India Electrocardiograph (ECG) Equipment Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD4311

December 2024

81

About the Report

India Electrocardiograph (ECG) Equipment Market Overview

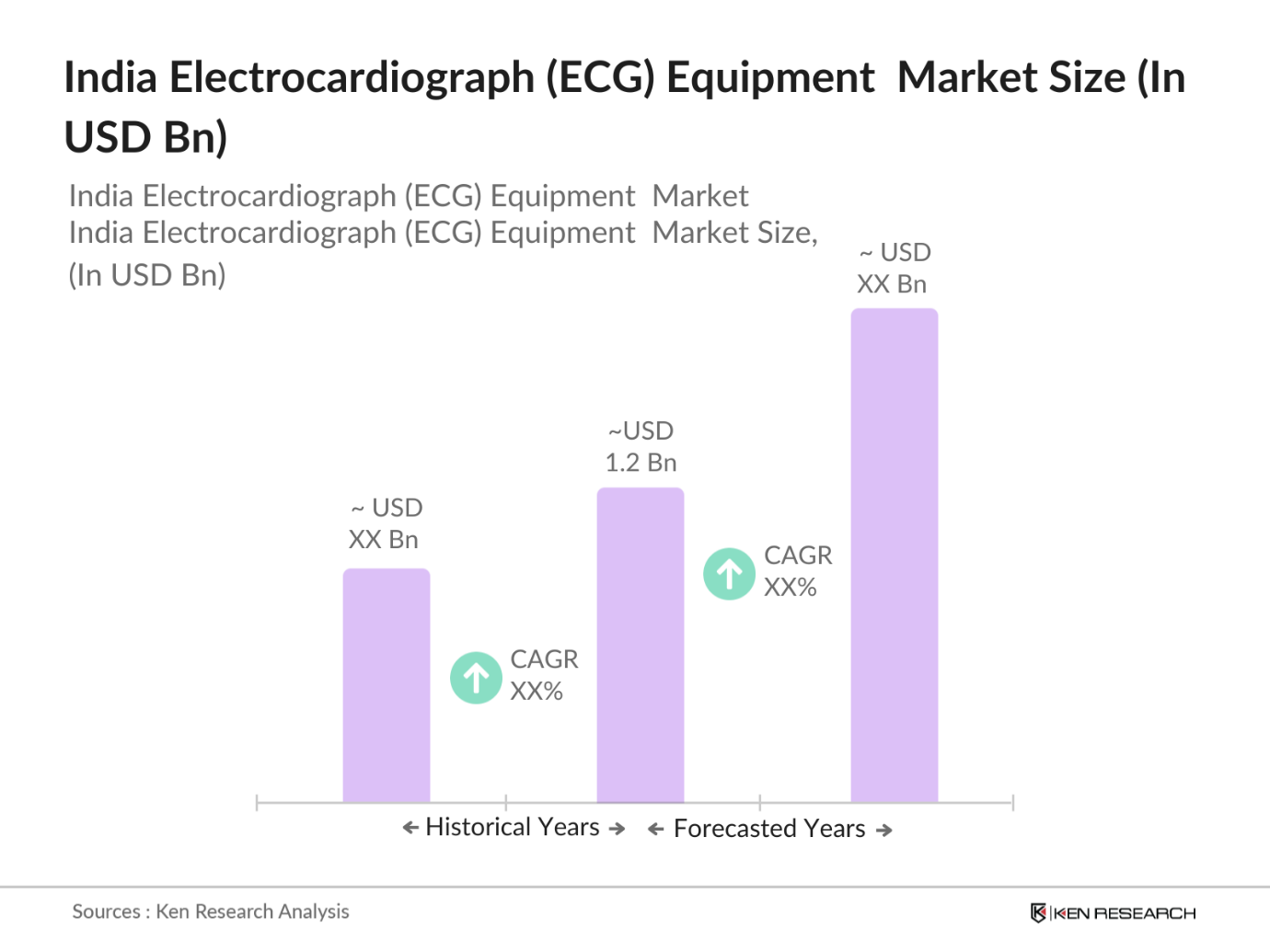

- The India Electrocardiograph (ECG) Equipment Market has seen steady growth, with a valuation of USD 1.2 billion in 2023, based on a comprehensive historical analysis. This growth is primarily driven by a rising prevalence of cardiovascular diseases and the increasing awareness about the importance of regular heart monitoring. The demand for advanced diagnostic tools, including ECG machines, has surged due to government-backed healthcare initiatives aiming to enhance medical infrastructure across the country.

- The dominance within the India ECG equipment market is largely concentrated in metropolitan cities such as Mumbai, Delhi, and Bangalore. These regions exhibit a higher concentration of advanced healthcare facilities, skilled medical personnel, and high patient footfall. Mumbai, for example, is home to several leading multi-specialty hospitals with advanced cardiac care facilities, thereby fostering the adoption of ECG equipment. The concentration of healthcare investments and the availability of advanced diagnostic tools make these regions leaders in the ECG equipment market.

- The Indian government, through the National Health Mission (NHM), has expanded rural healthcare funding, allocating INR 31 billion for healthcare infrastructure, including ECG diagnostics. These efforts focus on making diagnostics affordable for underserved populations and enhancing public hospital capabilities. Additionally, Pradhan Mantri Jan Arogya Yojana (PM-JAY) has boosted access to quality healthcare services for low-income groups, facilitating ECG equipment installations in more public health centres. Such initiatives underscore the governments commitment to improving preventive cardiac care in all regions.

India Electrocardiograph (ECG) Equipment Market Segmentation

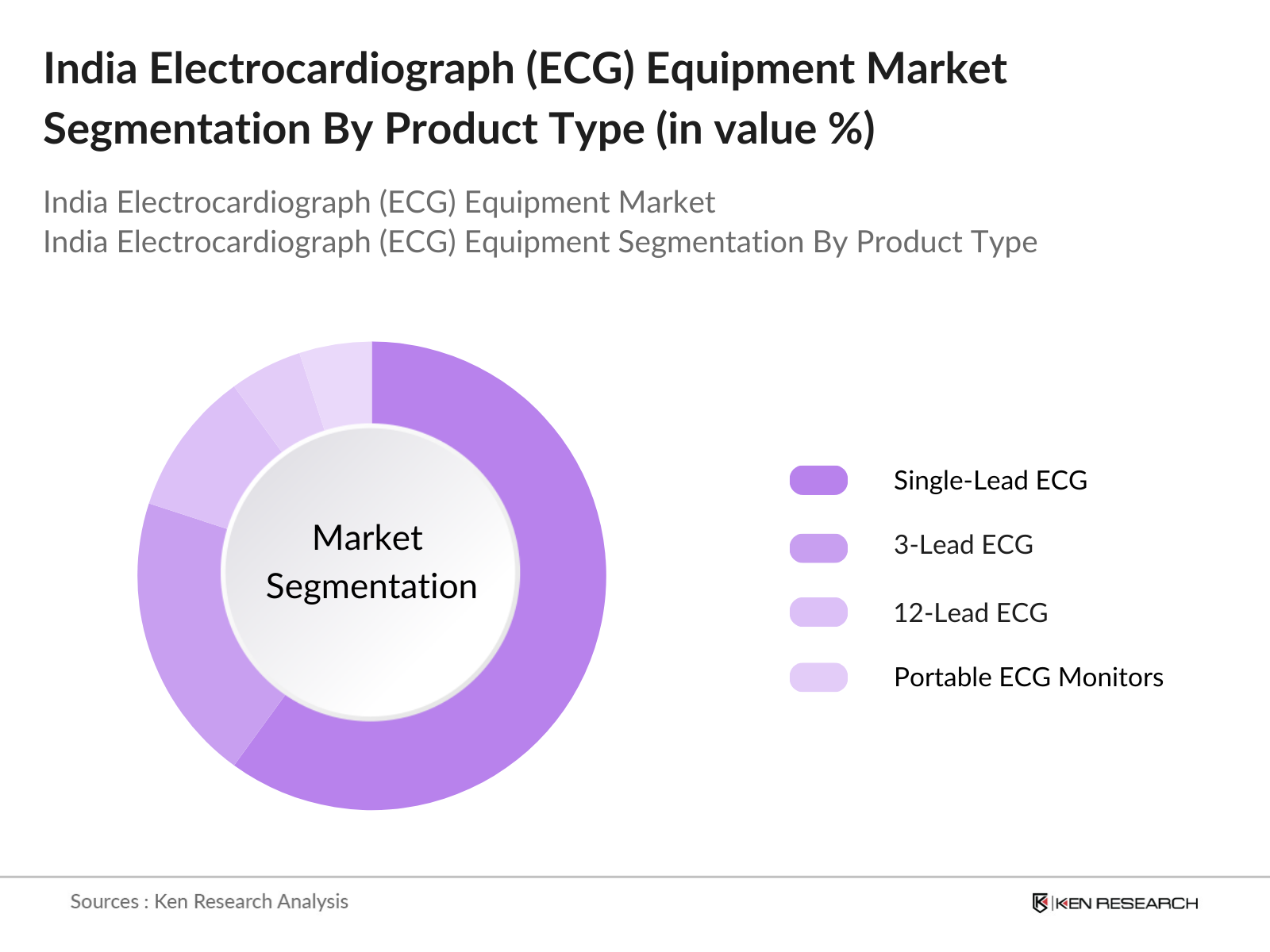

- By Product Type: The India ECG equipment market is segmented by product type into traditional single-lead ECG devices, 3-lead ECG devices, 12-lead ECG devices, and portable ECG monitors. Among these, 12-lead ECG devices hold a dominant position in the market. Their popularity stems from the comprehensive diagnostic capabilities they offer, providing a detailed view of cardiac health through multiple leads. This segments dominance is also attributed to its essential role in hospitals and specialty cardiac centres, where accuracy and multi-dimensional analysis are crucial for patient care.

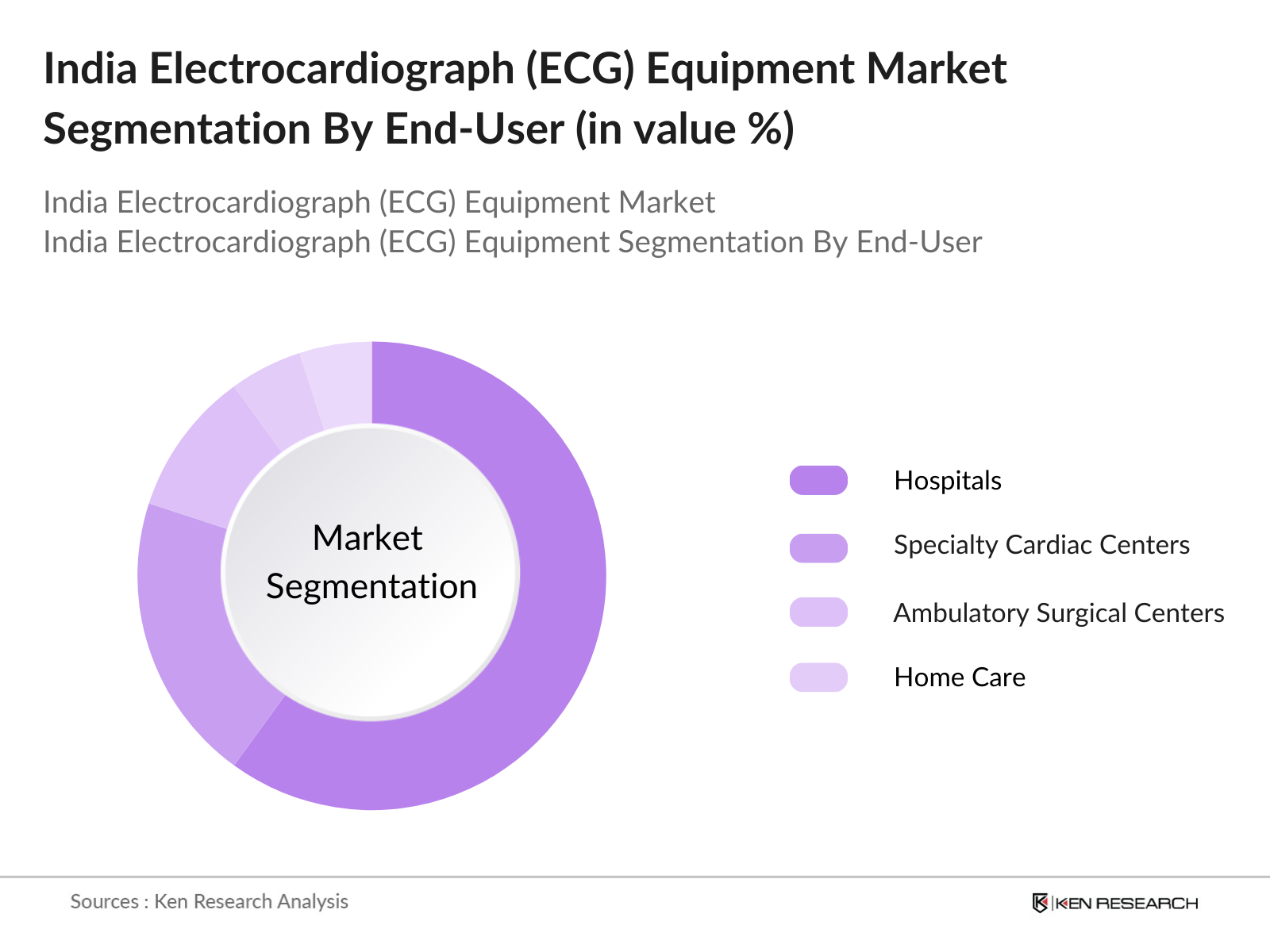

- By End-User:The India ECG equipment market is also segmented by end-user into hospitals, specialty cardiac centers, ambulatory surgical centers, and home care. Hospitals dominate this segment, driven by the availability of complex diagnostic services and specialized cardiac departments that require constant access to high-quality ECG equipment. This dominance is reinforced by the vast number of patients seeking treatment for cardiovascular diseases in hospitals, necessitating the installation and utilization of multiple ECG devices for round-the-clock monitoring.

India Electrocardiograph (ECG) Equipment Market Competitive Landscape

The India ECG equipment market is dominated by a few key players who leverage technology, innovation, and strong distribution networks to maintain their market position.

The India ECG equipment markets competitive landscape reflects a consolidation of top international and domestic players like Philips Healthcare and BPL Medical Technologies. This mix of global and local companies helps maintain a competitive environment where innovation, technological advancements, and service are key differentiators.

India Electrocardiograph (ECG) Equipment Market Analysis

Growth Drivers

- Rising Incidence of Cardiovascular Diseases: Cardiovascular diseases are a significant health burden in India, with around 17 million cases annually, as reported by the Indian Council of Medical Research. This high incidence has led to a surge in demand for ECG equipment, especially in rural and semi-urban health centers that are expanding cardiac care services. National health reports indicate cardiovascular disease is responsible for over 28% of all deaths, driving increased allocation of diagnostic resources, including ECG systems. Additionally, public health institutions are adopting ECG devices to cater to the growing patient load, improving accessibility.

- Increasing Geriatric Population: Indias elderly population is expected to reach around 140 million by 2025, according to government census data, driving demand for regular monitoring of age-related cardiac issues. The Ministry of Health has recorded increased cardiovascular incidences in individuals over 60, highlighting the need for accessible and reliable diagnostic tools like ECGs. This demographic shift underscores the significance of ECG devices in both urban hospitals and remote healthcare facilities to ensure continuous health monitoring, addressing the unique needs of elderly patients and improving healthcare outcomes in both private and public sectors.

- Technological Advancements in ECG Equipment: Technological innovations have improved the accuracy and usability of ECG devices, making them more accessible across India. Recent government policies have focused on healthcare technology, resulting in increased funding for digital advancements, including ECG equipment with wireless capabilities, data storage, and AI integration. According to the Ministry of Electronics and Information Technology, approximately INR 40 billion has been allocated to medical technology enhancements, directly benefiting the ECG equipment segment by promoting tech-friendly diagnostic tools in healthcare settings.

Market Challenges

- High Cost of Advanced ECG Equipment: Despite advances in technology, high costs remain a barrier to widespread adoption of advanced ECG systems, particularly in government-funded hospitals and smaller private clinics. Equipment import duties contribute significantly to pricing challenges, as 70% of advanced diagnostic tools in India are imported. This issue has slowed the adoption of high-end ECG machines, especially in non-metropolitan regions. With limited budget allocations in smaller hospitals, there is a growing need for affordable yet effective ECG solutions to meet healthcare demands.

- Limited Skilled Technicians: The shortage of skilled technicians has affected the effective deployment of ECG machines in rural and semi-urban areas. According to the Ministry of Health and Family Welfare, over 10,000 primary healthcare centers reported insufficient staff to operate advanced diagnostic tools, impacting the quality and efficiency of ECG usage. Government training programs are still catching up, with an estimated training output of only 5,000 ECG-capable technicians annually, leaving a gap in the expertise required for optimal equipment utilization.

India Electrocardiograph (ECG) Equipment Market Future Outlook

Over the next five years, the India Electrocardiograph (ECG) Equipment Market is expected to witness substantial growth. This growth trajectory is propelled by increasing investments in healthcare infrastructure, the rising adoption of wearable ECG devices, and growing awareness of preventative cardiac health monitoring. Continuous advancements in ECG technology and expanding government support for public health initiatives will further drive the market's evolution, with a focus on making healthcare accessible across urban and rural areas.

Market Opportunities

- Growth in Telemedicine and Remote Monitoring: The rapid adoption of telemedicine services, especially in rural areas, has increased the demand for portable ECG equipment that can be used for remote patient monitoring. According to the Ministry of Health, telemedicine consultations grew by approximately 600% in recent years, underscoring the need for mobile-compatible ECG devices. This trend is driving the production of compact, internet-enabled ECG equipment, facilitating remote cardiac assessments. This opportunity aligns with national digital health initiatives, providing a scalable model for addressing healthcare disparities and improving cardiac care accessibility.

- Increased Healthcare Investments: Rising investments in Indias healthcare infrastructure have significantly improved access to diagnostic services, including ECG monitoring. Data from the Ministry of Finance highlights a healthcare budget increase of INR 700 billion, aimed at modernizing facilities and expanding diagnostic services across the country. This substantial investment is fueling the procurement of advanced ECG devices, allowing hospitals to upgrade their diagnostic capabilities. This influx of capital supports the deployment of ECG equipment in primary and secondary healthcare facilities, expanding the market potential for ECG device manufacturers and distributors.

Scope of the Report

|

Segment |

Sub-segments |

|

Product Type |

Resting ECG Stress ECG Holter ECG Event Monitors |

|

Lead Type |

12-lead 6-lead 3-lead Single-lead |

|

End-User |

Hospitals Ambulatory Care Centers Home Healthcare Diagnostic Centers |

|

Technology |

Digital ECG Analog ECG |

|

Region |

North India South India East India West India |

Products

Key Target Audience

Healthcare Providers (hospitals, clinics, and specialty centers)

Medical Device Distributors

Cardiac Rehabilitation Centers

Government and Regulatory Bodies (e.g., Indian Ministry of Health and Family Welfare)

Investors and Venture Capitalist Firms

Medical Device Manufacturers

Telemedicine Service Providers

Home Healthcare Providers

Companies

Players mentioned in the report

Philips Healthcare

GE Healthcare

Schiller AG

BPL Medical Technologies

Fukuda Denshi

Mindray Medical International

Nihon Kohden Corporation

AliveCor, Inc.

Cardioline S.p.A

Medtronic PLC

Zoll Medical Corporation

Edan Instruments, Inc.

ERT

OSI Systems, Inc.

Mortara Instrument

Table of Contents

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves developing an ecosystem map to identify major stakeholders in the India Electrocardiograph (ECG) Equipment Market. This phase is informed by comprehensive desk research and secondary sources to map critical market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration, healthcare facility expansion, and usage patterns are compiled and analyzed. This step ensures the reliability of market sizing and segment data.

Step 3: Hypothesis Validation and Expert Consultation

To refine market insights, hypotheses are tested through interviews with industry experts and healthcare providers. This method provides direct insights into market trends, confirming data accuracy and comprehensiveness.

Step 4: Research Synthesis and Final Output

The final phase synthesizes research findings, integrating data from multiple sources to present a robust analysis of the India Electrocardiograph (ECG) Equipment Market, ensuring precise segmentation and growth projections.

Frequently Asked Questions

01. How big is the India Electrocardiograph (ECG) Equipment Market?

The India Electrocardiograph (ECG) Equipment Market is valued at USD 1.2 billion, fueled by rising healthcare demand and increased investment in advanced medical equipment.

02. What challenges does the India ECG Equipment Market face?

Key challenges include high equipment costs, limited access to rural healthcare, and regulatory complexities, which can hinder rapid adoption in some areas.

03. Who are the major players in the India ECG Equipment Market?

Leading players include Philips Healthcare, GE Healthcare, Schiller AG, and BPL Medical Technologies, leveraging strong distribution networks and cutting-edge technology.

04. What drives growth in the India ECG Equipment Market?

Growth is driven by increased cardiovascular disease awareness, government healthcare investments, and the demand for portable diagnostic tools.

05. What are the latest trends in the India ECG Equipment Market?

Current trends include the adoption of portable ECG devices, wearable health monitoring technologies, and telemedicine integration for remote diagnostics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.