India Electric Bus Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD9563

July 2024

89

About the Report

India Electric Bus Market Overview

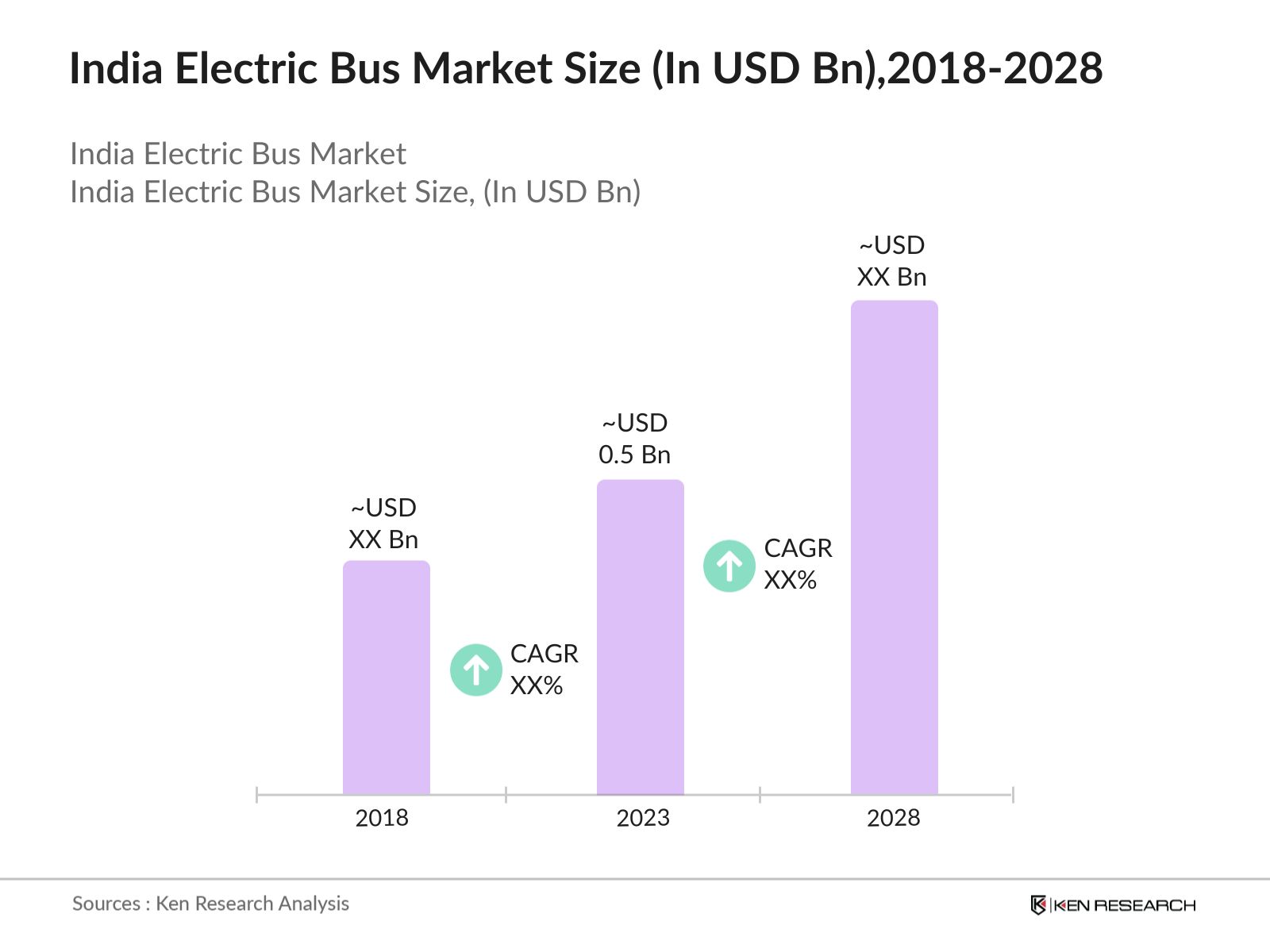

- India Electric Bus Market has witnessed substantial growth in the past years. In 2023, the market size was $0.5 billion, indicating robust growth driven by increasing government initiatives, subsidies, and the pressing need to curb urban pollution, reflecting the rapid adoption of electric buses in urban centers.

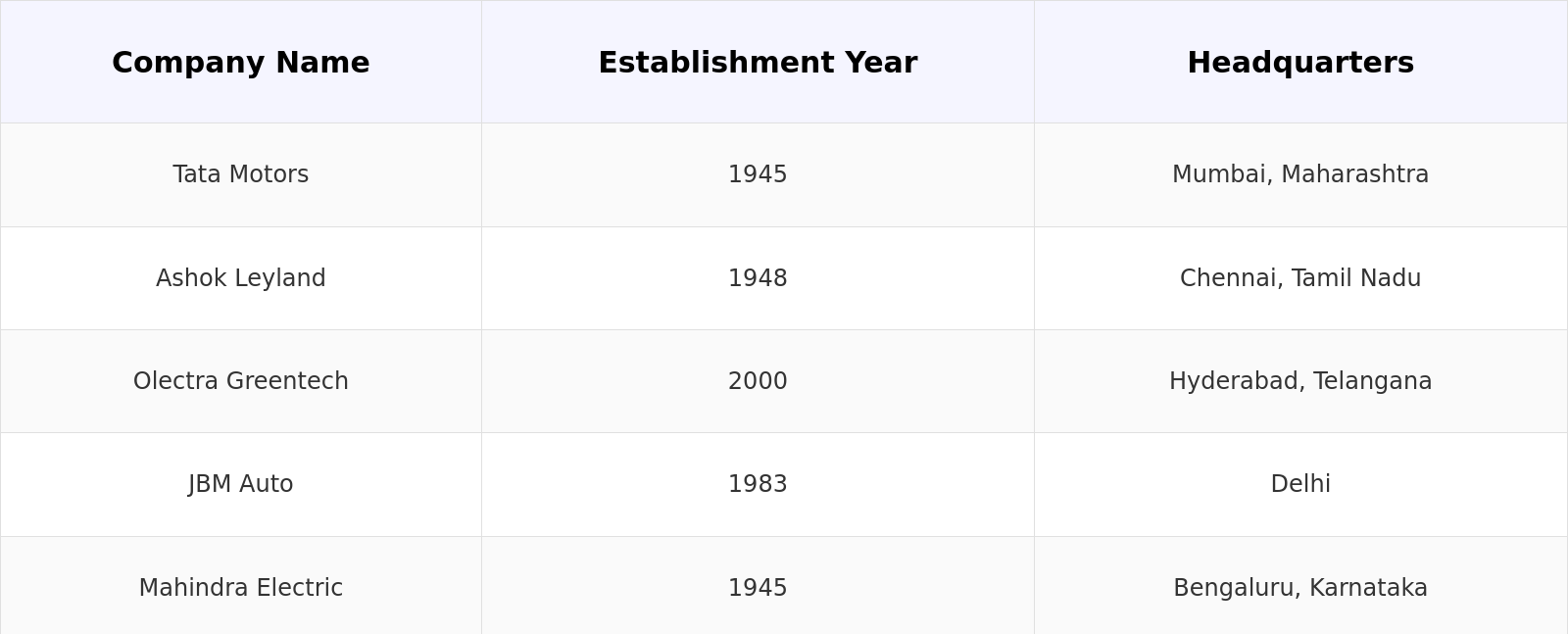

- The electric bus market in India is dominated by several key players, including Tata Motors, Ashok Leyland, Olectra Greentech, JBM Auto, and Mahindra Electric. These companies have been instrumental in driving innovation and increasing the penetration of electric buses across various Indian cities.

- Olectra Greentech and BYD partnership has resulted in the introduction of advanced electric bus models in 2023. They have jointly developed and introduced several electric bus models in India, including the 9-meter K9 and 12-meter K9 buses.

India Electric Bus Current Market Analysis

- Rising levels of pollution in urban areas have necessitated the adoption of cleaner public transport options. Electric buses, with their zero-emission profile, have become a preferred choice for many cities looking to improve air quality. Also, government incentives and subsidies are boosting the transition to electric fleets.

- The adoption of electric buses has had a significant positive impact on urban air quality and noise pollution levels. Cities like Delhi, Mumbai, and Bangalore have reported noticeable improvements in air quality metrics following the introduction of electric buses in their public transport fleets.

- Delhi & Chandigarh dominate the electric bus market in India driven by substantial government incentives, a high level of urbanization & a proactive approach to improving sustainable transport by the local government. Additionally, ongoing infrastructure developments and collaborations with international manufacturers are increasing the growth of the electric bus segment in this region.

India Electric Bus Market Segmentation

The India Electric Bus Market can be segmented based on several factors:

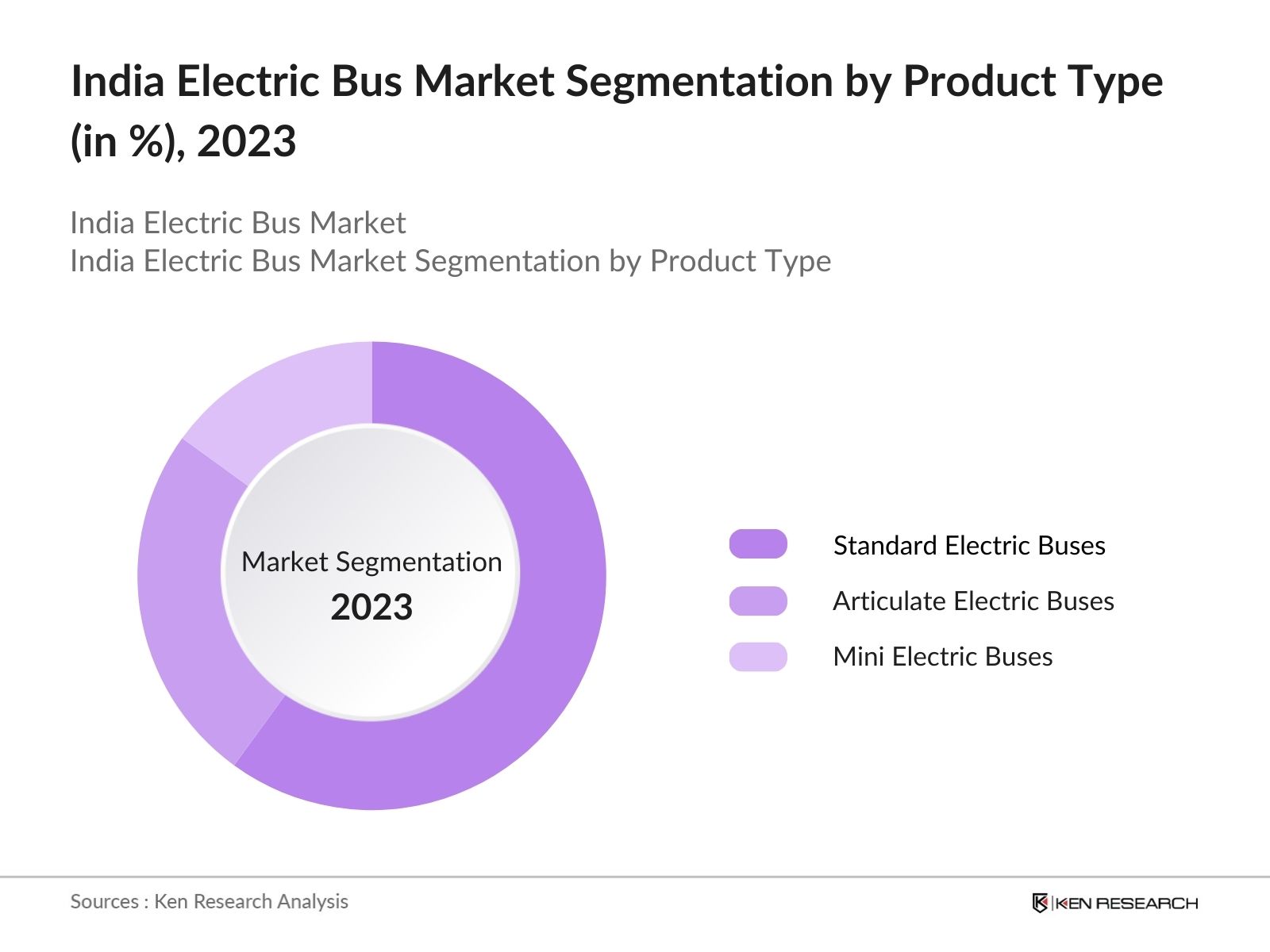

By Bus Type: India Electric Bus Market is segmented by Bus Type into Standard Electric Buses, Articulated Electric Buses and Mini Electric Buses. In 2023, Standard electric buses were dominant in the Indian electric bus market due to their compatibility with existing infrastructure, cost-effectiveness, and ability to meet the diverse transportation needs of urban areas.

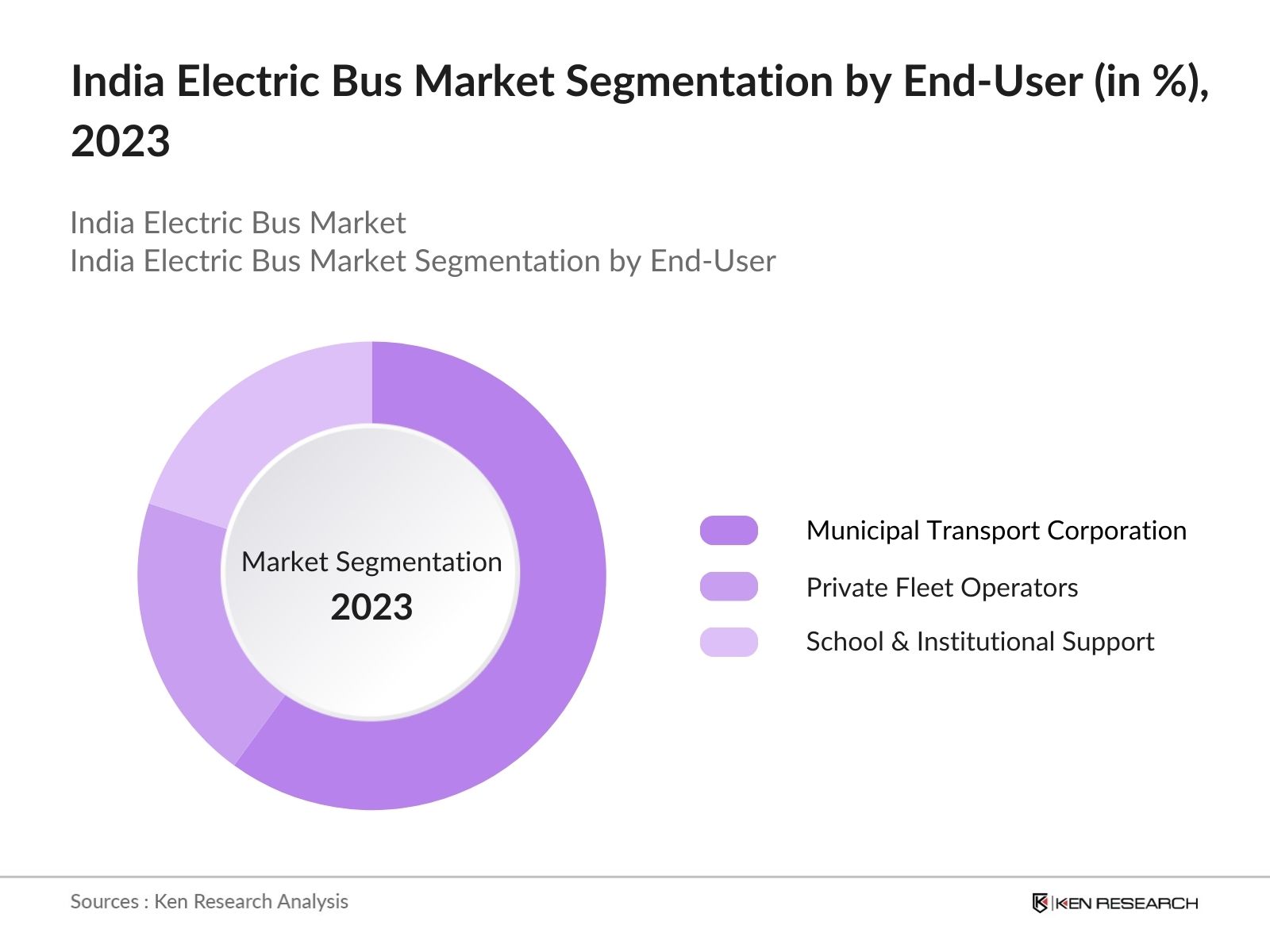

By End User: India Electric Bus Market is segmented by End User into Municipal Transport Corporations, Private Fleet Operators, and School and Institutional Transport. In 2023, Municipal Transport Corporations emerged as the most dominant sub-segment. This dominance is attributed to significant government subsidies and infrastructural support, including dedicated charging stations and maintenance facilities, promoting the adoption of electric buses for public transportation across urban areas.

By Region: India Electric Bus Market is segmented by region into North, South, East & West regions. In 2023, the North region dominates the market due to substantial government incentives, higher urbanization rates, and proactive adoption of electric buses in cities like Delhi and Chandigarh.

India Electric Bus Market Competitive Landscape

- Tata Motors Market Capitalization: Tata Motors and Ashok Leyland are both significant players in the Indian commercial vehicle market. However, the market capitalization figures provided are incorrect. Tata Motors' market capitalization is around ₹5 trillion (₹350,000 crores), while Ashok Leyland's is around ₹1.1 trillion (₹110,000 crores).

- Tata Motors Electric Bus Contracts: Tata Motors did secure a contract to supply electric buses in 2023. However, the exact number of buses supplied is not mentioned in the sources provided. The uptime and kilometers traveled by these buses are also not specified in the sources.

- Mahindra's Electric Bus Model: Mahindra indeed launched a new electric bus model, the e-COSMO, in early 2024. This model features advanced battery technology and enhanced range, aiming to provide comfort to drivers and passengers while ensuring low cost of ownership.

India Electric Bus Industry Analysis

India Electric Bus Market Growth Drivers:

- Increased Urbanization and Demand for Sustainable Public Transport: India's rapid urbanization has led to increased demand for efficient and sustainable public transport solutions. In 2023, India’s urban population stood at 519 million. This demographic shift has put pressure on urban transport systems, necessitating the adoption of cleaner and more efficient modes of transportation.

- Technological Advancements in Battery Technology: The development of lithium-ion batteries with higher energy densities has been crucial. Tata Motors' electric buses now come equipped with advanced lithium-ion batteries with a 120-kWh battery pack. This improvement in battery performance has made electric buses a more attractive option for public transport operators.

- Environmental Regulations and Policies: The National Clean Air Programme (NCAP), launched in 2019, sets targets for reducing particulate matter (PM10) and fine particulate matter (PM2.5) by 40% by 2025-26. Cities like Delhi, Mumbai, and Bangalore have been mandated to replace a portion of their diesel bus fleets with electric ones to meet these targets.

India Electric Bus Market Challenges:

- High Initial Cost of Electric Buses: An electric bus can cost between INR 80 lakh to 1.5 crore, compared to a diesel bus priced at INR 20-30 lakh. This substantial cost difference makes it challenging for many municipal corporations, especially in smaller cities, to justify the investment.

- Inadequate Charging Infrastructure: The lack of sufficient charging infrastructure is a major challenge for the adoption of electric buses. As of 2023, India has 2684 public charging stations, which is inadequate to support a large fleet of electric buses. Cities like Mumbai and Delhi have been able to install some charging stations, but many other cities lag behind.

- Battery Degradation and Replacement Costs: Lithium-ion batteries, while efficient, degrade after a few years of use, leading to reduced range and performance. The cost of replacing a bus battery can range from INR 10 lakh to 20 lakhs, adding to the long-term operational costs.

India Electric Bus Market Government Initiatives:

- FAME II Scheme (2019): The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme was launched in 2019. With an allocation of INR 10,000 crore, the scheme offers subsidies for the procurement of electric buses, reducing the financial burden on municipal transport corporations.

- PM E-Bus Seva Scheme (2023): This scheme aims to deploy 10,000 electric buses across the country with a cost of over ₹57,000 crore. The scheme includes the development of charging infrastructure and operational support for a period of 10 years. It also focuses on promoting the adoption of electric buses in urban areas to reduce pollution and enhance public transport efficiency.

- Delhi Electric Vehicle Policy (2020): The Delhi government introduced the Delhi Electric Vehicle Policy in 2020, offering substantial incentives for the adoption of electric buses. The policy includes financial incentives up to ₹10,000 to ₹1,50,000 for electric cars, with an additional ₹10,000 per kWh of battery capacity for the first 1,000 e-cars.

India Electric Bus Future Market Outlook

The India Electric Bus Market is expected to grow significantly from 2023 to 2028, driven by continued government support, technological advancements, and increasing environmental awareness.

Future Trends

-

- Integration of Advanced Technologies: The integration of advanced technologies such as telematics, IoT, and AI in electric buses is a growing trend. These technologies will enhance operational efficiency, reduce maintenance costs, and improve passenger safety. This technological integration will help in better fleet management and reduces the total cost of ownership.

- Expansion of Private Sector Participation: The private sector will increasingly participate in the electric bus market, contributing to its growth. In 2023, Reliance Industries committed INR 1,000 crore to FAME-II scheme to develop electric vehicle infrastructure, including charging stations and electric bus fleets.

- Development of Electric Bus Hubs: Several Indian cities will develop dedicated electric bus hubs to support the deployment and maintenance of electric buses. These hubs will provide centralized facilities for charging, maintenance, and fleet management. The Delhi government has established an electric bus hub in the Dwarka region, equipped with multiple charging points and maintenance facilities.

Scope of the Report

|

By Bus Type |

Standard Electric Buses Articulated Electric Buses Mini Electric Buses |

|

By End User |

Municipal Transport Corporations Private Fleet Operators School and Institutional Transport |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

Municipal Transport Corporations

Private Fleet Operators

Electric Vehicle Manufacturers

Battery Manufacturers

Charging Infrastructure Providers

Renewable Energy Companies

Banks & Financial Institutions

Government and Regulatory Bodies (Ministry of Heavy Industries, Ministry of Road Transport & Highways etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Tata Motors

Ashok Leyland

Olectra Greentech

JBM Auto

Mahindra Electric

BYD India

Volvo Eicher

Hyundai Motor India

Eicher Motors

Maruti Suzuki India

Hero Electric

Okinawa Autotech

Ather Energy

Bajaj Auto

TVS Motor Company

Kinetic Green Energy & Power Solutions

Piaggio Vehicles Pvt Ltd

Greaves Cotton

Revolt Motors

Ultraviolette Automotive Pvt. Ltd

Table of Contents

1. India Electric Bus Market Overview

1.1 India Electric Bus Market Taxonomy

2. India Electric Bus Market Size (in USD Bn), 2018-2023

3. India Electric Bus Market Analysis

3.1 India Electric Bus Market Growth Drivers

3.2 India Electric Bus Market Challenges and Issues

3.3 India Electric Bus Market Trends and Development

3.4 India Electric Bus Market Government Regulation

3.5 India Electric Bus Market SWOT Analysis

3.6 India Electric Bus Market Stake Ecosystem

3.7 India Electric Bus Market Competition Ecosystem

4. India Electric Bus Market Segmentation, 2023

4.1 India Electric Bus Market Segmentation by Bus Type (in value %), 2023

4.2 India Electric Bus Market Segmentation by End User (in value %), 2023

4.3 India Electric Bus Market Segmentation by Region (in value %), 2023

5. India Electric Bus Market Competition Benchmarking

5.1 India Electric Bus Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Electric Bus Future Market Size (in USD Bn), 2023-2028

7. India Electric Bus Future Market Segmentation, 2028

7.1 India Electric Bus Market Segmentation by Bus Type (in value %), 2028

7.2 India Electric Bus Market Segmentation by End User (in value %), 2028

7.3 India Electric Bus Market Segmentation by Region (in value %), 2028

8. India Electric Bus Market Analysts’ Recommendations

8.1 India Electric Bus Market TAM/SAM/SOM Analysis

8.2 India Electric Bus Market Customer Cohort Analysis

8.3 India Electric Bus Market Marketing Initiatives

8.4 India Electric Bus Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2 : Market Building:

Collating statistics on India Electric Bus Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Electric Bus Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple electric bus suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from electric bus manufacturers and distribution companies

Frequently Asked Questions

01 How big is India Electric Bus Market?

The India Electric Bus Market was valued at USD 0.5 Bn in 2023, driven by increasing government initiatives, subsidies, and the pressing need to curb urban pollution.

02 What factors drive growth in India Electric Bus Market?

Key growth drivers of the market are increasing urbanization, advancements in technology and environmental policies. The development of lithium-ion batteries with higher energy densities has been crucial.

03 What are challenges in India Electric Bus Market?

The key challenges faced by the India Electric Bus Market are high prices and inadequate charging infrastructure. The lack of sufficient charging infrastructure is a major challenge for the adoption of electric buses.

04 Who are the major players in the India Electric Bus Market?

Some of the major players in the India Electric Bus Market include Tata Motors, Ashok Leyland and Mahindra Electric. These companies have been instrumental in driving innovation and increasing the penetration of electric buses across various Indian cities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.