India Electric Car Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11148

December 2024

99

About the Report

India Electric Car Market Overview

- The India electric car market is valued at approximately USD 2.8 billion. This growth is largely attributed to government initiatives like the FAME II scheme, which encourages electric vehicle (EV) adoption through subsidies, tax exemptions, and infrastructure investments. Demand is further driven by high fuel costs and consumer preference for sustainable options. The favorable policy landscape and declining battery costs are expected to sustain demand, as more buyers recognize the long-term economic benefits and lower maintenance costs of EVs compared to internal combustion engine vehicles.

- The leading regions in the India electric car market are Uttar Pradesh, Delhi, and Maharashtra. These states have the highest EV adoption rates due to their larger urban populations and stronger government support, such as incentives on EV purchases and investments in public charging infrastructure. Uttar Pradesh, for instance, hosts numerous EV manufacturing facilities and benefits from government support under the FAME II scheme, positioning it as a favorable hub for electric mobility expansion.

- The Indian government introduced the Production-Linked Incentive (PLI) scheme to boost domestic manufacturing of electric vehicles and advanced battery technologies. With a budget of INR 18,100 crore, the scheme supports manufacturers through direct incentives for local production of EV components, reducing reliance on imports and fostering a robust supply chain. The initiative aims to enhance the Make in India movement, promoting India as a global EV manufacturing hub while creating local jobs and driving technological advancements in the sector.

India Electric Car Market Segmentation

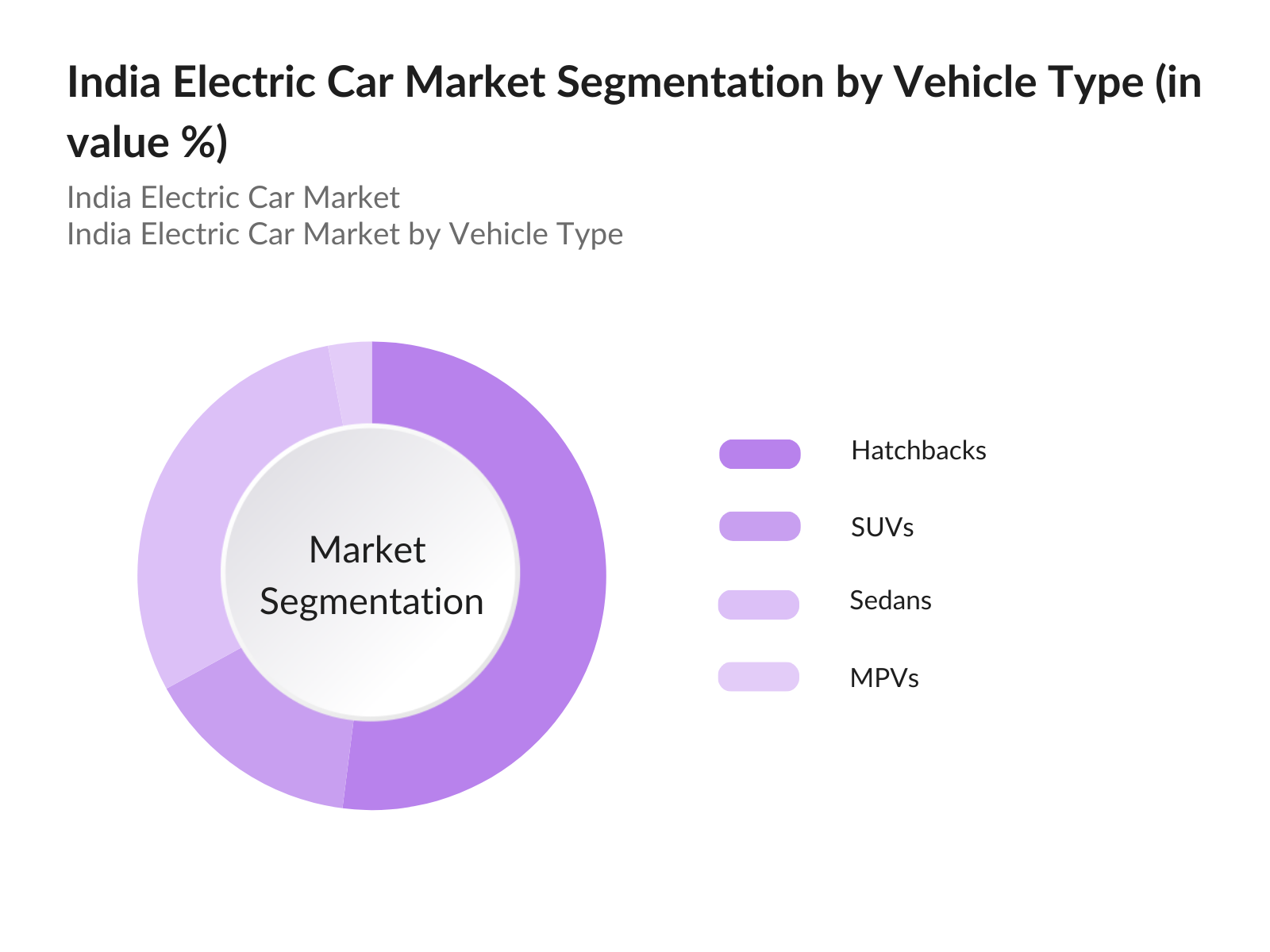

By Vehicle Type: The Indian electric car market is segmented by vehicle type into hatchbacks, sedans, SUVs, and MPVs. Currently, hatchbacks dominate this segment, with their compact size, affordability, and suitability for city commutes making them highly popular among urban consumers. Brands like Tata Motors and Mahindra have made strong strides with models like the Tata Nexon EV and Mahindra eVerito. SUVs are also gaining traction, especially among younger, high-income consumers, who prefer these models for their spacious design and off-road capabilities.

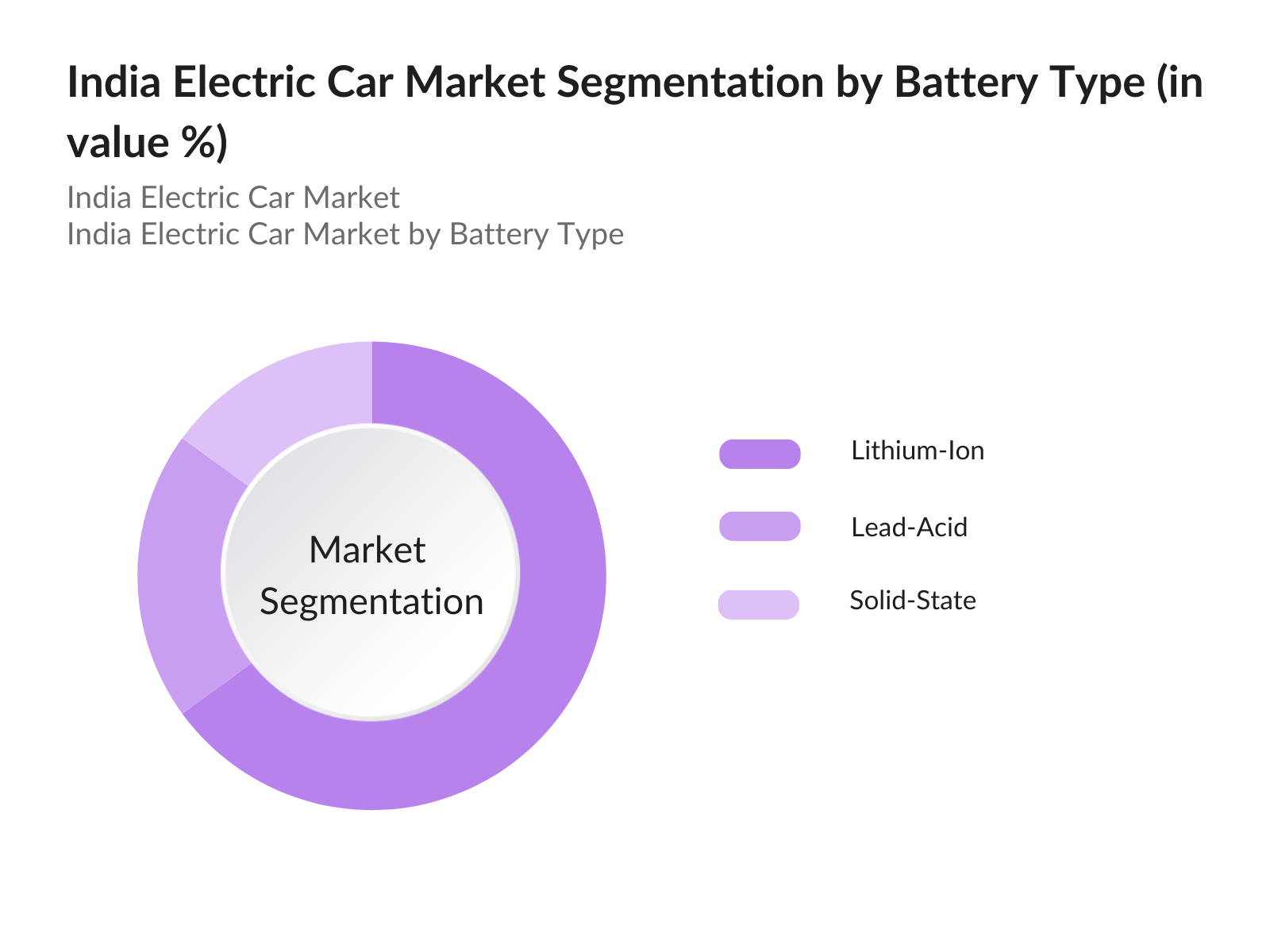

By Battery Type: The electric car market in India is also segmented by battery type, including lithium-ion, lead-acid, and solid-state batteries. Lithium-ion batteries hold the dominant share due to their high energy density, longer lifespan, and lower charging time compared to other battery types. This preference is further backed by government incentives for lithium-ion battery manufacturing and usage, which align with sustainability goals. Solid-state batteries, while still emerging, are expected to rise in popularity as technological advances reduce production costs.

India Electric Car Market Competitive Landscape

The India electric car market features both established automotive players and newer EV-specific manufacturers, creating a competitive environment. Leading brands like Tata Motors and Hyundai leverage robust distribution networks, R&D in battery technologies, and strategic partnerships to maintain their market positions. International players like MG Motor and Volvo also contribute to competition, introducing advanced EV models tailored for the Indian market.

|

Company |

Established |

Headquarters |

Market Presence |

Key Product Line |

Battery Technology |

Strategic Partnerships |

R&D Focus |

Sustainability Initiatives |

|

Tata Motors |

1945 |

Mumbai, India |

Nationwide |

- |

- |

- |

- |

- |

|

Mahindra & Mahindra |

1945 |

Mumbai, India |

Pan-India |

- |

- |

- |

- |

- |

|

MG Motor India |

2017 |

Gurgaon, India |

Major cities |

- |

- |

- |

- |

- |

|

Hyundai Motor India |

1996 |

Chennai, India |

Urban areas |

- |

- |

- |

- |

- |

|

Ather Energy |

2013 |

Bangalore, India |

Select markets |

- |

- |

- |

- |

- |

India Electric Car Market Analysis

Market Growth Drivers

- Environmental Policies (e.g., Emissions Regulations, BS VI Standards): Indias push for sustainable transport has been bolstered by stringent emission standards, notably the Bharat Stage VI (BS VI) regulations introduced in 2020, aimed at significantly reducing NOx emissions for diesel engines. The government has also committed to increasing the adoption of electric vehicles (EVs) as part of its National Electric Mobility Mission Plan (NEMMP). According to the Ministry of Environment, Indias investment in EV infrastructure has grown consistently in allocations from 2022 to 2024 to reduce greenhouse gas emissions from vehicles, a significant component of Indias environmental policy strategy.

- Technological Advancements (Battery Tech, Vehicle Autonomy): Battery technology advancements, such as lithium-ion batteries, have increased the energy density of EV batteries, reducing weight and boosting range. By 2024, battery capacity has improved, with some models now achieving over 400 km per charge, according to the Ministry of Heavy Industries. Battery production facilities in India, such as those by Tata and Maruti, have also grown in line with these advancements. The government aims to support battery R&D with subsidies and investments totaling INR 18,100 crore in the Production Linked Incentive (PLI) scheme to strengthen domestic battery technology and supply

- Incentives and Subsidies (e.g., FAME Scheme, Tax Breaks): Under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme, Indias Ministry of Heavy Industries has allocated INR 10,000 crore to promote EV sales, with over 300,000 EVs receiving subsidies as of 2024. Additionally, tax breaks on electric cars have incentivized purchases by reducing GST on EVs and providing tax deductions of up to INR 1.5 lakh on loan interest. This initiative has significantly boosted EV adoption in metro cities and Tier-I regions, promoting a low-emission transport culture.

Market Challenges:

- Infrastructure Constraints (Charging Stations and Standardization): India currently operates over 6,000 EV charging stations, with plans to double this by 2025 under initiatives led by the Ministry of Power. However, current infrastructure remains inadequate for the growing EV market, particularly in rural and Tier-II cities. Standards for charging ports and technology are also lacking, creating compatibility issues across charging networks. The Ministry has allocated funding for approximately 2,600 new charging stations in 68 cities as of 2024, though effective implementation remains essential to meet the charging needs of the countrys EV growth.

- Consumer Adoption Barriers (Range Anxiety, Cost Consciousness): Despite government incentives, many consumers hesitate to adopt EVs due to concerns about vehicle range and overall cost-efficiency. According to the Ministry of Transport, the average electric car in India has a range of 250-300 km, which poses challenges for long-distance travel. This range anxiety, combined with limited charging infrastructure, limits adoption outside urban areas. Additionally, cost-conscious consumers often find the upfront price of EVs restrictive, even with subsidies, which highlights the need for continued support to encourage wider market penetration.

India Electric Car Market Future Outlook

The Indian electric car market is poised for rapid expansion over the next five years, driven by continuous government support, advancements in EV battery technology, and the rising consumer demand for eco-friendly vehicles. As the cost of EV ownership declines, aided by battery price reductions and enhanced charging infrastructure, the market will likely see increased adoption rates across various consumer demographics. Strategic investments by domestic and international players further indicate a strong future for EV growth in India.

Market Opportunities:

- Local Manufacturing and Partnerships: The Indian government has introduced the PLI scheme with a budget allocation of INR 18,100 crore to support local EV and battery production, aiming to reduce dependence on imports. Partnerships between Indian manufacturers and foreign EV companies have risen, with companies like Mahindra and Tata exploring joint ventures. This initiative aligns with the Make in India movement and seeks to bolster local manufacturing capabilities. By 2024, local battery manufacturing units have increased, promoting a sustainable supply chain and providing employment opportunities, significantly contributing to Indias economic growth.

- Expansion in Rural and Tier-II Cities: In India, EV adoption has predominantly been in urban areas, but initiatives are now focusing on expanding access to rural and Tier-II cities. As of 2024, government-backed incentives have supported the installation of over 500 new charging stations in smaller cities, aiming to address the infrastructural imbalance. According to the Ministry of Power, a planned investment of INR 1,000 crore is allocated to build EV infrastructure in Tier-II and rural regions, making EVs more accessible to a broader consumer base, driving rural mobility, and aligning with Indias rural development goals.

Scope of the Report

|

By Vehicle Type |

Hatchbacks Sedans SUVs MPVs |

|

By Technology |

Battery Electric Vehicles PHEVs HEVs |

|

By Battery Type |

Lithium-Ion Lead-Acid Solid-State |

|

By Charging Type |

Normal Charging Fast Charging |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Electric Vehicle Manufacturers

Battery Component Suppliers

Charging Infrastructure Providers

Government and Regulatory Bodies (Ministry of Heavy Industries, Ministry of Road Transport)

Automotive Associations and Industry Bodies

Investments and Venture Capitalist Firms

Urban Planning and Development Authorities

Environment and Sustainability Advocates

Companies

Players Mention in the Report

Tata Motors

Mahindra & Mahindra

MG Motor India

Hyundai Motor India

Ather Energy

Hero Electric

Maruti Suzuki

Volvo Car Corporation

Honda Motor Co. Ltd

Toyota Kirloskar Motor

Kia India Pvt Ltd

Ultraviolette Automotive Pvt Ltd

Bajaj Auto Ltd

BYD India

TVS Motor Company

Table of Contents

01. India Electric Car Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Overview of Key Government Initiatives (e.g., FAME II, State-Specific EV Policies)

02. India Electric Car Market Size (In INR Crores)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Impact of Economic and Policy Shifts

03. India Electric Car Market Analysis

3.1 Growth Drivers

- Environmental Policies (e.g., Emissions Regulations, BS VI Standards)

- Technological Advancements (Battery Tech, Vehicle Autonomy)

- Incentives and Subsidies (e.g., FAME Scheme, Tax Breaks)

3.2 Market Challenges

- High Initial Costs (Battery and Component Pricing)

- Infrastructure Constraints (Charging Stations and Standardization)

- Consumer Adoption Barriers (Range Anxiety, Cost Consciousness)

3.3 Opportunities

- Local Manufacturing and Partnerships

- Expansion in Rural and Tier-II Cities

- Rise of Shared Mobility Platforms

3.4 Market Trends

- Shift to BEVs and High-Range EV Models

- Integration with IoT and Smart Vehicle Systems

- Increasing Investment in Public Charging Infrastructure

04. India Electric Car Market Segmentation

4.1 By Vehicle Type (Hatchbacks, Sedans, SUVs, MPVs)

4.2 By Technology (Battery Electric Vehicles, Plug-in Hybrid Vehicles, Hybrid Electric Vehicles)

4.3 By Battery Type (Lithium-Ion, Lead-Acid, Solid-State)

4.4 By Charging Type (Normal Charging, Fast Charging)

4.5 By Region (North, South, East, West, including top EV-adopting states like Maharashtra, Delhi, Karnataka)

05. India Electric Car Market Competitive Analysis

5.1 Profiles of Major Competitors

- Tata Motors

- Hyundai Motor India

- Mahindra & Mahindra

- Maruti Suzuki

- MG Motor India

- Toyota Kirloskar Motor

- BYD India

- Hero Electric

- Volvo Car Corporation

- Honda Motor Co. Ltd

- TVS Motor Company

- Ultraviolette Automotive Pvt Ltd

- Kia India Pvt Ltd

- Ather Energy Pvt Ltd

- Bajaj Auto Ltd

5.2 Cross-Comparison Parameters (Market Share, Regional Presence, Product Range, Revenue, Production Facilities, Technological Expertise, R&D Investments, Partnerships)

5.3 Strategic Initiatives and Investments

5.4 Mergers and Acquisitions

5.5 Key Partnerships and Collaborations

06. India Electric Car Market Regulatory Framework

6.1 Overview of National Policies (e.g., EV Incentives, GST Rates)

6.2 Regional and State-Specific Policies

6.3 Certification and Compliance Requirements

07. India Electric Car Market Future Size (In INR Crores)

7.1 Projected Market Growth

7.2 Key Drivers of Future Demand

08. India Electric Car Market Segmentation - Future Scope

8.1 By Vehicle Type

8.2 By Technology

8.3 By Battery Type

8.4 By Charging Type

8.5 By Region

09. India Electric Car Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Go-to-Market Strategies

9.3 Key Investment Areas

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of key stakeholders within the Indian electric car market. This process is backed by secondary research, using credible sources to gather data on market dynamics and key growth drivers.

Step 2: Market Analysis and Construction

In this phase, historical data and metrics for EV penetration and adoption trends are analyzed. This includes reviewing policies, infrastructural investments, and state-by-state EV adoption rates to validate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and tested through in-depth interviews with industry experts. These consultations offer insights into operational and financial trends, supporting data validation.

Step 4: Research Synthesis and Final Output

The final step synthesizes findings from various data points, including industry metrics and expert feedback, to deliver a comprehensive analysis. This ensures the reports conclusions are well-rounded, data-driven, and aligned with industry trends.

Frequently Asked Questions

01. How big is the India Electric Car Market?

The India electric car market is valued at approximately USD 2.8 billion, supported by strong government policies like the FAME II scheme and consumer shifts towards sustainable mobility solutions.

02. What are the primary challenges in the India Electric Car Market?

Challenges include high battery costs, limited charging infrastructure, and consumer concerns over range anxiety, which hinder widespread EV adoption in India.

03. Which companies dominate the India Electric Car Market?

Key players include Tata Motors, Mahindra & Mahindra, MG Motor India, and Hyundai Motor India, which lead through innovations in battery technology and consumer-friendly EV models.

04. What factors drive the growth of the India Electric Car Market?

Government incentives, increased consumer interest in eco-friendly vehicles, and rising fuel prices are primary growth drivers, prompting shifts to electric cars.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.