India Epoxy Resins Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3932

December 2024

94

About the Report

India Epoxy Resins Market Overview

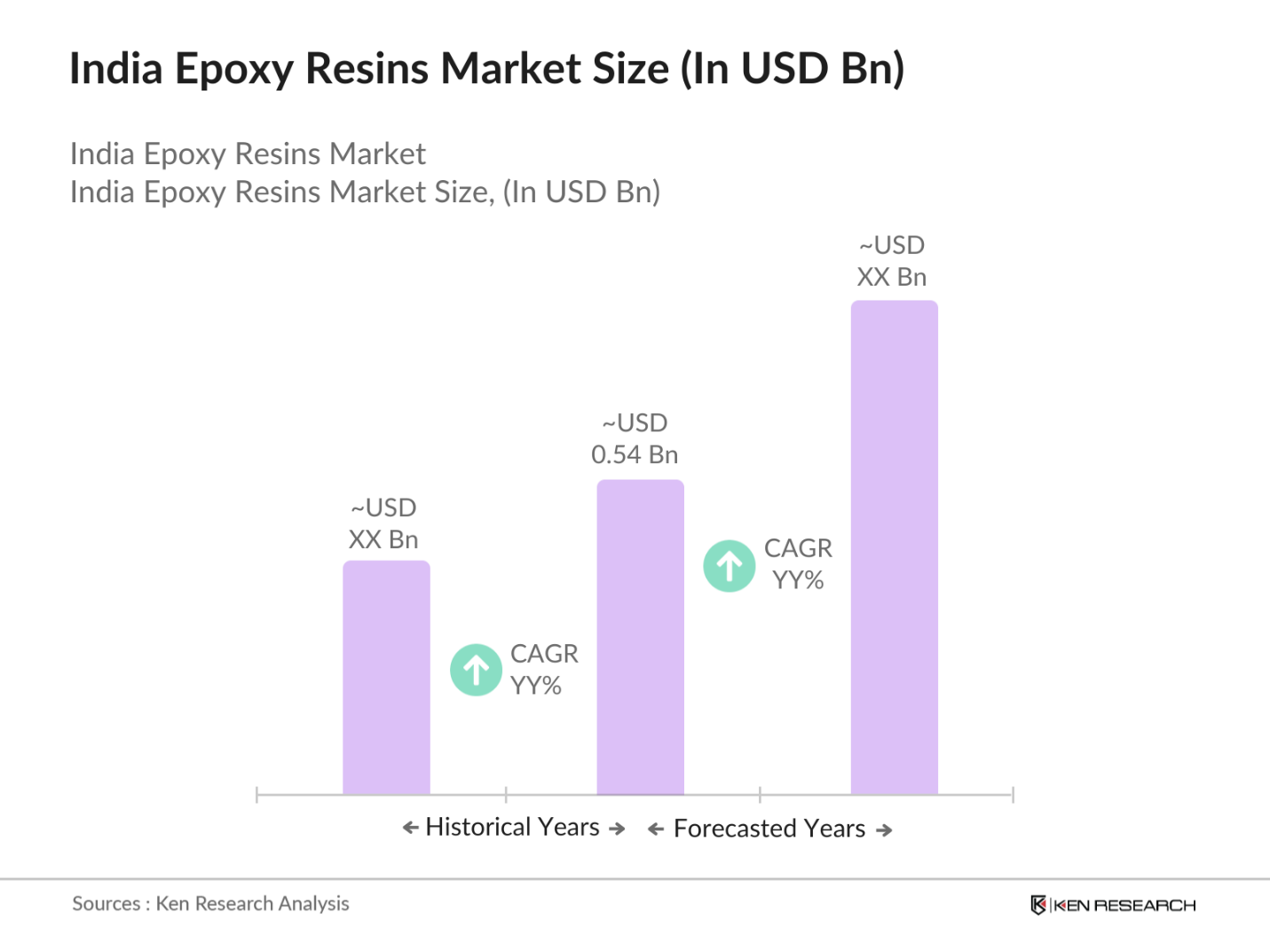

- The India Resin Industry is valued at USD 0.54 billion, following a five-year historical analysis. This market is primarily driven by rapid industrialization and urbanization, leading to high demand in sectors such as packaging, construction, automotive, and electronics. Government initiatives like "Make in India" have further accelerated industry growth. Additionally, advancements in resin technology, including the development of high-performance and sustainable resins, are playing a pivotal role in meeting industry needs and boosting overall market expansion.

- Regions such as Maharashtra, Gujarat, and Tamil Nadu dominate the resin industry market in India. Maharashtra and Gujarat are industrial hubs with a high concentration of manufacturing units, petrochemical complexes, and favorable infrastructure. Gujarat, in particular, is home to major players like Reliance Industries and Indian Oil Corporation's petrochemical plants. The presence of ports facilitates easy import and export, enhancing the region's dominance. Tamil Nadu's strong automotive and electronics sectors contribute significantly to resin demand in the southern part of India.

- The Indian government has implemented several initiatives to boost the resin industry. The "Make in India" campaign encourages domestic manufacturing and has attracted both local and foreign investments in the chemical and petrochemical sectors. Additionally, the Petroleum, Chemicals, and Petrochemicals Investment Region (PCPIR) policy aims to develop world-class infrastructure to support petrochemical industries, including resin manufacturers. Environmental regulations are also being strengthened, pushing companies to develop sustainable and eco-friendly resins.

India Epoxy Resins Market Segmentation

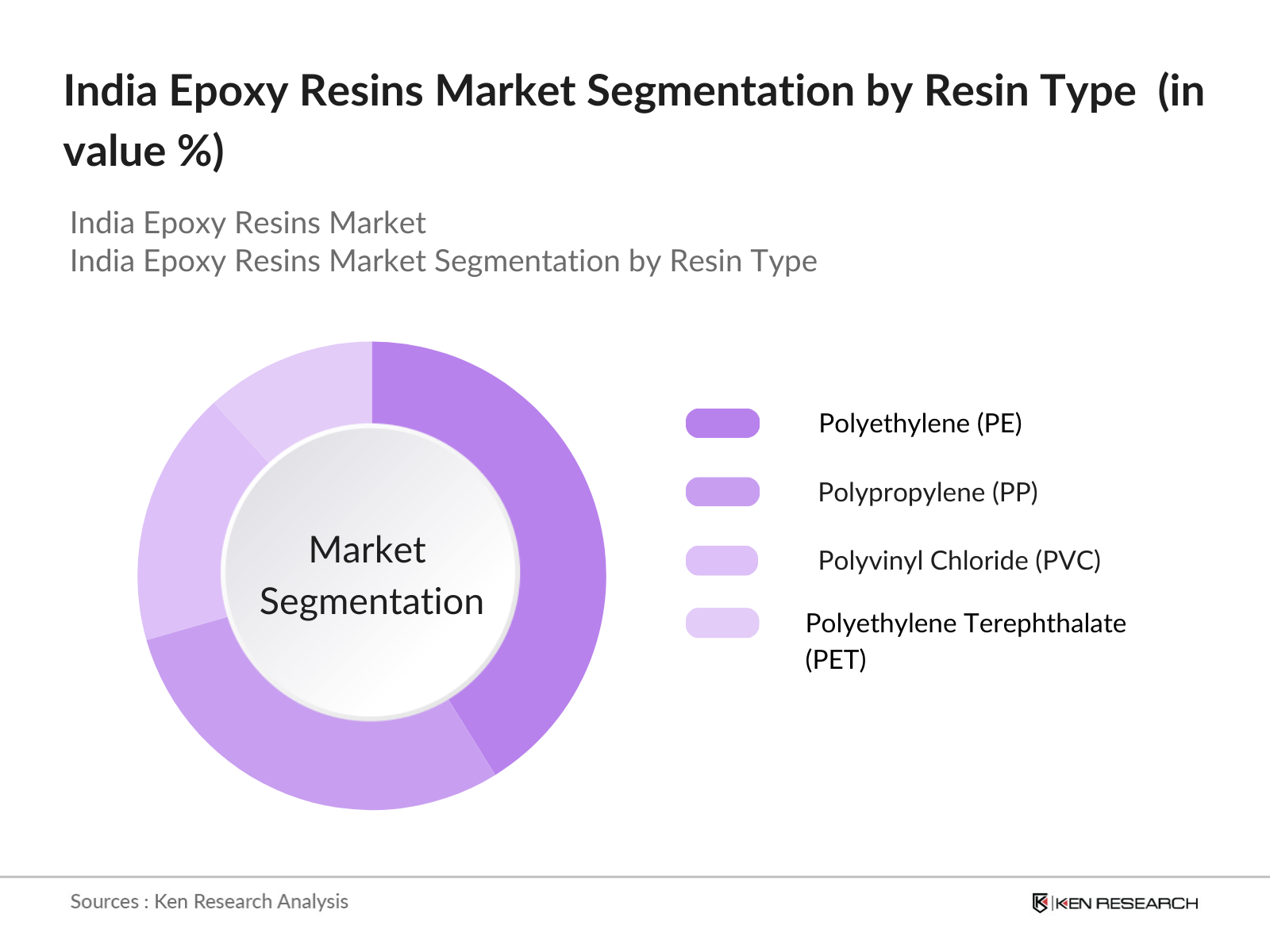

By Resin Type: The market is segmented by resin type into Polyethylene (PE) holds the largest market share due to its extensive use in packaging applications, such as plastic bags, containers, and films. Its versatility, durability, and cost-effectiveness make it a preferred choice in various industries.

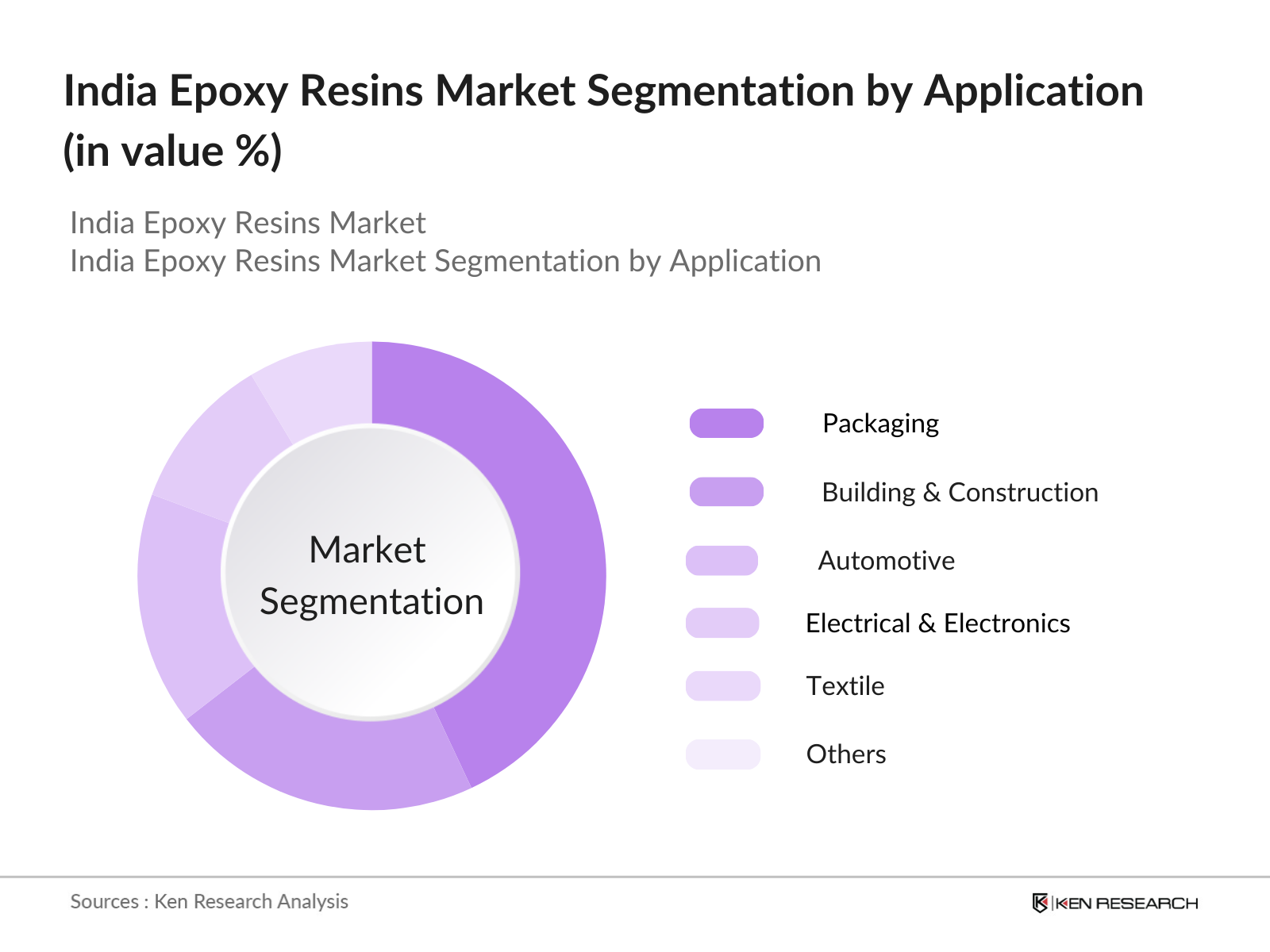

By Application: The market is further segmented by application Packaging is the dominant application segment due to the growing demand for flexible and rigid packaging solutions in the food, beverage, and consumer goods industries. The rise of e-commerce has also spurred the need for efficient packaging materials.

India Epoxy Resins Market Competitive Landscape

The India Resin Industry is highly competitive, featuring both domestic and multinational companies. Major players like Reliance Industries Limited, Indian Oil Corporation Limited, and Haldia Petrochemicals Limited dominate due to their extensive production capacities, integrated operations, and strong distribution networks. The industry is characterized by strategic collaborations, technological innovations, and expansions to increase market share. Companies are investing in R&D to develop high-performance and sustainable resins to meet evolving consumer demands and comply with environmental regulations.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Key Products |

R&D Investments |

Partnerships/Clients |

|

Reliance Industries Limited |

1966 |

Mumbai, India |

- |

- |

- |

- |

|

Indian Oil Corporation Limited |

1959 |

New Delhi, India |

- |

- |

- |

- |

|

Haldia Petrochemicals Limited |

1985 |

Kolkata, India |

- |

- |

- |

- |

|

Supreme Petrochem Ltd. |

1995 |

Mumbai, India |

- |

- |

- |

- |

|

ONGC Petro additions Limited (OPaL) |

2006 |

Dahej, Gujarat |

- |

- |

- |

- |

India Epoxy Resins Market Analysis

India Epoxy Resins Market Growth Drivers

- Rapid Industrialization and Urbanization: India's rapid industrial growth and urban development have increased the demand for resins in construction, automotive, and consumer goods sectors. Urbanization leads to infrastructure development, boosting the need for construction materials where resins are widely used.

- Growth in End-User Industries: The expansion of end-user industries such as packaging, automotive, and electronics significantly drives the resin market. The automotive industry's shift towards lightweight materials for fuel efficiency increases the use of high-performance resins.

- Government Initiatives Promoting Manufacturing: Government initiatives like "Make in India" and the establishment of Petroleum, Chemicals, and Petrochemicals Investment Regions (PCPIRs) encourage domestic production of resins. These policies provide incentives, infrastructure support, and ease of doing business, attracting investments in the resin industry.

- Technological Advancements in Resin Production:Advancements in polymer technology have led to the development of specialized resins with enhanced properties like high strength, durability, and resistance to chemicals. This drives demand from industries requiring high-performance materials.

India Epoxy Resins Market Challenges

- Environmental Regulations and Compliance: Stringent environmental regulations regarding plastic usage and waste management pose challenges. Companies need to invest in sustainable practices and develop eco-friendly resins, which can increase production costs.

- Fluctuating Raw Material Prices: The resin industry is heavily dependent on crude oil prices, as petrochemicals are primary raw materials. Volatility in crude oil prices affects profit margins and pricing strategies.

- Competition from Low-Cost Imports: Import of cheaper resins from countries with lower production costs creates competitive pressure on domestic manufacturers. This can impact market share and profitability for local companies.

India Epoxy Resins Market Future Outlook

The India Epoxy Resins Market is expected to experience robust growth by 2028, with projections estimating the market size to reach around. Key factors contributing to this growth include increased demand from end-user industries, technological advancements, and government support for domestic manufacturing. The shift towards sustainable and bio-based resins presents new opportunities.

Marketing Opportunities

- Development of Bio-based and Sustainable Resins: There is a significant opportunity to innovate and market bio-based resins in response to environmental concerns and regulations. Companies can capitalize on this demand by investing in R&D for eco-friendly products.

- Expansion into Emerging Rural Markets: As infrastructure development extends into rural areas, the demand for construction materials and packaging increases. Resin manufacturers can tap into these markets by establishing distribution networks and offering products suited to local needs.

Scope of the Report

|

By Resin Type |

Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) |

|

By Application |

Packaging Building & Construction Automotive Electrical & Electronics |

|

By End-User Industry |

Consumer Goods Healthcare Agriculture Aerospace & Defense Industrial Manufacturing |

|

By Production Process |

Injection Molding Extrusion Blow Molding Compression Molding Film Casting |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Resin Manufacturers

Packaging Companies

Automotive Manufacturers

Construction Firms

Electrical & Electronics Manufacturers

Government and Regulatory Bodies(CPCB)

Investment and Venture Capital Firms

Research and Development Institutions

Companies

Players Mention in the Report

Reliance Industries Limited

Indian Oil Corporation Limited

Haldia Petrochemicals Limited

Supreme Petrochem Ltd.

ONGC Petro additions Limited (OPaL)

BASF India Limited

Dow Chemical International Pvt. Ltd.

DuPont India Pvt. Ltd.

LG Chem India Pvt. Ltd.

SABIC India Pvt. Ltd.

Uflex Limited

JBF Industries Ltd.

Bhansali Engineering Polymers Limited

TCI Chemicals (India) Pvt. Ltd.

Aditya Birla Chemicals (India) Limited

Table of Contents

01. India Epoxy Resins Market Overview

1.1. Definition and Scope

1.2. Market Valuation and Historical Analysis

1.3. Key Market Developments and Trends

02. India Epoxy Resins Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Trends Impacting Market Growth

03. India Epoxy Resins Market Analysis

3.1. Growth Drivers

3.1.1. Rapid Industrialization and Urbanization

3.1.2. Growth in End-User Industries

3.1.3. Government Initiatives Promoting Manufacturing

3.1.4. Technological Advancements in Resin Production

3.2. Market Challenges

3.2.1. Environmental Regulations and Compliance

3.2.2. Fluctuating Raw Material Prices

3.2.3. Competition from Low-Cost Imports

3.3. Market Opportunities

3.3.1. Development of Bio-based and Sustainable Resins

3.3.2. Expansion into Emerging Rural Markets

3.4. Future Trends

3.4.1. Growth of E-Commerce in Resin Sales

3.4.2. Shift Towards Eco-Friendly Products

04. India Epoxy Resins Market Segmentation

4.1. By Resin Type (In Value %)

4.1.1. Polyethylene (PE)

4.1.2. Polypropylene (PP)

4.1.3. Polyvinyl Chloride (PVC)

4.1.4. Polystyrene (PS)

4.2. By Application (In Value %)

4.2.1. Packaging

4.2.2. Building & Construction

4.2.3. Automotive

4.2.4. Electrical & Electronics

4.3. By End-User Industry (In Value %)

4.3.1. Consumer Goods

4.3.2. Healthcare

4.3.3. Agriculture

4.3.4. Aerospace & Defense

4.3.5. Industrial Manufacturing

4.4. By Production Process (In Value %)

4.4.1. Injection Molding

4.4.2. Extrusion

4.4.3. Blow Molding

4.4.4. Compression Molding

4.4.5. Film Casting

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. Midwest

4.5.3. West Coast

4.5.4. Southern States

05. India Epoxy Resins Market Competitive Landscape

5.1. Profiles of Major Companies

5.1.1. Reliance Industries Limited

5.1.2. Indian Oil Corporation Limited

5.1.3. Haldia Petrochemicals Limited

5.1.4. Supreme Petrochem Ltd.

5.1.5. ONGC Petro additions Limited (OPaL)

5.1.6. BASF India Limited

5.1.7. Dow Chemical International Pvt. Ltd.

5.1.8. DuPont India Pvt. Ltd.

5.1.9. LG Chem India Pvt. Ltd.

5.1.10. SABIC India Pvt. Ltd.

5.2. Competitive Strategies and Market Share Analysis

5.3. Strategic Initiatives and Collaborations

5.4. Innovations and R&D Investments

06. Regulatory Framework for Epoxy Resins in India

6.1. Environmental Regulations

6.2. Compliance Standards and Certification Processes

07. India Epoxy Resins Market Future Outlook

7.1. Future Market Size Projections (In USD Billion)

7.2. Key Factors Driving Future Market Growth

08. Marketing Opportunities in the India Epoxy Resins Market

8.1. Emerging Trends and Consumer Preferences

8.2. Market Entry Strategies for New Entrants

8.3. Investment Opportunities in R&D

Disclaimer

Contact

Research Methodology

Step 1: Identification of Key Variables

Extensive desk research was conducted to identify key market variables, including market size, growth trends, and key stakeholders. Sources included industry reports, government publications, and reputable news outlets.

Step 2: Market Analysis and Construction

Historical data on market size, segmentation, and growth rates were compiled. Market penetration and revenue estimates were analyzed across different segments to build a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through interviews with industry experts, including executives from resin manufacturing companies and representatives from end-user industries. This provided insights into market dynamics, challenges, and future prospects.

Step 4: Research Synthesis and Final Output

All data and insights were synthesized into a detailed market report. The final output includes analysis, forecasts, and strategic recommendations for stakeholders in the India Resin Industry Market.

Frequently Asked Questions

1. How big is the India Resin Industry Market?

As of 2023, the market is estimated to be valued at around USD 0.54 billion, driven by demand from packaging, construction, and automotive industries.

2. What are the key factors driving growth in the resin industry?

Key drivers include rapid industrialization, growth in end-user industries, government initiatives promoting manufacturing, and technological advancements in resin production.

3. Which resin type dominates the India Resin Industry Market?

Polyethylene (PE) holds the largest market share at 35%, widely used in packaging applications due to its versatility and cost-effectiveness.

4. Who are the major players in the India Resin Industry Market?

Major players include Reliance Industries Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, Supreme Petrochem Ltd., and ONGC Petro additions Limited (OPaL).

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.