India Electrical Insulators Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD6978

December 2024

91

About the Report

India Electrical Insulators Market Overview

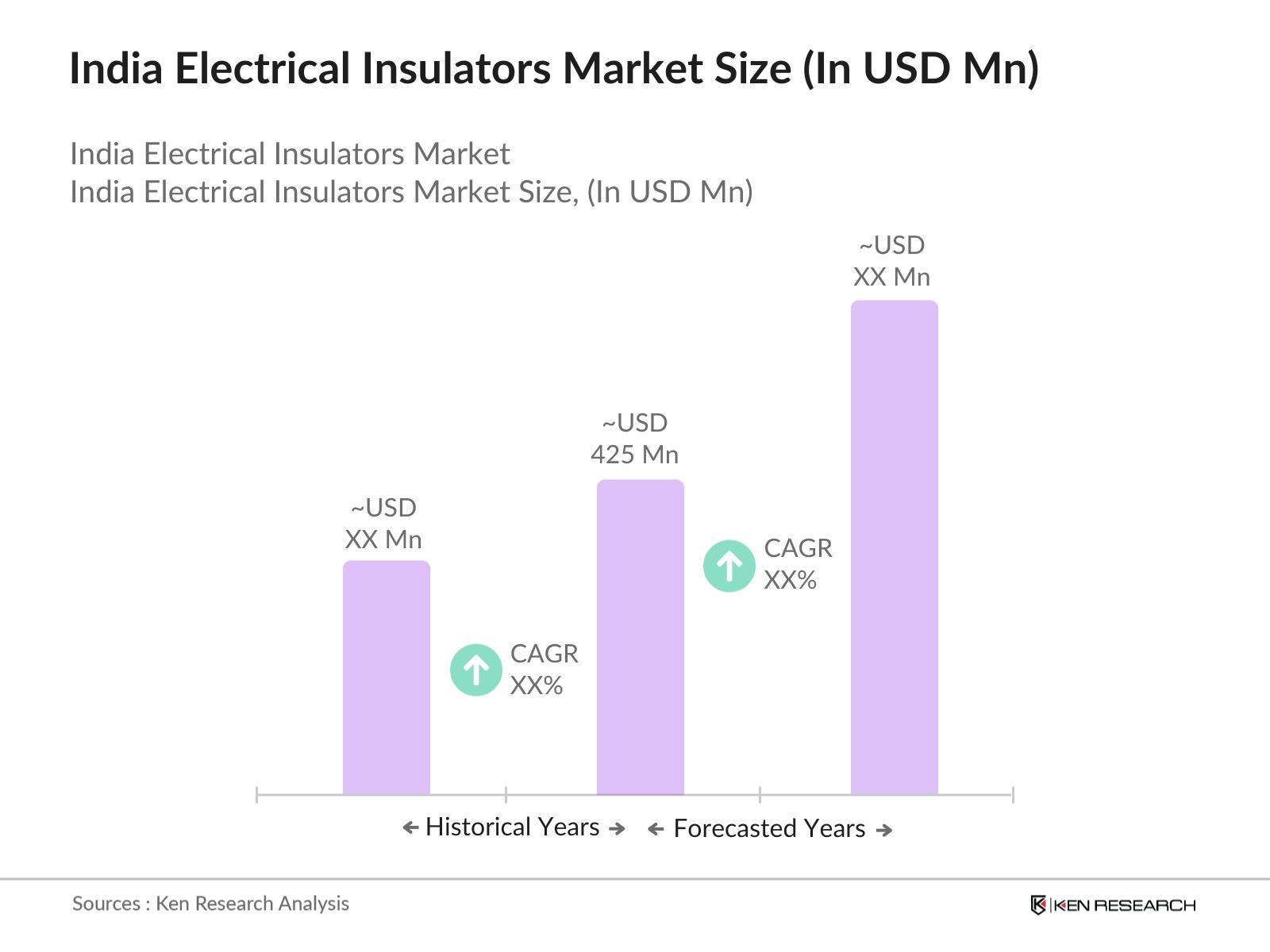

- The India electrical insulators market is valued at USD 425 million, driven by expanding transmission and distribution (T&D) infrastructure and increased investment in renewable energy projects. Government initiatives such as the National Smart Grid Mission and the electrification of rural areas have led to heightened demand for efficient and durable insulators. Additionally, the surge in industrial activities and urbanization is boosting electricity demand, further fueling the market's growth.

- Major cities such as Mumbai, Delhi, and Bengaluru dominate the market due to their large-scale industrial operations, robust power infrastructure, and significant investments in renewable energy. These cities experience higher demand for power, resulting in the need for durable electrical insulators. Regions in South India, particularly Tamil Nadu and Andhra Pradesh, have also gained prominence due to their focus on solar and wind power generation, which requires advanced insulation systems.

- The Indian Electricity Grid Code (IEGC) mandates stringent quality and safety requirements for all components used in the national grid, including insulators. The Central Electricity Authority (CEA) enforces these standards, ensuring that all insulators meet high-voltage safety protocols. As of 2024, compliance with these regulations is mandatory for all state and private utilities operating transmission lines, driving the demand for high-quality insulators that adhere to these safety requirements.

India Electrical Insulators Market Segmentation

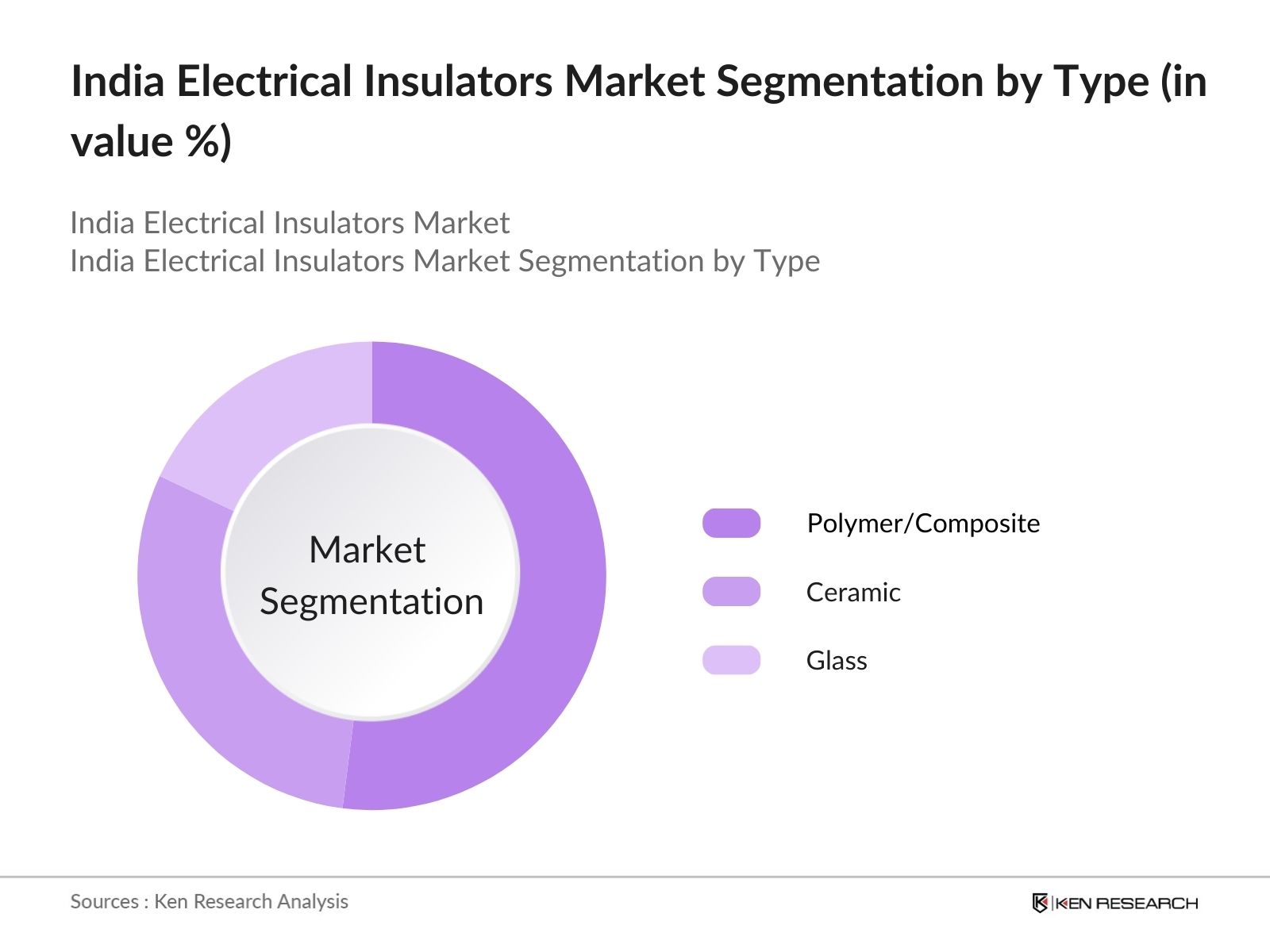

By Type: The India electrical insulators market is segmented by type into ceramic insulators, glass insulators, and polymer/composite insulators. Recently, polymer/composite insulators have held a dominant market share within this segment. The dominance of polymer-based insulators stems from their superior mechanical strength, lightweight properties, and ability to withstand harsh environmental conditions such as extreme weather.

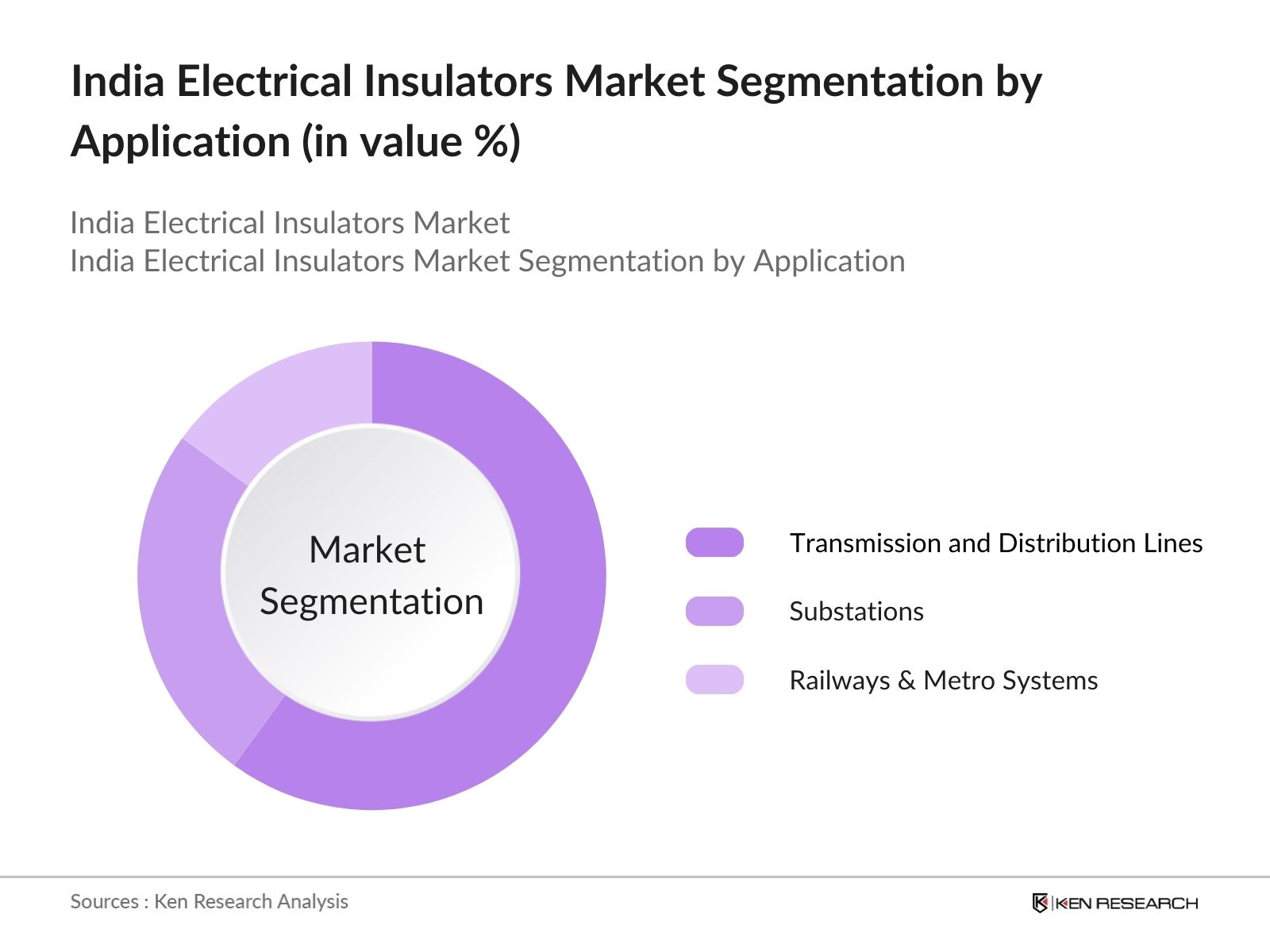

By Application: The market is also segmented by application into transmission and distribution lines, substations, and railways and metro systems. Transmission and distribution lines dominate this segment due to the ongoing efforts to expand India's power grid and modernize the country's electrical infrastructure. India's growing energy demands and focus on electrification of rural areas have led to significant investments in transmission lines.

India Electrical Insulators Market Competitive Landscape

The India electrical insulators market is dominated by a few key players, including major domestic manufacturers and global companies with Indian operations. These players have maintained their dominance through strong distribution networks, strategic partnerships, and technological innovation.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Product Portfolio |

Production Capacity (Units) |

Employees |

R&D Expenditure (USD Bn) |

Market Share (%) |

Geographic Reach |

|

Aditya Birla Insulators |

1988 |

Gujarat, India |

- |

- |

- |

- |

- |

- |

- |

|

Bharat Heavy Electricals Ltd |

1964 |

New Delhi, India |

- |

- |

- |

- |

- |

- |

- |

|

NGK Insulators Ltd |

1919 |

Nagoya, Japan |

- |

- |

- |

- |

- |

- |

- |

|

Siemens India |

1927 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

|

Raychem RPG |

1989 |

Maharashtra, India |

- |

- |

- |

- |

- |

- |

- |

India Electrical Insulators Market Analysis

Growth Drivers

- Expansion of Power Transmission Networks: Indias power transmission infrastructure is undergoing significant expansion to meet the growing electricity demand. The Power Grid Corporation of India reported an addition of 12,000 circuit kilometers of transmission lines between 2022 and 2023, with plans for further expansion into 2024. The government aims to strengthen the national grid through projects like the Green Energy Corridor, which directly boosts demand for electrical insulators.

- Growing Renewable Energy Projects: Indias renewable energy capacity reached 190 GW in 2023, including solar, wind, and biomass, reflecting the governments commitment to clean energy. Projects like the National Solar Mission and various wind energy farms require robust transmission networks, supported by high-quality electrical insulators. As renewable energy projects increase, so does the demand for high-voltage insulators to ensure uninterrupted power transmission.

- Increasing Investments in Smart Grid Infrastructure: India's National Smart Grid Mission has triggered large-scale investments in modernizing the country's grid infrastructure. By 2024, India plans to invest $44.9 billion in smart grid technologies, with a focus on advanced monitoring and efficient energy distribution. These investments include the integration of advanced insulators, necessary for withstanding increased grid capacity and voltage fluctuations.

Market Challenges

- Fluctuations in Raw Material Prices: The prices of key raw materials such as ceramic and glass, essential for producing insulators, have been volatile due to global supply chain disruptions. India's dependence on imported materials has heightened price sensitivity, with the cost of key raw materials increasing by 15% between 2022 and 2024. This fluctuation affects production costs, leading to potential pricing challenges for manufacturers. The volatility impacts both small and large-scale producers of electrical insulators, adding complexity to maintaining consistent profit margins.

- Technical Complexities in High-Voltage Insulation: High-voltage electrical systems, particularly those above 400 kV, require technically advanced insulation materials to withstand higher stresses and environmental conditions. The development and installation of such insulators come with technical challenges, particularly in ensuring durability and resistance to adverse weather conditions.

India Electrical Insulators Market Future Outlook

India electrical insulators market is expected to witness significant growth, driven by investments in power infrastructure, modernization of T&D networks, and increasing demand for renewable energy. Government initiatives such as the Smart Grid Mission and various renewable energy projects are likely to continue fostering demand for high-performance electrical insulators. The growing preference for polymer insulators due to their advanced characteristics, like lightweight, high durability, and pollution resistance, will further support market expansion.

Market Opportunities

- Adoption of Polymer-Based Insulators: Polymer-based insulators are becoming increasingly popular due to their superior performance in harsh environmental conditions, lightweight properties, and low maintenance requirements. The Indian electrical grid is increasingly utilizing polymer-based insulators, with a 20% adoption increase reported between 2022 and 2024. Polymer insulators are also expected to play a crucial role in India's upcoming high-voltage direct current (HVDC) projects.

- Increasing Demand from the Industrial Sector: As of December 2023, the Industrial Production Index (IIP) was reported at151.5, indicating a year-on-year growth of3.8%during that monthThe industrial sector's expansion, driven by the government's Make in India initiative and rising foreign investments, is directly contributing to the demand for reliable insulators. The need for high-performance insulation systems in steel plants, refineries, and chemical processing industries is expected to continue growing through 2024.

Scope of the Report

| By Type |

Ceramic Insulators Polymer/Composite Insulators |

| By Voltage | Low Voltage Medium Voltage High Voltage |

| By Application | Transmission and Distribution Lines Substations Railways and Metro Systems |

| By End-User | Utilities Industrial Commercial |

| By Region | North South East West |

Products

Key Target Audience

Power Transmission and Distribution Companies

Renewable Energy Project Developers

Electrical Equipment Manufacturers

Construction and Infrastructure Companies

Smart Grid Technology Providers

Government and Regulatory Bodies (Central Electricity Authority, CERC)

Investors and Venture Capitalist Firms

Companies

Major Players

Aditya Birla Insulators

Bharat Heavy Electricals Ltd (BHEL)

NGK Insulators Ltd

Siemens India

Raychem RPG

General Electric

Toshiba Transmission and Distribution Systems India

Modern Insulators Ltd

Lapp India Pvt. Ltd.

W.S. Industries (India) Limited

Dalian Insulator Group

MacLean Power Systems

Emerson Electric Co.

ABB India

Power Grid Corporation of India

Table of Contents

1. India Electrical Insulators Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Classification of Electrical Insulators)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Electrical Insulators Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Electrical Insulators Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Power Transmission Networks

3.1.2. Growing Renewable Energy Projects

3.1.3. Increasing Investments in Smart Grid Infrastructure

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Prices

3.2.2. Technical Complexities in High-Voltage Insulation

3.2.3. Competition from Unorganized Market

3.3. Opportunities

3.3.1. Adoption of Polymer-Based Insulators

3.3.2. Increasing Demand from the Industrial Sector

3.3.3. Technological Innovations in Insulation Materials

3.4. Trends

3.4.1. Integration of IoT in Electrical Insulation Monitoring

3.4.2. Focus on Energy Efficiency and Sustainability

3.4.3. Shift Toward Composite Insulators

3.5. Government Regulations

3.5.1. Indian Electricity Grid Code Compliance

3.5.2. Guidelines from the Central Electricity Regulatory Commission (CERC)

3.5.3. National Smart Grid Mission

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Electrical Insulators Market Segmentation

4.1. By Type (In Value %)

4.1.1. Ceramic Insulators

4.1.2. Glass Insulators

4.1.3. Polymer/Composite Insulators

4.2. By Voltage (In Value %)

4.2.1. Low Voltage

4.2.2. Medium Voltage

4.2.3. High Voltage

4.3. By Application (In Value %)

4.3.1. Transmission and Distribution Lines

4.3.2. Substations

4.3.3. Railways and Metro Systems

4.4. By End-User (In Value %)

4.4.1. Utilities

4.4.2. Industrial

4.4.3. Commercial

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Electrical Insulators Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Aditya Birla Insulators

5.1.2. Bharat Heavy Electricals Limited (BHEL)

5.1.3. General Electric

5.1.4. Siemens India

5.1.5. Lapp India Pvt. Ltd.

5.1.6. NGK Insulators Ltd.

5.1.7. Toshiba Transmission and Distribution Systems (India)

5.1.8. ABB India

5.1.9. Power Grid Corporation of India

5.1.10. W.S. Industries (India) Limited

5.1.11. Raychem RPG

5.1.12. Modern Insulators Ltd.

5.1.13. ERICO

5.1.14. MacLean Power Systems

5.1.15. Dalian Insulator Group

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Geographic Reach, R&D Expenditure)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Electrical Insulators Market Regulatory Framework

6.1. Safety Standards for Insulators (ISI Certification)

6.2. Environmental Compliance (Pollution Control Norms for Insulator Manufacturing)

6.3. Product Certification Processes (BIS Certification)

6.4. Trade Tariffs and Import Regulations

7. India Electrical Insulators Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Electrical Insulators Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Voltage (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Electrical Insulators Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves the development of a comprehensive ecosystem map for the India electrical insulators market. This step includes desk research using secondary databases and government resources to identify key stakeholders and variables that influence market performance.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical data on market performance, including transmission and distribution line installations and renewable energy projects. The aim is to evaluate the market's growth trajectory by assessing sales volumes and demand across different insulator types.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formed based on historical data and trends, followed by interviews with industry experts, including manufacturers and distributors. These insights help validate market estimates and trends.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the research findings and consulting with manufacturers to verify the accuracy of market forecasts. This step ensures that the final report provides an accurate and comprehensive analysis of the India electrical insulators market.

Frequently Asked Questions

01. How big is the India Electrical Insulators Market?

The India electrical insulators market was valued at USD 425 million in 2023, driven by investments in power grid expansion and the adoption of smart grid technologies.

02. What are the challenges in the India Electrical Insulators Market?

Challenges of India Electrical Insulators Market include fluctuations in raw material prices, technical complexities in high-voltage insulation, and the presence of low-cost, unorganized market players.

03. Who are the major players in the India Electrical Insulators Market?

Key players of India Electrical Insulators Market include Aditya Birla Insulators, Bharat Heavy Electricals Ltd (BHEL), Siemens India, NGK Insulators Ltd, and Raychem RPG. These companies dominate due to their strong distribution networks and technological innovations.

04. What are the growth drivers of the India Electrical Insulators Market?

The India Electrical Insulators Market is driven by increased investments in renewable energy projects, government electrification programs, and modernization of transmission and distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.