment Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4669

December 2024

92

About the Report

India ECG Equipment Market Overview

- The India ECG Equipment market is valued at USD 178 million, driven primarily by the rising prevalence of cardiovascular diseases and an increase in the geriatric population. The market's expansion is also supported by advancements in medical technology, such as AI-powered diagnostics, along with growing awareness regarding preventive healthcare. Government initiatives to strengthen healthcare infrastructure further boost the demand for ECG equipment across public and private sectors.

- In India, cities like Delhi, Mumbai, and Bengaluru dominate the market. These cities are home to the largest number of multi-specialty hospitals, private healthcare providers, and advanced diagnostic centers. Their dominance is a result of higher healthcare spending, larger populations requiring medical services, and the presence of world-class hospitals catering to both domestic and international patients.

- Indias National Health Policy (NHP) sets guidelines for improving healthcare infrastructure, with a focus on expanding diagnostic services, including ECG equipment. Under this policy, the government aims to increase public spending on healthcare to 2.5% of GDP by 2025. This policy framework encourages the adoption of advanced medical devices like ECG machines in public hospitals, contributing to improved access to cardiovascular care across the country.

India ECG Equipment Market Segmentation

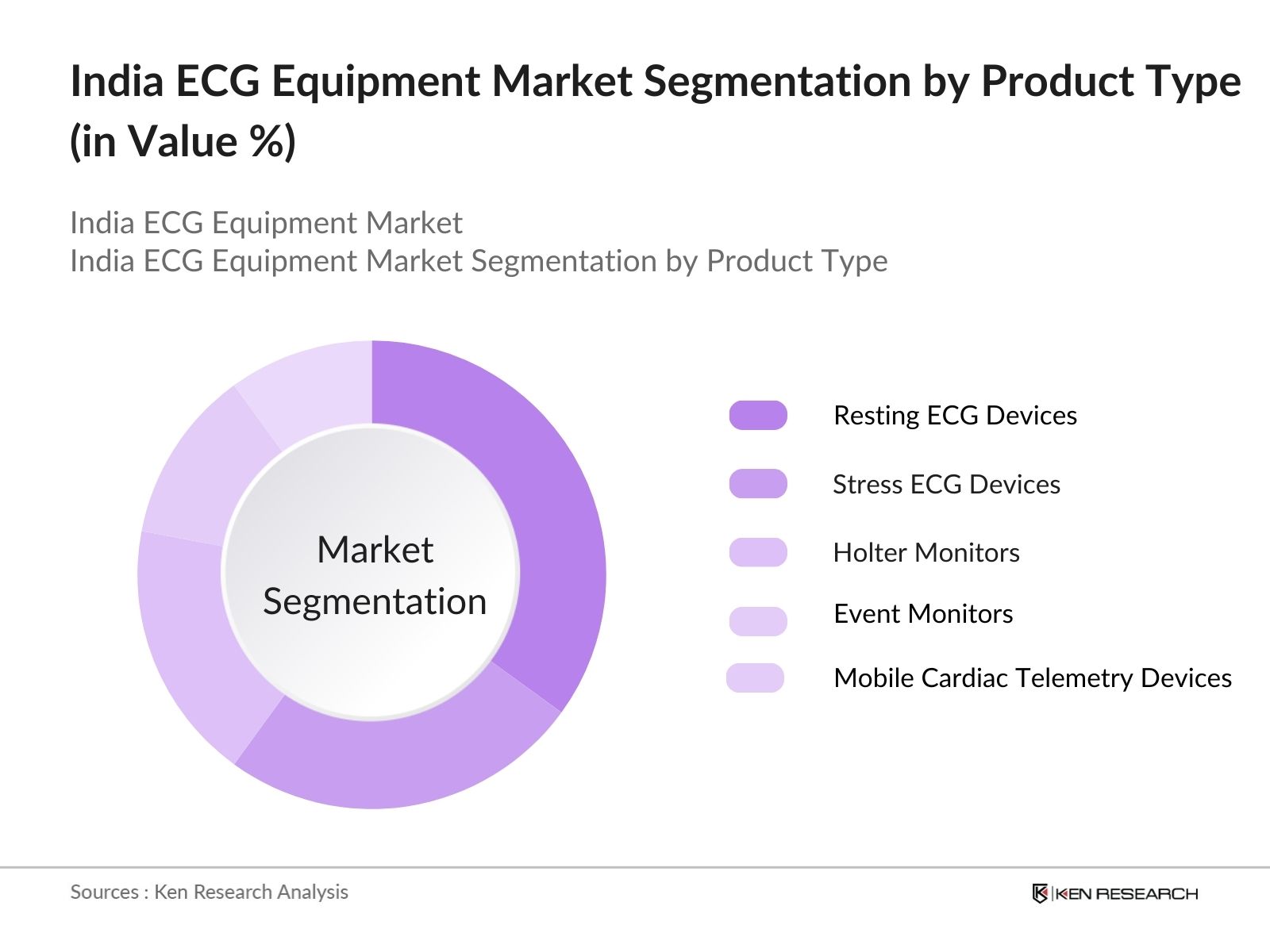

- By Product Type: India's ECG Equipment market is segmented by product type into resting ECG devices, stress ECG devices, Holter monitors, event monitors, and mobile cardiac telemetry devices. Resting ECG devices dominate the market due to their widespread usage in hospitals and clinics for routine cardiac checkups. Their ease of use and relatively low cost make them a standard tool in both urban and rural healthcare settings. With the growing demand for preventive healthcare, resting ECG devices are a preferred choice for initial heart condition screenings.

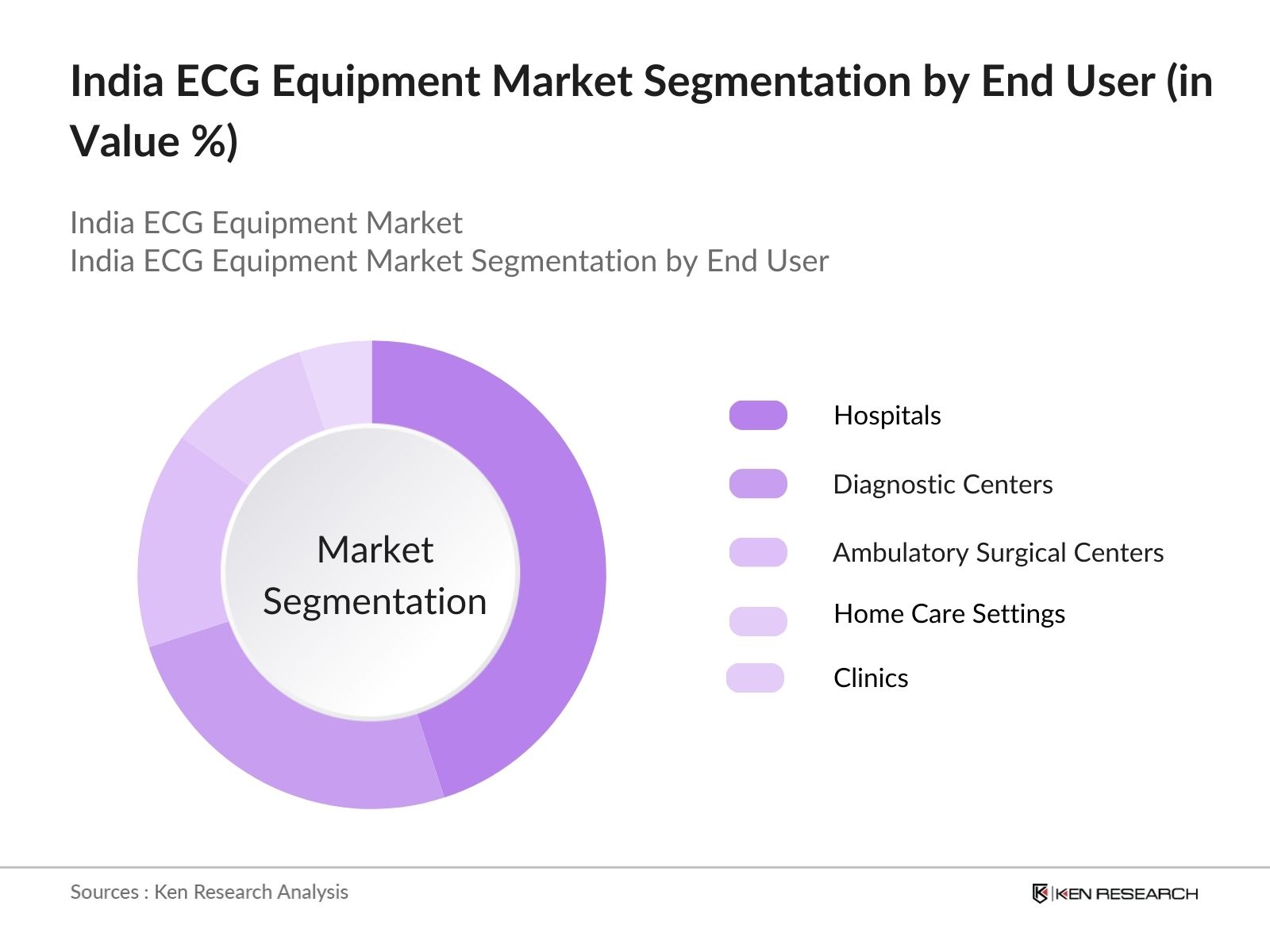

- By End User: The market is also segmented by end user into hospitals, diagnostic centers, ambulatory surgical centers, home care settings, and clinics. Hospitals represent the largest market share due to their large patient base and higher budget allocations for advanced diagnostic equipment. In addition, the governments push for modernizing healthcare facilities has led hospitals to invest in state-of-the-art ECG equipment to improve diagnostic accuracy and patient care.

India ECG Equipment Market Competitive Landscape

The Indian ECG Equipment market is dominated by a few major players, including global giants and local manufacturers, who offer a variety of products tailored to the Indian healthcare environment. These key players invest in research and development to enhance product capabilities and maintain a competitive edge in the rapidly evolving market.

|

Company |

Established |

Headquarters |

Product Portfolio |

Global Presence |

R&D Investments |

Market Strategy |

Revenue (2023) |

|

Philips Healthcare |

1891 |

Netherlands |

- |

- |

- |

- |

- |

|

GE Healthcare |

1892 |

USA |

- |

- |

- |

- |

- |

|

BPL Medical Technologies |

1967 |

India |

- |

- |

- |

- |

- |

|

Schiller AG |

1974 |

Switzerland |

- |

- |

- |

- |

- |

|

Nihon Kohden Corporation |

1951 |

Japan |

- |

- |

- |

- |

- |

India ECG Equipment Market Analysis

India ECG Equipment Market Growth Drivers

- Rise in Cardiovascular Diseases: India faces a growing burden of cardiovascular diseases, with nearly 28 million people currently diagnosed with heart-related conditions. This increase is driven by lifestyle changes, urbanization, and a rise in risk factors like hypertension and diabetes. According to the Ministry of Health and Family Welfare, India records about 2 million heart attacks annually, and cardiovascular diseases are responsible for almost 25% of deaths. This situation has led to increased demand for ECG equipment in hospitals and healthcare centers, as ECG is a crucial diagnostic tool for heart conditions.

- Technological Advancements in ECG Devices: The ECG equipment market in India has seen rapid technological advancements, with the integration of AI-powered diagnostics and portable devices. These advancements have improved diagnostic accuracy and enabled real-time monitoring. For instance, AI-enabled ECG devices can now interpret complex data in under 60 seconds, reducing diagnostic time. In India, the development of portable ECG equipment is allowing healthcare providers to reach remote areas. The global market for AI-powered medical devices is projected to exceed USD 44 billion in the coming years, enhancing the potential for ECG advancements.

- Growing Geriatric Population: Indias population aged 60 and above is expected to exceed 140 million by 2024. The elderly are more susceptible to heart diseases, leading to an increased demand for ECG monitoring. Data from the Ministry of Social Justice and Empowerment shows that over 12% of the elderly population suffers from chronic heart conditions. This demographic shift is creating a consistent demand for ECG equipment, especially in primary care and outpatient departments, to ensure early diagnosis and management of cardiovascular diseases.

India ECG Equipment Market Challenges

- High Equipment Costs: One of the significant challenges in the Indian ECG equipment market is the high initial cost of modern ECG machines. Advanced ECG equipment with AI and wireless capabilities can cost anywhere between INR 5 to 15 lakh, making it difficult for smaller healthcare facilities to afford. In rural areas, where resources are limited, this presents a considerable barrier to adoption. Data from the Ministry of Health shows that public healthcare facilities in India operate on tight budgets, and such expenditures may limit the widespread use of high-end ECG machines.

- Lack of Skilled Professionals: India faces a shortage of trained professionals who can operate advanced ECG equipment, especially in rural regions. The World Health Organization estimates that India has a shortfall of 600,000 skilled healthcare workers, and this shortage is acutely felt in diagnostics. The lack of technical training in handling and interpreting ECG results reduces the efficiency of these devices in rural healthcare settings. Addressing this gap requires targeted government training programs and partnerships with educational institutions to ensure that professionals are equipped with the necessary skills.

India ECG Equipment Market Future Outlook

Over the next five years, the India ECG Equipment market is expected to witness substantial growth driven by factors such as the rising incidence of heart-related illnesses, increased government spending on healthcare infrastructure, and growing awareness of cardiovascular health. Technological innovations, such as AI-assisted ECG interpretations and portable ECG devices, will further propel the market, making advanced diagnostic tools more accessible, especially in remote and underserved regions.

India ECG Equipment Market Opportunities

- Expansion into Rural Healthcare: Rural India presents a opportunity for the ECG equipment market. With over 65% of the population residing in rural areas, the lack of diagnostic infrastructure remains a critical gap. The governments Ayushman Bharat initiative, which aims to cover 500 million people with health insurance, is driving demand for better healthcare facilities in these regions. ECG manufacturers can capitalize on this by providing cost-effective and portable solutions that cater to the rural healthcare market.

- Telemedicine Integration: The growth of telemedicine in India is creating new opportunities for ECG equipment manufacturers. The telemedicine market in India was valued at USD 1.3 billion in 2022 and is expected to grow with increased adoption in remote diagnostics. ECG devices integrated with telemedicine platforms enable real-time monitoring and remote consultations, addressing the healthcare needs of underserved populations. This technological integration allows doctors to monitor patient heart health from a distance, expanding the reach of diagnostic services.

Scope of the Report

|

By Product Type |

Resting ECG Devices Stress ECG Devices Holter Monitors Event Monitors Mobile Cardiac Telemetry Devices |

|

By Lead Type |

Single Lead ECG 3-6 Lead ECG 12 Lead ECG |

|

By End User |

Hospitals Diagnostic Centers Ambulatory Surgical Centers Home Care Settings Clinics |

|

By Connectivity |

Wired Devices Wireless Devices |

|

By Region |

North India South India West India East India |

Products

Key Target Audience

Hospitals and Healthcare Providers

Diagnostic and Imaging Centers

Medical Device Distributors and Suppliers

Government and Regulatory Bodies (Ministry of Health and Family Welfare, Central Drugs Standard Control Organization)

Cardiologists and Healthcare Practitioners

Banks and Financial Institutions

Private Healthcare Facilities

Investor and Venture Capitalist Firms

Telemedicine and Remote Monitoring Companies

Companies

India ECG Equipment Market Major Players

Philips Healthcare

GE Healthcare

BPL Medical Technologies

Schiller AG

Nihon Kohden Corporation

Mindray Medical International

Spacelabs Healthcare

Medtronic PLC

Fukuda Denshi

Mortara Instrument Inc.

CardioComm Solutions

AliveCor Inc.

EDAN Instruments

Cardioline SpA

Hill-Rom Holdings, Inc.

Table of Contents

1. India ECG Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India ECG Equipment Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India ECG Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Cardiovascular Diseases (Increased patient base)

3.1.2. Technological Advancements in ECG Devices (AI-powered diagnostics, portable equipment)

3.1.3. Growing Geriatric Population (Higher demand for ECG monitoring)

3.1.4. Government Healthcare Initiatives (Increased spending on public health infrastructure)

3.2. Market Challenges

3.2.1. High Equipment Costs (Initial investment barrier)

3.2.2. Lack of Skilled Professionals (Training gaps in rural areas)

3.2.3. Reimbursement Issues (Policy and coverage limitations)

3.3. Opportunities

3.3.1. Expansion into Rural Healthcare (Untapped market potential)

3.3.2. Telemedicine Integration (Remote monitoring and diagnostic services)

3.3.3. Growth of Private Healthcare Facilities (New opportunities for ECG equipment manufacturers)

3.4. Trends

3.4.1. Wearable ECG Devices (Growth of consumer health devices)

3.4.2. AI-Assisted ECG Interpretations (Advanced diagnostic accuracy)

3.4.3. Wireless and Mobile ECG Devices (Improved mobility and patient monitoring)

3.5. Government Regulations

3.5.1. National Health Policy Regulations

3.5.2. Medical Device Import Policies (Impact of tariffs and taxes)

3.5.3. Public-Private Partnerships (Collaborations to expand healthcare infrastructure)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Specific to India ECG market dynamics)

3.9. Competition Ecosystem

4. India ECG Equipment Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Resting ECG Devices

4.1.2. Stress ECG Devices

4.1.3. Holter Monitors

4.1.4. Event Monitors

4.1.5. Mobile Cardiac Telemetry Devices

4.2. By Lead Type (In Value %)

4.2.1. Single Lead ECG

4.2.2. 3-6 Lead ECG

4.2.3. 12 Lead ECG

4.3. By End User (In Value %)

4.3.1. Hospitals

4.3.2. Diagnostic Centers

4.3.3. Ambulatory Surgical Centers

4.3.4. Home Care Settings

4.3.5. Clinics

4.4. By Connectivity (In Value %)

4.4.1. Wired Devices

4.4.2. Wireless Devices

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India ECG Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Philips Healthcare

5.1.2. GE Healthcare

5.1.3. BPL Medical Technologies

5.1.4. Nihon Kohden Corporation

5.1.5. Schiller AG

5.1.6. Mindray Medical International

5.1.7. Spacelabs Healthcare

5.1.8. Fukuda Denshi

5.1.9. Medtronic PLC

5.1.10. Mortara Instrument Inc.

5.1.11. CardioComm Solutions

5.1.12. EDAN Instruments

5.1.13. AliveCor Inc.

5.1.14. Cardioline SpA

5.1.15. Hill-Rom Holdings, Inc.

5.2. Cross Comparison Parameters (Revenue, Global Presence, Product Portfolio, R&D Investments, Pricing Strategy, Market Penetration, Technological Capabilities, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Healthcare Investments

5.8. Private Equity and Venture Capital Funding

6. India ECG Equipment Market Regulatory Framework

6.1. Medical Device Regulations (India-Specific Policies)

6.2. Compliance Standards (ISO, CE Marking, Indian Medical Council Regulations)

6.3. Certification Processes (Licensing and Registration)

7. India ECG Equipment Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth (Rising healthcare expenditure, advanced technologies, increasing awareness)

8. India ECG Equipment Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Lead Type (In Value %)

8.3. By End User (In Value %)

8.4. By Connectivity (In Value %)

8.5. By Region (In Value %)

9. India ECG Equipment Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Strategic Marketing Initiatives

9.3. Customer Segmentation Strategy

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the India ECG Equipment market's stakeholders, including manufacturers, suppliers, and healthcare providers. The primary objective was to identify and define the variables influencing market demand, such as pricing strategies, technological advancements, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, we compiled historical data on the adoption rates of ECG equipment across hospitals, diagnostic centers, and clinics. The analysis focused on evaluating market penetration and revenue generation from the top market players.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through direct consultation with cardiologists and medical equipment procurement specialists. These discussions provided valuable insights into market trends, the competitive landscape, and evolving consumer preferences.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data from both primary and secondary sources to ensure an accurate representation of the market dynamics. This comprehensive analysis provided actionable insights for stakeholders in the India ECG Equipment market.

Frequently Asked Questions

01. How big is the India ECG Equipment Market?

The India ECG Equipment market is valued at USD 178 million, driven by increasing demand for advanced diagnostic solutions in cardiovascular care.

02. What are the challenges in the India ECG Equipment Market?

The India ECG Equipment market faces challenges such as the high cost of advanced equipment, limited access to rural healthcare, and a shortage of skilled professionals trained to operate modern ECG devices.

03. Who are the major players in the India ECG Equipment Market?

India ECG Equipment market players include Philips Healthcare, GE Healthcare, BPL Medical Technologies, Schiller AG, and Nihon Kohden Corporation. These companies dominate the market due to their advanced product portfolios and strategic expansion efforts.

04. What are the growth drivers of the India ECG Equipment Market?

The India ECG Equipment market is propelled by rising cases of heart diseases, increased government spending on healthcare, and advancements in ECG technology, such as portable and AI-enabled devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.