India Electric Motor Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD2324

November 2024

89

About the Report

India Electric Motor Market Overview

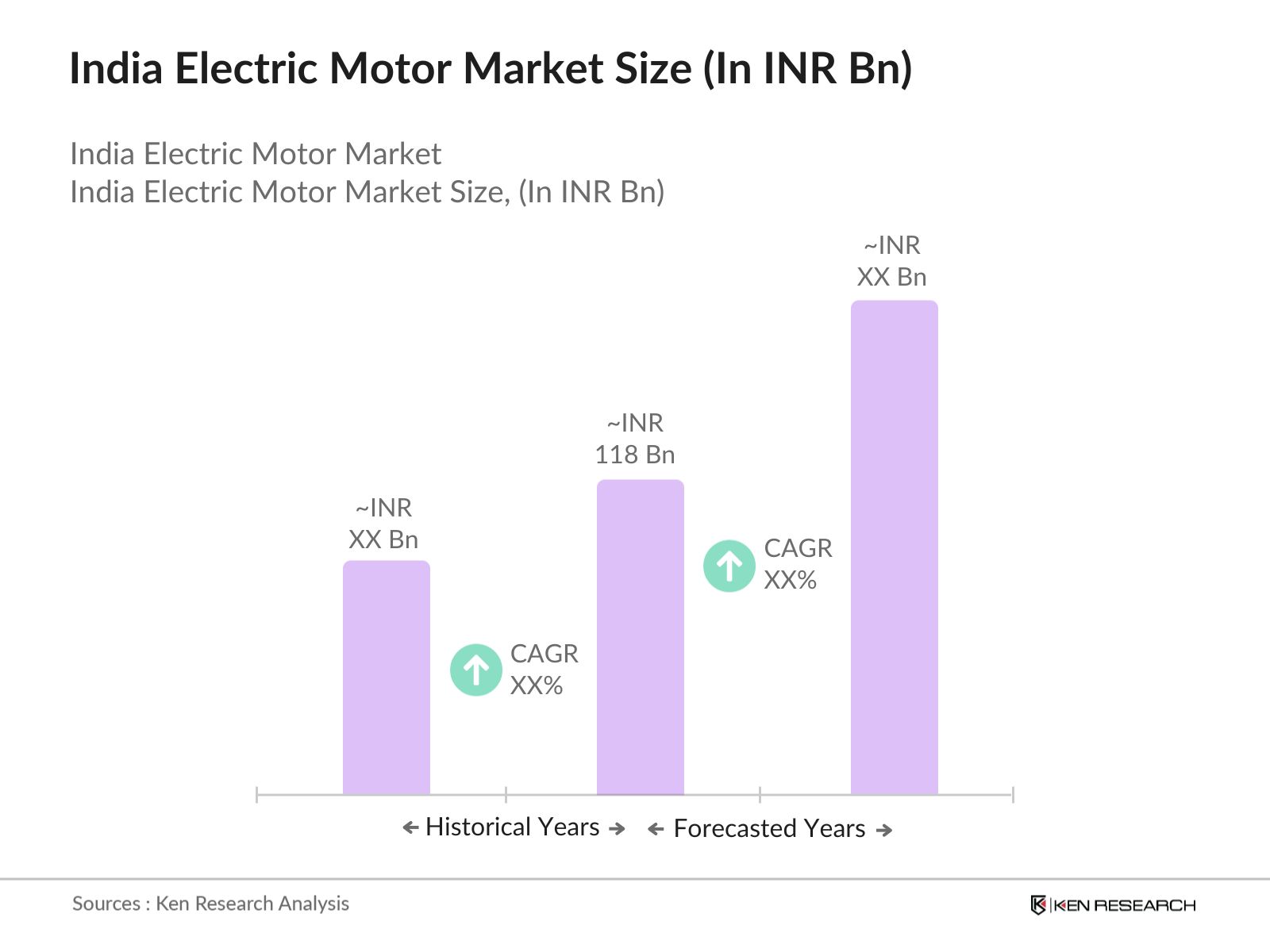

- The India Electric Motor Market was valued at INR 118 billion, driven by the increasing demand for electric vehicles (EVs), the rising industrial automation sector, and the growing government initiatives aimed at boosting energy efficiency across industries.

- Key players in the market include Bharat Heavy Electricals Limited (BHEL), Siemens India, ABB India, CG Power and Industrial Solutions, and Nidec India. These companies have successfully leveraged technological advancements and innovation to produce high-performance, energy-efficient motors catering to diverse applications across automotive, industrial, and consumer electronics sectors.

- Siemens India has acquired the electric vehicle (EV) division of Mass-Tech Controls for Rs 38 crore, enhancing its e-mobility offerings in India. The acquired division reported a turnover of around Rs 16.7 crore during FY23.

- The Western region led the market in 2023, driven by its high industrial activity, rapid urbanization, and adoption of renewable energy sources. Cities like Mumbai, Pune, and Ahmedabad have witnessed a surge in the use of electric motors across industries, ranging from automotive to heavy machinery manufacturing.

India Electric Motor Market Segmentation

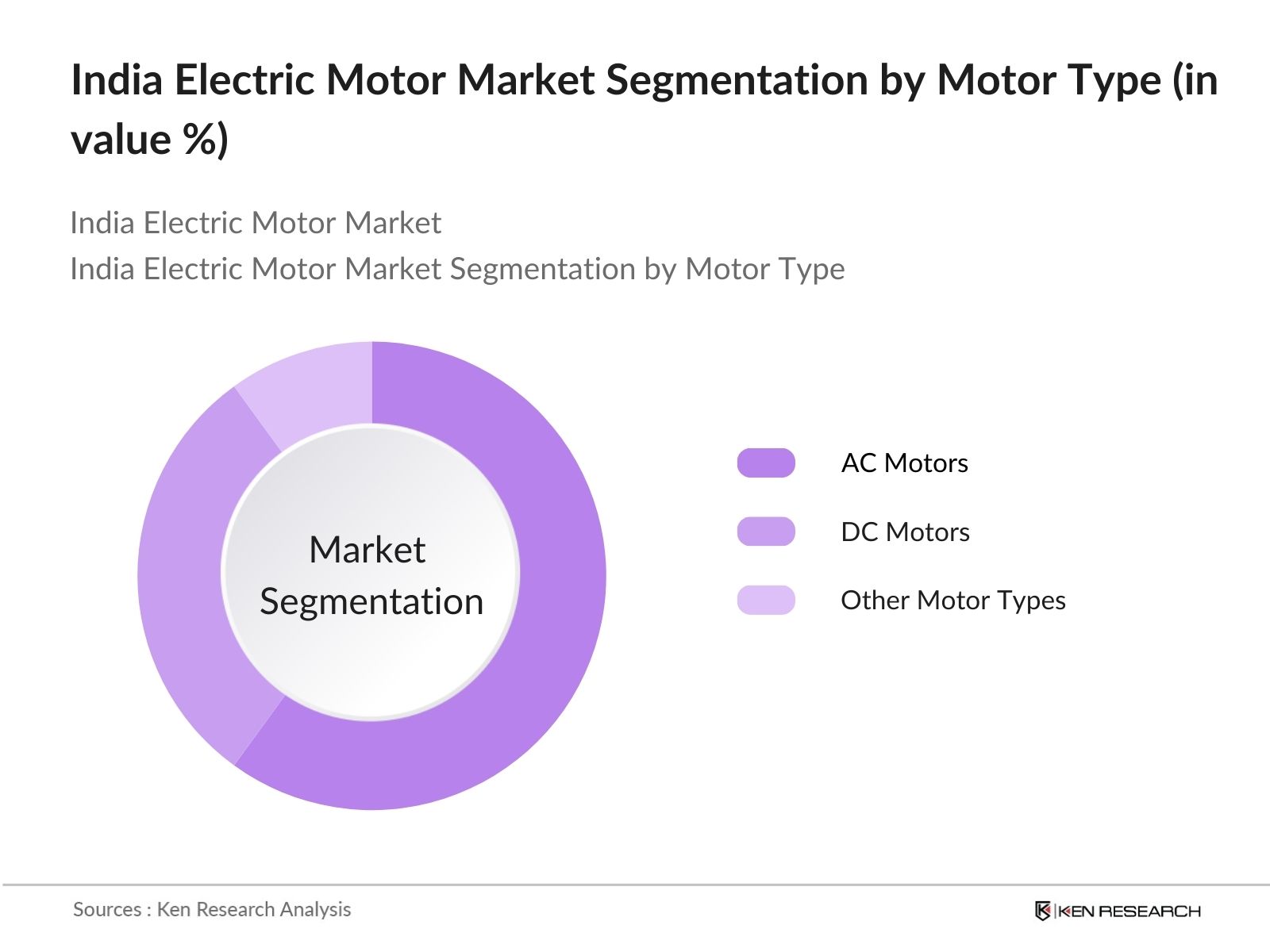

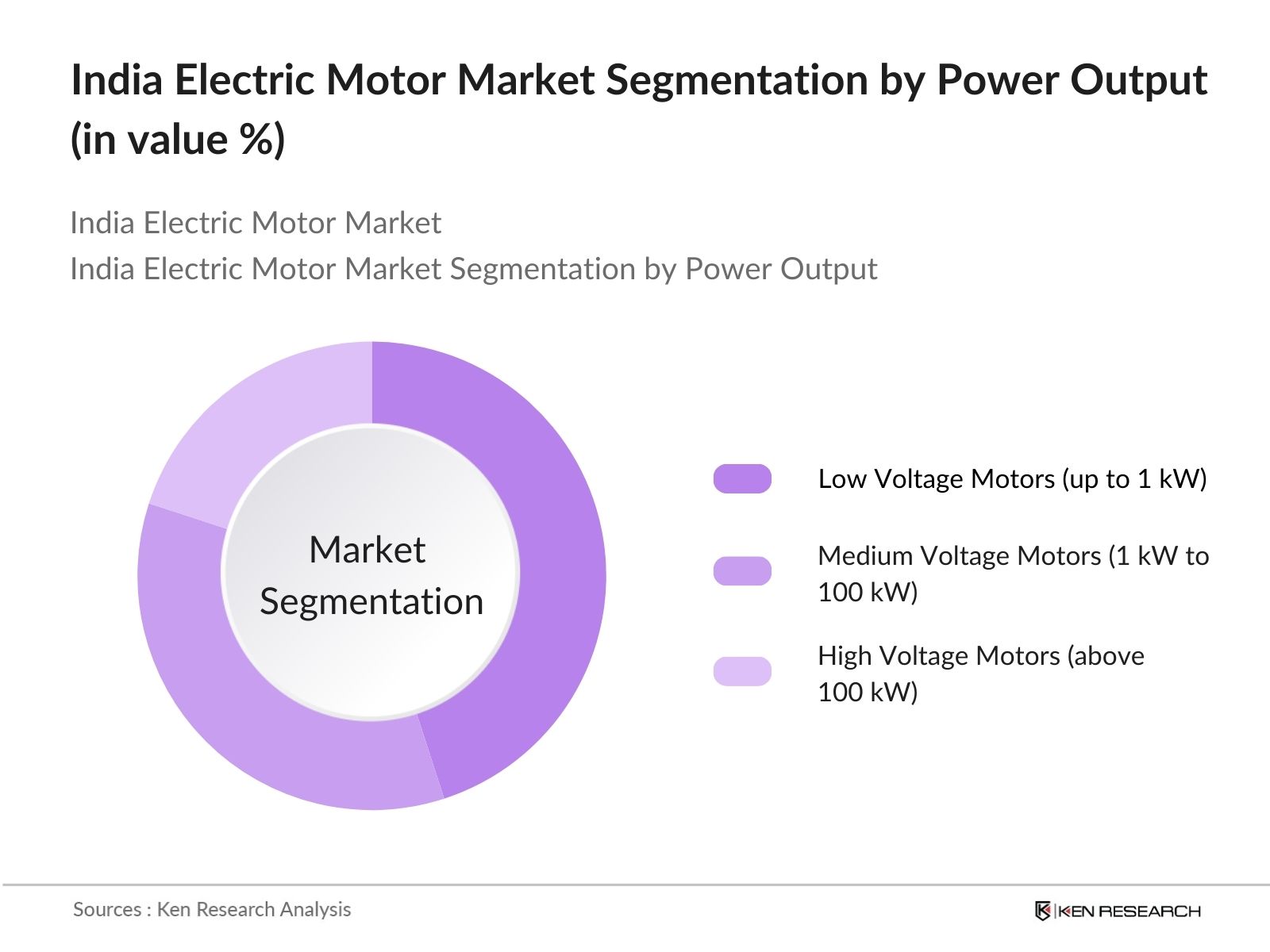

The India Electric Motor Market is segmented by motor type, power output, application, and region.

- By Motor Type: The market is segmented into AC motors, DC motors, and other motor types (synchronous and stepper motors). AC motors dominated the market in 2023 due to their extensive use in industrial applications and electric vehicles.

- By Power Output: The market is categorized into low voltage motors (up to 1 kW), medium voltage motors (1 kW to 100 kW), and high voltage motors (above 100 kW). Low voltage motors held the largest share in 2023, largely driven by their extensive use in home appliances, HVAC systems, and smaller industrial machines.

- By Region: The market is segmented into North, South, East, and West. The Western region dominated the market in 2023, driven by a concentration of manufacturing units and increased investments in electric vehicle infrastructure.

India Electric Motor Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Bharat Heavy Electricals Ltd (BHEL) |

1964 |

New Delhi |

|

Siemens India |

1922 |

Mumbai, Maharashtra |

|

ABB India |

1950 |

Bengaluru, Karnataka |

|

CG Power and Industrial Solutions |

1937 |

Mumbai, Maharashtra |

|

Nidec India |

1973 |

Chennai, Tamil Nadu |

- Bharat Heavy Electricals Ltd (BHEL): BHEL has secured orders for the 960 MW Polavaram hydroelectric project in India, marking a substantial development in renewable energy. The project includes the supply of pump-motor sets, enhancing India's hydroelectric capacity and supporting its transition to sustainable energy sources.

- ABB India: ABB India and Witt India partner to deliver state-of-the-art tunnel ventilation solutions, deploying ABB's smoke extraction motors in key projects across India to enhance safety and efficiency for over 1 million commuters daily.

India Electric Motor Market Analysis

India Electric Motor Market Growth Drivers:

- Surging Electric Vehicle (EV) Demand: The increasing shift towards electric vehicles is driven by consumer preference for cleaner transportation options. In FY 2023, India's electric two-wheeler market saw a notable 34.42% increase in sales compared to the previous quarter, boosting the demand for electric motors.

- Expansion of Industrial Automation: India's manufacturing sector is rapidly adopting Industry 4.0, with a dedicated policy allocating Rs. 500 crore to enhance green mobility and stimulate electric vehicle manufacturing. Electric motors are essential for automation across applications like robotics and conveyor systems.

- Rising Adoption of Renewable Energy: India aims to install 500 GW of non-fossil fuel-based energy capacity by 2030. The growing renewable energy sector, particularly solar and wind, requires electric motors to convert energy into usable power, contributing to the overall growth of the electric motor market.

India Electric Motor Market Challenges:

- Fluctuations in Raw Material Prices: he electric motor industry faces fluctuations in raw material costs, particularly for copper and steel. In 2023, copper prices surged by 15%, impacting manufacturing expenses and leading to price hikes that have affected profitability across the sector, complicating cost management.

- Technological Barriers: India's electric motor market is expanding, yet it lags in advanced technologies compared to India standards. Currently, only 20% of Indian manufacturers have adopted smart and sensor-integrated motors, highlighting a technological gap that hinders innovation and limits the competitive edge in the market.

India Electric Motor Market Government Initiatives:

- FAME II Scheme: The Faster Adoption and Manufacturing of Electric Vehicles (FAME) Phase II scheme has allocated INR 10,000 crore to accelerate EV adoption in India. This funding supports the development of electric infrastructure, including motors, aiming to incentivize the purchase of around 5 lakh electric three-wheelers and 10 lakh electric two-wheelers.

- Energy Conservation Building Code (ECBC): The Energy Conservation Building Code (ECBC) promotes energy-efficient motors in commercial buildings, mandating updated efficiency criteria for HVAC systems. Launched by the Government of India, the code aims to reduce energy consumption in buildings by 30-50% compared to conventional standards, enhancing overall energy efficiency.

India Electric Motor Market Future Market Outlook

The India Electric Motor Market is expected to continue its robust growth in next five years, with a focus on high-efficiency motors driven by EV adoption and increasing automation in various sectors. The market will likely see a greater shift towards brushless DC motors (BLDC) for EVs and industrial applications.

Future Market Trends:

- Increased Adoption of Brushless Motors: The adoption of brushless DC motors (BLDC) will rise substantially due to their higher efficiency and lower maintenance requirements. In the coming years, these motors will become the preferred choice for applications in electric vehicles and consumer electronics, enhancing performance and reliability.

- Smart Motors and IoT Integration: Smart motors equipped with sensors will gain traction in industrial settings, where predictive maintenance will become essential. In the coming years, IoT-enabled motors will be increasingly integrated into industrial automation and energy management systems, facilitating real-time monitoring and optimizing operational efficiency.

Scope of the Report

|

By Motor Type |

AC Motors DC Motors Other Motor Types |

|

By Power Output |

Low Voltage Motors Medium Voltage Motors High Voltage Motors |

|

By Application |

Automotive Industrial Residential Commercial |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Automotive Manufacturers

Industrial Automation Companies

Electric Motor Manufacturers

EV Infrastructure Developers

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Bharat Heavy Electricals Ltd. (BHEL)

Siemens India

ABB India

CG Power and Industrial Solutions

Nidec India

Kirloskar Electric Company

Havells India Ltd.

Weg Industries India

Toshiba Mitsubishi Electric India

Baldor Electric India (A subsidiary of ABB)

V-Guard Industries Ltd.

Lubi Industries LLP

Brook Crompton India Pvt. Ltd.

Regal Rexnord India Pvt. Ltd.

Schneider Electric India

Table of Contents

1. India Electric Motor Market Overview

1.1 Definition and Scope (Market Definition, Electric Motor Technologies, Industry Boundaries)

1.2 Market Taxonomy (By Motor Type, Power Output, Application, Region)

1.3 Market Growth Rate (CAGR, Key Trends, Market Dynamics)

1.4 Market Segmentation Overview (Segmentation by Motor Type, Power Output, Application, Region)

1.5 Overview of Key Market Developments (Technological Advancements, Strategic Partnerships, Government Initiatives)

2. India Electric Motor Market Size (in INR Billion)

2.1 Historical Market Size (2018-2023 Data, Analysis)

2.2 Year-on-Year Growth Analysis (Growth Trends, Performance Indicators)

2.3 Key Market Developments and Milestones (Investments, Industrial Advancements)

2.4 Current Market Valuation (2023 Valuation, Industrial Contributions)

3. India Electric Motor Market Analysis

3.1 Growth Drivers

3.1.1 Surging Electric Vehicle (EV) Demand

3.1.2 Expansion of Industrial Automation

3.1.3 Rising Adoption of Renewable Energy Sources

3.1.4 Government Energy Efficiency Initiatives

3.2 Restraints

3.2.1 Fluctuations in Raw Material Prices (Copper, Steel)

3.2.2 Technological Barriers in Smart Motors

3.2.3 High Initial Costs for Advanced Electric Motors

3.3 Opportunities

3.3.1 Increasing Investments in Electric Vehicle Infrastructure

3.3.2 Demand for Smart and IoT-Enabled Motors in Industry 4.0

3.3.3 Growth in Renewable Energy Applications

3.4 Trends

3.4.1 Increased Adoption of Brushless DC Motors

3.4.2 Integration of Smart Motors with IoT for Predictive Maintenance

3.4.3 Advancements in Energy-Efficient Motor Technologies

3.5 SWOT Analysis

3.5.1 Strengths

3.5.2 Weaknesses

3.5.3 Opportunities

3.5.4 Threats

4. India Electric Motor Market Segmentation

4.1 By Motor Type (in Value %)

4.1.1 AC Motors

4.1.2 DC Motors

4.1.3 Other Motor Types (Synchronous Motors, Stepper Motors)

4.2 By Power Output (in Value %)

4.2.1 Low Voltage Motors (Up to 1 kW)

4.2.2 Medium Voltage Motors (1 kW to 100 kW)

4.2.3 High Voltage Motors (Above 100 kW)

4.3 By Application (in Value %)

4.3.1 Automotive

4.3.2 Industrial

4.3.3 Residential

4.3.4 Commercial

4.4 By Region (in Value %)

4.4.1 North

4.4.2 South

4.4.3 East

4.4.4 West

5. India Electric Motor Market Competitive Landscape

5.1 Market Share Analysis (Top Companies, Market Shares in 2023)

5.2 Strategic Initiatives (Acquisitions, Partnerships, New Product Launches)

5.3 Competitive Benchmarking (Revenue, R&D Investments, Market Reach)

5.4 Detailed Profiles of Major Players

5.4.1 Bharat Heavy Electricals Ltd. (BHEL)

5.4.2 Siemens India

5.4.3 ABB India

5.4.4 CG Power and Industrial Solutions

5.4.5 Nidec India

5.4.6 Kirloskar Electric Company

5.4.7 Havells India Ltd.

5.4.8 Weg Industries India

5.4.9 Toshiba Mitsubishi Electric India

5.4.10 Baldor Electric India (A subsidiary of ABB)

5.4.11 V-Guard Industries Ltd.

5.4.12 Lubi Industries LLP

5.4.13 Brook Crompton India Pvt. Ltd.

5.4.14 Regal Rexnord India Pvt. Ltd.

5.4.15 Schneider Electric India

6. India Electric Motor Financial and Investment Landscape

6.1 Investment Analysis

6.1.1 Government Investments in Electric Motor and EV Infrastructure

6.1.2 Venture Capital Funding for Smart Motor Start-ups

6.1.3 Private Equity Investments (Mergers and Acquisitions in Electric Motor Industry)

6.2 R&D Expenditure of Key Players (Technological Advancements, New Innovations)

6.3 Investment Trends (Growth Opportunities, Investment Focus on EVs and Automation)

7. India Electric Motor Market Regulatory Framework

7.1 Government Energy Efficiency Regulations (Energy Conservation Building Code, ECBC)

7.2 Compliance Requirements (Efficiency Standards for Electric Motors)

7.3 Certification Processes (Bureau of Energy Efficiency Certifications)

7.4 Trade and Import/Export Policies (Impact on Raw Materials, India Trade Regulations)

8. India Electric Motor Future Market Size (in INR Billion)

8.1 Future Market Size Projections (Forecast Growth Rate, Market Valuation)

8.2 Key Factors Driving Future Market Growth (EV Adoption, Industrial Automation)

8.3 Technological Advancements in Electric Motors (Smart Motors, IoT Integration)

9. India Electric Motor Future Market Segmentation

9.1 By Motor Type (in Value %)

9.1.1 AC Motors

9.1.2 DC Motors

9.1.3 Other Motor Types (Synchronous Motors, Stepper Motors)

9.2 By Power Output (in Value %)

9.3 By Application (in Value %)

9.4 By Region (in Value %)

10. India Electric Motor Market Analysts Recommendations

10.1 TAM/SAM/SOM Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the India Electric Motor market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple electric motor manufacturers, suppliers, and end-users to understand product segments, sales trends, consumer preferences, and other parameters. This approach supports us in validating the statistics derived from the bottom-up approach of these manufacturers, suppliers, and end-users.

Frequently Asked Questions

01. How big is the India Electric Motor Market?

The India Electric Motor Market was valued at INR 118 billion, driven by the rising demand for electric vehicles and industrial automation.

02. Who are the major players in the India Electric Motor market?

Leading companies in the India Electric Motor Market include Bharat Heavy Electricals Ltd (BHEL), Siemens India, ABB India, CG Power and Industrial Solutions, and Nidec India.

03. What are the growth drivers of the India Electric Motor market?

Growth in the India Electric Motor Market include the surging demand for electric vehicles (EVs), the expansion of industrial automation, and the governments energy efficiency initiatives aimed at reducing power consumption.

04. What are the India Electric Motor market challenges?

The India Electric Motor Market faces challenges such as fluctuating raw material prices, particularly copper and steel, and a technological gap in advanced motor solutions like smart and sensor-integrated motors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.