India ERP (Enterprise Resource Planning) Software Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4165

October 2024

81

About the Report

India ERP Software Market Overview

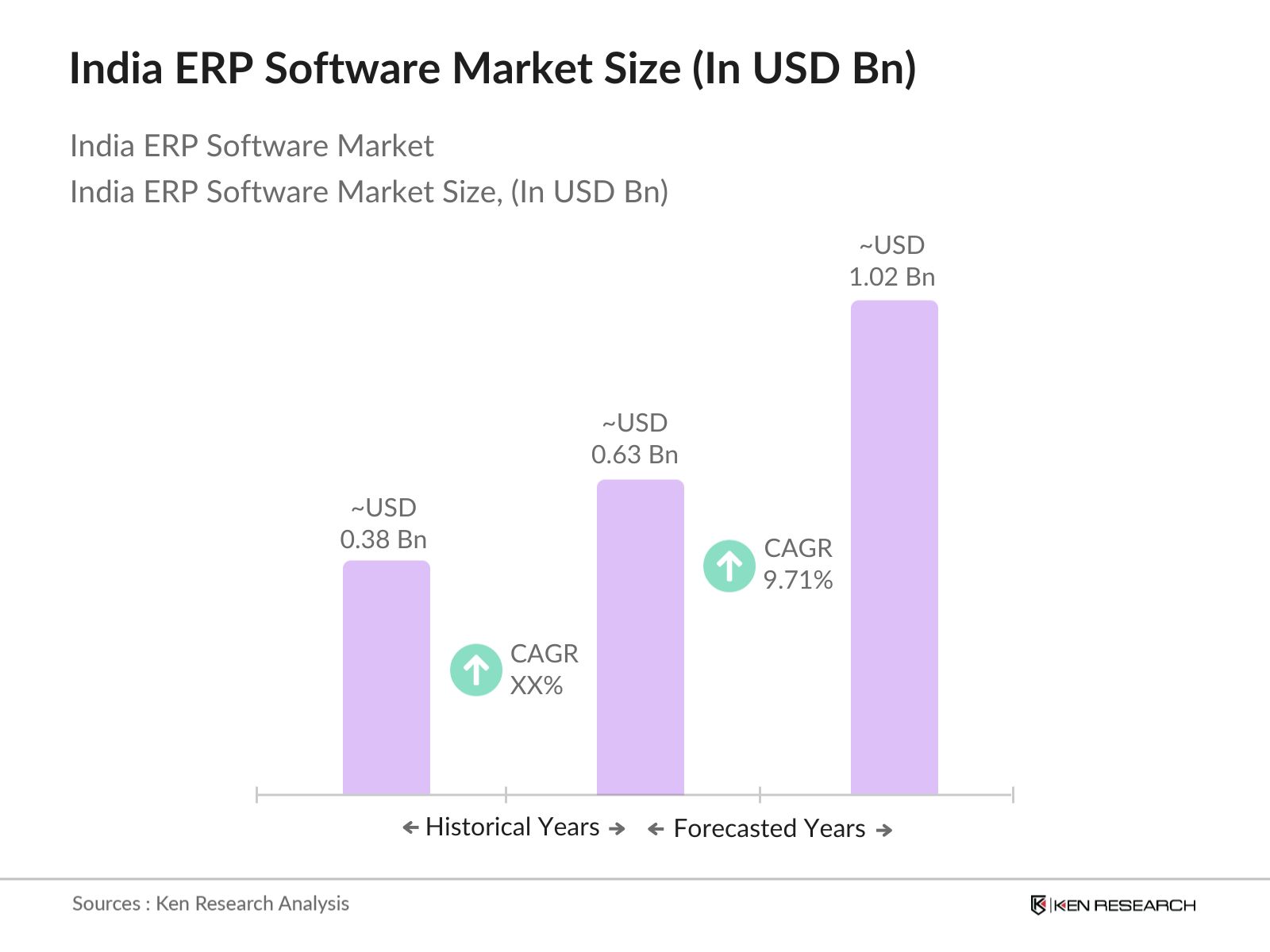

- The India ERP software market is valued at USD 0.63 billion based on a five-year historical analysis. This valuation is driven by the growing demand for streamlined business operations across sectors such as manufacturing, retail, healthcare, and BFSI (Banking, Financial Services, and Insurance). The rise in cloud adoption and the increasing need for efficient resource management have propelled market growth. Furthermore, the government's Digital India and Make in India initiatives have accelerated ERP implementation, fostering further demand for both cloud and on-premise solutions.

- Cities like Mumbai, Bengaluru, and Delhi dominate the ERP market due to their status as key economic and industrial hubs. These cities house large-scale manufacturing, IT services, and financial institutions that increasingly depend on ERP systems to enhance operational efficiency and decision-making. The presence of leading tech companies and startups further fuels the demand for ERP solutions, making these regions pivotal in market expansion.

- The implementation of Goods and Services Tax (GST) in India has necessitated businesses to integrate GST-compliant ERP systems. The GST regime, which contributed $212 billion to the government’s revenue in 2022, requires businesses to ensure proper invoicing, tax filing, and compliance with GST rules. ERP vendors are incorporating GST compliance modules in their software to enable businesses to automate tax calculations and ensure accurate reporting. This has significantly driven the adoption of ERP systems across sectors, particularly in retail and manufacturing.

India ERP Software Market Segmentation

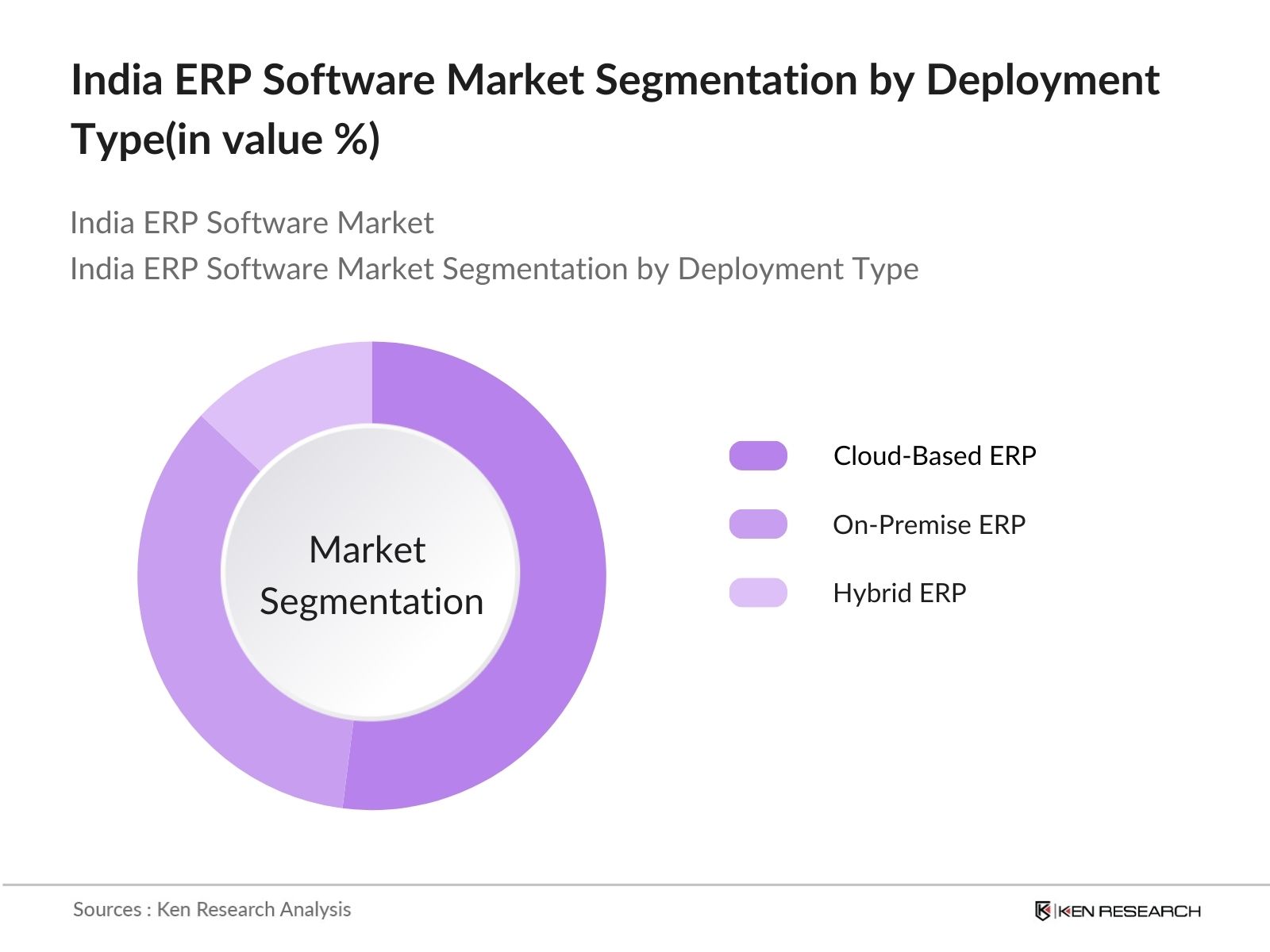

- By Deployment Type: The market is segmented by deployment type into cloud-based ERP, on-premise ERP, and hybrid ERP. Recently, cloud-based ERP has shown dominance in the market due to its flexibility, scalability, and cost-effectiveness. Businesses are increasingly transitioning from on-premise solutions to cloud-based platforms, particularly in sectors such as IT services and e-commerce, where agility and remote accessibility are critical. Cloud ERP solutions reduce the need for large upfront investments in IT infrastructure, enabling even smaller enterprises to adopt ERP systems.

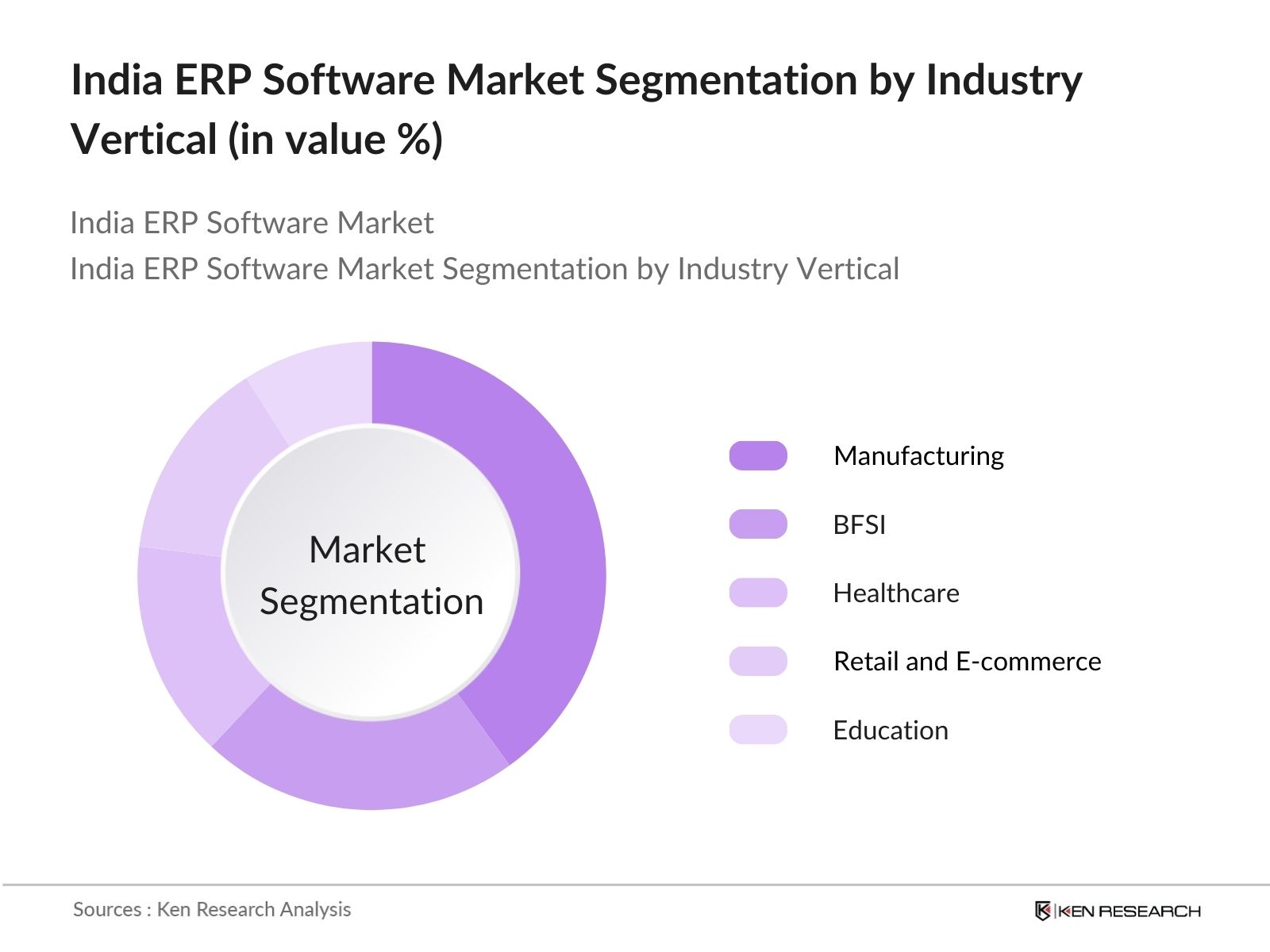

- By Industry Vertical: The market is further segmented by industry vertical into manufacturing, BFSI, healthcare, retail and e-commerce, and education. Manufacturing dominates this segment due to its high reliance on ERP systems for inventory management, production scheduling, and supply chain optimization. ERP solutions help manufacturers streamline their operations, optimize resource utilization, and ensure compliance with regulatory standards. The growing adoption of Industry 4.0 technologies also enhances the need for ERP solutions in this sector.

India ERP Software Market Competitive Landscape

The India ERP software market is dominated by a few major players, including global giants like SAP, Oracle, and Microsoft, as well as local providers like Tally Solutions and Ramco Systems. The consolidation in this market highlights the strong influence of these companies, which offer customized ERP solutions for various industries and enterprise sizes. Their ability to innovate and meet the diverse needs of Indian businesses gives them a significant competitive edge.

| Company | Establishment Year | Headquarters | Revenue (INR Bn) | Employee Strength | Specialization | Deployment Models | Customer Base | Product Offerings |

|---|---|---|---|---|---|---|---|---|

| SAP India Pvt. Ltd. | 1996 | Bengaluru, India | ||||||

| Oracle India Pvt. Ltd. | 1993 | Mumbai, India | ||||||

| Microsoft India Pvt. Ltd. | 1990 | Hyderabad, India | ||||||

| Tally Solutions Pvt. Ltd. | 1986 | Bengaluru, India | ||||||

| Ramco Systems | 1992 | Chennai, India |

India ERP Software Market Analysis

India ERP Software Market Growth Drivers

- Adoption of Cloud-Based ERP Solutions: India's cloud market is experiencing significant growth, driven by the increasing adoption of cloud-based ERP solutions. In 2023, the cloud infrastructure market in India reached $4.6 billion, according to government data. This shift is propelled by the enhanced scalability and flexibility offered by cloud ERP systems, catering to the operational needs of enterprises. India's government, through initiatives like Digital India, has encouraged companies to embrace digital solutions. As more businesses migrate from traditional on-premise solutions to cloud platforms, demand for ERP systems continues to rise, transforming business efficiency.

- Digital Transformation Initiatives by Indian Enterprises: Indian enterprises are actively embracing digital transformation, with investments in digital initiatives exceeding $8 billion by the end of 2023, according to the Ministry of Electronics and IT. The adoption of ERP solutions forms a critical part of this transformation, enabling companies to streamline processes, enhance decision-making, and achieve greater operational efficiency. Government programs such as Digital India and Make in India have catalyzed enterprise-level digital adoption, encouraging businesses to implement ERP systems as part of their modernization strategies. This drive is expected to continue through 2024 as enterprises prioritize automation and digitization.

- Increasing Demand from SMEs (Small and Medium Enterprises): India’s SME sector, comprising over 63 million enterprises, is increasingly adopting ERP solutions to optimize operations and improve competitiveness. SMEs contribute nearly 30% to India’s GDP, and many are leveraging ERP software to manage business processes more effectively. Cloud-based ERP solutions have made it easier for SMEs to access advanced tools without significant upfront investments, enhancing the sector's efficiency. Government initiatives, including the Micro, Small, and Medium Enterprises Development Act (2006), are designed to support the sector’s technological advancement and growth, further boosting demand for ERP solutions among SMEs.

India ERP Software Market Challenges

- High Initial Implementation Costs: The high cost of ERP implementation remains a significant barrier for many Indian companies, particularly SMEs. Data from the Ministry of Commerce and Industry show that the average cost of ERP implementation for mid-sized enterprises ranges from $100,000 to $300,000. These costs include software, hardware, and consultancy fees, which are often prohibitive for smaller businesses. Despite government incentives, such as tax breaks for digital adoption, the upfront expenditure required for ERP systems deters some companies from integrating these solutions, especially those operating on tighter margins.

- Data Security Concerns: Data security is a prominent concern for businesses adopting ERP solutions in India. With the growing adoption of cloud-based ERP systems, companies face increasing cybersecurity threats. According to data from the Indian Computer Emergency Response Team (CERT-In), India recorded over 1.4 million cybersecurity incidents in 2022, highlighting the importance of robust security frameworks. This has raised apprehensions among enterprises regarding the vulnerability of their data in cloud environments, impacting the wider acceptance of ERP systems. Ensuring compliance with data protection laws, such as India’s Personal Data Protection Bill, becomes critical in mitigating these concerns.

India ERP Software Market Future Outlook

Over the next five years, the India ERP software market is expected to experience substantial growth driven by increased adoption of digital technologies, particularly in the SME sector. The growing demand for cloud-based ERP solutions, fueled by cost-saving benefits and government incentives, will continue to shape the market's future. Additionally, advancements in AI and machine learning will enable ERP systems to offer more predictive and intelligent insights, further driving the demand for ERP systems in India.

India ERP Software Market Opportunities

- Rising Demand for Mobile and Remote ERP Solutions: With the increasing mobile and remote workforce in India, companies are seeking ERP solutions that offer mobile access and remote functionality. According to the International Labour Organization, India had 29 million remote workers by the end of 2022, representing a significant opportunity for mobile ERP solutions. The growing use of smartphones—expected to reach 1.1 billion by 2025—supports this trend, enabling businesses to manage their operations from remote locations. Mobile-friendly ERP systems are becoming essential tools for companies looking to provide real-time access to critical business data.

- Adoption of AI and Machine Learning in ERP Systems: The integration of artificial intelligence (AI) and machine learning (ML) into ERP systems is gaining momentum in India. AI-driven ERP platforms are helping businesses automate routine tasks, improve decision-making, and enhance productivity. By 2024, India is expected to have one of the fastest-growing AI adoption rates in the world, supported by government investment of over $1 billion in AI research and development. This trend presents a significant opportunity for ERP vendors to incorporate AI features into their solutions, making them more intelligent and adaptable to the evolving business landscape.

Scope of the Report

| By Deployment Type |

Cloud-Based ERP On-Premise ERP Hybrid ERP |

| By Enterprise Size |

Large Enterprises Medium Enterprises Small Enterprises |

| By Industry Vertical |

Manufacturing BFSI Retail & E-commerce Healthcare Education |

| By Functionality |

Financial Management HR Management Supply Chain CRM PM |

| By Region |

North India South India East India West India |

Products

Key Target Audience

Enterprise IT Managers

Chief Information Officers (CIOs)

ERP Software Developers

Banks and Financial Institutions

Large Enterprises (Manufacturing, Retail, BFSI)

SMEs and Startups (Tech & Non-Tech)

Government and Regulatory Bodies (Ministry of Electronics & IT, GST Council)

Investments and Venture Capitalist Firms

Cloud and SaaS Providers

Companies

SAP India Pvt. Ltd.

Oracle India Pvt. Ltd.

Microsoft India Pvt. Ltd.

Tally Solutions Pvt. Ltd.

Ramco Systems

Infor India Pvt. Ltd.

Zoho Corporation Pvt. Ltd.

Marg ERP Ltd.

NetSuite (Oracle)

IFS India Pvt. Ltd.

Epicor Software Corporation

Acumatica India

Sage Software Solutions Pvt. Ltd.

Odoo India Pvt. Ltd.

Focus Softnet India Pvt. Ltd.

Table of Contents

1. India ERP Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India ERP Software Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India ERP Software Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of Cloud-Based ERP Solutions

3.1.2. Digital Transformation Initiatives by Indian Enterprises

3.1.3. Increasing Demand from SMEs (Small and Medium Enterprises)

3.1.4. Government Initiatives (e.g., Digital India, Make in India)

3.2. Market Challenges

3.2.1. High Initial Implementation Costs

3.2.2. Data Security Concerns

3.2.3. Integration Issues with Legacy Systems

3.3. Opportunities

3.3.1. Rising Demand for Mobile and Remote ERP Solutions

3.3.2. Adoption of AI and Machine Learning in ERP Systems

3.3.3. Expanding ERP Usage in Non-Traditional Sectors (e.g., Education, Healthcare)

3.4. Trends

3.4.1. Growth of SaaS-Based ERP Platforms

3.4.2. Integration of IoT with ERP Systems

3.4.3. ERP Customization for Specific Industry Needs

3.5. Government Regulations

3.5.1. GST Compliance Requirements

3.5.2. Data Localization Policies

3.5.3. Industry-Specific Regulatory Compliance (e.g., BFSI, Manufacturing)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India ERP Software Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. Cloud-Based ERP

4.1.2. On-Premise ERP

4.1.3. Hybrid ERP

4.2. By Enterprise Size (In Value %)

4.2.1. Large Enterprises

4.2.2. Medium Enterprises

4.2.3. Small Enterprises

4.3. By Industry Vertical (In Value %)

4.3.1. Manufacturing

4.3.2. BFSI (Banking, Financial Services, and Insurance)

4.3.3. Retail and E-commerce

4.3.4. Healthcare

4.3.5. Education

4.4. By Functionality (In Value %)

4.4.1. Financial Management

4.4.2. Human Resource Management

4.4.3. Supply Chain Management

4.4.4. Customer Relationship Management

4.4.5. Project Management

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India ERP Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SAP India Pvt. Ltd.

5.1.2. Oracle India Pvt. Ltd.

5.1.3. Microsoft India Pvt. Ltd.

5.1.4. Tally Solutions Pvt. Ltd.

5.1.5. Ramco Systems

5.1.6. Infor India Pvt. Ltd.

5.1.7. Zoho Corporation Pvt. Ltd.

5.1.8. Marg ERP Ltd.

5.1.9. NetSuite (Oracle)

5.1.10. IFS India Pvt. Ltd.

5.1.11. Epicor Software Corporation

5.1.12. Acumatica India

5.1.13. Sage Software Solutions Pvt. Ltd.

5.1.14. Odoo India Pvt. Ltd.

5.1.15. Focus Softnet India Pvt. Ltd.

5.2. Cross Comparison Parameters (Employee Strength, Revenue, Headquarters, ERP Specialization, Customer Base, Industry Focus, Deployment Models, Customization Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. India ERP Software Market Regulatory Framework

6.1. Data Privacy and Protection Regulations

6.2. ERP Software Certification Standards

6.3. Compliance for Industry-Specific ERP (e.g., Healthcare, BFSI)

7. India ERP Software Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India ERP Software Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By Enterprise Size (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Functionality (In Value %)

8.5. By Region (In Value %)

9. India ERP Software Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Strategies

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the key stakeholders in the India ERP software market. We conduct extensive desk research through secondary and proprietary databases to gather comprehensive data. Key variables such as deployment models, enterprise size, and industry verticals are identified to build the market framework.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed, focusing on ERP software adoption rates across industries. Factors like the shift toward cloud deployment, the growing number of SMEs, and evolving regulatory requirements are assessed to construct a detailed market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with ERP industry experts. Telephone interviews and online surveys are used to obtain insights directly from ERP developers and system integrators, ensuring that the market data is accurate and reflective of current trends.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all gathered data into a comprehensive market report. This stage includes interactions with ERP solution providers to gain detailed insights into product segmentation, market positioning, and customer adoption patterns, ensuring a validated and reliable market analysis.

Frequently Asked Questions

01. How big is the India ERP Software Market?

The India ERP software market is valued at USD 0.63 billion, driven by increasing demand for operational efficiency across industries such as manufacturing, BFSI, and healthcare.

02. What are the challenges in the India ERP Software Market?

The key challenges in the India ERP software market include high implementation costs, data security concerns, and difficulties in integrating ERP solutions with legacy systems, which can hinder adoption.

03. Who are the major players in the India ERP Software Market?

Major players in the India ERP software market include SAP India Pvt. Ltd., Oracle India Pvt. Ltd., Microsoft India Pvt. Ltd., Tally Solutions Pvt. Ltd., and Ramco Systems, each contributing significantly to the market due to their established presence and wide product offerings.

04. What are the growth drivers for the India ERP Software Market?

The India ERP software market growth is driven by the increasing adoption of cloud-based solutions, government initiatives like Digital India, and the rising demand for AI-integrated ERP systems for predictive analysis and improved operational efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.