India Electric Two-Wheeler Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10126

November 2024

90

About the Report

India Electric Two-Wheeler Market Overview

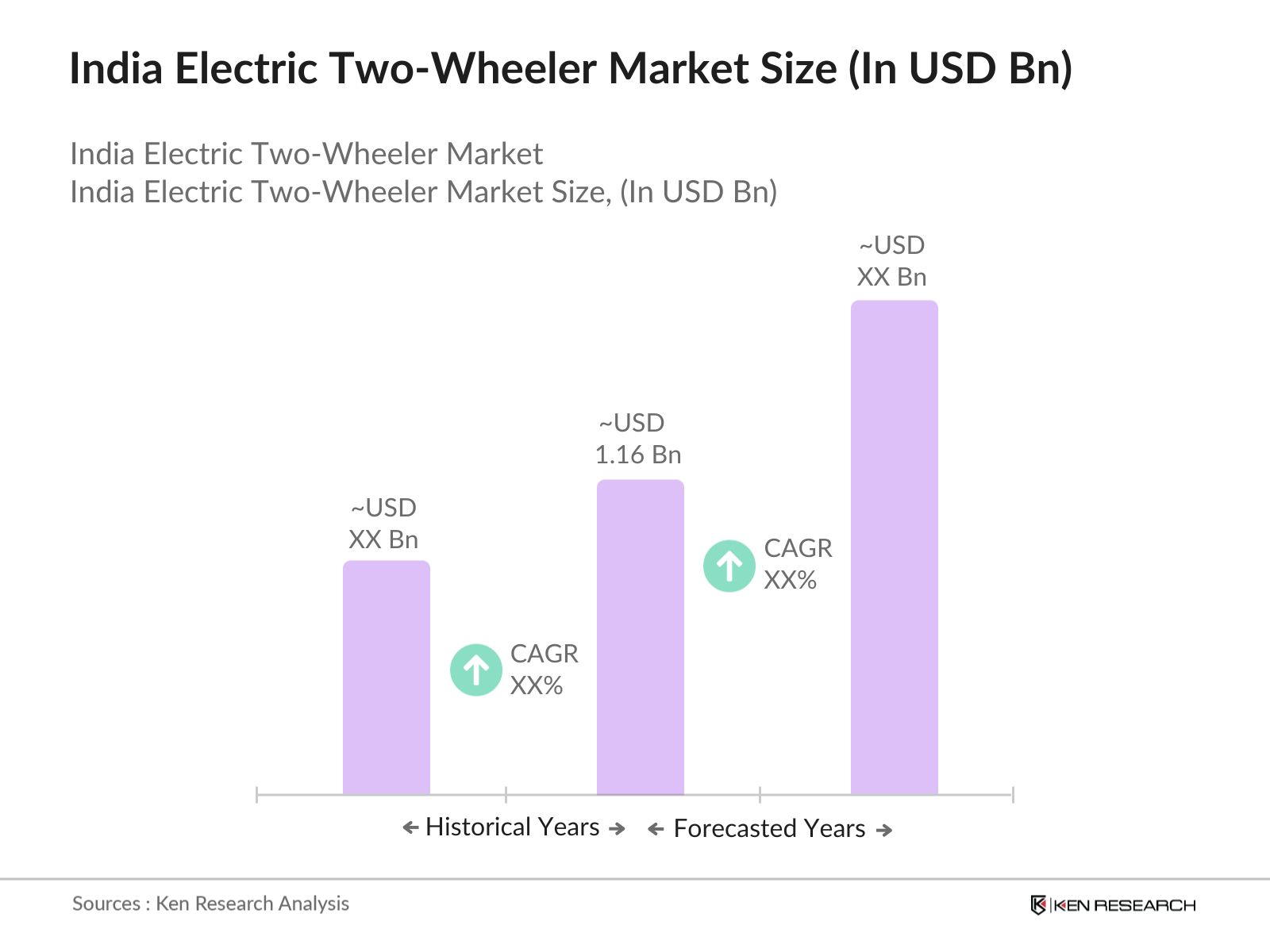

- The India Electric Two-Wheeler market, currently valued at USD 1.16 million, has seen considerable growth driven by increasing fuel prices, government incentives, and heightened environmental consciousness among consumers. As cities across India grapple with pollution and traffic congestion, the push towards eco-friendly transport solutions has led to a surge in demand for electric two-wheelers. Government policies such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme have further accelerated market growth, making electric two-wheelers an attractive option for both urban and rural consumers.

- Cities like Bengaluru, Delhi, and Pune are leading the market due to their higher levels of urbanization, availability of charging infrastructure, and government-backed initiatives aimed at reducing vehicular emissions. Bengaluru, for example, is home to several key electric vehicle (EV) startups and enjoys a supportive ecosystem, while Delhi has introduced policies to curb pollution, making electric two-wheelers an ideal alternative for daily commuters. Pune's adoption is driven by its role as a hub for last-mile delivery services, further supporting the demand for electric two-wheelers in commercial use.

- The Indian governments FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme is a critical part of Indias strategy to promote electric vehicle (EV) adoption. Launched in 2019 and extended until 2024, the scheme provides subsidies for electric two-wheeler purchases. Over 850,000 electric two-wheelers have benefited from this program as of 2024. The scheme has allocated INR 10,000 crore, primarily for incentivizing manufacturers to produce affordable EVs and develop supporting infrastructure, such as public charging stations. Under FAME II, customers receive up to INR 15,000 per kWh subsidy on electric two-wheelers.

India Electric Two-Wheeler Market Segmentation

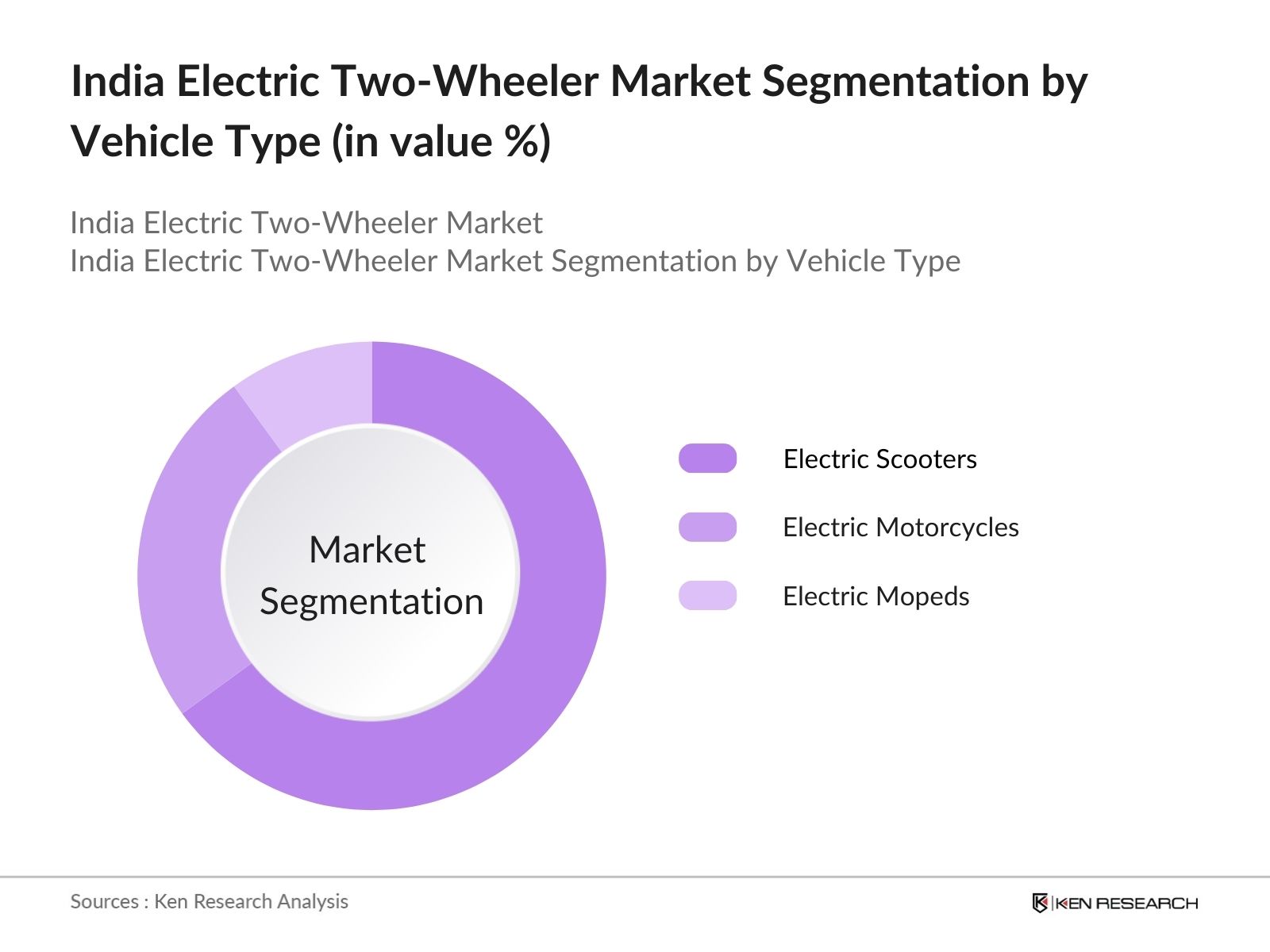

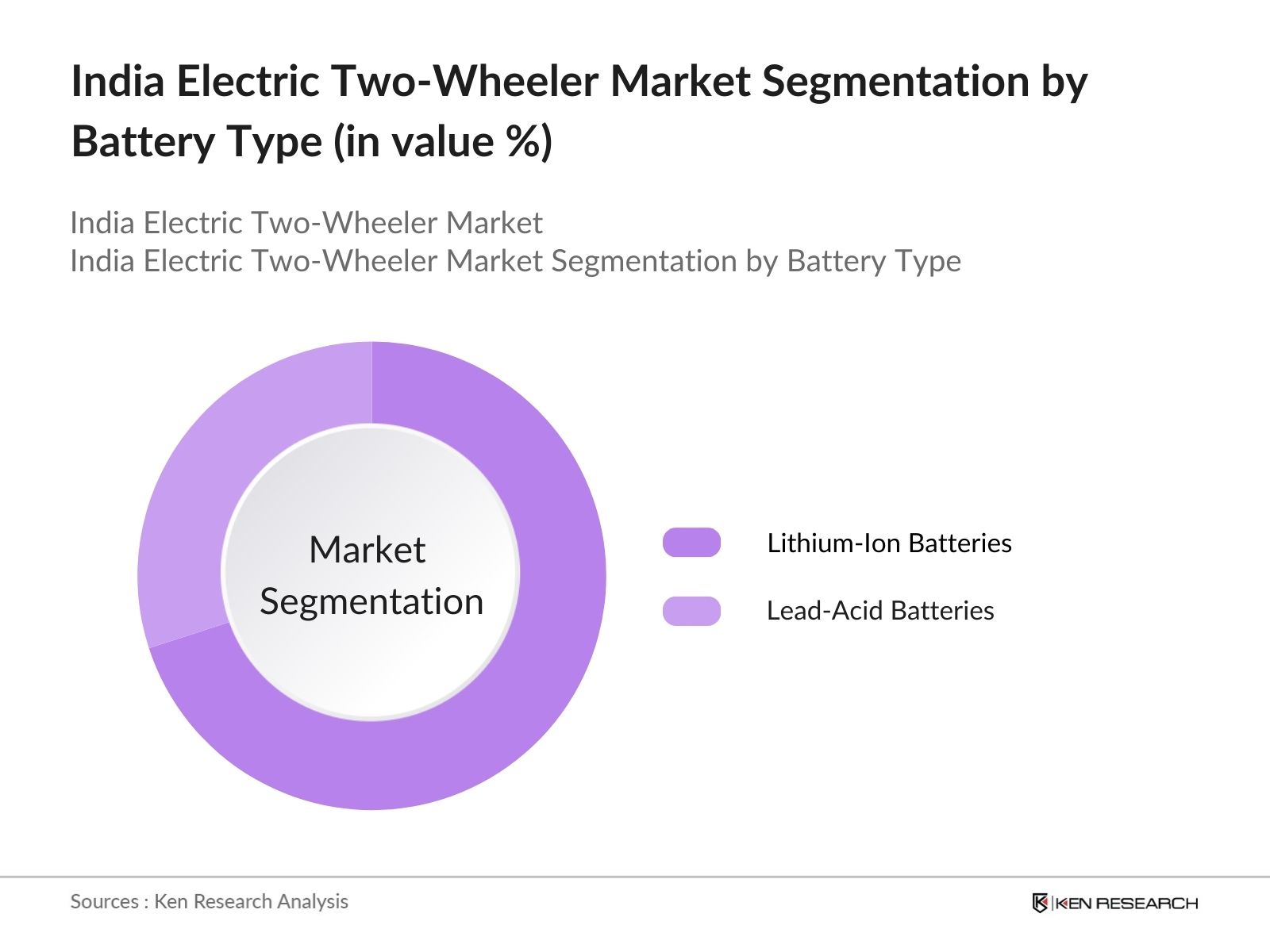

Indias electric two-wheeler market is segmented by vehicle type and by battery type.

- By Vehicle Type: The market is segmented by vehicle type into electric scooters, electric motorcycles, and electric mopeds. Among these, electric scooters have a dominant market share due to their affordability, ease of use, and lower maintenance costs compared to electric motorcycles. Brands like Hero Electric and Ola Electric have capitalized on the demand for short-distance, cost-effective transportation, especially in densely populated cities where scooters are a preferred choice for daily commuting.

- By Battery Type: The market is also segmented by battery type into Lithium-Ion and Lead-Acid batteries. Lithium-Ion batteries hold a commanding market share due to their longer lifespan, faster charging times, and higher energy density. This segments dominance is further bolstered by government initiatives promoting the use of Lithium-Ion technology over Lead-Acid, which is considered outdated and less efficient. Consumers and manufacturers alike prefer Lithium-Ion batteries for their performance and overall value.

India Electric Two-Wheeler Market Competitive Landscape

The India Electric Two-Wheeler market is dominated by a few key players, including both legacy manufacturers and emerging startups. Companies like Hero Electric and Ather Energy have established themselves as front-runners in the electric scooter segment, while brands like Bajaj and TVS are leveraging their extensive dealer networks to penetrate deeper into the market. Furthermore, the rise of Ola Electric as a disruptor with large-scale production capabilities has added competitive pressure, forcing traditional companies to innovate and expand their product lines.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

Battery Technology |

Sales Network |

|

Hero Electric |

1956 |

New Delhi |

|||

|

Ather Energy |

2013 |

Bengaluru |

|||

|

Bajaj Auto |

1945 |

Pune |

|||

|

Ola Electric |

2017 |

Bengaluru |

|||

|

TVS Motor Company |

1978 |

Hosur |

India Electric Two-Wheeler Industry Analysis

Growth Drivers

- Government Subsidies and Incentives: The Indian government has implemented several incentive schemes to boost the adoption of electric two-wheelers. Under the FAME II scheme, INR 10,000 crore has been allocated for electric vehicle (EV) adoption, specifically offering subsidies for two-wheeler manufacturers. In 2024, more than 850,000 electric two-wheelers were subsidized by the government. Additionally, several states, including Delhi, Maharashtra, and Karnataka, have offered tax rebates and incentives, pushing electric vehicle sales forward. The financial push from government initiatives has been key in driving consumer interest in electric two-wheelers.

- Increasing Fuel Prices: India has seen a significant rise in fuel prices, with petrol prices exceeding INR 110 per liter in some metro cities in 2024. This sharp rise in fuel costs has caused many daily commuters to shift towards electric two-wheelers, which offer far lower running costs. An electric two-wheeler can run at INR 15-20 per charge for a range of 70-100 km, making it a highly cost-effective alternative. With volatile global fuel markets, the adoption of electric two-wheelers in urban areas has spiked, making cost savings a critical driver.

Source - Rising Environmental Awareness: Increased awareness of environmental sustainability has led to greater adoption of electric vehicles, particularly two-wheelers. The Indian government has committed to reducing carbon emissions by 33-35% from 2005 levels by 2030. In 2024, the country has pushed for greener urban mobility, and public initiatives have encouraged environmentally conscious purchasing decisions. This rising awareness, combined with the visible pollution reduction efforts in large cities, has been instrumental in increasing the number of electric two-wheelers on the roads, contributing to cleaner air quality.

Market Challenges

- High Initial Costs of EVs: The initial cost of electric two-wheelers remains a key challenge for widespread adoption. In 2024, the average cost of an electric two-wheeler in India stands at INR 90,000-150,000, which is significantly higher than traditional gasoline-powered scooters. Although subsidies are available, many middle- and low-income consumers are still hesitant to make the switch due to the higher upfront costs. Additionally, financing options for EVs are less accessible compared to traditional vehicles, further limiting the potential buyer base.

- Limited Charging Infrastructure: As of 2024, India has around 8,000 publicly available charging stations, which is insufficient to meet the demands of the growing electric two-wheeler population. Most of these charging points are concentrated in urban areas, leaving vast rural regions underserved. The lack of reliable and widespread charging infrastructure has been a significant deterrent for potential EV buyers, especially for long-distance commuters or those in tier-2 and tier-3 cities where charging facilities are scarce.

India Electric Two-Wheeler Market Future Outlook

Over the next five years, the India Electric Two-Wheeler market is poised to witness significant expansion driven by technological advancements, increasing urbanization, and the ongoing support from the government through subsidies and incentives. The growing concern over environmental sustainability, combined with rising fuel prices, will further push the adoption of electric two-wheelers across the country. This sector is expected to experience robust growth, particularly in metropolitan areas where charging infrastructure and government initiatives are more prevalent.

Future Market Opportunities

- Technological Advancements in Battery Systems: Technological innovations in battery systems are creating new opportunities for electric two-wheeler growth. In 2024, lithium-ion batteries dominate the market, offering better energy efficiency and durability compared to older battery technologies. Battery manufacturers are now focusing on increasing the range of electric two-wheelers, with new models offering up to 150 km per charge. Research is also advancing in solid-state batteries, which promise faster charging times and longer lifespans, potentially transforming the market.

- Expanding Rural Electrification: Rural electrification efforts in India have significantly improved, with over 98% of villages connected to the grid as of 2024. This expansion offers a massive growth opportunity for electric two-wheeler adoption in rural regions, where access to conventional fuel stations is limited. The governments push for affordable and clean transportation options in these areas has increased interest in electric two-wheelers, which are becoming a viable mode of transport for the rural population.

Scope of the Report

|

Electric Scooters Electric Motorcycles Electric Mopeds

|

|

|

By Battery Type |

Lithium-Ion Batteries Lead-Acid Batteries |

|

By End-Use |

Personal Use Commercial (Last-Mile Delivery, E-commerce) |

|

By Charging Infrastructure |

Home Charging Public Charging Battery-Swapping Stations |

|

By Region |

North East West South |

Products

Key Target Audience

Electric Vehicle Manufacturers

Battery Manufacturers and Suppliers

Charging Infrastructure Providers

Electric Vehicle Component Suppliers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Heavy Industries, NITI Aayog)

Banks and Financial Institutes

Fleet Operators and Logistics Companies

EV Dealers and Distributors

Companies

Major Players in the India Electric Two-Wheeler Market

Hero Electric

Ather Energy

Ola Electric

Bajaj Auto

TVS Motor Company

Okinawa Autotech

Ampere Electric

Pure EV

Revolt Motors

Tork Motors

Etrio

Nexzu Mobility

Mahindra Electric

Jitendra New EV Tech

Avan Motors

Table of Contents

1. India Electric Two-Wheeler Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (By Vehicle Type, Battery Type, Charging Infrastructure, Power Output, and End-Use)

1.3. Market Growth Rate (Growth in Urbanization, Electrification Push, Government Initiatives, Rising Consumer Awareness)

1.4. Market Segmentation Overview (Detailed Segmentation across Key Parameters)

2. India Electric Two-Wheeler Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Vehicle Sales, Production Capacities, EV Infrastructure Development)

3. India Electric Two-Wheeler Market Analysis

3.1. Growth Drivers

3.1.1. Government Subsidies and Incentives

3.1.2. Increasing Fuel Prices

3.1.3. Rising Environmental Awareness

3.1.4. Growing Adoption of E-Commerce and Last-Mile Delivery Solutions

3.2. Market Challenges

3.2.1. High Initial Costs of EVs

3.2.2. Limited Charging Infrastructure

3.2.3. Battery Recycling and Disposal Issues

3.3. Opportunities

3.3.1. Technological Advancements in Battery Systems

3.3.2. Expanding Rural Electrification

3.3.3. Growth of Battery-Swapping Models

3.3.4. Collaboration with International OEMs

3.4. Trends

3.4.1. Use of Lithium-Ion Batteries (Battery Efficiency and Energy Density)

3.4.2. Increased Adoption of Connected and Smart Vehicles (IoT-enabled Systems)

3.4.3. Rise of Subscription-based EV Ownership Models

3.5. Regulatory Landscape (National and State-level Policies)

3.5.1. FAME II Scheme

3.5.2. Battery Standardization and Safety Regulations

3.5.3. Incentives for Domestic Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (OEMs, Battery Manufacturers, Charging Station Providers, Consumers)

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Threat of Substitutes, etc.)

3.9. Competition Ecosystem (Leading OEMs, Supply Chain Integration, Aftermarket Services)

4. India Electric Two-Wheeler Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Electric Scooters

4.1.2. Electric Motorcycles

4.1.3. Electric Mopeds

4.2. By Battery Type (In Value %)

4.2.1. Lithium-Ion Batteries

4.2.2. Lead-Acid Batteries

4.3. By Region (In Value %)

4.3.1. North

4.3.2. East

4.3.3. West

South

4.4. By Charging Infrastructure (In Value %)

4.4.1. Home Charging

4.4.2. Public Charging

4.4.3. Battery-Swapping Stations

4.5. By End-Use (In Value %)

4.5.1. Personal Use

4.5.2. Commercial (Last-Mile Delivery, E-commerce)

5. India Electric Two-Wheeler Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hero Electric

5.1.2. Ather Energy

5.1.3. Ola Electric

5.1.4. Bajaj Auto

5.1.5. TVS Motor Company

5.1.6. Okinawa Autotech

5.1.7. Revolt Motors

5.1.8. Ampere Electric

5.1.9. Pure EV

5.1.10. Tork Motors

5.1.11. Mahindra Electric

5.1.12. Etrio

5.1.13. Jitendra New EV Tech

5.1.14. Nexzu Mobility

5.1.15. Avan Motors

5.2. Cross Comparison Parameters (Headquarters, Market Share, Production Capacity, Revenue, Product Range, Expansion Strategies, Battery Technology Used, Charging Infrastructure Investment)

5.3. Market Share Analysis (Top Players and Regional Distribution)

5.4. Strategic Initiatives (Product Launches, Partnerships, Technological Advancements)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private and Government Investments)

5.7. Venture Capital Funding

5.8. Government Grants and Support

5.9. Private Equity Investments

6. India Electric Two-Wheeler Market Regulatory Framework

6.1. FAME II Policy Implementation and Impact

6.2. State-Level Electric Vehicle Policies (Maharashtra, Karnataka, Gujarat, etc.)

6.3. Battery Recycling and E-Waste Regulations

6.4. Import Duties on EV Components

7. India Electric Two-Wheeler Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Technological Innovations, Green Energy Push)

8. India Electric Two-Wheeler Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Battery Type (In Value %)

8.3. By Region (In Value %)

8.4. By Charging Infrastructure (In Value %)

8.5. By End-Use (In Value %)

9. India Electric Two-Wheeler Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Preferences and Behavior Analysis

9.3. Market Penetration Strategies

9.4. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we identified the major stakeholders in the India Electric Two-Wheeler Market, including manufacturers, suppliers, and government bodies. Extensive desk research was conducted using proprietary databases and secondary sources to map out critical variables that impact market growth and dynamics.

Step 2: Market Analysis and Construction

The second phase involved analyzing historical data related to electric two-wheeler sales, vehicle registrations, and charging infrastructure development. This was complemented by evaluating technological advancements and government policies that have shaped the market.

Step 3: Hypothesis Validation and Expert Consultation

To ensure data accuracy, we conducted computer-assisted telephone interviews (CATI) with industry experts, including OEM executives, charging station operators, and government officials. These consultations provided insights into operational challenges, consumer behavior, and market potential.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the research data to create a comprehensive report that includes detailed insights into vehicle segments, battery technologies, and market challenges. This data was cross-verified with manufacturers and suppliers to ensure its reliability.

Frequently Asked Questions

01. How big is the India Electric Two-Wheeler Market?

The India Electric Two-Wheeler market is currently valued at 1.16 million, driven by growing demand for affordable, eco-friendly transportation solutions, government subsidies, and the rising cost of petrol.

02. What are the challenges in the India Electric Two-Wheeler Market?

Challenges in India Electric Two-Wheeler market include the high cost of lithium-ion batteries, lack of widespread charging infrastructure, and consumer hesitation due to concerns over battery longevity and vehicle range.

03. Who are the major players in the India Electric Two-Wheeler Market?

Key players in India Electric Two-Wheeler market include Hero Electric, Ather Energy, Ola Electric, Bajaj Auto, and TVS Motor Company. These companies dominate the market through a combination of strong brand presence, extensive sales networks, and ongoing innovation.

04. What are the growth drivers of the India Electric Two-Wheeler Market?

Growth drivers in India Electric Two-Wheeler market include government incentives under schemes like FAME II, rising environmental awareness, advancements in battery technology, and the increasing adoption of electric vehicles in last-mile delivery services.

05. What are the opportunities in the India Electric Two-Wheeler Market?

Opportunities lie in the expansion of battery-swapping infrastructure, increasing rural electrification, and partnerships between domestic manufacturers and international OEMs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.