India Edible Oils Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2680

December 2024

94

About the Report

India Edible Oils Market Overview

- The India Edible Oils Market, valued at approximately USD 4.31 billion, has shown robust growth driven by increased consumer awareness of health benefits and evolving dietary preferences. High consumption levels are fueled by a growing urban population and a shift toward branded oils that emphasize quality and nutrition. Health-driven choices among consumers are leading to a preference for oils with higher nutritional content, such as rice bran, sunflower, and olive oils, which have seen significant market traction due to lifestyle-driven health concerns.

- The market dominance in India is notably high in Northern states, where consumption patterns are deeply rooted in cultural food habits and the availability of a wide variety of oils. These regions, including Uttar Pradesh and Punjab, have higher consumption due to traditional cooking practices, while the Southern states like Tamil Nadu see considerable demand due to the emphasis on palm and coconut oils that align with local cuisine preferences.

- Rashtriya Krishi Vikas Yojana (RKVY) has been implemented to improve agricultural practices, including oilseed cultivation, with a focus on increasing crop productivity and sustainable farming techniques. Through funding and resource allocation, RKVY supports farmers in oilseed production by providing access to better seeds, fertilizers, and training. The Ministry of Agriculture reported that RKVY has helped enhance oilseed yields, providing raw materials essential for edible oil production and contributing to the stability of domestic oil supply.

India Edible Oils Market Segmentation

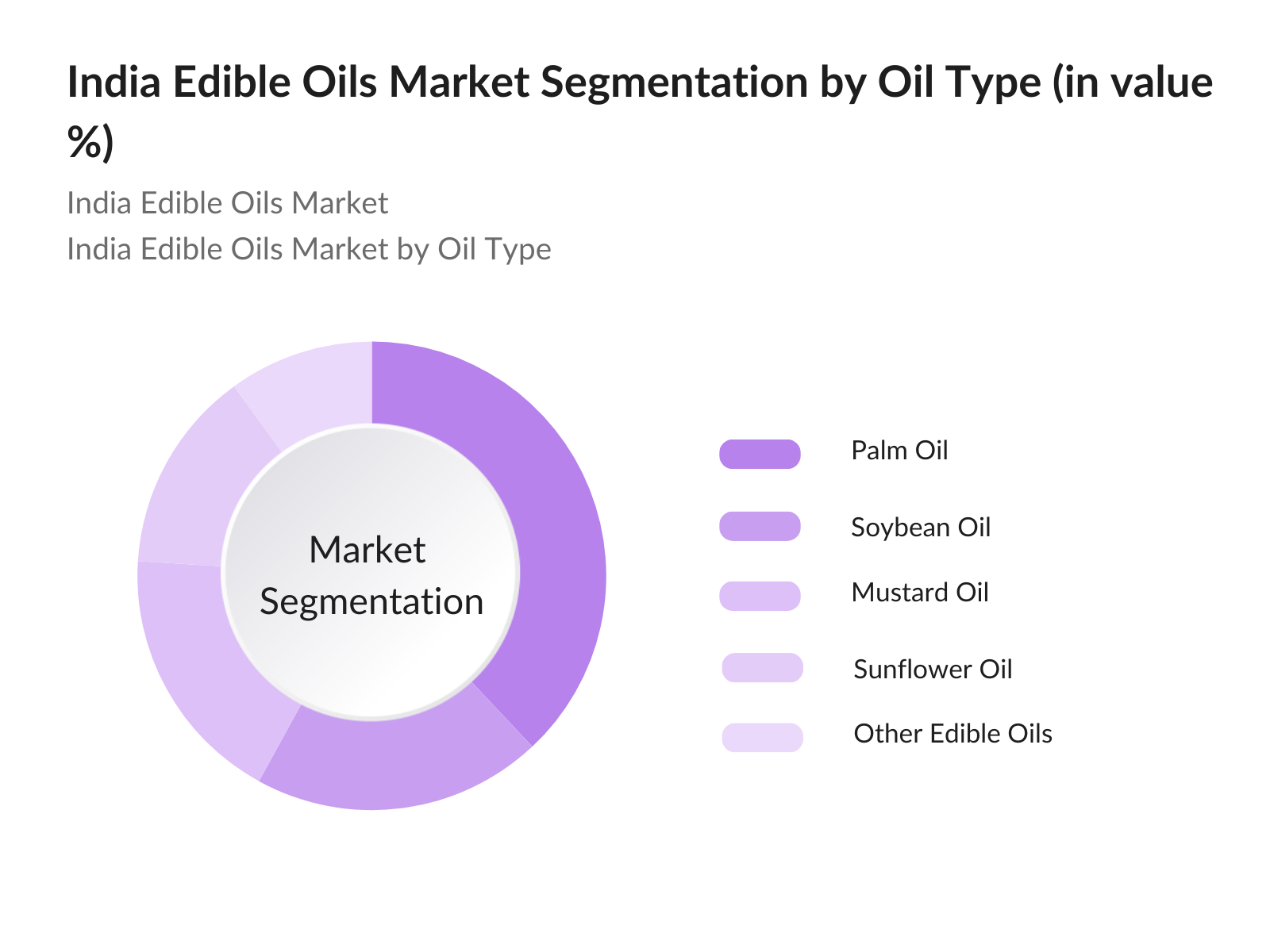

By Oil Type: The India Edible Oils Market is segmented by oil types into palm oil, soybean oil, mustard oil, sunflower oil, and other edible oils. Palm Oil: Palm oil holds a dominant market share in Indias edible oils market. Its popularity stems from its affordability and versatile usage in cooking, as well as its suitability for various food processing applications. Major brands leverage palm oil due to its stable price points, making it widely accessible in lower-income segments. Moreover, Indias dependence on imports for palm oil has enabled this segment to capture a significant market position.

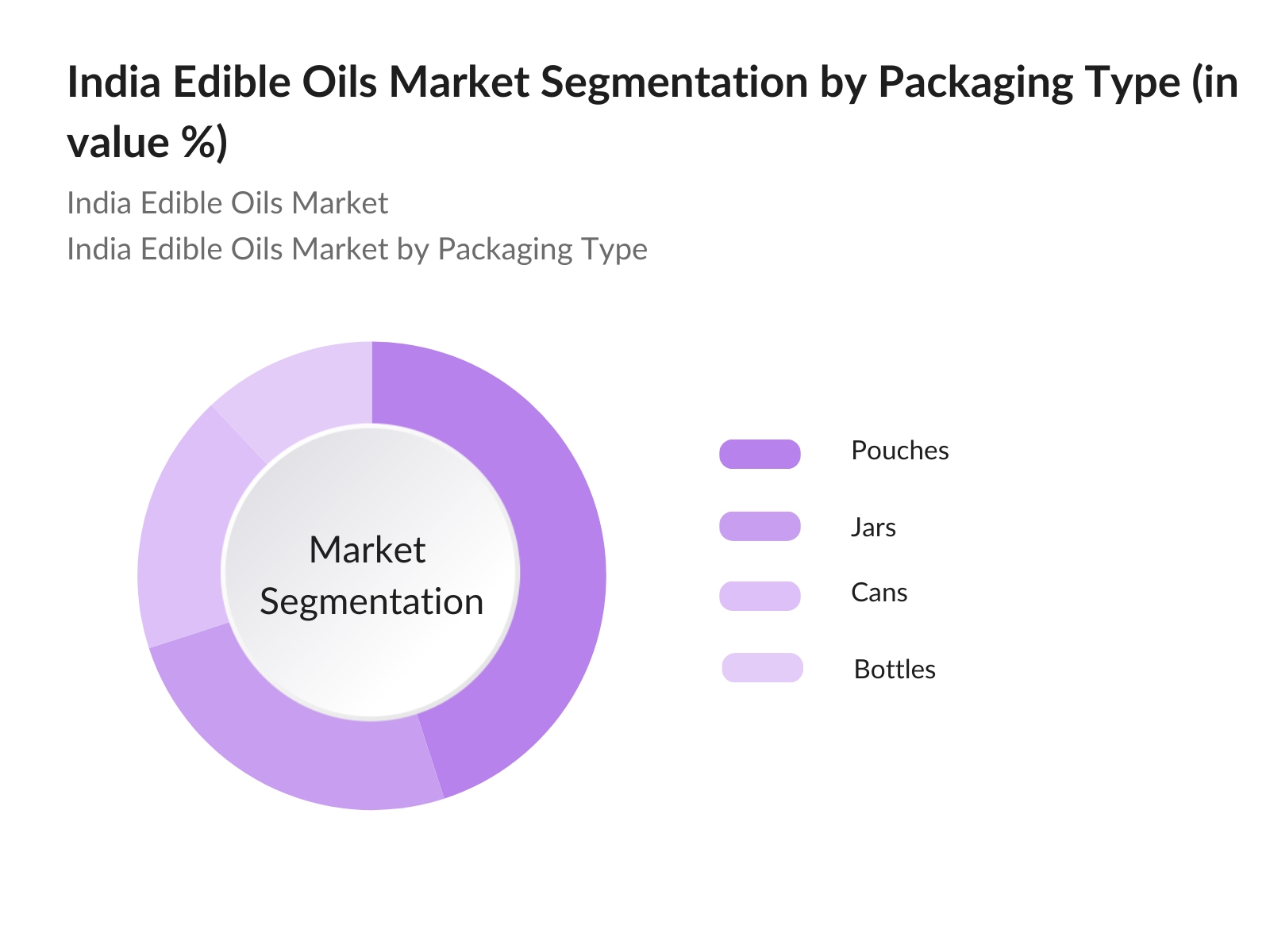

By Packaging Type: The market also segments by packaging type into pouches, jars, cans, and bottles. Pouches: The pouch packaging segment dominates due to its cost-effective nature, convenient storage options, and wide accessibility across urban and rural regions. Pouches appeal to budget-conscious consumers, who seek smaller packaging sizes for affordability and easy storage. This segment is further strengthened by modern retail stores, where flexible pouch packaging appeals to customers for both branded and unbranded oils.

India Edible Oils Market Competitive Landscape

The India Edible Oils Market is dominated by a few major players, both domestic and international, with a stronghold in branded and value-added oils. These companies capitalize on advanced packaging, extensive distribution networks, and a focus on premium product lines.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Market Reach |

Main Products |

Distribution Network |

Brand Strength |

Innovation Capability |

Import-Export Capacity |

|

Adani Group |

1988 |

Ahmedabad, India |

5.4 |

- |

- |

- |

- |

- |

- |

|

Ruchi Soya Industries Ltd |

1986 |

Indore, India |

4.3 |

- |

- |

- |

- |

- |

- |

|

Emami Ltd |

1974 |

Kolkata, India |

3.2 |

- |

- |

- |

- |

- |

- |

|

Cargill India Pvt Ltd |

1987 |

Gurgaon, India |

6.1 |

- |

- |

- |

- |

- |

- |

|

Marico Ltd |

1990 |

Mumbai, India |

4.8 |

- |

- |

- |

- |

- |

- |

India Edible Oils Market Analysis

Market Growth Analysis

- Economic Factors (GDP Growth, Population Trends): Indias economic resilience is a key driver for its edible oils market. According to the World Bank, Indias GDP is projected to sustain a steady annual increase, exceeding $3 trillion in 2024, benefiting various consumption sectors, including edible oils. Additionally, Indias population, expected to surpass 1.4 billion, has intensified demand for staple food products, pushing the market for edible oils higher. Urbanization continues to influence consumer preference for branded and packaged edible oils, reflecting a significant shift from rural, unbranded products to higher-quality, standardized options that suit urban lifestyles.

- Rising Health Awareness (Consumer Preferences for Value-added Oils): Health awareness among Indian consumers has led to a preference for oils with nutritional benefits, such as sunflower and rice bran oils. According to the National Health Survey, urban households in India are increasingly opting for oils labeled heart-healthy or fortified with vitamins and Omega-3 in 2023. This shift in demand aligns with the Ministry of Health's campaign promoting lifestyle changes and dietary improvements, positioning value-added edible oils as integral to consumer diets. This trend toward healthier alternatives significantly impacts demand, with increasing investment in the production of these premium oils.

- Demand for Packaged & Branded Oils (Shift from Unbranded Oils): The packaged edible oils market has grown due to consumer safety concerns and a preference for quality control. In 2023, branded oils have become a major part of urban household consumption, reflecting a significant departure from reliance on unbranded oils. According to the Indian Ministry of Food Processing Industries, India's ongoing focus on food safety standards has contributed to a steady increase in demand for these packaged and branded products. This shift enhances transparency in oil sourcing and quality, providing consumers with reliable product choices and fostering loyalty to branded oils.

Market Challenges:

- Dependence on Imports (Global Price Volatility Impact): India relies on imports for more than of its edible oil supply, particularly palm oil, sourced primarily from Indonesia and Malaysia. This dependence exposes the market to global price fluctuations, especially given ongoing trade policies affecting tariffs and export duties. The Reserve Bank of India reported in 2023 that volatile global oil prices had a direct impact on domestic pricing, as high import dependence makes it challenging to control price stability. The volatility is compounded by currency exchange rates, adding another layer of unpredictability to Indias edible oil market.

- Domestic Production Challenges (Infrastructure Limitations): Limited infrastructure and processing capacity have constrained Indias domestic production of edible oils, notably soy and sunflower oils. The Ministry of Agriculture reported in 2023 that oilseed yields in India lag due to outdated machinery and inefficient supply chains, producing only about 10 million metric tons of oil compared to a demand of over 20 million metric tons. This mismatch heightens reliance on imports, complicating domestic production efforts and discouraging new investments in processing infrastructure necessary for scale and efficiency.

India Edible Oils Market Future Outlook

Over the coming years, the India Edible Oils Market is anticipated to grow steadily, driven by changing dietary habits and increasing awareness of health-related attributes associated with different oils. This shift toward branded, value-added oils such as olive and sunflower is supported by a growing urban middle class, which prioritizes health over cost. Additionally, government initiatives to boost domestic oilseed production are expected to reduce import dependency, fostering growth in local production capabilities and refining processes.

Market Opportunities:

- Demand for Specialty Oils (Olive, Canola): Specialty oils, such as olive and canola, are gaining traction due to rising disposable incomes and shifting health preferences. The Ministry of Commerce indicated that imports of olive oil increased by 15,000 metric tons in 2023, reflecting a heightened demand among urban households. With olive and canola oils association with heart health benefits, consumers are increasingly drawn to these premium oils, creating an expanding market segment in India. This demand for high-quality oils offers an opportunity for growth in premium segments beyond staple oils, encouraging diversification in oil offerings.

- Sustainable Packaging Innovations: Sustainability has gained importance in the edible oils industry, with manufacturers adopting eco-friendly packaging solutions to appeal to environmentally conscious consumers. The Ministry of Environment reports that over 10,000 tons of plastic waste in the food packaging sector were managed through recycling programs in 2023, indicating increased industry commitment to sustainable practices. Additionally, edible oil companies are investing in biodegradable and reusable packaging options, responding to a rising demand for environmentally responsible products. These innovations align with India's sustainability goals and provide an opportunity for brands to enhance their market positioning.

Scope of the Report

|

By Type |

Palm Oil Soybean Oil Mustard Oil Sunflower Oil Other Edible Oils |

|

By Packaging Type |

Pouches Jars Cans Bottles |

|

By Packaging Material |

Plastic Metal Paper Other Materials |

|

By Pack Size |

Less than 1 Liter 1 Liter 1-5 Liters 5-10 Liters Above 10 Liters |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Edible Oil Manufacturers

Retail Chains and Supermarkets

HoReCa (Hotels, Restaurants, Catering) Sectors

E-commerce Platforms

Oilseed Growers and Cooperatives

Investment and Venture Capital Firms

Government and Regulatory Bodies (Ministry of Agriculture & Farmers Welfare, FSSAI)

Packaging and Distribution Service Providers

Companies

Players Mention in the Report

Adani Group

Emami Ltd

Ruchi Soya Industries Ltd

Cargill India Pvt Ltd

Marico Ltd

Mother Dairy

Patanjali Ayurved Ltd

Kaleesuwari Refinery Pvt Ltd

Liberty Oil Mills Ltd

Wilmar International Ltd

Modi Naturals Ltd

Gokul Refoils & Solvent Ltd

Gemini Edibles & Fats India Pvt Ltd

Bunge India Pvt Ltd

Dhara Oils

Table of Contents

01. India Edible Oils Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Lifecycle and Key Milestones

1.4 Market Segmentation Overview

02. India Edible Oils Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Growth Rate Analysis

2.3 Import-Export Analysis (Volume and Value)

2.4 Key Industry Developments

03. India Edible Oils Market Analysis

3.1 Growth Drivers

3.1.1 Economic Factors (GDP growth, population trends)

3.1.2 Rising Health Awareness (Consumer preferences for value-added oils)

3.1.3 Demand for Packaged & Branded Oils (Shift from unbranded oils)

3.2 Market Restraints

3.2.1 Dependence on Imports (Global price volatility impact)

3.2.2 Domestic Production Challenges (Infrastructure limitations)

3.3 Opportunities

3.3.1 Growth in Retail and E-commerce Channels

3.3.2 Demand for Specialty Oils (Olive, Canola)

3.4 Trends

3.4.1 Increasing Demand for Small-Sized Packaged Edible Oils

3.4.2 Sustainable Packaging Innovations

04. Government Regulations and Policies

4.1 Import Duty Structures

4.2 FSSAI Regulations on Adulteration

4.3 Subsidies for Oilseed Production

4.4 Regional Schemes (Focus on North and West India)

05. India Edible Oils Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

Adani Group

Emami Ltd

Ruchi Soya Industries Ltd

Cargill India Pvt Ltd

Kaleesuwari Refinery Pvt Ltd

Gemini Edibles & Fats India Pvt Ltd

Mother Dairy

Marico Ltd

Dhara Oils

Patanjali Ayurved Ltd

Wilmar International Ltd

Modi Naturals Ltd

Liberty Oil Mills Ltd

Gokul Refoils & Solvent Ltd

Bunge India Pvt Ltd

5.2 Cross-Comparison Parameters (Revenue, Operational Scale, Product Range, Distribution Network, Brand Popularity, Market Reach, Technical Capabilities, Customer Base)

5.3 Market Share Analysis (By Type and Region)

5.4 Strategic Initiatives (Mergers, Acquisitions, and Partnerships)

5.5 Investment Analysis (Venture Funding, Private Equity Investments)

06. India Edible Oils Market Segmentation

6.1 By Type (In Value %)

Palm Oil

Soybean Oil

Mustard Oil

Sunflower Oil

Other Edible Oils

6.2 By Packaging Type (In Value %)

Pouches

Jars

Cans

Bottles

6.3 By Packaging Material (In Value %)

Plastic

Metal

Paper

Other Materials

6.4 By Pack Size (In Value %)

Less than 1 Liter

1 Liter

1-5 Liters

5-10 Liters

Above 10 Liters

6.5 By Distribution Channel (In Value %)

Retail Channel

E-commerce

Wholesale/Bulk

Direct Institutional Sales

07. India Edible Oils Market Regional Analysis

7.1 North India (State-wise Consumption and Preferences)

7.2 West and Central India (Market Share and Trends)

7.3 South India (Product Segmentation and Demand Patterns)

7.4 East India (Regional Preferences and Consumption Trends)

08. Future Market Size of India Edible Oils Market (In USD Bn)

8.1 Market Forecast Analysis

8.2 Key Growth Determinants

09. India Edible Oils Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Innovation and Product Development

9.3 Customer Segmentation Strategy

9.4 Competitive Positioning Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all stakeholders in the India Edible Oils Market through extensive desk research, supported by data from primary and secondary sources. This establishes an understanding of the primary market variables influencing growth and trends.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data for market penetration, sales channels, and revenue generation across segments. An in-depth analysis of supply chain dynamics and pricing trends is conducted to build accurate market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested via consultations with industry professionals from various companies, capturing insights on operational practices and financial strategies that impact the edible oils market directly.

Step 4: Research Synthesis and Final Output

Data from these consultations and secondary research is synthesized to finalize the report, ensuring a comprehensive and validated analysis. The final output captures the India Edible Oils Market dynamics, consumer trends, and industry shifts with high accuracy.

Frequently Asked Questions

01. How big is the India Edible Oils Market?

The India Edible Oils Market, valued at approximately USD 4.31 billion, is driven by the growing consumption of packaged oils and rising health awareness among consumers.

02. What are the main challenges in the India Edible Oils Market?

The market faces challenges including high import dependence, fluctuating global oil prices, and infrastructural bottlenecks in the domestic oilseed processing sector.

03. Who are the major players in the India Edible Oils Market?

Key players include Adani Group, Ruchi Soya Industries Ltd, Emami Ltd, and Cargill India Pvt Ltd, all known for their strong brand presence and extensive distribution networks.

04. What are the growth drivers of the India Edible Oils Market?

The market is propelled by factors such as an expanding urban population, health-conscious consumer behavior, and the transition to branded oils with perceived health benefits.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.