India EHR Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD3785

October 2024

91

About the Report

India EHR Market Overview

- The India EHR Market is valued at USD 616 million in 2023, has been primarily driven by the ongoing digital transformation within the healthcare sector, coupled with government initiatives such as the Ayushman Bharat Digital Mission and the National Digital Health Blueprint. These initiatives are aimed at fostering greater access to healthcare services, improving patient care, and reducing the burden on healthcare infrastructure.

- Cities such as Delhi, Mumbai, and Bengaluru are at the forefront of the market in India due to the presence of large healthcare infrastructure, major private hospitals, and government-backed healthcare schemes. These urban centers have embraced digital health initiatives and have a higher concentration of tech-savvy healthcare providers who are more likely to adopt EHR solutions.

- The Digital Personal Data Protection Act, 2023 is a significant government initiative for India's EHR market, as it emphasizes safeguarding personal data, including sensitive health data. It ensures that healthcare providers using EHR systems must comply with stringent data protection regulations. The Act mandates explicit consent for data collection, ensures data security, and places responsibility on entities to protect patient data.

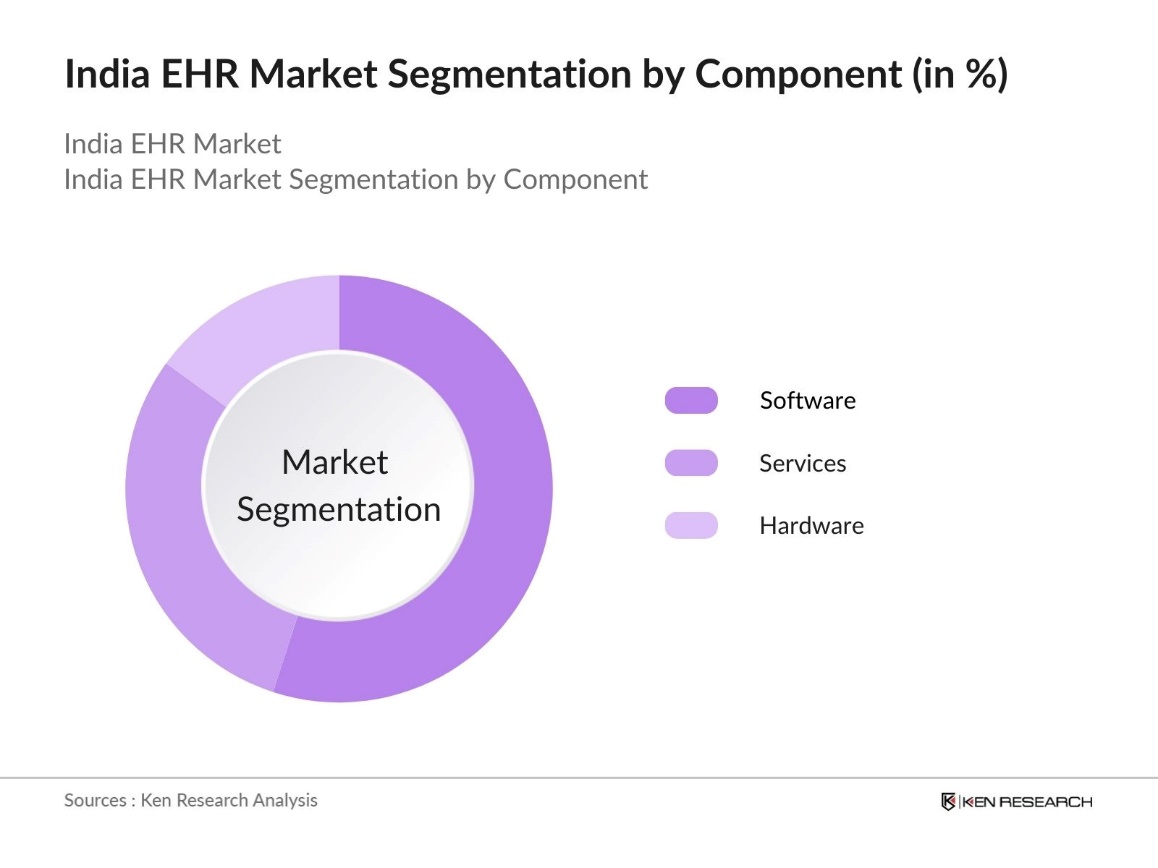

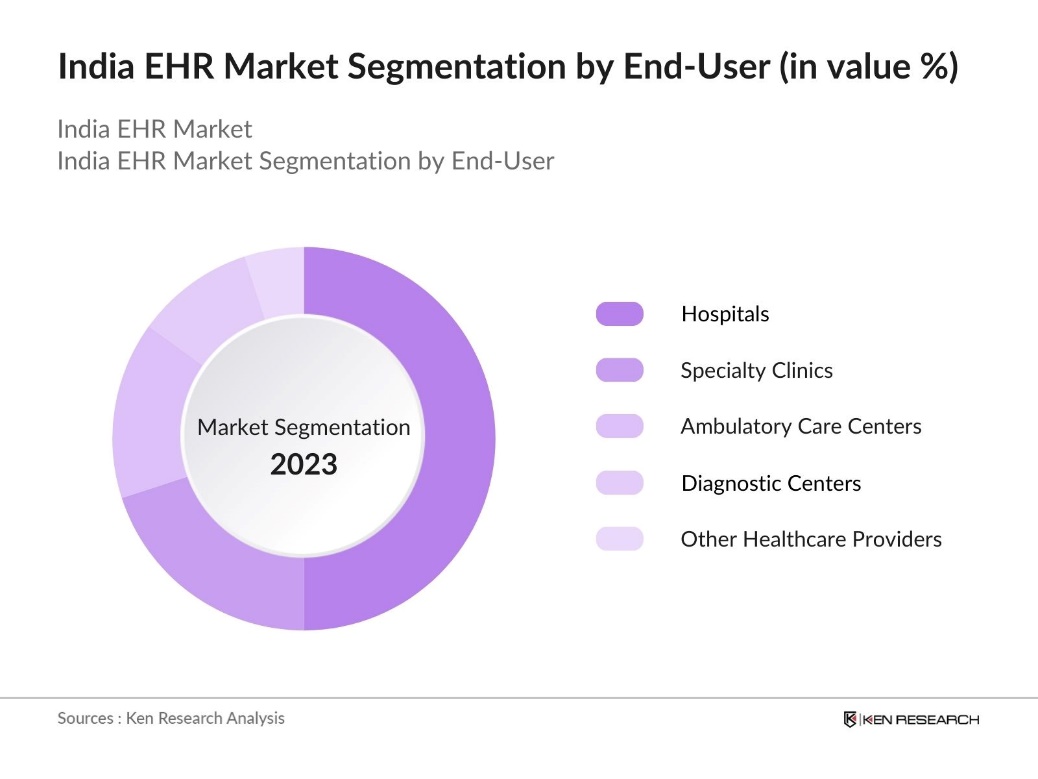

India EHR Market Segmentation

By Component: The India EHR market is segmented by component into software, services, and hardware. Software solutions dominate this segment due to their critical role in managing patient data, ensuring data security, and enabling seamless integration with other healthcare systems. The growing demand for cloud-based EHR systems, which allow for better storage, retrieval, and management of patient data, has further boosted the software segment.

By End-User: The India EHR market is segmented by end-user into hospitals, specialty clinics, ambulatory care centers, diagnostic centers, and other healthcare providers. Hospitals hold the largest share in this segment due to their large-scale operations, high patient inflow, and significant investment capabilities. Hospitals across urban areas are investing heavily in EHR systems to streamline operations, improve patient care, and comply with government mandates for digital healthcare.

India EHR Market Competitive Landscape

The India EHR market is characterized by the presence of both global and local players, with a few key companies dominating the market. These companies provide a range of EHR solutions that cater to the diverse needs of healthcare providers. The competition is largely centered around product differentiation, partnerships with hospitals and healthcare institutions, and adherence to the countrys regulatory standards. Major players like Cerner and Epic Systems have established a strong presence in India by leveraging their advanced EHR software capabilities and partnerships with leading hospitals.

|

Company Name |

Establishment Year |

Headquarters |

Number of Employees |

Revenue (USD) |

Product Portfolio |

EHR Certifications |

Regional Presence |

Key Clients |

Partnerships |

|

Cerner Corporation |

1979 |

Kansas, USA |

|||||||

|

Epic Systems Corporation |

1979 |

Wisconsin, USA |

|||||||

|

Allscripts Healthcare |

1986 |

Illinois, USA |

|||||||

|

GE Healthcare |

1892 |

Illinois, USA |

|||||||

|

eClinicalWorks |

1999 |

Massachusetts, USA |

India EHR Industry Analysis

Growth Drivers

- Increasing Healthcare Expenditure: Indias healthcare expenditure has seen a significant rise, in 2023-24, the estimated expenditure of the Department of Health and Family Welfare is Rs 86,175 crore, which is approximately 2% of the total central government expenditure for that year. This increased spending underscores the country's focus on enhancing healthcare infrastructure, including investments in digital health solutions like EHR. With public health expenditure projected to grow as a percentage of GDP, there is a broader push to modernize healthcare, contributing to the adoption of EHR systems across hospitals, clinics, and other medical facilities.

- Rising Demand for Telemedicine: Telemedicine has gained widespread adoption across India, particularly after the COVID-19 pandemic. The Ministry of Health and Family Welfare reported that in 2023, 100.11 million patients were serviced at 115,234 Health and Wellness Centres via 15,731 hubs and 1,152 online OPDs. EHR systems provide a seamless solution to manage patient data efficiently, facilitating telemedicine by offering a single platform for patient history, treatment, and consultations. This rise in telemedicine is a direct driver for increased EHR adoption.

- Growing Awareness of Patient-Centric Care: Healthcare in India is increasingly shifting toward patient-centric care, with a growing emphasis on personalized medicine and improved management of patient information. EHR systems play a critical role in facilitating this shift by allowing healthcare providers to store and manage personal health data more effectively. This transformation is contributing to the increased adoption of EHR systems, enhancing care coordination, and improving overall efficiency across hospitals and clinics by focusing more on the individual needs of patients.

Market Challenges

- Data Security and Privacy Concerns: Data security and privacy remain significant challenges in the adoption of EHR systems in India, with the healthcare sector being particularly vulnerable to cyberattacks. Concerns about the protection of sensitive patient information have made healthcare institutions hesitant to implement EHR systems fully. The absence of a comprehensive data protection framework further contributes to this caution, slowing the pace of adoption and raising questions about the security of electronic health records.

- Interoperability Issues: Interoperability, or the ability of different EHR systems to exchange and utilize information seamlessly, continues to be a major barrier in India. Many hospitals face challenges integrating various healthcare systems due to the lack of standardized protocols. This inability to efficiently exchange data between hospitals and healthcare providers can hinder effective patient care and limit the full potential of EHR deployment. Establishing uniform standards, such as FHIR (Fast Healthcare Interoperability Resources), is key to addressing this challenge.

India EHR Market Future Outlook

Over the next five years, the India EHR market is expected to witness significant growth, driven by continuous government support for digital healthcare initiatives, advancements in healthcare technologies, and the increasing demand for efficient healthcare solutions. The adoption of cloud-based EHR systems, AI integration, and mobile health applications is likely to further revolutionize the market.

Market Opportunities

- Integration of AI and Big Data Analytics: The integration of AI and big data analytics into EHR systems presents a significant opportunity for the healthcare sector in India. AI-driven analytics can enhance patient outcomes by identifying treatment patterns, predicting diseases, and improving clinical decision-making. By leveraging vast amounts of healthcare data, this integration can revolutionize the efficiency of EHR systems, offering better clinical insights and more personalized care.

- Cloud-Based EHR Adoption: Cloud-based EHR systems are becoming increasingly popular due to their cost-effectiveness and ease of deployment. These systems allow healthcare providers to access data more easily and scale their storage needs without investing heavily in infrastructure. Cloud-based EHR platforms offer flexibility, particularly for smaller hospitals and clinics, making them more feasible to adopt. As cloud technology continues to evolve, it opens up new possibilities for the widespread adoption of EHR systems, supporting better healthcare delivery and data management across the sector.

Scope of the Report

|

Component |

Software Services Hardware |

|

Deployment |

On-Premise Cloud-Based |

|

End-User |

Hospitals Specialty Clinics Ambulatory Care Centers Diagnostic Centers Other Healthcare Providers |

|

Functionality |

Clinical Administrative Financial |

|

Region |

North South East West |

Products

Key Target Audience

Healthcare IT Solution Companies

Telemedicine Companies

Health Insurance Companies

Medical Device Manufacturers Companies

Government and Regulatory Bodies (Ministry of Health and Family Welfare, Ayushman Bharat Digital Mission)

Investors and Venture Capital Firms

Banks and Financial Institutions

Companies

Major Players

Cerner Corporation

Epic Systems Corporation

Allscripts Healthcare Solutions, Inc.

GE Healthcare

eClinicalWorks

Orion Health

McKesson Corporation

Greenway Health

HealthFusion

Siemens Healthineers

Meditech

Intersystems Corporation

NextGen Healthcare

Practo

Kareo

Table of Contents

1. India EHR Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Adoption Rate of EHR Systems, Healthcare Digitalization)

1.4. Market Segmentation Overview

2. India EHR Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India EHR Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives (Ayushman Bharat Digital Mission, National Digital Health Blueprint)

3.1.2. Increasing Healthcare Expenditure

3.1.3. Rising Demand for Telemedicine

3.1.4. Growing Awareness of Patient-Centric Care

3.2. Market Challenges

3.2.1. Data Security and Privacy Concerns

3.2.2. Interoperability Issues

3.2.3. High Cost of Implementation for Small Hospitals

3.3. Opportunities

3.3.1. Integration of AI and Big Data Analytics

3.3.2. Cloud-Based EHR Adoption

3.3.3. Collaboration Between Private and Public Sectors

3.4. Trends

3.4.1. Adoption of Cloud-Based and Mobile EHR Solutions

3.4.2. Increasing Focus on Patient Engagement Tools

3.4.3. Integration of IoT and Wearable Technology

3.5. Government Regulation

3.5.1. Data Protection and Privacy Laws (Personal Data Protection Bill, 2019)

3.5.2. Healthcare Information Management Standards (ISO, HL7, FHIR)

3.5.3. Telemedicine Guidelines

3.5.4. EHR Standards by Ministry of Health and Family Welfare

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. India EHR Market Segmentation

4.1. By Component (In Value %)

4.1.1. Software

4.1.2. Services

4.1.3. Hardware

4.2. By Deployment (In Value %)

4.2.1. On-Premise

4.2.2. Cloud-Based

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Specialty Clinics

4.3.3. Ambulatory Care Centers

4.3.4. Diagnostic Centers

4.3.5. Other Healthcare Providers

4.4. By Functionality (In Value %)

4.4.1. Clinical Functionality

4.4.2. Administrative Functionality

4.4.3. Financial Functionality

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India EHR Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cerner Corporation

5.1.2. Allscripts Healthcare Solutions, Inc.

5.1.3. Epic Systems Corporation

5.1.4. GE Healthcare

5.1.5. eClinicalWorks

5.1.6. Orion Health

5.1.7. McKesson Corporation

5.1.8. Greenway Health

5.1.9. HealthFusion

5.1.10. Siemens Healthineers

5.1.11. Meditech

5.1.12. Intersystems Corporation

5.1.13. NextGen Healthcare

5.1.14. Practo

5.1.15. Kareo

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Product Portfolio, Regional Presence, EHR System Certifications, Years in Operation, Client Segments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Funding

5.8. Private Equity Investments

6. India EHR Market Regulatory Framework

6.1. Data Protection and Security Standards

6.2. Interoperability Standards (HL7, FHIR)

6.3. Compliance Requirements (GDPR, HIPAA)

6.4. Certification Processes for EHR Systems

7. India EHR Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India EHR Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Deployment (In Value %)

8.3. By End-User (In Value %)

8.4. By Functionality (In Value %)

8.5. By Region (In Value %)

9. India EHR Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This initial phase focuses on constructing a detailed ecosystem of the India EHR market, identifying the major stakeholders involved. Using both proprietary and secondary data sources, we map out the market landscape to pinpoint the critical variables influencing market growth.

Step 2: Market Analysis and Construction

At this stage, we analyze historical data on market penetration, EHR adoption rates, and healthcare infrastructure investments. Key performance indicators such as hospital adoption rates and the ratio of healthcare providers to population are examined to gauge market performance.

Step 3: Hypothesis Validation and Expert Consultation

We consult with industry experts through telephone interviews to validate our market hypotheses. These consultations provide first-hand operational insights and help refine our projections for the EHR market, ensuring accuracy and relevance.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesize all research data from both qualitative and quantitative sources, engaging directly with hospitals and healthcare institutions to validate the findings. This ensures that our final market report presents a comprehensive and well-validated analysis.

Frequently Asked Questions

01. How big is the India EHR Market?

The India EHR market was valued at USD 616 million, driven by the governments push for digital healthcare, increasing healthcare expenditure, and the growing demand for patient-centric healthcare solutions.

02. What are the challenges in the India EHR Market?

Challenges in the India EHR market include data privacy and security concerns, interoperability issues among different EHR platforms, and the high cost of implementation for smaller healthcare providers, which hampers widespread adoption.

03. Who are the major players in the India EHR Market?

Key players in the India EHR market include Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, GE Healthcare, and eClinicalWorks. These companies have established strong footholds due to their advanced software solutions and strategic partnerships with major hospitals.

04. What are the growth drivers of the India EHR Market?

The India EHR market is driven by the government's digital healthcare initiatives, rising healthcare expenditure, the growing need for patient-centric care, and the increasing adoption of cloud-based EHR systems by healthcare providers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.