India Electric Car Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD2796

October 2024

96

About the Report

India Electric Car Market Overview

- The India Electric Car Market is valued at USD 2.5 billion based on a five-year historical analysis, driven by government policies such as the FAME-II scheme and an increasing focus on reducing vehicular emissions. The growth is primarily supported by consumer awareness around sustainability and the cost benefits associated with electric vehicles (EVs) over traditional internal combustion engine (ICE) vehicles. Domestic car manufacturers have also embraced this transition, ramping up EV production to meet the rising demand.

- The cities dominating the electric car market in India include Delhi, Mumbai, and Bengaluru. These cities benefit from a combination of government subsidies, robust infrastructure, and higher disposable incomes among consumers. Delhi, in particular, has a comprehensive electric vehicle policy with aggressive goals to phase out ICE vehicles, supported by investments in charging stations and incentives for EV buyers. Similarly, Bengalurus tech-savvy population and Mumbais financial sector provide significant markets for electric vehicles.

- The European cold chain market is adopting renewable energy solutions. Cold storage facilities are increasingly integrating solar and wind-powered refrigeration systems to reduce operational costs and carbon emissions. As of 2023, around 15% of cold storage units in Europe had adopted renewable energy sources, driven by EU regulations under the European Green Deal, which mandates the reduction of carbon emissions and supports investment in sustainable energy solutions.

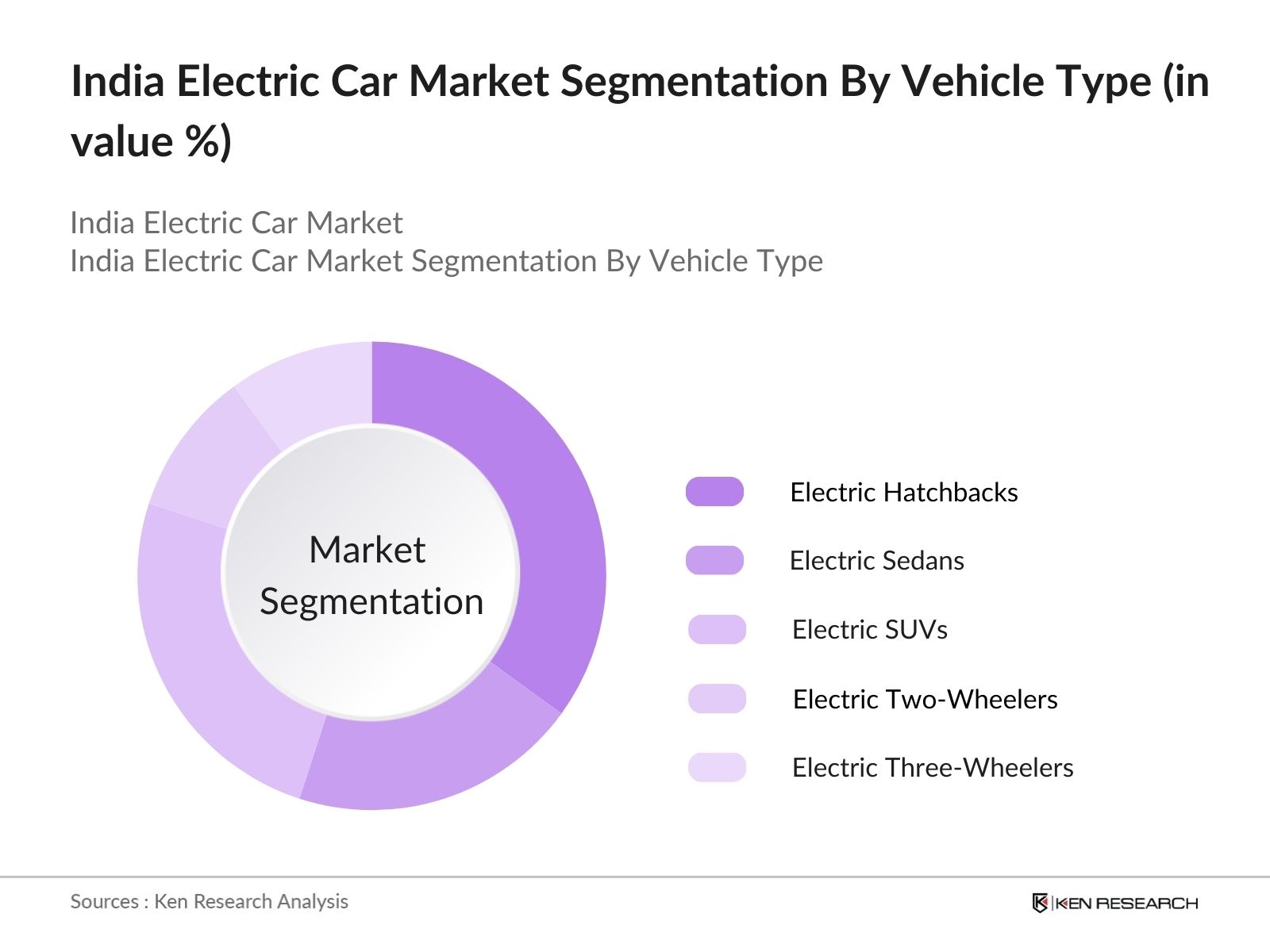

India Electric Car Market Segmentation

By Vehicle Type: The Indian electric car market is segmented by vehicle type into electric hatchbacks, electric sedans, electric SUVs, electric two-wheelers, and electric three-wheelers. Electric hatchbacks hold a dominant market share due to their affordability and compact size, making them ideal for city commutes. Popular models like the Tata Tigor EV have carved out a substantial market by offering a cost-effective solution for urban transportation, especially in densely populated metropolitan areas.

By Battery Type: The market is segmented by battery type into lithium-ion batteries, lead-acid batteries, and solid-state batteries. Lithium-ion batteries dominate the market, largely due to their superior energy density and longer life cycle compared to other battery types. With advancements in lithium-ion technology driving down costs and improving performance, they have become the go-to option for most electric vehicle manufacturers in India, including Tata Motors and Mahindra Electric.

India Electric Car Market Competitive Landscape

The India electric car market is highly competitive, with a mix of domestic and international players contributing to the rapid growth. Tata Motors, Mahindra Electric, and Ather Energy are key domestic players, while international brands like Hyundai and Tesla have gained traction with premium electric vehicles. These companies continue to innovate in terms of battery technology, charging infrastructure, and vehicle design, contributing to their stronghold in the market.

Competitive Landscape Table

|

Company Name |

Establishment Year |

Headquarters |

Vehicle Portfolio |

Battery Technology |

R&D Expenditure |

Sustainability Initiatives |

Market Strategy |

Production Capacity |

Company Name |

|

Tata Motors Ltd. |

1945 |

Mumbai, India |

|||||||

|

Mahindra Electric Mobility |

1945 |

Bengaluru, India |

|||||||

|

Hyundai Motor India Ltd. |

1996 |

Chennai, India |

|||||||

|

Ather Energy Pvt. Ltd. |

2013 |

Bengaluru, India |

|||||||

|

Tesla Inc. |

2003 |

Palo Alto, USA |

India Electric Car Market Analysis

Growth Drivers

- Increasing Demand for Temperature-Sensitive Products (e.g., Pharmaceuticals, Perishable Foods): The European market has seen a surge in demand for temperature-sensitive products, driven by pharmaceuticals and perishable foods. By 2024, Europe is projected to require over 60 million cubic meters of cold storage capacity to maintain the integrity of food and pharmaceuticals, according to European Commission reports on food storage. The increasing need for COVID-19 vaccines and biologics, which must be stored at precise temperatures, further stresses the cold chain logistics system. Governmental initiatives ensure that these products are safely stored and distributed, increasing cold chain investments.

- Expansion of E-commerce and Online Grocery Sales: E-commerce and online grocery sales in Europe have seen significant growth in recent years. In 2023, online food sales accounted for 151.88 billion, according to the European Unions e-commerce statistics. The increased use of online grocery services, driven by pandemic habits, now requires extensive cold chain logistics to handle perishable goods. Countries like Germany and France have experienced a near 20% increase in demand for refrigerated warehouses, supported by their expanding online grocery sector.

- Technological Innovations in Cold Chain Logistics (e.g., IoT-enabled Monitoring Systems): IoT and digital monitoring technologies have revolutionized cold chain logistics in Europe. According to a report by the European Commission on digital transformation, over 30% of European cold storage facilities now employ IoT-enabled sensors, which track temperature, humidity, and location in real-time. These advancements have reduced spoilage rates by 15%, providing more accurate monitoring and control during transportation. IoT has proven essential in optimizing the efficiency of cold chains for perishable goods.

Challenges

- High Energy and Infrastructure Costs (Energy Consumption, Infrastructure Investment): Energy consumption remains a critical challenge for Europes cold chain market, with cold storage facilities consuming roughly 2% of Europes electricity annually. According to data from the International Energy Agency (IEA), electricity costs in Europe increased by 7% in 2023, making energy efficiency a priority for cold storage operators. Investment in energy-efficient technologies like solar-powered refrigeration systems is crucial, though initial infrastructure costs pose a barrier for small to mid-sized operators.

- Complex Regulatory Environment (Food Safety, Carbon Emissions): Europes cold chain sector faces a complicated regulatory environment, with stringent rules regarding food safety and carbon emissions. The European Unions Green Deal aims to reduce carbon emissions to half by 2030, creating new challenges for cold chain operators to comply. According to the European Environment Agency (EEA), the cold chain industry was responsible for 5 million tons of CO2 emissions in 2023, pushing operators to invest in eco-friendly technology.

India Electric Car Market Future Outlook

Over the next five years, the Indian electric car market is expected to show significant growth, driven by continuous government support, advancements in EV technology, and increasing consumer demand for eco-friendly transportation solutions. Initiatives like the FAME-II scheme, investments in charging infrastructure, and growing public awareness around climate change are likely to boost market expansion. Furthermore, the domestic manufacturing sectors focus on building cost-effective EV solutions will play a critical role in making electric cars accessible to the wider population.

Market Opportunities

- Growth in Biopharmaceuticals and Vaccine Distribution (COVID-19, mRNA Vaccines): The biopharmaceutical industrys reliance on cold storage for vaccine distribution has grown significantly since the COVID-19 pandemic. Europe distributed over 2.5 billion vaccine doses between 2020 and 2023, necessitating a robust cold chain. The introduction of mRNA vaccines, which require sub-zero storage, has further expanded the need for cold chain logistics. According to the World Health Organization (WHO), the biopharmaceutical sector will continue to depend on highly efficient cold storage solutions to ensure vaccine efficacy.

- Adoption of Renewable Energy Solutions in Cold Chain Facilities: There is a growing trend toward adopting renewable energy solutions in cold storage facilities. The European Commission's Renewable Energy Directive mandates that 40% of Europes energy must come from renewable sources by 2030, creating opportunities for the cold chain sector to invest in solar and wind-powered refrigeration units. In 2023, renewable energy powered 10% of Europe's cold chain facilities, reducing carbon emissions and lowering long-term operational costs.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Vehicle Type |

Electric Hatchbacks Electric Sedans Electric SUVs Electric Two-Wheelers Electric Three-Wheelers |

|

By Battery Type |

Lithium-Ion Batteries Lead-Acid Batteries Solid-State Batteries |

|

By Charging Infrastructure |

Home Charging Public Charging Fast Charging Stations Battery Swapping Stations |

|

By Application |

Personal Use Commercial Use (Fleet, Taxi, Ride-Hailing) Government and Public Transport |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of Heavy Industries, Ministry of Power)

Electric Vehicle Manufacturers

Battery Suppliers and Manufacturers

Charging Infrastructure Providers

Fleet Operators and Logistics Companies

Electric Vehicle Financing Companies

Investments and Venture Capitalist Firms

Automotive Associations (SIAM - Society of Indian Automobile Manufacturers)

Companies

Players mentioned in the report:

Tata Motors Ltd.

Mahindra Electric Mobility Ltd.

Hyundai Motor India Ltd.

MG Motor India Pvt. Ltd.

Tesla Inc.

Ashok Leyland Electric Vehicles

Hero Electric Vehicles Pvt. Ltd.

Ather Energy Pvt. Ltd.

Ola Electric Mobility Pvt. Ltd.

TVS Motor Company

Bajaj Auto Ltd.

Okinawa Autotech Pvt. Ltd.

JBM Auto Ltd.

Greaves Cotton Limited (Ampere Electric)

Revolt Motors

Table of Contents

1. India Electric Car Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Electric Car Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Electric Car Market Analysis

3.1 Growth Drivers

3.1.1 Government EV Policies and Subsidies (FAME-II, State EV Policies)

3.1.2 Increasing Fuel Prices (Inflation-Linked Crude Oil Prices)

3.1.3 Consumer Shift Towards Sustainability (Environmental Awareness)

3.1.4 Rise in Domestic EV Manufacturing (PLI Scheme for Auto Industry)

3.2 Market Challenges

3.2.1 High Initial Purchase Cost (Price Parity with ICE Vehicles)

3.2.2 Underdeveloped Charging Infrastructure (Low Charging Station Penetration)

3.2.3 Range Anxiety (Limited Battery Capacity and Range)

3.2.4 Supply Chain Bottlenecks (Lithium-Ion Battery Sourcing)

3.3 Opportunities

3.3.1 Expansion of Charging Networks (Government-Private Collaborations)

3.3.2 Growth in EV Financing Options (Zero-Interest Loans, Leasing Models)

3.3.3 Integration of Renewable Energy in Charging Stations (Solar-Powered Charging)

3.3.4 Development of Battery Recycling Solutions (Circular Economy)

3.4 Trends

3.4.1 Rise in Electric Two-Wheelers and Three-Wheelers (Cost-Effective Urban Transport)

3.4.2 Introduction of New Battery Technologies (Solid-State, Fast-Charging Solutions)

3.4.3 Emergence of Connected EV Solutions (Telematics, IoT, Vehicle-to-Grid Technology)

3.4.4 Partnerships Between OEMs and Tech Companies (For AI, Autonomous Driving Integration)

3.5 Government Regulation

3.5.1 FAME-II (Faster Adoption and Manufacturing of Hybrid and EV Scheme)

3.5.2 State-Level EV Policies (Delhi, Maharashtra, Karnataka)

3.5.3 Corporate Average Fuel Efficiency (CAFE) Norms

3.5.4 National Electric Mobility Mission Plan (NEMMP)

3.6 SWOT Analysis

3.7 Stake Ecosystem (OEMs, Charging Infrastructure Providers, Government Bodies, Battery Suppliers)

3.8 Porter’s Five Forces

3.9 Competition Ecosystem

4. India Electric Car Market Segmentation

4.1 By Vehicle Type (In Value %)

4.1.1 Electric Hatchbacks

4.1.2 Electric Sedans

4.1.3 Electric SUVs

4.1.4 Electric Two-Wheelers

4.1.5 Electric Three-Wheelers

4.2 By Battery Type (In Value %)

4.2.1 Lithium-Ion Batteries

4.2.2 Lead-Acid Batteries

4.2.3 Solid-State Batteries

4.3 By Charging Infrastructure (In Value %)

4.3.1 Home Charging

4.3.2 Public Charging

4.3.3 Fast Charging Stations

4.3.4 Battery Swapping Stations

4.4 By Application (In Value %)

4.4.1 Personal Use

4.4.2 Commercial Use (Fleet, Taxi, Ride-Hailing)

4.4.3 Government and Public Transport

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Electric Car Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Tata Motors Ltd.

5.1.2 Mahindra Electric Mobility Ltd.

5.1.3 Hyundai Motor India Ltd.

5.1.4 MG Motor India Pvt. Ltd.

5.1.5 Tesla Inc.

5.1.6 Ashok Leyland Electric Vehicles

5.1.7 Hero Electric Vehicles Pvt. Ltd.

5.1.8 Ather Energy Pvt. Ltd.

5.1.9 Ola Electric Mobility Pvt. Ltd.

5.1.10 TVS Motor Company

5.1.11 Bajaj Auto Ltd.

5.1.12 Okinawa Autotech Pvt. Ltd.

5.1.13 JBM Auto Ltd.

5.1.14 Greaves Cotton Limited (Ampere Electric)

5.1.15 Revolt Motors

5.2 Cross Comparison Parameters (Market Share, Production Capacity, Battery Technology, Pricing Strategy, Customer Satisfaction Ratings, Sustainability Initiatives, R&D Expenditure, EV Model Portfolio)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Electric Car Market Regulatory Framework

6.1 Central and State EV Policies

6.2 Environmental Standards (BS-VI, Emission Norms)

6.3 Compliance Requirements for EV Manufacturing

6.4 Certification Processes for Electric Vehicles

7. India Electric Car Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Electric Car Market Future Market Segmentation

8.1 By Vehicle Type (In Value %)

8.2 By Battery Type (In Value %)

8.3 By Charging Infrastructure (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. India Electric Car Market Analysts’ Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step in our research methodology was to identify key variables influencing the Indian Electric Car Market, including government policies, consumer trends, and battery technology developments. Extensive secondary research was conducted using proprietary databases, government reports, and industry publications.

Step 2: Market Analysis and Construction

We analyzed historical data and growth drivers specific to the electric car market, including the penetration of EVs in major cities, production capacity of manufacturers, and infrastructure support. This analysis also involved comparing EV adoption rates across various vehicle segments.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses, such as the potential for future EV growth in Tier-II cities, were validated through expert interviews with industry professionals from leading EV manufacturers, battery suppliers, and government agencies. Their input was invaluable in fine-tuning our market analysis.

Step 4: Research Synthesis and Final Output

The final phase synthesized all the data and insights gathered from the above steps, including expert consultations and secondary research. The output was validated through direct interactions with EV manufacturers to ensure accurate representation of market trends, vehicle types, and consumer preferences.

Frequently Asked Questions

01.How big is the India Electric Car Market?

The India Electric Car Market was valued at USD 2.5 billion, driven by favorable government policies and the growing demand for sustainable transportation.

02.What are the challenges in the India Electric Car Market?

Challenges in the India Electric Car Market include underdeveloped charging infrastructure, high upfront costs, and supply chain issues related to lithium-ion batteries, which hinder market growth.

03.Who are the major players in the India Electric Car Market?

Key players in the India Electric Car Market include Tata Motors, Mahindra Electric, Hyundai, Ather Energy, and Tesla, all of which dominate through innovations in vehicle design, battery technology, and charging infrastructure.

04.What are the growth drivers of the India Electric Car Market?

Growth drivers in the India Electric Car Market include government incentives, rising fuel costs, and increased consumer awareness around the environmental impact of conventional vehicles, leading to higher EV adoption rates.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.