India Engineering and Infrastructure Service Market Outlook to 2030

India Engineering and Infrastructure Service Market: Growth Driven by Urbanization and Government Initiatives 2019–2030

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1532

August 2025

90

About the Report

India Engineering and Infrastructure Service Market Overview

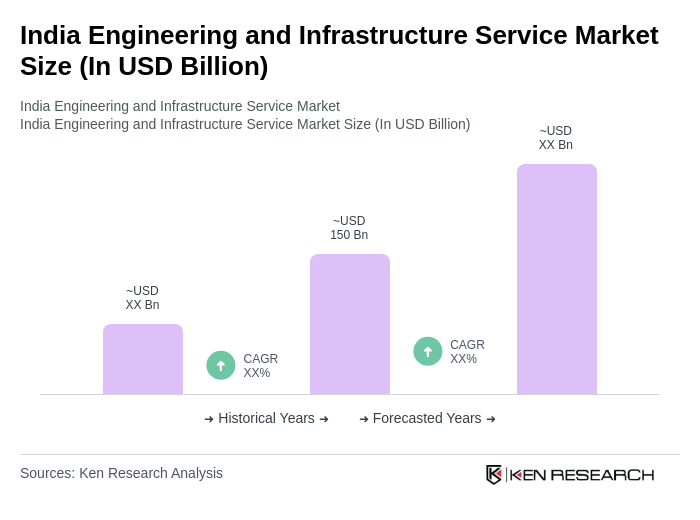

- The India Engineering and Infrastructure Service Market is valued at over USD 150 billion, based on a five-year historical analysis. This growth is primarily driven by rapid urbanization, government initiatives to boost infrastructure development, and increasing investments in engineering services. The demand for comprehensive engineering solutions has surged, reflecting the country's commitment to enhancing its infrastructure capabilities.

- Key players in this market include major cities like Mumbai, Delhi, and Bengaluru, which dominate due to their strategic economic significance and concentration of industries. These cities are hubs for construction and engineering projects, attracting both domestic and foreign investments, thereby fostering a competitive environment that drives market growth.

- In 2019, the Indian government launched the National Infrastructure Pipeline (NIP), which aims to invest INR 111 trillion in infrastructure projects across several years. This initiative, led by the Ministry of Finance’s Department of Economic Affairs, is designed to enhance connectivity, promote sustainable development, and create job opportunities, significantly impacting the engineering and infrastructure service market. The NIP covers sectors such as energy, roads, railways, and urban infrastructure, requiring compliance with sector-specific standards and periodic progress reporting.

India Engineering and Infrastructure Service Market Segmentation

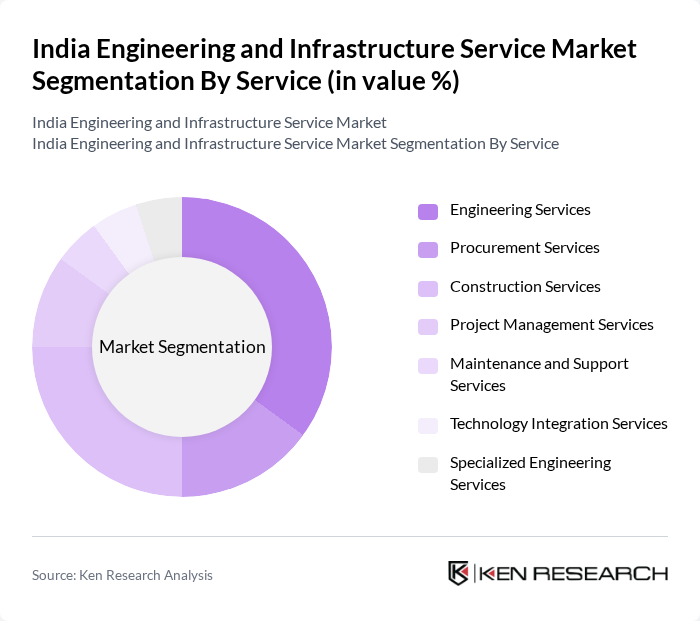

By Service: The service segment includes various offerings such as engineering services, procurement services, construction services, project management services, maintenance and support services, technology integration services, and specialized engineering services. Among these, engineering services are currently leading the market due to the increasing complexity of projects and the need for specialized skills. The demand for innovative engineering solutions is driven by advancements in technology, digitalization, and the growing emphasis on sustainable practices such as green building and smart infrastructure.

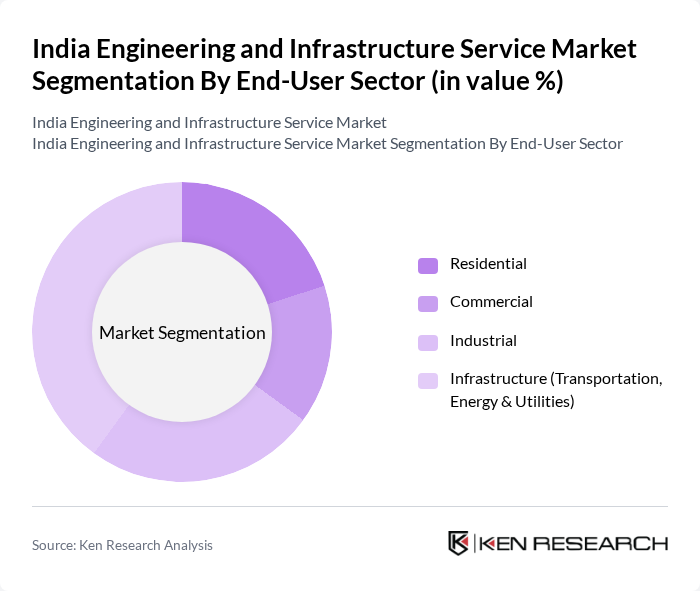

By End-User Sector: The end-user sector comprises residential, commercial, industrial, and infrastructure (transportation, energy & utilities) segments. The infrastructure sector is currently the dominant segment, driven by significant government investments and the need for improved public services. The increasing urban population and the demand for better transportation and utility services are propelling growth in this sector, making it a focal point for engineering and infrastructure services.

India Engineering and Infrastructure Service Market Competitive Landscape

A dynamic mix of regional and international players characterizes the India Engineering and Infrastructure Service Market. Leading participants such as Larsen & Toubro Limited, Tata Projects Limited, Shapoorji Pallonji Group, Hindustan Construction Company (HCC), JMC Projects (India) Ltd., contribute to innovation, geographic expansion, and service delivery in this space.

| Larsen & Toubro Limited | 1938 | Mumbai, India | – | – | – | – | – | – |

| Tata Projects Limited | 1979 | Hyderabad, India | – | – | – | – | – | – |

| Shapoorji Pallonji Group | 1865 | Mumbai, India | – | – | – | – | – | – |

| Hindustan Construction Company (HCC) | 1926 | Mumbai, India | – | – | – | – | – | – |

| JMC Projects (India) Ltd. | 1986 | Mumbai, India | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Group Size (Large, Medium, or Small as per industry convention) | Revenue (INR Crore/USD Million) | Revenue Growth Rate (%) | Market Share (%) | Order Book Value | Project Completion Rate (%) |

|---|

India Engineering and Infrastructure Service Market Industry Analysis

Growth Drivers

- Increasing Urbanization: Urbanization in India is accelerating, with projections showing that by 2030, approximately 600 million people could reside in urban areas, representing about 40% of the total population. This rapid urban growth necessitates significant infrastructure development, including housing, transportation, and utilities. The government has earmarked over ?100 trillion for infrastructure projects under the National Infrastructure Pipeline, which aims to support this urban expansion and improve living standards.

- Government Infrastructure Initiatives: The Indian government has launched several initiatives to bolster infrastructure development, including the Smart Cities Mission, which aims to develop 100 smart cities across the country. Additionally, the Pradhan Mantri Awas Yojana (PMAY) targets the construction of over 20 million affordable homes. These initiatives are expected to drive investments exceeding ?1.5 trillion (around in the engineering and infrastructure sector, fostering economic growth and job creation.

- Rising Foreign Direct Investment (FDI): FDI inflows into India's infrastructure sector have surged, reaching $25 billion in recent periods, a significant increase from previous years. The government has relaxed FDI norms, particularly in sectors like construction and urban development, to attract global investors. This influx of capital is crucial for financing large-scale projects, enhancing technological capabilities, and fostering innovation in engineering services, thereby contributing to the overall growth of the market.

Market Challenges

- Regulatory Hurdles: The engineering and infrastructure sector in India faces significant regulatory challenges, including complex approval processes and bureaucratic delays. Obtaining environmental clearances can take up to 2-3 years, hindering project timelines. In recent periods, over 30% of infrastructure projects were reported to be delayed due to regulatory issues, which not only increase costs but also discourage potential investors from entering the market.

- Skilled Labor Shortage: The sector is grappling with a shortage of skilled labor, with estimates indicating a gap of skilled workers in the future. This shortage is exacerbated by the rapid pace of technological advancements, which require specialized skills that the current workforce lacks. Consequently, project execution is often delayed, leading to increased labor costs and impacting the overall efficiency of infrastructure development in India.

India Engineering and Infrastructure Service Market Future Outlook

The future of the India Engineering and Infrastructure Service Market appears promising, driven by ongoing urbanization and government initiatives aimed at enhancing infrastructure. In the future, the focus on sustainable development and smart city projects will likely reshape the landscape, encouraging innovation and investment. Additionally, the integration of advanced technologies such as AI and automation will streamline operations, improving efficiency. As the government continues to prioritize infrastructure, the sector is poised for significant growth, attracting both domestic and international investments.

Market Opportunities

- Smart City Projects: The Smart Cities Mission presents a substantial opportunity, with an estimated investment of ?1.64 lakh crore (approximately $20 billion) planned for developing smart infrastructure. This initiative aims to enhance urban living through technology-driven solutions, thereby creating demand for engineering services that prioritize sustainability and efficiency.

- Renewable Energy Integration: With India’s commitment to achieving 500 GW of renewable energy capacity by 2030, there is a growing opportunity for engineering firms to engage in renewable energy projects. This sector is expected to attract investments exceeding ?10 trillion (around $120 billion), driving innovation and creating jobs in engineering and infrastructure services.

Scope of the Report

| By Service |

Engineering Services Procurement Services Construction Services Project Management Services Maintenance and Support Services Technology Integration Services Specialized Engineering Services |

| By End-User Sector |

Residential Commercial Industrial Infrastructure (Transportation, Energy & Utilities) |

| By Region |

North India South India East India West India |

| By Technology |

Building Information Modeling (BIM) Geographic Information Systems (GIS) Drones and Aerial Surveying D Printing in Construction Automation and Digital Twin Technologies |

| By Application |

Residential Projects Commercial Projects Industrial Projects Infrastructure Projects |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Road Transport and Highways, Ministry of Housing and Urban Affairs)

Infrastructure Development Corporations

Public-Private Partnership (PPP) Units

Construction and Engineering Firms

Real Estate Developers

Utility Service Providers

Financial Institutions and Banks

Companies

Players Mentioned in the Report:

Larsen & Toubro Limited

Tata Projects Limited

Shapoorji Pallonji Group

Hindustan Construction Company (HCC)

JMC Projects (India) Ltd.

Gammon India Limited

IRCON International Limited

NCC Limited

Simplex Infrastructures Limited

KEC International Limited

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. India Engineering and Infrastructure Service Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 India Engineering and Infrastructure Service Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. India Engineering and Infrastructure Service Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urbanization

3.1.2 Government Infrastructure Initiatives

3.1.3 Rising Foreign Direct Investment (FDI)

3.1.4 Technological Advancements

3.2 Market Challenges

3.2.1 Regulatory Hurdles

3.2.2 Skilled Labor Shortage

3.2.3 Project Delays

3.2.4 Environmental Concerns

3.3 Market Opportunities

3.3.1 Smart City Projects

3.3.2 Renewable Energy Integration

3.3.3 Public-Private Partnerships (PPP)

3.3.4 Infrastructure Modernization

3.4 Market Trends

3.4.1 Digital Transformation in Engineering

3.4.2 Sustainable Infrastructure Development

3.4.3 Increased Use of AI and Automation

3.4.4 Focus on Resilience and Adaptability

3.5 Government Regulation

3.5.1 National Infrastructure Pipeline (NIP)

3.5.2 Environmental Clearance Regulations

3.5.3 Building Code Compliance

3.5.4 Land Acquisition Policies

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. India Engineering and Infrastructure Service Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. India Engineering and Infrastructure Service Market Segmentation

8.1 By Service

8.1.1 Engineering Services

8.1.2 Procurement Services

8.1.3 Construction Services

8.1.4 Project Management Services

8.1.5 Maintenance and Support Services

8.1.6 Technology Integration Services

8.1.7 Specialized Engineering Services

8.2 By End-User Sector

8.2.1 Residential

8.2.2 Commercial

8.2.3 Industrial

8.2.4 Infrastructure (Transportation, Energy & Utilities)

8.3 By Region

8.3.1 North India

8.3.2 South India

8.3.3 East India

8.3.4 West India

8.4 By Technology

8.4.1 Building Information Modeling (BIM)

8.4.2 Geographic Information Systems (GIS)

8.4.3 Drones and Aerial Surveying

8.4.4 3D Printing in Construction

8.4.5 Automation and Digital Twin Technologies

8.5 By Application

8.5.1 Residential Projects

8.5.2 Commercial Projects

8.5.3 Industrial Projects

8.5.4 Infrastructure Projects

9. India Engineering and Infrastructure Service Market Competitive Analysis

9.1 Market Share of Key Players(Micro, Small, Medium, Large Enterprises)

9.2 Cross Comparison of Key Players

9.2.1 Company Name

9.2.2 Group Size (Large, Medium, or Small as per industry convention)

9.2.3 Revenue (INR Crore/USD Million)

9.2.4 Revenue Growth Rate (%)

9.2.5 Market Share (%)

9.2.6 Order Book Value

9.2.7 Project Completion Rate (%)

9.2.8 Average Project Size (INR Crore/USD Million)

9.2.9 Operational Efficiency Ratio

9.2.10 Employee Strength

9.2.11 R&D/Innovation Spend (% of Revenue)

9.2.12 EBITDA Margin (%)

9.2.13 Return on Capital Employed (ROCE) (%)

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis(By Class and Payload)

9.5 Detailed Profile of Major Companies

9.5.1 Larsen & Toubro Limited

9.5.2 Tata Projects Limited

9.5.3 Shapoorji Pallonji Group

9.5.4 Hindustan Construction Company (HCC)

9.5.5 JMC Projects (India) Ltd.

9.5.6 Gammon India Limited

9.5.7 IRCON International Limited

9.5.8 NCC Limited

9.5.9 Simplex Infrastructures Limited

9.5.10 KEC International Limited

10. India Engineering and Infrastructure Service Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Ministry of Road Transport and Highways

10.1.2 Ministry of Urban Development

10.1.3 Ministry of Railways

10.1.4 Ministry of Power

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Infrastructure Development Budgets

10.2.2 Energy Sector Investments

10.2.3 Public Sector Undertaking Expenditures

10.3 Pain Point Analysis by End-User Category

10.3.1 Delays in Project Approvals

10.3.2 Cost Overruns

10.3.3 Quality Assurance Issues

10.4 User Readiness for Adoption

10.4.1 Awareness of New Technologies

10.4.2 Training and Skill Development Needs

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Performance Metrics Evaluation

10.5.2 Scalability of Solutions

10.5.3 Long-term Maintenance Considerations

11. India Engineering and Infrastructure Service Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market Gaps Identification

1.2 Value Proposition Development

1.3 Revenue Streams Analysis

1.4 Cost Structure Evaluation

1.5 Key Partnerships Exploration

1.6 Customer Segmentation

1.7 Channels of Distribution

2. Marketing and Positioning Recommendations

2.1 Branding Strategies

2.2 Product USPs

3. Distribution Plan

3.1 Urban Retail vs Rural NGO Tie-ups

4. Channel & Pricing Gaps

4.1 Underserved Routes

4.2 Pricing Bands

5. Unmet Demand & Latent Needs

5.1 Category Gaps

5.2 Consumer Segments

6. Customer Relationship

6.1 Loyalty Programs

6.2 After-sales Service

7. Value Proposition

7.1 Sustainability

7.2 Integrated Supply Chains

8. Key Activities

8.1 Regulatory Compliance

8.2 Branding

8.3 Distribution Setup

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product Mix

9.1.2 Pricing Band

9.1.3 Packaging

9.2 Export Entry Strategy

9.2.1 Target Countries

9.2.2 Compliance Roadmap

10. Entry Mode Assessment

10.1 JV

10.2 Greenfield

10.3 M&A

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital Requirements

11.2 Timelines

12. Control vs Risk Trade-Off

12.1 Ownership vs Partnerships

13. Profitability Outlook

13.1 Breakeven Analysis

13.2 Long-term Sustainability

14. Potential Partner List

14.1 Distributors

14.2 JVs

14.3 Acquisition Targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Milestone Planning

15.2.2 Activity Tracking

Disclaimer Contact UsResearch Methodology

Phase 1: Approach

Desk Research

- Analysis of government reports and publications from the Ministry of Road Transport and Highways

- Review of industry white papers and market analysis reports from engineering and infrastructure associations

- Examination of infrastructure project announcements and funding allocations from state and central government budgets

Primary Research

- Interviews with project managers and engineers from leading infrastructure firms

- Surveys with stakeholders in public-private partnerships (PPPs) within the engineering sector

- Field interviews with local government officials overseeing infrastructure projects

Validation & Triangulation

- Cross-validation of data through multiple sources including industry reports and government statistics

- Triangulation of findings from primary interviews with secondary data insights

- Sanity checks conducted through expert panels comprising industry veterans and academic professionals

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of market size based on national infrastructure spending trends and GDP growth rates

- Segmentation of the market by key sectors such as transportation, energy, and urban development

- Incorporation of government initiatives like the National Infrastructure Pipeline (NIP) into market forecasts

Bottom-up Modeling

- Collection of project-level data from ongoing and upcoming infrastructure projects across states

- Cost analysis based on historical project budgets and current material pricing trends

- Volume estimates derived from the number of projects and average project size in various sectors

Forecasting & Scenario Analysis

- Multi-factor regression analysis incorporating economic indicators, policy changes, and investment trends

- Scenario modeling based on potential shifts in government funding and private sector participation

- Development of baseline, optimistic, and pessimistic forecasts through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Infrastructure Projects | 120 | Project Managers, Civil Engineers |

| Energy Sector Developments | 90 | Energy Analysts, Project Directors |

| Urban Development Initiatives | 60 | Urban Planners, Local Government Officials |

| Public-Private Partnership Projects | 50 | PPP Coordinators, Financial Analysts |

| Infrastructure Financing and Investment | 70 | Investment Managers, Financial Advisors |

Frequently Asked Questions

What is the current value of the India Engineering and Infrastructure Service Market?

The India Engineering and Infrastructure Service Market is valued at approximately USD 150 billion, reflecting significant growth driven by urbanization, government initiatives, and increased investments in engineering services.

What are the key drivers of growth in the India Engineering and Infrastructure Service Market?

Key growth drivers include rapid urbanization, substantial government infrastructure initiatives like the National Infrastructure Pipeline, and rising foreign direct investment (FDI) in the sector, which collectively enhance infrastructure capabilities across India.

Which cities are the major players in the India Engineering and Infrastructure Service Market?

Major cities such as Mumbai, Delhi, and Bengaluru dominate the India Engineering and Infrastructure Service Market due to their economic significance and concentration of industries, attracting both domestic and foreign investments.

What is the National Infrastructure Pipeline (NIP) and its significance?

The National Infrastructure Pipeline (NIP) is a government initiative aimed at investing INR 111 trillion in infrastructure projects over several years, enhancing connectivity, promoting sustainable development, and creating job opportunities in the engineering and infrastructure sector.

What types of services are included in the India Engineering and Infrastructure Service Market?

The market includes various services such as engineering services, procurement services, construction services, project management services, maintenance and support services, technology integration services, and specialized engineering services, with engineering services currently leading the market.

Which end-user sectors dominate the India Engineering and Infrastructure Service Market?

The dominant end-user sector in the India Engineering and Infrastructure Service Market is infrastructure, driven by significant government investments and the increasing demand for improved public services, including transportation and utilities.

What challenges does the India Engineering and Infrastructure Service Market face?

Challenges include regulatory hurdles, such as complex approval processes and bureaucratic delays, and a skilled labor shortage, which can hinder project timelines and increase costs in the engineering and infrastructure sector.

How is urbanization impacting the India Engineering and Infrastructure Service Market?

Urbanization is significantly impacting the market, with projections indicating that around 600 million people will reside in urban areas, necessitating extensive infrastructure development, including housing, transportation, and utilities to support this growth.

What opportunities exist in the India Engineering and Infrastructure Service Market?

Opportunities include smart city projects, which aim to enhance urban living through technology-driven solutions, and renewable energy integration, with substantial investments expected in these areas, driving innovation and job creation.

What role does foreign direct investment (FDI) play in the India Engineering and Infrastructure Service Market?

FDI plays a crucial role by providing capital for large-scale projects, enhancing technological capabilities, and fostering innovation in engineering services, with recent inflows reaching $25 billion, significantly boosting the sector's growth.

What technological advancements are influencing the India Engineering and Infrastructure Service Market?

Technological advancements such as Building Information Modeling (BIM), Geographic Information Systems (GIS), and automation are influencing the market by improving project efficiency, enhancing design accuracy, and streamlining operations in engineering and infrastructure services.

How does the government support the India Engineering and Infrastructure Service Market?

The government supports the market through initiatives like the Smart Cities Mission and Pradhan Mantri Awas Yojana, which aim to develop smart infrastructure and provide affordable housing, driving investments and economic growth in the sector.

What is the future outlook for the India Engineering and Infrastructure Service Market?

The future outlook is promising, with ongoing urbanization and government initiatives expected to drive significant growth. The focus on sustainable development and smart city projects will likely reshape the market, attracting further investments.

Who are the key players in the India Engineering and Infrastructure Service Market?

Key players include Larsen & Toubro Limited, Tata Projects Limited, Shapoorji Pallonji Group, Hindustan Construction Company (HCC), and JMC Projects (India) Ltd., among others, contributing to innovation and service delivery in the sector.

What is the impact of regulatory hurdles on the India Engineering and Infrastructure Service Market?

Regulatory hurdles, such as complex approval processes and delays in obtaining environmental clearances, significantly impact project timelines, leading to increased costs and discouraging potential investors from entering the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.