India Electrical Kitchen Appliances Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD7132

December 2024

99

About the Report

India Electrical Kitchen Appliances Market Overview

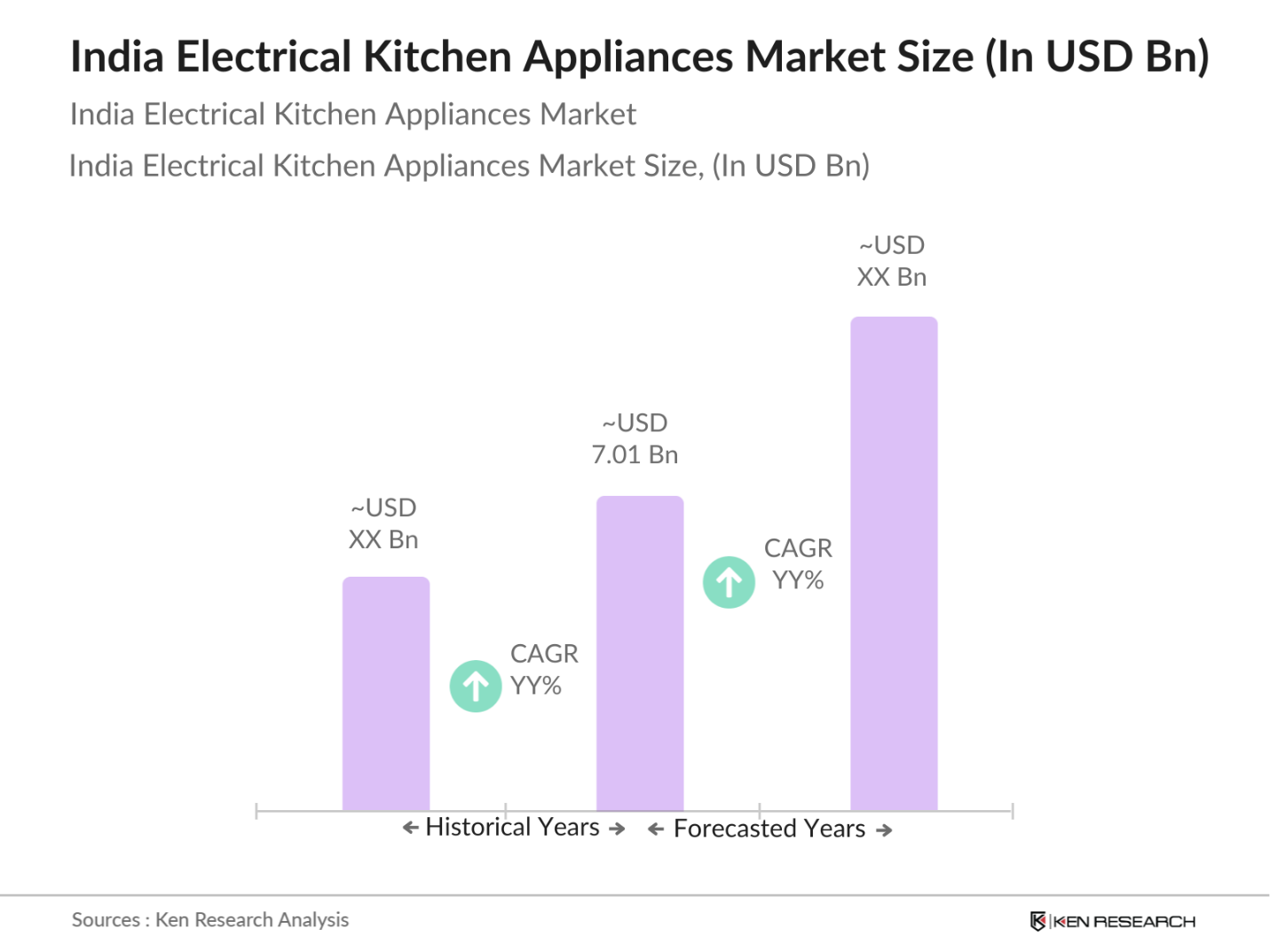

- The India Electrical Kitchen Appliances market is valued at USD 7.01 billion, based on a comprehensive analysis of historical data and market trends. This growth is driven primarily by the rising disposable incomes of consumers, urbanization, and a shift towards modern cooking solutions. As Indian households increasingly prioritize convenience and efficiency in their cooking processes, the demand for electrical kitchen appliances such as mixers, microwaves, and induction cooktops has surged. The market is expected to continue its upward trajectory, reflecting the evolving lifestyle of Indian consumers.

- Key cities dominating the India Electrical Kitchen Appliances market include Delhi, Mumbai, and Bengaluru. These urban centers are characterized by high population density, significant disposable income, and a growing trend towards modern living. The presence of a large number of retail outlets and e-commerce platforms in these cities facilitates easy access to electrical kitchen appliances, further bolstering their dominance in the market. The rapid adoption of technology and the increasing preference for smart home devices also contribute to the leadership of these metropolitan areas.

- The Indian government has implemented strict energy efficiency standards for electrical appliances to promote sustainable practices. The Bureau of Energy Efficiency (BEE) has established labeling programs to help consumers identify energy-efficient products. In 2022, a significant number of kitchen appliances sold were rated as five-star energy-efficient, indicating a growing trend towards environmentally friendly products. The enforcement of these standards aims to reduce energy consumption and lower carbon footprints, fostering a more sustainable market. This regulatory framework encourages manufacturers to innovate and produce appliances that meet these energy efficiency criteria, aligning with global sustainability goals.

India Electrical Kitchen Appliances Market Segmentation

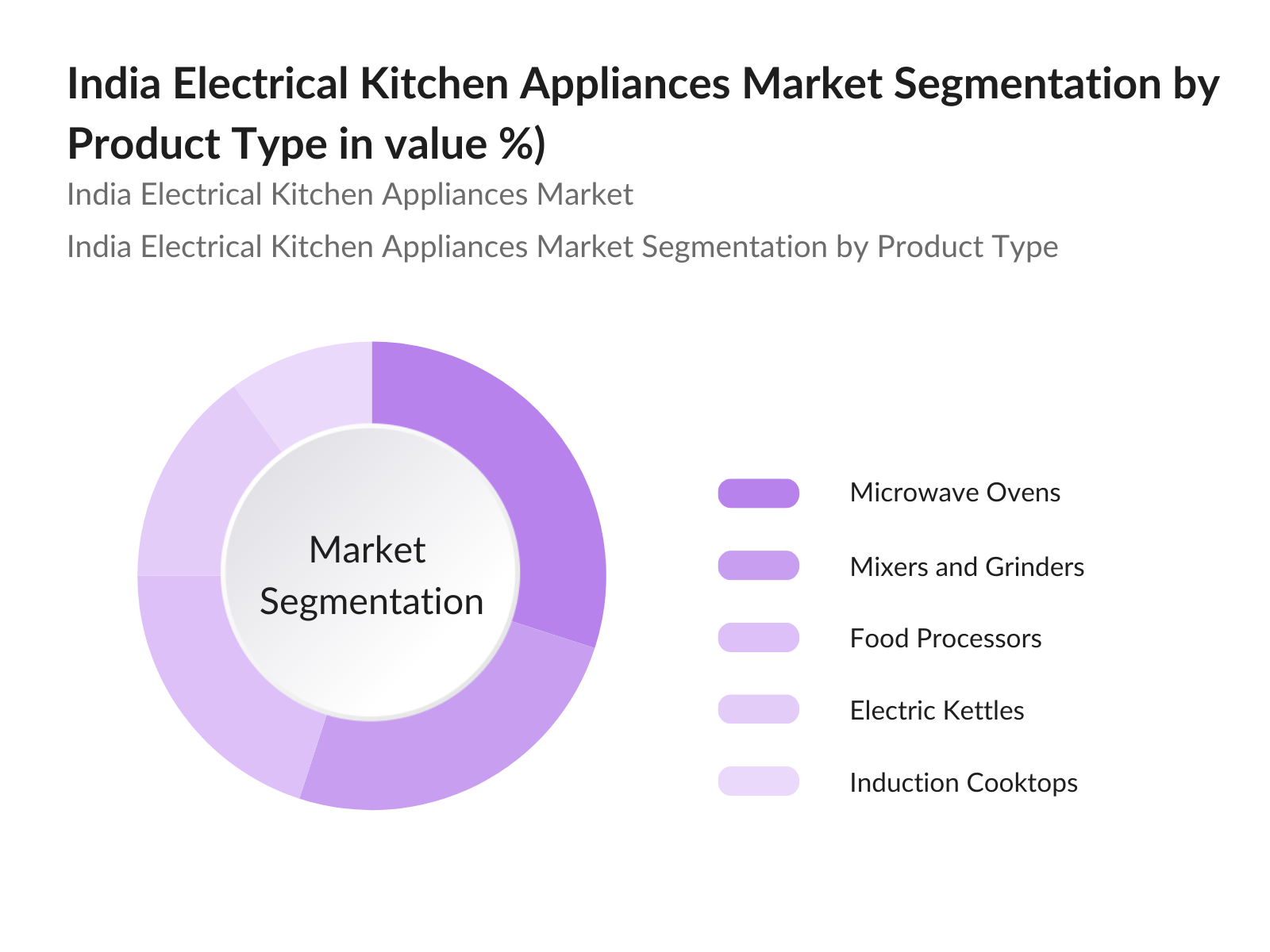

By Product Type: The India Electrical Kitchen Appliances market is segmented by product type into mixers and grinders, food processors, microwave ovens, electric kettles, and induction cooktops. Among these, the microwave ovens sub-segment currently holds a dominant market share. This is attributed to the increasing consumer preference for quick meal preparation and the versatility of microwave ovens in cooking, reheating, and defrosting various foods. As more households seek efficient cooking solutions, microwave ovens have become a staple in modern kitchens, enhancing their popularity and market presence.

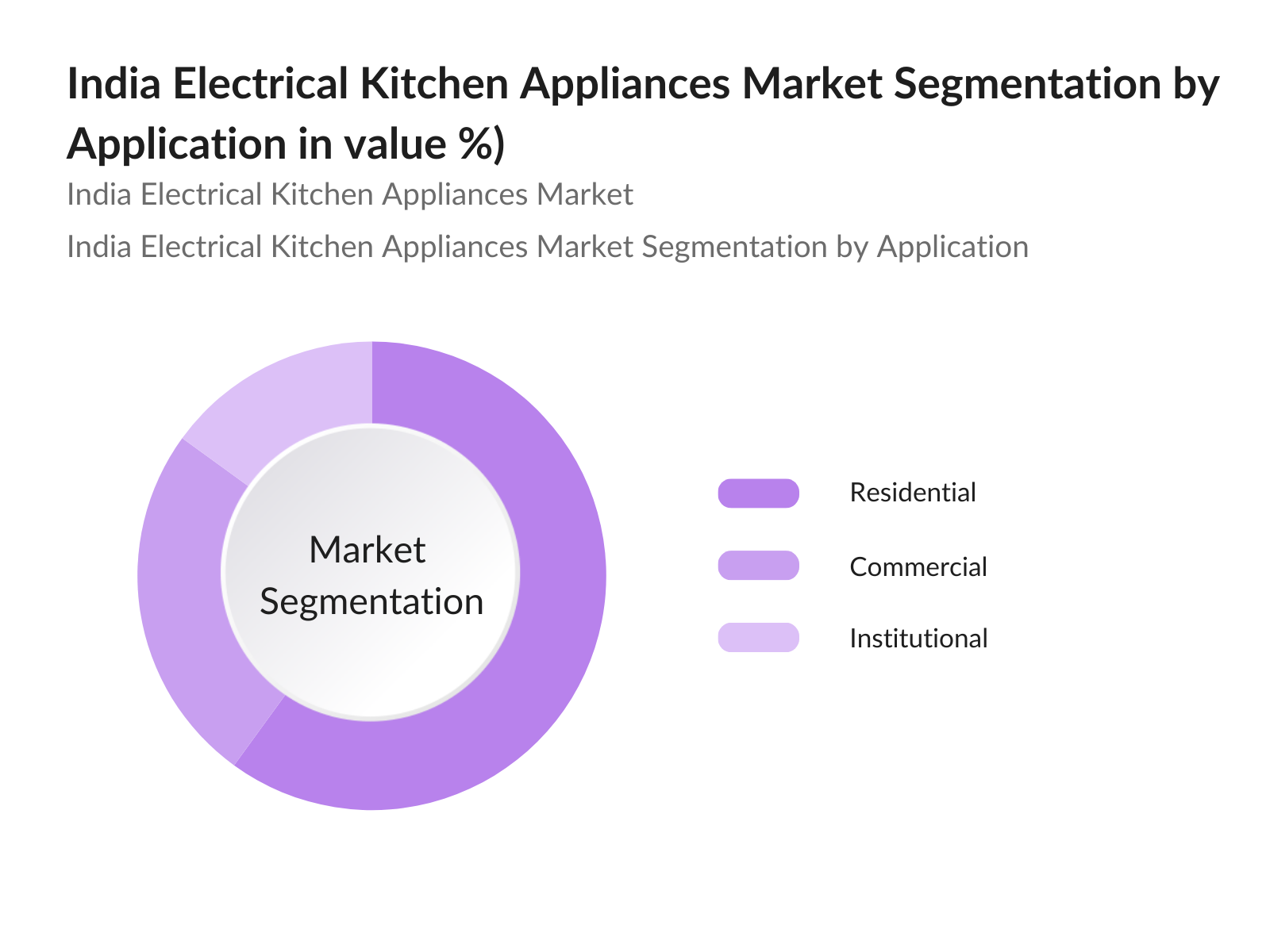

By Application: The market is also segmented by application into residential, commercial, and institutional sectors. The residential segment is currently leading the market share, primarily due to the growing trend of home cooking, especially in the post-pandemic era. With more consumers opting to cook at home rather than dining out, there has been a significant increase in the purchase of electrical kitchen appliances. This shift not only reflects changing consumer behavior but also a renewed focus on health and hygiene, making the residential application the key driver of market growth.

India Electrical Kitchen Appliances Market Competitive Landscape

The India Electrical Kitchen Appliances market is dominated by several key players that significantly influence market dynamics. Major companies in the market include Philips India Ltd., Bajaj Electricals Ltd., Whirlpool of India Ltd., LG Electronics India, and Morphy Richards India. These companies have established a strong presence through extensive distribution networks, product innovation, and robust marketing strategies. The competitive landscape showcases a mix of local and international brands, highlighting the market's appeal and potential for growth.

India Electrical Kitchen Appliances Market Analysis

Market Growth Drivers

- Increasing Urbanization: Urbanization in India is accelerating, with the urban population expected to reach approximately 600 million by 2025. This shift is creating a growing demand for modern kitchen appliances that save time and effort in food preparation. Urban dwellers tend to have different lifestyles, often seeking convenience, which drives the adoption of electrical kitchen appliances. In 2022, around 104 million urban households owned some form of electrical kitchen appliance, reflecting a significant growth trend as urbanization continues. This transformation is supported by the increasing migration of people to urban areas for better employment opportunities and living standards.

- Rising Disposable Incomes: As of 2022, India's per capita income was approximately $2,256, projected to increase to around $2,800 by 2025. The rise in disposable income enhances purchasing power, allowing consumers to invest in quality electrical kitchen appliances. Increased income levels correlate with higher spending on household goods, and the average household expenditure on kitchen appliances in 2022 was about 15,000, reflecting significant growth. The increasing trend in disposable income facilitates more households transitioning to modern cooking solutions, thus driving market growth. This shift indicates a growing market for premium kitchen appliances as consumers seek to improve their home cooking experiences.

- Growing Health Consciousness: In recent years, the Indian populace has become increasingly health-conscious, impacting their purchasing decisions. A significant number of Indian consumers prioritize healthy cooking methods and opt for appliances that support this lifestyle, such as air fryers and steam cookers. Health-related issues such as obesity are affecting approximately 40 million Indians in 2022, driving substantial demand for appliances that enable healthier cooking options. The focus on wellness and nutrition is a significant driver for the adoption of electrical kitchen appliances, as consumers seek solutions that align with their health goals and enhance their culinary experiences.

Market Challenges:

- High Initial Costs: The initial investment for electrical kitchen appliances can be substantial, acting as a barrier for many consumers. For instance, a premium kitchen appliance can cost between 15,000 to 30,000 ($180 to $360), making it unaffordable for lower-income households. A significant portion of Indias population lives below the poverty line, which restricts access to modern appliances for these consumers. Furthermore, the economic divide in India exacerbates this challenge, limiting the market's reach to affluent consumers who can afford to invest in high-quality kitchen appliances. This economic landscape underscores the need for more affordable options in the market.

- Intense Competition: The electrical kitchen appliances market is characterized by intense competition, with numerous domestic and international brands vying for market share. In 2022, the top five companies held a significant portion of the market share, leaving the remainder fragmented among smaller players. This competitive landscape leads to price wars and constant innovation pressure, which can hinder profitability for manufacturers. The competition not only revolves around price but also focuses on product differentiation and technological advancements, complicating market dynamics. As brands strive to capture consumer attention, they must continuously innovate and enhance their offerings to maintain relevance in the market.

India Electrical Kitchen Appliances Market Future Outlook

Over the next five years, the India Electrical Kitchen Appliances market is poised for significant growth. This expansion will be driven by continuous advancements in technology, increased consumer awareness regarding energy-efficient appliances, and rising demand for smart home solutions. The shift towards healthier cooking practices and convenience-driven products will further fuel this growth, with more households adopting electrical kitchen appliances as integral components of their daily lives.

Market Opportunities:

- Smart Kitchen Appliances: The trend towards smart kitchen appliances is gaining momentum in India, driven by consumer demand for convenience and efficiency. The market for smart kitchen appliances was projected to reach 10,000 crores ($1.2 billion), highlighting significant consumer interest in features like voice control and app connectivity. A notable number of consumers in urban areas express a preference for appliances that integrate with smart home systems, reflecting a shift towards automation in the kitchen. This increasing adoption of smart technologies in kitchen appliances indicates a broader trend towards enhancing user experience through innovation and connectivity.

- Increased Online Sales Channels: The growth of online sales channels is reshaping the landscape of the electrical kitchen appliances market. As of 2022, e-commerce platforms played a significant role in total sales in the kitchen appliance sector, driven by increased consumer trust in online shopping. Major players are offering exclusive online discounts and promotions, leading consumers to increasingly turn to the internet for their appliance needs. This trend indicates that online sales will continue to be a crucial focus area for companies in the industry, as the convenience of e-commerce aligns with changing consumer purchasing behaviors.

Scope of the Report

|

By Product Type |

Mixers and Grinders Food Processors Microwave Ovens Electric Kettles Induction Cooktops |

|

By Application |

Residential Commercial Institutional |

|

By Distribution Channel |

Online Offline |

|

By End-User |

Households Restaurants Catering Services |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Homeowners

Kitchen Renovation Contractors

Retailers and Distributors

E-commerce Platforms

Manufacturers and Suppliers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Bureau of Indian Standards)

Hospitality Industry Professionals

Companies

Players Mention in the Report

Philips India Ltd.

Bajaj Electricals Ltd.

Whirlpool of India Ltd.

LG Electronics India

Morphy Richards India

Prestige Smart Kitchen

TTK Prestige Ltd.

Panasonic India Pvt. Ltd.

Croma

Kenstar

V-Guard Industries Ltd.

Havells India Ltd.

Samsung India Electronics

Pigeon Appliances

Bosch Home Appliances

Table of Contents

01. India Electrical Kitchen Appliances Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. India Electrical Kitchen Appliances Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. India Electrical Kitchen Appliances Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization

3.1.2. Rising Disposable Incomes

3.1.3. Growing Health Consciousness

3.1.4. Technological Advancements

3.2. Market Challenges

3.2.1. High Initial Costs

3.2.2. Intense Competition

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. E-commerce Growth

3.3.2. Sustainable Product Demand

3.3.3. Expansion in Tier II and Tier III Cities

3.4. Trends

3.4.1. Smart Kitchen Appliances

3.4.2. Increased Online Sales Channels

3.4.3. Integration of IoT in Kitchen Devices

3.5. Government Regulation

3.5.1. Standards for Energy Efficiency

3.5.2. Safety Regulations for Electrical Appliances

3.5.3. Consumer Protection Policies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. India Electrical Kitchen Appliances Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Mixers and Grinders

4.1.2. Food Processors

4.1.3. Microwave Ovens

4.1.4. Electric Kettles

4.1.5. Induction Cooktops

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Institutional

4.3. By Distribution Channel (In Value %)

4.3.1. Online

4.3.2. Offline

4.4. By Region (In Value %)

4.4.1. North India

4.4.2. South India

4.4.3. East India

4.4.4. West India

4.4.5. Central India

4.5. By End User (In Value %)

4.5.1. Households

4.5.2. Restaurants

4.5.3. Catering Services

05. India Electrical Kitchen Appliances Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Philips India Ltd.

5.1.2. Bajaj Electricals Ltd.

5.1.3. Morphy Richards India

5.1.4. Whirlpool of India Ltd.

5.1.5. LG Electronics India

5.1.6. Samsung India Electronics

5.1.7. Panasonic India Pvt. Ltd.

5.1.8. Havells India Ltd.

5.1.9. Prestige Smart Kitchen

5.1.10. TTK Prestige Ltd.

5.1.11. Kenstar

5.1.12. Croma

5.1.13. V-Guard Industries Ltd.

5.1.14. Philips Lighting India

5.1.15. Pigeon Appliances

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Range, R&D Investment, Geographic Presence, Distribution Network, Customer Base, Brand Equity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. India Electrical Kitchen Appliances Market Regulatory Framework

6.1. Quality Standards

6.2. Safety Regulations

6.3. Environmental Compliance

07. India Electrical Kitchen Appliances Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. India Electrical Kitchen Appliances Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Region (In Value %)

8.5. By End User (In Value %)

09. India Electrical Kitchen Appliances Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins by constructing an ecosystem map that includes all major stakeholders in the India Electrical Kitchen Appliances market. Extensive desk research is utilized, drawing from both secondary and proprietary databases to gather comprehensive industry-level information. This step aims to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India Electrical Kitchen Appliances market is compiled and analyzed. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple electrical kitchen appliance manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Electrical Kitchen Appliances market.

Frequently Asked Questions

01. How big is the India Electrical Kitchen Appliances market?

The India Electrical Kitchen Appliances market is valued at USD 7.01 billion, driven by rising disposable incomes, urbanization, and a shift towards modern cooking solutions.

02. What are the challenges in the India Electrical Kitchen Appliances market?

Challenges include high competition among brands, fluctuations in raw material costs, and the need for continuous innovation to meet evolving consumer preferences.

03. Who are the major players in the India Electrical Kitchen Appliances market?

Key players include Philips India, Bajaj Electricals, Whirlpool of India, and LG Electronics. These companies dominate due to their extensive distribution networks and strong brand loyalty.

04. What are the growth drivers of the India Electrical Kitchen Appliances market?

The market is propelled by factors such as increasing disposable incomes, the trend towards home cooking, and a growing demand for energy-efficient and smart appliances.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.