India Electronics Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD10733

November 2024

85

About the Report

India Electronics Market Overview

- The India Electronics Market is valued at USD 91.08 billion, driven by an extensive base of consumer demand across diverse segments like smartphones, consumer electronics, and industrial electronics. This growth is fueled by an increasing focus on digitization, the push for domestic manufacturing supported by government schemes like Make in India and the Production Linked Incentive (PLI) scheme, and rising disposable income levels. As a result, the demand for both consumer and industrial electronics is surging, contributing significantly to the market size.

- In India, cities such as Delhi, Mumbai, and Bengaluru dominate the market due to their high concentration of technology and manufacturing hubs, availability of skilled labor, and well-established infrastructure. These urban centers are magnets for domestic and international investments, given their sizable consumer base and advanced supply chain networks. Additionally, these cities offer easy access to technological advancements and skilled workforces, establishing them as central to the electronics markets development.

- Multiple global players have set up or expanded manufacturing facilities in India, encouraged by government incentives. For example, Foxconn recently announced plans to invest 150 billion in a semiconductor plant in 2023, bolstering India's capability in component manufacturing.

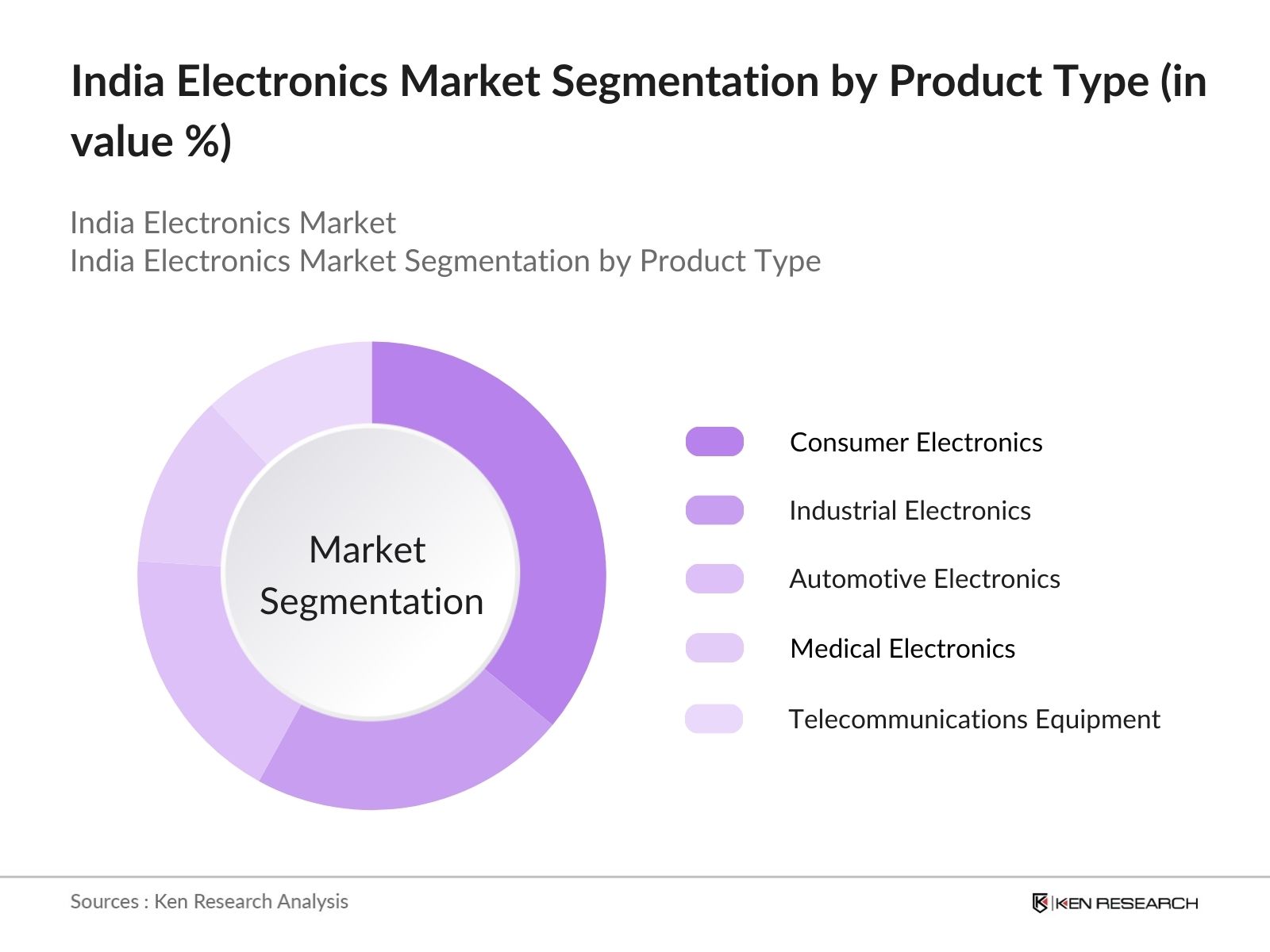

India Electronics Market Segmentation

By Product Type: The India Electronics Market is segmented by product type into consumer electronics, industrial electronics, automotive electronics, medical electronics, and telecommunications equipment. Currently, consumer electronics holds the dominant market share within the product type segment due to the widespread use and popularity of smartphones, laptops, and wearables. This growth is largely attributed to the rising demand for digital devices, advancements in technology, and the expansion of e-commerce platforms, enabling easier accessibility and distribution.

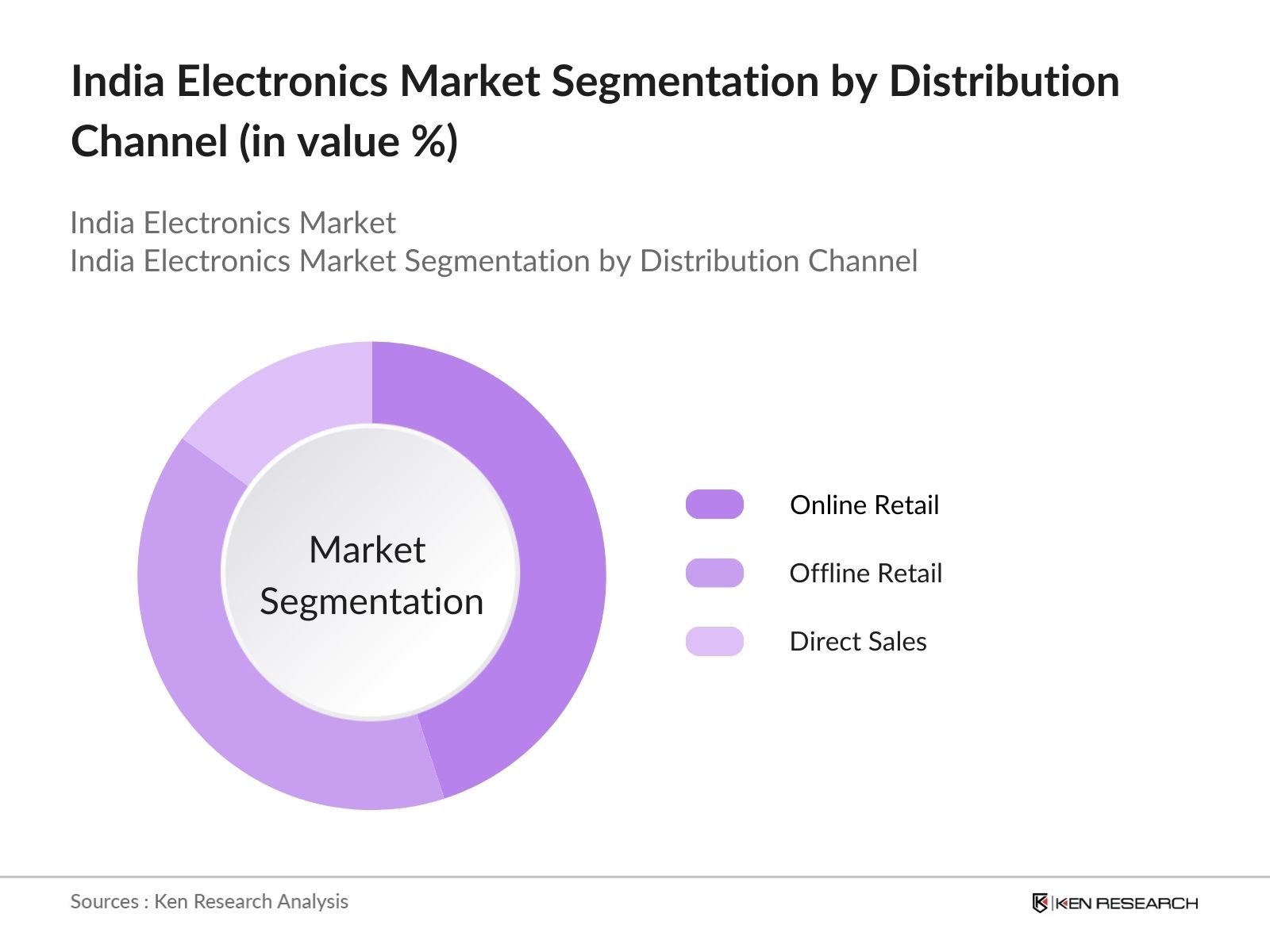

By Distribution Channel: The India Electronics Market is further segmented by distribution channels into online retail, offline retail, and direct sales. Online retail dominates this segment due to the convenience, extensive product variety, and competitive pricing it offers to consumers. The penetration of e-commerce giants like Amazon and Flipkart has also facilitated this trend, catering to the growing digital-savvy population across urban and rural areas alike.

India Electronics Market Competitive Landscape

The India Electronics Market is highly competitive, with key players including both domestic and global giants like Samsung, LG, and Tata Electronics. These companies have established robust supply chains, dedicated R&D centers, and strategic partnerships, which significantly shape market dynamics. The dominance of these established players underscores their market influence and customer loyalty.

India Electronics Market Analysis

Growth Drivers

- Increasing Consumer Demand for Smart Devices: The Indian electronics market is experiencing surging demand for smart devices, with over 100 million smartphones sold annually due to rising connectivity needs, according to the Ministry of Electronics and Information Technology. This demand extends to tablets, smart TVs, and wearable devices, driven by Indias youth demographic and their growing use of digital services.

- Government Initiatives (PLI Scheme, Digital India, Make in India): Government initiatives such as the Production Linked Incentive (PLI) Scheme have set targets for manufacturers to increase production within India. The PLI scheme alone aims to drive manufacturing output worth 10 trillion by 2025, focusing on smartphones, laptops, and semiconductor components. Additionally, Make in India and Digital India initiatives are designed to bolster the domestic manufacturing ecosystem.

- Expansion of E-commerce: With over 800 million internet users in India and rapid internet penetration into rural regions, e-commerce platforms are making electronic devices more accessible. For instance, Flipkart and Amazon report increased sales of electronic goods by at least 40% annually due to extended online retail in Tier II and Tier III cities, bolstering the electronics market.

Market Challenges

- High Import Dependency: India imports approximately $40 billion worth of electronic components annually, predominantly from China, reflecting a significant dependency on foreign suppliers. This reliance has raised concerns regarding supply chain stability, as witnessed during the pandemic when component shortages hindered production in India.

- Complex Regulatory Framework: The regulatory framework for electronics in India involves multiple compliance requirements, which are often time-consuming and costly for manufacturers. Companies are required to obtain clearances from multiple bodies, including BIS certification, WPC, and the Ministry of Environment, impacting ease of doing business and slowing down market entry for new players.

India Electronics Market Future Outlook

Over the coming years, the India Electronics Market is expected to witness sustained growth, driven by technological advancements, an increased focus on local manufacturing, and the expanding consumer base. Factors such as the adoption of AI, IoT integration, and green electronics will likely shape the market's trajectory, with government support enhancing manufacturing initiatives. The demand for electronics is anticipated to remain strong across both consumer and industrial applications.

Market Opportunities

- Growth of IoT and Smart City Initiatives: The Indian governments Smart Cities Mission aims to develop 100 smart cities, integrating IoT-enabled solutions. With an estimated allocation of 1.2 trillion, there is significant investment in IoT solutions, benefiting sectors such as transportation, healthcare, and energy. This initiative promotes the demand for IoT components like sensors, chips, and network devices.

- Expanding Rural Electrification: With over 60% of Indias population residing in rural areas, expanded electrification has opened new markets for electronics. As per the Saubhagya Scheme, 99.5% of rural households are now electrified, providing access to products like TVs, refrigerators, and other home appliances, especially in the less-served rural markets.

Scope of the Report

|

By Product Type |

Consumer Electronics Industrial Electronics Automotive Electronics Medical Electronics Telecommunications Equipment |

|

By Application |

Consumer Use Industrial Use Automotive Industry Healthcare Industry Telecommunications Sector |

|

By Distribution Channel |

Online Retail Offline Retail Direct Sales |

|

By End-User |

Individual Consumers Enterprises Government Sector |

|

By Region |

North South East West Central |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Electronics and Information Technology, Bureau of Indian Standards)

Consumer Electronics Manufacturers

Industrial Electronics Suppliers

Retail and E-commerce Platforms

Research and Development Firms

Electronics Distributors and Wholesalers

Automotive OEMs and Component Suppliers

Companies

Players Mentioned in the Report:

Samsung Electronics

LG Electronics

Panasonic Corporation

Tata Electronics Pvt. Ltd.

Xiaomi India

Havells India Ltd.

Bajaj Electricals Ltd.

Voltas Ltd.

Bharat Electronics Ltd.

Bosch India

Table of Contents

1. India Electronics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Electronics Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Electronics Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Consumer Demand for Smart Devices

3.1.2 Government Initiatives (PLI Scheme, Digital India, Make in India)

3.1.3 Rising Disposable Income

3.1.4 Expansion of E-commerce

3.2 Market Challenges

3.2.1 High Import Dependency

3.2.2 Complex Regulatory Framework

3.2.3 Supply Chain Disruptions

3.3 Opportunities

3.3.1 Growth of IoT and Smart City Initiatives

3.3.2 Expanding Rural Electrification

3.3.3 Increased Investments in Manufacturing Units

3.4 Trends

3.4.1 Shift Towards Green Electronics

3.4.2 Demand for Wearable Electronics

3.4.3 Integration of AI and Machine Learning in Consumer Electronics

3.5 Government Regulations

3.5.1 Import Tariffs and Duty Structure

3.5.2 Standards by Bureau of Indian Standards (BIS)

3.5.3 Compliance with Environmental Standards (RoHS, E-Waste Management)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter’s Five Forces Analysis

3.9 Competitive Ecosystem

4. India Electronics Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Consumer Electronics (Smartphones, Laptops, Wearables)

4.1.2 Industrial Electronics (PLC, Sensors, Motors)

4.1.3 Automotive Electronics (ADAS, Infotainment, ECU)

4.1.4 Medical Electronics (Diagnostic Equipment, Wearable Health Devices)

4.1.5 Telecommunications Equipment (Network Infrastructure, Routers)

4.2 By Application (In Value %)

4.2.1 Consumer Use

4.2.2 Industrial Use

4.2.3 Automotive Industry

4.2.4 Healthcare Industry

4.2.5 Telecommunications Sector

4.3 By Distribution Channel (In Value %)

4.3.1 Online Retail

4.3.2 Offline Retail (Department Stores, Specialty Stores)

4.3.3 Direct Sales

4.4 By End-User (In Value %)

4.4.1 Individual Consumers

4.4.2 Enterprises

4.4.3 Government Sector

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

4.5.5 Central

5. India Electronics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Samsung Electronics

5.1.2 LG Electronics

5.1.3 Sony Corporation

5.1.4 Panasonic Corporation

5.1.5 Havells India Ltd.

5.1.6 Bajaj Electricals Ltd.

5.1.7 Voltas Ltd.

5.1.8 Bharat Electronics Ltd.

5.1.9 Tata Electronics Pvt. Ltd.

5.1.10 Videocon Industries Ltd.

5.1.11 Bosch India

5.1.12 Whirlpool of India Ltd.

5.1.13 Foxconn Technology Group

5.1.14 Xiaomi India

5.1.15 Micromax Informatics Ltd.

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Market Presence, Strategic Partnerships, R&D Investment, Product Innovations, CSR Activities, Key Market Regions)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Electronics Market Regulatory Framework

6.1 Environmental Standards (RoHS Compliance, E-Waste Management)

6.2 BIS Certification Requirements

6.3 Import Duty and Tariff Regulations

7. India Electronics Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Electronics Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. India Electronics Market Analysts’ Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Demographic Analysis

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Identification

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins with an exhaustive assessment of the India Electronics Market landscape. We conducted in-depth desk research and referenced proprietary databases to identify and define critical market variables, such as product types, distribution channels, and consumer preferences.

Step 2: Market Analysis and Construction

We collected and analyzed historical data related to market penetration, revenue generation, and distribution patterns. The analysis covered various segments and sub-segments to assess factors impacting market trends and consumer demand.

Step 3: Hypothesis Validation and Expert Consultation

After constructing initial hypotheses, we consulted industry experts through structured interviews, providing insights into technology integration, supply chain factors, and market dynamics. These consultations aided in validating our data and refining market estimates.

Step 4: Research Synthesis and Final Output

The final stage involved integrating findings from various data sources to ensure a comprehensive and validated analysis. This phase included collaboration with major players and additional secondary research, providing a robust and credible market outlook.

Frequently Asked Questions

01. How big is the India Electronics Market?

The India Electronics Market, valued at USD 91.08 billion, is driven by increased digital adoption and government support for domestic manufacturing, particularly in consumer and industrial electronics sectors.

02. What are the challenges in the India Electronics Market?

Challenges in the India Electronics Market include high import dependency, regulatory complexities, and frequent supply chain disruptions. These factors collectively impact the profitability and stability of the market.

03. Who are the major players in the India Electronics Market?

Major players in the India Electronics Market include Samsung, LG, Tata Electronics, Panasonic, and Xiaomi. These companies have a strong market presence owing to their vast distribution networks, advanced R&D, and brand reputation.

04. What are the growth drivers of the India Electronics Market?

Growth drivers for the India Electronics Market include the demand for digital devices, government schemes like PLI, and the increase in e-commerce penetration. Additionally, the rise in consumer spending is supporting robust market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.