India Electrical Switch Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD2869

December 2024

92

About the Report

India Electrical Switch Market Overview

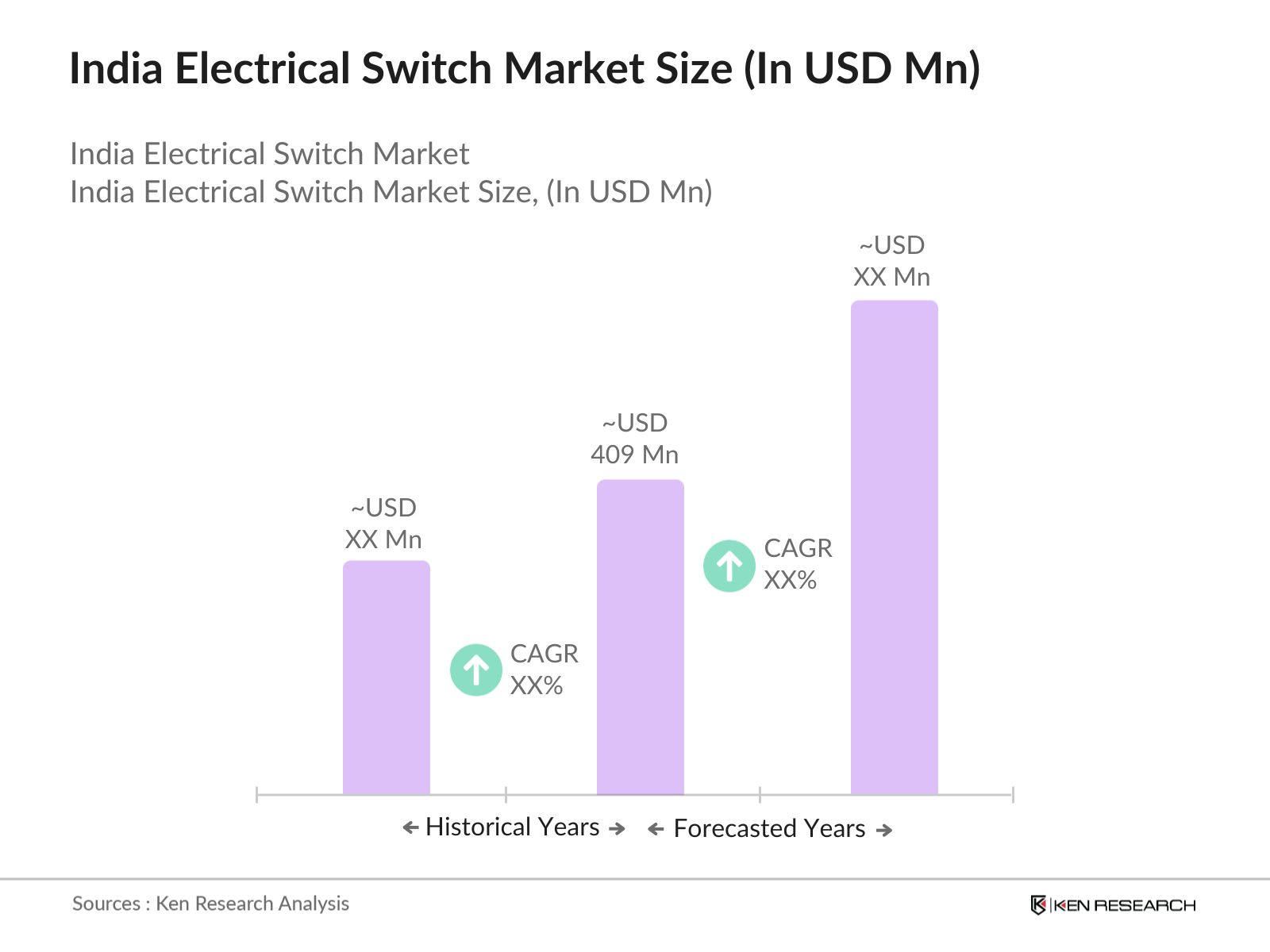

- The India Electrical Switch Market is valued at USD 409 million based on a five-year historical analysis. The market has been primarily driven by rapid urbanization, increasing construction activities in residential, commercial, and industrial sectors, and the growing adoption of smart home technologies. The integration of smart technologies in electrical switches, such as IoT-enabled and remote-controlled devices, is also playing a pivotal role in accelerating the demand. Government initiatives like Smart Cities Mission further fuel the market growth, making electrical switches an essential component of infrastructural advancements.

- The market is dominated by urban hubs such as Mumbai, Delhi, and Bangalore, due to their rapidly expanding real estate markets and the presence of large-scale industrial infrastructure projects. These cities have a high rate of residential development driven by population growth, modernization, and a surge in demand for energy-efficient, aesthetically pleasing, and technologically advanced switches. Additionally, industrial cities like Pune and Ahmedabad are driving demand due to the expansion of manufacturing hubs, where industrial switches are crucial.

- The Electrical Accessories (Quality Control) Order, effective from January 1, 2024, mandates that all switch-socket-outlets (non-interlock type) also comply with the IS 15787:2008 standard. This includes a requirement for the products to bear the BIS mark. This regulation ensures safety, durability, and performance in electrical installations across the country. BIS compliance has become a key market differentiator, with non-compliant products being phased out, ensuring that only certified, high-quality switches are installed in Indian homes and businesses.

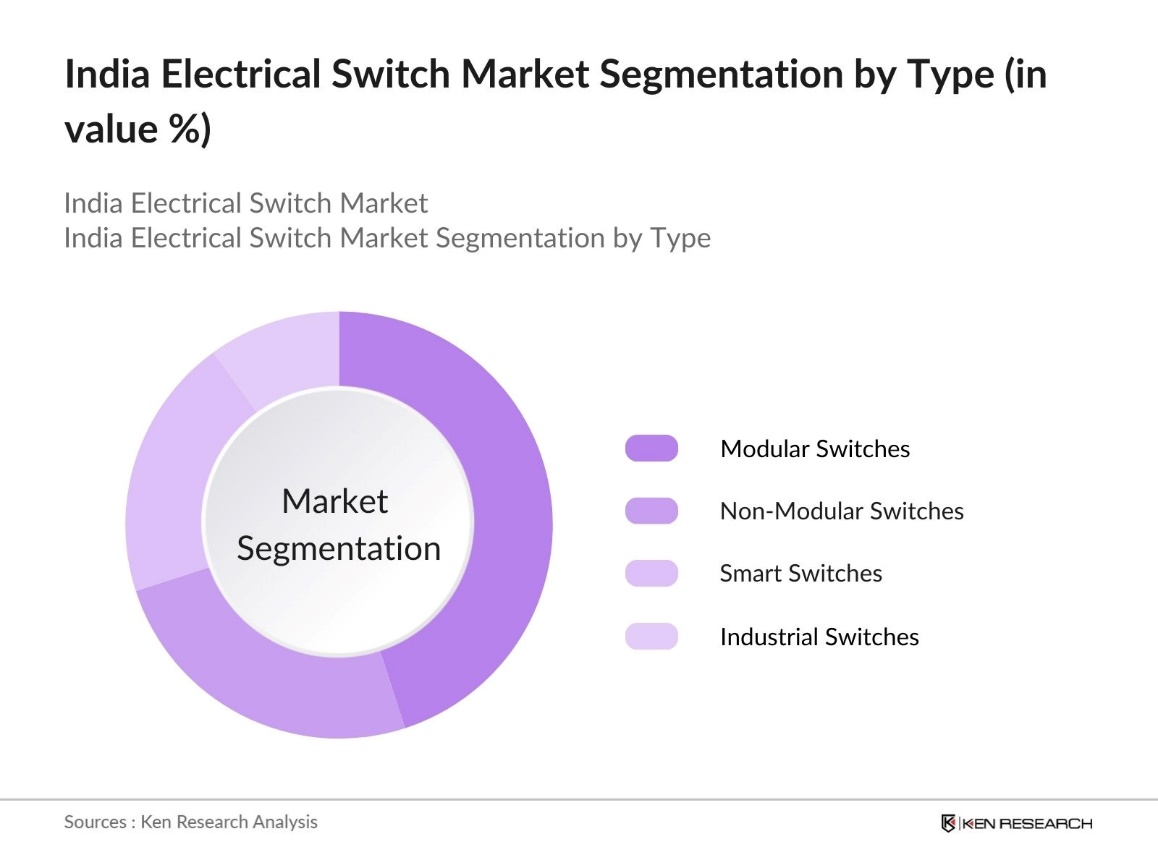

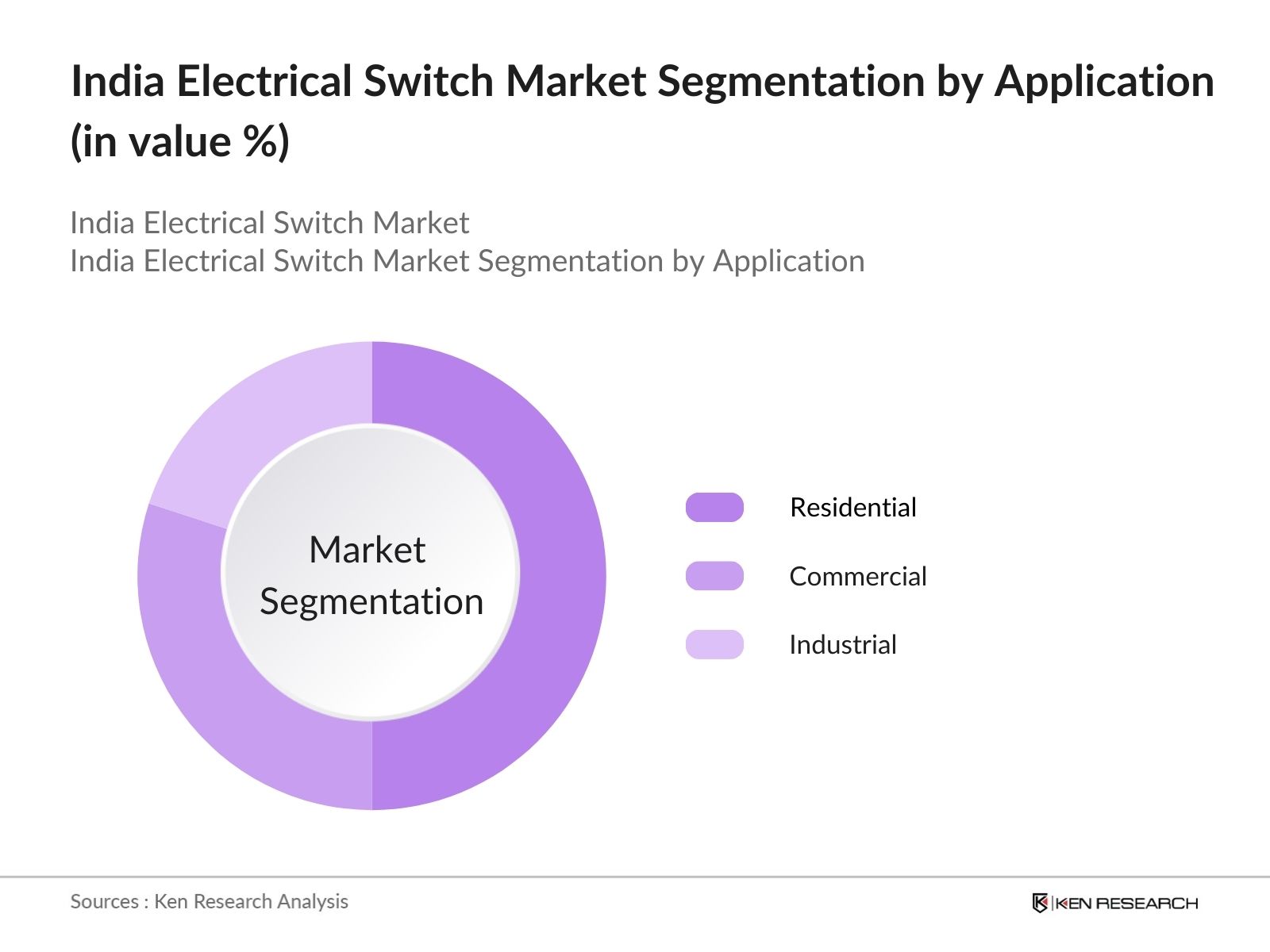

India Electrical Switch Market Segmentation

By Type: The India Electrical Switch market is segmented by type into modular switches, non-modular switches, smart switches, and industrial switches. Modular switches hold a dominant market share in the segmentation by type, due to their sleek designs, durability, and ease of installation, which have gained popularity among consumers. The rise in urbanization, combined with increasing consumer preference for sophisticated and premium aesthetics in homes and offices, has led to the growth of this segment. Additionally, modular switches are favored for their safety features, which comply with Indian safety regulations, further contributing to their market dominance.

By Application: The India Electrical Switch market is segmented by application into residential, commercial, and industrial applications. Residential applications account for the largest share in the market, driven by the increasing number of new housing projects, home renovations, and the growing awareness of energy-efficient switches. The demand for aesthetically pleasing, energy-saving switches that can easily integrate into smart home systems has made residential applications the key driver of this market. Moreover, the rising disposable incomes and increased consumer preference for branded and high-quality electrical products are bolstering the growth of this segment.

India Electrical Switch Market Competitive Landscape

The India Electrical Switch market is dominated by several key players, with major local and international companies holding substantial market positions. The market remains competitive due to the presence of unorganized sectors; however, organized players lead in terms of innovation, technology adoption, and brand loyalty. For instance, Legrand India and Anchor by Panasonic are major players in the modular switch segment, while companies like Schneider Electric and Havells India have gained significant traction in smart switches and industrial applications.

|

Company Name |

Established Year |

Headquarters |

No. of Employees |

Annual Revenue (2023) |

Product Portfolio |

Market Penetration |

R&D Investments |

Technology Focus |

Distribution Network |

|

Legrand India |

1994 |

Mumbai, India |

|||||||

|

Anchor by Panasonic |

1963 |

Mumbai, India |

|||||||

|

Havells India Ltd. |

1958 |

Noida, India |

|||||||

|

Schneider Electric India |

1836 (Parent) |

Gurgaon, India |

|||||||

|

Polycab India Ltd. |

1968 |

Mumbai, India |

India Electrical Switch Industry Analysis

Growth Drivers

- Increasing Urbanization: India is experiencing a significant shift towards urbanization, with an urban population of approximately 518 million as of 2023, constituting about 36% of the total population. This growing urbanization is driving demand for residential and commercial projects, increasing the need for modern electrical infrastructure, including electrical switches, particularly in newly developed housing and office spaces. Government initiatives like Housing for All are further fueling this demand by expanding affordable housing across the country, and with large-scale urban development projects in the pipeline, the electrical switch market is expected to benefit from the construction of new homes and offices.

- Industrialization and Infrastructure Development: India is the third-largest producer and consumer of electricity worldwide, with an installed power capacity of 442.85 GW as of April 30, 2024. And the total FDI inflows in the power sector reached US$ 18.28 billion between April 2000-March 2024.. The governments focus on smart grids and energy-efficient infrastructure for new industrial setups will further elevate the demand for technologically advanced switches in manufacturing units, industrial complexes, and infrastructure development projects.

- Technological Advancements: The growing adoption of IoT-enabled devices and smart home technologies is set to transform the Indian electrical switch market. Smart switches, which offer enhanced convenience and energy efficiency, are increasingly becoming a feature in modern homes. Government efforts toward digital transformation are further driving the uptake of these technologies, particularly in new housing developments. Indian manufacturers are keeping pace with this trend by innovating IoT-enabled switches that align with the growing demand for home automation. As smart home solutions continue to gain popularity, the market for advanced electrical switches is expected to expand significantly.

Market Restraints

- High Initial Investment: The adoption of advanced electrical switches, particularly IoT-enabled smart switches, comes with higher installation costs. These costs can be a significant barrier for middle-class households, especially in Tier-II and Tier-III cities, where affordability is a key concern. In such regions, where household incomes are lower, the uptake of advanced technologies tends to be slower compared to more affluent urban centers. This cost barrier limits the widespread adoption of smart switches in these areas.

- Competition from Unorganized Sector: The Indian electrical switch market faces strong competition from the unorganized sector, which offers products at much lower prices. This price sensitivity is particularly prominent in rural and semi-urban areas, where consumers often prefer more affordable, non-branded products over established brands. The presence of the unorganized sector hampers the growth of branded manufacturers, as they face difficulties in competing on price while maintaining product quality.

India Electrical Switch Market Future Outlook

Over the next few years, the India Electrical Switch market is expected to witness significant growth driven by the continued expansion of infrastructure projects, increasing urbanization, and the adoption of smart technology. The introduction of energy-efficient and smart switches, combined with government initiatives focusing on sustainable development, will be critical growth drivers. Rising consumer awareness about environmental sustainability and the implementation of stringent safety standards will further boost market demand, especially in urban residential and commercial spaces.

Market Opportunities

- Penetration into Tier-II and Tier-III Cities: Tier-II and Tier-III cities in India represent a vast untapped market for electrical switches, with significant potential for growth. These cities are experiencing increased urbanization and electrification, creating new opportunities for manufacturers to expand their reach. Government initiatives aimed at modernizing infrastructure, particularly in smaller cities, are providing a favorable environment for the adoption of modern electrical systems. As these regions continue to develop, there is substantial opportunity for electrical switch manufacturers to capture this growing market segment.

- Expansion of Smart Cities Projects: The Indian governments Smart Cities Mission is playing a crucial role in driving demand for advanced electrical systems, particularly in urban areas. As infrastructure in these cities is upgraded, there is an increasing need for modern, energy-efficient electrical solutions, including smart switches. The integration of smart, IoT-enabled electrical switches is becoming essential for connecting homes and buildings with smart city networks. This focus on urban electrification is opening up significant opportunities for manufacturers of advanced electrical systems to supply the growing demand driven by the Smart Cities initiative.

Scope of the Report

Products

Key Target Audience

Electrical Switch Manufacturers

Electrical and Electronics Retailers

Real Estate Developers and Builders

Home Automation Companies

Energy Management Companies

Investments and Venture Capital Firms

Infrastructure Development Agencies (National Smart Cities Mission)

Government and Regulatory Bodies (Bureau of Indian Standards)

Companies

Players Mentioned in the Report

Legrand India

Anchor by Panasonic

Havells India Ltd.

Schneider Electric

Polycab India Ltd.

Siemens India

Goldmedal Electricals

Luminous Power Technologies

Wipro Enterprises

ABB India

Crabtree (Havells)

GM Modular

Finolex Cables

Orpat Group

Syska LED

Table of Contents

1. India Electrical Switch Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Electrical Switch Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Electrical Switch Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization (Demand Surge in Residential and Commercial Projects)

3.1.2. Industrialization and Infrastructure Development (Boost in Energy Consumption)

3.1.3. Technological Advancements (Smart Switches, IoT-enabled Devices)

3.1.4. Government Initiatives (Make in India, Energy Efficiency Standards)

3.2. Market Restraints

3.2.1. High Initial Investment (Installation Costs for Advanced Systems)

3.2.2. Competition from Unorganized Sector (Price Sensitivity)

3.2.3. Supply Chain Issues (Raw Material Volatility)

3.3. Opportunities

3.3.1. Penetration into Tier-II and Tier-III Cities (Untapped Markets)

3.3.2. Expansion of Smart Cities Projects (Urban Electrification)

3.3.3. Renewable Energy Integration (Energy-efficient Switches)

3.4. Trends

3.4.1. IoT-Integrated Switches (Growth of Home Automation)

3.4.2. Aesthetic and Modular Switches (Design and Consumer Preferences)

3.4.3. Environmentally Sustainable Products (Green Building Certifications)

3.5. Government Regulation

3.5.1. Bureau of Indian Standards (BIS) Compliance

3.5.2. Energy Conservation Building Code (ECBC) Standards

3.5.3. Electrical Safety Norms (IS 3854: Switch Standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

4. India Electrical Switch Market Segmentation

4.1. By Type (In Value %)

4.1.1. Modular Switches

4.1.2. Non-Modular Switches

4.1.3. Smart Switches

4.1.4. Industrial Switches

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Switch Material (In Value %)

4.3.1. Plastic

4.3.2. Metal

4.3.3. Polycarbonate

4.4. By Technology (In Value %)

4.4.1. Manual Switches

4.4.2. Automatic Switches

4.4.3. Remote-Controlled Switches

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Electrical Switch Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Legrand India

5.1.2. Anchor by Panasonic

5.1.3. Havells India Ltd.

5.1.4. Schneider Electric

5.1.5. Polycab India Ltd.

5.1.6. Siemens India

5.1.7. Goldmedal Electricals

5.1.8. Luminous Power Technologies

5.1.9. Wipro Enterprises

5.1.10. ABB India

5.1.11. Crabtree (A brand of Havells)

5.1.12. GM Modular

5.1.13. Finolex Cables

5.1.14. Orpat Group

5.1.15. Syska LED

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Market Penetration, R&D Expenditure, Technology Innovation, Manufacturing Capacity, Distribution Network, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

6. India Electrical Switch Market Regulatory Framework

6.1. Safety and Compliance Standards (IS 3854, IS 732)

6.2. Certification Procedures (ISI Marking)

6.3. Environmental and Energy Regulations (E-Waste Management, Energy Star Compliance)

7. India Electrical Switch Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Electrical Switch Market Future Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Switch Material (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. India Electrical Switch Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying critical factors influencing the India Electrical Switch Market. Extensive desk research was conducted, leveraging both proprietary and open-access databases to map key variables such as market growth drivers, technological trends, and competitive forces.

Step 2: Market Analysis and Construction

In this phase, a comprehensive analysis of the historical data was conducted, evaluating market size, key market developments, and technological adoption in the India Electrical Switch Market. A detailed review of primary and secondary sources was used to ensure the accuracy of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market hypotheses were developed based on initial research, followed by in-depth interviews with industry experts to validate and refine the findings. Industry-specific insights provided critical data on market penetration, consumer preferences, and competitive dynamics.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all gathered data into a comprehensive and validated market report. This step involved collaboration with manufacturers and distributors to gather insights into product performance, distribution channels, and customer preferences.

Frequently Asked Questions

01 How big is the India Electrical Switch Market?

The India Electrical Switch Market was valued at USD 409 million, driven by rising demand from residential, commercial, and industrial sectors, coupled with technological advancements in switch designs and features.

02 What are the challenges in the India Electrical Switch Market?

Challenges in India Electrical Switch Market include the presence of an unorganized sector offering low-cost alternatives, raw material price fluctuations, and the need for compliance with stringent safety regulations, which could increase costs for manufacturers.

03 Who are the major players in the India Electrical Switch Market?

Key players in the India Electrical Switch Market include Legrand India, Anchor by Panasonic, Havells India, Schneider Electric, and Polycab India Ltd. These companies lead due to their established brand presence, strong distribution networks, and technological innovations.

04 What are the growth drivers of the India Electrical Switch Market?

The India Electrical Switch Market is driven by increasing urbanization, growth in residential and commercial construction projects, and the rising demand for energy-efficient and smart switches that align with modern infrastructure needs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.