India Electrical Motor Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD6177

November 2024

98

About the Report

India Electrical Motor Market Overview

The India electrical motor market is valued at USD 2.8 Bn, based on a five-year historical analysis. This valuation is driven primarily by the increasing demand for energy-efficient systems across industrial sectors, the expanding use of electrical motors in household appliances, and the rapid growth of electric vehicle (EV) adoption in India. The government's focus on industrial electrification and green energy initiatives such as the National Electric Mobility Mission Plan (NEMMP) further propels market growth.

Dominant regions in the market include Maharashtra, Gujarat, and Tamil Nadu, where industrialization is particularly robust. Maharashtra's dominance is due to its extensive manufacturing base and infrastructure development, while Gujarat benefits from significant investments in industrial automation and renewable energy. Tamil Nadu, being an industrial hub, has seen rapid adoption of electric motors across various sectors, further driving its leadership in the market.

Indias National Electric Mobility Mission Plan (NEMMP) aims to promote electric vehicle adoption across the country. By 2024, over INR 14,000 crore has been allocated to supporting EV manufacturing, infrastructure development, and charging stations. This initiative directly supports the growth of the electrical motor market, as electric motors are integral to EV propulsion. The plan is a key driver for the motor manufacturing industry.

India Electrical Motor Market Segmentation

By Motor Type: The market is segmented by motor type into AC motors, DC motors, synchronous motors, and asynchronous motors. Among these, AC motors dominate the market, primarily due to their widespread application in industries and appliances. AC motors are preferred for their efficiency and ability to handle varying power outputs, making them ideal for use in industrial machinery and HVAC systems. Additionally, the easy availability of AC motors in various sizes and specifications has cemented their dominance.

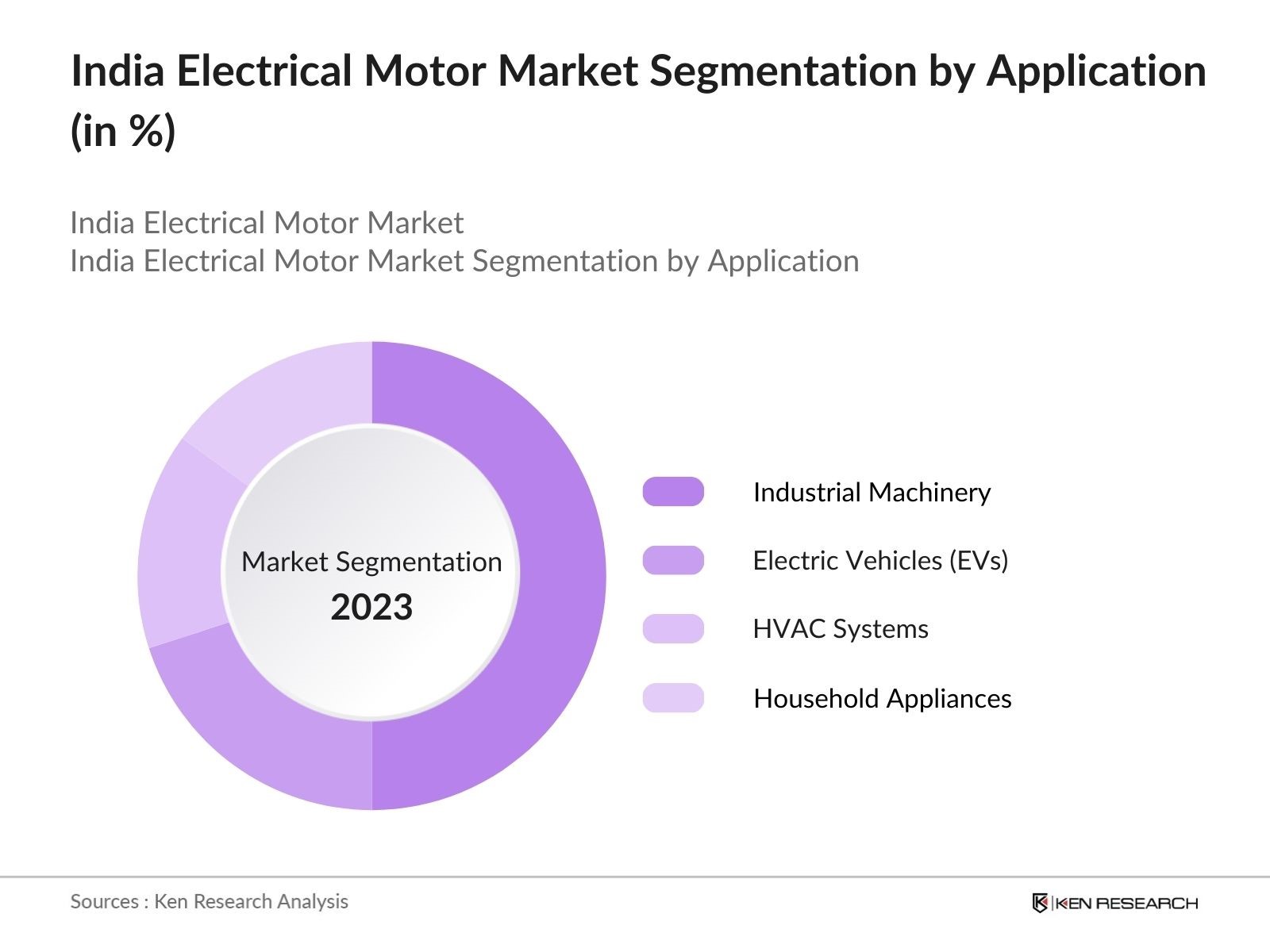

By Application: The market in India is also segmented by application into industrial machinery, electric vehicles (EVs), HVAC systems, and household appliances. Industrial machinery dominates this segment due to the increasing focus on automation and energy efficiency in manufacturing. The use of motors in electric vehicles is also rapidly growing, supported by government incentives for green technology adoption and infrastructure development for electric mobility.

India Electrical Motor Market Competitive Landscape

The India electrical motor market is dominated by both domestic and international players. These companies lead through a combination of technological advancements, strategic partnerships, and an expansive distribution network. Domestic firms benefit from government incentives under the "Make in India" initiative, while global players leverage their R&D capabilities to introduce innovative products that meet energy efficiency standards.

|

Company Name |

Establishment Year |

Headquarters |

Number of Employees |

Revenue (INR Cr) |

R&D Expenditure (INR Cr) |

Product Range |

Market Presence |

Recent Strategic Initiatives |

Technology Adoption Rate |

|

Siemens India |

1927 |

Mumbai |

|||||||

|

Crompton Greaves |

1937 |

Mumbai |

|||||||

|

ABB India Ltd. |

1949 |

Bengaluru |

|||||||

|

Bharat Heavy Electricals |

1964 |

New Delhi |

|||||||

|

Havells India Ltd. |

1958 |

Noida |

India Electrical Motor Industry Analysis

Growth Drivers

Expansion of Electric Vehicles: The electric vehicle (EV) sector in India is seeing rapid growth, largely driven by the country's push toward reducing carbon emissions and increasing energy independence. As of 2023, India has over 1.7 million electric vehicles on the road. With the governments plan to reach 30% electric mobility by 2030, the demand for electrical motors, which form the core component of EV propulsion, is significantly rising. India's National Electric Mobility Mission Plan (NEMMP) is also investing approximately INR 14,000 crore toward EV production. The resulting increase in electric motor demand in 2024 is evident in EV sales growth.

Government Push for Energy Efficiency: The Bureau of Energy Efficiency (BEE) continues to enforce stricter energy efficiency norms for motors under the Make in India initiative. India currently mandates IE2 and IE3 efficiency standards for motors, and 2023 saw an uptick in demand for IE4 standard motors, which consume about 15% less energy compared to IE3 motors. In 2024, industries are rapidly adopting energy-efficient motors, supported by incentives under the Energy Conservation Act of India. Energy-efficient motors are expected to power Indias manufacturing output, contributing significantly to India's GDP of $3.73 trillion as of 2023.

Increased Demand in HVAC Systems: With the expansion of urban infrastructure, India's construction and real estate sectors have seen an increase in the demand for Heating, Ventilation, and Air Conditioning (HVAC) systems. Electrical motors are critical components in HVAC equipment. As of 2024, Indias real estate market size reached INR 12.9 trillion. The growing number of commercial and residential buildings equipped with HVAC systems directly correlates with increased demand for efficient motors in the HVAC industry.

Market Challenges

Competition from Low-Cost Imports: India faces stiff competition from countries like China, which produces low-cost electrical motors. In 2023, India imported electrical machinery worth INR 1.5 trillion, much of which included cheaper motors that undermine local manufacturers. This influx of low-cost imports, combined with lower labor and production costs in countries like China and Vietnam, is squeezing margins for domestic manufacturers who produce high-efficiency motors at a higher cost.

Availability of Raw Materials: Electrical motor production is highly dependent on raw materials like copper and steel, whose prices have been volatile. In 2023, India imported 1.3 million tonnes of copper, and prices surged due to global supply chain disruptions. These materials, which are critical for motor winding and casing, have become costlier, increasing production costs for electrical motor manufacturers in India. Additionally, geopolitical tensions and supply chain issues exacerbate the problem, leading to production delays.

India Electrical Motor Market Future Outlook

Over the next five years, the India electrical motor market is expected to witness substantial growth, driven by the expanding application of electric motors in industries, households, and electric vehicles. With the Indian government's push for energy efficiency and the increasing adoption of electric vehicles, the demand for advanced electrical motors is likely to increase. Additionally, technological advancements such as IoT-enabled smart motors are expected to enhance operational efficiencies across various sectors, further boosting market growth. The market will also benefit from ongoing infrastructure projects and the push for renewable energy integration.

Future Market Opportunities

Adoption of Smart Motors with IoT Integration: The adoption of smart motors integrated with IoT and AI technologies is opening new market avenues. By 2023, India had 3 million IoT-connected devices, including motors used in industries such as automotive and manufacturing. These smart motors provide real-time data on performance, leading to improved energy efficiency and predictive maintenance. The Indian industrial IoT market is expected to increase, and this technological advancement in motors can cater to industries' growing need for automation.

Growth in Renewable Energy Installations: India's push toward renewable energy is driving the need for electrical motors in the wind and solar sectors. By 2023, Indias total renewable energy capacity reached 120 GW, and with the governments target of reaching 175 GW, the installation of wind turbines and solar panels is on the rise. Electrical motors are key components in these installations, particularly for solar tracking systems and wind turbine generators, making this an expanding market for motor manufacturers.

Scope of the Report

|

Segment |

Sub-Segment |

|---|

|

By Motor Type |

AC Motors DC Motors Synchronous Motors Asynchronous Motors |

|

By Power Output |

< 1 kW 15 kW 550 kW 50 kW and above |

|

By Voltage Rating |

Low Voltage Medium Voltage High Voltage |

|

By Application |

Industrial Machinery Electric Vehicles (EVs) HVAC Systems Household Appliances |

|

By Region |

North South East West |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Bureau of Energy Efficiency, Ministry of Heavy Industries)

Industrial Equipment Manufacturers

Electric Vehicle Manufacturers

Energy Efficiency Consultants

Renewable Energy Project Developers

Household Appliance Manufacturers

Smart Infrastructure Developers

Banks and Financial Institutes

Companies

Major Players

Siemens India

Crompton Greaves

ABB India Ltd.

Bharat Heavy Electricals Limited (BHEL)

Havells India Ltd.

Kirloskar Electric Company Ltd.

Nidec Corporation

Toshiba Mitsubishi-Electric Industrial Systems Corporation (TMEIC)

WEG Industries

Bharat Bijlee Ltd.

Baldor Electric Company (A member of ABB Group)

Schneider Electric India

Emerson Electric Co.

GE India

Rockwell Automation India

Table of Contents

1. India Electrical Motor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Indicators (Power Output, Voltage Rating, Motor Type)

1.4. Market Segmentation Overview

2. India Electrical Motor Market Size (In INR Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Industry-specific: Electrification, Automation)

3. India Electrical Motor Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Electric Vehicles (EV)

3.1.2. Government Push for Energy Efficiency (BEE Standards, Make in India)

3.1.3. Industrial Automation

3.1.4. Increased Demand in HVAC Systems

3.2. Market Challenges

3.2.1. High Cost of Advanced Motors (IE3, IE4 Standards)

3.2.2. Competition from Low-Cost Imports

3.2.3. Availability of Raw Materials (Copper, Steel)

3.3. Opportunities

3.3.1. Adoption of Smart Motors with IoT Integration

3.3.2. Growth in Renewable Energy Installations

3.3.3. Focus on Energy Efficient Retrofitting (Replacement Market)

3.4. Trends

3.4.1. Use of Permanent Magnet Synchronous Motors (PMSMs)

3.4.2. Shift Toward Electrification in Heavy Machinery

3.4.3. Growing Preference for Compact Motors in Urban Spaces

3.5. Government Regulations

3.5.1. Bureau of Energy Efficiency (BEE) Norms

3.5.2. National Electric Mobility Mission Plan (NEMMP)

3.5.3. Electrical Equipment Safety Regulations

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Suppliers, End-users)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Electrical Motor Market Segmentation

4.1. By Motor Type (In Value %)

4.1.1. AC Motors

4.1.2. DC Motors

4.1.3. Synchronous Motors

4.1.4. Asynchronous Motors

4.2. By Power Output (In Value %)

4.2.1. < 1 kW

4.2.2. 15 kW

4.2.3. 550 kW

4.2.4. 50 kW and Above

4.3. By Voltage Rating (In Value %)

4.3.1. Low Voltage Motors

4.3.2. Medium Voltage Motors

4.3.3. High Voltage Motors

4.4. By Application (In Value %)

4.4.1. Industrial Machinery

4.4.2. Electric Vehicles (EVs)

4.4.3. HVAC Systems

4.4.4. Household Appliances

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Electrical Motor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens India

5.1.2. Crompton Greaves

5.1.3. ABB India Ltd.

5.1.4. Bharat Heavy Electricals Limited (BHEL)

5.1.5. Havells India Ltd.

5.1.6. Kirloskar Electric Company Ltd.

5.1.7. Nidec Corporation

5.1.8. Toshiba Mitsubishi-Electric Industrial Systems Corporation (TMEIC)

5.1.9. WEG Industries

5.1.10. Bharat Bijlee Ltd.

5.1.11. Baldor Electric Company (A member of ABB Group)

5.1.12. Schneider Electric India

5.1.13. Emerson Electric Co.

5.1.14. GE India

5.1.15. Rockwell Automation India

5.2. Cross Comparison Parameters (Headquarters, Revenue, Motor Production Volume, R&D Expenditure, Market Share, Employee Strength, Strategic Collaborations, Technology Adoption Rate)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Product Launches, Technological Advancements)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Capex Trends)

5.7. Venture Capital Funding in Motor Tech

5.8. Government Grants for Energy-Efficient Motor Production

5.9. Private Equity Investments in Motor Startups

6. India Electrical Motor Market Regulatory Framework

6.1. ISI Certification Requirements

6.2. Energy Efficiency Compliance (IE2, IE3, IE4 Standards)

6.3. Certification Processes for Motor Manufacturers

7. India Electrical Motor Market Future Market Size (In INR Mn)

7.1. Key Factors Driving Future Market Growth (Electric Vehicles, Energy Efficiency, Smart Cities Initiative)

8. India Electrical Motor Market Future Market Segmentation

8.1. By Motor Type (In Value %)

8.2. By Power Output (In Value %)

8.3. By Voltage Rating (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. India Electrical Motor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Penetration Strategies

9.3. Product Innovation and Differentiation Strategies

9.4. Opportunity Assessment in Key Application Segments

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key stakeholders in the India Electrical Motor market, such as manufacturers, distributors, and end-users. Secondary research sources, including government databases and proprietary market reports, are used to gather insights into industry-level data. This step aims to define the critical variables affecting market trends.

Step 2: Market Analysis and Construction

The market analysis focuses on historical data to evaluate market size, competition, and industry revenue. We analyze the penetration of electric motors across various applications and regions to provide a comprehensive view of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market experts are consulted to validate hypotheses regarding market growth, key trends, and challenges. These consultations are conducted via computer-assisted telephone interviews (CATIs) with executives from major electrical motor manufacturers.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing research data from both primary and secondary sources, corroborated by expert insights. A bottom-up approach is used to estimate the market size and validate key trends, ensuring a detailed and accurate market analysis.

Frequently Asked Questions

01. How big is the India Electrical Motor Market?

The India electrical motor market is valued at USD 2.8 Bn, driven by increased demand in industrial machinery, electric vehicles, and energy-efficient household appliances.

02. What are the challenges in the India Electrical Motor Market?

Challenges include competition from low-cost imports, high costs associated with advanced motor technologies, and the fluctuating prices of raw materials such as copper and steel.

03. Who are the major players in the India Electrical Motor Market?

Major players include Siemens India, Crompton Greaves, ABB India, Bharat Heavy Electricals, and Havells India Ltd., each dominating through technological advancements, strategic partnerships, and a strong distribution network.

04. What are the growth drivers of the India Electrical Motor Market?

The market is driven by industrial electrification, the rapid adoption of electric vehicles, and government initiatives focusing on energy efficiency and sustainability.

05. What trends are shaping the India Electrical Motor Market?

Key trends include the increasing use of IoT-enabled smart motors, a shift toward compact and energy-efficient motors, and a growing focus on integrating renewable energy solutions with electrical motor technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.